Bulls Make Money, Bears Make Money, But Pigs Get Slaughtered

by Neill Peck

You may have heard this old Wall Street maxim that warns against greed and impatience, but have you followed it? Without a doubt, the stock market can be an exciting place, and it’s easy to get roped into the allure of finding the next home run or timing a trade just right. For instance, a friend at a cocktail party may tell you about the killing he made off that ABC trade, and you may think, heck, why can’t I do that? Then there’s your inner trader who may get the best of you and get you thinking that you too can perfectly time your entry and exit points. If you have ever found yourself directing trades based on your emotions or you have attempted to time the market, are you really investing for the long haul? Or are you looking to make a quick buck? At Tufton, we may even suggest that you are gambling (not investing) with your retirement savings.

Research has shown that investors are significantly better off by following the approach of “time in the market” rather than timing the market. From 1998 until 2012, CXO Advisory Group ran a study to attempt to see if 28 self-described market timers could successfully time the market. The overall results were not good. They found that market experts accurately predicted the direction of the market only 48% of the time. Only 10 of the 28 experts could accurately forecast equity returns more than 50% of the time, and not even one could outperform the S&P 500. The evidence was so conclusive that CXO decided to stop tracking the statistics entirely! Unfortunately, sales skills triumph over investment skills on Wall Street from time to time, and often the loudest pundits get most of the attention. If an investment strategy sounds too good to be true, it is.

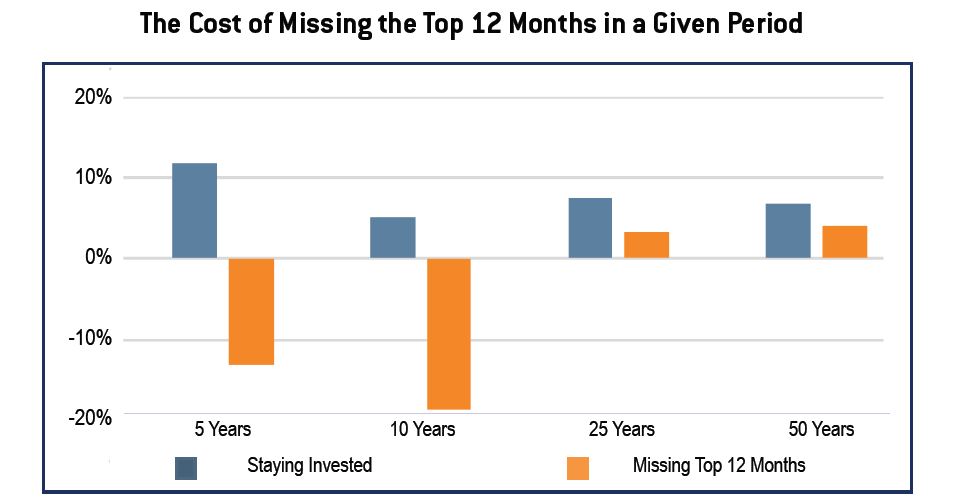

Another caveat to deter you from timing the market is that, over time, it’s possible to underperform significantly by sitting on the sidelines. Yes, it can be very costly to sit in cash. For instance, if you examine the chart below, you see that if you missed the top 12 months in the past 5, 10, 25, and 50 years, you would have underperformed the S&P 500 significantly in each scenario.

Even though a disciplined investment approach may sound like it’s old advice straight from your grandfather’s roll top desk, it’s an idea that has stood the test of time. By staying the course and grinding it out over a long period, investors avoid the worst of which can happen and will happen over the years. A disciplined approach to portfolio management keeps average investors from overreacting and hurting their long term positive return that we all need to retire well. It’s almost impossible to avoid the allure of “knocking it out of the park” with your investments. Just remember, as history has shown us, if you’re not careful, you may end up “getting slaughtered.”