The Weekly View (3/19/18)

What’s On Our Minds:

What is an activist investor? Well, sometimes companies just need a little push.

As activists, investors look to maximize their own returns by taking large enough positions in the company’s stock that they can influence management decisions. Often, they are looking to shake things up at the company. Activists may decide to move in on a company if they believe management has stumbled, it would be better off as a private company, it has excessive costs, or if the activist thinks they have a better capital allocation strategy, such as buying back stock or raising the dividend. Activist investing continues to gain supporters (and investment capital), according to Hedge Fund Research, activist funds’ assets under management increased by four times over the past 9 years, from a level of $32 billion to $176 billion.

Recently, activists have achieved increased success and gained credibility as the size of their targets have grown. Last year, Nelson Pletz was successful in his fight for a seat on the board of directors at Proctor and Gamble, a mega-cap blue chip company.

Often, activists are targeted by the media and politicians for being “hit and run” investors, but activists will argue that they are genuinely concerned about companies and the U.S. economy. The issues surrounding activism are not clear cut: some activist may just be greedy, while others want to maximize shareholder value over the long term. In 2016, billionaire investors decided to take on these attacks from Washington by launching their own lobbying group to fight these attacks, The Council for Investor Rights and Corporate Accountability (CIRCA). Bill Ackman, Paul Singer, Carl Icahn, Daniel Loeb, and Barry Rosenstein are the group’s largest backers. Together, they manage over $90 billion and believe that lousy corporate performance is a drag on the US economy.

Activists take positions in different types of companies across many different industries and of various market caps. Often, though, activists target companies that have been under pressure and are considered value stocks. At Tufton Capital, we are not activist investors, but we do look for undervalued stocks. Therefore it’s not uncommon for companies in our equity portfolio to have activist involvement. As a result of this overlap, we do have to pay attention to the hype created by these market players.

While activist investors grab plenty of headlines, it’s tough to determine the actual impact activism is having on the overall market. According to a study conducted by the Wall Street Journal last year, of the largest 71 activist campaigns between 2009 and 2014, only 50% of targeted companies outperformed their peers- that is, the same as chance.

Last Week’s Highlights:

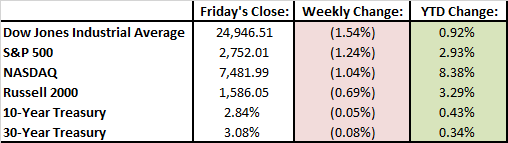

Stocks were lower last week and we continued to see elevated volatility. Partisan reaction to President Trump’s proposed steel and aluminum tariffs grabbed headlines. In a partisan flip flop, Congressional Republicans discussed limiting Presidential power on tariffs, while Democratic Senator Elizabeth Warren supported them. Technology stocks, which have been the best-performing sector so far in 2018, experienced a pullback last week as President Trump also proposed tariffs on Chinese imports.

Looking Ahead:

While tariff fears and political headlines influenced the market last week, investors will likely refocus on the Federal Reserve this week. The Fed will hold its two-day policy meeting on Tuesday and Wednesday where it is expected that Jerome Powell will increase interest rates for the first time in 2018. Investors will be listening to his comments Wednesday to hear how they might deviate from his predecessor, Janet Yellen. The federal funds futures market expects three rate increases by the end of the year, with a more than 30% chance of four.