AIming for Long-Term Investment Resilience

By: Alex Olshanskiy

Devices, machines and systems are rapidly evolving towards greater intelligence. In recent years, the rapid advancement of Artificial Intelligence (AI) has emerged as a defining global force reshaping industries and investment landscapes. This transformative technology not only revolutionizes how businesses operate but also presents compelling opportunities for growth and innovation within our investment portfolios.

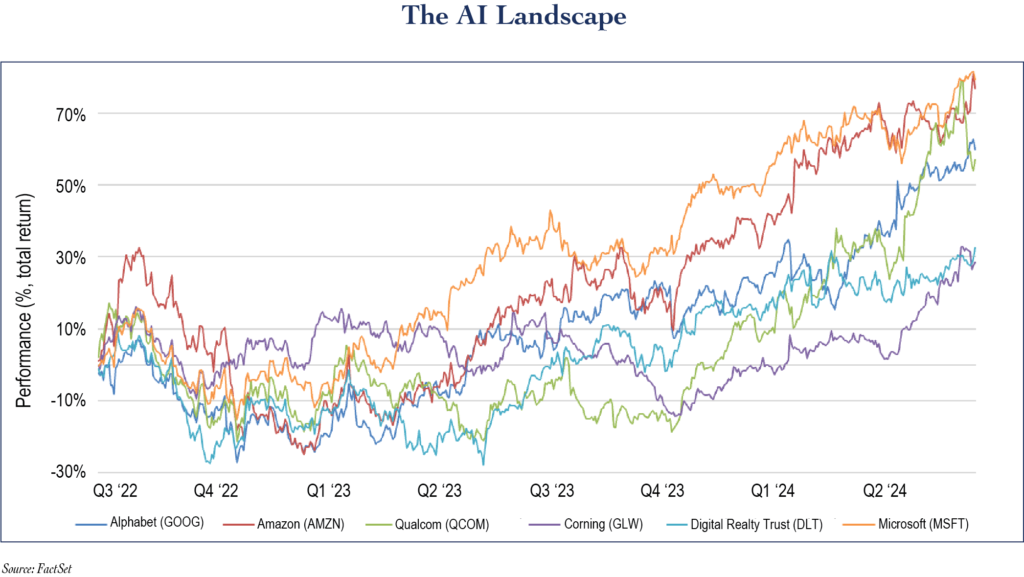

Across our holdings, leaders such as Microsoft (MSFT), Qualcomm (QCOM), Corning (GLW), Digital Realty (DLR), Google (GOOG) and Amazon (AMZN) are at the forefront of integrating AI into their business strategies. Microsoft’s Azure AI platform is empowering enterprises to harness machine learning for enhanced decision-making and productivity gains. Through strategic partnerships such as OpenAI, Microsoft is accelerating AI advancements by utilizing its robust infrastructure to train and deploy cutting-edge models such as GitHub Copilot, DALL·E 2 and ChatGPT.

Qualcomm is at the forefront of AI-driven innovations in 5G technology, showcasing significant progress in On-device intelligence. The Snapdragon® 8 Gen 3 Mobile Platform introduces a groundbreaking AI Engine capable of supporting up to 10 billion parameters for generative AI models directly on mobile devices, heralding a new era of creativity and technological advancement.

Meanwhile, Corning uses AI to optimize manufacturing processes and develop cutting-edge materials. The demand for fiber optics provides Corning with increased opportunities for innovation, which in turn could drive outperformance.

Digital Realty incorporates AI to enhance data center efficiency. Data centers will require the use of new technologies, such as AI systems, to provide more effective, secure and efficient services.

Google continues to push the boundaries of innovation with AI-driven products and services. Gemini, its largest and most advanced AI model, is setting new standards for capability and performance in the technology landscape.

Amazon’s foundational support for generative AI applications lies in its Amazon Web Services (AWS), which provides customers with scalable infrastructure, cost-effective solutions and a comprehensive suite of AI services. AWS empowers businesses across sectors to build and deploy AI models that drive innovation and efficiency.

As these companies continue to revolutionize and adapt, the investment environment surrounding AI remains dynamic. While AI-driven technologies present substantial growth opportunities, prudent navigation is essential amidst market fluctuations and valuation considerations. The recent surge in AI-related stocks underscores investor enthusiasm, but it also warrants caution regarding potential volatility in sectors where valuations may be perceived as stretched.

Our approach at Tufton emphasizes a balanced strategy that aligns with long-term growth prospects and resilience against market uncertainties. By actively monitoring industry trends and technological advancements, we aim to identify companies with sustainable competitive advantages and robust AI capabilities. This proactive stance ensures that your investments are well-positioned to capture the transformative potential of AI, while at the same time it effectively manages the risk.

We remain committed to providing insights and strategies that navigate the complexities of AI. Our focus on prudent investment decisions, supported by thorough research and analysis, aims to optimize portfolio performance and capitalize on the ongoing evolution of AI technologies.