The Third Quarter of 2024: The Hits Just Keep on Coming

By: Eric Schopf

As the air grows cooler and the daylight hours grow shorter, the dreams of the boys of summer have once again been dashed. For the second consecutive year, the young hopefuls of Camden Yards suffered an early exit from the American League Wild Card series, scoring just one run over two games. The same, however, cannot be said for the U.S. stock market. Its winning streak continues following robust third quarter results. The broad market delivered a total return of 5.89%, bringing the year-to-date total to 22.08%. While the market is short of the 30% returns delivered in 1997, it has still managed returns greater than 20% throughout the first three quarters of the year. Alas, the Orioles won the American League East in 1997, but the Cleveland Indians clinched the pennant and advanced to the World Series.

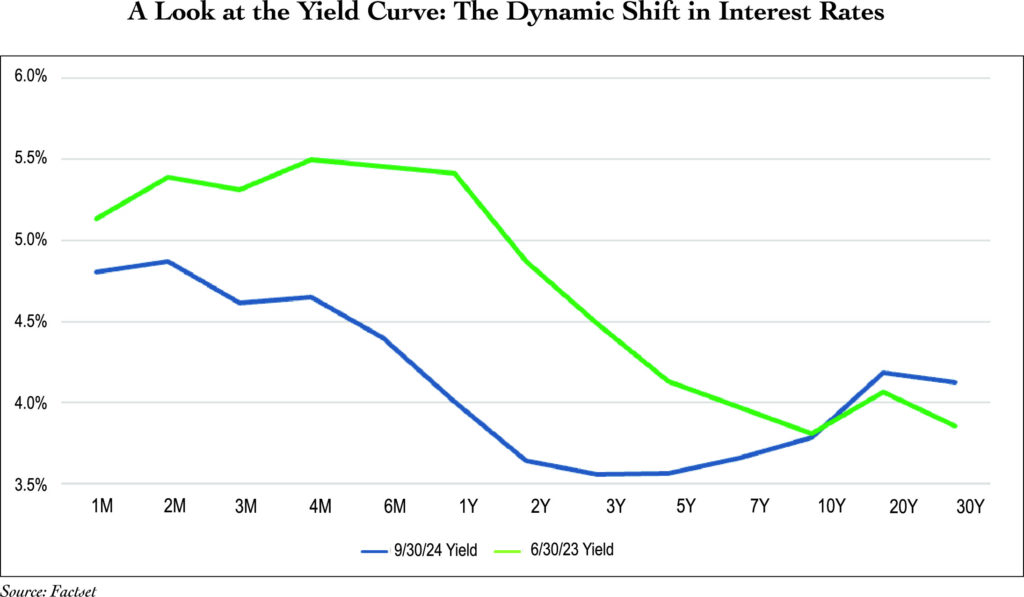

The bond market settled down in the third quarter with interest rates declining across the yield curve. The exception was in yields for bonds due in ten years or greater where the rates ticked higher. The Federal Reserve finally delivered the long-anticipated interest rate cut in September. However, the 50-basis point (one-half of one percent) cut was not widely anticipated. Although not unprecedented, cuts of that magnitude have typically been reserved for crisis-type events, such as the Dot Com bubble in 2001, the Great Financial Crisis in 2007-2008 and the Pandemic of 2020. The Fed typically moves in measured 25-basis point increments.

The most interesting dynamic of the shift in interest rates took place in the 10- to 30-year portion of the yield curve. The decline in shorter-term bonds was to be expected because they are closely tied to the Federal Funds rate. The fact that longer-term rates, which are primarily set by market supply and demand conditions, edged higher gives us a glimpse into the future as the yield curve normalizes. The inverted yield curve (when short-term interest rates are higher than long-term rates) present over the past two years has been very unusual for its lengthy duration.

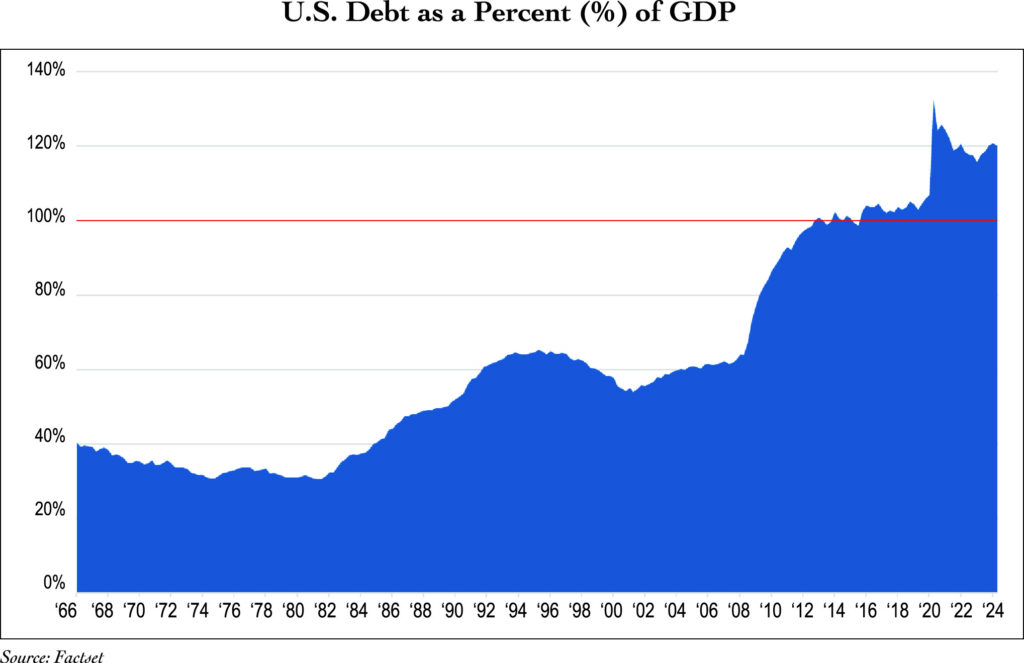

The Federal Reserve has played a very active role over the past fifteen years as the economy lurched from one crisis to another. The Great Financial Crisis required a dose of lower interest rates combined with some financial gymnastics to keep the money flowing. Economic growth in the years following the Crisis was uneven, but inflation was stable and well below long-term levels. The Fed was steady at the helm and kept interest rates low. It wasn’t until 2015 that economic growth and inflation began to accelerate. The Fed responded by raising interest rates. The Federal Funds rate moved from .25% to 2.5%. The Pandemic and brief recession resulted in rates once again being cut to .25% by May 2020. The aggressive and persistent monetary policy, combined with excessive fiscal policies, resulted in inflation levels not seen in the last forty years. We have now seen the first of what will most likely be many interest rate cuts on our way to a yield curve that is more normal in shape. There is a time-value aspect to finance that is very important—a dollar received today is worth more than a dollar received in the future due to the impact of inflation and the opportunity cost associated with investing that dollar today. An inverted yield curve disrupts this financial balance. The burgeoning federal debt has placed additional stress on interest rates and may keep longer-term interest rates elevated. The national debt now stands at roughly $36 trillion, equivalent to 125% of our gross domestic product. Prior to the Pandemic, the debt stood at $23 trillion, or 105% of our economic output.

Receding inflationary pressure and a softening labor market provide the support for further rate cuts. The dual mandate boxes of full employment and price stability have already been checked. Hesitation on the part of the central bank up to this point can be linked to the unusual economic conditions in the years following the Pandemic. Many once-reliable economic indicators whiffed in their predictive capacities. The Index of Leading Economic Indicators, the inverted yield curve and the Sahm rule, all highlighted in previous Viewpoints, provided false positive recession signals. The current economic backdrop signals a soft landing, with the economy slowing down enough to reduce inflation without causing a recession.

Perhaps the greatest risks lie outside of our borders. The situation in the Middle East is different this time. The attack on Israel one year ago has provoked an unwavering Israeli response that is now expanding geographically. The scope, scale and duration of the conflict indicate a great level of uncertainty. Our relations with China are deteriorating, which pushes them further to expand their relations with Russia. Trade agreements and the availability of goods impact employment as well as inflation. The Russian invasion of Ukraine almost three years ago continues to drain U.S. resources and goodwill.

The state of the economy cannot be overemphasized as we approach election day. The presidential election will clearly be close, and many congressional seats will be in the balance. In attempts to win over the electorate, Vice President Harris and former President Trump continue to introduce competing programs affecting taxes, trade and immigration. Predicting the winner and gauging policy implementation is nearly impossible. We continue to monitor the elections and will do our best to position your portfolio for success.

The economic backdrop that portends a soft landing today can quickly change as employment and inflation conditions are altered. Given the uncertainties, we at Tufton Capital will monitor the elections and do our best to position your portfolios for optimum financial success.