The Weekly View (3/5/18)

What’s On Our Minds:

Why was the Dow down 700 points last week between Thursday afternoon and Friday midday? Don’t the markets know the U.S. has a trade deficit, not a trade surplus?

To make sense of the reaction, there are two things we need understand: trade deficits and tariffs.

A trade deficit sounds scary. It sounds like “deficit spending,” which we all know is bad. But a trade deficit isn’t necessarily bad. In fact, sometimes it is decidedly good. A trade “deficit” just means that there is more money coming in than going out (exports-imports). We would expect that to be the case if our companies are doing well, our tax system has improved, and foreign investors and companies want to spend their money in the U.S.

As long as the US economy is strong, we want money to be coming into the country. And the US economy looks very strong. Your own political leanings can lead you to your own conclusions about why it is strong, but every economic indicator is looking up for the U.S.

Then there’s the issue of tariffs.

A tariff reduces the deficit by making certain imports more expensive for U.S. buyers. This makes domestically-produced goods look cheaper by comparison. The domestic producers’ companies are thereby protected from foreign competition.

This sounds good- why not protect our companies from foreign competition? This was indeed the general attitude in economics until David Ricardo developed the theory of comparative advantage in 1817. Without going into too much economic detail, comparative advantage shows that if every country produces what it is best at making (has the comparative advantage), and lets other countries make their best products, all the countries will benefit! It’s counterintuitive, but by letting everyone sell what they produce best, everyone ends up with more wealth overall.

Why make tariffs at all, then? Comparative advantage tells us the country will be better off overall, but that doesn’t mean every industry within the country will thrive. A concrete example (with made-up numbers for simplicity) is to suppose China can produce and sell steel for $50 a ton, but Americans can only produce it for $100 a ton. If we slap a tariff on steel, yes, it will save the 100,000 workers’ jobs at the steel mills. It also means all our manufacturers are paying $50/ton more for steel. If those manufacturers are buying 10 million tons of steel, that’s a difference of $500,000,000 that the consumer ends up paying in higher prices. That’s a lot of money, but the headline reading “1,000,000 Cars Cost $500 More on Average” isn’t quite as eye grabbing as a headline reading “100,000 Steel Workers Lose Jobs.”

In the end, economics, rather than politics, will drive the market.

Last Week’s Highlights:

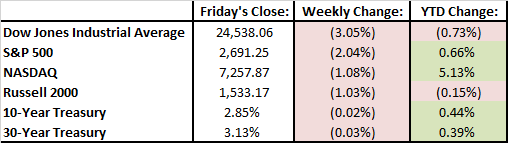

Markets fell last week and finished February in the red. This was the first monthly loss for the S&P 500 since October of 2016. Equity markets remained volatile last week, with four out of five trading days experiencing a move exceeding 1%.

On Thursday, President Trump announced he wants a proposed 10% tax on all aluminum imports and a 25% tariff on steel, causing U.S. stocks to fall sharply. American steel and aluminum manufacturers praised the policy but other businesses did not. Critics of the President’s announcement noted that consumers will see prices increase on everything from cars to canned goods to baseball bats.

On Saturday, the President held firm on his trade plans Tweeting; “Our jobs and wealth are being given to other countries that have taken advantage of us for years. They laugh at what fools our leaders have been. No more!” He also threatened a tax on European cars after the European Union threatened to tax American made motorcycles, bourbon, and jeans.

Looking Ahead:

Investors will continue to grapple with the economic consequences of newly-imposed tariffs and potential retaliation from other U.S. trading partners.

Investors are also preparing for the month’s biggest economic report – the February jobs report. This report will likely weigh on the Federal Reserve’s interest rate decision on March 21st. Investors are expecting that the U.S. economy added 205,000 jobs and that the unemployment rate fell to 4%.