What’s On Our Minds:

Over the weekend, Hurricane Harvey walloped the Texas coast and caused major flooding throughout the Houston area. Five deaths have been reported so far and over 3,000 water rescues have been performed. It looks like rain will continue through the week and the city could receive up to 50 inches of rain by the time it’s all said and done. Along with the humanitarian issues brought on by the storm, many are asking how this historic weather event will affect business along the Gulf Coast.

The storm will without a doubt be a major hit on insurance companies covering homes and business in the area and it will also affect the local oil industry. The hurricane’s path goes right through a corridor of critical energy infrastructure in the Houston and Galveston area. Investors are expecting the storm to send ripples through the energy industry this week. Thus far, the hurricane has forced 15% of the U.S.’s oil refining capacity to temporarily shut down, and it looks like it could get worse as the storm heads east towards refineries along the Texas and Louisiana boarder. Experts are saying that even though refineries may not be damaged, the Houston Shipping Channel has been closed since Friday. As a result, crude can’t get into port and refined product can’t be shipped. Several major pipelines that lead in and out of the Houston area may also see interrupted operations due to the storm. Rest assured, the U.S. prepares for times like these and has a large stockpile of gasoline on the east coast that can sustain the entire country for 2 weeks.

Oil investors are expecting the crack spread (the metric that tracks the difference between the price of oil and gasoline) to widen in the short term following the storm. Depending on how fast refineries can get back up and running after the storm will determine how quickly the crack spread will normalize. Look for gas prices to spike in the short term following the storm.

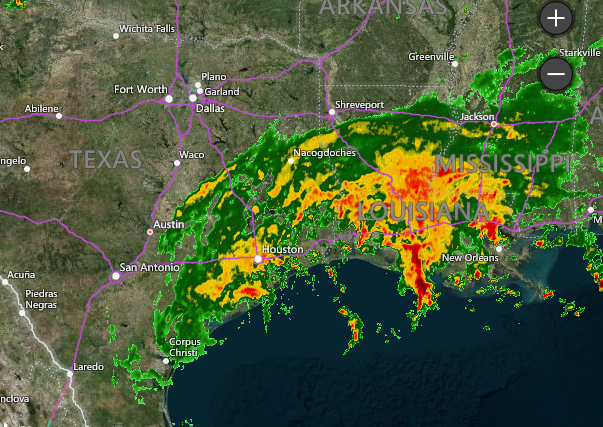

Texas and Louisiana are bracing for more rain as Hurricane Harvey moves onshore. Source: Accuweather.

Last Week’s Highlights:

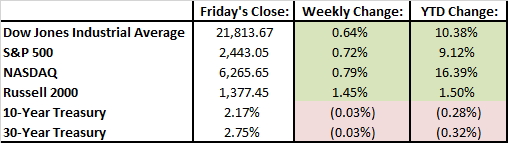

Domestic equity markets saw small gains last week. The S&P 500 was up 0.72% and the Dow Jones increased by 0.64%. Materials and telecom sectors had a strong week but consumer staple stocks declined. Grocery store stocks had a tough week due to Amazon’s announcement that they would lower prices at their recently acquired Whole Foods stores.

With earnings season wrapped up, happenings in Washington D.C. continue to drive investor sentiment. On Tuesday, markets were up 1% as President Trump renewed his focus on pushing pro-growth tax reform policies. Then, we witnessed a bit of a pullback on Wednesday when Trump threatened to allow for a shutdown of the federal government if Congress refused to fund his border wall.

Looking Ahead:

The last official week of summer going into the Labor Day weekend will have investors on their toes with a good amount of economic data coming across the wire. U.S. GDP numbers are being reported on Wednesday and consumer spending figures will be released on Thursday. Auto sales, ISM manufacturing data, and the unemployment number from August will all be reported on Friday. Wall Street is expecting strong gains in Friday’s job report.

What’s On Our Minds:

Tufton Capital has recently taken on the responsibility of sponsoring one mile of highway on Interstate 83 South. The firm is proud to partner with the Sponsor-A-Highway program. It is an easy and effective way to help keep our local roadways and environment clean. A sign with Tufton’s logo is now in place on our stretch of highway just north of our offices in Hunt Valley.

Last Week’s Highlights:

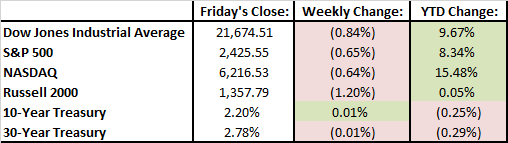

Stocks were lower again last week, mostly due to political drama in Washington D.C. and the terrorist attack in Barcelona. Since the S&P hit a record high on August 7, the index has pulled back 2.2%. President Trump’s pro-business agenda took a hit last week when it was announced that the White House Manufacturing Advisory council would be dissolved. Reduced optimism about the likelihood of passing the President’s pro-business reforms clearly weighed on investor sentiment last week. While we have witnessed some volatility lately, it’s important to remember that, in historic terms, markets have been unusually placid this year.

Looking Ahead:

Earnings season is over, so investors will refocus on big picture issues. The Federal Reserve is holding their annual Jackson Hole symposium this week and investors are expecting them to remain dovish in regards to increasing short term interest rates. Investors aren’t expecting any market moving news out of Jackson Hole. Investors will also keep an eye on Washington after President Trump’s incendiary comments following the protests in Charlottesville, VA last weekend.

New home sales data will be released on Wednesday and existing home sales data will be released on Thursday.

What’s On Our Minds:

The war of words between President Trump and North Korea’s Kim Jun Un caused the CBOE Volatility Index (“the fear index”) to spike 55% last week. While volatility has been extremely low this year, last week’s spike serves as an important reminder that volatility will inevitably rear its ugly head every once in a while. Read on to learn what drives high volatility and how investors should respond when markets gets turbulent.

High-volatility Markets

Originally used by chemists to describe chemicals that evaporate (and explode) easily, “volatile” has become the generic term for anything erratic or subject to sudden changes.

Today, most people hear about volatility in connection with investments and the stock market. But what does volatility mean in a market? Can we measure it? What does it mean for an investor’s current assets?

A Measure of Movement

Just like in chemistry, market volatility is about change. Stocks (or other investments) that are thought to have more predictable price fluctuations have “low volatility” while those expected to make drastic movements (both up and down) are said to have “high volatility.”

Most people use volatility to gauge the risk they are taking when purchasing an investment or planning a portfolio.

Highly volatile investments are judged as unpredictable with their returns. Though this means a volatile investment could significantly exceed its projected return, it also means that it is more likely to fall considerably short or cause a loss.

Two Types of Volatility

Investors commonly use one of two types of volatility when looking at stocks: historical volatility and implied volatility.

An investment’s historic volatility is measured according to its standard deviation—that is, comparing how much it has fluctuated in the past to its average rate of change.

Implied volatility, on the other hand, shows the expected volatility of a stock over the next 30 days. It is calculated using the current premiums on stock options.

Implied volatility is a measure of both anticipated performance and market sentiment. When option writers have increased concerns about a stock’s future price, they compensate by charging more for option contracts. The higher the premium they charge, the greater the anticipated fluctuations. The premium, therefore, implies the level of volatility.

The standard indicator of total market volatility is the Chicago Board Options Exchange Market Volatility Index—ticker symbol: VIX. It relates the implied volatility of all options on S&P 500 stocks due in the next 30 days.

Because the implied volatility is greatly influenced by investor emotions, the VIX is commonly referred to as “the fear index.”

What does High Volatility Mean for Investors?

Volatility is an inescapable part of investing. The future is uncertain and every investment carries risks.

However, unless an investor is involved with buying or selling options, a brief increase in volatility or the VIX is unlikely to require any changes to his or her investments.

A volatile market might cause stock prices to rise and fall by significant amounts, but it does not necessarily affect the future value of owning shares in a company.

Investors should choose stocks based on the underlying value of a company, not a temporary price fluctuation. The fear associated with the VIX should not give way to irrational buying or selling.

Nevertheless, prolonged periods of high volatility can make it more difficult for investors to plan for retirement. Even though the market could be rising in value, high volatility makes it difficult to set reliable retirement dates.

Those nearing retirement typically desire less volatility in their investments, as significant downturn can delay retirement by several years.

A high-volatility market is one that can produce both significant gains and significant losses. Investors must recognize that every investment has the potential to become volatile. Volatility is an expression of market fears and past changes, not a guarantee about the future.

Last Week’s Highlights:

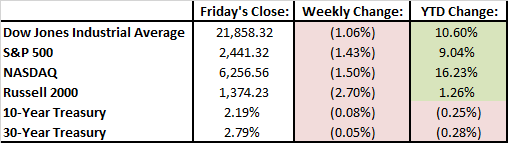

Domestic markets have been on a strong run recently during a solid second quarter earnings season. 90% of the S&P 500’s companies have reported and 74% of them have beaten investor expectations. Last week, domestic stock indices experienced a bit of a hiccup due to geopolitical tensions surrounding the situation in North Korea. After a strong run, the Dow Jones broke its 10-day winning streak on Wednesday. The trash talk between President Trump and North Korea’s Kim Jung Un caused safe havens (bonds and gold) to rally last week. Overall, last week served as a reminder that investors can be an anxious bunch and that geopolitics can in fact influence our markets here at home. The team here at Tufton continues to remind our clients and friends that these types of short term market jitters should not weigh on your long-term investment objectives.

Looking Ahead:

Aside from keeping an eye on the situation unfolding between the United States and North Korea, investors will continue monitoring earnings updates and continue trying to figure out what’s next for the Federal Reserve. The U.S Census Bureau will report retail sales for July on Tuesday. The Federal Open Market Committee will release its meeting minutes from its July 26th meeting on Wednesday and the first rounds of NAFTA negotiations between the U.S., Canada, and Mexico will commence. Weekly jobless claims will be released on Thursday. On Friday, we will close out the week with University of Michigan reporting their Consumer Sentiment figures for the month of August.

What’s On Our Minds:

One of the most interesting aspects of investment and the stock market is its ability to show trends. Any given company on any given day has a stock value that behaves individually. However, there are certain characteristics that people might expect to see from companies depending on their size.

Commonly referred to as its “market cap,” a company’s market capitalization is the total value of all shares of its stock (both common and preferred). Though market cap is easy to calculate (shares multiplied by price), determining why a company holds its current share price is much more difficult.

In general, companies are classified into one of four categories: large-cap, mid-cap, small-cap and micro-cap. Large-caps (sometimes called “big-caps”) typically have a value of over $10 billion. Mid-caps span approximately $2-$10 billion. Small-caps are usually below $2 billion, with micro-caps being smaller than $250 million. Sometimes the terms “mega-cap” or “nano-cap” are also used; these are reserved for truly gigantic and extremely small companies, respectively.

Characteristics of each Cap Category

Large

Large-caps are typically the most stable companies on the market. They are big companies with long histories and a lot of market recognition. Large-caps are more likely to pay out stock dividends and make good on bonds. Investors that focus on large-caps will try to use this stability to produce measured, consistent growth for their clients.

Mid

A mid-cap company usually carries a lot of weight in its particular industry, but is not as widespread as the large-cap companies are. Investors that predominantly use mid-caps aim to have higher gains from growth than large-caps, but put themselves at slightly more risk. During times of economic decline, mid-cap investors will usually lose more than large-cap investors.

Small

Most small-cap companies are well established, but individually, have a minor role in the market. Their functions are usually non-essential, but they have plenty of room to expand and might possibly move into the mid-cap range. Small-cap investors try to harness this growth potential, but cannot be certain of success. These funds often have years of significant gain broken up with occasional years of loss. Small-caps will often boom during economic recovery.

Choosing a Market Cap Style

There is no “right answer” when it comes to choosing a type of cap for investing. Although any single type of market-cap might outperform any other type, success in the future is ultimately unknowable. Large and mid-caps might weather economic downturns better, but are less likely to grow quickly when things are good.

When investing, whether in bonds or stocks, it is important to get all the information. Risk and return must be balanced properly in every portfolio and the means to do it is not always clear. If you are consider adjusting your investments, contact Tufton Capital Management with all your questions and concerns.

Last Week’s Highlights:

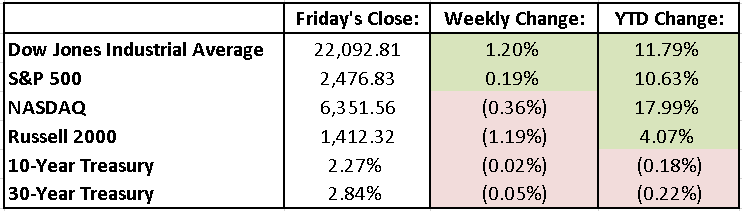

There was a flurry of activity during the week as strong earnings continued to drive the major indices higher. The Dow set a new high water mark above 22,000 and the S&P 500 continues to march towards 2500. A particular Cupertino phone company continues to be the apple of the markets eye, as AAPL had a large earnings beat. The stock finished the week with a 4.5% gain and is up 34.5% YTD. Tesla had a strong quarter on unexpected revenue growth and continues to trek higher into even frothier levels. The market values Tesla $15B more than Ford motor company and $7B more than General Motors.

There was positive economic data this week as employers added 209,000 jobs in July and brought the unemployment rate down to 4.3%. In political news, General Kelly replaced Reince Preibus as White House Chief of Staff and fired Director of Communications Anthony Scarramucci, who only held the position for 10 days.

Looking Ahead:

Earnings are starting to slow down, but Disney and Home Depot, along with younger companies, like Snap Inc., are reporting. It’s supposed to be a quiet week in Washington D.C. as no major bills or testimonies are scheduled. These truly are the dog days of summer…