What’s On Our Minds:

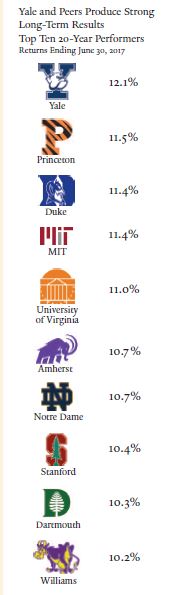

On Memorial Day, Yale University’s Men’s Lacrosse team took down Duke for the program’s first ever National Championship. While Yale may now be known for its strong lacrosse program, the school’s endowment fund has long been heralded as an investment powerhouse under the leadership of David Swensen, who has been the endowment fund manager at the school since 1985. While he underperformed the S&P 500 during their 2017 fiscal year, his long-term results remain in the top-tier of institutional investors. Over the past 20 years, Yale’s endowment has recorded annualized returns of 12.1%, and during that period the endowment fund grew from $5.8 billion to $27.2 billion. For the sake of comparison, the S&P 500 returned just 7.15% over that same period.

Swensen’s strategy has been so successful that numerous other endowment funds have followed suit and adopted his model. At Yale, Swensen plays “quarterback” where he allocates funds to various outside money managers that he believes can outperform. During his tenure, he has continuously increased Yale’s allocation towards alternative investments and hedge funds, or what he refers to as “absolute return” strategies. He is an avid supporter of hiring active managers and he believes their fees can be justified over the long term.

In last year’s annual letter, he wrote “Net performance matters. Strong active management has contributed to Yale’s outstanding absolute and relative performance. While passive investment strategies result in low fee payments, an index approach to managing the university’s endowment would shortchange Yale’s student, faculty, and staff now and for generations to come.” Swenson’s strong support for the active manager model is in stark contrast with Warren Buffet who believes most investors would be better off in an index fund.

It may seem tempting to try and mimic David Swensen’s strategy at Yale, but it’s important to remember that he has a few distinct advantages over individual investors, and unfortunately, it’s virtually impossible to copy his model. First, universities have a boundless time horizon, which means they can take much riskier investments than what would be prudent for an individual. Another consideration is that due to the size of endowments that utilize numerous complex strategies, they enjoy lower fees than even the wealthiest private investors. Lastly, universities don’t have to worry about Uncle Sam taking a piece of the pie. The tax free exemption is by far the biggest advantage that endowments have over everyday investors. With long term capital gains taxed at 15-20%, a school’s tax-free status makes a huge difference in their annual returns.

While it’s easy to get caught up in the notion that you might be able to beat the market over the short term, we suggest that our clients and friends take a note from Swensen and remain focused on the long term success of their investment portfolio. Yale’s endowment has underperformed in recent years but Swensen’s 20-year performance figures are extremely impressive.

Last Week’s Highlights:

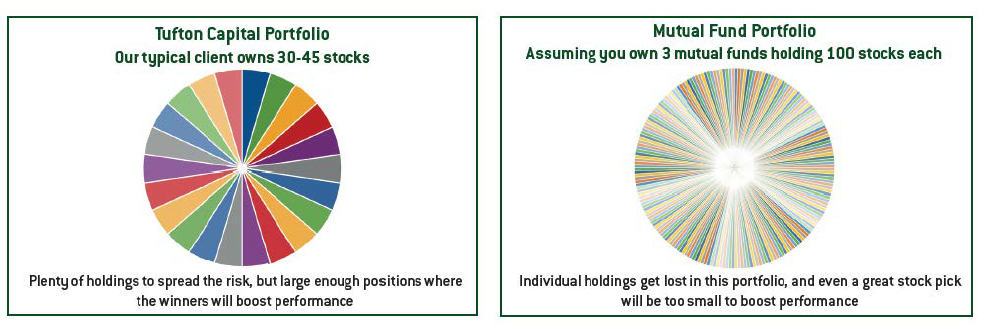

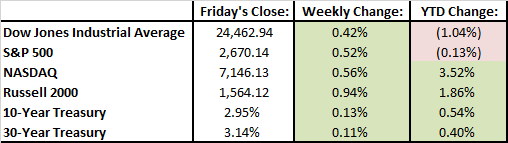

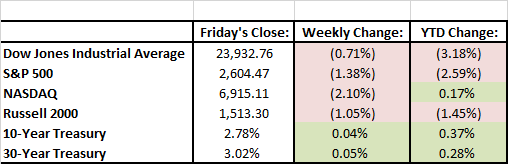

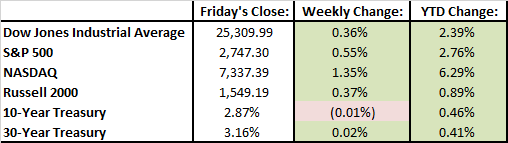

Stocks edged out slight gains last week. Stocks were up and down over the course of the week as both setbacks and developments were made in trade negotiations with China. Ongoing tensions with North Korea also weighed on investor sentiment last week. The Federal Reserve also came into play as it announced it planned to stay the course and gradually continue increasing interest rates.

Looking Ahead:

U.S. markets were closed on Monday in observance of Memorial Day. The Conference Board releases its index of consumer confidence for May on Tuesday and the Federal Reserve releases its beige book on economic conditions on Wednesday. The Federal Reserve will hold a meeting in Washington on Wednesday to discuss possibly changing the Volcker Rule, which could ease restrictions that ban proprietary trading by banks. U.S. nonfarm payrolls for May will be reported on Friday. Investors are expecting the unemployment rate to hold steady at 3.9%.

What’s On Our Minds:

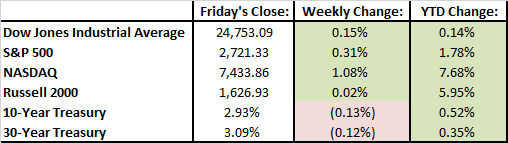

At Tufton Capital, we often bring in new accounts holding numerous mutual funds. It’s likely that the client’s previous advisor was “filling the buckets” by picking what they believed were the best funds for each category (large-cap, mid-cap, small-cap, international, etc.). It’s a common strategy that is not necessarily a bad one, but we believe investors with sizable assets deserve a higher level of service: a customized portfolio constructed with individual securities.

It’s commonly said that “diversification is the only free lunch in investing.” In its most basic sense, diversification involves the accumulation of assets that have negative or low correlations to reduce risk and increase potential return. At Tufton, we believe in diversification, but we’re not for over-diversification, or what famous fund manager Peter Lynch coined as “diworsification:”

The process of adding investments to one’s portfolio in such a way that the risk/return trade-off is worsened. Diworsification is investing in too many assets with similar correlations that will result in an averaging effect. It occurs where risk is at its lowest level and additional assets reduce potential portfolio gains, as well as the chances of outperforming a benchmark.

Consider that the average mutual fund owns about 100 different stocks. If you own 5 to 10 different mutual funds, do you know exactly what you own? An account invested in 10 different mutual funds may own over 1,000 different securities, and you may even hold the same stocks in different funds. Moreover, the fund likely charges a management fee on top of the fee paid to the financial advisor playing “quarterback” and picking the funds. If an investor wants this type of broad diversification, why not just purchase an index fund? It would be much cheaper!

At Tufton, we believe that an equity portfolio made up of 30 to 45 stocks is a sweet spot where portfolio managers can limit volatility stemming from each security (company-specific risk) and still produce alpha in an account.

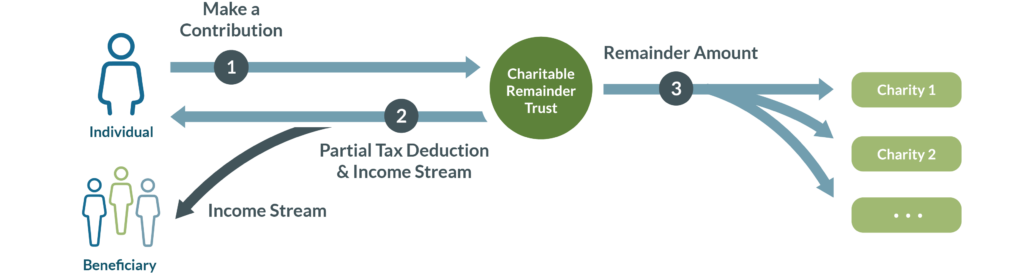

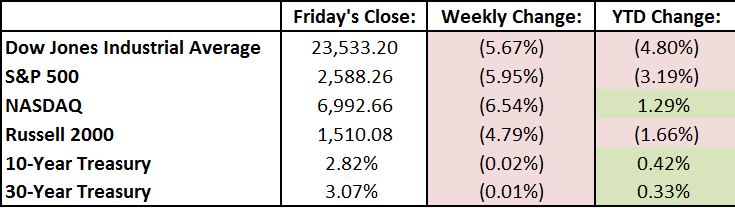

Last Week’s Highlights:

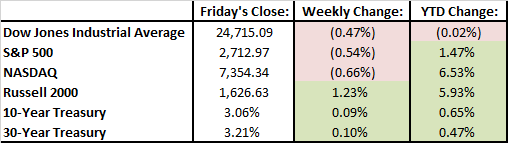

Stocks declined a bit last week as investors shifted their attention away from earnings and towards to interest rates, macroeconomic developments and global politics. The yield on the 10-year Treasury Note had a high during the week of 3.115%, after closing the previous week at 2.971%. Market pundits have been fixated on this 3% number as some believe investors may favor these bonds over stocks. On the other hand, borrowing costs are still low, and rates have not yet climbed to a level that will begin choking off economic growth.

Looking Ahead:

First quarter earnings season continues to wrap up this week and economic data will be on the light side. New home sales will be reported on Wednesday, existing home sales on Thursday, and then consumer sentiment will be reported on Friday.

What’s On Our Minds:

5-Point Portfolio Checkup

The goal of investing is to see your money grow over time. However, even though you can’t control how your investments rise and fall, your portfolio is anything but automatic. Like most things, it’s important to check up on your portfolio to make sure nothing is out of date and that its goals are still in line with your own. Tufton Capital’s portfolio managers are always available to help guide you through a quick “portfolio checkup”.

Update Your Goals

Naturally, your investment goals will change as you get closer to retirement. The first thing to do is determine where you want your investments to be headed. Do you have a new goal, like a child’s college fund, or have you decided to aim for higher retirement income?

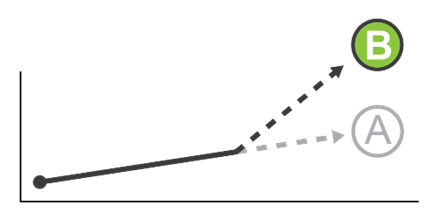

Check Your Performance

Are your investments on track to meet your goals? Do you need to aim for increased investment returns or start contributing more? If your portfolio is lagging behind the appropriate benchmarks over a long period of time, it is probably time to reconsider your investment strategy.

Review Assets

Over time, some assets may grow to be an oversized or undersized part of your portfolio, or perhaps your appetite for risk has changed. Often times, individuals inherit a large position in a single company and it’s necessary to diversify. Or, perhaps someone has worked hard over the course of their career and amassed a sizable equity stake with their company. Either way, re-balancing your assets is often a smart strategy as you plan for the future.

Check Your Beneficiaries

Do all of your investment accounts have listed beneficiaries? While it may not be fun to think about, it’s very important to plan ahead. In the event of your death, having direct beneficiaries for your accounts will keep them from passing through your estate and incurring unnecessary costs.

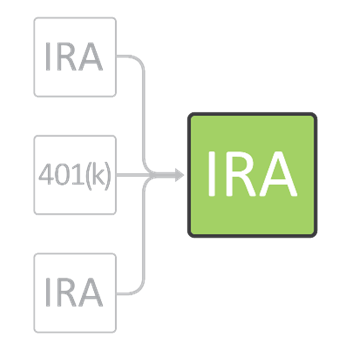

Consolidate Extra Accounts

Many people forget about old accounts (past IRAs, CDs and 401(k)s) and do not coordinate their holdings with the rest of their portfolio. Talk to your Tufton portfolio manager about rolling these accounts into a single IRA that will be easier to manage. Along with streamlining your investment strategy, you also may be able to lower your management fees by consolidating more assets with a single firm.

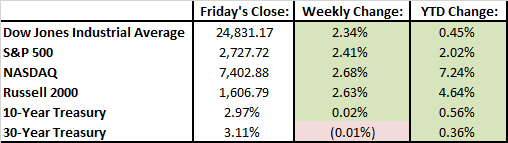

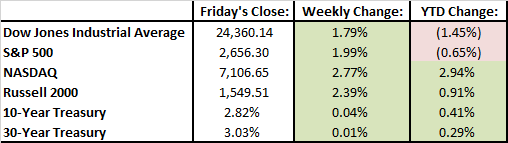

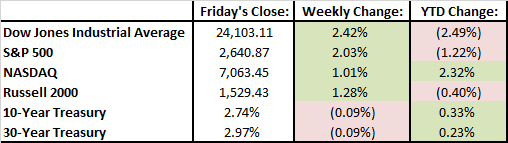

Last Week’s Highlights:

Investor sentiment turned bullish last week and stocks logged solid gains. Strong earnings results lifting the S&P 500 and Dow Jones by more than 2%. At this point, more than 90% of S&P 500 companies have reported earnings, and results from the quarter are on pace to be the strongest since the 3rd quarter of 2010. On average, we have saw an impressive 8.2% increase in revenue from S&P 500 companies in the first quarter.

Looking Ahead:

Earnings season begins to wrap up this week with only 10 companies in the S&P 500 reporting. Thus, investor attention will likely return to any pending political news and economic data. Retail sales figures are reported on Tuesday, housing starts on Wednesday, and the Leading Economic Index figure is released on Thursday.

What’s On Our Minds:

William Holbrook Beard was one of America’s finest animal painters. Many of his paintings employed animals to mimic and satirize human behavior. In 1879, Beard painted “The Bulls and Bears in the Market” which depicts a battle between bulls and bears on New York’s Wall Street. Over the past 140 years this fight continues!

There has been a bull vs. bear tug of war on Wall Street this year. On the bull’s side of the ring, analysts have been increasing their earnings expectations and yet companies are still beating their estimates at a record pace. 81% of S&P 500 have reported first quarter earnings this spring, with results on pace to be the strongest since the third-quarter of 2010. Furthermore, tensions on the Korean peninsula have eased in recent weeks which sharply reduces geopolitical tensions that have been weighing on investor sentiment this year. The market has been hesitant to read too much into the positive reporting trend though. A group that tracks bullish sentiment by way of survey, the American Association of Individual Investors, notes that bullish sentiment peaked back in January at 59.75% and has since decreased to 28.4%. Of course, this survey is useful with the benefit of hindsight, but clearly investors have become skittish this spring.

Which brings us to the bear’s corner of the ring. Heightened risk of trade wars, which could hurt manufactures of targeted goods and their suppliers are stoking investor fears. Investors are also worried about rising interest rates, which makes equities less attractive. An apparent lack of reinvestment of tax savings on the corporate level has also spooked investors. Instead of investing savings for long term sustainable growth, companies have prioritized stock buybacks and employee bonuses.

The constant back and forth between bullish and bearish sentiment this year may seem worrisome but it these types of conditions are expected as you invest over the long term. Remember, Tufton Capital’s portfolio managers are hard at work looking for undervalued companies, balancing your portfolio and trimming your winners. We’re not focused on short term performance, but rather, the long-term growth of your portfolio!

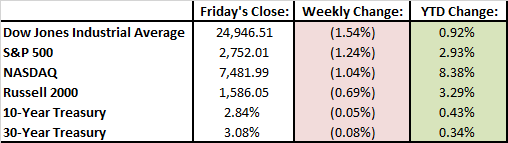

Last Week’s Highlights:

Daily moves were volatile last week but we finished the week close to where we started. It was a tough week until stocks rallied back on Friday. April’s Jobs report was released last week which showed that the U.S. economy added 164,000 jobs and the unemployment rate dropped to 3.9% from 4.1%. The report missed expectations though. Investors were expecting 190,000 new jobs. The Federal Reserve said it still plans to raise rates later this year.

Looking Ahead:

Earnings season begins to wrap up this week with only 9% of S&P 500 companies reporting first quarter results. Important economic updates this week include inflation on Thursday and consumer sentiment on Friday.

What’s On Our Minds:

The yield on the U.S. 10-year Treasury hit 3% last week: the highest level it has reached since 2014. Low interest rates have been a key ingredient for our current bull market’s run so recent increases have garnered plenty of attention from investors. The recent move higher puts upward pressure on borrowing costs and has driven investor attention back to the Federal Reserve’s plan to hike interest rates. Below, we break down the various levers that make this number so significant.

Interest rates are, to put it mildly, a complex beast. There are a few mechanisms by which rates affect the economy and the stock market, not all of which are obvious, but which have large effects.

The first is the most obvious: a lower interest rate means it’s cheaper to borrow. Consumers borrow more money to buy houses or cars, businesses borrow money to expand production. And thus, we get economic growth. Everybody’s happy. Except, maybe, the people who get less money in interest for loaning out their hard-earned cash.

An interest rates increase, like the one that seems imminent, is a signal that rates are moving higher, might cause both consumers and Chief Financial Officers to cut back on spending. So, businesses earn less, and earnings fall.

Another very important but more abstract concept is the valuing of stocks via a discount rate. If I think a company is going to earn $10 million in ten years, the interest rate would have to be 0 for an investor to want to buy its stock now for with a $10 million valuation. But if interest rates are higher, investors would be better off just putting the money in the bank for ten years and earning some interest in those ten years. In this way, investors compare interest rates with their expectations for the earnings of companies. If interest rates are low, companies’ stocks are more attractive, and therefore worth more in today’s dollars.

The Federal Reserve must think about all of this, with the added complexity of inflation. The inflation target is 2-3%: at this level, prices are stable, but there is incentive to spend, rather than save, money, and to push the economy along. With inflation at zero, you know that the car you want to buy will cost about the same in year, so you might just think about it for a while, dampening economic activity.

Deflation, when inflation falls below zero, is a major problem: here, you might wait to buy that car, since it will be cheaper next year. And the year after that. This gives rise to the “pushing on a string” phenomenon that was one of our investment committee’s favorite metaphors. You can’t entice people to spend money by cutting rates indefinitely, since rates below zero (usually) are avoided by simply keeping the cash.

Last Week’s Highlights:

The S&P 500 was little changed last week and the Dow Jones was down just over half a percent. Crosscurrents continue to weigh on investor sentiment. We have seen strong first quarter earnings reports and improving economic growth but investors are skeptical because of rising interest rates. 10-year interest rates rose above 3% last week for the first time since 2014. On one hand, low interest rates have been a major factor for this bull market so recent increases have caused anxiety on Wall Street. On the other hand, corporate profits are still expanding and businesses are still realizing the benefits of last year’s tax reform.

Looking Ahead:

The flow of first quarter earnings reports continues this week. Analyst will be busy dissecting reports from 147 of the S&P 500’s components. So far, nearly 80% of the S&P’s companies that have reported have beaten consensus earnings forecast. The Federal Open Markets Committee will announce their interest rate decision on Wednesday. No rate increase is expected.

What’s On Our Minds:

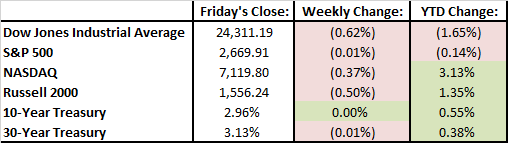

A charitable remainder trust (CRT) is a powerful estate planning tool that can provide a variety of benefits. These accounts enable investors to move funds out of their taxable estate, they provide a steam of income, and they enable wealthy individuals to fulfill their philanthropic goals.

Contributing a portion of your estate to charity may be something that you and your family strongly believe in, whether or not you receive any benefit from it. Although generosity is the driving force behind philanthropy, there are also many benefits that a donor can reap from making charitable contributions.

Considering that federal government charges a 40% estate tax (on individual estates larger than $11.2 million), it’s important for wealthy families to consider the many estate planning strategies available that can help reduce the tax bite upon a generational wealth transfer. One strategy is the creation of a charitable remainder trust (CRT).

CRTs are an excellent option as they allow wealthy individuals to fulfill their philanthropic goals by moving assets out a taxable estate which can then grow, tax free, through investment. Meanwhile, during the life of the trust, it is required that the CRT distributes between 5 and 50 percent annually to the beneficiary of the trust (either the grantor of the trust or their family). These payments will last for a set number of years or the remainder of the grantor’s life, depending on how the trust document is written. The trust will end at the predetermined time and the remaining funds with go to the charity of your choice.

The tax advantages continue with the creation of a CRT. Along with moving funds out of a taxable estate, upon the creation of the trust, the grantor can take an income tax deduction for the full value of the trust that can be spread over five years. Finally, the creation of a trust helps individuals avoid capital gains taxes. Assets with large unrealized gains can be moved into the trust, sold, and reinvested into a portfolio of income producing investments.

At Tufton, we provide comprehensive planning services to portfolios of all sizes and complexities and give you objective solutions. Armed with a plan, you can plan how your assets can help forge your family’s legacy.

Last Week’s Highlights:

U.S. equity markets were in the green last week, adding to the previous week’s 2% rally. At this point, the S&P 500 is essentially flat for the year. Earnings continued its strong start which helped to distract investors’ attention away from political headlines that have caused investor anxiety recently.

Looking Ahead:

Earnings season continues this week with one third of the S&P 500’s companies reporting their first quarter results. Important economic indicators will also be reported this week. Home sales data will be reported on Monday, the new homes sales figure on Tuesday, and first quarter GDP will be reported on Friday. We’ll see if calm heads prevail during this important week of data released.

What’s On Our Minds:

Many investment companies will advertise their strategies as “value” or “growth.” According to standard definitions, these two types of investment strategies stand opposite to one another. Each uses its own elements and metrics to determine a sound investment, and each has its own standards and expectations for returns. That being said, both strategies feature similarities.

Defining “Value” and “Growth”

In traditional terms, “value investing” is the purchase of stocks or other securities that are currently undervalued by the market. To make a value investment, an investor must find a security that is being sold for less than what its calculated and/or historical value suggests. Value investing works off a person’s logical expectation that a security will return to a normal price. At Tufton, our value philosophy takes advantage of the emotions in the market. The price of a stock gyrates around its intrinsic value as investors’ emotions cause them to make irrational decisions. We buy securities when the market has given up on them – when it feels “dread” and “desolation.” Later, when the market is “deliriously” happy with an investment, we look to sell. Typically, our investment committee will not chase a hot stock higher.

On the other end, “growth investing” is the purchase of shares in a company that is expected to grow in importance or become more valuable than it is now. To pursue growth investment, an investor seeks out companies that have excellent potential to expand. The current cost of their shares are not undervalued, their growth has simply not yet been realized. Growth investing is based on the optimistic anticipation of a company’s future.

Differences

Investors will undoubtedly notice that several firms and funds will either label themselves “value” or “growth.” In general, this reflects the fund’s volatility: value funds are often less volatile than growth funds. Though growth funds make up for their risk by claiming to offer the potential for higher returns, economic downturn can cause them significant losses. By purchasing securities at a significant discount, Tufton provides a “margin of safety” which can provide downside protection.

Similarities

In recent years, several well-known investors, including Warren Buffet, have stated that the difference between “value” and “growth” investing are arbitrary. A company’s shares might be a good deal because they are undervalued, but an investor is expecting some form of growth or performance to push it back to its normal value. Similarly, if an investor feels a company’s growth is certain, then he or she sees its shares as undervalued at their current price.

The differences between “value” and “growth” are only noticeable if an investor is speculating on growth or continued performance. Any experienced and well-informed investor (growth or value) will consider a company’s past and future before purchasing a security. After taking everything into account, it becomes a simple judgment of whether the company’s expected future is worth the current price, market risk and length of time.

If you have questions about your current market positions or would like to learn more about Tufton’s value strategy, please give us a call today!

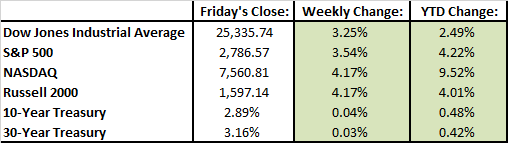

Last Week’s Highlights:

Fears of a looming trade war with China eased last week and stocks increased by nearly 2%. It was the sixth week in a row where we saw the S&P 500 move by more than 1%, up or down. It was a week chock full of headlines. The FBI seized records from President Trump’s personal lawyer; Facebook’s CEO, Mark Zuckerberg, appeared before congress to defend the company’s business practices; and the tariff spat with China continued. On top of all that, on Friday night, the U.S. led a missile strike on Syria. While these types of headlines won’t necessarily drive earnings higher or lower, they can affect investor sentiment overall.

Looking Ahead:

Global markets did not seem to worry over the weekend about the U.S. air strikes on Syria. This week, investor attention will return to company earnings reports with 10% of the S&P 500’s companies report their first quarter results. Blue chip companies reporting this week include Goldman Sachs, Proctor & Gamble, Johnson & Johnson, United Airlines, IBM, Bank of America, and General Electric. The economic reporting calendar is light but we will see retail sales figures on Monday.

What’s On Our Minds:

Receiving dividend payments from your equity holdings every quarter is similar to collecting interest on money in a savings account – it’s very nice but it’s not exciting. Buying a stock and betting its share price will increase is much more exhilarating, but today we will take this opportunity to remind our readers of the several advantages of owning dividend-paying stocks.

- Dividends provide passive income, which investors can either spend or reinvest. Dividend-paying stocks are particularly attractive to folks looking to benefit from supplemental income, especially retirees.

- Companies that pay a dividend tend to be mature and stable.

- Dividends can be viewed as a hedge against inflation. Many blue-chip companies pay a dividend higher than the rate of inflation. Unfortunately, a savings account simply cannot keep up.

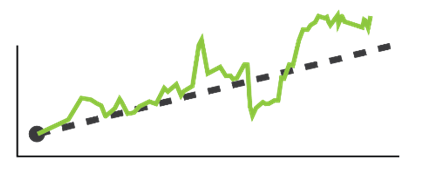

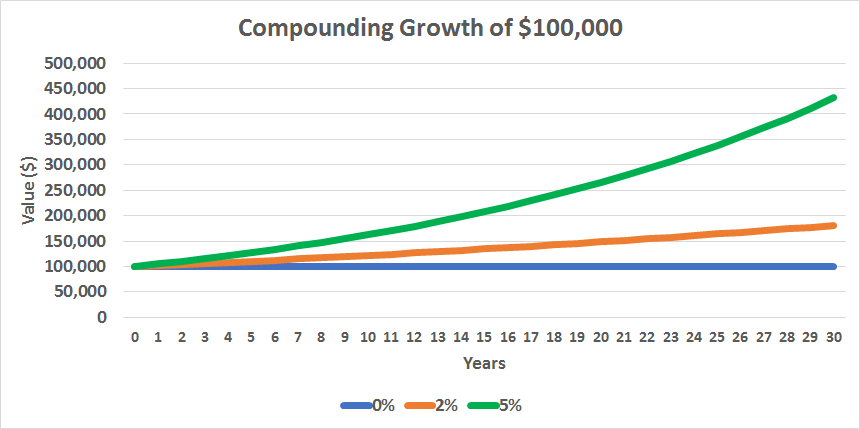

Investors who opt to re-invest their dividends, rather than spend them, have far better investment returns thanks to compounding interest. With compounding, your original investment is growing due to repeated reinvestment, and every year you are getting a larger and larger sum of interest. Imagine a snowball rolling downhill, growing bigger in size as it picks up more snow along the way.

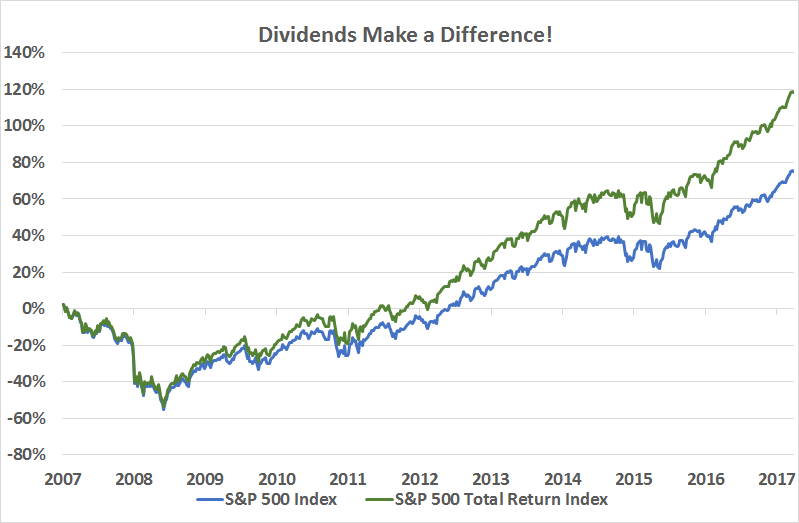

Dividends are central to your long-term returns and studies have shown that if you don’t own dividend paying stocks, it is likely that you will underperform the market over the long term. Credit rating agency Standard & Poor’s recently conducted a study showing that over the past 80 years dividends were responsible for 44% of the S&P 500’s total return.

The chart below shows the S&P 500 Index’s return vs. the S&P 500’s total return which includes dividends. Dividends make a difference!

Last Week’s Highlights:

Ebbing and flowing concerns over a potential trade fight between the U.S. and China and the impact such a scuffle would have on domestic and global growth drove a series of ups and downs for the stock market last week. On Monday, China announced it would impose tariffs on $3 billion of U.S. goods in response to the steel and aluminum tariffs President Trump announced last month. The White House retaliated with a proposed tariff on 1,300 Chinese products worth about $50 billion. Then, the Chinese matched that with a $50 billion tariff on U.S. automotive, agriculture, and aerospace industries.

Looking Ahead:

While headline news from the White House may continue to drive market volatility this week, investors’ attention will also return to corporate earnings with large U.S. financial services firms reporting late in the week. This group includes Well Fargo, Citigroup, J.P. Morgan Chase, and Blackrock. Investors will also be watching the release of inflation data and the Federal Reserve’s minutes from March.

What’s On Our Minds:

Investor sentiment continues to swing between optimism and pessimism as new information about the technology sector, global trade, and monetary policy is released. Over the past two weeks, investors have not taken kindly to the data privacy controversy engulfing Facebook which, up until recently, was one of the most popular stocks on Wall Street. Recent turbulence in the tech industry adds another element of uncertainty to an existing combination of worries: that inflation might bubble up and prompt the Federal Reserve to hike interest rates faster than expected, and that President Trump’s protectionist views on trade could spark a trade war.

What does Volatility Mean for Investors?

Volatility is an inescapable part of investing. The future is uncertain and every investment carries risks. It is in the stock market’s nature to fluctuate sharply during the short term as market participants receive and digest new information. However, unless an investor is involved with buying or selling options, a brief increase in volatility (measured by the VIX) is unlikely to require any changes to his or her investments. A volatile market might cause stock prices to rise and fall by significant amounts, but it does not necessarily affect the future value of owning shares in a company. Investors should choose stocks based on the underlying value of a company, not a temporary price fluctuation. The fear associated with the VIX should not give way to irrational buying or selling.

So, what is an investor to do?

For starters, remember that success in the market does not depend on predicting the future over the short term and that timing the market’s ups and downs is nearly impossible. Instead, focus on staying diversified, understand your risk tolerance and stick to a long-term plan.

Above all, remember that market returns are driven by economic and earnings growth, and both continue to appear positive, in our view.

Last Week’s Highlights:

It was a shortened week of trading due to the holiday on Friday but equity markets rallied by more than 2% to close out the first quarter of 2018. Even though the week’s numbers ended up in the green, it was another volatile week where the S&P 500 moved by more than 1.5% on three of the four trading days. Concerns about privacy issues and regulatory scrutiny in the tech sector sent a ripple effect throughout the broader market.

Looking Ahead:

A good amount of economic data will be released this week, with the Purchasing Managers Index on Monday, vehicle sales on Tuesday, and a very important jobs report on Friday. The jobs report should provide clarity on the state of the U.S. labor market and levels of wage growth. The jobs report number will be watched closely by investors who have become cautious about the level of inflation in the economy, and whether the Federal Reserve might become more aggressive in raising rates to suppress a spike in inflation.

What’s On Our Minds:

What’s on our minds this week is the same thing that’s on everyone’s minds this week. And on their screens every day. And their phones. And, maybe, in their data, rummaging around: Facebook. “Lax Data Policies Haunt Facebook.” “Data Blowback Pummels Facebook.” As of this writing, Facebook (FB) is down a hefty 22.1% from its February 1st high.

The trouble last week initially centered on the issue of how Cambridge Analytica used millions of users’ information that it collected over the years. It tied in with the Trump campaign, Russia, and raised hackles in Congress, where lawmakers called for CEO Mark Zuckerberg to explain himself. The ire spread across the pond, where British MPs similarly demanded an explanation. Each day, Facebook dropped precipitously.

At Tufton, we are watching carefully. Not because we own Facebook in spades- FB is a ticker that rarely passes over a value investor’s desk. But rather, we watch because the calls for regulation and oversight of how data is used will affect not just Facebook, but other big-tech names. Notably, Google. We expect that we’ll see if GOOGL’s “Don’t Be Evil” motto did, in fact, prevent data from being used improperly.

No company wants to see an article about itself that includes the phrase “The Federal Trade Commission is investigating…” If the FTC finds Facebook violated terms of a 2011 settlement, it will face large fines, to be sure, but it will also call into question its business model generally. Further, it will raise questions over the business practices of Silicon Valley generally.

The Technology team at Tufton continues to believe that the United States’ strength in the world is in its superior brainpower and knowledge in tech (the Technology team, who is writing this piece, also recognizes it may be biased). As the world moves away from manufacturing and toward automation and services as the highest value-add, superior technology will be integral throughout all of business. However, as with any major change, we do not expect there to be a smooth ride to get there.

Last Week’s Highlights:

Stocks were lower last week on sharpening fears of a trade war with China. And of course, as we detailed above, high-flier Facebook was pummeled.

Looking Ahead:

Tufton’s economic team will be interested in the GDP numbers released Wednesday. Otherwise, it will be a short and largely uneventful week with Good Friday leading into the holiday weekend.

What’s On Our Minds:

What is an activist investor? Well, sometimes companies just need a little push.

As activists, investors look to maximize their own returns by taking large enough positions in the company’s stock that they can influence management decisions. Often, they are looking to shake things up at the company. Activists may decide to move in on a company if they believe management has stumbled, it would be better off as a private company, it has excessive costs, or if the activist thinks they have a better capital allocation strategy, such as buying back stock or raising the dividend. Activist investing continues to gain supporters (and investment capital), according to Hedge Fund Research, activist funds’ assets under management increased by four times over the past 9 years, from a level of $32 billion to $176 billion.

Recently, activists have achieved increased success and gained credibility as the size of their targets have grown. Last year, Nelson Pletz was successful in his fight for a seat on the board of directors at Proctor and Gamble, a mega-cap blue chip company.

Often, activists are targeted by the media and politicians for being “hit and run” investors, but activists will argue that they are genuinely concerned about companies and the U.S. economy. The issues surrounding activism are not clear cut: some activist may just be greedy, while others want to maximize shareholder value over the long term. In 2016, billionaire investors decided to take on these attacks from Washington by launching their own lobbying group to fight these attacks, The Council for Investor Rights and Corporate Accountability (CIRCA). Bill Ackman, Paul Singer, Carl Icahn, Daniel Loeb, and Barry Rosenstein are the group’s largest backers. Together, they manage over $90 billion and believe that lousy corporate performance is a drag on the US economy.

Activists take positions in different types of companies across many different industries and of various market caps. Often, though, activists target companies that have been under pressure and are considered value stocks. At Tufton Capital, we are not activist investors, but we do look for undervalued stocks. Therefore it’s not uncommon for companies in our equity portfolio to have activist involvement. As a result of this overlap, we do have to pay attention to the hype created by these market players.

While activist investors grab plenty of headlines, it’s tough to determine the actual impact activism is having on the overall market. According to a study conducted by the Wall Street Journal last year, of the largest 71 activist campaigns between 2009 and 2014, only 50% of targeted companies outperformed their peers- that is, the same as chance.

Last Week’s Highlights:

Stocks were lower last week and we continued to see elevated volatility. Partisan reaction to President Trump’s proposed steel and aluminum tariffs grabbed headlines. In a partisan flip flop, Congressional Republicans discussed limiting Presidential power on tariffs, while Democratic Senator Elizabeth Warren supported them. Technology stocks, which have been the best-performing sector so far in 2018, experienced a pullback last week as President Trump also proposed tariffs on Chinese imports.

Looking Ahead:

While tariff fears and political headlines influenced the market last week, investors will likely refocus on the Federal Reserve this week. The Fed will hold its two-day policy meeting on Tuesday and Wednesday where it is expected that Jerome Powell will increase interest rates for the first time in 2018. Investors will be listening to his comments Wednesday to hear how they might deviate from his predecessor, Janet Yellen. The federal funds futures market expects three rate increases by the end of the year, with a more than 30% chance of four.

What’s On Our Minds:

Warren Buffett recently announced that he’s offering up $1 million per year, for life, to one of his 377,000 employees if they can correctly predict the NCAA basketball teams that make it to the tournament’s Sweet Sixteen. A charitable gesture? Hardly. USA Today reminds us that the odds of predicting the sixteen bracket slots correctly is less than one in a million. Still, with 377,000 employees, someone at Berkshire Hathaway has a shot, right? Our own math suggests someone at the USA Today writing office is being lazy: the chances of randomly* picking those 48 games correctly is more like one in 281,400,000,000,000.

This is a great example of how Warren Buffett knows what Tufton knows: most people vastly overestimate their chances of being “right.” We all have a bias in thinking that we have special information, looking for that unique chance to make a million dollars (every year for life, in this case). A better route is to depend on two things: a time-tested, rational strategy, and other people consistently acting on their emotions— and being wrong.

Aside from his basketball wager, the billionaire investor also made headlines recently when he released his annual letter to Berkshire Hathaway shareholders on February 24th. His letter was shorter this year than in years past at “just” sixteen pages, but readers got a good idea of how Buffett is feeling about his business and the market.

For some perspective on Buffett’s success and why his annual letter draws so much attention from investors, let’s briefly consider what brought us here. When Warren Buffet acquired a controlling stake in Berkshire in 1965, the stock was trading at $18 per share. Since then, the stock has risen to $314,345 per share, a return of 1,600,000%. Comparatively, the S&P 500 has returned 3,000% over the same time. It’s no wonder that investors anticipate Buffet’s annual insights and are keen to hear how his company will move forward now that he is eighty-seven years old and his partner Charlie Munger is ninety four. They have had an amazing run, but they are not exactly spring chickens!

Buffett held his cards close to the chest when discussing a succession plan at Berkshire, noting “Our directors know my recommendations. All candidates currently work for or are available to Berkshire and are people in whom I have total confidence.” Many commentators have speculated that board members Gregory Abel and Ajit Jain could potentially be tapped to take the reins at Berkshire.

Buffett was also a bit vague on Berkshire’s plans to spend the company’s $116 billion in cash that it has amassed. For the most part, it sounds as if Buffett has had trouble finding anything to buy – at least at what he considers an attractive valuation. The company only spent $2.7 billion on acquisitions in 2017. By comparison, Berkshire spent $31 billion buying companies in 2016. There is speculation that moving forward Buffett may finally begin to pay a dividend to shareholders, instead of using all the company’s cash to make acquisitions. Buffett’s struggle to find businesses that are “affordable” according to his own strict calculations reminds us of his mentor, the fabled value investor Benjamin Graham.

As he has in years in the past, Buffet dedicated a portion of his letter criticizing the “helper” class of investment professionals (those who use products with high fees that deliver under performance over the long term). This year, Buffett wrote, “Performance comes, performance goes. Fees never falter.”

*Nitpicker’s note: The winners aren’t exactly random. For example, there’s a pretty good chance that in the first round, the #1 seed will beat the #16 seed in each of the four divisions. But those exact probabilities are largely a matter of opinion, so we used 50% for our calculations. The actual probability of choosing a correct bracket will be better than our number.

Last Week’s Highlights:

Stocks had a very strong week and closed out the week considerably higher. The Dow gained 3.5%, the S&P 500 rose 3.9%, and the Nasdaq increased 3.1%.

Stocks struggled on Wednesday after Gary Cohn announced late on Tuesday that he was planning on resigning as President Trump’s top economic adviser. Cohn has long been considered a free trade supporter and most are speculating that the President’s protectionist ideas in recent weeks brought about his exit. On Tuesday, fears of an impending trade war were tempered when the President announced Canada and Mexico would be excluded from steel and aluminum tariffs.

Friday’s Jobs Report revealed robust jobs gains which pushed the market higher. The US economy added 313,000 jobs in February, but wage growth came in below expectations. Friday’s data and reaction was a marked difference from January which showed a spike in hourly earnings. Lower wage growth in February quelled investors’ inflation fears on Friday.

Looking Ahead:

Information is light this week but investors will likely continue to focus on inflation and how it could weigh on the Federal Reserve’s interest rate decisions moving forward. We get indication of inflation this week, with an update on consumer prices due Tuesday. Retail sales are scheduled for release on Wednesday.

What’s On Our Minds:

Why was the Dow down 700 points last week between Thursday afternoon and Friday midday? Don’t the markets know the U.S. has a trade deficit, not a trade surplus?

To make sense of the reaction, there are two things we need understand: trade deficits and tariffs.

A trade deficit sounds scary. It sounds like “deficit spending,” which we all know is bad. But a trade deficit isn’t necessarily bad. In fact, sometimes it is decidedly good. A trade “deficit” just means that there is more money coming in than going out (exports-imports). We would expect that to be the case if our companies are doing well, our tax system has improved, and foreign investors and companies want to spend their money in the U.S.

As long as the US economy is strong, we want money to be coming into the country. And the US economy looks very strong. Your own political leanings can lead you to your own conclusions about why it is strong, but every economic indicator is looking up for the U.S.

Then there’s the issue of tariffs.

A tariff reduces the deficit by making certain imports more expensive for U.S. buyers. This makes domestically-produced goods look cheaper by comparison. The domestic producers’ companies are thereby protected from foreign competition.

This sounds good- why not protect our companies from foreign competition? This was indeed the general attitude in economics until David Ricardo developed the theory of comparative advantage in 1817. Without going into too much economic detail, comparative advantage shows that if every country produces what it is best at making (has the comparative advantage), and lets other countries make their best products, all the countries will benefit! It’s counterintuitive, but by letting everyone sell what they produce best, everyone ends up with more wealth overall.

Why make tariffs at all, then? Comparative advantage tells us the country will be better off overall, but that doesn’t mean every industry within the country will thrive. A concrete example (with made-up numbers for simplicity) is to suppose China can produce and sell steel for $50 a ton, but Americans can only produce it for $100 a ton. If we slap a tariff on steel, yes, it will save the 100,000 workers’ jobs at the steel mills. It also means all our manufacturers are paying $50/ton more for steel. If those manufacturers are buying 10 million tons of steel, that’s a difference of $500,000,000 that the consumer ends up paying in higher prices. That’s a lot of money, but the headline reading “1,000,000 Cars Cost $500 More on Average” isn’t quite as eye grabbing as a headline reading “100,000 Steel Workers Lose Jobs.”

In the end, economics, rather than politics, will drive the market.

Last Week’s Highlights:

Markets fell last week and finished February in the red. This was the first monthly loss for the S&P 500 since October of 2016. Equity markets remained volatile last week, with four out of five trading days experiencing a move exceeding 1%.

On Thursday, President Trump announced he wants a proposed 10% tax on all aluminum imports and a 25% tariff on steel, causing U.S. stocks to fall sharply. American steel and aluminum manufacturers praised the policy but other businesses did not. Critics of the President’s announcement noted that consumers will see prices increase on everything from cars to canned goods to baseball bats.

On Saturday, the President held firm on his trade plans Tweeting; “Our jobs and wealth are being given to other countries that have taken advantage of us for years. They laugh at what fools our leaders have been. No more!” He also threatened a tax on European cars after the European Union threatened to tax American made motorcycles, bourbon, and jeans.

Looking Ahead:

Investors will continue to grapple with the economic consequences of newly-imposed tariffs and potential retaliation from other U.S. trading partners.

Investors are also preparing for the month’s biggest economic report – the February jobs report. This report will likely weigh on the Federal Reserve’s interest rate decision on March 21st. Investors are expecting that the U.S. economy added 205,000 jobs and that the unemployment rate fell to 4%.

What’s On Our Minds:

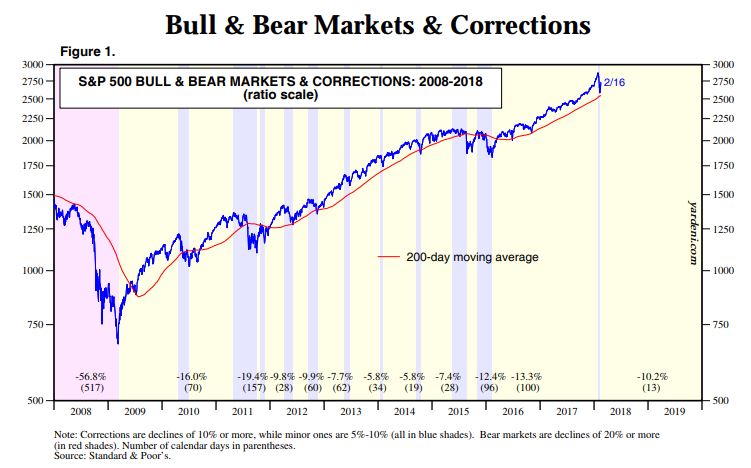

As stocks have zigged and zagged in recent weeks, it is likely that some investors can’t help but worry. While we do not take market declines lightly at Tufton Capital, we are stressing the importance of staying the course over the long haul. We understand that it can be a bit worrisome when market pundits are stoking investors’ fears. As long-term investors, however, we must force ourselves to wear “blinders” in order to avoid this type of media hype. Instead of getting caught up in short-term market moves, our Investment Committee continues to rely on its fundamental market research. We suggest that our clients and friends do the same.

Investors Take Note: Blinders keep racehorses focused on what is ahead, rather than what is at the side or behind.

Ten percent corrections like the one we experienced earlier this month are common and have occurred about once every two years since 1957. Selling or trimming positions during these correction is one of the worst investment decisions one can make. Rather than running for the sidelines, history has shown that during these brief periods of investor panic, it’s best to get tough and stay in the game.

Historically, it is in the stock market’s nature to fluctuate sharply during the short term, making volatility inevitable. The market’s volatility is often measured by its standard deviation, a formula that shows how results differ from the expected average. Periods when prices fall or rise quickly can cause spikes in volatility and take time to revert back to the norm. While driven by many factors, uncertainty is a primary culprit.

But what drives uncertainty? Everything from investors’ emotional responses to differing opinions from experts. Investors tend to overreact to specific events in the market, causing a contagion-like episode that spreads from one institution to another. The 24-hour news cycle and differing opinions from market experts also complicate matters. Emotional reactions along with oversaturation with financial information drive volatility.

Investors must understand their personal risk tolerance levels to succeed during volatile times. Remaining disciplined to proven strategies can be effective if you force yourself to stick to your plan in the face of short term volatility. It’s vital to remember that the short term is merely a blip on the market’s long-term journey.

Given the absence of a change in fundamentals, Tufton Capital’s investment approach will mimic our advice, “Stay the Course”.

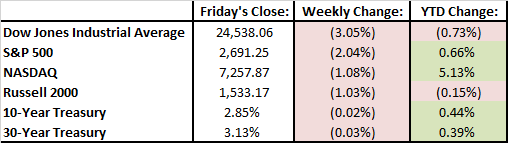

Last Week’s Highlights:

Stocks remained volatile last week but finished in the green. Investors grew jittery as the 10-year treasury bond increased to almost 3%. The Federal Reserve signaled that it saw broad improvement in the U.S. economy and pointed to a pickup in inflation toward the end of last year. However, it didn’t suggest that a rise in prices warranted more aggressive policy action. This dovish view helped ease investor concerns later in the week.

Looking Ahead:

A full economic schedule will have investors on their toes this week.

On Monday, investors will likely be reviewing Warren Buffet’s annual letter to shareholders, and the U.S. Census Bureau will release January new home sales figures. On Tuesday, Fed Chairman Jerome Powell is set to deliver his first semiannual monetary policy report. Fourth quarter GDP estimates will be released on Wednesday, followed by personal income and spending levels on Thursday. On Friday, we will wrap up the week with University of Michigan’s Consumer Sentiment number.

And while Friday does mark the first Friday of the month, we will not get the February jobs report until the following Friday, news that will come just a few days ahead of the next monetary policy announcement from the Federal Reserve.

What’s On Our Minds:

The markets have quickly recovered some of their losses, but that doesn’t mean we’re out of the woods yet.

As we said last week, the market has taken, on average, 220 days after a 10% correction to reach its previous highs. In this quick dip, we’re already up some 7.5% from the bottom and have only about 5% more to go to get back to record highs. Or, 150 points on the S&P and 1,400 on the Dow.

Phew, back to normal, right? Hopefully not. We hope that this dip and the emotions that it stirred will help to reverse two related trends in the financial markets.

First, the “stocks always go up” mentality in savers. While we have certainly had corrections since the Great Recession, there has been just one since 2011: the 12.4% correction in late 2015. Any associated woes were quickly forgotten in the wildly positive markets of 2016 and 2017. Therefore, there is a generation of savers who have been working since 2009-2011 that have never really seen their investment accounts decline.

It’s easy to call yourself a long-term investor when the market numbers are green. “Oh, me? I don’t worry about market volatility. I know if I leave my 401(k) alone, it’ll all work itself out, on average, over the next 15 years,” says the 29-year old as he sips on his latte. “Frankly, I don’t even check my account balance that often,” he lies, as he closes the internet browser he had open on his phone just moments before.

We hope at Tufton that the fictitious Millennial above is as good as his word, because a “market correction of 15%” is a lot easier to rationalize than seeing $13,000 disappear from your accounts in a week. The latter tends to have a lot more impact than we realize. OF course, strength is forged through trials, and this correction wasn’t so bad, so it might temper savers for the next one.

Second, the over-reliance on (or undue faith in) index funds. More and more investors have heard that index funds, on average, outperform their actively managed counterparts. As more money moves into indexes, there are fewer analysts moving dollars to take advantage of mispricings in the market. That is, if a respected analyst comes out and says “Google is too hot! Sell Sell Sell!”, it won’t stay hot for long. But if everyone’s in index funds, it will stay too hot. Those mispricings can grow and cause market distortions.

What will that means for the market? No one knows yet. But a few corrections will help to remind people that we need to have active traders for the markets to function.