Last Week’s Highlights:

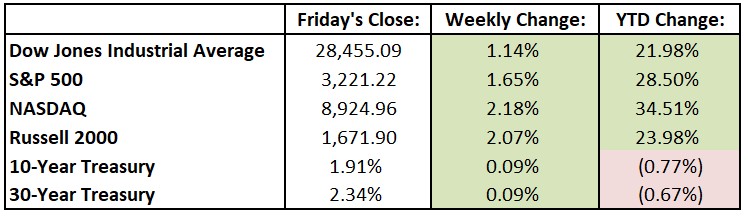

U.S. equities closed out the week at record levels, energized by new signs of economic strength and lessened trade tensions. The U.S. and China agreed last week to a preliminary trade truce, and promising economic numbers released by both countries signaled better than expected global growth. The House voted to impeach President Donald Trump for abuse of power and obstruction of Congress, the third impeachment in U.S. history. For the week, the Dow Jones Industrial Average (DJIA) rose 319.71 points, or 1.1%, to 28,455.09, while the S&P 500 advanced 1.7% to 3221.22. The tech-heavy NASDAQ was up 2.2%, closing at 8924.96.

What a difference a year makes! – current investor optimism and market strength is indeed a different environment than this time a year ago when major indexes couldn’t seem to stop falling. The S&P 500 had dropped 12% through December 21st and was on the way to its worst December since 1931.

Looking Ahead:

It will be a slow week on Wall Street. The Census Bureau reports new-home sales data for November on Monday – consensus estimates call for a seasonally adjusted annual rate of 730,000 new homes sold, roughly the same as the month before. On Tuesday, trading ends at 1pm on the New York Stock Exchange and Nasdaq Composite for Christmas Eve. The bond market closes at 2pm. The Bank of Japan releases minutes from its monetary-policy meeting at the end of October. Markets all over the world are closed on Wednesday in observance of Christmas Day. Many bourses are closed on Thursday, including those in Canada, England and Hong Kong, in observance of Boxing Day. The Department of Labor reports initial jobless claims for the week ending December 21st. On Friday, the U.S. Energy Administration releases its Petroleum Status report for the week ending December 20th.

All of us at Tufton Capital Management wish you and your families a very Merry Christmas and a Happy Holiday!

Last Week’s Highlights:

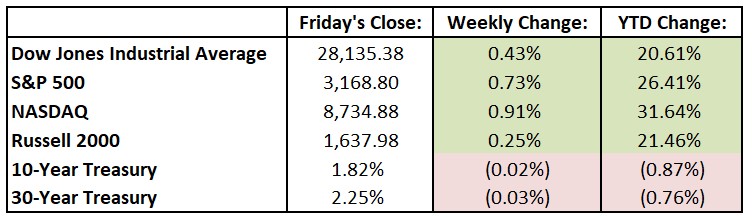

Quite a bit went right last week for equity investors. The Federal Reserve left interest rates unchanged and signaled a pause through 2020, while the European Central Bank pledged continued favorable monetary support. In the United Kingdom, Boris Johnson’s Conservative Party received a landslide victory, signaling that the Brexit drama is nearing an end. And on Friday, President Trump announced that a phase-one deal with China had been completed and that negotiations on phase two would begin immediately. Stock markets, however, were only slightly up, as much of the week’s positive news appears to already be discounted in equity valuations. For the week, the Dow Jones Industrial Average (DJIA) rose just 120.32 points, or 0.4%, to 28,135.38, while the S&P 500 advanced 0.7% to 3168.80. The tech-heavy NASDAQ was up 0.9%, closing at 8734.88.

Looking Ahead:

With third-quarter earnings season largely in the books, economic reports will take center stage this week. On Monday, the National Association of Home Builders releases its NAHB/Wells Fargo Housing Market Index for December – economists estimate a 71 reading, up slightly from November’s print. On Tuesday, FedEx (FDX), Cintas (CTAS) and Navistar International (NAV) report earnings results. The Bureau of Labor Statistics releases its Jobs Openings and Labor Turnover Survey for September – economists forecast seven million job openings on the last business day of October, unchanged from the prior month. Look for financial results from General Mills (GIS), Paychex (PAYX) and Micron Technology (MU) on Wednesday. The Conference Board releases its Leading Economic Index for November on Thursday – forecasts call for a 0.1% rise after falling the three previous months. CarMax (KMX) reports quarterly results on Friday.

Tufton Capital Team hopes that you have a wonderful week!

Last Week’s Highlights:

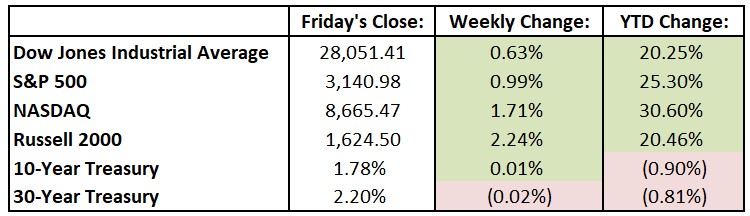

Friday was the last trading day of November, and stocks closed out their best month since June. A strong third-quarter earnings season and hints that a “phase one” U.S.-China trade deal is in its final stages have contributed to the recent market strength. For the holiday-shortened week, the Dow Jones Industrial Average (DJIA) rose 175.79 points, or 0.63%, to 28,051.41, while the S&P 500 advanced 0.99% to 3140.98. The tech-heavy NASDAQ was up 1.71%, closing at 8666.47. Black Friday results hinted at a very strong upcoming holiday shopping season. Online sales on Friday hit $7.4 billion according to Adobe Analytics. This is a 19.6% increase from last year and the second largest online shopping day ever. Walt Disney’s (DIS) release of Frozen 2 set a box-office record for an animated debut, with $358 million of ticket sales globally. Tesla (TSLA) remained in the headlines, as Elon Musk claimed that the company had 250,000 preorders for its electric truck. Merger mania continued with announced unions between Charles Schwab (SCHW) and TD Ameritrade (AMTD), LVMH (LVMUY) and Tiffany (TIF) and Novartis (NVS) and Medicines (MDCO). eBay (EBAY) also announced a deal to sell StubHub to Swiss ticket reseller Viagogo for $4 billion.

Looking Ahead:

The Institute for Supply Management releases its Manufacturing Purchasing Managers’ Index for November on Monday – economists forecast a 49.3 reading, up from October’s 48.3 print. General Electric (GE) holds an investor day in Chicago to discuss its health-care division. Bank of Montreal (BMO), Workday (WDAY) and Salesforce.com (CRM) report earnings on Tuesday. Wednesday brings financial results from AutoZone (AZO), H&R Block (HRB), Royal Bank of Canada (RY) and Slack Technologies (WORK). Microsoft (MSFT) hosts its annual meeting of stockholders via a live webcast. ADP releases its National Employment Report for November – estimates call for a gain of 140,000 private-sector jobs, up from October’s 125,000 increase. Brown-Forman (BF), Dollar General (DG), Kroger (KR) and Ulta Beauty (ULTA) announce financial results on Thursday. On Friday, the Bureau of Labor Statistics (BLS) releases the jobs report for November – expectations are for a 186,500 rise in nonfarm payrolls. The unemployment rate is expected to be unchanged at 3.6%.

Tufton Capital Team hopes that you have a wonderful week!