The Weekly View (1/11 – 1/15)

What’s On Our Minds

Investors last week had concerns over corporate earnings and guidance as well as the further depreciation of the Chinese Yuan (implying slower economic growth from Chinese regulators). The decline in crude oil did not seem to help as WTI, the US Benchmark, fell to approximately 10.5%. Despite anxieties over global growth, there are several companies that have been beaten up year to date that will be able to grow their sales and earnings this year. Taking advantage of these opportunities, rather than locking in losses, is often the more prudent action.

Last Week’s Highlights

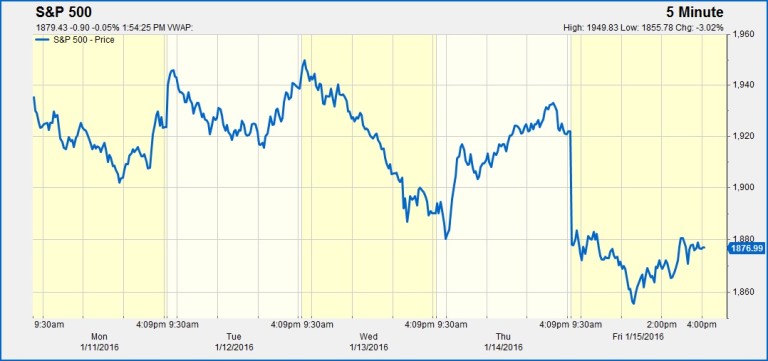

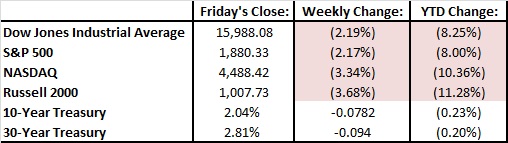

The markets had a rough second week with the Dow Jones and the S&P 500 falling 2.2%. The Dow Jones is now down 8.25% for the year and 10.7% off its all-time high while the S&P 500 is down 8% for year and off 11.8% from its all-time high. Year to date, the defensive Utility and Telecom sectors have shown to be the best performers while Materials has been hurt by concerns over global growth and lower interest rates continue to weigh on Financials.

Looking Ahead

Looking to the week ahead, the market will mostly be focusing on corporate earnings. On Tuesday, investors will get a gauge of the banking and financial sectors with earnings releases from Bank of America and Morgan Stanley. Results from the long-time technology blue chip IBM and new technology high-flier Netflix will also report after the closing bell. On Thursday, the railroads will report earnings – in addition to energy companies, this group has also suffered from the decline in crude oil as the transportation of the commodity has declined. Finally, the oldest Dow Jones component, General Electric, will give investors a view into the power, aerospace, energy, and health care sectors.

Hold on tight.