What’s On Our Minds

Oil continues its downward slide, and is now at levels not seen since ’09. A lot of people wonder what that means at the pump: how low could gas prices get? We’ve seen a few stations with sub-$2 gas recently, but gasoline can’t get too cheap- they still have to pay to refine it and ship it to the station. Even if the cost of a barrel of West Texas Crude were $0, it would still cost almost a dollar to get it to us.

Last Week’s Highlights

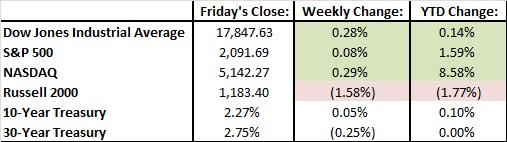

Are we done talking about the Fed yet? Well, the board itself is: Fed members are about to enter their quiet period ahead of next week’s meeting. Given Chair Janet Yellen’s comments, the market has baked in a hike at this point. The stellar jobs report on Friday was the final nail in the coffin. Yellen had earlier commented that it would take a new-jobs number of around 100,000 or less to change the Fed’s views, and the report came in with a higher than expected 211,000. Add to that the fact that unemployment remained unchanged at 5%, and we are ready for liftoff.

Looking Ahead

Looking ahead, there isn’t much going on this week. There will be some Chinese economic data being released throughout the week, but none of it should be too earth-shattering.

A combination of strong economic data and concerns over tensions in the Middle East left us with a flat week in the markets last week. In the short week of trading due to the Thanksgiving holiday, the S&P 500 closed on Friday at 2090.11, gaining 0.05% for the week. Stocks slid on Tuesday morning when news broke that Turkey had shot down a Russian fighter jet after it violated its airspace, but markets rebounded to finish the day as strong numbers were reported for durable goods orders and home price data. An upward revision of third quarter GDP growth also provided support to the market last week. These positive numbers helped the market to rebound towards the end of the week and demonstrate that the economy could very well be ready for a minor increase in interest rates next month. An increase in rates would be the first rise in the Fed’s official short-term rate since 2006. We saw a change in consumer habits over the Thanksgiving/Black Friday weekend. According to the National Retail Federation, more people took to their computers and smart phones than actual stores for their annual Holiday shopping sprees.

This week, Fed Chair Janet Yellen is in the spotlight. She is speaking twice this week ahead of the December Fed meeting on the 16th. While market participants will look at her comments for confirmation or denial for a rate hike, the rate liftoff seems to be all but foregone. The only thing that may derail the Fed is a truly dismal jobs report this Friday.

Abroad, OPEC has a policy meeting, at which Saudi Arabia will likely be under pressure from other members to lower output in the face of low oil prices. It’s unlikely that the Saudis will bend, however.

MARKETS IGNORE PARIS ATTACKS. POST BEST WEEK OF THE YEAR.

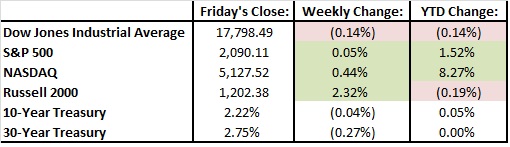

Believe it or not, the S&P 500 quietly posted the best week of 2015 as the index jumped 3.3%. The Dow Jones Industrial Average posted stronger results with a 3.4% gain led by better than anticipated earnings from Nike. Nevertheless, Dow Jones returns are flat for the year while S&P 500 has returned 1.5%. After shrugging off the horrifying terrorist attacks in Paris, investors seem to finally be embracing a potential interest rate hike from the Federal Reserve in December as it appears the growth of US economy could be getting stronger. Previously, any signs of ending the zero-interest rate “party” was taken as bad news as there was nervousness that higher interest rates could derail the slow economic recovery.

Looking to the week ahead, the markets will be focusing on several economic reports that will provide a further reading on the US economy as Thanksgiving approaches. Like the rest of us, Wall Street traders will be enjoying their turkeys on Thursday with the markets closed for the holiday. They will also reap the benefits of an early weekend with a shorter trading day on Friday (US markets will have the normal 9:30 AM open, but will close at 1:00 PM on 11/27).

Monday morning will provide insight into the housing market as Existing Home Sales results are released for the month of October. Wall Street estimates a seasonally adjusted rate of 5.4 million existing homes were sold last month, up 3.8% from 5.2 million in October of last year.

Eyes will also be on the Purchasing Managers’ Index (PMI) that will give a gauge of economic conditions in the private company sector. The survey follows product output, new orders, and prices for the construction, service, and retail industries. A reading of over 50 implies that there was growth in the previous month. Estimates are for a reading of 54.5.

All reports will influence the Federal Reserve’s decision on interest rates at their December 16th meeting. Until then, Have a Happy Thanksgiving!

U.S. Stocks snapped a six-week winning streak, with the S&P 500 declining 3.6% and the Dow falling 3.7% during the week. Stocks appear to be digesting the reality of a near-term interest rate increase (December 16th Fed meeting), which would be the first hike since 2006. While this move would reflect a stronger economy, it means the days of easy money won’t last forever.

Consumer discretionary stocks, specifically the retailers, had a difficult week following earnings reports from companies such as Macy’s, Nordstrom and J.C. Penney. While the warm weather has been an excuse for many department store operators, there’s no doubt that online retailers continue to take share from the bricks and mortar retailers.

Commodity prices also had a tough week, with oil falling 8% to $40.74 per barrel, contributing to a 6% slide in the overall energy sector.

Here is a look at last week’s numbers:

| Friday’s Close: | Weekly Change: | YTD Change: | |

| Dow Jones Industrial Average | 17,245.24 | (3.71%) | (3.24%) |

| S&P 500 | 2,023.04 | (3.63%) | (1.74%) |

| NASDAQ | 4,927.88 | (4.26%) | 4.05% |

| Russell 2000 | 1,146.55 | (4.43%) | (4.83%) |

| 10-Year Treasury | 2.27% | (0.06%) | 0.10% |

| 30-Year Treasury | 2.75% | (0.34%) | 0.00% |

Looking Ahead – A preview of the week of November 16, 2015:

This week will be filled with more earnings reports, largely from retailers such as Wal-Mart, Target, Home Depot and Best Buy. The coming days will also be busy with more “Fed speak”, with minutes from the October 27-28 meeting being released on Wednesday. Wall Street is now expecting the first rate hike since 2006. Fed funds futures, used by investors to place bets on central-bank policy, have risen to reflect a 70% likelihood of a rate hike in December. Wall Street is beginning to look past December and focus on rate hike #2 and its timing. The pace of tightening is beginning to become more important than the date Fed liftoff.

Commodity prices, oil in particular, will continue to be on the minds of investors this week. Energy stocks have been hit hard over the past 20 months, falling by a third since oil prices began to plunge in mid-2014.

Major earnings this week include:

Monday (11/16): Tyson Foods (TSN), Agilent Technologies (A), Urban Outfitters (URBN), JD.com (JD)

Tuesday (11/17): Dick’s Sporting Goods (DKS), Home Depot (HD), TJX (TJX), Wal-Mart (WMT)

Wednesday (11/18): Lowes (LOW), Staples (SPLS), Target (TGT), salesforce.com (CRM), NetApp (NTAP), Semtech (SMTC)

Thursday (11/19): Best Buy (BBY), J.M. Smucker (SJM), Autodesk (ADSK), The Gap (GPS), Intuit (INTU), Splunk (SPLK), Fresh Market (TFM), Workday (WDAY)

Friday (11/20): Abercrombie & Fitch (ANF), Foot Locker (FL), Hibbett Sports (HIBB)

Economic / macro reports this week include:

Monday (11/16): G20 Leaders Summit (11/15 and 11/16)

Tuesday (11/17): October CPI (consensus +0.2%) and IP #s

Wednesday (11/18): Fed minutes from 10/27-28 meeting

Thursday (11/19): ECB meeting minutes

A succession plan for your business is one of the most important safeguards you can use to ensure the company’s future success. Approximately one third of family businesses that transfer to the next generation are successful, and only 15 percent make it to the third generation. Choosing tomorrow’s leaders and formulating a plan for your retirement, death, divorce or disability are tasks that should be done early and tweaked often. The transfer of power and wealth can provide a smooth transition or can be the demise of a company, depending on how future leaders are chosen and groomed, and how tax and estate planning implications are handled.

There are various business succession options available to the owners of privately held businesses. These include:

- Transfer of ownership to the next generation

- Employee stock ownership plan (ESOP)

- Public offering

- Recapitalization of the business

- Sale of the business to a third party

- Liquidation of the business

Transfer Ownership to Next Generation

When choosing and grooming successors for your business, you must consider their business strength and savvy, and the psychological and emotional impacts of any decision on employees and family members. (more…)

Mr. Rubin joins Hardesty Capital as Vice President, Senior Portfolio Manager, and member of the Investment Committee. His role is to manage existing high net worth client portfolios while also increasing Hardesty Capital’s client base. Mr. Rubin also uses his experience as Co-Head of Equity Research at Mercantile Trust (now PNC) to actively manage the investment research process with the Investment Committee.

Mr. Rubin joins Hardesty Capital as Vice President, Senior Portfolio Manager, and member of the Investment Committee. His role is to manage existing high net worth client portfolios while also increasing Hardesty Capital’s client base. Mr. Rubin also uses his experience as Co-Head of Equity Research at Mercantile Trust (now PNC) to actively manage the investment research process with the Investment Committee.

He has worked in many leadership roles throughout his 22 years in the investment management industry. Most recently, he was Senior Investment Advisor at PNC Wealth Management, where he spent twelve years working with high net worth clients. He also served as Senior Equity Research Analyst, where he was responsible for research coverage and securities recommendations to portfolio managers. Prior to that, he spent five years at Legg Mason Wood Walker (now Stifel Nicolaus) as an Equity Research Analyst.

Mr. Rubin successfully completed the Chartered Financial Analyst program in 2000. He received his Certified Public Accountant (CPA) certificate in 1994 and his Masters of Business Administration (MBA) from Loyola University Maryland in 1998. Mr. Rubin is a member of the Baltimore CFA Society and the CFA Institute.

Mr. Peck joins Hardesty Capital as Marketing Associate and is responsible for identifying prospects as well as other marketing efforts. Prior to joining Hardesty Capital, Mr. Peck was a Client Service Associate at Morgan Stanley Wealth Management. He graduated from Denison University in 2014 and served as an intern for Hardesty Capital during the summer of 2013.

Mr. Peck joins Hardesty Capital as Marketing Associate and is responsible for identifying prospects as well as other marketing efforts. Prior to joining Hardesty Capital, Mr. Peck was a Client Service Associate at Morgan Stanley Wealth Management. He graduated from Denison University in 2014 and served as an intern for Hardesty Capital during the summer of 2013.

We are excited for Rick and Neill to join the team at Hardesty Capital. We have so much opportunity and will continue our growth strategy with the addition of new staff while maintaining our integrity as a value-oriented investment firm.

Hunt Valley, MD – Hardesty Capital Management announced the retirement of company cofounder James D. Hardesty, CFA, effective April 15, 2015. Hardesty’s decision to retire will end an extraordinary 45-year career in the investment management industry.

Mr. Hardesty served as Chairman of the Board, Market Strategist and Chief Economist. He cofounded Hardesty Capital in 1995 with V. Randolph McMenamin, CFA, Managing Director and Vice President of Hardesty Capital Management. After retiring, Mr. Hardesty now serves as Chairman Emeritus of Hardesty Capital, and he continues to serve in a consulting role mentoring young staff members.

Mr. Hardesty held numerous leadership positions in the industry prior to Hardesty Capital, including Chief Investment Officer and Executive Vice President at Mercantile Safe Deposit and Trust Company. Under his leadership at Hardesty Capital, assets under management have grown to just under one billion dollars.

In addition to his business activities, Jim sits on a number of industry and non-profit boards. He currently serves as Vice Chairman of the Board for the Harford Mutual Insurance Company. Previously, he was Trustee of LINC (Learning Independence Through Computers) as well as the Board of Family & Children’s Services of (more…)

As we look back on the past twelve months, we’re pleased to report another strong year of performance for our firm’s clients. A strengthening economy has helped the bull market continue, with the S&P 500 Index posting its fifth double-digit gain in six years. Hardesty Capital Management also experienced a very positive year, as our AUM (assets under management) reached a level just shy of $1 billion, a company record. We are so appreciative of our wonderful clients and their support of our firm’s continued growth. (more…)

As we look back on the past twelve months, we’re pleased to report another strong year of performance for our firm’s clients. A strengthening economy has helped the bull market continue, with the S&P 500 Index posting its fifth double-digit gain in six years. Hardesty Capital Management also experienced a very positive year, as our AUM (assets under management) reached a level just shy of $1 billion, a company record. We are so appreciative of our wonderful clients and their support of our firm’s continued growth. (more…)

A local investment-management firm quite literally followed the money and moved from Baltimore City to Hunt Valley.

By Rick Seltzer, The Baltimore Business Journal Sep 16, 2014, 7:27am EDT

Investment firm’s offices had been in Mount Vernon since its founding in 1995

By Natalie Sherman, The Baltimore Sun 6:59 p.m. EDT, September 15, 2014

Stay the course. That’s what Baltimore-area money managers are telling their clients in the wake of the stock market’s 5 percent slide this year.

By Gary Haber, The Baltimore Business Journal Feb 6, 2014, 2:47pm EST

Money management companies report growth in 2013

By Natalie Sherman, The Baltimore Sun 10:16 a.m. EST, January 4, 2014

If you want to know something about the history of the Baltimore investment community, you might want to call James Hardesty.

The 67-year-old history buff and chairman of Hardesty Capital Management has spent his career in Baltimore, starting with a job in the mail room of Alex. Brown & Sons and later as an executive at the old Mercantile Safe Deposit & Trust Co. Both Baltimore companies eventually were acquired.

He founded his own investment firm in Baltimore in 1995. Today, it manages $800 million in assets, with a goal of reaching $1 billion within two years. To help achieve that, the firm recently hired a new president.

Hardesty recently discussed the stock market, challenges for his firm and an old classmate who is a former U.S. president.

After buying a Timonium court reporting company and a Towson spice maker, Chad Meyer is returning to his business roots — the world of high finance.

By Gary Haber, The Baltimore Business Journal Dec 3, 2013, 2:19pm EST

‘Uncertainty fatigue’ has set in among investors

By Eileen Ambrose, The Baltimore Sun October 13, 2013