By Ted Hart

NXP Semiconductors NV (NXPI) is a semiconductor company based in the Netherlands. It operates in the business of producing High-Performance Mixed Signals (HPMS) in four distinct lines. These lines include Automotive, Industrial & Internet of Things and Mobile and Communication Infrastructure. The company holds market leading positions within each of these business lines, and despite softer sales guidance due to the coronavirus, future growth for their products is still expected to outpace their respective markets. During the 1950s until 2006, the company was the semiconductor segment of Philips before it was sold to a private equity group. Though the spread of the coronavirus may temporarily slow growth, we believe there is a buying opportunity while we wait for sales to rebound. Recently, we have initiated positions in NXPI with the intention of achieving a full size position of 2% of equities.

By Ted Hart

Many investors may remember the mid to late 1990s when Microsoft (MSFT) first started firing on all cylinders. Founder and then CEO Bill Gates and President Steve Ballmer were dancing on stage to the Rolling Stones’ song “Start Me Up” before introducing Windows 95. Consumers lined the sidewalks outside of computer stores eagerly awaiting the release of the new operating system as if it were a new iPhone. Today, Microsoft investors are reliving those glory days, but it is not without a decade and a half of pain and heartache. (more…)

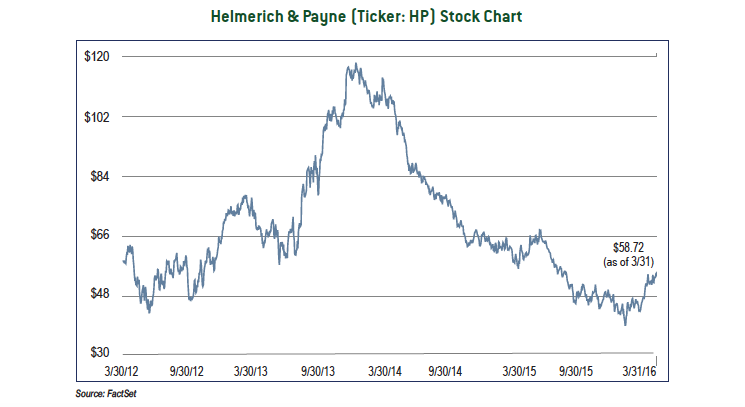

Helmerich & Payne (Ticker: HP) is a contract driller that provides well-drilling services for oil and gas exploration and production, specializing in meeting the unconventional needs of the Shale Boom. Counting some of the best oil and gas companies among its clients, HP leads the market in unconventional onshore drilling rig services, having developed a rig uniquely suited to drill horizontal shale wells with outstanding efficiency. The company primarily operates through its 343 US-based onshore rigs, though it also operates offshore and internationally in Latin America.

Since the 1990s, the rig specialist has secured a position at the forefront of the Shale Revolution through a history of principled innovation, anticipating the demands of the market to make drilling faster, safer, more adaptable, more mobile, and exploit any opportunity to increase the output on a drilling site. The company first introduced its FlexRig technology in the late 1990s to provide the market with a rig that has increased mobility and an ability to drill at a range of depths. The first two models of the FlexRig line, FlexRig1 and the FlexRig2, were designed to drill at depths between 8,000 feet and 18,000 feet. In 2001, HP introduced the FlexRig3 with enhanced safety features and an even wider range of depth capability – from 8,000 to 22,000 feet. The company next focused on increasing the efficiency of the drill site as a whole. The FlexRig4 in 2006 introduced a “skidding” feature that gave improved mobility, allowing up to 22 wells to be drilled on a single pad space. In 2011, the FlexRig5 continued this trend and facilitated long lateral drilling of multiple wells in a single location. But the most important contribution of recent years has been the FlexRig’s ability to adapt to unconventional horizontal shale wells with staggering efficiency. The rigs, in fact, are capable of fetching daily rates nearly 50% higher than their peers.

Despite uncertainty in the energy markets, Helmerich & Payne is trading at an attractive valuation. Though forecasting the sales and earnings may prove to be difficult, conventional valuations of onshore drilling companies can be calculated on the basis of the value per rig and per unit of horsepower. Given the company’s market share and the exceptional efficiency delivered by their rigs relative to competitors’, Helmerich & Payne is more than likely to command a premium rate on either basis. Previously, acquirers have paid as much as $24 million per rig in precedent transactions, according to investment bank Johnson Rice. At a valuation of $24 million per rig, Helmerich & Payne is worth $87 per share. On a basis of horsepower, acquirers have paid as much as $17,500 per unit. Based on this valuation, the company is worth nearly $97 per share.

More than likely, Helmerich & Payne will not be acquired, but their market position and current valuation provide a solid margin of safety for investors. Its management has proven to be prudent and conservative with their capital, distinguishing the company as one of the few in the energy universe that entered the downturn without any debt. Further, Helmerich & Payne has paid a dividend every year since 1977, and the stock is currently yielding about 5%. In a no-to-low growth world, we would be happy to be “paid to wait.”

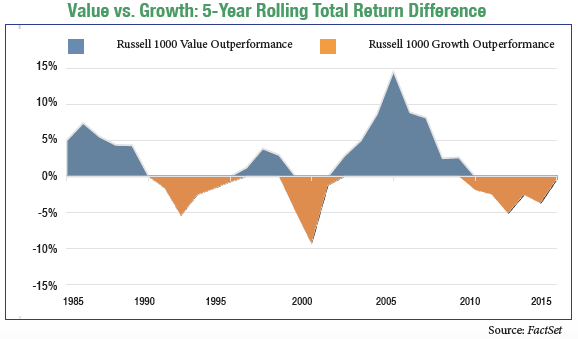

Generally speaking, there are two schools of investing: growth and value. Growth investors look to invest in companies that are normally growing their sales, earnings, and perhaps customers at a rate well above the typical company. A successful growth company firing on all cylinders and achieving the above factors often leads to the company’s stock outperforming the broader market. However, when the markets start to decline and overall growth is anticipated to slow, growth stocks frequently decline more than the market. On the other side of the spectrum lies value investing. Often, value investors are more risk-averse and first look for the downside scenario that might face a company. With the downside determined, value investors attempt to buy the company’s stock at a discount to the estimated intrinsic value. While the company’s earnings may not grow at a rate faster than or even matching the broader market, the expected downside in the company’s stock price is limited during periods of stock market volatility. As a result, value investing has proven to outperform growth investing over the long term.

The investing styles move in and out of favor depending on what investments are perceived to deliver the best returns. Since the beginning of this bull market in 2009, growth investing has been en vogue as investors have sought companies that are actually growing in a no-to-slow-growth economic environment. 2015 was no exception as Facebook, Amazon.com, Netflix, and Google were among the S&P 500’s best performers. Often known by the acronym FANG, these four companies held up the S&P 500 from further declines during the year, while the average stock in the index was down 18% from its 52-week high.

A handful of stocks leading the market is nothing new to Wall Street. In the late 1960s and early 1970s, investors were enamored with “the Nifty Fifty” which included companies such as IBM, Walt Disney, Coca-Cola & McDonalds. All came crashing down when the bear market arrived in 1974. A similar craze occurred in the late 1990s and early 2000s with several technology stocks, such as Microsoft and Intel, leading the market. Once the “tech bubble” burst, some overvalued technology stocks lost more than 80% of their value. A share purchased in Microsoft or Intel early in the 2000s would, even today, not have made an investor a single dollar.

At Tufton Capital, we practice the value investing philosophy, looking to outperform in bear markets while performing adequately in bull markets. There is no telling when the next bear market will arrive, but one thing is definite – we are currently in the second longest bull market of all time. Our style will come back into favor. Until then, we will maintain our discipline, be patient, and continue to focus on finding a dollar’s worth of assets trading for fifty cents.

The month of August showed the return of volatility in the financial markets. The S&P 500 dropped 11% in the span of seven days and the VIX, widely known as “the Fear Index,” hit an intraday high of 53 – a level not seen since the financial crisis. In one day of trading, the Dow Jones Industrial Average opened down more than 1,000 points within the first hour, causing a “Flash Crash” as many ETF investors attempted to run for the exits. All of this chaos resulted in the >10% correction we had been long awaiting.

The month of August showed the return of volatility in the financial markets. The S&P 500 dropped 11% in the span of seven days and the VIX, widely known as “the Fear Index,” hit an intraday high of 53 – a level not seen since the financial crisis. In one day of trading, the Dow Jones Industrial Average opened down more than 1,000 points within the first hour, causing a “Flash Crash” as many ETF investors attempted to run for the exits. All of this chaos resulted in the >10% correction we had been long awaiting.

Throughout this volatile time, I received texts and calls from relatives asking if they should sell or trim their portfolios. My response often was “What? Why would you? I’m buying!” As we have mentioned in previous articles, >10% corrections are common and have occurred about every two years since 1957. Selling or trimming your portfolio during these corrections is one of the (more…)

The U.S. Shale Revolution has proved to be nothing short of remarkable. Through the use of horizontal drilling and hydraulic fracturing, also known as “fracking,” the U.S. has become one of the world’s largest oil producers with production of 9.7 million barrels per day, representing approximately 10% of global production. However, many investors believe that the recent decline in oil prices to $60 per barrel has posed a threat to many U.S. shale producers.

The U.S. Shale Revolution has proved to be nothing short of remarkable. Through the use of horizontal drilling and hydraulic fracturing, also known as “fracking,” the U.S. has become one of the world’s largest oil producers with production of 9.7 million barrels per day, representing approximately 10% of global production. However, many investors believe that the recent decline in oil prices to $60 per barrel has posed a threat to many U.S. shale producers.

Although prior oil crashes have imposed drastic effects on oil producers, the dynamics of shale drilling offer a different production scenario. While production from a conventional well can produce a steady volume for several decades, production from the average shale well typically declines an estimated 60% to 70% after the first year. This drop forces companies to have more flexibility in well development in addition to well production. (more…)

The VIX (VIX), widely known as the “Fear Gauge” index, is a measurement of the implied 30-day volatility of the S&P 500. The higher the VIX, the more investors fear that a market decline is in the near future; conversely, the lower the VIX, the more complacent investors are about the market.

The VIX (VIX), widely known as the “Fear Gauge” index, is a measurement of the implied 30-day volatility of the S&P 500. The higher the VIX, the more investors fear that a market decline is in the near future; conversely, the lower the VIX, the more complacent investors are about the market.

This past summer, the VIX registered the lowest level seen in the last seven years, implying that investors are not fearful of a near-term market correction or a stock market crash. Despite the political conflicts in Russia and the Middle East, the VIX today is not far from that summer low, signaling that investors still do not expect a sharp stock market decline. (more…)