Last Week’s Highlights:

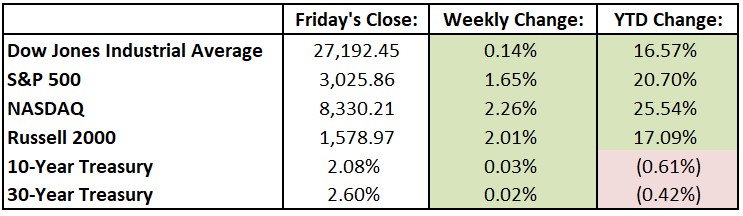

Last week brought record levels for two of the three major U.S. equity indexes. The S&P 500 and NASDAQ hit new highs as technology stocks roared after Google parent Alphabet (GOOGL) and Twitter (TWTR) handily beat earnings estimates. Alphabet’s announced $25 billion stock buyback was especially well received by investors. The Dow Jones Industrial Average (DJIA) was held back by component Boeing (BA), which slumped 8.6% after the grounding of the 737 MAX hit the company’s earnings. The Dow is a price-weighted index (as opposed to the S&P, which is market capitalization-weighted), so higher priced stocks such as Boeing have especially large impacts on the index’s performance. For the week, the DJIA advanced just 38.25 points, or 0.1%, to 27,192.45, while the S&P 500 rose 1.7% to 3025.86. The tech-heavy NASDAQ gained 2.3%, closing at 8330.21. Second-quarter gross domestic product (GDP) numbers, released Friday, showed that the U.S. economy grew at an annualized pace of 2.1%, a slowdown from the first-quarter’s 3.1% but slightly above economists’ forecasts of 2.0%. On the M&A front, the long-predicted Justice Department approval of the $26 billion T-Mobile (TMUS)/US-Sprint (S) merger finally took place. The U.K.’s Conservative Party elected Boris Johnson, the former London mayor and foreign minister, as party leader and prime minister. Johnson has been adamantly pro-Brexit, arguing that he will take the U.K. out of the European Union “do or die” by October 31st, without a deal if necessary.

Looking Ahead:

This is the busiest week of earnings season, with 156 S&P 500 constituents reporting their second-quarter financial results. On Monday, Affiliated Managers Group (AMG), Illumina (ILMN), SBA Communications (SBAC) and Vornado Realty Trust (VNO) release earnings. Tuesday brings financial results from Advanced Micro Devices (AMD), Procter & Gamble (PG) and Apple (AAPL). The Bank of Japan announces its monetary policy decision – the central bank is widely expected to keep its key interest rate at negative 0.1%. The week’s main event will be Wednesday’s Federal Open Market Committee’s July meeting. Wall Street has already priced in a 25-basis-point cut to the federal-funds rate, to 2% to 2.25%. The committee’s statement will be release at 2PM, followed by a news conference with Fed Chairman Jerome Powell. Automatic Data Processing (ADP), Dominion Energy (D) and Qualcomm (QCOM) announce their financial results. Look for earnings releases on Thursday from Corteva (CTVA), General Motors (GM), Verizon Communications (VZ) and Yum! Brands (YUM). The Institute for Supply Management announces its Manufacturing Index for July – consensus estimates call for a 52 reading, up from June’s 51.7 print. Chevron (CVX), Exxon Mobil (XOM) and Sempra Energy (SRE) announce their financial results on Friday. The Bureau of Labor Statistics releases the jobs report for July – economists forecast a 160,000 gain in nonfarm payroll employment after a 224,000 jump in June.

The Tufton Capital Team hopes that you have a wonderful week!

Last Week’s Highlights:

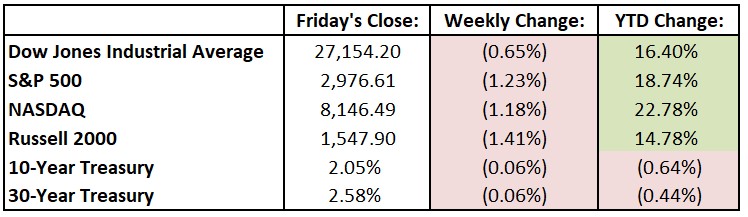

U.S. equities finished slightly lower last week, with most of Wall Street’s attention shifting to corporate earnings announcements. Bank earnings took center stage, reporting solid loan growth and low credit losses. These factors indicate a healthy consumer, boding well for the overall economy. The energy sector lagged as oil prices declined for five straight days, finishing 7% lower on global demand concerns. Netflix (NFLX) reported a decline in its U.S. subscriber numbers, while Microsoft (MSFT) released very impressive earnings results. For the week, the Dow Jones Industrial Average (DJIA) declined 177.83 points, or 0.65%, to 27,154.20, while the S&P 500 fell 1.23% to 2976.61. The tech-heavy NASDAQ lost 1.18%, closing at 8146.49. The dog days of summer are certainly upon us, even with the bevy or earnings announcements. Last week, the largest one-day move in either direction for one of the large U.S. equity indexes was a 0.74% drop for the NASDAQ on Friday, while the Dow never closed more than 0.42% away from its opening level.

Looking Ahead:

Earnings season is in full swing, with 133 S&P 500 constituents reporting financial results this week. On Monday, Halliburton (HAL), GNC Holdings (GNC) and Zions Bancorp (ZION) report financial results. The Chicago Fed releases its National Activity Index – estimates call for a 0.10 reading for June compared with May’s -0.05 print. Tuesday is jam-packed with earnings, including numbers from Coca-Cola (KO), Whirlpool (WHL), Visa (V), Lockheed Martin (LMT) and Robert Half International (RHI), among others. The National Association of Realtors releases existing-home sales for June – sales are estimated to remain flat at a seasonally adjusted annual rate of 5.33 million units from May’s 5.34 million. The U.K.’s Conservative Party is expected to announce its choice for prime minister and party leader to replace outgoing Theresa May. The two contenders are Jeremy Hunt and Boris Johnson. On Wednesday, look for earnings reports from AT&T (T), Ford Motor (F), Boeing (BA) and Facebook (FB). The Census Bureau releases new-home sales data for June – estimates call for a seasonally adjusted annual rate of 650,000 homes, up from May’s rate of 626,000. Southwest Airlines (LUV), Alphabet (GOOGL). Amazon.com (AMZN) and Bristol-Myers Squibb (BMY) report on Thursday. The European Central Bank holds its monetary policy meeting in Frankfurt – analysts forecast the bank to cut its key interest rate, which is currently at minus 0.4%, or signal a rate cut before its September meeting. The busy business week ends with earnings results from McDonald’s (MCD), Twitter (TWTR) and Colgate-Palmolive (CL) on Friday.

The Tufton Capital Team hopes that you have a wonderful week!

Last Week’s Highlights:

U.S. equities rallied to record highs as Federal Reserve Chairman Powell strongly signaled that the central bank is ready to cut interest rates at the end of the month and perhaps again later in the year. For the week, all three major U.S. indices closed at record levels: the Dow Jones Industrial Average (DJIA) rose 409.91 points, or 1.52%, to 27,332.03, while the S&P 500 gained 0.8% to 3013.77. The tech-heavy NASDAQ climbed 1.0% to 8244.14. The Dow industrials have risen 17% this year, while the S&P has jumped over 20%, with much of these gains following the Fed’s encouragements of a rate cut. Health-care stocks did especially well last week, as the Trump administration abandoned a plan to curb drug rebates. The decision canceled a proposal that would have eliminated rebates from government drug plans, easing concerns of a disruption to the U.S. pharmaceutical industry. Many health-care stocks, including Dow component UnitedHealth Group (UNH), rallied on the news.

Looking Ahead:

Earnings season unofficially kicks off on Monday. Citigroup (C) is the first of the major banks to be up, reporting its second-quarter numbers before the market open. Charles Schwab (SCHW), Luby’s (LUB) and J.B. Hunt Transport Services (JBHT) also release numbers that day. JPMorgan Chase (JPM), Wells Fargo (WFC), Goldman Sachs (GS) and Johnson & Johnson (JNJ) are among a long list of companies announcing quarterly earnings on Tuesday. Look for financial results from Alcoa (AA), Bank of America (BAC) and Abbott Laboratories (ABT) on Wednesday. Thursday brings earnings results from over 58 publicly listed U.S. companies, including numbers from Blackstone Group (BX), Union Pacific (UNP), Nucor Corporation (NUE) and Microsoft (MSFT). The busy business week concludes with financial releases from American Express (AXP), State Street Corporation (STT) and Schlumberger NV (SLB) on Friday. Economic reports during the week include Chinese GDP for Q2, Industrial and Manufacturing Production for June and Eurozone GDP for Q1.

The Tufton Capital Team hopes that you have a wonderful week!

Last Week’s Highlights:

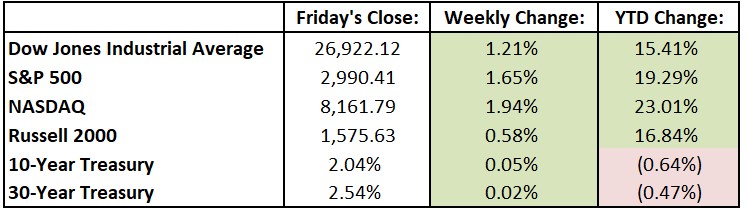

In a holiday-shortened week, U.S. equities hit new highs on expectations of a Fed rate cut and positive news regarding trade talks with China. For the week, the Dow Jones Industrial Average (DJIA) rose 322.16 points, or 1.21%, to 26,922.12, while the S&P 500 gained 1.7% to 2990.41. The tech-heavy NASDAQ climbed 1.9% to 8161.79. The rally in bonds also continued, as the 10-year Treasury yield fell to its lowest level in over two years (closing the week at 2.04%) amid signs of slower U.S. growth and expectations of more central bank easing. The 10-year continues to trade at a lower yield than the three-month bill – an inverted yield curve, which has been a reliable recession predictor over the years. On Sunday, the U.S. women’s national soccer team won its fourth World Cup, defeating the Netherlands 2-0 in Lyon, France.

Looking Ahead:

The Federal Reserve reports consumer credit data for May on Monday – economists forecast a $16 billion increase in consumer credit to $4.07 trillion, an all-time high. Pepsico (PEP) and Levi Strauss (LEVI) announce quarterly earnings on Tuesday. The Bureau of Labor Statistics releases its Job Openings and Labor Turnover Survey for May – forecasts call for 7.4 million job openings at the end of May, down from 7.45 million in late April. Look for earning results from Bed Bath & Beyond (BBBY) and MSC Industrial Direct (MSM) on Wednesday. Federal Reserve Chairman Jerome Powell delivers the semiannual Monetary Policy Report and testifies before the House. The Federal Open Market Committee releases minutes from its June monetary policy meeting. Delta Air Lines (DAL) and Fastenal (FAST) report earnings on Thursday. The Bureau of Labor Statistics announces its Consumer Price Index (CPI) for June – economists forecast the annual rate of inflation to rise 1.6%, slower than May’s 1.8% print. Friday brings the Bureau’s release of its Producer Price Index (PPI) for June – expectations call for a 0.1% increase, even with May’s rise. Excluding volatile food and energy prices, the PPI is seen rising 0.2%, in line with May’s gain.

The Tufton Capital Team hopes that you have a wonderful week!

Last Week’s Highlights:

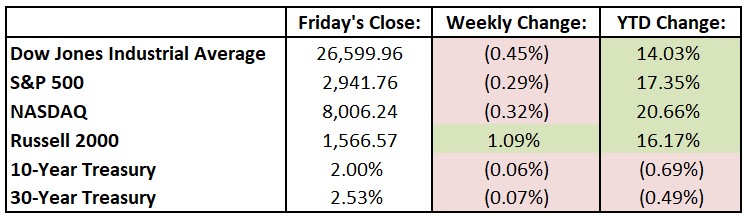

Equity markets finished the week mixed as investors anxiously awaited trade news from the G-20 Summit in Japan. Friday marked the end of the quarter and the first half of 2019 as well as an important milestone: the 10th anniversary of the current economic expansion. For the week, the Dow Jones Industrial Average (DJIA) dropped 119.17 points, or 0.4%, to 26,599.96, while the S&P 500 slipped 0.3% to 2941.76. The tech-heavy NASDAQ declined 0.3% to 8006.24. For the month, the S&P 500 gained 6.9%, its best June since 1955. The index rose 17% for the first six months of 2019, its strongest first half since 1997. The Dow increased 14% during the first six months of the year, its best first half since 1999. Over the weekend, investors received the positive news they were hoping for. At the G-20, the U.S. and China agreed to hold off on implementing additional tariffs on their products in an effort to resume trade talks. Stock market futures rallied Sunday night, and U.S. markets are on track to open at record highs Monday morning.

Looking Ahead:

Monday is the first day of July – rabbit rabbit! Canadian bourses are closed in observance of Canada Day. The Institute for Supply Management releases its Manufacturing Index for June – economists forecast a 51 reading, down from May’s 52.1 print. The World Economic Forum holds its 2019 Annual Meeting of the New Champions in Dalian, China. The three-day summit’s theme for this year is Leadership 4.0: Succeeding in a New Era of Globalization. On Tuesday, the European Union is expected to open a disciplinary procedure over Italy’s rising debt. In 2018, Italy’s debt grew to 132% of GDP, well above the EU’s ceiling of 60% for member states. U.S. stock markets close early (1 p.m.) on Wednesday, and bond markets close an hour later. The Bureau of Economic Analysis reports the trade balance for May – economists forecast a deficit of $52.5 billion for international trade in goods and services. The shortfall would be about even with April’s data. U.S. stock and bond markets are closed Thursday in observance of Independence Day. On Friday, the Bureau of Labor Statistics releases the June jobs report – average hourly earnings are expected to increase 3.2% year over year, and the average workweek is seen remaining unchanged at 34.4 hours.

The Tufton Capital Team wishes you a wonderful Fourth of July holiday!

Last Week’s Highlights:

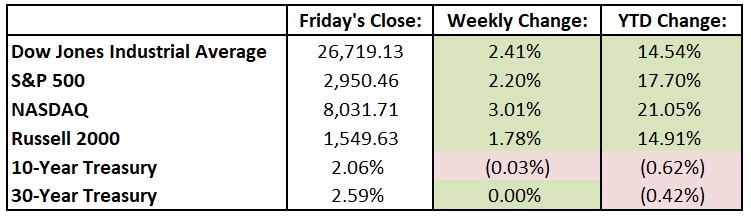

U.S. equities continued their winning ways last week, as equities set records on Thursday after the Federal Reserve and European Central Bank promised to ease interest rates if needed. Bond yields and the dollar fell, and oil rose as U.S. tensions with Iran escalated. For the week, the Dow Jones Industrial Average (DJIA) increased 629.52 points, or 2.4%, to 26,719.13, while the S&P 500 advanced 2.2% to 2950.46. The tech-heavy NASDAQ gained 3% to 8013.71. Stock markets have shown strength all month, as the S&P has advanced 7.2% despite lingering trade tensions and earlier uncertainty over the future of Federal Reserve policy. The index is heading towards its best June since 1955.

Looking Ahead:

Centene (CNC) and WellCare Health Plans (WCG) hold shareholder meetings on Monday in St. Louis and New York, respectively. Centene agreed to acquire WellCare in late March in a deal valued at $17.3 billion. FedEx (FDX), Lennar (LEN) and Micron Technology (MU) release financial results on Tuesday. The Census Bureau reports new-home sales data for May – consensus estimates call for a seasonally adjusted annual rate of 677,500, up from April’s 673,000 print. The Federal Housing Finance Agency releases its House Price Index for April – expectations are for a 0.2% rise after a 0.1% increase in March. Look for earnings results from General Mills (GIS), IHS Markit (INFO) and Paychex (PAYX) on Wednesday. Boston Scientific (BSX) hosts an investor day in New York. The Census Bureau reports its Durable Goods report for May – new orders for durable goods are expected to rise 0.1% after a 2.1% drop in April. Accenture (ACN), McCormick (MKC), Nike (NKE) and Conagra Brands (CAG) report quarterly results on Thursday. The Bureau of Economic Analysis reports the third and final estimate for first-quarter gross domestic product. Real GDP for the first quarter increased at an annual rate of 3.1% and is expected to remain unchanged with the final release. The business week ends with Constellation Brands (STZ) reporting financial results on Friday. The two-day G20 Summit convenes in Osaka, Japan, and all eyes will be on President Donald Trump and China’s President Xi Jinping and their ongoing trade discussions. The Institute for Supply Management releases its Chicago Purchasing Manager Index for June – consensus estimates call for a 54.4 reading, up from May’s 54.2.

The Tufton Capital Team hopes that you have a wonderful week!

Last Week’s Highlights:

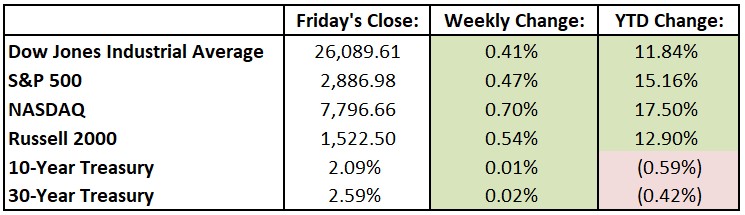

Stocks edged up early last week as the U.S. announced that it would not levy tariffs on Mexican imports. Markets sagged a bit mid-week as Chinese trade rhetoric picked up, followed by disappointing financial results reported by Broadcom (AVGO). The company lowered its full-year sales guidance by $2 billion, warning that the U.S.-China trade tensions are dampening demand. There was bad geopolitical news as the U.S. blamed Iran for attacking two tankers carrying petroleum products. Despite these negative reports, the Dow Jones Industrial Average (DJIA) extended its recent strength and rose 105.67 points, or 0.4%, to 26,089.61, while the S&P 500 rose 0.5% to 2886.98. The tech-heavy NASDAQ advanced 0.7%, closing at 7796.66. After last week’s market rise, the S&P 500 is up 4.9% in June and just 2% shy of its record close. The index is having a difficult time breaking through the 2900 mark, a level that has been identified as resistance by technical analysts. The initial public offering (IPO) calendar remained strong, as a number of companies made their public debut, including Crowd-Strike Holdings (CRWD), Fiverr (FVRR) and Chewy (CHWY). It was a big week for sports fans, as the St. Louis Blues won hockey’s Stanley Cup, and Toronto’s Raptors edged past the Golden State Warriors to capture their first NBA title. Gary Woodland won golf’s U.S. Open late Sunday at Pebble Beach.

Looking Ahead:

The National Association of Home Builders releases the NAHB/Wells Fargo Housing Market Index for June on Monday – economists forecast a 66 reading, equal to May’s print. The Federal Reserve Bank of New York reports its Empire State Manufacturing Survey for June – consensus estimates call for a 11 reading, down from May’s 17.8. On Tuesday, Adobe (ADBE) reports its financial results. MetLife (MET) hosts its annual shareholder meeting in New York. The Census Bureau releases data on new residential construction for May – estimates call for 1.25 million housing starts at a seasonally adjusted rate. The Federal Open Market Committee (FOMC) announces its monetary-policy decision on Wednesday – the futures market predicts a 25% chance that the Fed will cut the federal-funds rate by a quarter of a percentage point, to 2%-2.25%. The Fed’s tone regarding possible rate cuts later in the year will be especially interesting to investors. Oracle (ORCL) reports earnings results. Look for financial results from Darden Restaurants (DRI), Kroger (KR) and Red Hat (RHT) on Thursday. The Bank of England and the Bank of Japan announce their monetary-policy decisions. Both central banks are expected to keep their key short-term rates unchanged at 0.75% and minus 0.1%, respectively. The business week ends with earnings results from CarMax (KMX) on Friday. The National Association of Realtors reports existing-home sales data for May – expectations call for a seasonally adjusted annual rate of 5.3 million home sales, up from April’s 5.2 million.

The Tufton Capital Team hopes that you have a wonderful week!

Last Week’s Highlights:

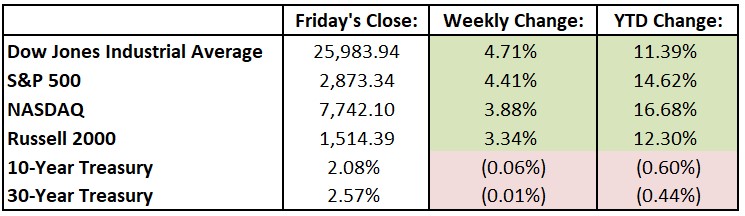

The Dow Jones Industrial Average (DJIA) extended its rally Friday, resulting in the best week for the index in over six months. Investor optimism that the Federal Reserve will cut interest rates was the main driver of recent market strength. Fed Chairman Jerome Powell stated that the central bank would “act as appropriate to sustain the expansion”, alluding to a possible rate cut as a solution to contracting economic data. The Dow rose over 500 points on the day of these comments, followed by a 200+-point rise the following day after private-sector employment data showed a large drop in hiring. For the week, the DJIA rallied 1,168.90 points, or 4.7%, to 25,983.94, while the S&P 500 rose 4.4% to 2873.34. The tech-heavy NASDAQ advanced 3.9%, closing at 7742.10. The Dow is now off just 3.1% from its October record, while the S&P 500 is within 2.5% of its April 30th closing high. Over the weekend, President Trump announced that proposed tariffs on Mexican imports would be suspended indefinitely. Trump said in a Twitter post that he has “full confidence” that Mexico will crack down on migration from Central America. Adding to the bullish sentiment was the announcement of a blockbuster deal in the aerospace industry, as Raytheon (RTN) and United Technologies (UTX) announced an all-stock merger that would create a combined company with $74 billion in annual revenues. Both company stocks rallied in premarket trading.

Looking Ahead:

DuPont de Nemours (DD), formally known as DowDuPont, hosts a conference call on Monday to discuss financial guidance as a stand-alone company. The corporation completed spinoffs of both Dow (DOW) and Corteva (CTVA) earlier this year. The Bureau of Labor Statistics reports its Job Openings and Labor Turnover Survey for April – economists forecast 7.4 million job openings at the end of April, about even with March’s report. On Tuesday, HD Supply Holdings (HDS) and H&R Block (HRB) release their quarterly financial results. Best Buy (BBY) hosts its annual meeting of stockholders online. The BLS releases its producer price index (PPI) for May – expectations call for a year-over-year rise of 2.1% after a 2.2% gain in April. Lululemon Athletica (LULU) reports earnings on Wednesday, and Caterpillar (CAT) and Target (TGT) host annual shareholder meetings in Clayton, N.C., and Columbus, Ohio, respectively. The BLS reports the consumer price index (CPI) for May – economists forecast the annual rate to rise 1.9%. The core CPI is expected to increase 2.1%. Both rates would be about even with April’s prints. Broadcom (BRCM) reports financial results on Thursday. Campbell Soup (CPB) hosts an investor day in Camden, N.J. Friday brings another initial public offering (IPO), as Chewy, the online pet-products retailer, is expected to begin trading on the NYSE under the ticker CHWY. The company plans to go public at $17 to $19 a share, which would result in a market capitalization of $7.5 billion. Centene (CNC) and Corning (GLW) host investor days in New York. The Census Bureau releases retail sales data for May – estimates call for a 0.6% increase after a 0.2% decline in April.

The Tufton Capital Team hopes that you have a wonderful week!

Last Week’s Highlights:

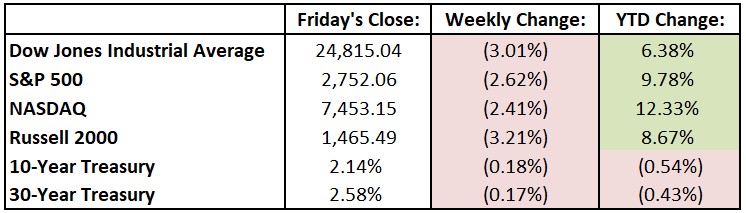

The continued stalemate between the U.S and China on a potential trade deal continued to pressure equity markets. Rhetoric from politicians on tariffs and trade once again resulted in share weakness of companies that rely on sales in China and those that buy supplies there. Things got even more volatile late in the week when President Trump announced that the U.S. will impose 5% tariffs on Mexican imports due to the border crisis. The Dow Jones Industrial Average (DJIA) closed lower for a sixth consecutive week, its longest such losing streak since 2011. For the past week, the DJIA declined 770.65 points, or 3.01%, to 24,815.04, while the S&P 500 fell 2.6% to 2752.06. The tech-heavy NASDAQ dropped 2.4%, closing at 7453.15. While May marked the largest stock market pullback this year, bonds rallied significantly, with the 10-year Treasury ending the week at 2.14%, the lowest level in 21 months.

Looking Ahead:

The business week begins with quarterly earnings results from Box Inc. (BOX) and Coupa Software (COUP). President Trump begins a three-day state visit to the United Kingdom. The Institute for Supply Management reports its Manufacturing Purchasing Managers’ Index for May – economists forecast a 53 reading, about even with April’s print. Salesforce.com (CRM), Tiffany (TIF) and Navistar International (NAV) report financials on Tuesday. General Motors (GM) hosts its annual meeting of stockholders – the meeting will be online only. The Census Bureau reports factory orders for April – estimates call for a 0.9% decline after a 1.9% rise in March. Look for earning releases from Campbell Soup (CPB), Five Below (FIVE) and Brown-Forman (BF) on Wednesday. Walmart (WMT) holds its annual shareholder meeting in Rogers, Ark. ADP releases its National Employment Report for May – economists forecast a 178,000 gain in private sector jobs after a 275,000 increase in April. Vail Resorts (MTN) and J.M. Smucker (SJM) report earnings on Thursday. Netflix (NFLX) holds its annual meeting of shareholders online. The European Central Bank announces its monetary-policy decision – the ECB is widely expected to keep its key short-term interest rate at negative 0.4%. On Friday, the Department of Labor releases the jobs report for May – the unemployment rate is estimated to remain at a 50-year low of 3.6%. Nonfarm employment is expected to increase by 183,000, down from April’s 263,000 print. Theresa May steps down as Conservative Party leader after a three-year tenure. She will stay on as U.K. prime minister until her successor is elected this summer. Financial markets in China and Hong Kong are closed in observance of the Duanwu Festival, also known as the Dragon Boat Festival.

The Tufton Capital Team hopes that you have a wonderful week!

Last Week’s Highlights:

The continued stalemate between the U.S and China on a potential trade deal continued to pressure equity markets. Rhetoric from politicians on tariffs and trade once again resulted in share weakness of companies that rely on sales in China and those that buy supplies there. The Dow Jones Industrial Average (DJIA) closed lower for a fifth consecutive week, its longest such losing streak since 2011. For the past week, the DJIA declined 178.31 points, or 0.7%, to 25,585.69, while the S&P 500 fell 1.2% to 2826.06. The tech-heavy NASDAQ dropped 2.3%, closing at 7637.01. The Commerce Department blacklisted China telecom giant Huawei Technologies from buying U.S.-made components. The Department then gave Huawei a reprieve for 90 days to fulfill existing orders. Shares of suppliers to the company, including Alphabet (GOOGL) and Intel (INTC), rose and fell as trade headlines continued. British Prime Minister Theresa May finally said she would resign as Conservative Party leader on June 7th. She’ll remain as PM until a successor is named. May’s discussions with the Labour Party and her final attempt to pass a Brexit plan have both collapsed.

Looking Ahead:

On Tuesday, Bank of Nova Scotia (BNS) and Workday (WDAY) release their quarterly financial results. The Conference Board reports its Consumer Confidence Survey for May – economists forecast a 130 reading, up from April’s 129.2 print. President Trump concludes his four-day visit to Japan. The trade war with China and sanctions against North Korea are expected to be topics of discussion with Prime Minister Shinzo Abe. Palo Alto Networks (PANW), Dick’s Sporting Goods (DKS), Amerco (UHAL) and Bank of Montreal (BMO) report earnings on Wednesday. Bristol-Myers Squibb (BMY) and Exxon Mobile (XOM) hold their annual stockholder meetings in Lawrence Township, N.J., and Dallas, respectively. The Federal Reserve Bank of Richmond releases its Fifth District Manufacturing Survey for May – analysts call for a reading of seven, up from April’s three, indicating that manufacturing activity is still expanding in the region. On Thursday, look for earnings reports from Burlington Stores (BURL), Costco Wholesale (COST), Dell Technologies (DELL) and Ulta Beauty (ULTA). The National Association of Realtors reports its Pending Home Sales Index for April – economists forecast a 1% increase after a 3.8% rise in March. Lowe’s (LOW) and Zions Bancorp (ZION) host their annual meetings of stockholders in Charlotte and Salt Lake City, respectively. The Institute for Supply Management announces its Chicago Purchasing Managers’ Index for May – economists forecast a 55 reading, up from April’s 52.6 report.

The Tufton Capital Team hopes that you have a wonderful week!

Last Week’s Highlights:

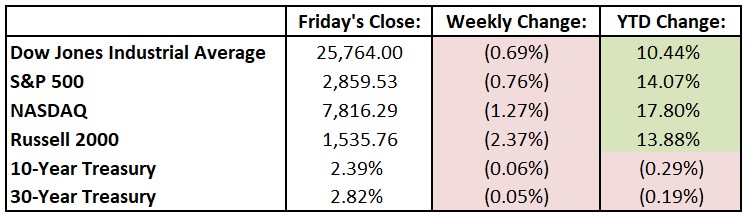

Major U.S. equity markets slumped for yet another week as trade disputes between Washington and Beijing continued. All three U.S. indexes posted weekly declines, with the Dow Jones Industrial Average (DJIA) posting its longest losing streak since May of 2016, and the S&P 500 and NASDAQ recording two straight weeks of losses. Last week began with a bang, as the S&P 500 index dropped 2.5% on Monday when investors realized that the trade war would not end quietly. Markets spent the rest of the week making back Monday’s losses. For the past week, the DJIA declined 178.37 points, or 0.7%, to 25,764.00, while the S&P 500 fell 0.8% to 2859.53. The tech-heavy NASDAQ dropped 1.3%, closing at 7816.28. The trade news wasn’t all negative, nor was it solely between the U.S. and China. On Friday, the Trump administration agreed to drop tariffs on steel and aluminum imports from Canada and Mexico. The two countries dropped their own retaliatory measures in response. The agreement clears the way for the U.S.-Mexico-Canada Agreement (USMCA), which is intended to replace Nafta. Congressional approval is still needed.

Looking Ahead:

The week begins with annual shareholder meetings hosted by Consolidated Edison (ED) and Omnicom Group (OMC) in New York and Boston, respectively. The Federal Reserve Bank of Chicago releases its National Activity Index for April – consensus estimates call for a 0.08 reading, up from March’s -0.15 print. Canadian markets are closed Monday in observance of Victoria Day. On Tuesday, AutoZone (AZO), Home Depot (HD), Nordstrom (JWN) and TJX Companies (TJX) report their quarterly financial results. The National Association of Realtors reports existing-home sales data for April – economists forecast a seasonally adjusted annual rate of 5.3 million, up 2% from March’s 5.2 million sales number. Wednesday brings earnings results from Target (TGT), Lowe’s (LOW), VF (VFC) and Analog Devices (ADI). The Federal Open Market Committee release minutes from its monetary-policy meeting that concluded earlier this month. Amazon.com (AMZN) holds its annual meeting of stockholders in Seattle. Expect financial results on Thursday from Best Buy (BBY), Hewlett Packard (HPE) and Intuit (INTU). The United Kingdom holds European parliamentary elections. Voting in the other 27 European Union (EU) member states takes place over the next four days through Sunday. The Census Bureau releases new-home sales data for April – expectations call for a seasonally adjusted annual rate of 678,000 new single-family home sales, down from March’s rate of 692,000. On Friday, Foot Locker (FL) holds a conference call to discuss quarterly financial results. The Census Bureau releases its Durable Goods report for April – new orders for durable goods are seen declining 2% after rising 2.8% in March.

The Tufton Capital Team hopes that you have a wonderful week!

Last Week’s Highlights:

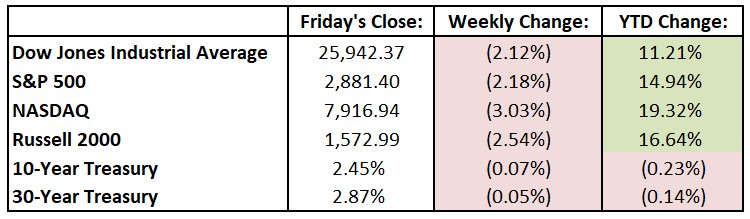

Elevated trade and tariff tensions took center stage last week and set the mood for global equities. The market had been counting on a trade deal between the U.S. and China, so stocks sold off as the rhetoric out of the White House increased. The U.S. levied new tariffs on $200 billion of Chinese goods Friday and threatened more, even as the 11th trade meeting between the U.S and China took place in Washington. For the past week, the Dow Jones Industrial Average (DJIA) declined 562.58 points, or 2.1%, to 25,942.37, while the S&P 500 fell 2.2% to 2881.40. The tech-heavy NASDAQ dropped 3.0%, closing at 7916.94. Ride-hailing leader Uber Technologies (UBER) went public on Friday, pricing its IPO at $45 per share (valuing the company at $82.4 billion). The stock opened at $42 and closed the day at $41, hardly a solid first day of trading. Apparently Wall Street isn’t buying Silicon Valley’s excitement about ride hailing and the sharing economy. On top of Uber’s weak IPO, rival Lyft’s (LYFT) stock is down 30% since its March initial offering. Trade anxieties continued through the weekend, resulting in S&P 500 futures falling sharply on Sunday night.

Looking Ahead:

Earnings season winds down this week, with only nine companies in the S&P 500 reporting their first-quarter results. Investors will continue to focus closely on continued comments from President Trump (please see details above) and their impact on trade developments and global markets. Monday brings financial reports from Legg Mason (LM) and Take-Two Interactive (TTWO). The Federal Reserve Bank of Boston will host a FedListens conference. On Tuesday, Ralph Lauren (RL), Agilent Technologies (A) and Container Store (TCS) are among companies reporting financial results. Trade results will be reported – prices for U.S. imports are expected to rise 0.7% in April, after increasing 0.6% in March. U.S. export prices are expected to advance 0.6% in April after rising 0.7% in March, according to the Bureau of Labor Statistics. On Wednesday, look for financial results from Cisco Systems (CSCO), Macy’s (M), Alibaba Group Holding (BABA) and Tencent Holding (TME). The National Association of Home Builders releases the NAHB/Wells Fargo Housing Market index for May – economists forecast a 64 reading, up from April’s 63. Walmart (WMT), Applied Materials (AMAT) and Pinterest (PINS) report their earnings results on Thursday. The Census Bureau releases housing starts for April – economists forecast 1.22 million seasonally adjusted annual units, up from March’s 1.14 million unit change. On Friday, the Conference Board reports its Leading Economic Index for April – expectations call for a 0.2% rise after a 0.4% gain in March. The University of Michigan releases its preliminary Consumer Sentiment index – estimates call for a reading of 97.5 in May, up slightly from April’s 97.2 print.

The Tufton Capital Team hopes that you have a wonderful week!

Last Week’s Highlights:

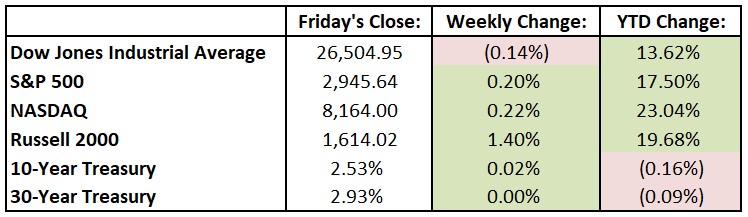

U.S. equities rallied on Friday (up 1% on the day), moving the S&P 500 to positive territory for the week and leaving it just below its recent record. A more accommodative stance from central banks, rising earnings and signs of easing trade tensions (more on that below) continue working together to keep the market moving higher. For the past week, the Dow Jones Industrial Average (DJIA) slipped 38.38 points, or 0.1%, to 26,504.95, while the S&P 500 advanced 0.2% to 2945.64. The tech-heavy NASDAQ was up 0.2%, closing at 8164.00, capping off its best four-month start to a year since 1991. The main driver for last week’s market strength was corporate earnings. With earnings season more than three-quarters over, corporate profits appear to be on track for modest gains (0.9%) in the first quarter. While these gains are small, they’re much better than feared going into reporting season. On the economic front, Friday’s jobs report was above expectations, with nonfarm payrolls increasing by a seasonally adjusted 263,000, the Labor Department reported. The unemployment rate ticked down to 3.6%, the lowest level in 50 years. The news wasn’t all rosy, as President Trump threatened to drastically ramp up U.S. tariffs on Chinese imports, a surprise twist to the recently positive trade talks. In a pair of Twitter messages Sunday, the president wrote that he planned to raise levies on $200 billion in Chinese imports to 25% starting Friday, from 10% currently. He added that he would impose 25% tariffs “shortly” on $325 billion in Chinese goods that haven’t yet been taxed. These developments resulted in S&P 500 futures falling sharply on Sunday night.

Looking Ahead:

Earnings season winds down this week, with only 10% of the companies in the S&P 500 reporting their first-quarter results. Investors will be focusing closely on Sunday’s Twitter comments by President Trump (please see details above) and their impact on trade developments and global markets. Monday brings financial reports from American International Group (AIG), Kilroy Realty (KRC) and Occidental Petroleum (OXY). Aflac (AFL) and Eli Lilly (ELI) hold their annual meetings of stockholders in Columbus, Ga., and Indianapolis, respectively. Expect earnings results on Tuesday from Allergan (AGN), Anheuser-Busch InBev (BUD), Lyft (LYFT) and Sempra Energy (SRE). American Express (AXP) and Danaher (DHR) hold their annual meetings of stockholders in New York and Washington, D.C., respectively. The Bureau of Labor Statistics releases its Jobs Openings and Labor Turnover survey for March – economists forecast 7.1 million job openings in March, even with February. Walt Disney (DIS), Microchip Technology (MCHP) and Marathon Petroleum (MPC) report earnings on Wednesday. Intel (INTC) holds an investor meeting in Santa Clara, Ca. On Thursday, look for financial results from Cardinal Health (CAH), Becton Dickinson (BDX) and Symantec (SYMC). The Bureau of Labor Statistics releases the producer price index (PPI) for April – economists look for a 0.3% increase in wholesale prices after a 0.6% rise in March. On Friday, ride-sharing giant Uber Technologies begins trading under the ticker symbol UBER. The company is going public by selling shares at an expected range of $44 to $50, which would value Uber at over $80 billion. Viacom (VIA) and Marriott International (MAR) report their first-quarter financial results.

The Tufton Capital Team hopes that you have a wonderful week!

Last Week’s Highlights:

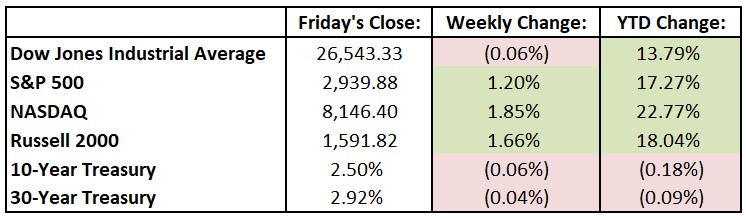

U.S. equities rallied to record closing highs – the S&P 500 and the tech-heavy NASDAQ hit record levels on Tuesday before slightly losing ground on Wednesday. A more accommodative stance from central banks, rising earnings and signs of easing trade tensions continue working together to keep the market moving higher. For the past week, the Dow Jones Industrial Average (DJIA) slipped 16.21 points, or 0.06%, to 26,543.33, while the S&P 500 advanced 1.2% to 2939.88. The NASDAQ was up 1.85%, closing at 8146.40. The main driver for last week’s market strength was corporate earnings. With over 40% of the S&P 500 companies having reported results, corporate profits appear to be on track for small gains in the first quarter, supporting current market valuations. On the economic front, Friday’s Q1 gross domestic product (GDP) number came in above expectations – the U.S. economy grew at a 3.2% pace in the first quarter, accelerating from 2.2% at the end of 2018. On the big screen, “Avengers: Endgame” became the first film in Hollywood history to gross more than $1 billion in its worldwide box office debut over the weekend.

Looking Ahead:

First-quarter earnings season remains in full swing this week. Monday brings financial reports from Google-parent Alphabet (GOOG), MGM Resorts International (MGM), SBA Communications (SBAC) and Western Digital (WDC). The Bureau of Economic Analysis releases personal income data for March – economists forecast a 0.4% rise in personal income after a 0.2% gain in February. Boeing (BA) and Honeywell International (HON) hold their annual meetings of stockholders in Chicago and Morris Plains, NJ, respectively. Tuesday is another bevy of financial results, including numbers from Advanced Micro Devices (AMD), Amgen (AMGN), Apple (AAPL), General Motors (GM) and Mondelez International (MDLZ). The Conference Board releases its Consumer Confidence Index for April – expectations call for a 125.4 reading, a slight increase from March’s 124.1 print. Wednesday is May Day – the Federal Open Markets Committee (FOMC) announces its monetary-policy decision. The central bank is widely expected to keep its benchmark federal-funds rate unchanged at 2.25% to 2.5%. Automatic Data Processing (ADP), CVS Health (CVS), Qualcomm (QCOM) and CME Group (CME) report earnings. On Thursday, look for financial results from Cigna (CI), Dow (DOW), DowDuPont (DWDP), Kellogg (K) and Under Armour (UA). The BLS releases productivity and labor-costs data for the first quarter – nonfarm productivity is expected to rise 1%, down from the 1.9% report in the last quarter of 2018. The busy business week ends with earnings reports from American Tower (AMT), Dominion Energy (D) and Noble Energy (NBL) on Friday. The BLS releases its Employment Situation Summary for April – economists forecast a 175,000 rise in nonfarm payrolls. Down from March’s 196,000 gain.

The Tufton Capital Team hopes that you have a wonderful week!

Last Week’s Highlights:

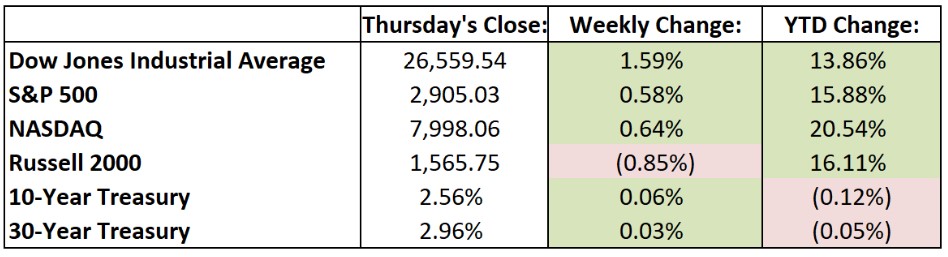

In a holiday-shortened week of trading, equities were essentially flat. Weakness in the health care sector due to increasing political headlines was offset by solid gains in industrial stocks, driven by solid earnings results and better-than-expected manufacturing data from China. It was a very quiet four days on Wall Street trading desks, as anemic trading volumes were some of the lowest seen in the past year. The Cboe Volatility Index, or VIX (also known as the “fear index” – it’s a popular measure of the stock market’s expectation of volatility implied by S&P 500 index options), slipped below 13, further reflecting the current relatively complacent environment for many investors. For the past week, the Dow Jones Industrial Average (DJIA) rose 147.24 points to 26,559.54, while the S&P 500 dipped just over 2 points to 2905.03. The tech-heavy NASDAQ edged up slightly, closing at 7998.06. Apple (AAPL) and Qualcomm (QCOM) settled hours after a case in federal court began on iPhone patent royalties – QCOM shares rallied on the news. Strength in the initial public offering (IPO) market continued as Pinterest priced at $19 per share – two dollars above its expected range – resulting in a valuation of $12.6 billion. Later in the week, the stock rose 28% to $24.40.

Looking Ahead:

First-quarter earnings season takes center stage this week, with about one-third of the S&P 500 components reporting financial results. Monday brings earnings reports from Halliburton (HAL), Kimberly-Clark (KMB), Zions Bancorp (ZION) and Cadence Design Systems (CDNS). Many markets across the globe, including those in Germany, Hong Kong and the United Kingdom, are closed in observance of Easter. Tuesday is full of more earnings reports with numbers expected from Coca-Cola (KO), Harley-Davidson (HOG), Procter & Gamble (PG), Nucor (NUE) and Verizon Communications (VZ). Northern Trust (NTRS) and Wells Fargo (WFC) host their annual stockholders meeting in Chicago and Dallas, respectively. The Census Bureau reports new-home sales data for March – economists forecast a 652,000 seasonally adjusted annual rate, down from February’s 667,000 print. Wednesday brings financial results from Anthem (ANTM), Caterpillar (CAT), Visa (V), Microsoft (MSFT) and General Dynamics (GD), among many others. Thursday includes earning reports from Amazon.com (AMZN), Ford Motor (F) and Bristol-Myers Squibb (BMY). The Bank of Japan announces its monetary policy – expectations call for the central bank to keep its key short-term interest rates at negative 0.1%. The busy business week ends on Friday with earnings numbers from Chevron (CVX), Exxon Mobil (XOM) and Archer-Daniels-Midland (ADM).

The Tufton Capital Team hopes that you have a wonderful week!