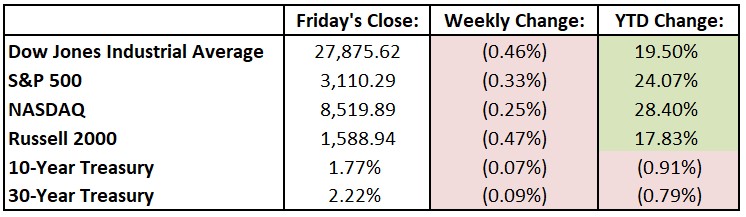

Last Week’s Highlights:

U.S. stock indexes took a breather from their recent record-setting highs, as continued U.S.-China trade rhetoric and soft retail sales data weighed on equities. For the week, the Dow Jones Industrial Average (DJIA) fell 129.27 points, or 0.5%, to 27,875.62, while the S&P 500 dropped 0.3% to 3110.29. The tech-heavy NASDAQ slipped 0.2%, closing at 8519.88. Trade discussions cooled down again, as both the U.S. and China dug in on key issues and look to be stuck on fundamental points of their “phase one” deal. Wall Street deal making continued, as Charles Schwab (SCHW) made an offer to buy TD Ameritrade (AMTD) for $28 billion. They are the two largest discount brokers and together would have $5 trillion in assets. HP, Inc (HPQ) continued its effort to buy Xerox (XRX), although XRX isn’t interested unless the current $33 billion bid is raised. LVMH Moet Hennessy Louis Vuitton (LMMUY) raised its offer for Tiffany (TIF) to $130 a share, or nearly $16 billion.

Looking Ahead:

Third-quarter earnings season is about done, although we’ll see several companies report financials on Monday including Hewlett Packard Enterprise (HPE), Palo Alto Networks (PANW) and Jacobs Engineering Group (JEC). The Chicago Federal Reserve releases its National Activity Index – economists forecast a -0.20 reading for October, compared with a -0.45 print in September. Analog Devices (ADI), Best Buy (BBY), Hormel Foods (HRL) and Burlington Stores (BURL) announce earnings on Tuesday. The Census Bureau releases sales of new single-family homes for October – forecasts call for a seasonally adjusted annual rate of 710,000, up from September’s 701,000 report. Deere (DE) hosts a webcast on Wednesday to discuss fourth-quarter and full-year financial results. The Federal Reserve issues its beige book summarizing economic conditions in its 12 districts. U.S. markets are closed on Thursday in observance of Thanksgiving. Major U.S. markets will close early on Friday, with stock trading ending at 1pm and bonds at 2pm. The holiday shopping season officially kicks in on Black Friday – the National Retail Federation expects retail sales to total over $729 billion this season, up 4% from last year.

The Tufton Capital Team wishes you and your family a very Happy Thanksgiving!

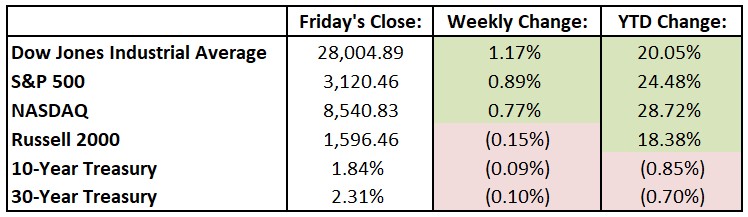

Last Week’s Highlights:

U.S. stocks hit new records as investors grew more confident that the economic cycle has more room to run. The Dow Jones Industrial Average (DJIA) crossed the 28,000 level for the first time as fading recession fears extended the bull-market rally. Trade optimism also helped fuel market strength, as U.S.-China negotiations looked to be moving toward a phase-one deal that may include both sides rolling back some existing tariffs. Fresh data on Friday showed that U.S. retail sales rebounded in October, rising 0.3% after a decline the previous month. This report reflected continued confidence in the U.S. consumer, an integral ingredient in domestic growth. Walmart’s (WMT) strong financial report on Thursday also supported a healthy consumer environment, as the retail giant reported its fifth consecutive year of quarterly sales gains. For the past week, the Dow rose 323.65 points, or 1.2%, to 28,004.89, while the S&P advanced 0.9% to 3120.46. The tech-heavy NASDAQ was up 0.8%, closing at 8540.83.

Looking Ahead:

A bevy of retailers will report earnings this week as third-quarter earnings season nears its end. On Monday, the National Association of Home Builders releases its Housing Market Index for November – economists call for a 72 reading, up from October’s 71 print. Tuesday brings earnings results from Home Depot (HD), TJX (TJX) and Alcon (ALC). Oracle (ORCL) holds its annual shareholders meeting in Redwood City, CA. Retail earnings continue Wednesday, with results expected from Lowe’s (LOW), Target (TGT) and L Brands (LB). The Federal Open Market Committee (FOMC) releases minutes from its previous monetary-policy meeting from late October. Gap (GPS), Intuit (INTU) and Ross Stores (ROST) announce earnings results on Thursday. The National Association of Realtors reports existing-home sales for October – consensus estimates call for a seasonally adjusted annual rate of 5.5 million, up 2.2% from September’s 5.4 million. The business week ends with financial results from Foot Locker (FL) and J.M. Smucker (SJM) on Friday. The Federal Reserve Bank of Kansas City reports its Manufacturing Survey for November – expectations are for a reading of +1, up from October’s -3.

The Tufton Capital Team hopes that you have a wonderful week!

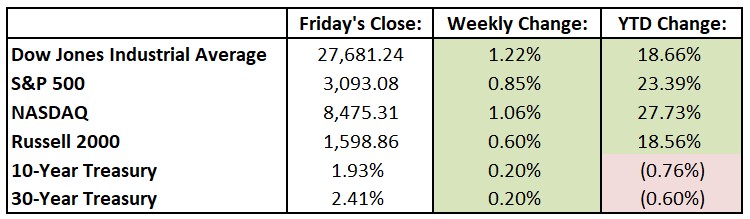

Last Week’s Highlights:

U.S. stocks hit new records and government-bond yields notched their biggest weekly gain in over a month as investors grew more confident that the economic cycle has more room to run. Trade optimism also helped fuel market strength, as U.S.-China negotiations looked to be moving toward a phase-one deal that may include both sides rolling back some existing tariffs. For the past week, the Dow Jones Industrial Average (DJIA) rose 333.88 points, or 1.2%, to 27,681.24, while the S&P advanced 0.8% to 3093.08. The tech-heavy NASDAQ was up 1.1%, closing at 8475.31. Investors appeared to be unravelling bets on investments that are traditionally safer, such as U.S. Treasurys, and buying riskier parts of the market. This “risk-on” atmosphere helped boost the yield on the 10-year Treasury note to its highest level since July, as it ended the week at 1.930%. (Bond yields and bond prices move in opposite directions). Let’s look at market valuations: with the stock market strength this year (the S&P 500 is up 23% YTD), the index sells for a forward price/earnings ratio of 17.2 times. Yes, this looks expensive, as the index has traded for 14.4 times forward estimates, on average, since 1986 (excluding the dot-com bubble). However, with continued strong economic growth (especially for the U.S. consumer), more trade progress and an accommodative Federal Reserve, a case can be made that stocks, while perhaps not cheap, still have room to move higher.

Looking Ahead:

Third-quarter earnings season winds down this week with just 14 S&P 500 companies reporting their financial results. Monday is Veterans Day, and U.S. bond markets and banks are closed in honor of this very important holiday. DXC Technology (DXC) and Tencent Music Entertainment Group (TME) report quarterly results. Advance Auto Parts (AAP), CBS (CBS) and Tyson Foods (TSN) release financials on Tuesday. The National Federation of Independent Business announces its Small Business Optimism Index for October – consensus estimates call for a 102 reading, about even with September’s print. Look for earnings reports from Canada Goose Holdings (GOOS), Cisco Systems (CSCO) and NetApp (NTAP) on Wednesday. Fed Chairman Jerome Powell heads to Capitol Hill, where he’s scheduled to testify on the economic outlook before the Joint Economic Committee. Applied Materials (AMAT), Nvidia (NVDA) and Walmart (WMT) announce financials on Thursday. The Bureau of Labor Statistics (BLS) releases the producer-price index (PPI) for October – economists call for a 1% year-over-year rise. Helmerich & Payne (HP) and JD.com (JD) report earnings results on Friday. The Census Bureau announces retail-sales data for October – consensus estimates are for a 0.2% gain. Excluding the more volatile auto and gas inputs, retail sales are expected to rise 0.3%.

The Tufton Capital Team hopes that you have a wonderful week!

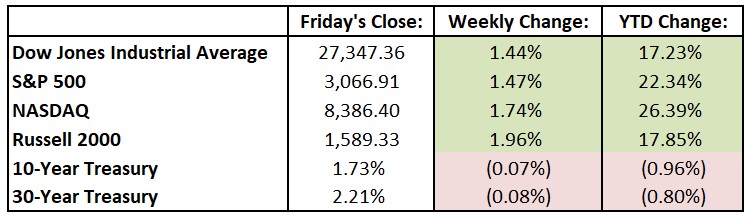

Last Week’s Highlights:

The S&P 500 and tech-heavy NASDAQ Composites closed at new highs Friday after a strong October jobs report (the U.S. added 128,000 jobs for the month) reassured investors about the pace of economic growth. Wall Street also welcomed continued solid corporate earnings reports and a quarter point rate cut by the Federal Reserve (as expected). For the past week, the Dow Jones Industrial Average (DJIA) rose 389.30 points, or 1.4%, to 27,347.36, while the S&P advanced 1.5% to 3066.91. The NASDAQ was up 1.7%, closing at 8386.40. More than three-quarters of companies in the S&P 500 that have reported earnings results through the end of last week have beaten analysts’ expectations. For the month of October (which ended last Thursday), the S&P 500 rose 2%, setting a new high and undermining the month’s reputation for havoc. Though most Octobers pass without incident, the market’s biggest crashes (most notably in 1929 and 1987) have occurred in October.

Looking Ahead:

Third-quarter earnings season continues this week, with Sysco (SYY), Consolidated Edison (ED), Marriott International (MAR) and Uber Technologies (UBER) reporting financial results Monday. On Tuesday, look for results from Becton Dickinson (BDX), Emerson Electric (EMR) and Newmont Goldcorp (NEM). It’s also Election Day across much of the country. The Institute for Supply Management reports its Non-Manufacturing PMI for October – estimates call for a 53.5 reading, up from September’s 52.6 print. CVS Health (CVS), Qualcomm (QCOM) and Humana (HUM) report earnings on Wednesday. The Bank of Japan releases minutes from its monetary policy meeting held in September. Thursday is a busy one for more financial reports, including numbers from Amerisource-Bergen (ABC), Cardinal Health (CAH), Walt Disney (DIS) and Zoetis (ZTS). The Bank of England announces its monetary policy decision – the central bank is widely expected to keep its key short-term rate unchanged at 0.75%. Duke Energy (DUK) and Honda Motor (HMC) release quarterly results on Friday. The University of Michigan reports its November Consumer Sentiment Survey – economists expect a 96.3 reading, up from October’s 95.5.

The Tufton Capital Team hopes that you have a wonderful week!

Last Week’s Highlights:

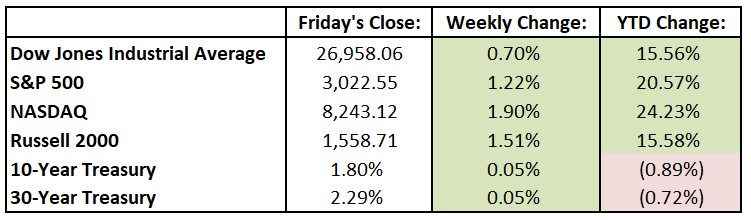

The S&P 500 index closed the week just shy of a new record high as investors welcomed solid corporate earnings and an encouraging update on trade talks between the United States and China. For the past week, the Dow Jones Industrial Average (DJIA) rose 187.86 points, or 0.7%, to 26,958.06, while the S&P advanced 1.2% to 3022.55. The tech-heavy NASDAQ was up 1.9%, closing at 8243.12, its fourth consecutive week finishing in positive territory. The yield on the 10-year U.S. Treasury note rose, another indication that investors are more optimistic about growth and overall economic prospects. The yield closed at 1.805% on Friday, climbing 0.058 percentage points for the week. (Bond yields and bond prices move in opposite directions). The Brexit drama continued as Parliament blocked United Kingdom Prime Minister Boris Johnson yet again, forcing him to seek a three-month extension from the European Union. Over the weekend, Microsoft (MSFT) won a landmark Pentagon contract, one that many investors thought would go to cloud-computing rival Amazon (AMZN). Tiffany (TIF) received a takeover offer from French conglomerate LVMH Moet Hennessy Louis Vuitton, valuing Tiffany at $14.5 billion.

Looking Ahead:

Third-quarter earnings season remains in full swing this week with over 145 S&P companies reporting their financial results. Alphabet (GOOG), AT&T (T), T-Mobile US (TMUS) and Spotify Technology (SPOT) report their Q3 numbers on Monday. Tuesday brings more earning releases from Advanced Micro Devices (AMD), Chubb (CB), General Motors (GM) and Merck (MRK). The National Association of Realtors reports pending home sales for September – economists forecast a 1.0% increase after a 1.6% rise for September. The Federal Reserve Open Market Committee (FOMC) meeting begins. The FOMC announces its monetary-policy decision on Wednesday – the central bank is widely expected to cut the federal-funds rate for the third time this year, to 1.50%-1.75%. Earnings continue with financial results from Apple (AAPL), Automatic Data Processing (ADP) and General Electric (GE). Potential Game 7 of the World Series may be played Wednesday evening. On Thursday, look for earnings results from Altria Group (MO), Bristol-Myers Squibb (BMY) and DuPont (DD). And Boo! – Thursday is Halloween. Friday, the first day of November, brings earnings from AbbVie (ABBV), American International Group (AIG) and Exxon Mobil (XOM).

The Tufton Capital Team hopes that you have a wonderful week!

Last Week’s Highlights:

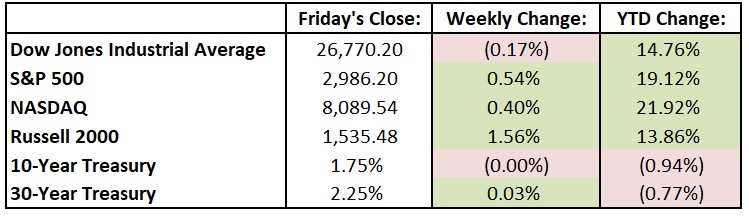

U.S. equities ended the week mostly higher as better-than-expected corporate earnings and optimism around Brexit were offset by continued global growth concerns. The third-quarter earnings season kicked off, and large U.S. banks took center stage with results that exceeded investors’ low expectations. While Wall Street began the week concerned that the lower interest rate environment might dampen results from the big banks (including Citigroup (C), Wells Fargo (WFC), Bank of America (BAC)), results came in largely better than expectations. On Saturday, U.K lawmakers forced Prime Minister Boris Johnson to ask European Union (EU) for yet another delay to Britain’s withdrawal. As the Brexit drama continues, Johnson will bring his proposed deal back to Parliament this week for another critical vote. For the past week, the Dow Jones Industrial Average (DJIA) fell 46.39 points, or 0.2%, to 26,770.20, while the S&P 500 advanced 0.5% to 2986.20. The tech-heavy NASDAQ was up 0.4%, closing at 8089.54. Why was the Dow Jones down but other U.S. indexes up? The Dow is a price-weighted index, while most others are market capitalization-weighted. With the Dow, higher-priced stocks have larger impacts on its pricing than do lower-priced ones. With last week’s weakness in high-priced Boeing (BA), Johnson & Johnson (JNJ) and IBM (IBM), the DJIA declined while the rest of the market traded higher.

Looking Ahead:

Third-quarter earnings season remains in full swing this week. Monday brings financial reports from Halliburton (HAL), TD Ameritrade Holdings (AMTD) and Cadence Design Systems (CDNS). Canadians go to the polls to elect members of Parliament. The Liberal Party, headed by Prime Minister Justin Trudeau, seeks to retain the majority it won four years ago. More earnings are released Tuesday, including numbers from Biogen (BIIB), Lockheed Martin (LMT), McDonald’s (MCD) and Procter & Gamble (PG). It’s a big day for sports fans, as baseball’s World Series begins, and the NBA season tips off. Look for earnings from Boeing (BA), Ford Motor (F), Microsoft (MSFT) and Caterpillar (CAT) on Wednesday. Facebook (FB) CEO Mark Zuckerberg testifies before the House Financial Services Committee. The hearing is titled, “An Examination of Facebook and Its Impact on the Financial Services and Housing Sectors.” Intel (INTC), Amazon.com (AMZN) and Northrop Grumman (NOC) report financials on Thursday. The Census Bureau releases its Durable Goods report for September – new orders for manufactured durable goods are expected to fall 0.5% after a 0.2% gain in August. The busy business week winds down Friday with earnings announcements from Verizon Communications (VZ), Anheuser-Busch InBev (BUD) and Charter Communications (CHTR).

The Tufton Capital Team hopes that you have a wonderful week!

Last Week’s Highlights:

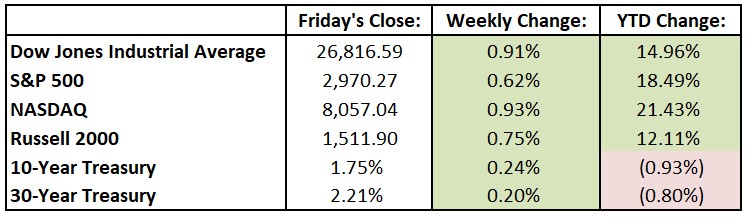

Global equities snapped a three-week losing streak on optimism that U.S. and Chinese delegates are making progress in their ongoing trade negotiations. While talks appear to be more of a “cease-fire” for now, markets responded favorably and investors were relieved that trade discussions seem to be moving forward. Positive comments on the Brexit front added to traders’ optimism, leading international developed-market stocks to record their biggest weekly rise in over four months. For the past week, the Dow Jones Industrial Average (DJIA) rose 242.87 points, or 0.9%, to 26,816.59, while the S&P 500 advanced 0.6% to 2970.27. The tech-heavy NASDAQ was up 0.9%, closing at 8057.04.

Looking Ahead:

Third-quarter earnings season ramps up this week, with 50 S&P 500 constituents reporting financial results. Things accelerate next week, as 110 release earnings and 114 the week after that. U.S. bond markets are closed on Monday in observance of Columbus Day, while Canadian bourses are closed in observance of Thanksgiving. Tuesday brings quarterly earnings results from BlackRock (BLK), Johnson & Johnson (JNJ), United Airlines Holdings (UAL) and UnitedHealth Group (UNH). Big Banks also report numbers, including results from Citigroup (C), Goldman Sachs Group (GS), Wells Fargo (WFC) and JPMorgan Chase (JPM). Look for financials from Abbott Laboratories (ABT), Bank of America (BAC). IBM (IBM) and Netflix (NFLX) on Wednesday. The Census Bureau reports retail-sales data for September – consensus estimates call for a 0.3% gain after a 0.4% rise in August. On Thursday, Morgan Stanley (MS), Philip Morris International (PM) and Taiwan Semiconductor (TSM) announce earnings. The Census Bureau releases new residential construction data for September – forecasts call for a seasonally adjusted annual rate of 1.35 million building permits and 1.3 million housing starts. The busy week ends with financials reports from American Express (AXP), Coca-Cola (KO) and State Street (STT) on Friday. The Conference Board releases its Leading Economic Index for September – economists forecast a 112.2 reading, little changed from the past two months’ data.

The Tufton Capital Team hopes that you have a wonderful week!

Last Week’s Highlights:

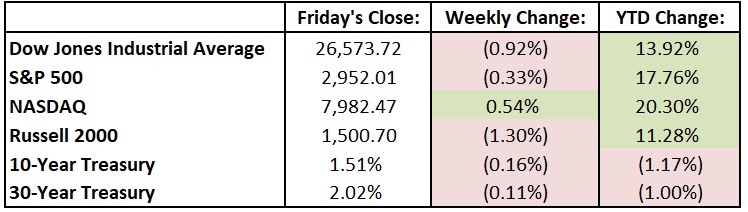

U.S. equities declined for a third straight week while bonds rose. Cyclical sectors led stocks lower as a string of disappointing economic reports fueled concerns that a slowdown in manufacturing might spread to other parts of the U.S. economy. Markets finished the week on a strong note, as the Dow Jones Industrial Average (DJIA) rose 372.72 points (1.42%) on Friday as the September jobs report helped ease fears about an economic slowdown. For the week, the DJIA fell 246.53 points, or 0.9%, to 26,573.72, while the S&P 500 declined 0.3% to 2952.01. The tech-heavy NASDAQ bucked the trend, rising 0.5% and closing at 7982.47.

Looking Ahead:

The Federal Reserve release consumer credit data for August on Monday – economists forecast a $15 billion increase in total outstanding consumer debt to $4.14 trillion, which would be an all-time high. Blue jeans inventor Levi Strauss (LEVI) reports third quarter financials on Tuesday. The Bureau of Labor Statistics reports its producer price index (PPI) for September – expectations are for a 0.1% increase, even with August’s uptick. On Wednesday, the Federal Open Market Committee releases minutes from its mid-September meeting, when it cut the federal-funds rate a quarter of a percentage point to 1.75%-2%. Delta Air Lines (DAL) holds a conference call on Thursday to discuss its September quarter earnings results. The Bureau of Labor Statistics reports its consumer price index (CPI) for September – economists call for a 1.8% year-over-year increase, up from August’s 1.7% rise. Fastenal (FAST) releases earnings results on Friday.

The Tufton Capital Team hopes that you have a wonderful week!

Last Week’s Highlights:

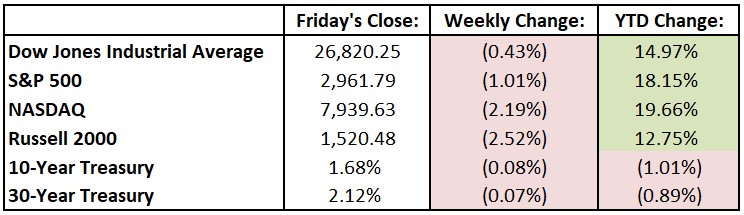

Fading optimism about trade talks with China combined with lackluster economic data, resulting in a second consecutive week of losses for major U.S. stock indexes. It was domestic politics, however, dominating the news wires, as House Democrats announced the initiation of an impeachment inquiry into President Trump. An impeachment would require a supermajority vote in the Senate where Republicans maintain control, making the chances of an actual conviction less likely. Ending the volatile week, reports surfaced Friday that the White House was considering delisting Chinese companies and limiting U.S. investments in China. For the week, the Dow Jones Industrial Average (DJIA) fell 114.82 points, or 0.4%, to 26,820.25, while the S&P 500 declined 1.0% to 2961.79. The tech-heavy NASDAQ lost 2.2%, closing at 7939.63. Talks between Altria Group (MO) and Philip Morris International (PM) ended, largely due to the vaping crisis at Altria investment Juul Labs. Interactive fitness company Peloton Interactive (PTON) spun in reverse, falling 11% on its first day of trading as a public company. Peloton raised $1.16 billion through its initial public offering (IPO) at a valuation of approximately $8 billion.

Looking Ahead:

The Institute for Supply Management releases the MNI Chicago Purchasing Managers Index for September on Monday – economists forecast a 50 reading, about even with August’s print. Spice maker McCormick & Co. (MKC) reports third-quarter earnings results on Tuesday. The Census Bureau releases construction spending data for August – consensus estimates call for a 0.4% rise to a seasonally adjusted annual rate of $1.29 trillion. Wednesday brings earnings reports from Paychex (PAYX), Lennar (LEN) and Lamb Weston Holdings (LW). Eli Lilly (LLY) hosts a webcast to update shareholders on some of its cancer drugs. ADP reports its National Employment Report for September – expectations call for a gain of 150,000 private-sector jobs, down from August’s 195,000 increase. Constellation Brands (STZ), Costco Wholesale (COST) and PepsiCo (PEP) report financials on Thursday. The ISM announces its Non-Manufacturing Index for September – consensus estimates forecast a 55.3 reading, down from August’s 56.4 report. On Friday, the BLS releases the jobs report for September – economists forecast a 150,000 rise in nonfarm payrolls, and that the unemployment rate will remain unchanged at 3.7%.

The Tufton Capital Team hopes that you have a wonderful week!

Last Week’s Highlights:

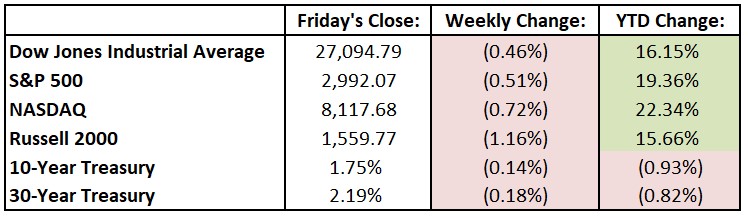

Major U.S. equity indexes broke a three-week winning streak, finishing last week with a modest loss after a volatile stretch in the markets. Recent trading has featured turmoil in money markets and big swings in oil prices following an attack on crude oil facilities in Saudi Arabia. A drone attack knocked out 5.7 million barrels a day of oil production, sending Brent crude prices up 15% on Monday (to $69 a barrel) before slipping back the next day. Additionally, investors continue to be very sensitive to trade-related headlines as discussions with China continue. As expected, the Federal Reserve cut interest rates on Wednesday by a quarter point. For the week, the Dow Jones Industrial Average (DJIA) fell 284.45 points, or 1.0%, to 26,935.07, while the S&P 500 declined 0.5% to 2992.07. The tech-heavy NASDAQ lost 0.7%, closing at 8117.67. Although last week saw stock indexes soften, both the Dow and S&P 500 are still within about 1.5% of their closing records from July.

Looking Ahead:

Climate Week NYC kicks off Monday with the U.N. secretary general’s Climate Action Summit. The event attracts CEOs, government officials and investors from across the globe. The Federal Reserve Bank of Chicago releases its National Activity Index for August – economists forecast a reading of -0.08 for August, up from July’s -0.36 print. On Tuesday, AutoZone (AZO), CarMax (KMX) and Nike (NKE) report their quarterly financial results. The Conference Board releases its Consumer Confidence Survey for September – forecasts call for a reading of 133.3, down from August’s 135.1. President Trump is scheduled to address the United Nations General Assembly. Look for earnings reports on Wednesday from KB Home (KB) and Pier 1 Imports (PIR). The U.S. Census Bureau announces new-home sales for August – consensus estimates are for 659,000 homes, up from July’s 635,000 report. On Thursday, Micron Technology (MU), FactSet Research Systems (FDS) and Vail Resorts (MTN) host earnings conference calls. The National Association of Realtors releases its Pending Home Sales Index for August – economists forecast a 1.5% gain after a 2.5% decline in July. Friday brings the Bureau of Economic Analysis’ release of personal income and outlays for August – personal income is expected to rise 0.4% after a 0.1% gain in July.

The Tufton Capital Team hopes that you have a wonderful week!

Last Week’s Highlights:

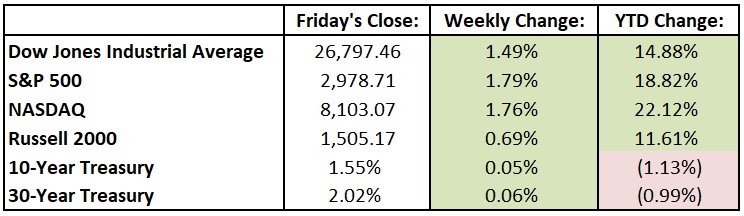

U.S. equities finished the week higher after the August jobs report indicated that hiring slowed in a month highlighted by continued trade threats with China. The soft employment report (130,000 new jobs, below the 150,000 projected by economists) likely keeps the Federal Reserve on track to cut interest rates again at their late September meeting. Wall Street likes certainty, and investors got more of it last week on the interest rate, trade and economic fronts. For the week, the Dow Jones Industrial Average (DJIA) advanced 394.18 points, or 1.5%, to 26,797.46, while the S&P 500 rose 1.8% to 2978.71. The tech-heavy NASDAQ gained 1.8%, closing at 8103.07. A delicate balance continues to face markets. Global investors are on one hand increasingly uneasy about signs that economies around the world are slowing. Any indications about slowing growth, whether it be from rising tariffs or political uncertainty, have sent markets reeling. On the other hand, any indications of economic softness are often met with rate cuts by the Federal Reserve, usually leading to strength for U.S. corporations and equity markets overall. Investors (and we at Tufton Capital, of course) continue to analyze and balance each of these competing dynamics.

Looking Ahead:

The business week begins with earnings results from Ctrip.com International (CTRP) on Monday. The Federal Reserve reports consumer credit data for July. Total outstanding credit topped $4.1 trillion at the end of June, a record high. GameStop (GME) and HD Supply Holdings (HDS) report quarterly results on Tuesday. The Bureau of Labor Statistics (BLS) releases its Job Openings and Labor Turnover Summary for July – consensus estimates call for 7.4 million open jobs on the last business day of July, up from 7.3 million in June. Apple (AAPL) hosts a product launch event in Cupertino, California. The company is expected to unveil three iPhone 11 models. Wednesday is the 18th anniversary of the 9/11 terrorist attacks. The BLS releases the producer price index (PPI) for August – expectations are for a 0.1% gain after a 0.2% rise in July. Broadcom (AVGO), Kroger (KR) and Oracle (ORCL) report financial results on Thursday. The Bureau of Labor Statistics announces its consumer price index (CPI) for August, which is expected to rise 1.8% year over year. The core CPI is seen gaining 2.3%. On Friday, the Census Bureau reports retail sales for August – economists forecast a 0.1% gain for the month.

The Tufton Capital Team hopes that you have a wonderful week!

Last Week’s Highlights:

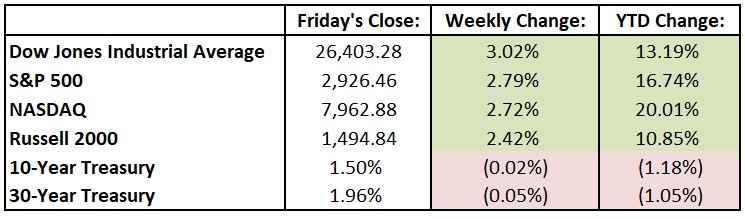

Even with continued recession concerns and falling bond yields, investor enthusiasm returned last week as China’s request for “calm” in the ongoing trade war resulted in ebullient equity markets. For the week, the Dow Jones Industrial Average (DJIA) rallied 774.38 points, or 3.0%, to 26,403.28, while the S&P 500 rose 2.8% to 2926.46. The tech-heavy NASDAQ gained 2.7%, closing at 7962.88. As summer comes to an end, we’re reminded of the old Wall Street adage to “sell in May and go away,” meaning that many June through August stretches have led to flat or down stock market movements. Those investors who followed these words this past summer may have left some market returns on the table this year. The S&P 500 rose 3.5% from Memorial Day through the end of August – the fourth straight year when the index has risen during the summer vacation season.

Looking Ahead:

Stock and bond markets in the U.S. and Canada are closed Monday in observance of Labor Day. On Tuesday, Coupa Software (COUP) reports earnings for the second quarter of fiscal 2020. The Census Bureau reports construction spending data for July – economists forecast a 0.3% gain to a seasonally adjusted annual rate of $1.29 trillion, after a 1.3% decline in June. Wednesday brings more financial results with earnings releases from American Eagle Outfitters (AEO), Navistar International (NAV), Slack Technologies (WORK) and Palo Alto Networks (PANW). The Bank of Canada announces its interest rate decision – the futures market predicts a small chance that the central bank will lower its key short-term rate to 1.5% from the current 1.75%. On Thursday, Lululemon Athletica (LULU), and Guidewire Software (GWRE) report earnings. The NFL’s 100th season kicks off with the Chicago Bears hosting the Green Bay Packers at Soldier Field. The BLS releases the employment report for August on Friday – economists call for a gain of 157,000 in nonfarm hires, with the unemployment rate unchanged at 3.7%.

The Tufton Capital Team wishes you and your families a very happy Labor Day!

Last Week’s Highlights:

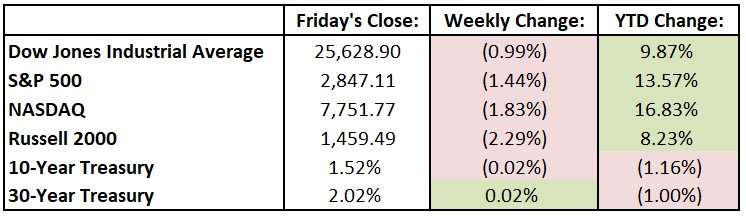

Stocks continued their wild swings as the U.S.-China trade war and comments from Fed Chairman Jerome Powell dominated business headlines. Equities were on track to finish higher for the week until China announced a new round of retaliatory tariffs on Friday morning, unveiling new tariffs on $75 billion of U.S. goods and a resumption of penalties on U.S. cars. While markets took this news in stride, stocks sold off sharply once President Trump responded. “My only question is, who is our bigger enemy, Jay Powell of Chairman Xi,” the president tweeted. From there, he turned his attention to China and “ordered” U.S. companies to “immediately start looking for an alternative to China.” Equities didn’t respond well to the news, as the Dow Jones Industrial Average (DJIA) sold off 623.34 points on Friday, ruining what had been a strong week. For the week, the DJIA fell 257.11 points, or 1.0%, to 25,628.90, while the S&P 500 declined 1.4% to 2847.11. The tech-heavy NASDAQ dropped 1.8%, closing at 7751.77. After Friday’s drop, the S&P 500 sits 5.9% below its all-time high, well above the 10% threshold for a market correction. Stock market futures rallied ahead of Monday’s open on positive comments from the White House regarding trade optimism. U.S. markets are on track to open higher Monday morning.

Looking Ahead:

With second-quarter earnings season largely in the books, the focus for the stock and bond markets will be on economic reports and continued U.S.-China trade talks this week. On Monday, the Census Bureau releases the Durable Goods report for July – consensus estimates call for a 1.1% gain in new orders for manufactured durable goods, down from June’s 1.9% rise. Autodesk (ADSK), Hewlett Packard Enterprises (HPE) and J.M. Smucker (SJM) report financial results on Tuesday. The Conference Board releases the results of its Consumer Confidence Survey for August – expectations are for a 130 reading, down from July’s 135.7 report. Look for earnings reports from Brown-Forman (BF), H&R Block (HRB) and Tiffany (TIF) on Wednesday. Thursday brings financial results from Best Buy (BBY), Burlington Stores (BURL), Dell Technologies (DELL) and Dollar General (DG). The National Association of Realtors reports its Pending Home Sales Index for July – estimates call for a 0.8% gain after a 2.8% rise in June. On Friday, the Bureau of Economic Analysis releases the Federal Reserve’s favored inflation gauge, the PCE price index, for July – consensus estimates are for a 1.4% year-over-year rise, even with June’s print.

The Tufton Capital Team hopes that you have a wonderful week!

Last Week’s Highlights:

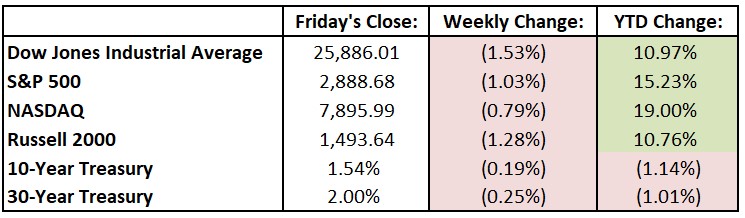

Stocks swung wildly as the yield curve inverted last week. The Dow Jones Industrial Average (DJIA) bounced back from Wednesday’s 800-point selloff with two consecutive sessions of solid gains and a modest loss for the week. Investors’ biggest worry concerned tumbling bond yields, as the 10-year Treasury yield traded as low as 1.47% on Thursday, its lowest since 2016. The 30-year yield dropped below 2% for the first time ever. With this activity, the 10-year briefly fell below that of the two-year (the yield curve inversion that has dominated headlines), a move that has historically foreshadowed a recession. For the week, the DJIA fell 401.43 points, or 1.5%, to 25,886.01, while the S&P 500 declined 1.0% to 2888.68. The tech-heavy NASDAQ dropped 0.8%, closing at 7895.99. All three indexes fell for the third consecutive week. While the yield curve was on the top of traders’ minds, President Trump was also moving markets as the U.S.-China trade war continued. Stocks rallied earlier in the week after Trump said that the U.S. would delay tariffs on some $156 billion in Chinese goods – mostly consumer items, including smartphones, laptops and toys. “We’re doing this for the Christmas season, just in case some of the tariffs would have an impact on U.S. consumers,” the president told reporters. Stock market futures rallied Sunday night on positive comments from the White House regarding the economy, and U.S. markets are on track to open higher Monday morning.

Looking Ahead:

With second-quarter earnings season largely in the books, the focus for the stock and bond markets will be on the Federal Reserve this week. Chairman Jerome Powell is scheduled to speak at the central bank’s annual retreat in Jackson Hole, Wyoming. On Monday, Baidu (BIDU), BHP Group (BHP) and Estee Lauder (EL) report their financial results. Home Depot (HD), Toll Brothers (TOL) and TJX Companies (TJX) announce earnings on Tuesday. Microchip Technology (MCHP) holds its annual shareholder meeting in Chandler, Arizona. Look for financial reports from Analog Devices (ADI), Nordstrom (JWN) and Target (TGT) on Wednesday. The Federal Open Market Committee releases minutes from its monetary policy meeting at the end of July. The National Association of Realtors releases home sales data for July – economists forecast a 2.5% rise in existing home sales, compared with a 1.7% decline in June. On Thursday, Hormel Foods (HRL), Salesforce.com (CRM) and Gap (GPS) report earnings. The Conference Board releases its Leading Economic Index for July – the consensus estimate calls for a 0.3% gain after declining 0.3% in June. Foot Locker (FL) releases second quarter fiscal 2020 earnings on Friday. Chairman Powell’s speech in Jackson Hole also takes place that day. The three-day G-7 Summit convenes on Saturday in Biarritz, France. The agenda is geared toward tacking issues of inequality.

The Tufton Capital Team hopes that you have a wonderful week!

Last Week’s Highlights:

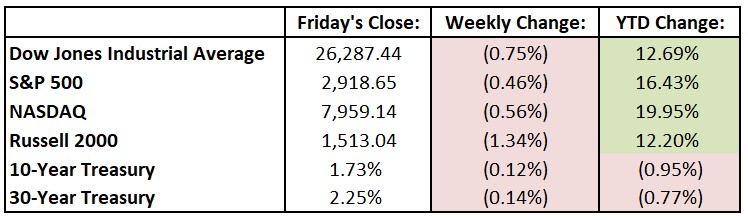

U.S. equity markets ended the week slightly below where they started. However, quite a bit happened between Monday and Friday as investors rotated between riskier and safer assets. The U.S.-China trade war continued to dominate headlines, and Beijing’s currency depreciation took center stage. The Dow Jones Industrial Average (DJIA) gave up 767.27 points on Monday after China let its currency weaken past 7 yuan to the dollar. Markets rallied on Tuesday, then tumbled Wednesday morning after India, Thailand and New Zealand announced unexpected interest rate cuts due to the global economic situation. Markets came back Wednesday afternoon and Thursday before faltering on Friday. For the week, the DJIA fell 197.57 points, or 0.8%, to 26,287.44, while the S&P 500 declined 0.5% to 2918.65. The tech-heavy NASDAQ dropped 0.6%, closing at 7959.14. Gold prices rallied to over $1,500 an ounce for the first time since 2013 and the 30-year U.S. Treasury briefly yielded 2.12% (its lowest since 2016), signaling investors’ appetites for safer assets in these volatile times.

Looking Ahead:

Second-quarter earnings season is in its final stretch, with Sysco (SYY) and Barrick Gold (GOLD) reporting financial results on Monday. The Treasury Department reports the nation’s budget statement for July – consensus estimates call for a $111 billion deficit, worse than July’s $77 billion shortfall. JD.com (JD), Tilray (TLRY) and Advance Auto Parts (AAP) announce earnings on Tuesday. The Bureau of Labor Statistics reports its consumer price index (CPI) for July – economists estimate a 1.8% year-over-year increase, up from June’s 1.6% print. The core CPI, which excludes volatile food and energy prices, is expected to be up 2.1%. Look for earnings reports Wednesday from Cisco Systems (CSCO), Agilent Technologies (A) and Macy’s (M). The BLS releases the Import and Export Indexes for July – import prices are expected to decline 0.2%, while export prices are seen falling 0.1%. On Thursday, Applied Materials (AMAT), Walmart (WMT) and Nvidia (NVDA) report their financial results for the past quarter. The Census Bureau releases retail sales data for July – analyst estimates forecast a 0.3% gain after the 0.4% rise in June. Deere (DE) reports earnings results on Friday. The BLS announces productivity and costs data for the second quarter – non-farm business sector productivity is expected to increase 0.9% after a 3.4% first-quarter rise.

The Tufton Capital Team hopes that you have a wonderful week!