2011 Q1 | Economic Calm, Geopolitical Storm

The first quarter of 2011 was dominated by a series of events that eclipsed the financial markets as front-page news. An unexpected breakdown in the political order in North Africa spread throughout the Mideast, and several governments important to Western economic interests tottered on the brink of collapse by quarter’s end. Governments in Tunisia and Egypt fell and significant unrest spread to Bahrain, a small but important financial center responsible for the coordination of Middle Eastern oil settlements. We were surprised that by quarter’s end a Western coalition had begun offensive air operations against the repressive government of Libya and, under the supervision of NATO, the West was attempting to bring down the government of Muammar Gaddafi, the long-running leader of Libya.

The first quarter of 2011 was dominated by a series of events that eclipsed the financial markets as front-page news. An unexpected breakdown in the political order in North Africa spread throughout the Mideast, and several governments important to Western economic interests tottered on the brink of collapse by quarter’s end. Governments in Tunisia and Egypt fell and significant unrest spread to Bahrain, a small but important financial center responsible for the coordination of Middle Eastern oil settlements. We were surprised that by quarter’s end a Western coalition had begun offensive air operations against the repressive government of Libya and, under the supervision of NATO, the West was attempting to bring down the government of Muammar Gaddafi, the long-running leader of Libya.

The European banking system came under pressure as banks in Portugal, Greece, Italy, and Spain joined those of Iceland and Ireland in experiencing varying degrees of loss of confidence by depositors and members of the European Union. France and Germany, the wealthy nations in the E.U., although willing to aid the affected nations, offered bailout terms that were quite steep. At quarter’s end, the E.U. banking situation remained unresolved.

If these events weren’t enough, major earthquakes struck on the Western edge of the Pacific “Ring of Fire.” The first disaster was in New Zealand in February, and then a monster quake hit Japan on March 11, severely damaging a major nuclear power center and threatening the entire island of Japan with uncertain levels of radiation. We, like the rest of the world, are shocked by the loss of life and the suffering being experienced by Japan. It is not an easy thing to put aside the human aspect, but we have taken a look at the economic impact of the quake.

The economic impact of the Japanese quake by itself could be addressed, as that economy is the world’s third largest, at just over $4 trillion of GDP. The scale of the Japanese economy appears quite sufficient to deal with the $300 billion of losses the earthquake is estimated to have caused. On the other hand, the potential for ongoing disruption to the Japanese economy from nuclear consequences is a major unknown at this time.

Yet despite all this bad news, world economies and financial markets shrugged off the developments and experienced only a temporary price retreat. The major stock market indexes closed the quarter near the recovery highs that were established just prior to the earthquakes. For the quarter just ended, S&P and Dow advanced 6% and 7%, respectively, resulting in a near-doubling of share prices from the lows of March 6-9, 2009. How could this have happened against the backdrop of sluggish employment, higher food and oil prices, and very large federal deficits as measured both by absolute dollars and as a percent of gross domestic product?

The answer could be a phrase coined by political consultant James Carville in the 1992 presidential campaign. The slogan, “It’s the economy, stupid,” may explain today’s strong recovery in share prices. Almost daily, signs of an economic recovery are becoming more visible. The consumer is spending more, new factory orders are up, inventories at both the retail and wholesale levels are being rebuilt, and consumer confidence, although down in the most recent report, is still up 21% from year-ago levels.

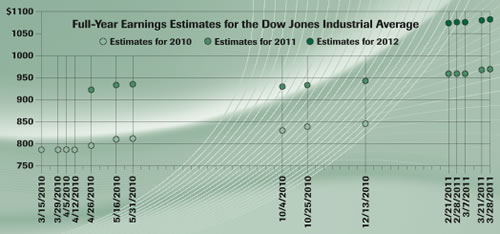

But the really good news is to be found in reported corporate earnings. Fourth-quarter results were quite strong, with as many as three quarters of all companies exceeding Wall Street’s earnings projections. Non-farm fourth quarter profits advanced 21% over last year’s fourth quarter, while full-year 2010 profits were up 31% to a record $874 billion. Even better, earnings estimates for 2011 and 2012 have been steadily revised upwards over the last twelve months (see chart above). Earnings for the S&P have returned to peak levels, yet we remain some 15% below the peak in price.

——————————————————————-

Despite all this bad news, world economies and financial markets closed the quarter near the prior recovery highs.

——————————————————————-

Housing remains as one of the most discouraging sectors, with many houses in foreclosure or subject to short sales (a sale at less than mortgage value), and millions of homeowners are underwater with negative equity. Residential housing remains our biggest concern and the biggest challenge to sustaining this recovery. New government legislation designed to aid housing and construction, such as the proposed Dodd-Frank bill, may result in a smorgasbord of new bureaucracies and regulations and may not achieve the goal of restoring strength in the housing markets. In fact, there have been very few reforms since the housing debacle began in mid-decade, and another fall in housing prices cannot be ruled out.

As positive as we are on the outlook for stocks, we continue to be cautious on longer-term bonds: those with maturities of greater than ten years. In an effort to restore solvency to the financial system, the Federal Reserve, the Federal Deposit Insurance Corporation and the U.S. Treasury Department implemented a government monetary stimulus program in 2008. It continued with a second round in 2010. This program, Quantitative Easing II, is set to expire in May of this year, and we do not believe it will be extended or renewed. The consequence of the expiration of “QE2,” as it is known, will result in a drawdown of liquidity in the U.S. financial system. This could result in a rise in interest rates and a fall in bond prices. Higher rates would be consistent with our view of a stronger economy, and at least initially this should be positive for equity prices.

Interest rates will be influenced by the level of inflation. The official core number for inflation moved up slightly in the quarter from a level of 1.5% to 2.1%, overall an acceptable number. Forecasting inflation is importantly dependant on the future prices of a number of commodities, especially energy, and overall labor cost. Such forecasts range widely amongst economists.

During the quarter, we found evidence that the inflation number was deteriorating at a more rapid rate than admitted to by the government. A number of important commodities experienced sharp increases in prices. Oil price, as measured by West Texas Crude, increased 17% from $91 a barrel on January 1, 2011 to $106 a barrel on March 31. This translates into 38 cents per gallon at the gasoline pump. The annualized cost to the American consumer: $60 billion. This is equivalent to a tax increase and will restrain consumer spending if the current prices hold—or go even higher, as is normal in the seasonally strong summer driving season.

Food cost also jumped sharply as corn and wheat cost increased by 101% and 69%, respectively, from March 31, 2010 to March 31, 2011. By the quarter’s end, these costs were being readily passed along to the consumer. Indeed, in most major categories in food stores, price increases were approaching double digits in year-over-year comparisons. Even the venerable Hershey Chocolate Company announced a 10% price increase just before the important Easter season, a tragedy for our younger consumers.

——————————————————————-

Today, signs of a solid economic recovery are becoming more visible.

——————————————————————-

At quarter’s end, there was little to suggest that the price increases were slowing. Walmart CEO Bill Simon noted that sharp increases in wholesale prices could no longer be absorbed at the corporate level and would be passed on to the consumer in the coming months. Also contributing to the poor outlook on the inflation front has been the disruption to the automotive industry brought about by the earthquake in Japan. A shortage of Japanese cars was to be expected. However, Japan was the sole supplier of various parts essential for the production of cars across virtually all geographic boundaries. The impact of the earthquake could be price increases in, and shortages of, automobiles.

On the other hand, labor cost, an important component of the Consumer Price Index, provides a basis for optimism. For the year 2010, the employment cost index was up only 1.75%, which was more than offset by a 3.9% gain in worker productivity. Given the likely commodity price hikes, the key 2011 inflation outlook will be the degree to which productivity gains can offset raw material and labor cost increases, which we estimate to be in the 3-5% range.

For the present our immediate forecast is for interest rates to increase between one-half and one percent from the 3.4% level accorded the ten-year Treasury on March 31, 2011. This level of rates, although of concern, should not interrupt the economic recovery that is haltingly under way. Further deterioration in the inflation and interest rate outlooks would be troubling and could result in the possibility of a moderate recessionary environment developing in 2012.

In looking back two years to the fire-sale prices then accorded equities, as well as the major worries as to the solvencies of both the United States and world economies, we observe that today’s outlook has vastly improved. However, we feel it has yet to be completely reflected in our stock markets. We continue to feel that equities, as measured by the Dow Jones average, could reach between thirteen and fourteen thousand by year’s end. Our concerns center about the surprising geopolitical events that have come in rapid succession during the past three months. Looking ahead, an optimist would see an improving political fabric developing in the Middle East and possibly a regime change in Libya. We would also hope there would be significant improvement in Japan, and furthermore that the rebuilding effort provides economic stimulus for the entire region.