Are you FED up?

By: Alex Olshanskiy

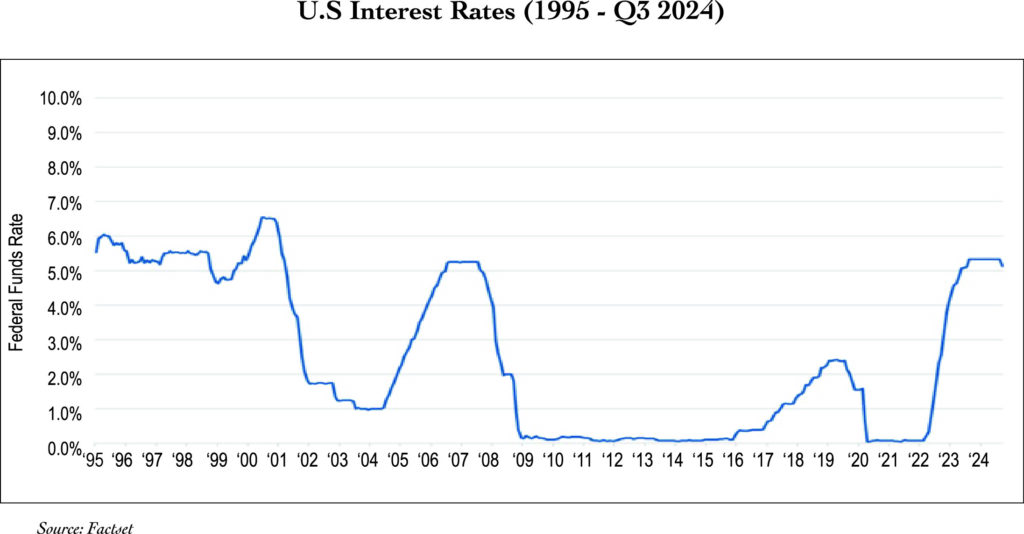

On September 18, the Federal Reserve’s (Fed) Open Market Committee made headlines by announcing a rate cut that exceeded market expectations. This decision, long anticipated and hotly debated throughout 2024, is being viewed as a potential catalyst for significant movements in both interest rates and stock prices.

Market reactions have been mixed following the announcement. There was a notable initial dip, but the markets rebounded the next day, indicating a more nuanced response to this pivotal change. The Fed’s recent actions may ripple through various industries and financial markets, and although every situation is different, there are certain insights that help us navigate the evolving economic landscape.

The theory is that by cutting rates, borrowing costs will decrease, which will prompt businesses to take out loans, to hire more people and to expand production. This logic works in reverse when the economy is hot. However, the Fed sets only one interest rate—the Fed Funds rate—and that none of the rates we encounter in our lives, whether as consumers (on mortgages, credit cards or fixed deposits) or businesses (loans and bonds), are directly set by or even indexed to this rate. The Fed Funds Rate is an overnight intra-bank borrowing rate that primarily affects short-term lending between banks. This means that while the Fed can influence overall borrowing costs, the relationship is not direct. Instead, various factors including inflation, market conditions and risk perceptions also play significant roles in determining the interest rates consumers and businesses actually face.

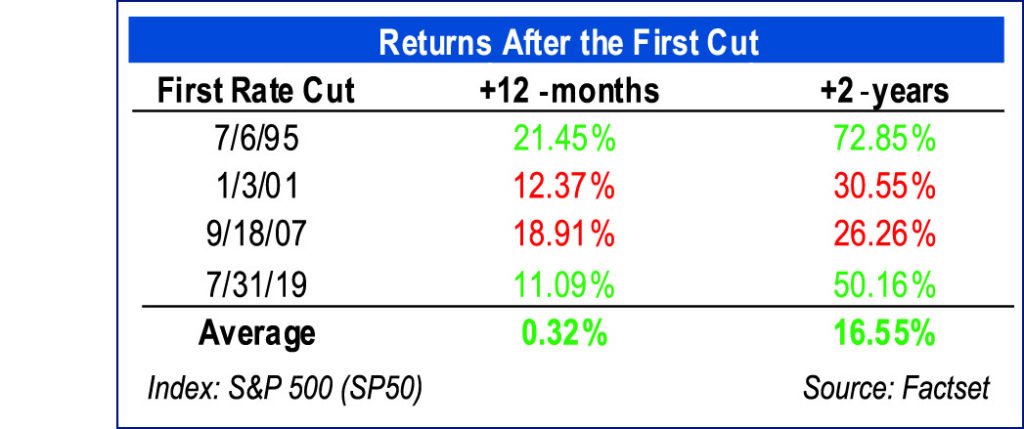

What happens after the Fed begins to cut interest rates? Based on the last four first-rate cuts after rate-hiking cycles, the S&P 500 has generated mixed returns (on a cumulative basis). After twelve months, the average return is 0.32%, and after two years, the average return is 16.55%. Although the Fed controls the Federal Funds rate, its effects eventually trickle down to lower discount rates, which can enhance the present value of future cash flows for businesses. This, in turn, tends to boost investor sentiment and drive equity prices higher over time.

This sure does sound good, but why does the Fed cut rates? One interpretation is that the Fed is finally convinced that inflation has been effectively tamed, and that lower inflation may persist. However, the decision to implement a fifty-basis point decrease—double the anticipated twenty-five basis points—suggests that the Fed may be responding to more concerning signs of an economic slowdown that aren’t fully reflected in public employment and growth data.

With an election looming there is a more cynical perspective to consider. Some critics argue that the Fed’s decision to cut rates could be less about addressing inflation or fostering genuine economic growth, and more about political considerations.

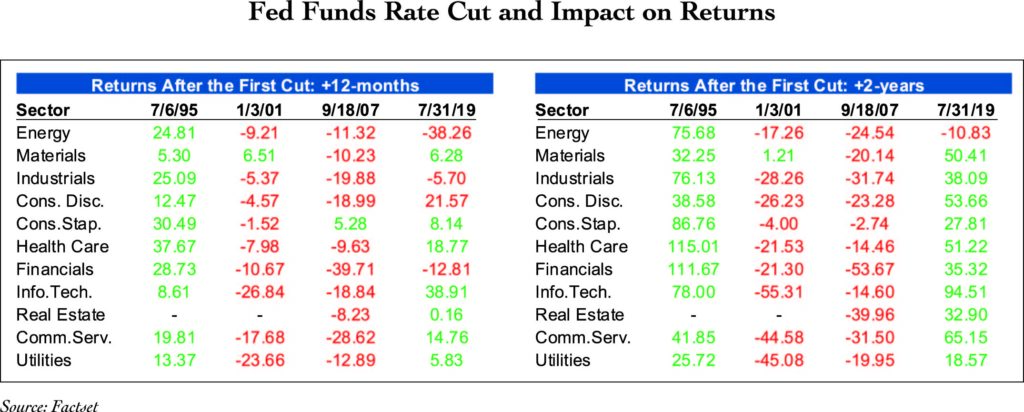

Different sectors in the market perform differently after an initial rate cut. Defensive sectors (such as Consumer Staples and Healthcare) tended to outperform after one and two years after the first initial cut after a restrictive monetary policy.

The future remains uncertain. Here at Tufton Capital we find and invest in companies that can maintain or even increase cash flows, regardless of the rate cycle. We identify businesses with strong fundamentals, robust cash flow generation and competitive advantages that enable them to weather and thrive in varying economic conditions. As we navigate this shifting landscape, it’s essential to remain adaptable and informed, and we will continue to monitor indicators such as inflation trends, employment figures and consumer sentiment that will assist us in making strategic investment decisions.