The Weekly View (2/15 – 2/19)

What’s On Our Minds:

Recently, equity markets have been volatile and wild intra-day price swings have many investors on the edge of their seats. In times like these, it’s more important than ever to stick to your guns and focus on your long term portfolio. In this sort of environment, we are reminded of Ben Graham’s “Mr. Market” whose view on an individual company’s share price changes from wildly optimistic one day, to overly pessimistic the next. According to Graham, the only way to beat Mr. Market was to perform fundamental analysis on a company to determine it’s fair market value and trade shares with Mr. Market accordingly. This oversimplified version of investing rings true today.

Last Week’s Highlights:

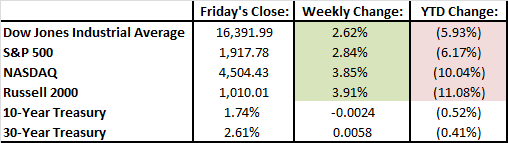

Last week was a breath of fresh air for investors as stocks rose out of correction territory. We saw the best week of the year with the Dow up 2.6%, the S&P 500 up 2.8% and the Nasdaq up 3.9%. Crude oil prices rallied last week on news that Saudi Arabia and Russia would agree to freeze production levels as long as other countries agree to participate. The Federal Reserve said that they would not change their economic outlook for the year but would keep a close eye on the global economy and developments in both the energy and stock markets.

Looking Ahead:

We will be monitoring economic and company data this week as we reach the end of 4th quarter earnings season. On Tuesday, January Existing Home Sales will be reported and J.M. Smuckers, Home Depot, and Macy’s will report earnings. On Wednesday we will see results from Target, HP, and Lowe’s followed by Campbell’s Soup, Best Buy and Kraft Heinz on Thursday. Finally, on Friday, J.C. Penney and EOG Resources will report their 4th quarter results and we will get a look at January’s consumption and personal income levels.