What’s On Our Minds:

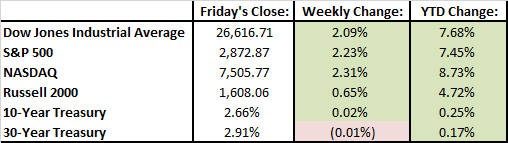

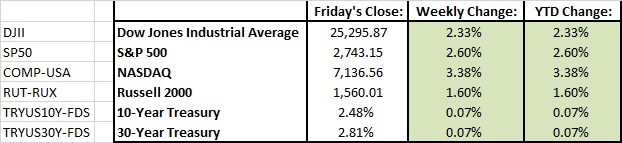

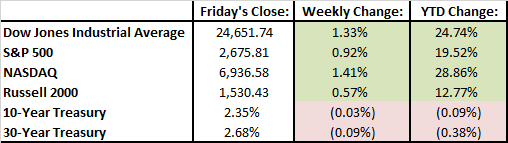

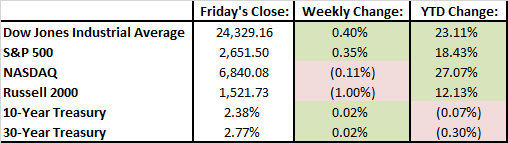

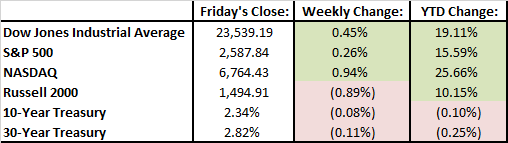

Last week, stocks rallied to fresh record highs, boosted by stronger-than-expected earnings reports from a number of US companies, corporate tax rate reductions, and an improving economy. Believe it or not, the Dow Jones and S&P 500 are both up more than 7% after just one month of trading in 2018. Equity investors who have been long the market are likely riding high and feeling great as we continue to see gains but some might be asking, “how long can this bull run?”

As always, we continue to stress the importance of staying invested over the course of the market cycle. As history has shown us time and time again, it’s nearly impossible to successfully time the market (at the top or the bottom) and long term outperformance can be enjoyed by following a disciplined approach and investing throughout the market’s ups and downs.

Retail investors (those who trade their portfolios non-professionally) have performance that significantly lags the market overall. This dynamic occurs because they tend to act on emotion, selling at the bottom and missing the large early gains of a recovery. There is a common example often given of the costs of missing the “best days in the market” that shows this point, but we find it misleading—missing the worst days is just as good as missing the best days is bad! So instead, we focus on the fact that if you act on emotion, you tend to sell near bottoms. We’re not missing “the best days,” we’re standing on the sidelines for the best months: the recovery itself.

We encourage our clients and friends to remember that we look to the long-term and that downturns are not only “ok,” they are expected, and are a reminder that our understanding of the markets is sound. We look for areas of the market that have good long-term growth. Short-term, temporary problems are at worst inconsequential, and may present a buying opportunity.

It’s easy to say these things when the market is chugging along. But we also remember the panic 10 years ago, when it seemed the world was ending. Even then, we knew of those who called their advisor or portfolio manager in March 2009 and told them to sell it all. That was the absolute bottom, and you would have missed out on one of the longest bull market runs in history.

So, when the downturn comes, just remember: we’ve been here before, we’ll be here again, and we have a plan.

Last Week’s Highlights:

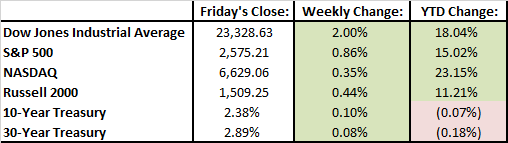

The stock market notched out impressive gains last week. All sectors advanced into the green with telecom as a leader. For the most part, earnings season has shown us that corporations had a positive fourth quarter and most reports have shared a positive outlook for 2018.

Looking Ahead:

It will be a busy week for investors with a slew of important news coming across the wire. Throughout the week, 4th quarter earnings season will be in full swing. President Trump will deliver his State of the Union speech on Tuesday evening. Many are expecting him to provide some color on an infrastructure spending plan. The Federal Reserve will provide an updated policy statement on Wednesday. January’s Jobs Report will be released on Friday.

What’s On Our Minds:

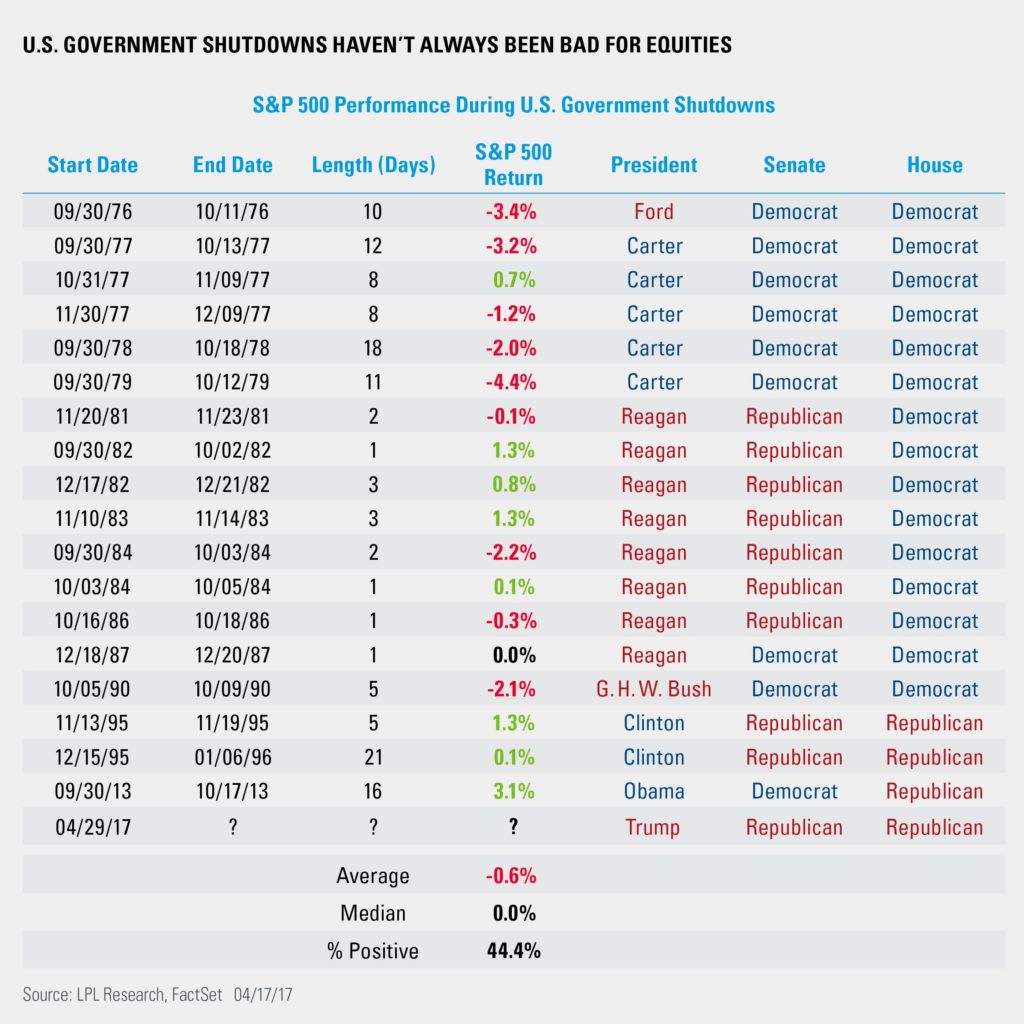

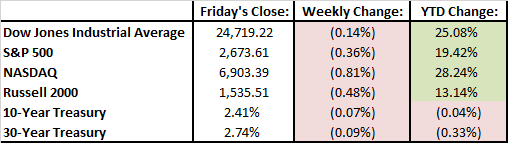

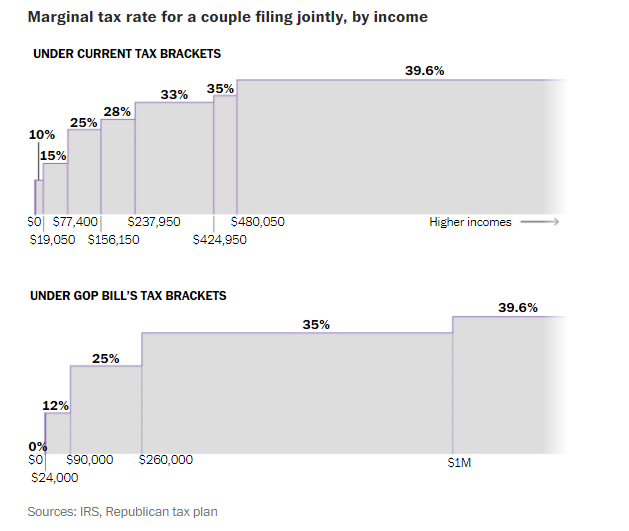

The federal government will enter its third day under a partial shutdown on Monday after the Senate failed to break an impasse on Sunday. On Monday, roughly 800,000 federal workers woke up locked out of their jobs. This turmoil in D.C. has investors wondering what may happen to the stock market if this political stalemate persists over a long period.

While this post is not meant to predict what may happen during this shutdown period and past performance is not indicative of future results, historically, stocks have traditionally shrugged off the pessimism brought on by previous government shutdowns.

The partisan tug-of-war currently occurring in Washington is without a doubt disconcerting, but we continue to remind our clients and friends that there is no need to panic. In the past, government shutdowns have been fleeting events that have left no economic scars. All in all, volatility may tend to increase around these events, however, historically, shutdowns have had little lasting impact on markets. Remember, stock prices are almost random over short periods of time and it is important to focus on the long-term prospects of your portfolio.

Last Week’s Highlights:

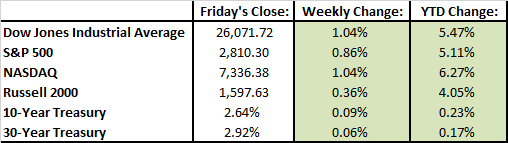

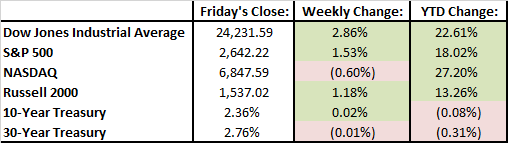

The stock market didn’t miss a beat last week. It was an abbreviated week of trading due to the MLK holiday on Monday but market indices charged higher. Both the S&P 500 and the Dow Jones are up by more than 5% this year after just 14 days of trading. Overall, there was giddy optimism among investors as corporations are still counting all the extra cash on hand that the reduced tax rate will make available to them.

Looking Ahead:

79 companies from the S&P 500 will report their 4th quarter earnings this week. There will also be some important economic metrics released – existing home sales will be released on Wednesday, the Leading Economic Index will be reported on Thursday, and GDP from last year’s 4th quarter will be released on Friday.

What’s On Our Minds:

There’s a saying used this time of year as folks are diligently working on sticking to their new years’ resolution. – The trick of getting ahead is getting started. This phrase is especially true for saving for retirement. Below are our 10 tips that may help reach your retirement goals. Remember, it’s never too late to start and it doesn’t hurt to save more!

1. Start now

It’s a simple fact that the earlier you begin saving for retirement, the more time your money has to earn interest and grow. If you’ve put off saving until your 30s or later, make up for lost time now by stashing away 10 to 15 percent of your salary.Plan your retirement needs

2. Plan your retirement needs

If you want to retire at 55 and travel the globe or work for as long as you can but stick close to home, how much money you need to retire is unique to you. Rather than relying on figures that suggest you’ll need 80 percent of your preretirement income to live comfortably later in life, talk with your spouse and financial advisor to settle on an amount to save that’s tailored to you.

3. Learn about and contribute to your employer’s plan

If your employer offers a tax-sheltered plan, contribute at least enough to get the employer match. Your employer can provide you with a summary plan description, which recaps your plan and vesting eligibility, as well as an individual benefits statement.

4. Consider saving “on the side”

If you don’t have access to an employer-based plan, contributing to a traditional or Roth IRA allows you to get similar tax benefits for your retirement savings. Even if you do contribute to an employer-based plan, an IRA can supplement those savings.

5. Make saving as easy as possible

Eliminate the need to move money from one account to another by setting a monthly savings goal and automating a deposit to that amount. By making savings routine, you are more likely to see your retirement nest egg grow. To help boost your regular savings, funnel any extra cash windfalls, such as from a bonus or inheritance, directly to your retirement savings.

6. Increase savings as you near retirement

Your income will likely rise with age and experience, so it makes sense to save more as you earn more. After age 50, you will also be eligible for catch-up contributions, which allow you to contribute beyond the set limit. For 401(k)s, you can contribute an extra $6,000, while for IRAs you can contribute an extra $1,000.

7. Be an active participant in your plan

Automating your retirement savings and amount doesn’t mean you should “set it and forget it.” Examine your quarterly statements to ensure you are on track to meet your goals. Can you afford to contribute more? Are your investments still appropriate? Do you need to lower your exposure to risk? By taking active control now, you take control of creating the best retirement lifestyle possible.

8. Decide on your Social Security strategy

Social Security benefits may be available at age 62, but up until age 70, your retirement benefit will increase by a fixed rate (based on your year of birth) each year you delay retirement. Waiting means you may be able to take advantage of some extra cash. If you are married, you may also be able to receive spousal benefits, which boost the amount you and your spouse receive in Social Security as a couple. To learn more, visit www.socialsecurity.gov.

9. Be a savvy investor

It’s important to be smart about not only the amount you save but also how you save. To help insulate against market swings, diversify your investments within sectors and across asset classes and geographic regions. The more intentional you are about where your assets are invested, the more secure you can feel about them.

10. Don’t touch your savings until retirement

Dipping into your retirement savings is a last resort. In addition to harsh penalties, you lose principal, which in turn depletes interest earnings and tax benefits. Also, if you switch jobs, rollover your retirement account rather than “cashing out.” Preserving your retirement savings may be difficult when funds are tight, but will benefit you when you truly need it most.

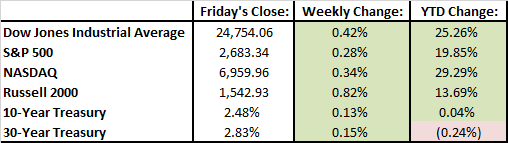

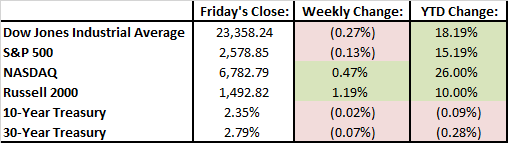

Last Week’s Highlights:

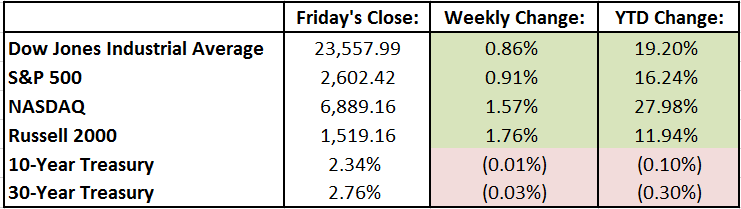

Stocks were up for the second week in a row. We have had a remarkable start to the year and major indexes are up more than 4%. Stocks have not recorded two consecutive weeks of 1% moves higher since July of 2016. Earnings season kicked off last week. Big banks reported losses due to the new tax code but had pre-announced so the loses had been baked into share prices.

Looking Ahead:

Markets were closed on Monday in observance of Martin Luther King Day. Along with earnings reports coming across the wire, investors will be eyeing some important economic data this week. Industrial production and capacity utilization is reported on Wednesday. Housing starts are reported on Thursday followed by consumer sentiment data on Friday.

What’s On Our Minds:

The Tufton Economics Team takes the reins this week to talk a bit about the changing shape of the American consumer. As our readers know, the stock market continues to hit new highs as corporations enjoy an increasingly business friendly environment in the US. But the consumer does not seem to be sharing in those gains. Now more than in decades, Americans’ balance sheets are looking weak: they “owe more, save less, and are poorer.”

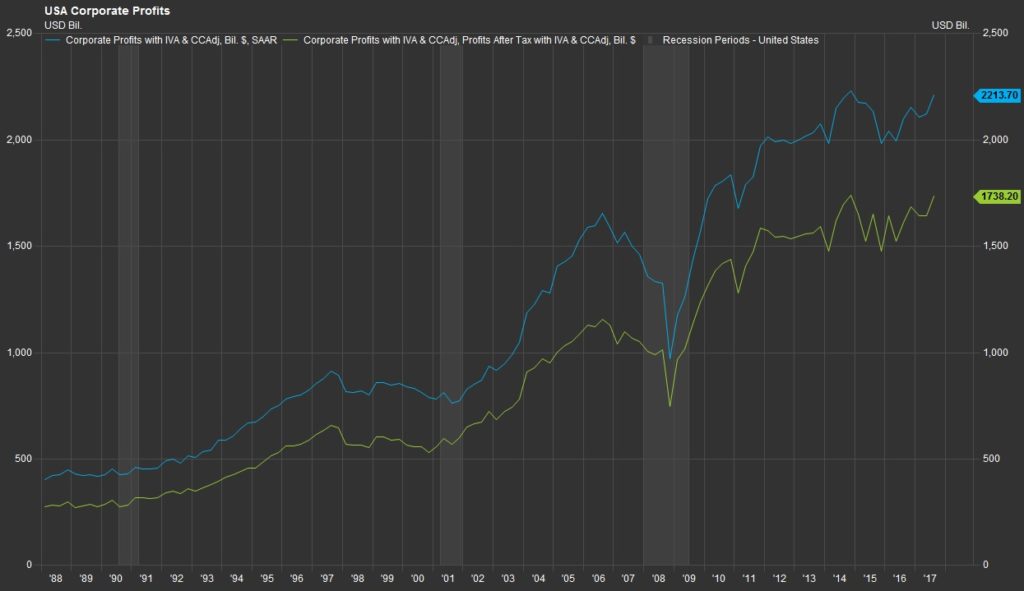

Corporations’ earnings have steadily risen, but the median consumer hasn’t seen the gains (note that the comparison isn’t perfect: there is no “per-corporation” data like the per-capita data we have for consumers). The Economics Team will stay on the sidelines as far as the political implications of this relationship, but we would like to point out that weakening consumers are also bad for economic growth.

Corporations’ earnings have steadily risen, but the median consumer hasn’t seen the gains (note that the comparison isn’t perfect: there is no “per-corporation” data like the per-capita data we have for consumers). The Economics Team will stay on the sidelines as far as the political implications of this relationship, but we would like to point out that weakening consumers are also bad for economic growth.

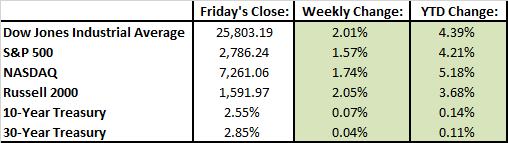

Last Week’s Highlights:

The new year got off to a good start, and interest rates ticked up slightly, resulting in an all-green summary chart below. Hopefully we can keep that up all year.

Looking Ahead:

This week should be a relatively light one in terms of earnings and economics. We’ll be watching the weekly claims, as always. CPI and retail sales numbers come out Friday, which should help us get a better picture of the consumer economy that we talked about in the blog post.

What’s On Our Minds:

Happy New Year! By all measures, 2017 was a stellar year for stock markets around the globe. It appears the bull market continued to climb its proverbial “wall of worry”. For the first time since 2012, international stocks outperformed U.S. stocks. Domestic market indexes were no slouches though. The S&P 500 was up over 20% and the Dow Jones added 5,000 points, its largest ever point gain in a calendar year. The rally was fueled by resurgent economic growth, blockbuster corporate profits, and the promise of sweeping Republican tax cuts which should save corporate American billions of dollars.

After a great 2017, investors are likely asking, “so what does 2018 have in store?” Well, of course it is hard to predict but market experts seem to agree that the outlook for the new year is good but not a rosy as last year. Wells Fargo forecasts the U.S. economy will grow by an average of 2.5% each quarter in 2018 and 2019. As the labor market continues to tighten, wage growth and increased energy prices could start to squeeze corporate earnings, but expanding sales and lower corporate tax rates should also give earnings a boost. Meanwhile, if the economy continues to improve, the Federal Reserve plans to continue increasing interest rates.

If Wall Street’s predictions for the new year hold up and the bull market continues, it will put the economy on track for its longest expansion in decades.

Last Week’s Highlights:

Stocks were down slightly during the final week of 2017 which was shortened by the Christmas holiday. It was reported that Russian tankers have been supplying North Korea with oil in recent months which increased geopolitical worry. The minor declines experienced last week still left investors happy with significant gains experienced across the board in 2017.

Looking Ahead:

Important economic data comes across the wire this week as we kick off 2018. Manufacturing purchasing managers index will be reported on Tuesday followed by vehicle sales and minutes from the Federal Reserve’s December meeting on Wednesday. On Friday, we will close out the week with December’s jobs report.

What’s On Our Minds:

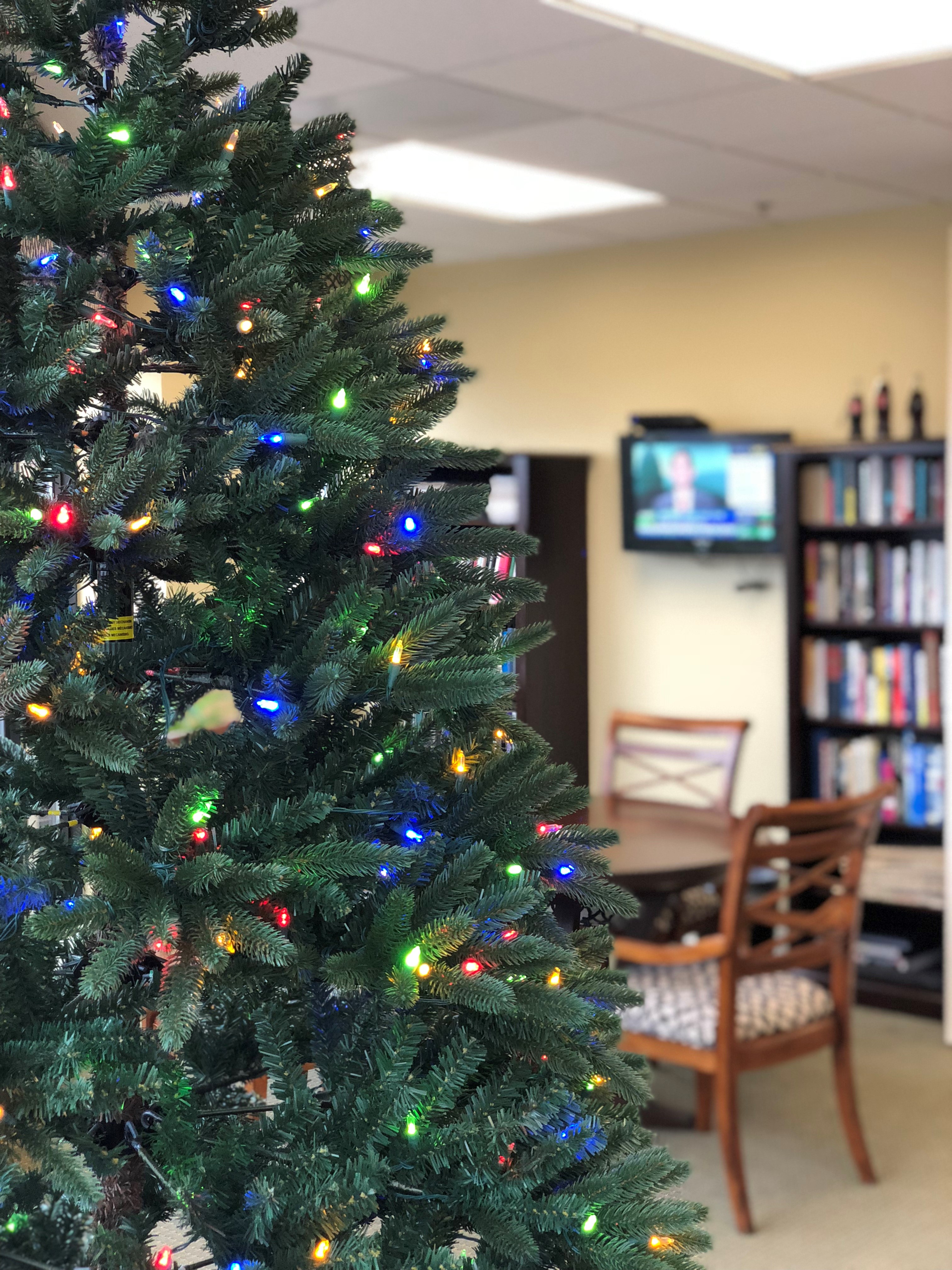

The team at Tufton Capital Management wishes you a season of joy as we look forward to continued success in 2018.

Last Week’s Highlights:

Stocks were up last week as investors focused on the passage of the U.S. tax bill.

The tax bill is the largest tax cut in U.S. history for the nation’s largest companies. Starting on January 1, 2018, big businesses’ tax rates will be reduced from 35% to 21%. Republicans have argued that companies’ tax burden will be decreased one trillion dollars over the next ten years which should help the economy. Time will tell if the tax bill will accelerate economic growth.

Looking Ahead:

This week, investors will be busy closing the books on 2017 which has been a strong year in equity markets. Many are wondering if we experience a “Santa Claus Rally” this year. This typically occurs when investors see a surge in the price of stocks during the last week of December though the first two trading days in January. There are numerous explanations for it, including tax considerations, happiness around Wall Street, and people investing their holiday bonuses.

What’s On Our Minds:

The economic team at Tufton has been thinking about employment quite a bit lately. We have a few internal reports, the first of which we’ve adapted here for our blog.

The employment rate has remained remarkably low, while wages have refused to budge. In theory, when labor is in low supply, employers will raise wages to attract talent. That increase in wages tells us that our economy is starting to heat up, and we need to be caution of above-trend growth- the kind that causes recessions. At least, that’s how it’s always happened in the past. What is different now? Our labor force is changing, in age, skill, and desires.

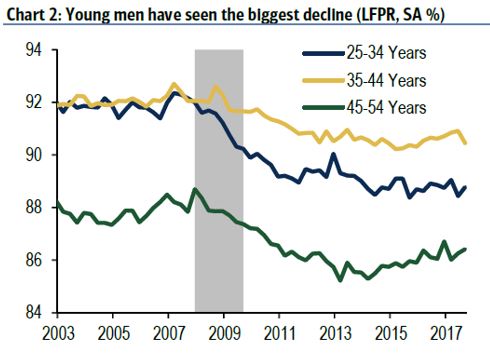

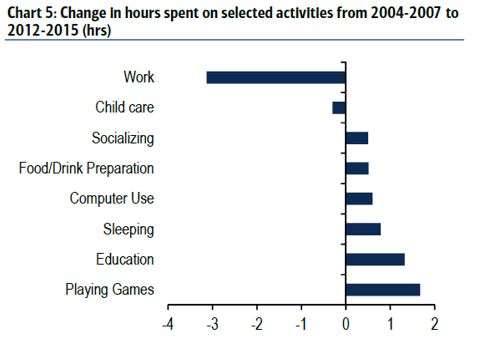

That is to say: not only are consumer preferences changing, but so are labor preferences, as evidenced by the below chart. The reasons for the labor force decline among young men are likely threefold: drugs, jail, and video games. The opiate epidemic has hit hard, especially in those young males who found themselves jobless. Additionally, supply has been fueled by drug companies who have pushed these drugs on doctors. Because of these and other causes, the percentage of previously-incarcerated males has risen from 1.8% in 1980 to 5.8% in 2010. Of course, this makes it harder for this segment to re-enter the workforce, and they may choose to stay on the sidelines. Finally, to the dismay of parents everywhere, it seems that many young men would rather simply stay home and play video games (see charts, from Bank of America / Merrill Lynch).

Last Week’s Highlights:

We are experiencing a bonfire Santa Claus rally this month.

Markets continued their march higher as investors continue to weigh the impacts of the tax reform deal. The S&P 500 rose nearly 1% and the Dow Jones added 1.3%. The S&P experienced a drop on Thursday when Senator Marco Rubio said he would oppose the bill if it didn’t include a larger tax credit for parents with children. On Friday, senators gave in to Rubio’s suggestions and equity markets charged to reach new all-time highs. Since the tax reform bill passed in Congress, the S&P 500 has gained roughly 3%.

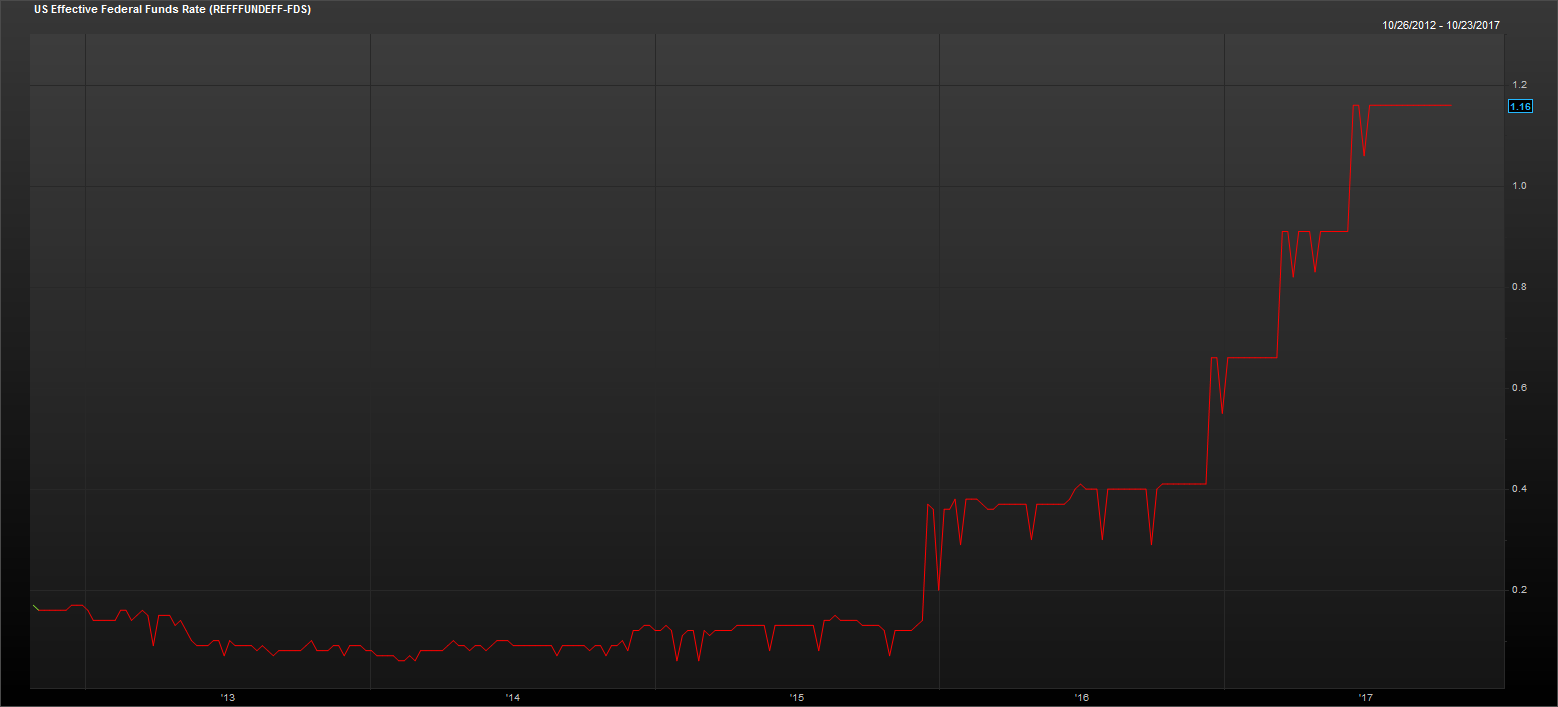

As investors had expected, the Federal Reserve increased its federal funds target rate by 25 basis points to 1.25%-1.5%. Janet Yellen shared an optimistic view on the economy and upgraded the Fed’s outlook on GDP growth citing the impact of corporate and personal tax cuts.

Looking Ahead:

Market futures are up big to begin the week before Christmas. The House of Representatives is set to vote on the tax bill either Monday or Tuesday and Senate will vote shortly thereafter.

Important housing data will be in focus this week. New home starts and permit data will be released on Tuesday and new home sales will be reported on Friday.

What’s On Our Minds:

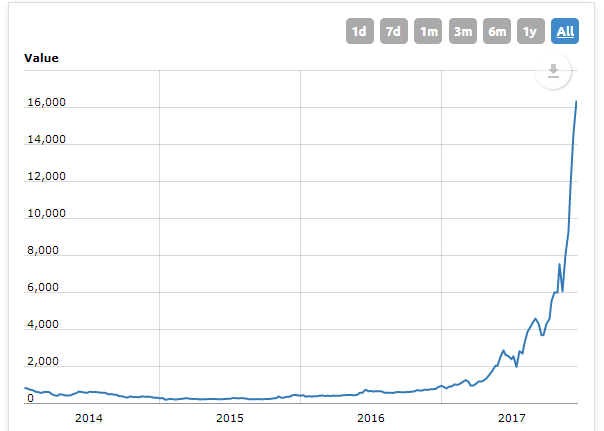

Even with a strong year in equity markets, the meteoric rise in the value of Bitcoin has been grabbing headlines left and right. Bitcoin’s run up in price has been nothing short of astounding. For instance, if you invested $1,000 in bitcoin at the start of 2013 and never sold any of it, you would now have around $1.3 million. In 2010, a software developer paid 10,000 bitcoins for two large pizzas which today would be worth about $160 million. Bitcoin has seemingly deified the laws of gravity as levels of speculation and fascination continue to increase.

Just this morning Bitcoin’s value has surged again as the Chicago based CBOE launched a futures exchange Sunday evening that allows traditional investors to trade futures contracts on the unregulated currency. Even though it has been exciting watching Bitcoin’s meteoric rise, Tufton Capital does not believe there is a place for Bitcoin in a traditional investment portfolio given its “Wild West” like nature, its volatility, its shady history, and the cyptocurrency’s unproven track record. Many critics of Bitcoin are suggesting it shows the classic signs of a bubble.

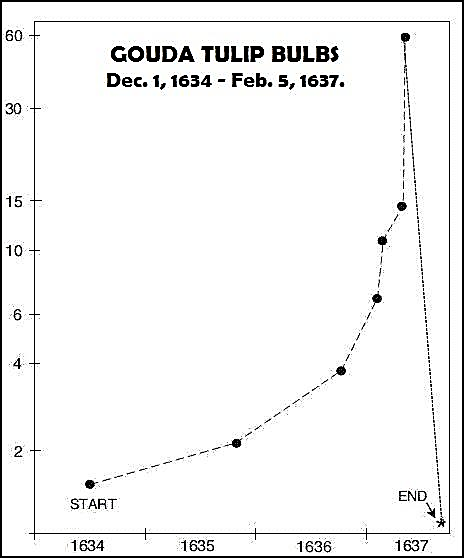

Market bubbles, like the tech bubble of the 1990’s, have formed for as long as there is record of exchange, and all follow a similar pattern of speculation.

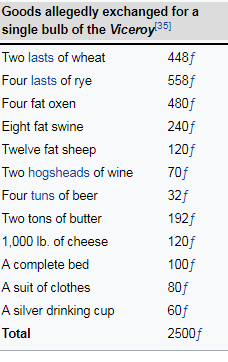

In the early 17th century, the Dutch became enraptured by tulips, and created the first chronicled speculative bubble in history. As recorded in Charles Mackay’s Madness of Crowds, tulips began to grow rapidly in popularity all around Europe, and therefore tulip prices rose sharply. Many deft merchants identified this trend and made a large profit in trading tulips. Other merchants and the nobility, seeing these extraordinary profits, jumped into the tulip market. As a result, prices for tulips kept rising and rising, backed by nothing but speculation. Soon enough, nobles, farmers, seamen, chimney sweepers, and maidservants alike were all dabbling in tulips. Below is a chart of what one individual paid for a single tulip bulb!

Eventually, the tulip market ran out of new money to keep bidding up prices. As reality sat in, speculators all ran for the exit and prices plummeted. Many speculators lost all their savings as contracts they purchased were ten times the price that tulips were then trading.

This is an important lesson for us in 2017. As Benjamin Graham poignantly argues, “an investment operation is one which, upon thorough analysis, promises safety of principal and an adequate return. Operations not meeting these requirements are speculative.” Graham would certainly have chuckled at otherwise serious individuals who lost a whole year’s salary on buying tulips.

Buying something, be it tulips, Bitcoin, or the hot stock of the day, as an investment because everyone else is doing it, or because of tremendous recent returns is not investing, but speculating. It may work in the short term, but it always has devastating effects in the long term.

The lessons of manias past are always important to keep in mind in an ever changing market. This isn’t to compare any particular asset to the tulip bulb craze, but it is always smart to study history in an attempt to understand the present. Many people will make bold claims about “X being in a bubble” or “Y will never go down.” A prudent investor, not speculator, will not be swayed by the opinions of crowds and will continue to drown out the noise and invest in quality assets at good prices.

BitCoin Price Cart (2014-Present)

Last Week’s Highlights:

US stocks had a strong week. Equity markets closed on Friday near record highs as investors continue to wait for a finalized tax reform bill.

Friday’s job report was better than expected. The US economy added 228,000 jobs in November. Average hourly earnings grew 2.5% over the past year which is up from November’s 2.3% number. GDP has risen by more than 3% over the past 6 months which continues to show a favorable backdrop for stocks.

Looking Ahead:

Investors will keep their focus on Washington D.C. The GOP’s plan promises to be the biggest change to individual and corporate rates since Ronald Reagan’s tax overhaul in the 1980s.

Investors are expecting the Federal Reserve to increase its federal funds rate from 1.25% to 1.50% on Wednesday. Janet Yellen recently restated that she and her colleges, “continue to expect that gradual increases in the federal funds rate will be appropriate to sustain a healthy labor market and stabilize inflation around the FOMC’s 2% objective.”

What’s On Our Minds:

The hum of the holidays has begun at our offices in Hunt Valley, and with equity markets at or near all-time highs this year, investors are feeling joyous indeed. With plenty of green flashing across traders’ screens this holiday season as opposed to the dreaded red, the hangover left by the Great Recession feels like a distant memory to most. Not everywhere is the good cheer so merry, though. Customers are experiencing sticker shock thanks to the 2008-2009 downturn somewhere many wouldn’t guess: the Christmas tree lot.

During the financial crisis, cash-strapped Americans cut back on their spending and bought fewer trees. As demand plummeted tree growers either went out of business or planted fewer saplings during those years. Because it takes 7 to 10 years for a Christmas tree to grow, the entire market is now faced with a shortage this year.

The leading source in the Christmas tree business is the state of Oregon, which harvested an estimated 5.2 million trees in 2016. They are followed by North Carolina with 3.5 million, Michigan with 3 million, Pennsylvania with 2.3 million and Washington with 1.5 million. Since a freshly cut tree can retail anywhere between 60 and 80 dollars, that adds up to some serious money in the Christmas tree business.

The high prices of authentic trees this year has growers worried that families will switch to artificial trees that outlast their natural competitors. The American Christmas Tree Association estimates that artificial trees accounted for nearly 81 million of those displayed in the U.S. in 2016, while 19 million were natural.

Last Week’s Highlights:

Happenings in Washington D.C. had investors on their toes last week. Stocks were higher but more volatile. The Dow Jones passed 24,000 for the first time in history. Tuesday and Thursday were both strong days as investors grew more optimistic that the Senate was getting closer to passing a tax reform bill. On Friday we saw a pullback when news broke that President Trump’s former national security advisor, Mike Flynn, might testify regarding interference in last year’s Presidential election.

GDP data from the third quarter was revised higher to 3.3%. This was the second consecutive quarter that saw growth above 3%. Business investment figures were up, suggesting that economic conditions continue to improve.

Looking Ahead:

News coming out of Washington will likely drive investor sentiment again this week. Funding for the government is set to expire on Friday. Government officials are hoping to avoid a government shutdown by pushing the deadline out into the future but President Trump has signaled that he could play hardball. Meanwhile, the GOP is looking to pass their tax reform bill before the end of the month.

On Thursday, AT&T will go to court against the Justice Department over AT&Ts bid to acquire Time Warner. The government has cited antitrust concerns.

Friday’s jobs report will also have investors watching.

What’s On Our Minds:

Oil investors will be focused on the OPEC meeting this week. The Organization of Petroleum Exporting Countries (OPEC), which controls over 30% of the world’s oil production, will meet this Thursday in Vienna, Austria to discuss the continuation of production cuts. The cartel agreed to a production cut at the meeting one year ago and investors are expecting a continuation of the deal – keeping roughly 1.8 million barrels a day offline.

Brent crude oil, the global oil benchmark, has risen 12% year-to-date and the price is near the highest level in nearly two years. The Brent crude oil futures curve has returned to backwardation – meaning that the Brent crude price today is higher than all future price in months and years ahead. Historically, a rotation into backwardation has been a bullish view for oil and despite the S&P Energy Index down 7% year-to-date, the index has rallied about 3.5% over the past three months as the futures curve has shifted.

It may be too soon to call, but the futures curve is saying the worst of the oil glut is behind us. Though that may not be an advantage for prices at the pump, client portfolios should benefit from rising energy stocks.

Last Week’s Highlights:

Last week, the three major indexes reached all-time highs. The S&P 500 closed above 2,600 for the first time last Friday, despite lighter trading volumes due to the Thanksgiving holiday and a shortened trading session. The Dow Jones Industrial Average is less than 2% away from breaching the 24,000 mark and the technology driven Nasdaq is rapidly approaching 7,000. Earnings season is winding down with 98% of S&P 500 companies having reported earnings updates. Up to this point, S&P 500 earnings grew 6% year over year. In corporate news, Department of Justice is suing to block the AT&T merger with Time Warner.

Looking Ahead:

This week, investors will continue to monitor news out of the Federal Reserve as well as the White House. On Tuesday, Federal Reserve Governor Jerome Powell will have a confirmation hearing before Congress. Powell has been selected as the next Chair of the Federal Reserve once Chair Janet Yellen finishes her term. Also on Tuesday, President Trump is expected to meet with congressional leaders to discuss a deal that could avoid a government shutdown in December. On Wednesday, Fed Chair Yellen will provide her views on monetary policy. Finally, on Thursday, OPEC will meet to determine oil production strategy and the Senate will vote on tax legislation.

What’s On Our Minds:

With the end of the year quickly approaching, portfolio managers are busy reviewing accounts and, if the opportunity presents itself, harvesting tax losses in accounts.

Aside from research roles, Tufton Capital’s portfolio managers are responsible for all aspects of portfolio construction and supervision, which includes the management of gains and losses that are realized in our clients’ taxable accounts. Of course, tax implications are not the paramount concern in the management of a portfolio, but trading responsibly with this in mind can make a big difference for investors come tax day in April.

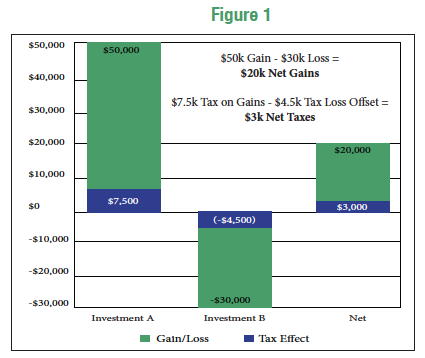

Selling at a loss may seem to run counter to your investment goals, but because the IRS allows for investment losses to be used to offset capital gains, investors should look to make the best of an otherwise unprofitable investment. With that in mind, investors should consider selling poor performers in their taxable accounts by conducting tax loss sales. This strategy is especially good for investors in the 25-35% Federal tax brackets who must pay a long-term capital gains rate of 15%. The tax savings increase for the highest income earners in the 39.6% Federal tax bracket, who must pay 20% on long-term capital gains. Plus, depending on where you live, you may be subject to capital gains taxes at the state level. Our clients in Maryland know this all too well!

Of course, we don’t make trades just for tax purposes. If we think a stock is going to increase in value, we hold it. If we think it is going to go down, we sell it. But using a tax wash sale, in which a security is sold and then repurchased after 30 or more days, enable an investor to claim the tax loss but still hang on to an investment that he or she thinks has long-term potential.

Take for example a single person who has an annual income of $100,000. He would be in the 15% long-term capital gains bracket. In his brokerage account, he has a realized long-term capital gain of $50,000 in Investment A and an unrealized long-term capital loss of $30,000 in Investment B. If he sells his shares of the losing stock, he can offset the $50,000 gain against the $30,000 loss, resulting in $20,000 of net long-term gains. If he does not harvest the loss, the Federal tax on his $50,000 long-term gain would be $7,500. By partaking in this tax loss harvest, he will save himself $4,500, which would have otherwise been a piece of his Federal tax liability for the year (See Figure 1).

Portfolios with large unrealized gains will likely have some positions that have unrealized losses. Although a loss may be hard to look at, sometimes it’s best to bite the bullet and clean these losers out of a portfolio. This management strategy allows investors to free up cash in the portfolio, which can be deployed into other, more attractive investments.

While it’s important to avoid the tax tail wagging the investment dog in your overall investment strategy, a disciplined approach to managing tax liabilities is an important component of wealth management.

Last Week’s Highlights:

Stocks were lower for the second week in a row. After a calm summer and placid fall, we have seen a bit of volatility return over the past two weeks. Markets reacted to lower oil prices and worries surrounding the progress of Republican’s tax reform plan. Investors seem to be a bit doubtful that Republicans will be able to reconcile Congress’s plan and Senate’s tax reform plans in a timely fashion.

Looking Ahead:

Existing homes sales will be reported on Tuesday and the Federal Reserve is releasing minutes from their meeting earlier this month on Wednesday. Markets will be closed Thursday and will close early on Friday.

The entire team at Tufton Capital Management hopes all of our friends and clients have a wonderful Thanksgiving holiday this week!

What’s On Our Minds:

This morning, Tufton Capital Associates Ted Hart, John Kernan, and Neill Peck taught a sixth-grade math class at Mid Town Academy in Bolton Hill. The purpose of the trip downtown was to teach the students about stocks and the stock market. The students participate in the Stocks in the Future program which is a 501C3 charitable organization that partners with schools in downtown Baltimore and provides a three-year financial literacy curriculum for middle school students in under-served communities.

The Stocks in the Future Program introduces students to business concepts, expansion possibilities, reasons for taking a company public, and ways to compare company performance. As students progress through the program, they earn money by attending school regularly and improving their grades. The students can earn up for $80 per year which enables them buy shares in a publicly traded company. When they graduate from high school, they get to keep the shares they have purchased. Today, our Associates explained how an investment advisory firm operates and we showed them how to analyze two companies; Facebook and Under Armor.

By the end of the class, the students remembered the 3 most important rules of investing.

1. Don’t Lose Money.

2. Don’t Lose Money.

3. Don’t Lose Money.

To learn more about Stocks In the Future’s Mission, follow the link below:

Last Week’s Highlights:

After 8 straight weeks of gains, U.S. large-cap stocks fell last week. Investors were focused on tax reform and the overall consensus is that the federal government is nowhere close to passing a bill. Congress and the Senate have both presented a plan and it will be in limbo until both houses compromise and present a mutually agreed upon plan.

On Thursday, the Dow was down over 200 points at its lows and the S&P 500 nearly broke its more than 40-day streak of no losses greater than 0.5% for a given session. Investors should see last week’s dip as a healthy retreat based on the rally we have seen in the last year. Remember, we have been experiencing one of the calmest markets in history this year and we remain close to all time highs.

Looking Ahead:

Earnings season is coming to an end. 483 companies in the S&P 500 have already reported. Economic news and progress on tax reform will likely rule the headlines this week. On Wednesday, retail sales numbers will be released and on Friday, we will hear housing starts and building permit figures.

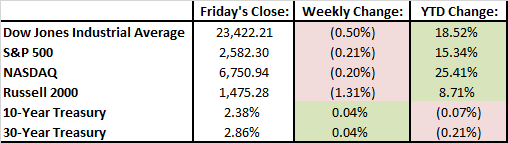

What’s On Our Minds:

House Republicans released their long-awaited tax reform bill last week. They are calling the bill the Tax Cuts and Jobs Act and are looking to have it passed by the end of the year. The bill aims to permanently lower the corporate tax rate from 35% to 20% and to reduce the number of individual tax brackets. The plan eliminates the alternative minimum tax and it doubles the standard deduction for individuals and couples. The plan limits the home interest deduction to loans up to $500,000, increases the child tax credit to $1,600, and doubles the estate tax exemption immediately and then will eliminate it by 2024.

Under the Republican plan, people will still be able to deduct up to $10,000 on the property taxes they pay locally, but they will no longer be able to deduct the other taxes they pay to state and local governments from their federal tax payments. This compromise appears to cater to a Republican’s base living in states where local taxes are relatively low and has drawn criticism from GOP representatives from New York, New Jersey, and Pennsylvania.

The tax plan does not make direct changes to how income on your investment portfolio is taxed. While the new plan doesn’t directly address capital gains and investment income taxes, setting new income tax rates means many investors will pay less in taxes on short term capital gains and dividends because their ordinary income tax rate will effectively be lower.

Though cutting benefits for 401k contributions was allegedly on the table at first, the official plan makes no changes to retirement savings tax breaks provided by contributing to 401k and IRA accounts. That is good news for investors saving for retirement.

Last Week’s Highlights:

Stocks has a strong week and were in the green for the eighth week in a row.

President Trump nominated Jerome Powell to replace Janet Yellen as the 16th chairman of the Federal Reserve board early next year. Powell is a lawyer by training who served as a top Treasury Department official under H.W. Bush and then joined the Carlyle Group (a private equity firm), where he remained from 1997 to 2005. President Obama nominated him for a spot on the Federal Board of Governors in 2012. Powell has always been supportive of Yellen’s moves, which suggests a continuation of slowly raising rates and easing regulations.

October’s Jobs Report was released on Friday. Nonfarm payrolls rose by 261,000 and the unemployment rate dropped to 4.1%.

Earnings season continued. Facebook and Apple reported strong numbers. Baltimore’s Under Armour reported poor performance and shares took a beating.

Looking Ahead:

We are getting close to the end of earnings season but hundreds of companies are set to report third-quarter results this week. 48 companies in the S&P 500 report earnings will share their results this week. President Trump will spend the week touring Asia. University of Michigan’s Consumer Sentiment report is set to be released on Friday.

What’s On Our Minds:

The Tufton Investment Committee meets weekly to discuss our current holdings and examines our entire universe of companies that we would like to own at the right price. Managing all assets in house and conducting independent research is a timely process but the strategy is designed to pay off over the long term. We believe that it is our responsibility to manage a portfolio of individual securities, rather than merely play “quarterback” by redirecting funds to outside managers.

The Tufton Investment Committee is very conscious of price and we shy away from overpaying for shares in a company. While this may hurt us when the rest of the street is chasing momentum stocks higher, we believe that by purchasing undervalued securities our clients are provided a “margin of safety”. We believe that our independence is an advantage.

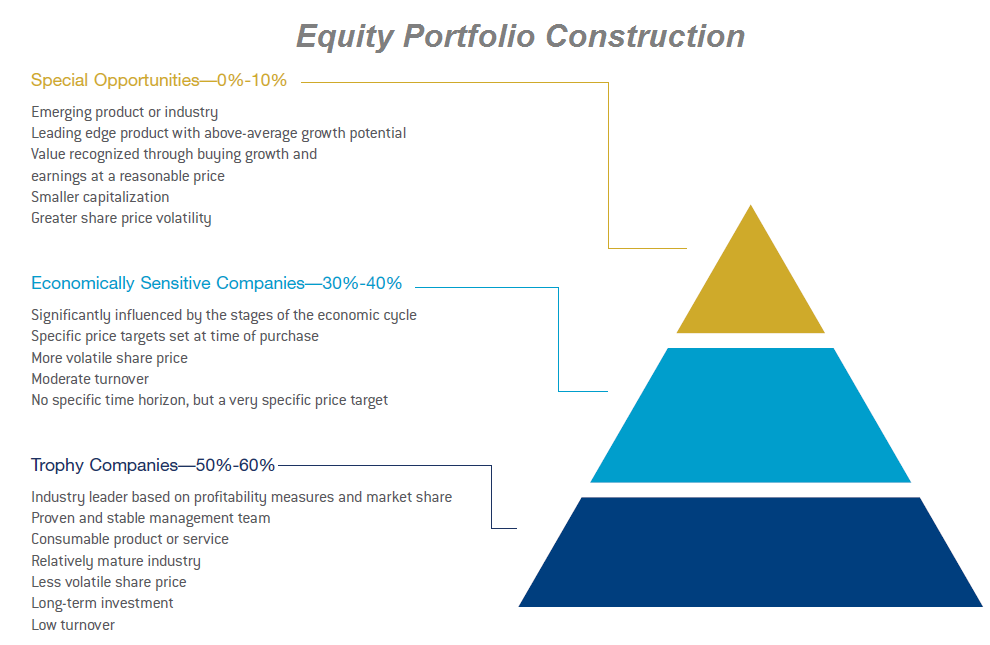

Tufton Capital seeks to build our equity portfolios of 40-50 stocks. Of these companies, 50-60% equities we hold are what we consider to be “trophy companies”. These companies are industry leaders based on profitability measures and market share. These companies have proven and stable management teams, consumable products or services, operate in a relatively mature industry, pay a dividend, and their share price is typically stable. We look to buy and hold these stocks for the long haul.

30-40% of a Tufton’s equity portfolios are made up of what we consider to be “economically sensitive companies”. These companies we purchase with no specific time horizon, but we set very specific price targets. These companies are significantly influenced by the stages of the economic cycle and can be more volatile than our trophy companies.

The remaining 0-10% of an equity portfolio is what we consider to be “special opportunities”. These companies are typically have smaller market capitalization, operate in an emerging industry, have some sort of leading edge product with above average growth potential. These companies’ share prices can be volatile but we recognize the value in buying shares in these types of companies at a reasonable price.

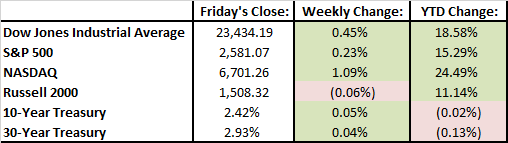

Last Week’s Highlights:

For the seventh week in a row, domestic equities were positive and reached record levels. It was the busiest week of third quarter earnings season and investor optimism was confirmed by strong numbers. The technology sector had a particularly strong week. The NASDAQ was up 2.2% on Friday. While single stock volatility can be increased during earnings season, overall, equity markets continue to be strong.

Looking Ahead:

It’s a busy week with 135 of the S&P 500’s companies reporting third quarter earnings. The Federal Reserve will issue its decision on interest rates on Wednesday. October’s jobs report will come across the wire on Friday morning.

What’s On Our Minds:

Equity markets have been on a roll lately, but don’t forget about interest rates!

Interest rates are, to put it mildly, a complex beast. There are a few mechanisms by which rates affect the economy and the stock market, not all of which are obvious, but which have large effects. We’ve tried to break down these levers without getting too granular or using financial jargon.

The first is the most obvious: a lower interest rate means it’s cheaper to borrow. Consumers borrow more money to buy houses or cars, businesses borrow money to expand production. And thus, we get economic growth. Everybody’s happy. Except, maybe, the people who get less money in interest for loaning out their hard-earned cash.

An interest rate raise, like the one that seems imminent, is a signal that rates are moving higher, might cause both consumers and Chief Financial Officers to cut back on spending. So businesses earn less, and earnings fall.

Another very important but more abstract concept is the valuing of stocks via a discount rate. If I think a company is going to earn $10 million in ten years, the interest rate would have to be 0 for me to want to buy its stock now for a $10 million valuation. But if interest rates are higher, I’d be better off just putting the money in the bank for ten years and earning some interest in those ten years. In this way, investors compare interest rates with their expectations for the earnings of companies. If interest rates are low, companies’ stocks are more attractive, and therefore worth more in today’s dollars.

Whenever you hear about Janet Yellen attending a big Federal Reserve meeting, they have to think about all of this, with the added complexity of inflation. The inflation target is 2-3%: at this level, prices are stable, but there is incentive to spend, rather than save, money, and to push the economy along. With inflation at zero, you know that the car you want to buy will cost about the same in year, so you might just think about it for a while, dampening economic activity.

Deflation, when inflation falls below zero, is a major problem: here, you might wait to buy that car, since it will be cheaper next year. And the year after that. And… This gives rise to the “pushing on a string” phenomenon that was one of our investment committee’s favorite metaphors. You can’t entice people to spend money by cutting rates indefinitely, since rates below zero (usually) are avoided by simply keeping the cash. This illustrates, in part, one of the major limitations of monetary policy (setting interest rate, money supply, etc.) vs. fiscal policy (where and how the government spends their money). But fiscal policy is a topic for another post.

Last Week’s Highlights:

Equity markets enjoyed their 6th consecutive week in the green. The Dow Jones and S&P 500 recorded record highs on Thursday on the 30th anniversary of Black Monday. The Dow Jones had a great week and was up 2%. So far, we have seen strong third quarter earnings reports that has investors pushing equity market ever higher. General Electric was an exception to the news of strong earnings figures. GE’s CEO opened earnings remarked by saying, “The results I’m about to share with you are completely unacceptable.” He telegraphed big changes ahead for the company. According to the numbers, American companies appear strong and the economy continues to improve. Investors were also supportive of the news that Jerome Powell could be nominated to replace Janet Yellen.

Looking Ahead:

Can stocks continue steaming upward? That’s the question on everybodys’ minds.

Politicians in Washington seem to be getting closer to proposing a tax reform plan. Equity analyst will be busy listening to earnings calls this week. CNBC provided the chart below highlighting key earnings releases coming from blue chip companies this week.