What’s On Our Minds:

This Thursday marks the thirty year anniversary of “Black Monday”. On that day, the Dow Jones tanked nearly 23% in a chaotic selling spree. For the most part, the one day crash was caused by growing complexity in the market. Computerized trading platforms were new at the time and complicated hedging strategies that used equity index futures contracts were just being introduced. Today, on a percentage basis, that correction would knock over 5,200 points off the DJIA. As a former stock broker told us this morning, “that was a tough day in the trenches”. On the bright side, the S&P 500 has returned nearly 900% since.

Tufton Capital Portfolio Managers, Randy McMenamin, saved the Wall Street Journal from that day. This paper, along with other “fateful” days in the markets are kept it in our firm’s library as a reminder that corrections can and do happen.

Last Week’s Highlights:

Third quarter earnings season kicked off and investors were optimistic.

Going into the week, investors were expecting solid performance in the big bank’s earnings reports. On Friday, Bank of America’s report was met with happy investors and the company’s share price increased by 1.5%. JPMorgan and Citi sold off as they failed to meet some important metrics. Particularly, both banks failed to deliver strong loan growth and loan quality metrics.

Looking Ahead:

Investors will have a keen eye on earnings reports coming across the wire this week. Many believe that in order to sustain the rally we have seen in equity markets, investors will need to see strong earnings growth over the next few week.

On Monday we will hear from highflier, NetFlix. On Tuesday we will see earnings from Goldman Sachs and Harley Davidson. On Wednesday, Abbot Labs reports their results. Phillip Morris, Berkshire Hathaway and Taiwan Semiconductor report on Thursday. On Friday, we will wrap up the week with reports from General Electric and Proctor & Gamble.

What’s On Our Minds:

Donating Appreciated Securities

This time of year, charities may begin hounding you to make your annual donations. Have you ever considered donating appreciated securities? It’s a tax efficient way to support charities. Read on to learn how you might be able to “kill two birds with one stone” utilizing this strategy.

Charitable giving provides donors with tax relief every tax season in the form of deductions. In an effort to encourage positive social action, the IRS provides incentives for all kinds of charitable contributions, from monetary donations to used cars. You can even donate your appreciated securities (stocks, bonds, mutual funds, etc. that have risen in value) to the charity of your choice. Long-term appreciated securities are the most common non-cash donations, and they can be the best way for donors to give more to their chosen charities. The tax advantages to donating stocks are such that both the donor and the charity benefit.

What are the benefits?

Donating appreciated securities yields two tax benefits for the donor. The first tax benefit is the elimination of capital gains tax. Normally when you sell an appreciated stock, you pay capital gains tax on the amount your securities have increased in value since being purchased. For example, if you bought stocks for a total of $1,000 and then sold them years later for $5,000, you would owe capital gains tax on $4,000 of income from the sale. This tax can add up significantly depending on what tax bracket you fall under, how many stocks you sell and how much they’ve appreciated over time. When you donate appreciated securities, however, you don’t owe any capital gains tax, no matter how much they’ve increased in value. The charity receiving your donation is free from capital gains tax on your contribution as well.

Tax Deductions

The second tax benefit is writing off the donation on your tax return. As long as you itemize, you can deduct charitable contributions on your return, and the more you donate, the more you can deduct. In this case, you’ll be donating more since you can donate the entire value of the asset, not the value minus taxes. Thus, your tax write-off will be greater. In other words, you can take a charitable deduction on money that hasn’t been taxed. This also benefits the charity, because they’ll get a larger donation than they’d otherwise receive.

There is a limit to how much you can deduct for charitable contributions, which varies depending on what you’re giving and what organization you’re donating to. Most organizations are subject to a 50 percent limit, meaning your charitable tax deduction cannot exceed 50 percent of your adjusted gross income. Other organizations have a 30 percent limit. You can check with the IRS or ask the organization themselves to be sure. These limits apply to monetary charitable donations. If you’re donating appreciated securities, the limits change; a 50 percent organization’s limit becomes 30 percent for appreciated securities, and a 30 percent organization’s limit moves to 20 percent.

Reducing Risk

Another benefit to donating your appreciated securities is reducing risk in your portfolio. If too much of your portfolio is dedicated to a certain kind of investment, your risk increases because your portfolio is less diversified, so your assets are all relying on that one kind of investment to succeed. To decrease that risk, you’d normally have to sell the stocks and pay capital gains taxes. Donating them, on the other hand, is a tax-free way to rebalance your portfolio.

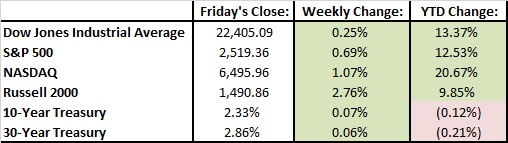

Last Week’s Highlights:

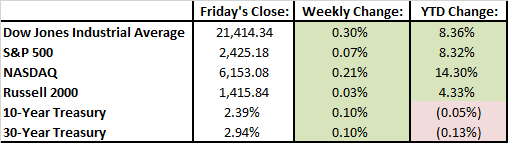

Equity markets hit record highs again last week. Stocks continue to “climb a wall of worry” but investors got some encouraging economic data releases last week. Reports showed stronger than expected trends in the automotive, manufacturing, and service sectors. Friday’s job report was weaker than expected but that was attributed to the effects of the recent hurricanes in the southeast.

Looking Ahead:

Earning season is upon us! We will kick things off with Delta and BlackRock on Wednesday. Thursday we will see earnings from JPMorgan and Citigroup and then Bank of America and Well Fargo on Friday. Also on Friday, the U.S. Census Bureau will announce retail sales numbers for September. August’s figures showed a 0.2% dip from July to August, but an increase of 3.2% from August 2016. We will also see how the American consumer is feeling with the University of Michigan’s consumer sentiment figure for October. Their survey found a 1.7% dip in confidence from August to September so it will be interesting if things change course.

What’s On Our Minds:

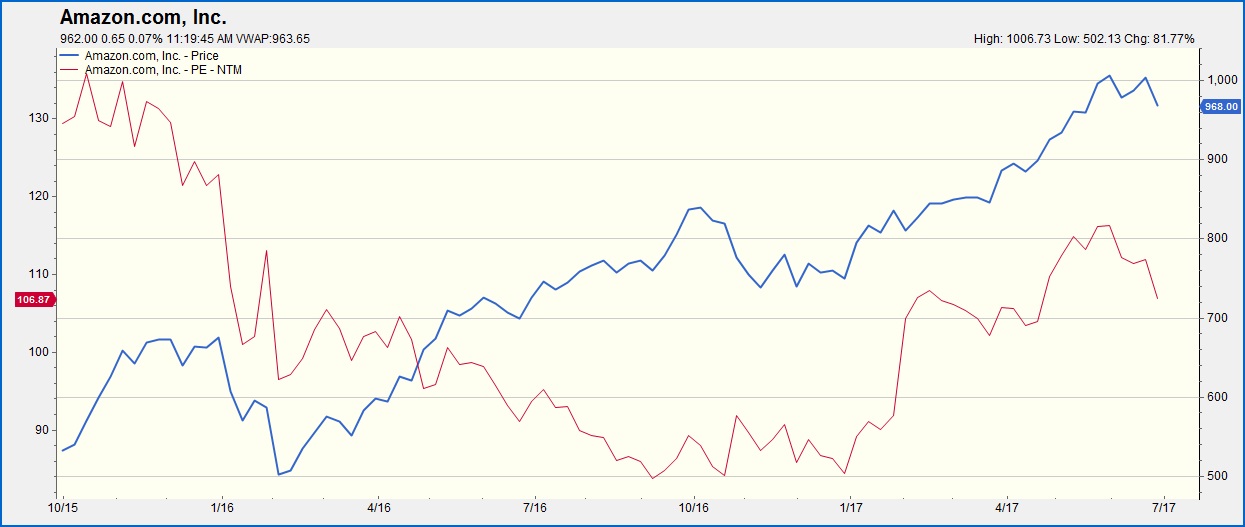

“A year from now, it’s not going to be Tech.”

Such was the general consensus at last week’s investment meeting at Tufton Capital. While the Tech sector analyst is characteristically overenthusiastic about the forward march of technology, we are reminded by history that the high flyers are rarely up for very long, and when they are, the crash is ever the more painful.

As we look at this year’s winners, the Tufton approach gets pooh-poohed as more exciting names are gobbled up and soar ever higher. “Why isn’t half your portfolio cryptocurrencies?” is not quite the question we are always getting, but it seems that way. We are confident, however, that a disciplined approach will win out over time. But in the mean time, the temptation remains strong to jump into these names that just seem to keep going up in price. Why shouldn’t you?

Another joke around the Tufton offices when we have another big up day is to say, “Wow, stocks just always go up!” Of course, the joke is that they don’t, and to be careful of another fall. The tech stocks at the head of the run-up have amazing possibility in them: self-driving cars, artificial intelligence, interconnected everything, a new kind of currency that will reshape accounting and the financial world. Even if all these things come to fruition, there is a price for everything, and an overvaluation for everything. How does one determine the correct valuation for Bitcoin? We’re afraid no one will know for sure until after the climb comes to a screeching halt. Similarly, Amazon and Facebook are valued like they will rule their respective worlds someday very soon. Perhaps they will, but betting on the next world-changing trend has been nothing but a loser’s game in the past.

Amazon has had Price/Earnings ratios in the triple digits for years.

What’s a value investor to do?

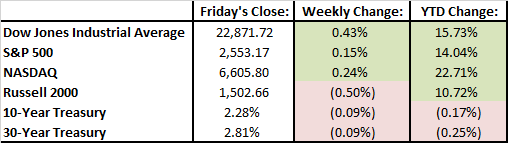

Last Week’s Highlights:

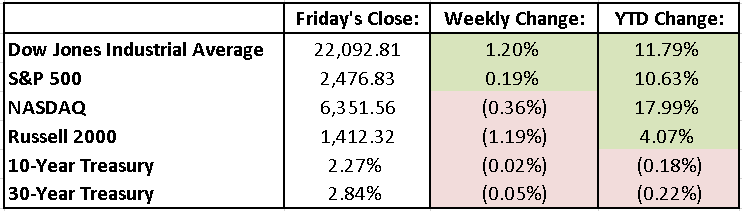

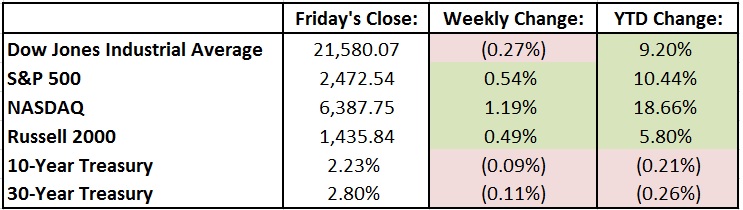

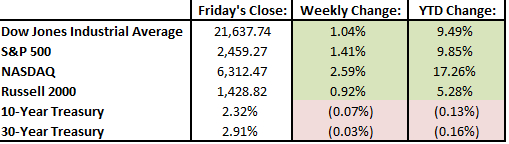

Stocks were again higher last week and hit record levels. High hopes for the Republicans’ tax plan pushed stocks ever upward. Stocks are looking at moving into mid-teen growth for the year, a solid performance to be sure. The 10-year Treasury continued to rise. While resulting in lower bond prices, increased rates are signs of a solid recovery, and gives the Fed more breathing room.

Looking Ahead:

Plenty of economic data this week, including manufacturing PMI on Monday, vehicles sales Tuesday, and the September jobs report on Friday.

What’s On Our Minds:

Tune your TV to CNBC on any given day and more and more attention is given to activist investors and the companies they target. As activists, investors look to maximize shareholder value by often taking large enough positions to influence management decisions- they are looking to shake things up at the company. Activists may decide to move in on a company if they believe management has stumbled, it would be better off as a private company, it has excessive costs, or if the activist think they have a better capital allocation strategy, such as buying back stock or raising the dividend.

Often activists are targeted by the media and politicians for being “hit and run” investors, but activists will argue that they are genuinely concerned about companies and the U.S. economy. The issues surrounding activism are not clear cut; some activist may just be greedy, while others actually want to maximize shareholder value over the long-term.

Over the summer, Nelson Peltz’s $12.7 billion hedge fund, Trian Partners, took aim at household product conglomerate Proctor and Gamble. His fund currently owns $3.3 billion worth of P&G shares. Peltz thinks P&G is not structured properly and believes that the company in resistant to change. He is currently in a proxy fight for a seat on the company’s board. The company says they have been actively working with Trian but is against adding him to the board. In dollar terms, P&G is the largest company to ever face a proxy fight of this nature.

Activists take positions in all different types of companies, across many different industries and of various market caps, but more often than not, activist target companies that have been beaten up and are considered value stocks. At Tufton Capital, we are not activist investors but we do look for undervalued stocks so it’s not uncommon for companies in our equity portfolio to have activist involvement. Thus, we do have to pay attention to the hype created by these market players.

While activist investors grab plenty of headlines, it’s tough to determine the actual impact activism is having on the overall market. According to a study conducted by the Wall Street Journal last year, of the largest 71 activist campaigns between 2009 and 2014, only about 50% of targeted companies outperformed their peers.

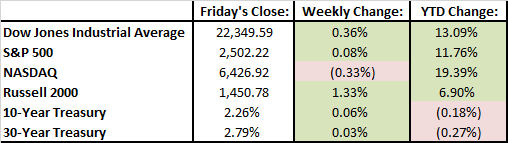

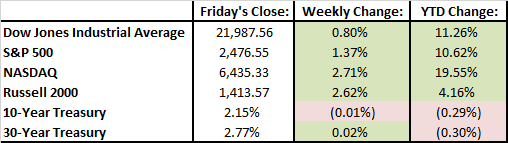

Last Week’s Highlights:

Stocks were marginally higher last week and hit record highs. The highlight of the week was the Federal Reserve’s announcement that it would begin normalizing its balance sheet in October. The Fed also stated that it would keep its federal funds rate between 1 and 1.25 percent. The announcement caused 2 and 10 year Treasury yields to increase along with the the value of the dollar.

Looking Ahead:

Investors will see how the housing market is doing this week when the Case-Shiller Index of home prices and new home sales figures are released on Tuesday. We will also get a report on consumer confidence on Tuesday and Janet Yellen is scheduled to deliver a speech. Investors are expecting her elaborate on the Fed’s plans to unwind the huge balance sheet it has amassed since the financial crisis.

What’s On Our Minds:

There was a good amount of stock speculating in recent weeks as day traders tried to take advantage of the short-term effects of Hurricanes Harvey and Irma. While it may be tempting to speculate how companies’ stock prices may gyrate around these types of events, we believe it’s important to remember that stock speculation is rarely successful over the long term.

Conversely, the investment professionals at Tufton Capital believe that a long-term, buy and hold investment strategy is the to safest, and smartest, way to build wealth in the stock market. Quite simply, it’s been proven time and time again to return exponential gains on invested capital.

Cultivating Your Portfolio

The term “buy and hold” doesn’t mean investing and forgetting about your portfolio for the next 20 years. There are ways to cultivate and prune your portfolio while still maintaining a long-haul investing strategy. For instance, if a company you invest in changes fundamentally, you may not want to continue owning that security. If the overall market changes dramatically, as it has in the past, you may actually benefit from selling an investment or group of investments. Finally, changing goals as you get closer to retirement may warrant a more conservative portfolio.

Bad Markets

The typical investor is tempted to get out of a bad market by selling when prices are low, which is a poor strategy. The economy fluctuates between good and bad all the time, and those who constantly buy and sell will be hit the hardest in a bad economy. By holding on to your investments, you’ll be better able to ride out a down market, especially if your portfolio is diversified.

Taxes and Fees

Frequent trading results in higher fees, so long haul-investors pay less while fees eat up much of a day trader’s profits. Additionally, short-term gains are taxed at a higher rate than long-term gains. Even if you have the fortune of timing the market successfully, your profits will be diminished by taxes and fees.

Investing for the long-haul is the best investing strategy for the majority of investors because it not only ensures modest gains but is also less likely to yield major losses. A long-haul investment strategy is based on informed, careful decision making and patience.

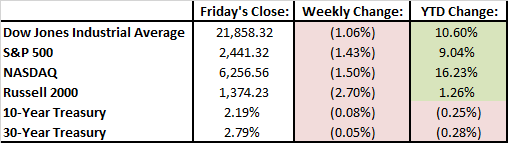

Last Week’s Highlights:

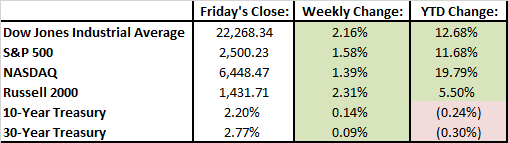

Equity markets were strong last week. The Dow Jones surged more than two percent and the S&P 500 was up over one and a half percent. It was the strongest week for the S&P since January. Most of the optimism was spurred by news that congressional Republicans are planning on releasing their tax reform policies later this month.

Looking Ahead:

The Federal Reserve is holding their two-day Federal Open Market Committee meeting this week. It will wrap up on Wednesday and Janet Yellen will give a speech. Investors don’t expect a bump in interest rates but it’s likely that the central bank will hash out how they plan to start unwinding their 4.5 trillion-dollar balance sheet.

What’s On Our Minds:

Tufton Capital Management is committed to helping our clients take control of their financial future. Armed with an effective estate plan, you can be sure you preserve your family’s legacy while minimizing taxes. By taking advantage of direct gift limits allowed by the IRS, individuals with estates totaling $5.49 million, and married couples with $10.98 million, can get a head start on generational wealth transfer and reduce the ramifications inflicted by estate taxes.

Taxes and direct gifts

Depending on their amount, direct gifts can be given tax-free. You may give up to a combined $5.45 million in life or death without the money being subject to estate or gift taxes, and there is also a $14,000 annual exemption rate per donee (recipient). Couples can combine their annual exclusions to double this amount, meaning they can give $28,000 per donee per year. Even if only one spouse technically makes the gift, as long as both spouses consent, it is considered by the IRS to have come from both. This allows couples to maximize their gifting ability. In addition, all gifts you give to your spouse throughout your lifetime are tax-free, as long as he or she is a U.S. citizen. Annual gifts can make a big difference over time, and since they are a “use it or lose it” exclusion, it makes sense to transfer as much money as possible this way as part of an estate plan.

Since annual gift tax exemptions are based on the calendar year, timing is important when gifting. For example, instead of gifting $25,000 to someone in December, if you gifted $14,000 in December and the remaining $11,000 in January, you could avoid gift taxes altogether. If your gifting amount for the year does end up exceeding the annual exemption amount, you have to file an informational gift tax return for that year and either pay 40 percent of the excess amount or use up some of your $5.49 million lifetime estate/gift exemption. One thing to consider with estate and gift taxes is that if you have to choose between the two, it will usually cost less to gift while you are living (even if it is above the exemption amount) than to wait until after death. Gifts made before death shrink your taxable estate by both the amount of the gift and the interest the money would have gained by the time of your death.

In addition to gift taxes, generation-skipping transfer tax (GST tax) is also a consideration for those subject to estate taxes. GST tax is applied to property that is passed to related persons more than one generation younger than the donor or to unrelated persons who are more than 37.5 years younger than the donor via a will or trust. This tax was created because many people had discovered that they could pass their estates directly to their grandchildren and therefore avoid one generation of estate taxes. GST tax rates and exemptions are the same as estate taxes, with up to a $5.49 million exemption and a 40 percent taxation rate.

Appreciated Assets

Gifts do not always have to be in cash. By gifting appreciated assets, you not only move money out of your estate, but you also move any future appreciation of those assets out of your estate and out of the grip of estate taxes. Another benefit of gifting appreciated assets is a possible capital gains tax advantage. Capital gains tax is enforced on the amount that the value of the asset increases from its original value. For example, if a stock was bought for $2,000 and then gifted when it was worth $2,500, capital gains tax would be assessed on $500. If the recipient of the assets is in a lower tax bracket than the donor, he or she will end up owing less money on this asset.

Last Week’s Highlights:

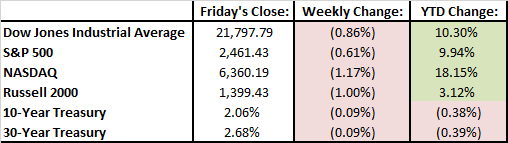

Stocks were lower last week. Political headlines and the impact of both Hurricanes Harvey and Irma weighed on investors’ minds. The Dow Jones slipped .86% and the S&P 500 shaved off .61%.

Investors were relieved last week when President Trump reached across party lines to extend the nation’s debt ceiling which will keep the government funded for the next 3 months. Although they may have only “kicked the can” on the issue, the move showed some rare bipartisan cooperation.

The monetary cost of Hurricanes Harvey and Irma will not be totally calculated for some time but the overall cost of both storms together could be in the several hundred billion dollar range. It is likely that property and casualty insurers covering Texas and Florida will see large claims in coming quarters.

Looking Ahead:

Monday is the 16th anniversary of the 9/11/2001 terror attacks.

On Tuesday, Apple will release the highly-anticipated iPhone 8. Experts are expecting the new iPhone to include “Face ID” technology that will recognize the owner’s face so that users and simply look at the phone to unlock it.

On Friday, retail sales, industrial production, and capacity utilization figures will all be reported. Also on Friday, contracts for stock index futures, stock index options, and stock options all expire on the same day. These “triple witching” days occur four times a year and can result in escalated trading activity during the final hour of the day.

What’s On Our Minds:

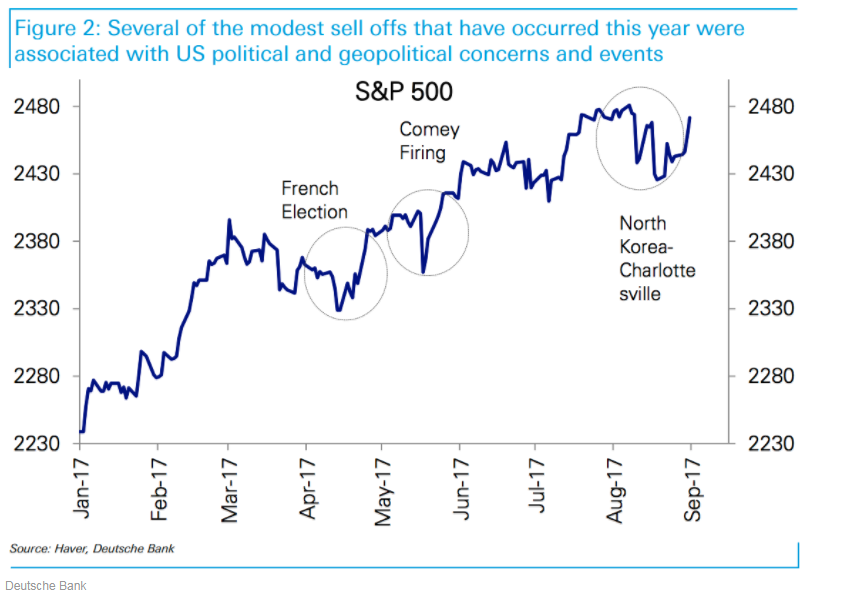

The S&P 500 has been on a ten-month run without a 3% sell off. It has been a historically calm market that has some investors worried that we are long overdue for a pullback. As we wrap up summer and move into fall, bears are concerned that markets are poised to get more volatile.

With plenty of geopolitical uncertainties currently in the mix, their worries are not without basis. Congress must decide to raise the debt ceiling this month and the civilized world must deal with a North Korean regime that continues to threaten nuclear war. Of course, the 24 hour news cycle is doing its best to frighten the average investor.

Optimists disagree with the bears and believe that any volatility spurred from these coming events will be short lived. Bulls are pointing to recent double digit growth in corporate earnings and increased economic growth throughout the world as catalysts that can continue pushing the market higher. Furthermore, market bears have continued to be disappointed this year as sell offs instigated by geopolitical and US political drama have been brief. (See the graph below from Deutsche Bank.)

At Tufton, we continue to remind our clients and friends that even though “noise” may affect equity markets from day to day, it remains crucial to remain focused on the long term. Uncertainty is a fact of life in the investment business, and over the years, a disciplined approach through thick and thin has benefited our clients handsomely.

Last Week’s Highlights:

Equity markets moved higher last week in the face of devastating flooding in Texas and more hostile moves by the North Korean regime. Hurricane Harvey dumped 50 inches on rain in the Houston area, killed 46 people, and temporarily shut down a good portion of the nation’s refineries which has pushed fuel prices higher.

Friday’s job report was strong and showed that the U.S. economy added 156,000 jobs in August. Treasury Secretary Steven Mnuchin said that the Trump administration and Congress will release more details on their plans to overhaul U.S. tax code in coming days. United Technologies announced they are closing on a deal to acquire Rockwell Collins. Gilead Sciences announced it was purchasing Kite Pharma.

Looking Ahead:

Domestic markets were closed on Monday in observance of Labor Day. Factory and durable goods orders will be reported on Tuesday. The ISM non manufacturing index for August will be reported on Wednesday. The European Central Bank is meeting on Thursday to issue its decision on interest rates. Another hurricane is making its way across the Atlantic and could potentially hit Florida and head into the Gulf of Mexico

What’s On Our Minds:

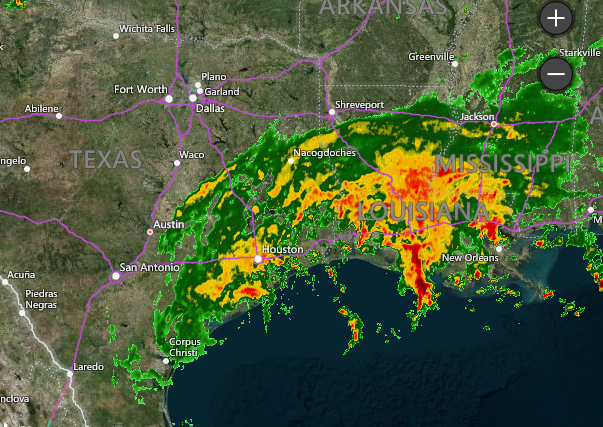

Over the weekend, Hurricane Harvey walloped the Texas coast and caused major flooding throughout the Houston area. Five deaths have been reported so far and over 3,000 water rescues have been performed. It looks like rain will continue through the week and the city could receive up to 50 inches of rain by the time it’s all said and done. Along with the humanitarian issues brought on by the storm, many are asking how this historic weather event will affect business along the Gulf Coast.

The storm will without a doubt be a major hit on insurance companies covering homes and business in the area and it will also affect the local oil industry. The hurricane’s path goes right through a corridor of critical energy infrastructure in the Houston and Galveston area. Investors are expecting the storm to send ripples through the energy industry this week. Thus far, the hurricane has forced 15% of the U.S.’s oil refining capacity to temporarily shut down, and it looks like it could get worse as the storm heads east towards refineries along the Texas and Louisiana boarder. Experts are saying that even though refineries may not be damaged, the Houston Shipping Channel has been closed since Friday. As a result, crude can’t get into port and refined product can’t be shipped. Several major pipelines that lead in and out of the Houston area may also see interrupted operations due to the storm. Rest assured, the U.S. prepares for times like these and has a large stockpile of gasoline on the east coast that can sustain the entire country for 2 weeks.

Oil investors are expecting the crack spread (the metric that tracks the difference between the price of oil and gasoline) to widen in the short term following the storm. Depending on how fast refineries can get back up and running after the storm will determine how quickly the crack spread will normalize. Look for gas prices to spike in the short term following the storm.

Texas and Louisiana are bracing for more rain as Hurricane Harvey moves onshore. Source: Accuweather.

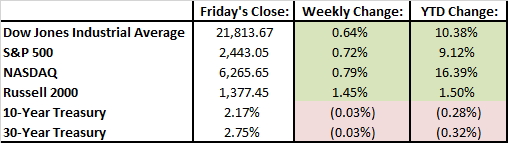

Last Week’s Highlights:

Domestic equity markets saw small gains last week. The S&P 500 was up 0.72% and the Dow Jones increased by 0.64%. Materials and telecom sectors had a strong week but consumer staple stocks declined. Grocery store stocks had a tough week due to Amazon’s announcement that they would lower prices at their recently acquired Whole Foods stores.

With earnings season wrapped up, happenings in Washington D.C. continue to drive investor sentiment. On Tuesday, markets were up 1% as President Trump renewed his focus on pushing pro-growth tax reform policies. Then, we witnessed a bit of a pullback on Wednesday when Trump threatened to allow for a shutdown of the federal government if Congress refused to fund his border wall.

Looking Ahead:

The last official week of summer going into the Labor Day weekend will have investors on their toes with a good amount of economic data coming across the wire. U.S. GDP numbers are being reported on Wednesday and consumer spending figures will be released on Thursday. Auto sales, ISM manufacturing data, and the unemployment number from August will all be reported on Friday. Wall Street is expecting strong gains in Friday’s job report.

What’s On Our Minds:

Tufton Capital has recently taken on the responsibility of sponsoring one mile of highway on Interstate 83 South. The firm is proud to partner with the Sponsor-A-Highway program. It is an easy and effective way to help keep our local roadways and environment clean. A sign with Tufton’s logo is now in place on our stretch of highway just north of our offices in Hunt Valley.

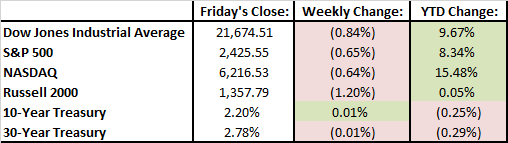

Last Week’s Highlights:

Stocks were lower again last week, mostly due to political drama in Washington D.C. and the terrorist attack in Barcelona. Since the S&P hit a record high on August 7, the index has pulled back 2.2%. President Trump’s pro-business agenda took a hit last week when it was announced that the White House Manufacturing Advisory council would be dissolved. Reduced optimism about the likelihood of passing the President’s pro-business reforms clearly weighed on investor sentiment last week. While we have witnessed some volatility lately, it’s important to remember that, in historic terms, markets have been unusually placid this year.

Looking Ahead:

Earnings season is over, so investors will refocus on big picture issues. The Federal Reserve is holding their annual Jackson Hole symposium this week and investors are expecting them to remain dovish in regards to increasing short term interest rates. Investors aren’t expecting any market moving news out of Jackson Hole. Investors will also keep an eye on Washington after President Trump’s incendiary comments following the protests in Charlottesville, VA last weekend.

New home sales data will be released on Wednesday and existing home sales data will be released on Thursday.

What’s On Our Minds:

The war of words between President Trump and North Korea’s Kim Jun Un caused the CBOE Volatility Index (“the fear index”) to spike 55% last week. While volatility has been extremely low this year, last week’s spike serves as an important reminder that volatility will inevitably rear its ugly head every once in a while. Read on to learn what drives high volatility and how investors should respond when markets gets turbulent.

High-volatility Markets

Originally used by chemists to describe chemicals that evaporate (and explode) easily, “volatile” has become the generic term for anything erratic or subject to sudden changes.

Today, most people hear about volatility in connection with investments and the stock market. But what does volatility mean in a market? Can we measure it? What does it mean for an investor’s current assets?

A Measure of Movement

Just like in chemistry, market volatility is about change. Stocks (or other investments) that are thought to have more predictable price fluctuations have “low volatility” while those expected to make drastic movements (both up and down) are said to have “high volatility.”

Most people use volatility to gauge the risk they are taking when purchasing an investment or planning a portfolio.

Highly volatile investments are judged as unpredictable with their returns. Though this means a volatile investment could significantly exceed its projected return, it also means that it is more likely to fall considerably short or cause a loss.

Two Types of Volatility

Investors commonly use one of two types of volatility when looking at stocks: historical volatility and implied volatility.

An investment’s historic volatility is measured according to its standard deviation—that is, comparing how much it has fluctuated in the past to its average rate of change.

Implied volatility, on the other hand, shows the expected volatility of a stock over the next 30 days. It is calculated using the current premiums on stock options.

Implied volatility is a measure of both anticipated performance and market sentiment. When option writers have increased concerns about a stock’s future price, they compensate by charging more for option contracts. The higher the premium they charge, the greater the anticipated fluctuations. The premium, therefore, implies the level of volatility.

The standard indicator of total market volatility is the Chicago Board Options Exchange Market Volatility Index—ticker symbol: VIX. It relates the implied volatility of all options on S&P 500 stocks due in the next 30 days.

Because the implied volatility is greatly influenced by investor emotions, the VIX is commonly referred to as “the fear index.”

What does High Volatility Mean for Investors?

Volatility is an inescapable part of investing. The future is uncertain and every investment carries risks.

However, unless an investor is involved with buying or selling options, a brief increase in volatility or the VIX is unlikely to require any changes to his or her investments.

A volatile market might cause stock prices to rise and fall by significant amounts, but it does not necessarily affect the future value of owning shares in a company.

Investors should choose stocks based on the underlying value of a company, not a temporary price fluctuation. The fear associated with the VIX should not give way to irrational buying or selling.

Nevertheless, prolonged periods of high volatility can make it more difficult for investors to plan for retirement. Even though the market could be rising in value, high volatility makes it difficult to set reliable retirement dates.

Those nearing retirement typically desire less volatility in their investments, as significant downturn can delay retirement by several years.

A high-volatility market is one that can produce both significant gains and significant losses. Investors must recognize that every investment has the potential to become volatile. Volatility is an expression of market fears and past changes, not a guarantee about the future.

Last Week’s Highlights:

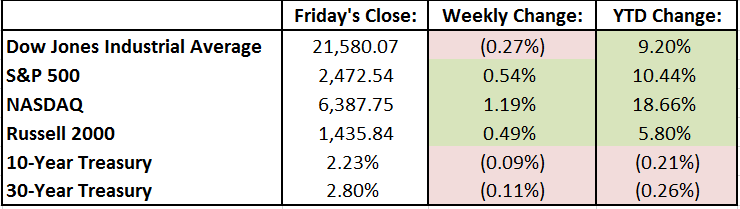

Domestic markets have been on a strong run recently during a solid second quarter earnings season. 90% of the S&P 500’s companies have reported and 74% of them have beaten investor expectations. Last week, domestic stock indices experienced a bit of a hiccup due to geopolitical tensions surrounding the situation in North Korea. After a strong run, the Dow Jones broke its 10-day winning streak on Wednesday. The trash talk between President Trump and North Korea’s Kim Jung Un caused safe havens (bonds and gold) to rally last week. Overall, last week served as a reminder that investors can be an anxious bunch and that geopolitics can in fact influence our markets here at home. The team here at Tufton continues to remind our clients and friends that these types of short term market jitters should not weigh on your long-term investment objectives.

Looking Ahead:

Aside from keeping an eye on the situation unfolding between the United States and North Korea, investors will continue monitoring earnings updates and continue trying to figure out what’s next for the Federal Reserve. The U.S Census Bureau will report retail sales for July on Tuesday. The Federal Open Market Committee will release its meeting minutes from its July 26th meeting on Wednesday and the first rounds of NAFTA negotiations between the U.S., Canada, and Mexico will commence. Weekly jobless claims will be released on Thursday. On Friday, we will close out the week with University of Michigan reporting their Consumer Sentiment figures for the month of August.

What’s On Our Minds:

One of the most interesting aspects of investment and the stock market is its ability to show trends. Any given company on any given day has a stock value that behaves individually. However, there are certain characteristics that people might expect to see from companies depending on their size.

Commonly referred to as its “market cap,” a company’s market capitalization is the total value of all shares of its stock (both common and preferred). Though market cap is easy to calculate (shares multiplied by price), determining why a company holds its current share price is much more difficult.

In general, companies are classified into one of four categories: large-cap, mid-cap, small-cap and micro-cap. Large-caps (sometimes called “big-caps”) typically have a value of over $10 billion. Mid-caps span approximately $2-$10 billion. Small-caps are usually below $2 billion, with micro-caps being smaller than $250 million. Sometimes the terms “mega-cap” or “nano-cap” are also used; these are reserved for truly gigantic and extremely small companies, respectively.

Characteristics of each Cap Category

Large

Large-caps are typically the most stable companies on the market. They are big companies with long histories and a lot of market recognition. Large-caps are more likely to pay out stock dividends and make good on bonds. Investors that focus on large-caps will try to use this stability to produce measured, consistent growth for their clients.

Mid

A mid-cap company usually carries a lot of weight in its particular industry, but is not as widespread as the large-cap companies are. Investors that predominantly use mid-caps aim to have higher gains from growth than large-caps, but put themselves at slightly more risk. During times of economic decline, mid-cap investors will usually lose more than large-cap investors.

Small

Most small-cap companies are well established, but individually, have a minor role in the market. Their functions are usually non-essential, but they have plenty of room to expand and might possibly move into the mid-cap range. Small-cap investors try to harness this growth potential, but cannot be certain of success. These funds often have years of significant gain broken up with occasional years of loss. Small-caps will often boom during economic recovery.

Choosing a Market Cap Style

There is no “right answer” when it comes to choosing a type of cap for investing. Although any single type of market-cap might outperform any other type, success in the future is ultimately unknowable. Large and mid-caps might weather economic downturns better, but are less likely to grow quickly when things are good.

When investing, whether in bonds or stocks, it is important to get all the information. Risk and return must be balanced properly in every portfolio and the means to do it is not always clear. If you are consider adjusting your investments, contact Tufton Capital Management with all your questions and concerns.

Last Week’s Highlights:

There was a flurry of activity during the week as strong earnings continued to drive the major indices higher. The Dow set a new high water mark above 22,000 and the S&P 500 continues to march towards 2500. A particular Cupertino phone company continues to be the apple of the markets eye, as AAPL had a large earnings beat. The stock finished the week with a 4.5% gain and is up 34.5% YTD. Tesla had a strong quarter on unexpected revenue growth and continues to trek higher into even frothier levels. The market values Tesla $15B more than Ford motor company and $7B more than General Motors.

There was positive economic data this week as employers added 209,000 jobs in July and brought the unemployment rate down to 4.3%. In political news, General Kelly replaced Reince Preibus as White House Chief of Staff and fired Director of Communications Anthony Scarramucci, who only held the position for 10 days.

Looking Ahead:

Earnings are starting to slow down, but Disney and Home Depot, along with younger companies, like Snap Inc., are reporting. It’s supposed to be a quiet week in Washington D.C. as no major bills or testimonies are scheduled. These truly are the dog days of summer…

What’s On Our Minds:

Market bubbles, like the tech bubble of the 1990’s, have formed for as long as there is record of exchange, and all follow a similar pattern of speculation.

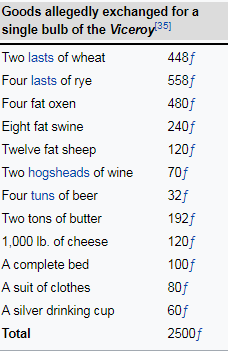

In the early 17th century, the Dutch became enraptured by tulips, and created the first chronicled speculative bubble in history. As recorded in Charles Mackay’s Madness of Crowds, tulips began to grow rapidly in popularity all around Europe, and therefore tulip prices rose sharply. Many deft merchants identified this trend and made a large profit in trading tulips. Other merchants and the nobility, seeing these extraordinary profits, jumped into the tulip market. As a result, prices for tulips kept rising and rising, backed by nothing but speculation. Soon enough, nobles, farmers, seamen, chimney sweepers, and maidservants alike were all dabbling in tulips. Below is a chart of what one individual paid for a single tulip bulb!

(Source: The Tulipmania: Fact or Artifact?)

Eventually, the tulip market ran out of new money to keep bidding up prices. As reality sat in, speculators all ran for the exit and prices plummeted. Many speculators lost all their savings as contracts they purchased were ten times the price that tulips were then trading.

This is an important lesson for us in 2017. As Benjamin Graham poignantly argues, “an investment operation is one which, upon thorough analysis, promises safety of principal and an adequate return. Operations not meeting these requirements are speculative.” Graham would certainly have chuckled at otherwise serious individuals who lost a whole year’s salary on buying tulips.

Buying something, be it tulips, Bitcoin, or the hot stock of the day, as an investment because everyone else is doing it, or because of tremendous recent returns is not investing, but speculating. It may work in the short term, but it always has devastating effects in the long term.

The lessons of manias past are always important to keep in mind in an ever changing market. This isn’t to compare any particular asset to the tulip bulb craze, but it is always smart to study history in an attempt to understand the present. Many people will make bold claims about “X being in a bubble” or “Y will never go down.” A prudent investor, not speculator, will not be swayed by the opinions of crowds and will continue to drown out the noise and invest in quality assets at good prices.

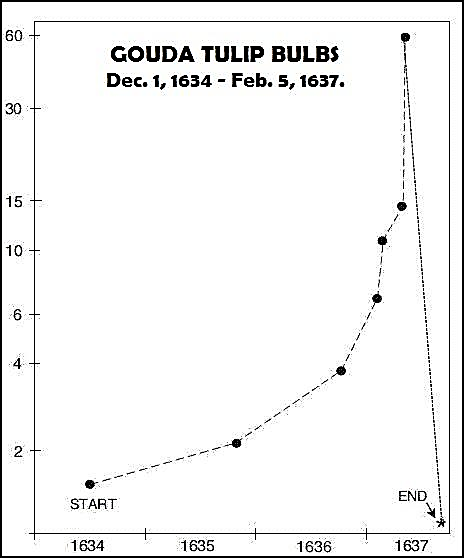

Tulip Price

(Source: The Tulipmania: Fact or Artifact?)

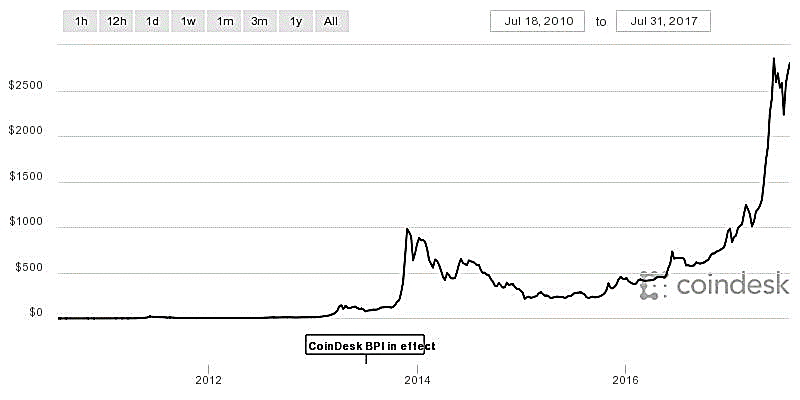

Bitcoin Price

((Source: www.coindesk.com)

Last Week’s Highlights:

The Dow Jones Industrial Average climbed to a record 21,830.31, up 1.2% the past week, backed by strong earnings. Big names like Verizon, Google, McDonald’s, and Boeing all surpassed expectations for the second quarter and gave an optimistic forecast for the future. Oil rose 8.6% last week after Saudi Arabia cut its oil exports and OPEC said they might discipline member nations who do not follow OPEC’s production limits.

The Federal Reserve left interest rates unchanged after their meeting Wednesday. They hinted that the tapering of its $4.5 trillion balance sheet will begin “relatively soon.” GDP rose 2.6% in the second quarter, which was slightly less than the estimated 2.7%. The growth was driven by increased consumer spending and increased business investment, both positive signs for the macroeconomic health of the US economy.

In Washington, the GOP’s repeal and replace effort to end ObamaCare has concluded for now. In a vote for “skinny repeal,” John McCain shocked the nation by casting the decisive “no” vote, resulting in a 49-51 vote. The market has been indifferent to the chaos in Washington as the major indices continue to climb, despite a recent legislative defeat (TrumpCare), high profile firings (Chief of Staff Reince Preibus), and swirling allegations surrounding the current administration. The next major agenda item is tax reform, which is very important to corporate America, and has been a major reason for the so-called Trump Bump.

Looking Ahead:

There will be a slew of economic data released this week. On Monday, the Chicago Purchasing Managers Index will be announced. Personal income and spending data, and the ISM Manufacturing Index will be reported on Tuesday, and nonfarm payrolls will be released Friday. The Bank of England also will issue a rate decision on Thursday.

In large cap earnings this week, Apple, Under Armour, Sprint, Time Warner, Kraft Heinz, and Pfizer are all set to report. Oil earnings are in full swing with BP, EOG, Devon, Chesapeake, and EPD reporting throughout the week. At General Electric, John Flannery will be replacing Jeff Immelt on Tuesday and investors will be waiting for any news about the direction of the company.

In political news, there are hopes that Republicans will abandon Healthcare reform for the time being and begin to focus on tax reform. Mike Pence will visit Eastern Europe.

What’s On Our Minds:

With very little volatility in domestic markets lately, let’s review the tax management strategy of “tax loss harvesting”.

Aside from research roles, Tufton Capital’s portfolio managers are responsible for all aspects of portfolio construction and supervision, which includes the management of gains and losses that are realized in our clients’ taxable accounts. Of course, tax implications are not the paramount concern in the management of a portfolio, but trading responsibly with this in mind can make a big difference for investors come tax day in April.

Selling at a loss may seem to run counter to your investment goals, but because the IRS allows for investment losses to be used to offset capital gains, investors should look to make the best of an otherwise unprofitable investment. With that in mind, investors should consider selling poor performers in their taxable accounts by conducting tax loss sales. This strategy is especially good for investors in the 25-35% Federal tax brackets who must pay a long-term capital gains rate of 15%. The tax savings increase for the highest income earners in the 39.6% Federal tax bracket, who must pay 20% on long-term capital gains. Plus, depending on where you live, you may be subject to capital gains taxes at the state level. Our clients in Maryland know this all too well!

Of course, we don’t make trades just for tax purposes. If we think a stock is going to increase in value, we hold it. If we think it is going to go down, we sell it. But using a tax wash sale, in which a security is sold and then repurchased after 30 or more days, enable an investor to claim the tax loss but still hang on to an investment that he or she thinks has long-term potential.

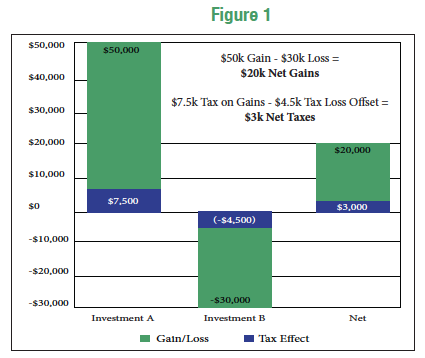

Take for example a single person who has an annual income of $100,000. He would be in the 15% long-term capital gains bracket. In his brokerage account, he has a realized long-term capital gain of $50,000 in Investment A and an unrealized long-term capital loss of $30,000 in Investment B. If he sells his shares of the losing stock, he can offset the $50,000 gain against the $30,000 loss, resulting in $20,000 of net long-term gains. If he does not harvest the loss, the Federal tax on his $50,000 long-term gain would be $7,500. By partaking in this tax loss harvest, he will save himself $4,500, which would have otherwise been a piece of his Federal tax liability for the year (See Figure 1).

Portfolios with large unrealized gains will likely have some positions that have unrealized losses. Although a loss may be hard to look at, sometimes it’s best to bite the bullet and clean these losers out of a portfolio. This management strategy allows investors to free up cash in the portfolio, which can be deployed into other, more attractive investments.

While it’s important to avoid the tax tail wagging the investment dog in your overall investment strategy, a disciplined approach to managing tax liabilities is an important component of wealth management.

Last Week’s Highlights:

On the back of strong earnings, all three domestic market indices notched new record highs during the week, but finished with mixed results. Major banks reported earnings, with most producing top and bottom line beats but with mixed results beyond the headline numbers. Goldman Sachs had gains in its equity portfolio but reported weak trading revenue. Bank of America posted a surprise drop in net interest income. Netflix was a major winner for the week, adding 5.2 million users in the quarter, and posting a 32% jump in revenue. Activist investor Nelson Peltz stated his intentions to begin a proxy battle with Procter and Gamble over obtaining a board seat. He argues that P&G has not followed through on long term plans and doubts future plans will be implemented.

In economic news, ECB President Mario Draghi hasn’t discussed the wind-down of the ECB’s bond buying program, but is expected to do so later this year. Baker Hughes’ U.S. rig count reported a loss of 2 rigs but still reports 488 more rigs than the year prior.

On Capitol Hill, Republicans failed to bring the health care reform bill to vote due to lack of support, but they promise to bring a full repeal bill to vote soon. They also hinted at a potential tax cut, and Dodd-Frank partial repeal, but markets failed to react due to Republicans’ perceived inability to enact legislation.

Looking Ahead:

This coming week has a packed schedule, both on Wall Street and in Washington. The Senate is poised to vote on a stand-alone repeal of ObamaCare sometime this week, as Republicans try to keep true to their 7 year old campaign promise. The Senate is going to hear testimonies from Jared Kushner, Donald Trump Jr., and Paul Manafort, which should provide some color on the ongoing Russia investigation.

On Monday, ministers from six OPEC nations gather in Russia to discuss the current supply gut in oil and how the cartel is going to respond to it. On Wednesday, the Federal Reserve will end its two-day meeting and announce its decision on interest rates. They are expected to clarify their language on when they will start to normalize their $4.5 trillion balance sheet. Treasury Secretary Steve Mnuchin will testify on the state of the International Financial System on Thursday. Lastly on Friday, the US’s 2nd quarter GDP growth will be reported.

In the markets, Google, Haliburton, AT&T, Caterpillar, Coca-Cola, and Exxon Mobil are among the notable companies reporting earnings this week. Tesla is expected to deliver the first of its lower-cost Model 3 cars. Scaling and production have been hiccups for Tesla in the past, so the market is looking to see if the Model 3 rollout will be successful.

What’s On Our Minds:

THE WORST OF THE BEST: Mistakes Made by (Otherwise) Successful Investors

In Wall Street’s long history, many investors and companies have made successful investments that put them on the map (and made them hundreds of millions of dollars). Their success leaves people astounded and, in all likelihood, a bit envious.

But, despite their prolific returns, no one has a perfect investment record. In the hunt for extraordinary profits, an investor’s mistakes can lead to extraordinary losses. And, though it won’t make your stock-picking skills any better, it’s nice to be reminded that even investing giants are still human beings. Here are just a few of the biggest investing mistakes from the past few decades.

Carl Icahn Bets on Blockbuster’s Resilience and Loses

A skilled investor known for turning around failing businesses, Carl Icahn is reported to have invested over $190 million in video rental giant Blockbuster from 2004–05. Icahn believed the shares to be severely undervalued, but, in reality, the company was permanently losing its market share and was later forced to liquidate. Icahn ended up losing around 97 percent (more than $180 million) of his total investment by the time he threw in the towel in 2010.

The silver lining? Icahn recognized the value of video streaming service Netflix, which was largely responsible for Blockbuster’s decline, and quickly bought nearly 10 percent of the company. When he sold just half of his shares in October 2013, he pocketed over $800 million in profits.

Warren Buffett’s Oil Fiasco

Despite being the most successful investor of all time, Warren Buffett has made a few errors in judgment. His biggest mistake began in 2007–08, when oil prices peaked across the world. Buffett, known for his ability to pick out undervalued stocks, made an uncharacteristic purchase of highly priced ConocoPhillips stock. His purchase was massive, approximately $7 billion in shares. As demand and prices fell following 2008, the stock lost almost half its value. Although ConocoPhillips somewhat recovered, it is estimated that Buffett lost at least $1.5 billion on his commodity speculation.

LTCM Defeated by the Russian Winter

In the 1990s, John Meriwether and his hedge fund Long-Term Capital Management (LTCM) were astounding investors on Wall Street. Using detailed mathematical models and borrowing money to leverage their investments, LTCM targeted small, but predictable, bond trades. LTCM was rarely wrong and produced fantastic returns. However, in 1998, LTCM made a $10 billion bet on Russian bonds, leveraging their money 100-fold. When the bonds went the wrong way later that year, LTCM became destabilized and had to be bailed out by other Wall Street firms to avoid a meltdown in the bond market. By the time Meriwether dismantled LTCM in 2000, it had lost some $4.6 billion.

Bill Ackman Helms a Sinking J.C. Penney

An activist investor, Bill Ackman is known for finding underperforming stocks and pushing their company profits to the limit. In October 2010, Ackman’s hedge fund took a nearly $1 billion stake in the struggling J.C. Penney and put Ackman on the company’s board of directors. However, the changes made to the company were largely ineffective and the share price continued to plummet. In less than three years, Ackman stepped down from the board and sold his fund’s shares in the company; the resulting losses exceeded $400 million.

David Bonderman’s Bankrupt Bank

Billionaire David Bonderman has been known to find huge profits in scooping up companies on the brink of failure. During the financial crisis, the giant Seattle-based bank Washington Mutual, or “WaMu,” looked like a perfect buying opportunity for Bonderman. Spearheaded by his renowned investment firm TPG Capital, investors dumped a total of $7 billion into the bank in April 2008. However, just five months later, the FDIC shut down WaMu and took all its assets, destroying its investment value. Investors lost every dollar they paid, and TPG Capital’s own $1.35 billion stake in the bank vanished overnight.

Conclusion

The history of investing is littered with hundreds of investors, financiers, and businesses that made big bets and lost. These examples serve as a good reminder that all investments are uncertain, even for the smartest investors in the world.

In investing, success is not about being perfect, but about getting more investments right than wrong. As an investor who is not working with millions or billions, you can only aim to avoid extremely risky investments and not get carried away when buying into an apparent opportunity.

Last Week’s Highlights:

Markets finished the week at a record high Friday with the all major indices gaining a percent or more. Oil prices were up 5%. Janet Yellen spoke in a dovish tone when speaking in front of congress. She highlighted the strength of job growth and indicated the intent to wind down the Fed’s $4.5 trillion balance sheet starting this fall. Her major worry is that inflation remains below the Fed’s target of 2%. Low inflation coincides with a soft Consumer Price Index (CPI) number and lagging real estate prices- not good for economic growth. China posted Q2 GDP growth of 6.9%, driven by 10% growth in consumer spending and firmer exports, especially steel. President Trump has made cutting US’s trade deficit with China a top agenda item and has also flagged the steel trade as a point of contention.

Looking Ahead:

Earnings season is officially in full swing with some big names reporting this week, including Under Armour, Bank of America, Microsoft, and General Electric just to name a few. With major tech, industrials, and financial firms all reporting, earnings this week will showcase the health of corporations across a large portion of the economy.

There will also be a host of economic data being reported. Tuesday will have export and import data. Housing data will be released this week on Tuesday and Wednesday, and initial jobless claims will be reported on Thursday. With Janet Yellen taking a slightly dovish tone, all eyes will be on any potential data points for the Fed to base its monetary policy on. Also, Japan and ECB will be announcing their monetary decisions later this week.

In political news, gridlock continues on Capitol Hill as the vote on the bill to replace Obamacare has been delayed until Senator John McCain recovers from surgery.

What’s On Our Minds:

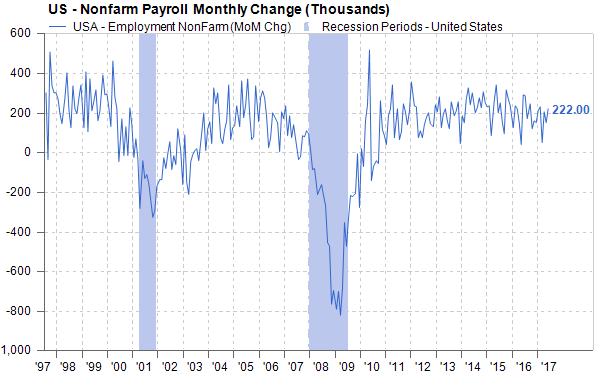

Nonfarm payrolls rose 222,000 in June, beating economists’ expectations. Unemployment remains near historic lows at 4.4%. This came in well above economists’ predictions of 178,000 jobs. April and May numbers were also revised upward. A negative in Friday’s report was the wage growth numbers, which rose 2.5% from last year, below estimates of 2.6%. Wage growth continues to be slow and is another indicator of lower than expected inflation.

Economists believe low wage growth and inflation will give the Fed an even greater case to continue to tighten monetary policy. It is also important to realize these numbers are constantly revised, so all interpretations should be taken with a grain of salt. Moving forward, all eyes will be on wage growth and whether strong jobs numbers will have a positive effect on GDP growth, which has been tepid.

Another interesting topic is whether or not the natural employment rate is lower than once thought. The Fed believes the natural rate is somewhere between 4.7%-5.8%. Economists normally believe inflation should “catch” soon after employment dips below the natural rate and that a shortage in the labor market should force wages higher. In theory, this should cause the economy to start to overheat, but this has yet to be seen in the current expansion. Is the natural rate lower than once thought or is something else going on?

Last Week’s Highlights:

With a mix of strong economic data and geopolitical uncertainty, markets eked out gains during the week of trading shortened by the July 4th holiday. Both the S&P 500 and Dow Jones remain up by more than 8% for the year. Stocks had a good day Friday after the June jobs report was released. The Federal Reserve’s meeting minutes were released, and the Fed discussed plans to continue unwinding its $4.5 trillion balance sheet. The G20 summit and tensions with North Korea put geopolitics in the forefront of investors’ minds.

Looking Ahead:

Janet Yellen will be speaking before Congress on Wednesday. Investors are eager to hear what she will have to say regarding the Fed’s reaction to recent jobs and inflation data. Inflation and retail sales data will be released on Friday. Second quarter earnings season gets underway this week with reports coming out of J.P Morgan Chase, Wells Fargo, and Citigroup on Friday.