The Weekly View (1/4 – 1/8)

What’s On Our Minds

Last week, good news was hard to come by in the investment section of any paper and investors took it on the chin. It’s not easy seeing your holdings come down in value when the market experiences a pullback. Value investors seek opportunity in these situations, and while many investors rushed for the exits last week, our firm’s shopping list grew and we carefully continue to look to put cash positions to work for our clients. In times like these we remember Warren Buffet’s quote: “Be fearful when others are greedy and greedy when others are fearful.”

Last Week’s Highlights

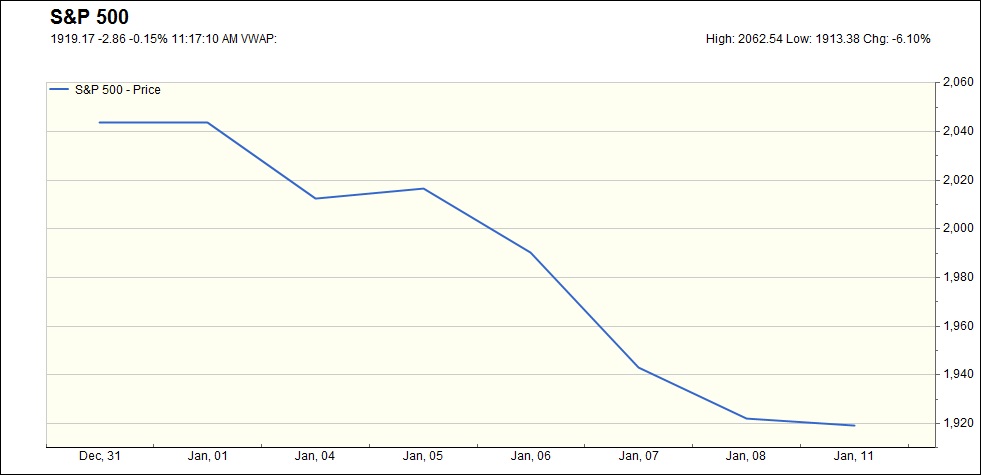

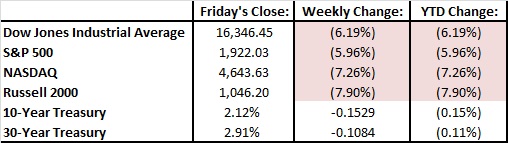

On the back of plunging stock prices in China, last week was nothing short of ugly on Wall Street as we experienced the worst opening week in history. On top of China’s woes, an alleged North Korean nuclear test, lower oil prices, and tensions in the Middle East added to bearish sentiments last week. With all this negativity on the Street, the S&P finished the week down 6%. On the bright side, Friday’s U.S. jobs report numbers were higher than expected and the automotive industry closed out 2015 with record domestic sales.

Looking Ahead

China’s markets continued their slide downward Monday in the face of a slowing Chinese economy and continued currency troubles. In domestic markets, Alcoa kicks off earnings season on Monday when the company reports 4th quarter earnings following the closing bell. This week, retail sales and consumer sentiment numbers are reported which, based on last Friday’s positive job numbers, could very well confirm that the US consumer is doing well.