The Weekly View (12/03/18)

Last Week’s Highlights:

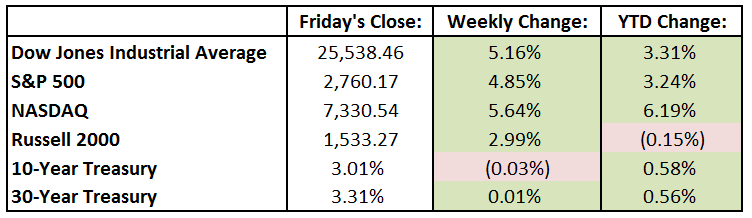

U.S. stocks rebounded sharply last week, initially helped by Black Friday and Cyber Monday holiday sales reports. Things got really exciting on Wednesday when Federal Reserve Chairman Jerome Powell stated that interest rates are “just below neutral”, signaling to investors that fewer rate hikes may be on the horizon. Powell’s dovish tone resulted in stocks and bonds rallying, and the U.S. 10-year Treasury yield fell below 3%, its lowest level in over 10 weeks. The Dow Jones Industrial Average (DJIA) rose 1252 points, or 5.16%, to 25,538.46, while the S&P 500 increased 4.85% to 2760.16. The beaten-down tech-heavy NASDAQ soared 5.64% for the week to 7330.54. General Motors (GM) announced plans to stop making some models, which will result in nearly 15,000 job cuts. The European Union approved the draft Brexit plan negotiated by U.K. Prime Minister Theresa May. An agreement is now needed from Parliament, which may be more challenging. Tariff rhetoric continued throughout last week, as President Trump and Chinese President Xi Jingping continued their threats ahead of the G20 meeting (more about that below).

Looking Ahead:

G20 trade talks over the weekend in Buenos Aires resulted in a trade truce between China and the U.S., setting the stage for a powerful market rally to start the week. The deal was greeted with relief as concerns over a new Cold War between the two largest economies abated. On Monday, we’ll see earnings from Finisar (FNSR), and Ford Motor (F) reports U.S. sales data for November. The Institute for Supply Management releases its Purchasing Managers’ Index for November, with expectations calling for a 57.5 reading. Tuesday is a busy one for earnings, as we’ll see results from AutoZone (AZO), Dollar General (DG), Hewlett Packard Enterprise (HPE) and Toll Brother (TOL). Wednesday has been declared a Federal Holiday in honor of the 41st President of the United States, George H.W. Bush. Markets will be closed that day. Wednesday also brings earnings from H&R Block (HRB) and Brown-Forman (BF), and ADP releases its National Employment Report for November (expectations call for a 200,000 gain in private-sector employment after adding 227,000 jobs in October). On Thursday, OPEC and several of its allies will meet in Vienna to discuss possible production cuts for 2019. We wrap up the week with earnings from Vail Resorts (MTN). Also on Friday, the Bureau of Labor Statistics releases its employment report for November. Estimates call for an increase in nonfarm payrolls of 200,000 after jumping 250,000 in October.

The Tufton Capital Team hopes that you have a wonderful week!