What’s On Our Minds:

Tune your TV to CNBC on any given day and more and more attention is given to activist investors and the companies they target. As activists, investors look to maximize shareholder value by often taking large enough positions to influence management decisions- they are looking to shake things up at the company. Activists may decide to move in on a company if they believe management has stumbled, it would be better off as a private company, it has excessive costs, or if the activist think they have a better capital allocation strategy, such as buying back stock or raising the dividend.

Often activists are targeted by the media and politicians for being “hit and run” investors, but activists will argue that they are genuinely concerned about companies and the U.S. economy. The issues surrounding activism are not clear cut; some activist may just be greedy, while others actually want to maximize shareholder value over the long-term.

Over the summer, Nelson Peltz’s $12.7 billion hedge fund, Trian Partners, took aim at household product conglomerate Proctor and Gamble. His fund currently owns $3.3 billion worth of P&G shares. Peltz thinks P&G is not structured properly and believes that the company in resistant to change. He is currently in a proxy fight for a seat on the company’s board. The company says they have been actively working with Trian but is against adding him to the board. In dollar terms, P&G is the largest company to ever face a proxy fight of this nature.

Activists take positions in all different types of companies, across many different industries and of various market caps, but more often than not, activist target companies that have been beaten up and are considered value stocks. At Tufton Capital, we are not activist investors but we do look for undervalued stocks so it’s not uncommon for companies in our equity portfolio to have activist involvement. Thus, we do have to pay attention to the hype created by these market players.

While activist investors grab plenty of headlines, it’s tough to determine the actual impact activism is having on the overall market. According to a study conducted by the Wall Street Journal last year, of the largest 71 activist campaigns between 2009 and 2014, only about 50% of targeted companies outperformed their peers.

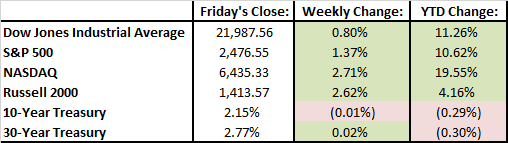

Last Week’s Highlights:

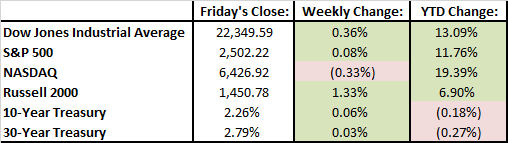

Stocks were marginally higher last week and hit record highs. The highlight of the week was the Federal Reserve’s announcement that it would begin normalizing its balance sheet in October. The Fed also stated that it would keep its federal funds rate between 1 and 1.25 percent. The announcement caused 2 and 10 year Treasury yields to increase along with the the value of the dollar.

Looking Ahead:

Investors will see how the housing market is doing this week when the Case-Shiller Index of home prices and new home sales figures are released on Tuesday. We will also get a report on consumer confidence on Tuesday and Janet Yellen is scheduled to deliver a speech. Investors are expecting her elaborate on the Fed’s plans to unwind the huge balance sheet it has amassed since the financial crisis.

What’s On Our Minds:

There was a good amount of stock speculating in recent weeks as day traders tried to take advantage of the short-term effects of Hurricanes Harvey and Irma. While it may be tempting to speculate how companies’ stock prices may gyrate around these types of events, we believe it’s important to remember that stock speculation is rarely successful over the long term.

Conversely, the investment professionals at Tufton Capital believe that a long-term, buy and hold investment strategy is the to safest, and smartest, way to build wealth in the stock market. Quite simply, it’s been proven time and time again to return exponential gains on invested capital.

Cultivating Your Portfolio

The term “buy and hold” doesn’t mean investing and forgetting about your portfolio for the next 20 years. There are ways to cultivate and prune your portfolio while still maintaining a long-haul investing strategy. For instance, if a company you invest in changes fundamentally, you may not want to continue owning that security. If the overall market changes dramatically, as it has in the past, you may actually benefit from selling an investment or group of investments. Finally, changing goals as you get closer to retirement may warrant a more conservative portfolio.

Bad Markets

The typical investor is tempted to get out of a bad market by selling when prices are low, which is a poor strategy. The economy fluctuates between good and bad all the time, and those who constantly buy and sell will be hit the hardest in a bad economy. By holding on to your investments, you’ll be better able to ride out a down market, especially if your portfolio is diversified.

Taxes and Fees

Frequent trading results in higher fees, so long haul-investors pay less while fees eat up much of a day trader’s profits. Additionally, short-term gains are taxed at a higher rate than long-term gains. Even if you have the fortune of timing the market successfully, your profits will be diminished by taxes and fees.

Investing for the long-haul is the best investing strategy for the majority of investors because it not only ensures modest gains but is also less likely to yield major losses. A long-haul investment strategy is based on informed, careful decision making and patience.

Last Week’s Highlights:

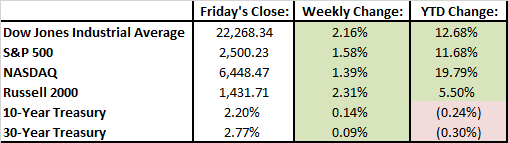

Equity markets were strong last week. The Dow Jones surged more than two percent and the S&P 500 was up over one and a half percent. It was the strongest week for the S&P since January. Most of the optimism was spurred by news that congressional Republicans are planning on releasing their tax reform policies later this month.

Looking Ahead:

The Federal Reserve is holding their two-day Federal Open Market Committee meeting this week. It will wrap up on Wednesday and Janet Yellen will give a speech. Investors don’t expect a bump in interest rates but it’s likely that the central bank will hash out how they plan to start unwinding their 4.5 trillion-dollar balance sheet.

What’s On Our Minds:

Tufton Capital Management is committed to helping our clients take control of their financial future. Armed with an effective estate plan, you can be sure you preserve your family’s legacy while minimizing taxes. By taking advantage of direct gift limits allowed by the IRS, individuals with estates totaling $5.49 million, and married couples with $10.98 million, can get a head start on generational wealth transfer and reduce the ramifications inflicted by estate taxes.

Taxes and direct gifts

Depending on their amount, direct gifts can be given tax-free. You may give up to a combined $5.45 million in life or death without the money being subject to estate or gift taxes, and there is also a $14,000 annual exemption rate per donee (recipient). Couples can combine their annual exclusions to double this amount, meaning they can give $28,000 per donee per year. Even if only one spouse technically makes the gift, as long as both spouses consent, it is considered by the IRS to have come from both. This allows couples to maximize their gifting ability. In addition, all gifts you give to your spouse throughout your lifetime are tax-free, as long as he or she is a U.S. citizen. Annual gifts can make a big difference over time, and since they are a “use it or lose it” exclusion, it makes sense to transfer as much money as possible this way as part of an estate plan.

Since annual gift tax exemptions are based on the calendar year, timing is important when gifting. For example, instead of gifting $25,000 to someone in December, if you gifted $14,000 in December and the remaining $11,000 in January, you could avoid gift taxes altogether. If your gifting amount for the year does end up exceeding the annual exemption amount, you have to file an informational gift tax return for that year and either pay 40 percent of the excess amount or use up some of your $5.49 million lifetime estate/gift exemption. One thing to consider with estate and gift taxes is that if you have to choose between the two, it will usually cost less to gift while you are living (even if it is above the exemption amount) than to wait until after death. Gifts made before death shrink your taxable estate by both the amount of the gift and the interest the money would have gained by the time of your death.

In addition to gift taxes, generation-skipping transfer tax (GST tax) is also a consideration for those subject to estate taxes. GST tax is applied to property that is passed to related persons more than one generation younger than the donor or to unrelated persons who are more than 37.5 years younger than the donor via a will or trust. This tax was created because many people had discovered that they could pass their estates directly to their grandchildren and therefore avoid one generation of estate taxes. GST tax rates and exemptions are the same as estate taxes, with up to a $5.49 million exemption and a 40 percent taxation rate.

Appreciated Assets

Gifts do not always have to be in cash. By gifting appreciated assets, you not only move money out of your estate, but you also move any future appreciation of those assets out of your estate and out of the grip of estate taxes. Another benefit of gifting appreciated assets is a possible capital gains tax advantage. Capital gains tax is enforced on the amount that the value of the asset increases from its original value. For example, if a stock was bought for $2,000 and then gifted when it was worth $2,500, capital gains tax would be assessed on $500. If the recipient of the assets is in a lower tax bracket than the donor, he or she will end up owing less money on this asset.

Last Week’s Highlights:

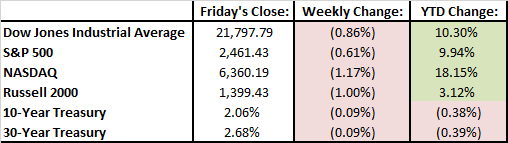

Stocks were lower last week. Political headlines and the impact of both Hurricanes Harvey and Irma weighed on investors’ minds. The Dow Jones slipped .86% and the S&P 500 shaved off .61%.

Investors were relieved last week when President Trump reached across party lines to extend the nation’s debt ceiling which will keep the government funded for the next 3 months. Although they may have only “kicked the can” on the issue, the move showed some rare bipartisan cooperation.

The monetary cost of Hurricanes Harvey and Irma will not be totally calculated for some time but the overall cost of both storms together could be in the several hundred billion dollar range. It is likely that property and casualty insurers covering Texas and Florida will see large claims in coming quarters.

Looking Ahead:

Monday is the 16th anniversary of the 9/11/2001 terror attacks.

On Tuesday, Apple will release the highly-anticipated iPhone 8. Experts are expecting the new iPhone to include “Face ID” technology that will recognize the owner’s face so that users and simply look at the phone to unlock it.

On Friday, retail sales, industrial production, and capacity utilization figures will all be reported. Also on Friday, contracts for stock index futures, stock index options, and stock options all expire on the same day. These “triple witching” days occur four times a year and can result in escalated trading activity during the final hour of the day.

What’s On Our Minds:

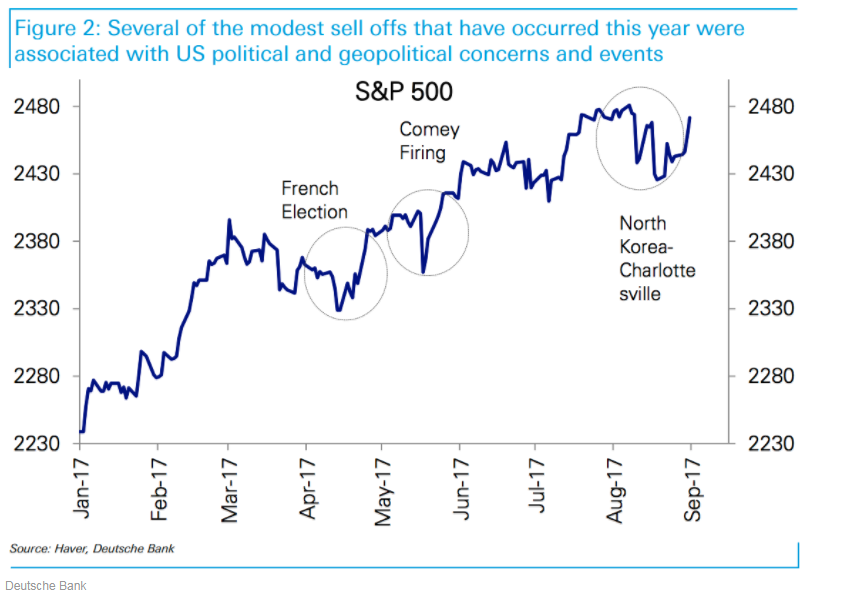

The S&P 500 has been on a ten-month run without a 3% sell off. It has been a historically calm market that has some investors worried that we are long overdue for a pullback. As we wrap up summer and move into fall, bears are concerned that markets are poised to get more volatile.

With plenty of geopolitical uncertainties currently in the mix, their worries are not without basis. Congress must decide to raise the debt ceiling this month and the civilized world must deal with a North Korean regime that continues to threaten nuclear war. Of course, the 24 hour news cycle is doing its best to frighten the average investor.

Optimists disagree with the bears and believe that any volatility spurred from these coming events will be short lived. Bulls are pointing to recent double digit growth in corporate earnings and increased economic growth throughout the world as catalysts that can continue pushing the market higher. Furthermore, market bears have continued to be disappointed this year as sell offs instigated by geopolitical and US political drama have been brief. (See the graph below from Deutsche Bank.)

At Tufton, we continue to remind our clients and friends that even though “noise” may affect equity markets from day to day, it remains crucial to remain focused on the long term. Uncertainty is a fact of life in the investment business, and over the years, a disciplined approach through thick and thin has benefited our clients handsomely.

Last Week’s Highlights:

Equity markets moved higher last week in the face of devastating flooding in Texas and more hostile moves by the North Korean regime. Hurricane Harvey dumped 50 inches on rain in the Houston area, killed 46 people, and temporarily shut down a good portion of the nation’s refineries which has pushed fuel prices higher.

Friday’s job report was strong and showed that the U.S. economy added 156,000 jobs in August. Treasury Secretary Steven Mnuchin said that the Trump administration and Congress will release more details on their plans to overhaul U.S. tax code in coming days. United Technologies announced they are closing on a deal to acquire Rockwell Collins. Gilead Sciences announced it was purchasing Kite Pharma.

Looking Ahead:

Domestic markets were closed on Monday in observance of Labor Day. Factory and durable goods orders will be reported on Tuesday. The ISM non manufacturing index for August will be reported on Wednesday. The European Central Bank is meeting on Thursday to issue its decision on interest rates. Another hurricane is making its way across the Atlantic and could potentially hit Florida and head into the Gulf of Mexico