The Weekly View (4/9/18)

What’s On Our Minds:

Receiving dividend payments from your equity holdings every quarter is similar to collecting interest on money in a savings account – it’s very nice but it’s not exciting. Buying a stock and betting its share price will increase is much more exhilarating, but today we will take this opportunity to remind our readers of the several advantages of owning dividend-paying stocks.

- Dividends provide passive income, which investors can either spend or reinvest. Dividend-paying stocks are particularly attractive to folks looking to benefit from supplemental income, especially retirees.

- Companies that pay a dividend tend to be mature and stable.

- Dividends can be viewed as a hedge against inflation. Many blue-chip companies pay a dividend higher than the rate of inflation. Unfortunately, a savings account simply cannot keep up.

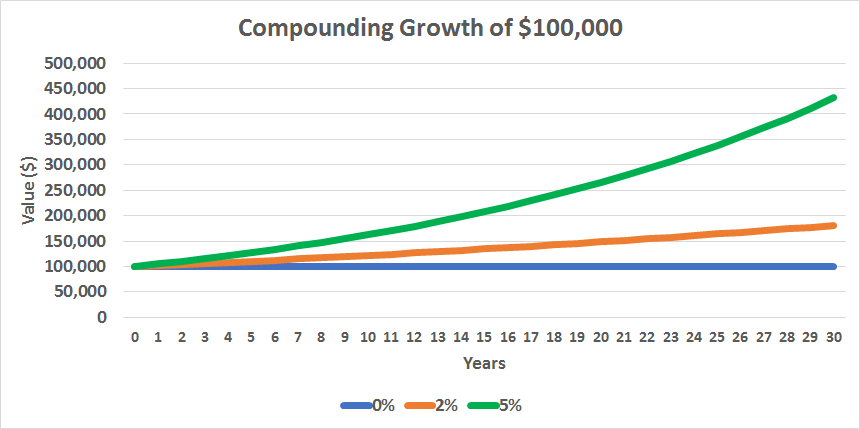

Investors who opt to re-invest their dividends, rather than spend them, have far better investment returns thanks to compounding interest. With compounding, your original investment is growing due to repeated reinvestment, and every year you are getting a larger and larger sum of interest. Imagine a snowball rolling downhill, growing bigger in size as it picks up more snow along the way.

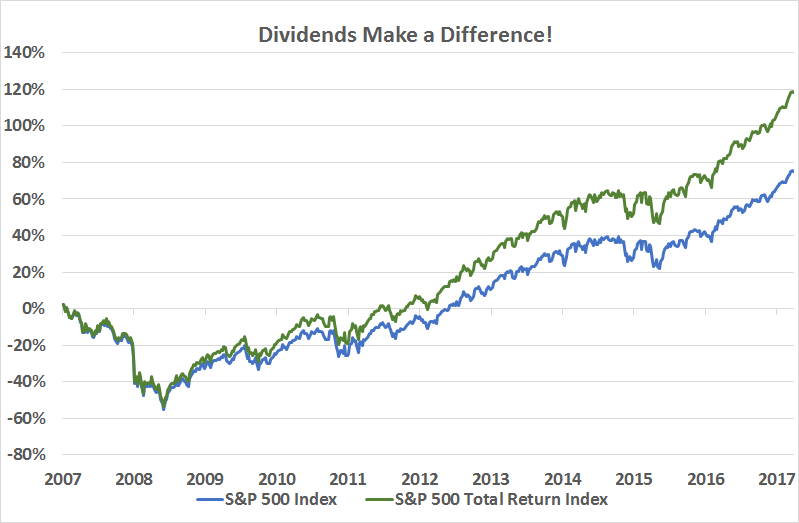

Dividends are central to your long-term returns and studies have shown that if you don’t own dividend paying stocks, it is likely that you will underperform the market over the long term. Credit rating agency Standard & Poor’s recently conducted a study showing that over the past 80 years dividends were responsible for 44% of the S&P 500’s total return.

The chart below shows the S&P 500 Index’s return vs. the S&P 500’s total return which includes dividends. Dividends make a difference!

Last Week’s Highlights:

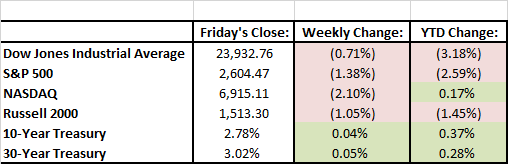

Ebbing and flowing concerns over a potential trade fight between the U.S. and China and the impact such a scuffle would have on domestic and global growth drove a series of ups and downs for the stock market last week. On Monday, China announced it would impose tariffs on $3 billion of U.S. goods in response to the steel and aluminum tariffs President Trump announced last month. The White House retaliated with a proposed tariff on 1,300 Chinese products worth about $50 billion. Then, the Chinese matched that with a $50 billion tariff on U.S. automotive, agriculture, and aerospace industries.

Looking Ahead:

While headline news from the White House may continue to drive market volatility this week, investors’ attention will also return to corporate earnings with large U.S. financial services firms reporting late in the week. This group includes Well Fargo, Citigroup, J.P. Morgan Chase, and Blackrock. Investors will also be watching the release of inflation data and the Federal Reserve’s minutes from March.