The Baltimore Sun featured Tufton, and briefly explaining our vision for the rebrand. Click here to read the article.

Effective February 23, Hardesty will being operating as Tufton Capital Management, LLC

Hunt Valley-based Hardesty Capital Management has rebranded and officially changed their company name to Tufton Capital Management effective immediately. The independently owned investment advisory firm is one of the largest in the region with nearly $1 billion dollars in assets for individual clients and institutions.

The firm previously known as Hardesty was founded in Baltimore, Maryland in 1995 by Jim Hardesty and Randy McMenamin. The namesake of the company, Jim Hardesty, retired from the firm in April of 2015 and passed away the following month. In explaining the name change, Chad Meyer, President of the firm remarked “The Hardesty name will always connote trust, financial acumen and a deep devotion to our clients. We feel strongly, however, that the contributions of all of our employees, and not just those of our co-founder, be reflected in our corporate name. While Jim Hardesty’s legacy and invaluable contribution to our organization will live on, we believe that a new name will best represent our entire firm as we move forward.”

The Tufton Capital Management name was selected after a thorough evaluative review and was ultimately voted on unanimously by the entire firm. The offices of Tufton Capital, a 13 person firm, overlook the beautiful Tufton Valley of northern Baltimore County. The company will celebrate their 21st anniversary this year.

Tufton Capital Management is an independently owned wealth management and investment advisory firm located in Hunt Valley, Maryland with nearly $1 billion in assets for individual clients and institutions. The 13-person firm, founded in 1995, provides a value-oriented investment approach to high net worth individuals, families and institutions.

For more information, please contact Dana Metzger Cohen or Karen Evander at Clapp Communications at 410-561-8886 or dana@clappcommunications.com or evander@clappcommunications.com.

What’s On Our Minds:

Recently, equity markets have been volatile and wild intra-day price swings have many investors on the edge of their seats. In times like these, it’s more important than ever to stick to your guns and focus on your long term portfolio. In this sort of environment, we are reminded of Ben Graham’s “Mr. Market” whose view on an individual company’s share price changes from wildly optimistic one day, to overly pessimistic the next. According to Graham, the only way to beat Mr. Market was to perform fundamental analysis on a company to determine it’s fair market value and trade shares with Mr. Market accordingly. This oversimplified version of investing rings true today.

Last Week’s Highlights:

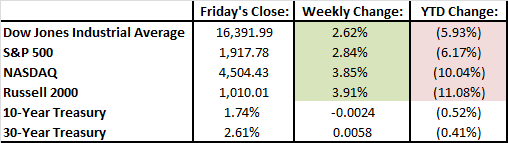

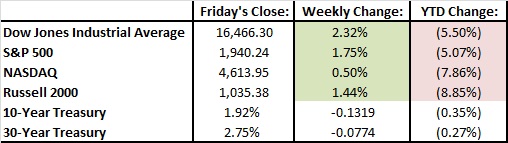

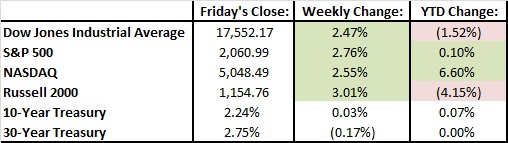

Last week was a breath of fresh air for investors as stocks rose out of correction territory. We saw the best week of the year with the Dow up 2.6%, the S&P 500 up 2.8% and the Nasdaq up 3.9%. Crude oil prices rallied last week on news that Saudi Arabia and Russia would agree to freeze production levels as long as other countries agree to participate. The Federal Reserve said that they would not change their economic outlook for the year but would keep a close eye on the global economy and developments in both the energy and stock markets.

Looking Ahead:

We will be monitoring economic and company data this week as we reach the end of 4th quarter earnings season. On Tuesday, January Existing Home Sales will be reported and J.M. Smuckers, Home Depot, and Macy’s will report earnings. On Wednesday we will see results from Target, HP, and Lowe’s followed by Campbell’s Soup, Best Buy and Kraft Heinz on Thursday. Finally, on Friday, J.C. Penney and EOG Resources will report their 4th quarter results and we will get a look at January’s consumption and personal income levels.

What’s On Our Minds:

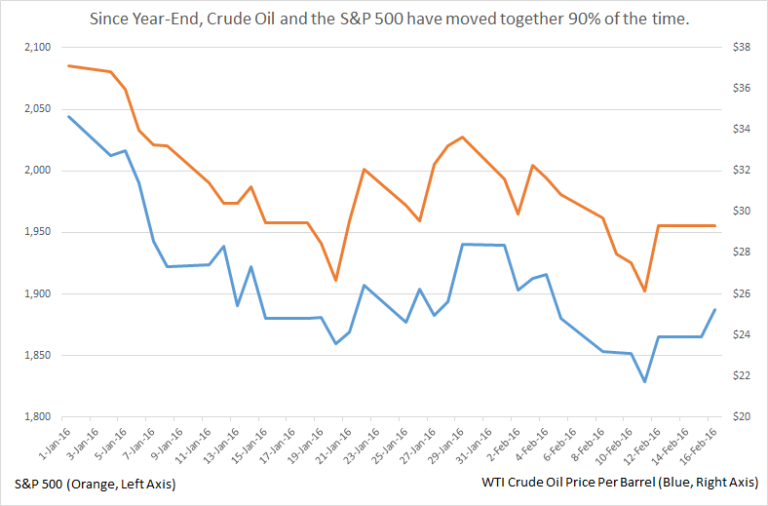

Early Tuesday morning, it was announced that four oil producers (importantly Saudi Arabia and Russia) will “freeze” oil production levels. Though this may seem as a sign of higher oil prices, production levels for both the world’s largest producers were at an all-time high in January. However, a compromise among these producers appears to be an apparent sign of financial stress in these commodity dependent economies. If the price of oil does not stabilize or move higher, additional deals could be on the table. Furthermore, the markets have been consistently focused the price of oil as investors have increasingly been quick to sell their stock positions when the oil price declines.

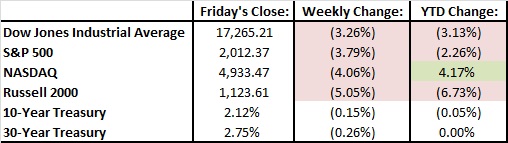

Last Week’s Highlights:

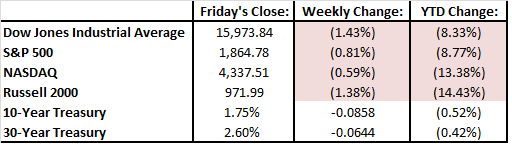

Stocks rallied on Friday before the long-weekend as West Texas Intermediate crude oil had the largest daily gain since February of 2009. Nevertheless, markets were still down for the week without a clear catalyst for a global selloff. Investors cited a multitude of reasons for the market turmoil. The list included, but was not limited to Federal Reserve Chairman Janet Yellen’s observation that she was not in a hurry to raise interest rates, investors taking money out of China due to an economic slowdown, fear of slowing growth in United States, and additional in declines the price of oil. As a result of Chairman Yellan’s view for lower for longer interest rates, the financial stocks were the worst performers declining 2.4% on the week.

Looking Ahead:

This week, investors’ eyes will be on data for January housing starts and building permits on Wednesday morning. Housing starts have recently been hurt by harsh winter weather around the country. Following housing data, investors will get a gauge of the industrial sector with the release of Industrial Production. Output has been in decline since the beginning of the fall in the price of oil in mid-2014. And lastly, it will be hard to forget about South Carolina Republican Primary this weekend. This Primary is historically known for dirty politics – get your popcorn ready.

What’s On Our Minds:

Just as the Broncos and Panthers went into Super Bowl 50 with a game plan, investors are re-positioning themselves for what many expect to be a year of decelerated growth. Thus far in 2016, it appears investors are going on the defensive as consumer staples, telecom, and utility stocks have held up during sell offs. Meanwhile, financial, healthcare, consumer discretionary, and technology stocks (which largely led the market in 2015) have sold off in face of a slowdown in the global economy. Although nobody welcomes an economic slowdown, as a value-focused firm, we are reassured that our inherently defensive investment approach prepares our clients’ portfolios for this type of environment.

Last Week’s Highlights:

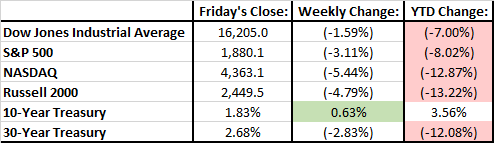

The volatility continued, with Friday capping off yet another turbulent week. Investors focused on oil, the US economy, and weakness in various industries’ corporate earnings, and there was not much good news to be delivered. The Dow Jones fell 1.6% on the week, and the S&P 500 dropped even more, closing down 3.1%. Technology shares were especially pressured, as earnings from companies such as LinkedIn (LNKD) and Tableau Software (DATA) disappointed shareholders. The tech-heavy NASDAQ finished last week down 5.4%.

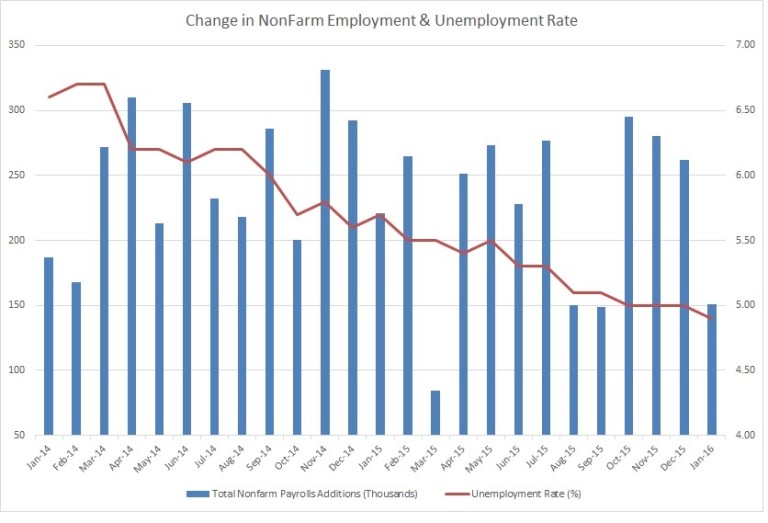

Friday’s jobs report came in below expectations, with the US economy adding 151,000 jobs in January (below economists’ 190,000 estimate). While the figure was slightly disappointing, other employment data was more promising: the unemployment rate dipped to 4.9% (from 5%) and average hourly earnings increased 0.5% in January.

Looking Ahead:

While earnings season is nearing its end, we’ll see 65 more reports this week from S&P 500 companies, including Coca-Cola (KO), Disney (DIS), Time Warner (TWX) and Cisco (CSCO). Of the 315 S&P companies that have reported so far, 77% have beaten earnings estimates, while only 46% have beaten revenue expectations. For the quarter, earnings have declined by 6% and sales by 5%.

The economic calendar remains relatively light this week, although reports on retail sales, import and export prices, and consumer sentiment will be released on Friday. Comments from Fed Chair Janet Yellen will be closely monitored this week, as she’s scheduled to deliver her semi-annual testimony to Congress on Wednesday and Thursday.

What’s On Our Minds

Everyone has been talking about oil, so let’s revisit the energy markets this week. Oil is solidly above $30 a barrel- which sounds great until you remember that even sub-$50 was unthinkable not long ago. Talks and rumors abound suggesting that major oil-producing countries, if they perhaps aren’t about to enter a “grand bargain,” will at least move to stop the free fall. Additionally, some major US shale companies announced capital expenditure reductions, meaning 2016 supply should come down.

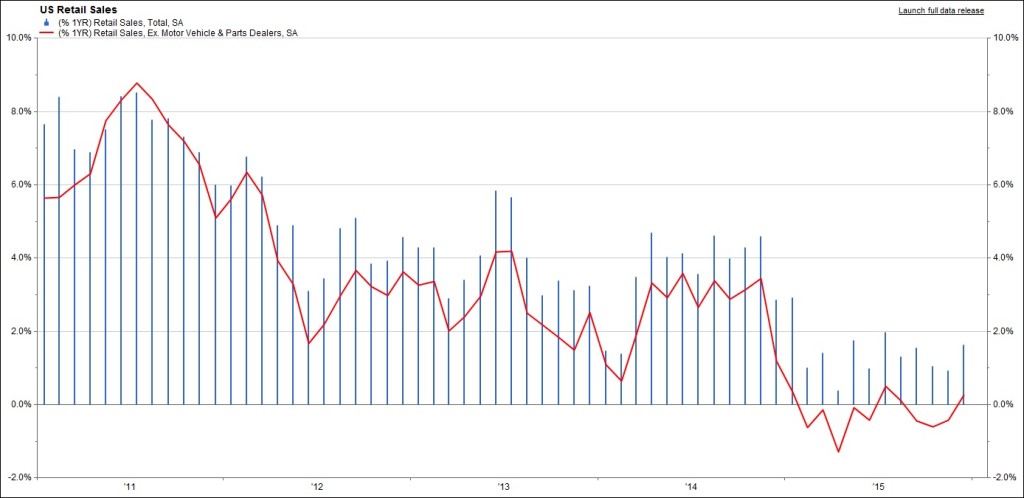

Also, what happened to the “oil dividend”? Prevailing theory is that a reduction in oil prices is like a check made out to the American consumer. Consumer demand hasn’t been awful (see chart), but it hasn’t been great, either. It seems Americans are saving their gas station discounts.

Last Week’s Highlights

Last week’s numbers were saved by a big rally Friday that turned what would’ve been a down week into a gain of 1.8%. This is the second week of gains in a row, easing some concerns, but we must not (and we certainly don’t around here) forget that we are still down 5% for the year.

Looking Ahead

On Monday morning, the Institute of Supply Management (ISM) released their manufacturing PMI for the US, coming in at 48.2 vs 48.0 last month. Any reading under 50 indicates contraction. The Purchasing Manager’s Index indicates that manufacturers are still feeling the effects of global issues here in the US. We try not to get political here, but we will all certainly be closely watching the Iowa caucus and a new president’s potential effects on the US’ business environment.

We recently welcomed LaShawn Jenkins back to the Hardesty Capital team as an Account Administrator.

We recently welcomed LaShawn Jenkins back to the Hardesty Capital team as an Account Administrator.

LaShawn has over 20 years of experience working as an administrative and customer service professional. She began her career as a receptionist at Prudential Securities, followed by positions at A.G. Edwards & Sons and M&T Bank. LaShawn worked at Hardesty Capital Management from 1996 through 2001 and returned to the firm in 2015. Just prior to rejoining Hardesty, she worked as a Gift Entry Coordinator at Kennedy Krieger Institute.

LaShawn is involved in fundraising and raising awareness for the Cystic Fibrosis Foundation. She is also actively involved in fundraising efforts for the Kennedy Krieger Institute. LaShawn lives in Parkville with her daughter, Amaya.

Help your descendants help themselves by learning about these common wealth transfer problems.

Money can make even the closest family relationships turn ugly. Anticipating the emotional issues attached to wealth transfer can help you avoid them altogether or deal with them more efficiently if they do arise.

Sudden wealth syndrome

Coming into a large amount of money unexpectedly seems great from an outside perspective. However, if an heir receives this money without being adequately prepared for the responsibilities that come with it, he or she can experience something similar to what lottery winners often feel. This instant gratification is often called “sudden wealth syndrome.” Because the heir did not have to work to gain the money and/or may not have talked with his or her predecessor about the work that went into earning the money, it may result in a lack of motivation. The person may find it hard to develop skills like delayed gratification and thrift. Therefore, an heir is more likely to spend the windfall and blow through most of the inheritance. Heirs in this situation often experience frustration, feelings of failure or a false sense of entitlement. They may avoid accountability or withdraw from others, sometimes even developing serious social disorders.

How to fix it

The most important thing to remember to avoid giving your children sudden wealth syndrome is to take the time to communicate to your family the values that allowed you to accumulate your wealth. Children who understand and empathize with the struggle that their parents may have gone through to attain their wealth will feel more of an emotional attachment to this money and will be less likely to spend it all at once. If you feel that your children are not emotionally ready to handle this wealth, consider setting up trusts or placing an age restriction on when your future heirs can inherit their money. This sets up a longer time line and gives the next generation time to mature.

Leadership voids

A leadership void can occur when a family business owner dies suddenly before training the next generation. If it’s not clear who should step up to take responsibility of the business, power struggles can occur among the remaining heirs. Even if financial wealth or the entire business isn’t lost, the vision for the business often is.

How to fix it

If a business is among your assets, one of the first things your wealth transfer plan should establish is how that business will function after you are gone. Will your family continue to run the business, or will it pass through sale to a third party? If you choose to keep it within the family, you will want to set specific role designations for your future heirs. It’s important to remember that “fair” is not always “equal.” For example, if you have two children, one who has worked alongside you in the business for years and understands your business plan and ethics, and one who has shown no interest in the business and knows little about your business practices, you may not want to split the business equally between these children. When making these choices, it’s important to discuss your rationale with your family ahead of time so that your future heirs understand why they are placed in their roles and what is expected of them in those roles.

Trustee-beneficiary relationships

Difficult trustee-beneficiary relationships can occur when families adhere to the “nothing revealed until death” principle of estate planning. If trustees and beneficiaries are not kept in the loop during the planning process, the beneficiaries suddenly find themselves inheriting an unexpected amount of wealth at an already emotional time in their lives. If they haven’t talked to the grantor about the idea of a trust before the grantor’s death, they can feel as though the trustee is standing between them and what they are “rightfully entitled” to.

How to fix it

It’s important to consider who you name as trustee and why. For example, it can be common practice to name a child as a trustee. However, what if you die before your spouse and your spouse then has to ask your son or daughter for principal distributions from a trust? This can create an uncomfortable family situation. It’s important to consider the possible ramifications of who you name as trustee and whether or not they will be able to handle the difficult decisions left to them. Depending on your family situation, it may be best to name a trustee who is impartial to family dynamics.

Property squabbles

Depending on how specific you are in your wealth transfer, there may be certain items that are “up for grabs” in your estate. These items may have emotional value to one of your descendants, or may be culturally significant, such as prominent works of art. This can lead to arguments among family members over who gets to keep what, especially amongst siblings or descendants who may already be prone to fighting.

How to fix it

Depending on the personalities within your family, it might be wise to avoid leaving property division decisions to your descendants. You have the option to try to be as specific as possible in your estate planning documents, or you can name an impartial executor to divvy up your property. If you do choose to leave property division to yourself, make sure you are open and honest with your future heirs about how and why you chose to leave certain things to certain people. Also, you should avoid promising the same piece to more than one person—a tactic that some people use to try to avoid conflict in the moment. Unfortunately, this usually leads to enlarged conflict later on.

Communication is key

Even if you set up a beautifully planned wealth transfer with a variety of financial strategies and your financial planner executes it perfectly , it still has the potential to fail if you don’t have your future heirs on board. Beyond preserving your wealth, communicating money values and generational wealth transfer plans in the most open way possible can also help your children to become more knowledgeable and responsible with their finances.

This article was written by Advicent Solutions, an entity unrelated to HardestyCapital Management. The information contained in this article is not intended to be tax, investment, or legal advice, and it may not be relied on for the purpose of avoiding any tax penalties. Hardesty Capital Management does not provide tax or legal advice. You are encouraged by your tax advisor or attorney regarding specific tax issues. Copyright 2013 Advicent Solutions. All rights reserved.

What’s On Our Minds

Last week, our Weekly View urged readers to “hold tight” and based on last week’s volatility, it looks like we got it right. Media pundits had many panicking last week as we saw a major sell off mid-week only to finish the week in positive territory. Yes, volatility can be very stressful for investors, but in situations like last week, we continue to stress the importance of keeping a long term view on your investment portfolio.

Last Week’s Highlights

The S&P 500 closed out the week up 1.4%. The market kicked its 2016 weekly losing streak and finished in the green, but it wasn’t easy. Concerns over global economic growth continued and depressed oil prices worried investors. It was a wild week. On Wednesday, the Dow sank 1.6% on a day when oil hit $26.55 per barrel at one point, the lowest “black gold” has traded since May of 2003. By the end of trading Friday, oil rallied back to $32.16 per barrel, which helped the markets recover. As of the close Friday, the S&P 500 was still down 6.70% year to date.

Looking Ahead

The Federal Reserve will release its Federal Open Market Committee Statement on Wednesday afternoon and Fourth Quarter GDP numbers on Friday morning. This week we will also be watching fourth quarter earnings releases from notable companies such as Apple, Johnson & Johnson, Proctor & Gamble, and Microsoft.

What’s On Our Minds

Investors last week had concerns over corporate earnings and guidance as well as the further depreciation of the Chinese Yuan (implying slower economic growth from Chinese regulators). The decline in crude oil did not seem to help as WTI, the US Benchmark, fell to approximately 10.5%. Despite anxieties over global growth, there are several companies that have been beaten up year to date that will be able to grow their sales and earnings this year. Taking advantage of these opportunities, rather than locking in losses, is often the more prudent action.

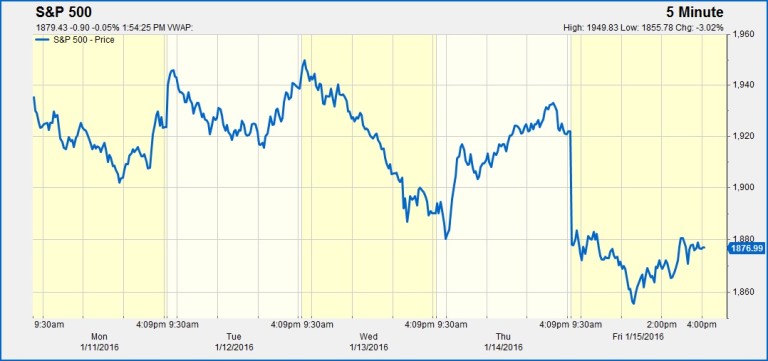

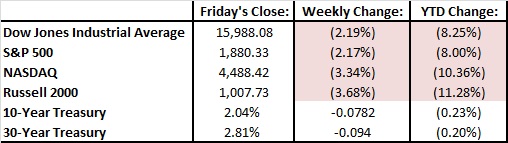

Last Week’s Highlights

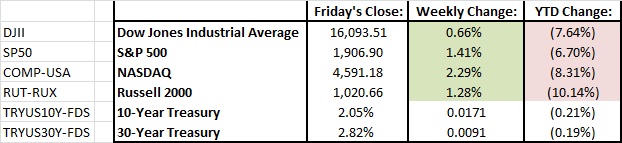

The markets had a rough second week with the Dow Jones and the S&P 500 falling 2.2%. The Dow Jones is now down 8.25% for the year and 10.7% off its all-time high while the S&P 500 is down 8% for year and off 11.8% from its all-time high. Year to date, the defensive Utility and Telecom sectors have shown to be the best performers while Materials has been hurt by concerns over global growth and lower interest rates continue to weigh on Financials.

Looking Ahead

Looking to the week ahead, the market will mostly be focusing on corporate earnings. On Tuesday, investors will get a gauge of the banking and financial sectors with earnings releases from Bank of America and Morgan Stanley. Results from the long-time technology blue chip IBM and new technology high-flier Netflix will also report after the closing bell. On Thursday, the railroads will report earnings – in addition to energy companies, this group has also suffered from the decline in crude oil as the transportation of the commodity has declined. Finally, the oldest Dow Jones component, General Electric, will give investors a view into the power, aerospace, energy, and health care sectors.

Hold on tight.

What’s On Our Minds

Last week, good news was hard to come by in the investment section of any paper and investors took it on the chin. It’s not easy seeing your holdings come down in value when the market experiences a pullback. Value investors seek opportunity in these situations, and while many investors rushed for the exits last week, our firm’s shopping list grew and we carefully continue to look to put cash positions to work for our clients. In times like these we remember Warren Buffet’s quote: “Be fearful when others are greedy and greedy when others are fearful.”

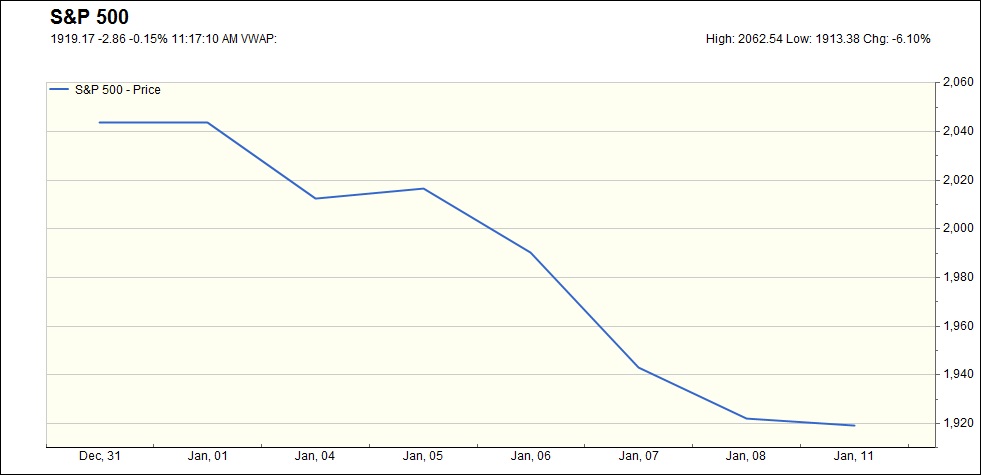

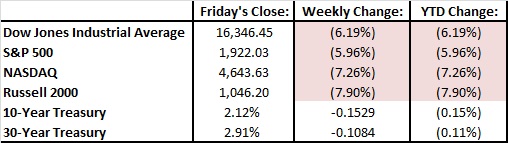

Last Week’s Highlights

On the back of plunging stock prices in China, last week was nothing short of ugly on Wall Street as we experienced the worst opening week in history. On top of China’s woes, an alleged North Korean nuclear test, lower oil prices, and tensions in the Middle East added to bearish sentiments last week. With all this negativity on the Street, the S&P finished the week down 6%. On the bright side, Friday’s U.S. jobs report numbers were higher than expected and the automotive industry closed out 2015 with record domestic sales.

Looking Ahead

China’s markets continued their slide downward Monday in the face of a slowing Chinese economy and continued currency troubles. In domestic markets, Alcoa kicks off earnings season on Monday when the company reports 4th quarter earnings following the closing bell. This week, retail sales and consumer sentiment numbers are reported which, based on last Friday’s positive job numbers, could very well confirm that the US consumer is doing well.

What’s On Our Minds

The new year started with a perhaps not-so-shocking 7% drop in the Chinese equity market. Once again, the drop in the East doesn’t seem to have to do with fundamentals so much as expectations about how the People’s Bank of China (PBOC) will juggle interest rates, foreign exchange rates, and policy. We fielded questions in the past about why the firm didn’t invest more in China and other foreign markets during their booms. This is why: countries developing their physical markets means still-developing financial markets, too.

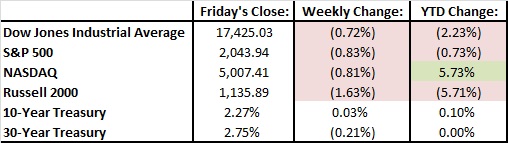

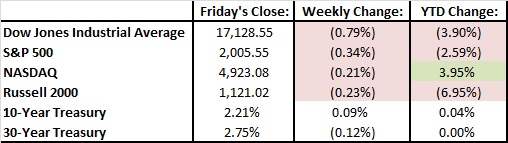

Last Week’s Highlights

Last week was another holiday-abbreviated one that featured little in the way of news, economic or otherwise. We did get our year-end numbers (below), capping off a disappointing but not disastrous year.

Looking Ahead

On Friday, we will get the December jobs report and see how the US labor is holding up this winter. We’ll also see how the Fed thought about last month’s interest rate increase with the release of the FOMC’s minutes. However, there are likely no surprises in those minutes. Markets are still slow-moving after the holidays.

What’s On Our Minds

While investors have had a tough time in this year’s choppy (and ultimately flat) market, our firm has seen a major benefit from our bias toward owning dividend-paying stocks. We continue to focus on the long term. There are major forces acting in the markets right now that will have major effects in the new year. Some look positive, and some are not as rosy. We know that whatever plays out, our disciplined strategy will build wealth over time.

Last Week’s Highlights

Last week, stocks rose 3%. It was a quiet week of trading as markets closed for the week on Christmas Eve (Thursday) at 1 PM. Energy stocks lead the market, but still remain beaten up for the year. Many market participants hoped for more of a rally in the U.S. stock market to wrap up the year, but a combination of the strong dollar, shrinking corporate profits, slow economic growth, and depressed commodity prices continue to be a drag. Heading into last week of 2015, the S&P is up 0.1% and the Dow Jones is down 1.5%.

Looking Ahead

After a long weekend, many investors continue to look for a year-end rally but with markets trading sideways this year, a Santa Claus rally may be too little, too late. It will likely be a quiet week for US investors as there is very little economic news coming across the wire.

What’s On Our Minds

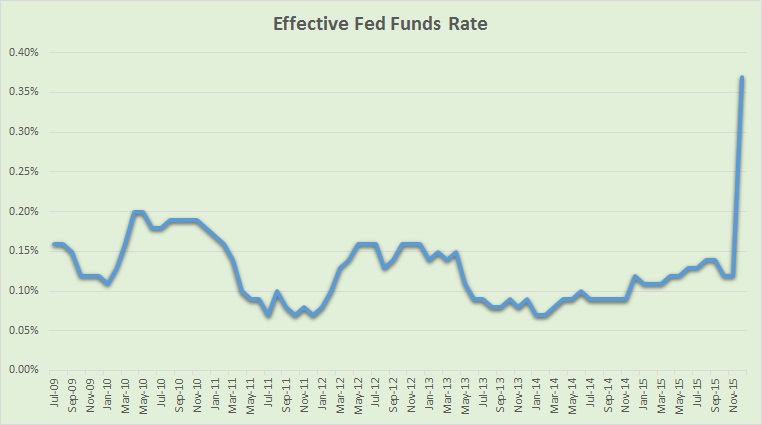

The markets had a choppy week, with the S&P 500 finishing down 0.34%. Investors kept a close eye on the Federal Reserve interest rate decision last Wednesday as well as the price of oil which continued to decline to one of the lowest levels since 2009. The Federal Reserve raised their target interest rate to 0.5%, which represented their first increase in nearly a decade. Now, creditworthy banks that are lending money that is maintained at the Federal Reserve will be charged an annual rate of 0.5% for each overnight stay as opposed the 0.07% to 0.20% range that was charged over the last six and a half years. As a result, banks will begin raising interest rates on their future and some current customers and we have already seen this occur at many financial institutions – Bank of America and Wells Fargo both raised their prime lending rate to 3.50% from 3.25%.

Looking Ahead

Looking to the week ahead, the Bureau of Economic Analysis will release their final calculation of 3rd quarter of Gross Domestic Product. The previous reading released in November estimated that the US economy grew 2% year over year. Analysts believe the economy was actually stronger than 2.0% in the 3rd quarter as tomorrow’s estimate is for growth of 2.2%.

On Wednesday, investors will be gain further insight on the American consumer with the release of data on personal income and spending for November. Growth in the month is estimated to be 0.3%, which was the same rate as last November. Though growth in economy is stronger this year, Black Friday sales were not as strong as anticipated. Black Friday sales have displayed that online spending has continued to grow as percentage of the total weekend sales with “Cyber Monday” becoming increasingly popular.

The stock market will close at 1 PM on Thursday as investors prepare for Santa. All are hoping Old Saint Nick will bring us a nice year-end market rally as we close out 2015.

Have a Happy Holiday!

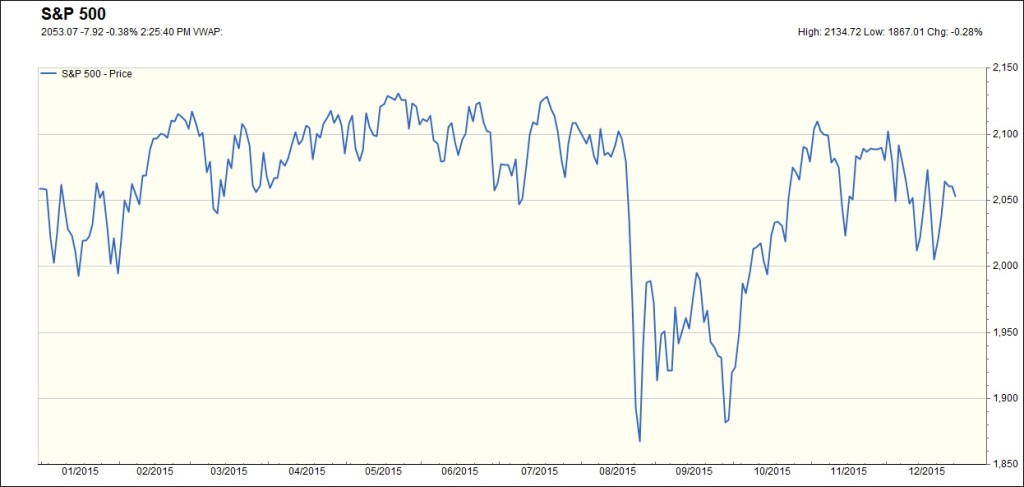

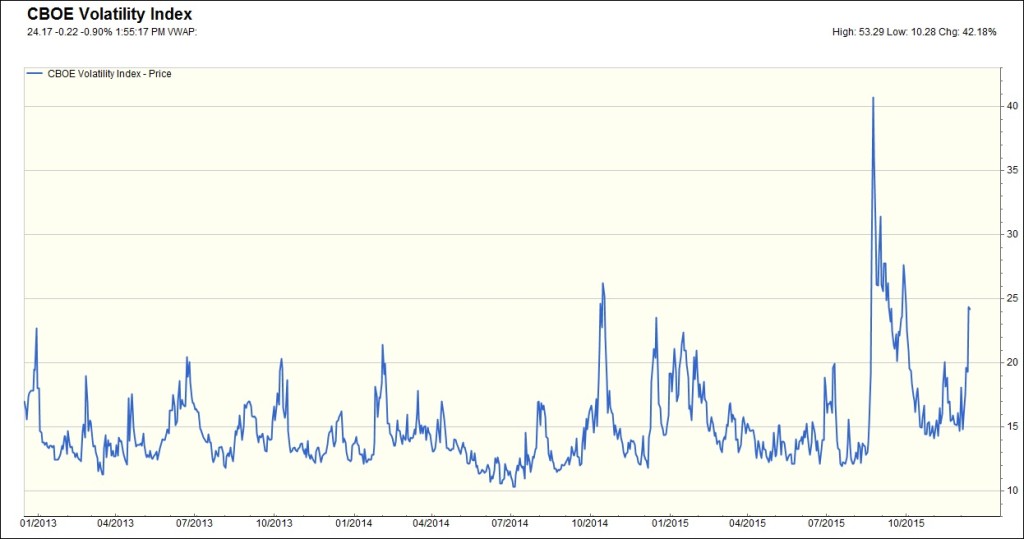

What’s On Our Minds

Understanding the stock market’s unpredictable tendencies is a challenge during the best of times. But what happens when price swings grow abnormally large? It is the stock market’s nature to be volatile over the short term. Staying informed, understanding risk tolerance, and sticking to long-term goals and planning is in our clients’ (and everyone’s, we believe) best interest.

Last Week’s Highlights:

The financial markets faced a rough week last week as participants prepare for the Federal Reserve to raise interest rates this Wednesday (12/16). The Dow finished the week down 3.3% and the S&P 500 closed out the week down 3.8%, which puts the index in the red for the year. In company news, Dupont (DD) announced it would merge with Dow Chemical (DOW). After the merger, the new company plans on splitting itself into three publicly traded companies.

The pain in the oil markets continues to play out as prices dropped significantly, with crude futures falling $4.35, or 10.9%, for the week. We also saw a major selloff in Junk bonds last week. Fears in the junk bond market were exacerbated when the Third Avenue Credit fund, which owns distressed bonds and private equity holdings, closed its doors on Wednesday.

Looking Ahead:

The long awaited Federal Reserve meeting takes place this Tuesday and Wednesday, when the Fed is widely expected to raise short term interest rates by 25 basis points. Despite recent volatility, it is unlikely that the Fed will pass up a gradual increase in rates. Janet Yellen will likely emphasize the Fed’s intent to gradually raise rates going forward.