The Third Quarter of 2016: The Calm Before the Storm

by Eric Schopf

The third quarter proved to be somewhat docile for the stock market when compared to the first and second quarters. There was no interest rate increase hangover like we experienced in January, and no Brexit panic that rocked the market in June. A total return of 3.85% for the three months leaves the S&P 500 up 7.84% for the year. The bond market was much more volatile. The 10-year U.S. Treasury started the quarter with a yield of 1.47%. Interest rates steadily climbed during the quarter and peaked at 1.69% on September 21st, the day the Federal Reserve released its meeting minutes. To put the increase in interest rates into perspective, investors buying the 10-year note at a yield of 1.47% at the beginning of the quarter would have lost 3.8% of their principal when rates reached their intra-quarter peak. This 3.8% is the equivalent of over two and one half years of interest income. With only ten years to collect interest payments, there is little margin for error. Interest rates have retraced some of their gains, and the 10-year Treasury closed the quarter at 1.58%. The Fed’s dovish stance, reflective of the low growth and low inflation environment, continues to keep interest rates low and stock prices high. The S&P 500 reached all-time highs through July and August.

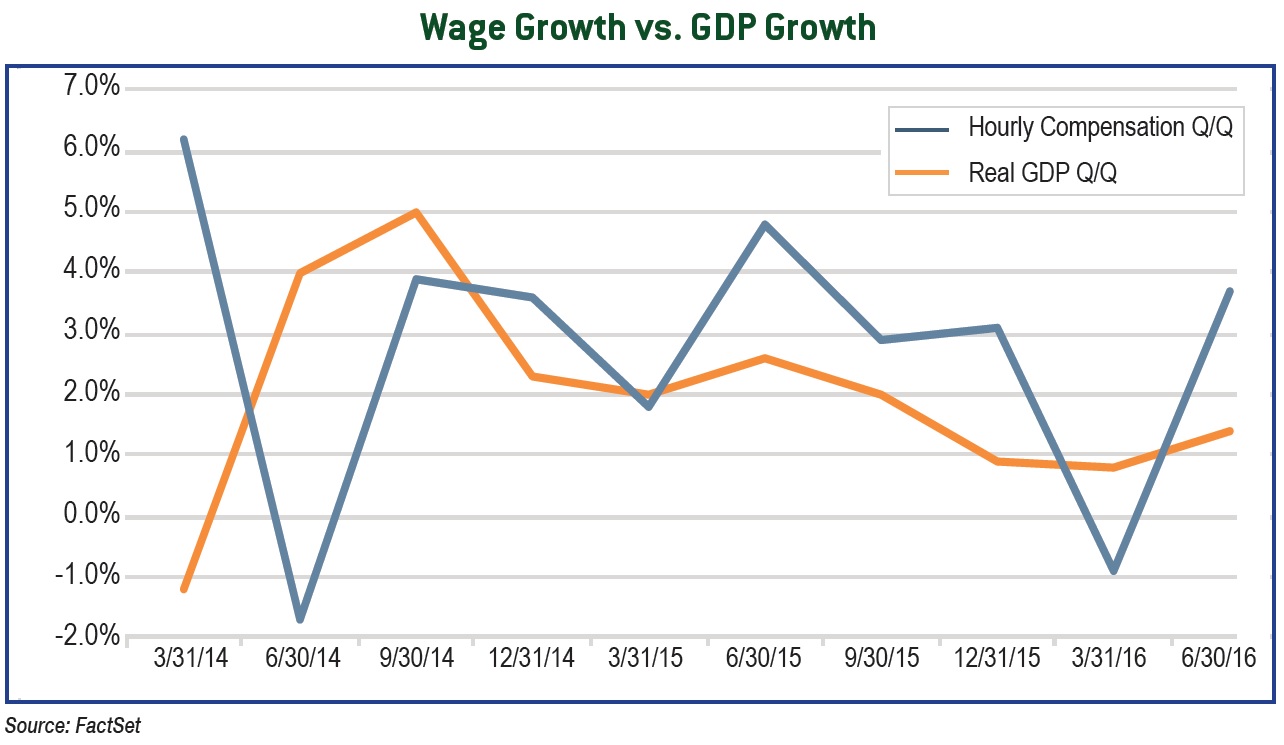

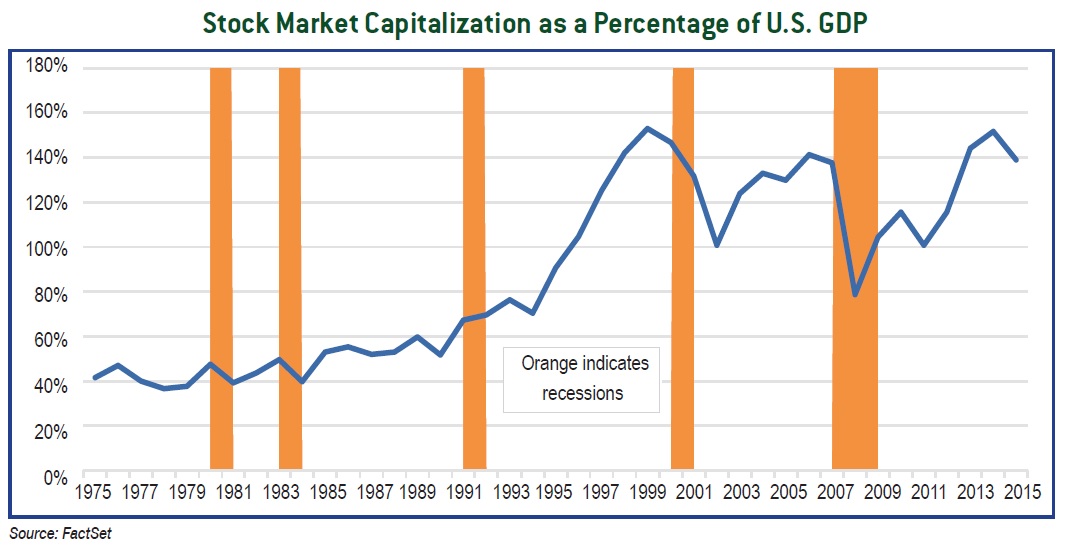

Although the market was more placid during the third quarter, we continue to remain on high alert. S&P 500 earnings will likely fall for a sixth consecutive quarter as we close the books in September. Corporations have responded by reducing fixed investment and slowing the rate of hiring. Productivity has slipped when comparing wage growth to the growth in GDP. If the situation does not improve, we may see a shift from slow hiring, to no hiring, to outright layoffs as corporations take measures to maintain profitability. Despite the difficult earnings environment, the S&P 500 is down only 2% from the all-time high reached in August. Equity valuations, a function of earnings and prices, are stretched. Many corporations have supported the cause by leveraging their balance sheets to repurchase shares. For the first time since before the market correction of 2000, the market capitalization of U.S. stocks is close to 150% of GDP.

Accommodative monetary policy is having a profound impact on global bond and stock markets. However, alternative views are beginning to emerge on the usefulness of ultra-low, and in some cases, negative interest rates. Rather than spurring demand, we are finding that low interest rates lead to greater savings rates as rational individuals act to offset their drops in investment income. The Bank of Japan has shifted its monetary policy to move closer to a zero interest rate instead of a negative rate. The U.S., in a position to learn from Japan’s experience, is less likely to travel down the same negative interest rate path.

The third quarter may have been the calm before the fourth quarter storm. The presidential election has the potential to be the eye of that storm. If nothing else, the rise in Mr. Trump’s popularity is an indication that fiscal austerity has lost its punch. Many members of the electorate feel disenfranchised and are ready for change. Regardless of who wins, deficit control may give way to tax cuts and expanded benefits. The Federal Reserve would then have to reassess its accommodative position in the face of fiscal policy actually being expansionary instead of neutral or negative. Higher interest rates would shift the current tailwind into a headwind for richly valued stocks.

The changing economic and political landscape has kept us busy this year. As you have noticed in your portfolio, we have sold or reduced numerous stocks over the past nine months. As always, we have been cautious and selective when buying new positions and adding to existing names. We took the opportunity in mid-September to increase bond positions in balanced portfolios when interest rates moved higher leading up to the Federal Reserve Open Market Committee meeting. Given the uncertainty that prevails and the solid equity returns, our focus has been to maintain asset allocation targets in the face of risk.