Last Week’s Highlights:

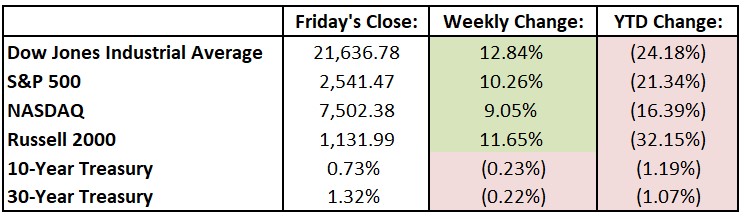

Fiscal and monetary policies helped lift equity markets, as the Dow Jones Industrial Average (DJIA) posted its biggest weekly gain since 1938. The Federal Reserve has dropped interest rates to near zero and is purchasing large quantities of Treasuries and other securities. Congress passed a $2 trillion spending package worth about 9% of U.S. gross domestic product. For the week, the Dow rallied 2462.80 points, or 12.8%, to 21,636.78, while the S&P 500 gained 10.3% to 2541.47. The tech-heavy NASDAQ rose 9.1%, closing at 7502.38. Even after last week’s market rally, equities are still down 25% from the peak reached a month ago. The coronavirus pandemic has forced widespread shutdowns and has ground much of the U.S. economy to a halt, and last week 3.28 million people filed for unemployment benefits, well above previous records.

Looking Ahead:

Global investors are preparing for another volatile ride this week. On Monday, the National Association of Realtors reports pending home sales for February – economists forecast a 1.3% decline, after a 5.2% jump in January. Broadcom (AVGO) hosts its annual shareholder meeting. Spice maker McCormick (MKC) and Conagra Brands (CAG) report quarterly results on Tuesday. The Institute for Supply Management (ISM) releases its Chicago Purchasing Managers’ Index for March – economists forecast a 39 reading, well below the expansionary level of 50. Wednesday brings earnings reports from Lamb Weston Holdings (LW) and PVH (PVH). Hewlett Packard Enterprise (HPE) and Schlumberger (SLB) hold their annual shareholder meetings. CarMax (KMX) and Walgreens Boots Alliance (WBA) announce financial results on Thursday. The Department of Labor reports initial jobless claims for the week ending on March 28th. Constellation Brands (STZ) holds a conference call on Friday to discuss quarterly earnings results. The ISM releases its Non-Manufacturing Index for March – economists look for a 45 reading, well below February’s 57.3 print.

All of us at Tufton Capital wish you a safe and healthy week!

Last Week’s Highlights:

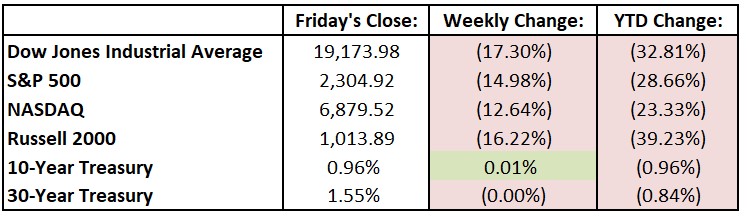

Equity markets finished sharply lower and volatility persisted as the number of coronavirus cases continued to rise globally. Central banks and governments around the globe rushed to announce support measures amid event cancellations, school closures and work-from-home arrangements. The U.S. called for a $1.2 trillion stimulus plan and European countries reported a combined $1 trillion in new fiscal spending. The Federal Reserve cut interest rates by a full percentage point and announced that it would buy $700 billion in Treasuries and mortgage-backed securities. For the week, the Dow Jones Industrial Average (DJIA) fell 4011 points, or 17.3%, to 19,173.98, while the S&P 500 dropped 15% to 2304.92. The tech-heavy NASDAQ lost 12.6%, closing at 6879.52. Stock market futures were weak Sunday night but appear to have recovered going into Monday morning on news of additional Fed stimulus.

Looking Ahead:

Global investors are preparing for another volatile ride following a week of frantic and at times disorderly trading. On Monday, the Federal Reserve Bank of Chicago releases its Chicago Fed National Activity Index for February – consensus estimates call for a -0.43 reading, in line with the January data. Nike (NKE) and IHS Markit (INFO) release quarterly results on Tuesday. The Census Bureau announces new residential home sales for February – economists expect a seasonally adjusted annual rate of 740,000 homes sold. Micron Technology (MU) and Paychex (PAYX) report earnings on Wednesday. The Federal Housing Finance Agency releases its Home Price Index for January. Thursday brings earnings announcements from GameStop (GME) and Lululemon Athletica (LULU). The Department of Labor reports initial jobless claims for the week ending on March 21st – expectations are for an annualized 2.1% rate of growth, unchanged from the second estimate released in late February. On Friday, the Bureau of Economic Analysis releases its Personal Income and Outlays report for February – personal income is expected to rise 0.3%, following a 0.6% jump in January.

All of us at Tufton Capital wish you a safe and healthy and week!

Last Week’s Highlights:

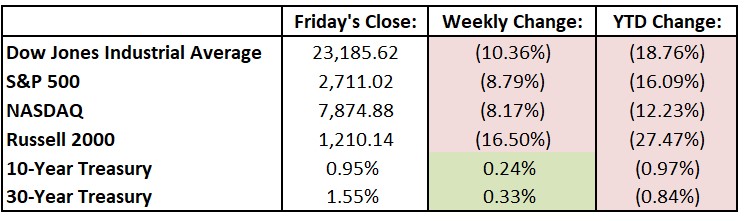

Equity markets finished sharply lower and entered into bear-market territory after the World Health Organization declared the coronavirus a global pandemic and oil prices saw the biggest one-day decline since 1991. Central banks and governments around the globe rushed to announce support measures amid event cancellations, school closures and work-from-home arrangements. For the week, the Dow fell 2,679 points, or 10.4%, to 23,185.62, while the S&P 500 dropped 8.8% to 2711.02. The tech-heavy NASDAQ lost 8.2%, closing at 7874.88. The week’s drop for the Dow Jones came despite an epic 1,985-point rally on Friday. The Federal Reserve took drastic emergency action Sunday evening to stabilize the economy. The Fed cut interest rates by a full percentage point and announced that it would buy $700 billion in Treasuries and mortgage-backed securities. Stock market futures were crushed Sunday night despite the Fed action (down over 4% – trading “limit down”), setting up what will be another very volatile week ahead on Wall Street.

Looking Ahead:

Global investors are preparing for another volatile ride following a week of frantic and at times disorderly trading. Monday brings earnings releases from Coupa Software (COUP) and Tencent Music Entertainment Group (TME). The Federal Reserve Bank of New York releases its Empire State Manufacturing Survey for March – consensus estimates call for a 0.5 reading, down from February’s 12.9 print. FedEx Corp. (FDX) announces financial results on Tuesday, and American Express (AXP) webcasts its 2020 Investor Day. Wednesday brings earnings from General Mills (GIS), and Agilent Technologies (A) and Starbucks (SBUX) host their annual shareholder meetings. The Census Bureau reports new residential construction data for February – economists look for a seasonally adjusted annual rate of 1.48 million housing starts, down from January’s 1.55 million. Accenture (ACN) and Darden Restaurants (DRI) report earnings on Thursday. The Conference Board releases its Leading Economic Index for February – consensus estimates are for a flat reading following a 0.8% gain in January. The National Association of Realtors reports existing-home sales for February on Friday – economists forecast a seasonally adjusted annual rate of 5.55 million homes sold, up 1.7% from January’s 5.46 million.

All of us at Tufton Capital wish you a good and safe week!

Last Week’s Highlights:

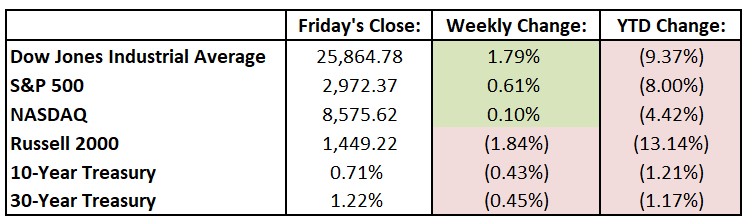

While it certainly didn’t feel like it, the three major U.S. stock market indexes posted modest gains last week following wild swings due to accelerating coronavirus fears and monetary stimulus hopes. (The Dow Jones Industrial Average (DJIA) was up 1293 (Monday), down 785 (Tuesday), up 1173 (Wednesday), down 969 (Thursday) and down 256 (Friday)). For the week, the Dow gained 455.42 points, or 1.8%, to 25,864.78, while the S&P 500 rose 0.6% to 2972.37. The tech-heavy NASDAQ advanced 0.1%, closing at 8575.62. By the end of the week, the yield on the 10-year U.S. Treasury note had fallen to 0.707%, its lowest on record. Stock market futures were crushed Sunday night (down over 4%), setting up what will be another very volatile week ahead on Wall Street.

Looking Ahead:

Global investors are preparing for another volatile ride following a week of frantic and at times disorderly trading. Monday brings earnings releases from Franco-Nevada (FNV) and Vail Resorts (MTN). Dick’s Sporting Goods (DKS) reports financial results on Tuesday. Qualcomm (QCOM) holds its annual shareholders meeting in San Diego. On Wednesday, the Treasury Department releases the U.S. monthly budget statement for February. For fiscal 2019, which ended in September, the federal deficit was $984 billion – the largest since 2012. The Congressional Budget Office projects a $1 trillion deficit for 2020. Thursday brings earnings reports from Adobe (ADBE), Broadcom (AVGO), Dollar General (DG) and Ulta Beauty (ULTA). The Bureau of Labor Statistics release the producer price index (PPI) for February – consensus estimates are for a flat reading, with the core PPI expected to rise 0.2%. Friday brings the University of Michigan’s release of its Consumer Sentiment index for March – economists forecast a 94 number, down from February’s 101 print.

The Tufton Capital Team hopes that you have a wonderful week!

Last Week’s Highlights:

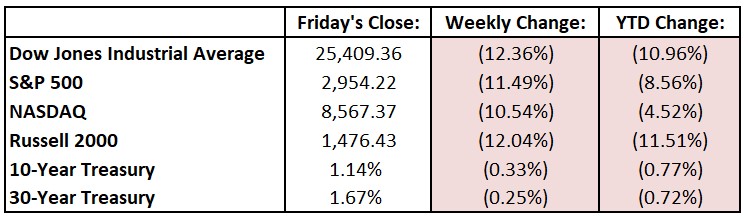

Equities plunged as the coronavirus spread beyond China. Pandemic fears shifted from China, where the outbreak began, to South Korea, Japan Italy and Iran. The United States reported its first case that couldn’t be traced overseas. Oil prices tumbled and “safe haven” assets soared – yields on 10-year Treasuries fell to record lows, and the yield-curve inverted. For the week the Dow Jones Industrial Average (DJIA) tumbled 3583.05 points, or 11.5%, to 25,409.36, while the S&P 500 fell 11.5% to 2954.22. The tech-heavy NASDAQ was down 10.5%, closing at 8567.37. Stock market futures were all over the place Sunday night, setting up what will be another very volatile week ahead on Wall Street.

Looking Ahead:

Global investors are preparing for another volatile ride following a week of frantic and at times disorderly trading. Monday brings earnings releases from Dentsply Sirona (XRAY) and Evergy (EVRG). The Census Bureau reports construction spending for January – consensus estimates call for a seasonally adjusted annual rate of $1.34 trillion, up 0.6% from December’s level. AutoZone (AZO), Nordstrom (JWN), Ross Stores (ROST) and Target (TGT) release financial results on Tuesday. It’s Super Tuesday in the Democratic primary, with a third of all delegates up for grabs as 14 states head to the polls. Wednesday brings earnings reports from Brown-Forman (BF), Campbell Soup (CPB) and Dollar Tree (DLTR). Exxon Mobil (XOM) webcasts its 2020 investor day on Thursday, and Burlington Stores (BURL), Kroger (KR) and H&R Block (HRB) report earnings. The Bureau of Labor Statistics (BLS) releases the jobs report for February on Friday – economists forecast a 175,000 rise in nonfarm payrolls and expect the unemployment rate to remain steady at 3.6%.

The Tufton Capital Team hopes that you have a wonderful week!

Last Week’s Highlights:

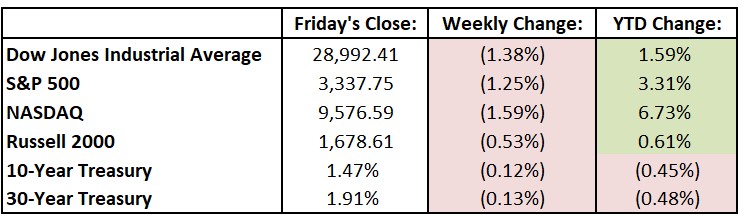

Equities sold off last week as investors flocked to traditionally safer assets such as government bonds and gold. The coronavirus epidemic and its impact on global growth continued to dominate headlines and will likely be the major international news story in weeks to come (more on this below). The yield on the benchmark 10-year U.S. Treasury note reached its lowest level since September on Friday, ending the day at 1.470%. For the week the Dow Jones Industrial Average (DJIA) dropped 405.67 points, or 1.4%, to 28,992.41, while the S&P 500 fell 1.2% to 3337.75. The tech-heavy NASDAQ was down 1.6%, closing at 9576.59. Merger mania continued, as Franklin Resources (BEN) agreed to buy Legg Mason (LM) for $4.5 billion, and Morgan Stanley (MS) announced a $13 billion all-stock deal for E*Trade (ETFC). Stock market futures dropped over 2% Sunday night as global worries about the coronavirus epidemic accelerated, setting up what will be a very volatile week ahead on Wall Street.

Looking Ahead:

A bevy of retailers will report financials this week, signifying the tail end of fourth-quarter earnings season. Japanese bourses are closed on Monday in observance of the emperor’s birthday. HP Inc. (HPQ), Intuit (INTU) and Palo Alto Networks (PANW) release quarterly results. JP Morgan Chase (JPM) hosts its 2020 investor day in New York on Tuesday. American Tower (AMT), Home Depot (HD), Macy’s (M) and Bank of Montreal (BMO) announce earnings results. Wednesday brings financials from L Brands (LB), TJX Companies (TJX) and Crown Castle International (CCI). The Census Bureau reports new residential home sales for January – expectations call for a seasonally adjusted annual rate of 710,000 single-family homes sold, up 2.3% from December. Best Buy (BBY), Dell Technologies (DELL) and Autodesk (ADSK) report numbers on Thursday. The Census Bureau releases the Durable Goods report for January – economists look for a 0.9% decline. The business week ends with earnings results from AES (AES) and Occidental Petroleum (OXY) on Friday. The Institute for Supply Management reports its Chicago Purchasing Manager’s Index for February – expectations are for a 45 reading, up from January’s 42.5 print.

The Tufton Capital Team hopes that you have a wonderful week!

Last Week’s Highlights:

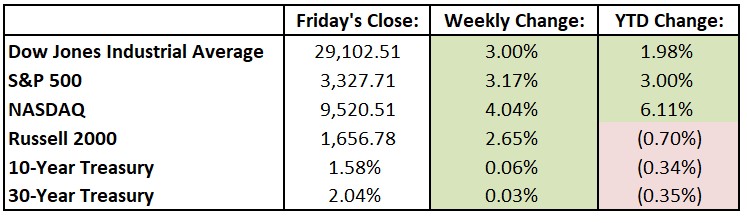

U.S. stocks posted their biggest weekly gains in months as concerns about a global economic slowdown due to the coronavirus eased. Equities hit new highs midweek before slipping on Friday, when the U.S. jobs report came in above expectations (225,000 jobs were added in January, beating the 165,000 estimate). Friday’s selloff is a classic case of good news is bad news, as the strong employment report may reduce the chance of a rate cut by the Federal Reserve in the coming months. For the week the Dow Jones Industrial Average (DJIA) rallied 846.48 points, or 3.0%, to 29,102.51, while the S&P 500 advanced 3.2% to 3327.71. The tech-heavy NASDAQ was up 4.0%, closing at 9520.51. Stocks taking center stage included Tesla (TSLA), which continued its volatile ascent. Alphabet (GOOG) sold off after the company disclosed financials about specific business units (such as YouTube) for the first time. Investors continued to focus on the coronavirus (with 40,000 confirmed cases and over 900 deaths as of Sunday). China pumped more than $200 billion in liquidity into its economy, and the rate of the spread of the virus fortunately appears to have slowed.

Looking Ahead:

Sixty S&P 500 components are scheduled to report their fourth quarter financial results this week, beginning with Allergan (AGN), DaVita (DVA) and Loews (L) on Monday. Automatic Data Processing (ADP) hosts an innovation day in New York. Tuesday brings financial results from Dominion Energy (D), Under Armour (UA), Hasbro (HAS) and Lyft (LYFT). The Bureau of Labor Statistics reports its Jobs Openings and Labor Turnover Survey for December – economists forecast 6.78 million job openings on the last business day of December, little changed from November. Federal Reserve Chairman Jerome Powell delivers his semiannual Monetary Policy Report to Congress before the House Financial Services Committee. Wednesday is packed with earnings releases, including numbers from Applied Materials (AMAT), Cisco Systems (CSCO), CVS Health (CVS) and Barrick Gold (GOLD). On Thursday, Kraft Heinz (KHC), Pepsico (PEP), Zoetis (ZTS) and Duke Energy (DUK) release financial results. Emerson Electric (EMR) holds its annual investor conference at the New York Stock Exchange. The business week ends with earnings from Newell Brands (NWL) and AstraZeneca (AZN) on Friday. The Census Bureau reports retail sales data for January – economists forecast a 0.3% gain, in line with December’s rise.

The Tufton Capital Team hopes that you have a wonderful week!

Last Week’s Highlights:

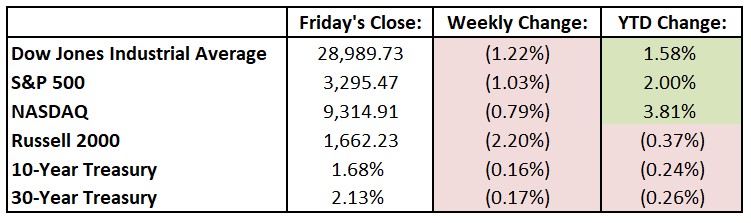

Equities ended the week in the red as American authorities confirmed a second case of the coronavirus in the U.S. and the count of infected patients and deaths rose in China. As of Sunday night, the virus had killed 80, with close to 2100 confirmed cases (including a total of five in the U.S.), while spreading throughout China to neighboring countries. Authorities are especially concerned that the outbreak coincided with the Lunar New Year, when millions of Chinese travel. Earnings season rolled on with largely positive results – numerous companies (and their stocks) performed well, including IBM (IBM), American Express (AXP), Netflix (NFLX), Abbott Laboratories (ABT), and others. However, the coronavirus crisis dampened investors’ moods and market prices. For the week, the Dow Jones Industrial Average (DJIA) fell 358.37 points, or 1.2%, to 28,989.73, while the S&P 500 dropped 1.0% to 3295.47. The tech-heavy NASDAQ lost 0.8%, closing at 9314.91.

Looking Ahead:

This week marks the busiest stretch of fourth-quarter earnings reports, as 132 S&P 500 components release financial results over the next five days. D.R. Horton (DHI), Juniper Network (JNPR) and Whirlpool (WHR) post quarterly numbers on Monday. The Census Bureau releases new home sales data for December – economists forecast a seasonally adjusted annual rate of 728,000 new single-family homes sold, up from November’s 719,000 report. Tuesday is packed with more earnings with releases coming from McCormick (MKC), Lockheed Martin (LMT), Starbucks (SBUX), United Technologies (UTX) and Apple (AAPL). The Conference Board announces its Consumer Confidence Index for January – consensus estimates call for a 128.4 reading, up from December’s 126.5 print. Look for earnings releases Wednesday from AT&T (T), Microsoft (MSFT), Norfolk Southern (NCS), Boeing (BA), T. Rowe Price Group (TROW) and Novartis (NVS). The Federal Open Market Committee (FOMC) announces its monetary-policy decision – the market widely expects the central bank to keep the federal-funds rate unchanged at 1.50%-1.75%. Altria Group (MO), Biogen (BIIB), Coca-Cola (KO) and United Parcel Service (UPS) are among a large group of companies reporting financials on Thursday. The Bank of England releases its monetary-policy decision – futures markets predict a greater-than-50% chance that the central bank will cut its short-term interest rate to 0.50% from 0.75%. Charter Communications (CHTR), Chevron (CVX), Exxon Mobil (XOM) and Honeywell International (HON) report quarterly results on Friday.

The Tufton Capital Team hopes that you have a wonderful week!

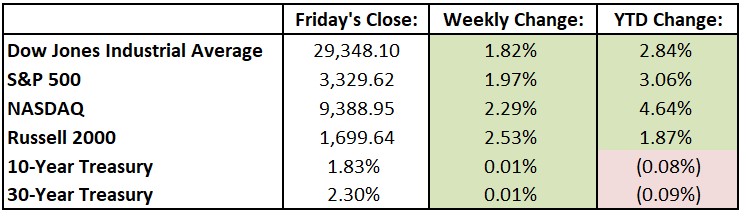

Last Week’s Highlights:

U.S. stocks ended a strong week on a strong note, with the three major equity indexes each rising about 2% last week to record highs. The first wave of companies reporting fourth-quarter earnings was largely positive, as many of the big banks posting strong financial results. Several of these banks’ consumer-related businesses showed robust growth, a positive sign for the overall economy (and market). Alphabet (GOOG) became the fourth U.S. stock to cross the trillion-dollar market-cap line (other members of the trillion-dollar club include fellow tech companies Apple (AAPL), Microsoft (MSFT) and Amazon.com (AMZN)). The U.S. and China signed a phase-one trade deal in Washington – the pact takes some U.S. tariffs on Chinese goods off the table and opens the U.S. to more Chinese purchases. Next up is phase-two which looks to tackle more complicated matters. For the week, the Dow Jones Industrial Average (DJIA) rose 542.33 points, or 1.8%, to 29,348.10, while the S&P 500 advanced 2.0% to 3329.62. The tech-heavy NASDAQ was up 2.3%, closing at 9388.94.

Looking Ahead:

U.S. markets are closed on Monday in observance of Martin Luther King Jr. Day. Fourth-quarter earnings seasons ramps up once markets reopen Tuesday morning, with 43 S&P components releasing financial results through Friday. Capital One Financial (COF), IBM (IBM), Halliburton (HAL) and Netflix (NFLX) release numbers on Tuesday. The World Economic Forum’s 50th annual meeting convenes in Davos, Switzerland. Political and business leaders from around the world will attend, and this year’s theme will be “Stakeholders for a Cohesive and Sustainable World.” On Wednesday, earnings reports include results from Abbott Laboratories (ABT), Johnson & Johnson (JNJ) and Texas Instruments (TXN). The National Association of Realtors reports existing home sales for December – economists forecast a 1.5% rise after declining 1.7% in November. American Airlines Group (AAL), Procter & Gamble (PG) and Southwest Airlines (LUV) report earnings on Thursday. The European Central Bank announces its monetary-policy decision and is widely expected to announce that interest rates will remain steady at negative 0.5%. Friday brings financial results from American Express (AXP) and Air Products & Chemicals (APD). Many markets throughout Asia, including China and South Korea, are closed in observance of the lunar New Year, which falls on Saturday, January 25th.

The Tufton Capital Team hopes that you have a wonderful week!

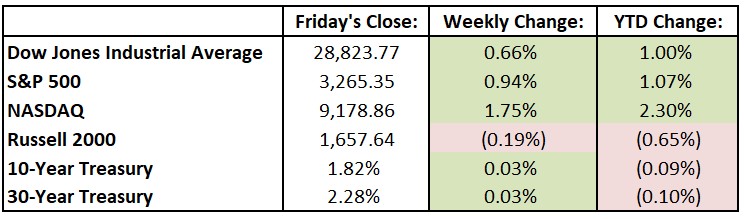

Last Week’s Highlights:

U.S. stocks jumped around last week largely on tensions with Iran and lackluster domestic economic numbers reported later in the week. Equities sold off sharply on Tuesday night on news of an Iranian missile strike. The markets recovered the next morning as it became clear that there had been no casualties and a war was not beginning. By Thursday, the tension in the Middle East was largely forgotten as stocks marched to all-time highs. A lower-than-forecasted December employment number reported Friday led to a selloff, although stocks remained on the positive side for the week. Last week, the Dow Jones Industrial Average (DJIA) rose 188.89 points, or 0.7%, to 28,823.77, while the S&P 500 advanced 0.9% to 3265.35. The tech-heavy NASDAQ was up 1.8%, closing at 9178.86. All three indices are within a half-point of their highest-ever closes.

Looking Ahead:

Fourth-quarter earnings season kicks off this week, with 26 S&P 500 components releasing financial results. Japanese markets are closed on Monday in observance of Coming of Age Day. Banks as usual are among the first to report earnings, and first up are Citigroup (C), JPMorgan Chase (JPM) and Wells Fargo (WFC), as these megabanks release fourth-quarter and full-year 2019 results on Tuesday. The Bureau of Labor Statistics announces the consumer price index (CPI) for December – expectations call for a 2.3% year-over-year rise, following November’s 2.1% increase. Bank of America (BAC), BlackRock (BLK), Goldman Sachs Group (GS) and UnitedHealth Group (UNH) report quarterly earnings on Wednesday. On Thursday, look for more financial results from Bank of New York (BK), CSX (CSX) and Morgan Stanley (MS). The Census Bureau reports retail sales data for December – expectations are for a 0.3% rise, following a 0.2% gain in November. The busy business week concludes with earnings from Citizens Financial Group (CFG), Kansas City Southern (KSU) and State Street (STT) on Friday. The University of Michigan releases its Consumer Sentiment Index for January – economists look for a 99.6 reading, even with December’s print.

The Tufton Capital Team hopes that you have a wonderful week!

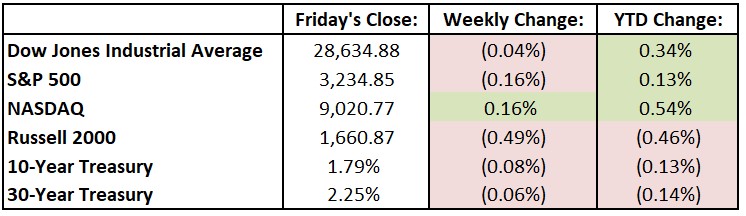

Last Week’s Highlights:

Stocks finished 2019 on Tuesday close to record highs, as the Dow Jones Industrial Average (DJIA) ended the year up 22.3%. The S&P 500 and tech-heavy NASDAQ performed even better last year, finishing up 28.9% and 35.2%, respectively. The new year began with U.S. equities reaching new highs Thursday on reports of China stimulus, then slipped on Friday with the turmoil in the Middle East. For the week, the Dow declined 10.38 points, or 0.04%, to 28,634.88, while the S&P 500 fell 0.2% to 3234.85. The NASDAQ was up 0.2%, closing at 9020.77.

Looking Ahead:

Wall Street returns to its first full week of trading since the holidays began. Cal-Maine Foods (CALM) reports quarterly earnings on Monday. On Tuesday, the Institute for Supply Management releases its Non-Manufacturing Purchasing Managers’ Index for December – consensus estimates call for a 54.5 reading, about even with November’s data. Wednesday brings earnings reports from Bed Bath & Beyond (BBBY), Constellation Brands (STZ) and Walgreens Boots Alliance (WBA). The Federal Reserve reports consumer-credit data – consumer debt is expected to continue its rise to just below the $4.2 trillion level. KB Home (KB), Synnex (SNX) and Acuity Brands (AYI) report financial results on Thursday. The Department of Labor releases initial jobless claims for the week ending on January 4th – the four-week average of claims is 232,500. Infosys (INFY) reports quarterly results on Friday.

The Tufton Capital Team hopes that you have a wonderful week!

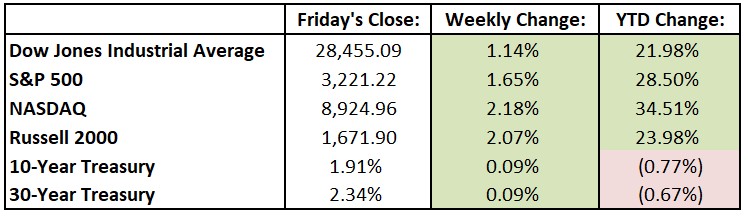

Last Week’s Highlights:

U.S. equities closed out the week at record levels, energized by new signs of economic strength and lessened trade tensions. The U.S. and China agreed last week to a preliminary trade truce, and promising economic numbers released by both countries signaled better than expected global growth. The House voted to impeach President Donald Trump for abuse of power and obstruction of Congress, the third impeachment in U.S. history. For the week, the Dow Jones Industrial Average (DJIA) rose 319.71 points, or 1.1%, to 28,455.09, while the S&P 500 advanced 1.7% to 3221.22. The tech-heavy NASDAQ was up 2.2%, closing at 8924.96.

What a difference a year makes! – current investor optimism and market strength is indeed a different environment than this time a year ago when major indexes couldn’t seem to stop falling. The S&P 500 had dropped 12% through December 21st and was on the way to its worst December since 1931.

Looking Ahead:

It will be a slow week on Wall Street. The Census Bureau reports new-home sales data for November on Monday – consensus estimates call for a seasonally adjusted annual rate of 730,000 new homes sold, roughly the same as the month before. On Tuesday, trading ends at 1pm on the New York Stock Exchange and Nasdaq Composite for Christmas Eve. The bond market closes at 2pm. The Bank of Japan releases minutes from its monetary-policy meeting at the end of October. Markets all over the world are closed on Wednesday in observance of Christmas Day. Many bourses are closed on Thursday, including those in Canada, England and Hong Kong, in observance of Boxing Day. The Department of Labor reports initial jobless claims for the week ending December 21st. On Friday, the U.S. Energy Administration releases its Petroleum Status report for the week ending December 20th.

All of us at Tufton Capital Management wish you and your families a very Merry Christmas and a Happy Holiday!

Last Week’s Highlights:

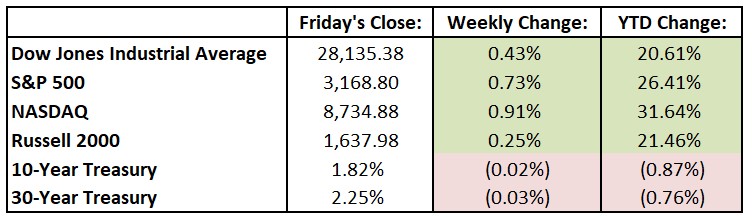

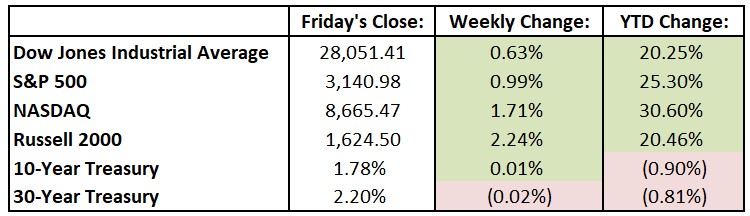

Quite a bit went right last week for equity investors. The Federal Reserve left interest rates unchanged and signaled a pause through 2020, while the European Central Bank pledged continued favorable monetary support. In the United Kingdom, Boris Johnson’s Conservative Party received a landslide victory, signaling that the Brexit drama is nearing an end. And on Friday, President Trump announced that a phase-one deal with China had been completed and that negotiations on phase two would begin immediately. Stock markets, however, were only slightly up, as much of the week’s positive news appears to already be discounted in equity valuations. For the week, the Dow Jones Industrial Average (DJIA) rose just 120.32 points, or 0.4%, to 28,135.38, while the S&P 500 advanced 0.7% to 3168.80. The tech-heavy NASDAQ was up 0.9%, closing at 8734.88.

Looking Ahead:

With third-quarter earnings season largely in the books, economic reports will take center stage this week. On Monday, the National Association of Home Builders releases its NAHB/Wells Fargo Housing Market Index for December – economists estimate a 71 reading, up slightly from November’s print. On Tuesday, FedEx (FDX), Cintas (CTAS) and Navistar International (NAV) report earnings results. The Bureau of Labor Statistics releases its Jobs Openings and Labor Turnover Survey for September – economists forecast seven million job openings on the last business day of October, unchanged from the prior month. Look for financial results from General Mills (GIS), Paychex (PAYX) and Micron Technology (MU) on Wednesday. The Conference Board releases its Leading Economic Index for November on Thursday – forecasts call for a 0.1% rise after falling the three previous months. CarMax (KMX) reports quarterly results on Friday.

Tufton Capital Team hopes that you have a wonderful week!

Last Week’s Highlights:

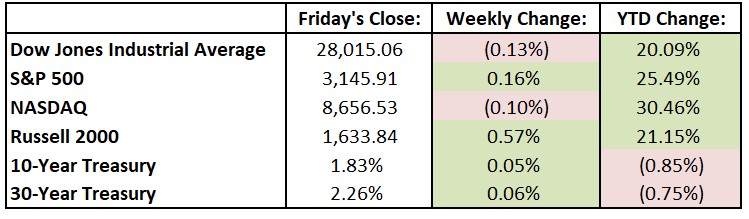

Friday was the last trading day of November, and stocks closed out their best month since June. A strong third-quarter earnings season and hints that a “phase one” U.S.-China trade deal is in its final stages have contributed to the recent market strength. For the holiday-shortened week, the Dow Jones Industrial Average (DJIA) rose 175.79 points, or 0.63%, to 28,051.41, while the S&P 500 advanced 0.99% to 3140.98. The tech-heavy NASDAQ was up 1.71%, closing at 8666.47. Black Friday results hinted at a very strong upcoming holiday shopping season. Online sales on Friday hit $7.4 billion according to Adobe Analytics. This is a 19.6% increase from last year and the second largest online shopping day ever. Walt Disney’s (DIS) release of Frozen 2 set a box-office record for an animated debut, with $358 million of ticket sales globally. Tesla (TSLA) remained in the headlines, as Elon Musk claimed that the company had 250,000 preorders for its electric truck. Merger mania continued with announced unions between Charles Schwab (SCHW) and TD Ameritrade (AMTD), LVMH (LVMUY) and Tiffany (TIF) and Novartis (NVS) and Medicines (MDCO). eBay (EBAY) also announced a deal to sell StubHub to Swiss ticket reseller Viagogo for $4 billion.

Looking Ahead:

The Institute for Supply Management releases its Manufacturing Purchasing Managers’ Index for November on Monday – economists forecast a 49.3 reading, up from October’s 48.3 print. General Electric (GE) holds an investor day in Chicago to discuss its health-care division. Bank of Montreal (BMO), Workday (WDAY) and Salesforce.com (CRM) report earnings on Tuesday. Wednesday brings financial results from AutoZone (AZO), H&R Block (HRB), Royal Bank of Canada (RY) and Slack Technologies (WORK). Microsoft (MSFT) hosts its annual meeting of stockholders via a live webcast. ADP releases its National Employment Report for November – estimates call for a gain of 140,000 private-sector jobs, up from October’s 125,000 increase. Brown-Forman (BF), Dollar General (DG), Kroger (KR) and Ulta Beauty (ULTA) announce financial results on Thursday. On Friday, the Bureau of Labor Statistics (BLS) releases the jobs report for November – expectations are for a 186,500 rise in nonfarm payrolls. The unemployment rate is expected to be unchanged at 3.6%.

Tufton Capital Team hopes that you have a wonderful week!