The Weekly View (5/29/18)

What’s On Our Minds:

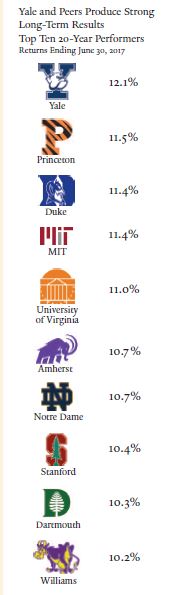

On Memorial Day, Yale University’s Men’s Lacrosse team took down Duke for the program’s first ever National Championship. While Yale may now be known for its strong lacrosse program, the school’s endowment fund has long been heralded as an investment powerhouse under the leadership of David Swensen, who has been the endowment fund manager at the school since 1985. While he underperformed the S&P 500 during their 2017 fiscal year, his long-term results remain in the top-tier of institutional investors. Over the past 20 years, Yale’s endowment has recorded annualized returns of 12.1%, and during that period the endowment fund grew from $5.8 billion to $27.2 billion. For the sake of comparison, the S&P 500 returned just 7.15% over that same period.

Swensen’s strategy has been so successful that numerous other endowment funds have followed suit and adopted his model. At Yale, Swensen plays “quarterback” where he allocates funds to various outside money managers that he believes can outperform. During his tenure, he has continuously increased Yale’s allocation towards alternative investments and hedge funds, or what he refers to as “absolute return” strategies. He is an avid supporter of hiring active managers and he believes their fees can be justified over the long term.

In last year’s annual letter, he wrote “Net performance matters. Strong active management has contributed to Yale’s outstanding absolute and relative performance. While passive investment strategies result in low fee payments, an index approach to managing the university’s endowment would shortchange Yale’s student, faculty, and staff now and for generations to come.” Swenson’s strong support for the active manager model is in stark contrast with Warren Buffet who believes most investors would be better off in an index fund.

It may seem tempting to try and mimic David Swensen’s strategy at Yale, but it’s important to remember that he has a few distinct advantages over individual investors, and unfortunately, it’s virtually impossible to copy his model. First, universities have a boundless time horizon, which means they can take much riskier investments than what would be prudent for an individual. Another consideration is that due to the size of endowments that utilize numerous complex strategies, they enjoy lower fees than even the wealthiest private investors. Lastly, universities don’t have to worry about Uncle Sam taking a piece of the pie. The tax free exemption is by far the biggest advantage that endowments have over everyday investors. With long term capital gains taxed at 15-20%, a school’s tax-free status makes a huge difference in their annual returns.

While it’s easy to get caught up in the notion that you might be able to beat the market over the short term, we suggest that our clients and friends take a note from Swensen and remain focused on the long term success of their investment portfolio. Yale’s endowment has underperformed in recent years but Swensen’s 20-year performance figures are extremely impressive.

Last Week’s Highlights:

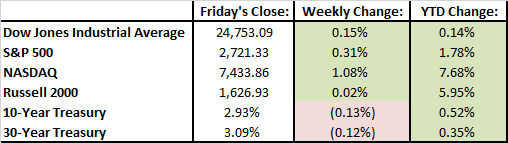

Stocks edged out slight gains last week. Stocks were up and down over the course of the week as both setbacks and developments were made in trade negotiations with China. Ongoing tensions with North Korea also weighed on investor sentiment last week. The Federal Reserve also came into play as it announced it planned to stay the course and gradually continue increasing interest rates.

Looking Ahead:

U.S. markets were closed on Monday in observance of Memorial Day. The Conference Board releases its index of consumer confidence for May on Tuesday and the Federal Reserve releases its beige book on economic conditions on Wednesday. The Federal Reserve will hold a meeting in Washington on Wednesday to discuss possibly changing the Volcker Rule, which could ease restrictions that ban proprietary trading by banks. U.S. nonfarm payrolls for May will be reported on Friday. Investors are expecting the unemployment rate to hold steady at 3.9%.