What’s On Our Minds:

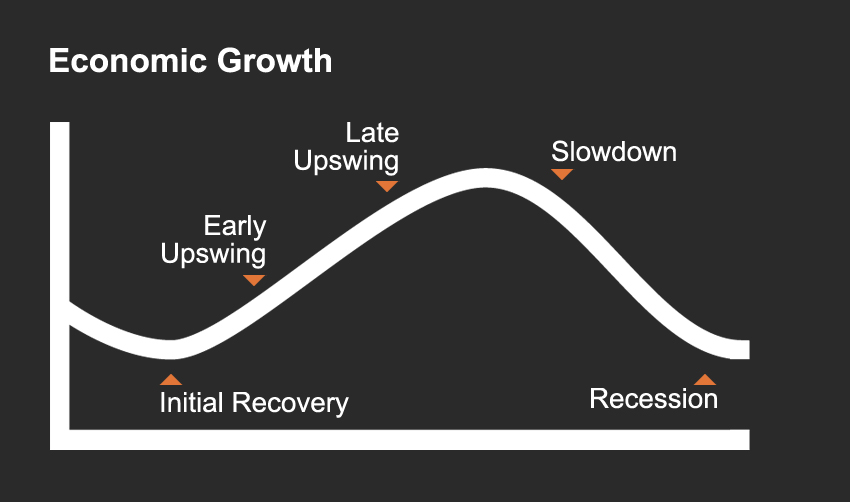

Market cycles represent fluctuations in stock, bond and investment markets. These cycles are closely tied with large-scale economic business cycles and have an important impact on investment, financial, cash flow and personal planning.

Market Cycles Versus Business Cycles

Market cycles and business cycles may sound the same, and are indeed very similar, but are slightly different. A market cycle typically refers to different phases in the stock market, whereas the business cycle is an underlying fundamental change in economic business activity as measured by real Gross Domestic Product (GDP) percent change (an important measure of the level of business activity in the economy), unemployment rates, manufacturing data and more.

The difference can be more clearly seen in the terminology; market cycles are defined by bull and bear markets, while business cycles are defined by economic growth and recession. A typical definition for bear market is a downturn of at least 20 percent over longer than a two-month period in either the S&P 500 for Dow Jones Industrial Average (DJIA). This is not to be confused with a correction, which is a short-term downtrend in stock markets. The length of market cycles also is important to note. If market analysts believe that stock appreciation will be a short-term trend, then it is referred to as cyclical. Long-term trends longer than a few months in duration are referred to as secular.

Business Cycle Stages

Not all phases of the business cycle can be easily separated, and the stages of the business cycle may only be able to be identified in retrospect. Still, it is useful to define the five stages to business cycles, as follows:

- Initial recovery: usually a short period in which the economy comes out of a recession. Unemployment remains high and consumer confidence will most likely be suppressed. At this point in the business cycle, open market activities to reduce interest rates or governmental policies, such as stimulus efforts, are enacted.

- Early upswing: confidence recovers and the economy gains some momentum. This is a very healthy period in time, where productive capacity is still able to keep pace with growing demand and there is no sign of significantly higher inflation.

- Late upswing: although confidence is high and unemployment is low, inflation is starting to pick up and offsets nominal economic growth.

- Slowdown: as a result of rising interest rates, the economy starts to slow. Investors reduce risk and shift stock allocations to bonds. Although there is a slowdown in activity, inflation is still likely to rise during a slowdown.

- Recession: typically defined as two consecutive quarterly declines in GDP; consumer spending contracts. Once the recession is confirmed, central banks start to cautiously increase the supply of money to spur growth. Recessions may be highlighted by bankruptcies, fraud or a financial crisis.

Although forecasting upcoming business cycles is particularly challenging, it helps to know how these cycles tie into market cycles and, ultimately, the performance of your investment portfolio.

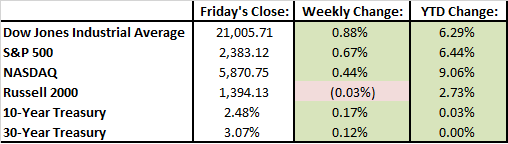

Last Week’s Highlights:

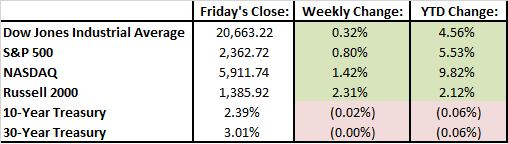

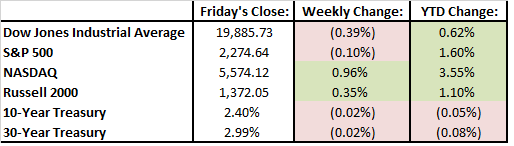

Stocks rebounded last week as both large and small caps made a move higher. The S&P 500 was up .8% and the Dow Jones was up .32%. Over the past two weeks we’ve seen some volatility return to equity markets that we haven’t seen in some time. Investors were spooked after Trump failed to repeal and replace Obamacare but last week’s rally shows that investors remain confident that he will be able to deliver on his promises of sweeping tax reform, regulatory relief and infrastructure spending.

Looking Ahead:

There’s a heap of economic data coming across the wire this week including vehicle sales on Monday, the Federal Reserve’s March meeting minutes on Wednesday, and the March Jobs report on Friday. Investors will be looking at these numbers closely as many believe equity markets have been running hot and these numbers will either confirm or refute those beliefs.

As always, Tufton portfolio managers remain focused on managing accounts for the long term as opposed to getting caught up in pundits’ hype.

What’s On Our Minds:

Tufton Capital Management is committed to helping our clients take control of their financial future. Armed with an effective estate plan, you can be sure you preserve your family’s legacy while minimizing taxes. By taking advantage of direct gift limits allowed by the IRS, wealthy families can get a head start on generational wealth transfer.

Taxes and direct gifts

Depending on their amount, direct gifts can be given tax-free. You may give up to a combined $5.45 million in life or death without the money being subject to estate or gift taxes, and there is also a $14,000 annual exemption rate per donee (recipient). Couples can combine their annual exclusions to double this amount, meaning they can give $28,000 per donee per year. Even if only one spouse technically makes the gift, as long as both spouses consent, it is considered by the IRS to have come from both. This allows couples to maximize their gifting ability. In addition, all gifts you give to your spouse throughout your lifetime are tax-free, as long as he or she is a U.S. citizen. Annual gifts can make a big difference over time, and since they are a “use it or lose it” exclusion, it makes sense to transfer as much money as possible this way as part of an estate plan.

Since annual gift tax exemptions are based on the calendar year, timing is important when gifting. For example, instead of gifting $25,000 to someone in December, if you gifted $14,000 in December and the remaining $11,000 in January, you could avoid gift taxes altogether. If your gifting amount for the year does end up exceeding the annual exemption amount, you have to file an informational gift tax return for that year and either pay 40 percent of the excess amount or use up some of your $5.49 million lifetime estate/gift exemption. One thing to consider with estate and gift taxes is that if you have to choose between the two, it will usually cost less to gift while you are living (even if it is above the exemption amount) than to wait until after death. Gifts made before death shrink your taxable estate by both the amount of the gift and the interest the money would have gained by the time of your death.

In addition to gift taxes, generation-skipping transfer tax (GST tax) is also a consideration for those subject to estate taxes. GST tax is applied to property that is passed to related persons more than one generation younger than the donor or to unrelated persons who are more than 37.5 years younger than the donor via a will or trust. This tax was created because many people had discovered that they could pass their estates directly to their grandchildren and therefore avoid one generation of estate taxes. GST tax rates and exemptions are the same as estate taxes, with up to a $5.49 million exemption and a 40 percent taxation rate.

Appreciated Assets

Gifts do not always have to be in cash. By gifting appreciated assets, you not only move money out of your estate, but you also move any future appreciation of those assets out of your estate and out of the grip of estate taxes. Another benefit of gifting appreciated assets is a possible capital gains tax advantage. Capital gains tax is enforced on the amount that the value of the asset increases from its original value. For example, if a stock was bought for $2,000 and then gifted when it was worth $2,500, capital gains tax would be assessed on $500. If the recipient of the assets is in a lower tax bracket than the donor, he or she will end up owing less money on this asset.

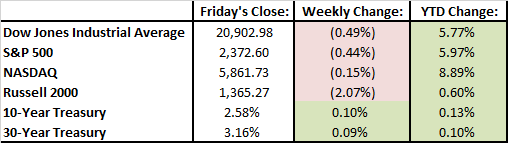

Last Week’s Highlights:

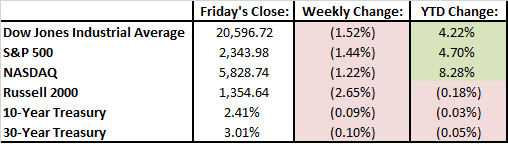

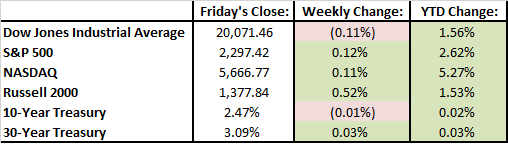

Stocks were lower last week and bonds were higher. It was the worst week for stocks since last November’s election. Tuesday was a particularly tough day for stocks as investor angst grew over doubts that Republicans would successfully get their health care bill through congress. Tuesday’s 1.2% decline accounted for most of the week’s losses. On Friday afternoon, Republicans pulled their healthcare bill, which was meant to overhaul the Affordable Care Act. This was viewed as a major setback for the president. On Friday, the president also mentioned his administration would now focus on getting “big tax cuts” through Congress.

Media pundits have taglined the bearish sentiment as the “Trump Slump” even though the economy continues to improve and it’s been a strong year for stocks thus far.

Looking Ahead:

Stocks opened at six-week lows Monday morning after President Trump failed to push through his healthcare bill last Friday.

Fed chair Janet Yellen will deliver a speech on Tuesday where she may shed some light on the Fed’s plans for interest rates moving forward. We will also get some important economic data this week with the Case-Shiller index and consumer confidence figures on Tuesday and pending home sales on Wednesday. On Thursday we will see fourth quarter GDP numbers and weekly jobless claims. On Friday, we will close out the week with personal income and spending data.

What’s On Our Minds:

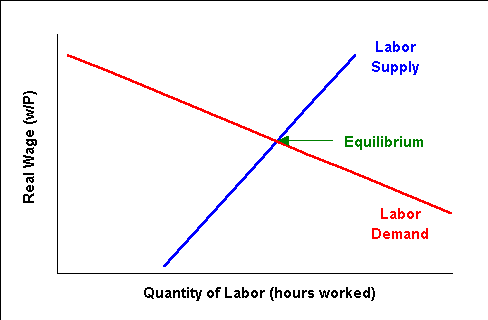

The Economics Team at Tufton Capital normally takes the helm of the blog only every fourth week. It is filling in this week for its vacationing colleagues, and would like to take the opportunity to talk about the fabled “economic equilibrium” that is used as a guiding star- but somehow never reached.

We begin with Kenneth Arrow, a Nobel Prize-winning economist who passed away last month. Arrow mathematically showed many economic ideas to be true, and in fact has a mathematical theorem named after him, but of interest to us now is his work on market equilibriums. Arrow showed in his Nobel-winning work that a market exists where an equilibrium price can be reached for all goods. This intersection of Supply and Demand is an extension of Adam Smith and Economics 101. However, Arrow’s theorem requires, among other things, that a futures market exists for all goods. And of course, we do not trade our babysitter’s labor costs two years from now on the NYSE (that said, could babysitter futures be a good product for an enterprising salesman on Wall Street?).

Despite this and other discrepancies, the idea that there is a perfect equilibrium price that will be reached and will balance all costs- human, economic, and otherwise- prevails in many discussions of the markets and politics today. The Tufton Economics team is quick to caution (as it always does) that real life is rarely so orderly as the simple graphs of 18th century economics. While they certainly illustrate some basic ideas about markets, applying them to a society at large can be overly simplistic.

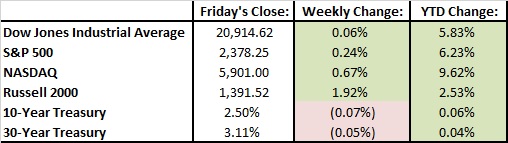

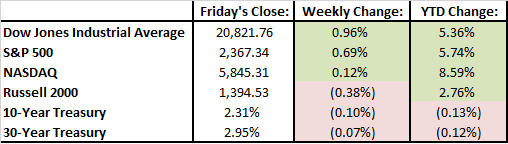

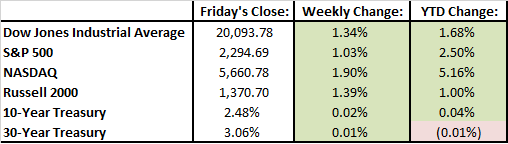

Last Week’s Highlights:

Stocks managed to eke out some gains last week, returning tentatively to what has been the bull market of early ’17. The S&P 500 and Dow Jones both gained under a quarter percent. Both remain up roughly 6% year to date. Interest rates, while still very low by historical (or any) standards, seem like they might be rending up, with the Fed indicating more rate hikes are on the way, despite the tick down this week.

Looking Ahead:

A pretty quiet week ahead. We’ll be interested to see home sales numbers, as they could be confirmation- or a warning flag- of the general belief that the US economy is still chugging healthily along.

What’s On Our Minds:

Many investment companies will advertise their strategies as “value” or “growth.” According to standard definitions, these two types of investment strategies stand opposite to one another. Each uses its own elements and metrics to determine a sound investment, and each has its own standards and expectations for returns.

Defining “Value” and “Growth”

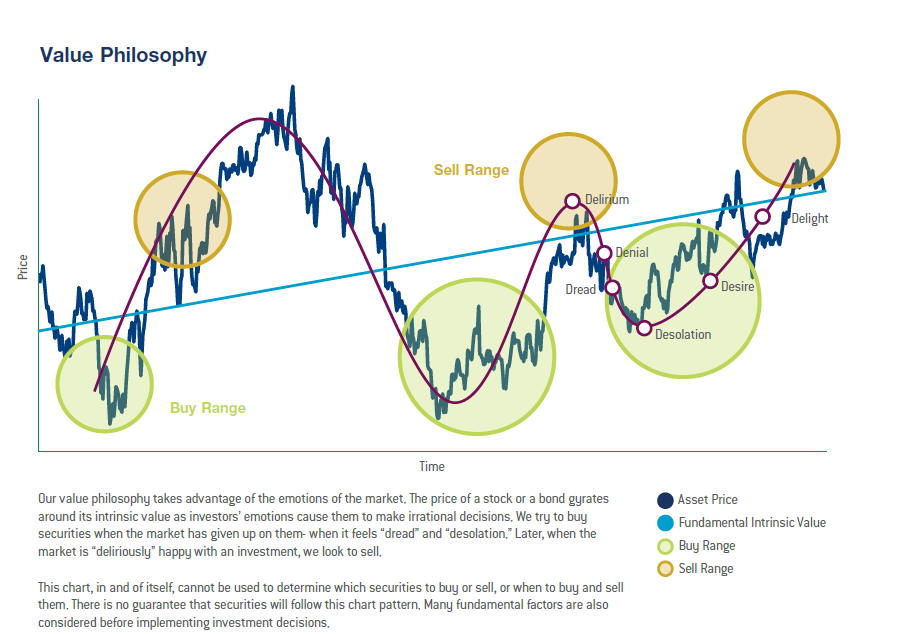

In traditional terms, “value investing” is the purchase of stocks or other securities that are currently undervalued by the market. To make a value investment, an investor must find a security that is being sold for less than what its calculated and/or historical value suggests. Value investing works off a person’s logical expectation that a security will return to a normal price. At Tufton, our value philosophy takes advantage of the emotions in the market. The price of a stock gyrates around its intrinsic value as investors’ emotions cause them to make irrational decisions. We try to buy securities when the market has given up on them – when it feels “dread” and “desolation”. Later, when the market is “deliriously” happy with an investment, we look to sell. We don’t chase hot stocks higher.

On the other end, “growth investing” is the purchase of shares in a company that is expected to grow in importance or become more valuable than it is now. To pursue growth investment, an investor seeks out companies that have excellent potential to expand. The current cost of their shares are not undervalued, their growth has simply not yet been realized. Growth investing is based on the optimistic anticipation of a company’s future.

Differences

Investors will undoubtedly notice that several firms and funds will either label themselves “value” or “growth.” In general, this reflects the funds volatility: value funds are often less volatile than growth funds. Though growth funds make up for their risk by offering the potential for higher returns, economic downturn can cause them significant losses. By purchasing securities at a significant discount, Tufton provides a “margin of safety” which provides downside protection.

Similarities

In recent years, several well-known investors, including Warren Buffet, have stated that the difference between “value” and “growth” investing are arbitrary. A company’s shares might be a good deal because they are undervalued, but an investor is expecting some form of growth or performance to push it back to its normal value. Similarly, if an investor feels a company’s growth is certain, then he or she sees its shares as undervalued at their current price.

The differences between “value” and “growth” are only noticeable if an investor is speculating on growth or continued performance. An experienced and well-informed investor will consider a company’s past and future before purchasing a security. After taking everything into account, it becomes a simple judgment of whether the company’s expected future is worth the current price, market risk and length of time.

If you have questions about your current market positions or would like to learn more about Tufton’s value strategy, please give us a call today!.

Last Week’s Highlights:

Stocks broke their six-week winning streak last week. The S&P 500 and Dow Jones both fell by less than 0.5%. Both remain up roughly 6% year to date. Oil prices declined by 9.1% last week which pulled shares of energy companies lower. Healthcare stocks moved up and down as President Trump and the GOP proposed major changes to Obamacare. On Friday, we closed out the week with a solid jobs report.

Looking Ahead:

Earnings season is wrapping up. Tiffany, DSW, and Oracle report earnings this week. The Federal Reserve is expected to increase interest rates on Wednesday. Investors are viewing a 25-basis point increase as an almost certainty after last week’s strong jobs report.

What’s On Our Minds:

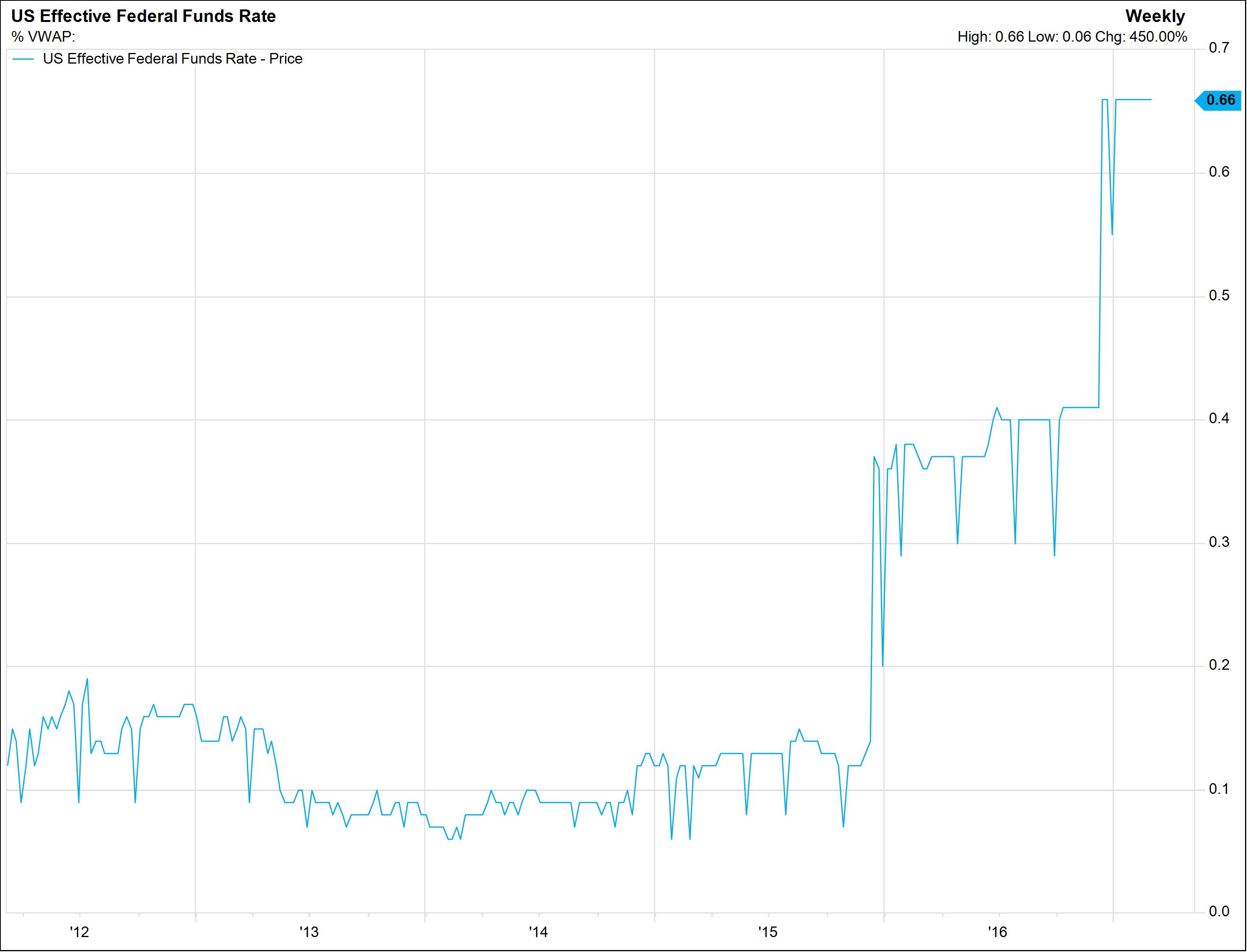

Interest rates are, to put it mildly, a complex beast. There are a few mechanisms by which rates affect the economy and the stock market, not all of which are obvious, but which have large effects. We’ve tried to break down these levers without getting too granular or using financial jargon.

The first is the most obvious: a lower interest rate means it’s cheaper to borrow. Consumers borrow more money to buy houses or cars, businesses borrow money to expand production. And thus, we get economic growth. Everybody’s happy. Except, maybe, the people who get less money in interest for loaning out their hard-earned cash.

An interest rate raise, like the one that seems imminent, is a signal that rates are moving higher, might cause both consumers and Chief Financial Officers to cut back on spending. So businesses earn less, and earnings fall.

Another very important but more abstract concept is the valuing of stocks via a discount rate. If I think a company is going to earn $10 million in ten years, the interest rate would have to be 0 for me to want to buy its stock now for a $10 million valuation. But if interest rates are higher, I’d be better off just putting the money in the bank for ten years and earning some interest in those ten years. In this way, investors compare interest rates with their expectations for the earnings of companies. If interest rates are low, companies’ stocks are more attractive, and therefore worth more in today’s dollars.

When Janet Yellen and the Fed meets this month, they have to think about all of this, with the added complexity of inflation. The inflation target is 2-3%: at this level, prices are fairly stable, but there is incentive to spend, rather than save, money, and to push the economy along. With inflation at zero, you know that the car you want to buy will cost about the same in year, so you might just think about it for a while, dampening economic activity.

Deflation, when inflation falls below zero, is a major problem: here, you might wait to buy that car, since it will be cheaper next year. And the year after that. And…

This gives rise to the “pushing on a string” phenomenon that was one of our founder Jim Hardesty’s favorite metaphors. You can’t entice people to spend money by cutting rates indefinitely, since rates below zero (usually) are avoided by simply keeping the cash. This illustrates, in part, one of the major limitations of monetary policy (setting interest rate, money supply, etc.) vs. fiscal policy (where and how the government spends their money). But fiscal policy is a topic for another post.

Last Week’s Highlights:

For the fourth straight week, stocks increased and closed at record highs on Wednesday. Donald Trump laid out an optimistic vision of the country during his address to Congress on Tuesday evening. Economic data was strong last week. Consumer confidence reached a new high and the ISM Non-manufacturing index, which measures business activity and employment trends, rose to a level last seen in October of 2015.

Warren Buffet shared that Berkshire Hathaway had taken a larger position in Apple stock earlier this year. It’s now one of their largest equity holdings.

Target shares had a rough week as they decreased 14% in value after the company announced it had missed earnings expectations. The company reduced profit targets and said they are focusing on investing in stores and lowering prices to bring back customers.

Snapchat went public on Thursday. Shares surged from their $17 IPO price to as high as $26.05. The company is now worth about $33 billion even though it lost $515 million last year.

Companies continue releasing earnings reports this week. Armstrong Flooring and Korn/Ferry International report first quarter results on Monday. On Tuesday investors will hear from Dick’s Sporting Goods and Navistar International. Breakfast chain Bob Evans Farms reports results on Wednesday.

February’s jobs report will be released on Friday. A surprise to the upside would likely increase prospects for the Fed to raise interest rates after their 2-day policy meeting on March 15th.

On Friday, the Department of Labor will issue a report detailing the status of its new fiduciary rule. President Trump has mentioned he might cancel the new rule’s implementation.

What’s On Our Minds:

Everyone remembers the old saying, “don’t put all your eggs in one basket”. Well, sometimes investors end up with a whole lot of their eggs in one basket whether it be intentionally or unintentionally. Often times, entire fortunes are tied to the prospects of one single company and while this is great when business is good, it can get ugly when the tides turn. Large individual positions in companies are acquired every day through employer retirement plans, inheritances, stock options, and business sales. It’s not unusual for successful professionals and executives and their heirs to find themselves with too much of a good thing: owning a large quantity of highly appreciate stock or a large equity position in a private partnership.

While countless individuals and families have accumulated great wealth by holding large amounts of a single position, betting your financial future on a concentrated position is rarely the best course of action. Even if an investor has the utmost faith in their largest holding, the return prospects simply are not worth the risks. If you are approaching retirement age and will need to start living off of your investment portfolio, a concentrated position can create a problem because your long-term financial security is dependent on the success of a single business.

The only way to reduce the inherent risk of a concentrated investment portfolio is to diversify. Of course, this is easier said than done! Due to the bite of capital gains taxes, fully selling out of a concentrated position can be a long process, but over time an investor can sell a certain amount of shares, per quarter, or per year and reinvest the proceeds into a well-diversified account.

At Tufton Capital, we take a customized approach to wealth management which allows us to manage the complex situation brought on by a concentrated portfolio.

Last Week’s Highlights:

Equity markets continued their 5-week trek higher last week. The Dow Jones closed at 20,822 on Friday, which was a record high.

A better-than-expected earnings season has helped stocks move higher. Nearly 66% of S&P 500 companies have reported earnings above analyst estimates.

Treasury Secretary, Steven Mnuchin, laid out an ambitious time frame last week saying that a tax-reform package could be passed by Congress before their August recess. He also said that the Trump administration is aiming for sustained 3% or higher economic growth.

While equity markets have been chugging along, bond investors have been hunkering down recently. Despite a reflationary trade in stocks and expectations of an interest rate hike in by June, the 10-year U.S. Treasury ended the week at 2.317%, its lowest since last November.

On Tuesday evening, President Trump will address Congress in a televised speech. A lot is expected from this speech as he will lay out his plans for the rest of the year. He will likely touch on his fiscal-policy plans, and discuss tax reform, border security, healthcare, and future infrastructure spending plans.

Economic data from January is coming across the wire this week. Retail sales will be reported on Tuesday. On Wednesday, construction spending and automotive sales will be reported.

What’s On Our Minds:

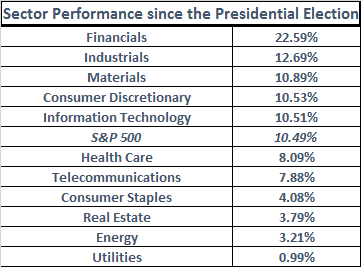

The “Trump Rally” or “Trump Bump” continued the Tuesday morning after President’s Day. Since the election, sectors that had underperformed the S&P 500 began to rally on the back of the possibility of higher interest rates, stronger economic growth and President Trump’s agendas. The Financial sector, which includes the “Big Banks”, Insurance companies, and asset managers, has led all sectors with a 23% return since President Trump’s win. In the more cyclical sectors, Industrials are up nearly 13%, while the Materials sector is up 11%. Consumer Discretionary and Technology also barely outperformed the broader index with a roughly 10.5% return from each sector. Health Care, Telecom, Consumer Staples, Energy, REITs and Utilities sectors have all underperformed after mostly leading in 2016.

Looking “under the hood,” higher interest rates will help earnings growth for the banks as their loans spreads widen, creating higher profits. Investors are also speculating that President Trump’s plans for deregulation will allow the financial companies, specifically the systematically important financial institutions, to hold less capital, which would give them the ability to lend more.

Industrial companies have rallied on speculation that President Trump’s infrastructure plan will translate into new orders for the group. Leaders include United Rentals, which is up nearly 69%. The company rents construction equipment and tools to the construction industry. Other beneficiaries of infrastructure investment would include the railroad companies as they would be utilized to transport the new orders from the industrial companies. As a result, CSX Corporation and Norfolk Southern Corporation are up 52% and 29%, respectively.

Investors also believe that the Materials sector will benefit from stronger economic growth and potential inflation. Earnings growth would be expected if further demand for their raw materials and products created price increases to their customers. Material leaders include steel manufacturer Nucor, paint maker Sherwin Williams and chemical producer LyondellBassell Industries.

Of the S&P 500 companies that have reported 4th quarter results, 68% of them have beaten on earnings. However, only 52% of the companies have beat their sales estimates, suggesting that companies are growing earnings more through cost cutting than growth of their business. The market may keep making new highs on the back of potential policy changes, but eventually, sales growth will have to follow.

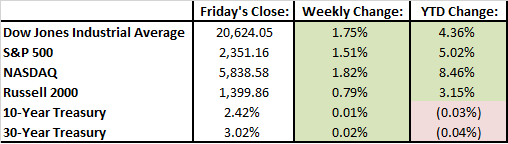

Last Week’s Highlights:

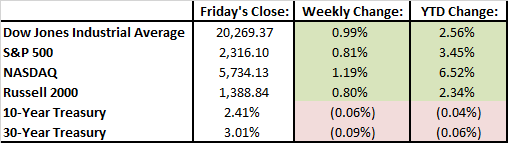

Stocks extended their winning streak last week as both the S&P 500 and the Dow Jones gained over a full percentage point. The Trump rally continues. Investors remained euphoric as most expect President Trump to reduce U.S. corporate taxes and introduce some sort of fiscal stimulus package. Strong earnings reports along with robust economic data have also helped to push indexes to record highs.

Janet Yellen took a hawkish stance last week during her testimony to Congress. Her tone increased the odds that the Fed will raise interest rates before their next policy meeting in June. Her latest stance on rates helped push the financial sector higher.

Kraft Heinz offered to acquire Unilever last week. However, over the weekend, Kraft said it “has amicably agreed to withdraw its proposal.” Unilever shares took a hit on the news.

Shares of Boeing enjoyed a 1% bounce on Friday when President Trump visited their South Carolina manufacturing plant. Shares of Campbell Soup Co. decreased 6.5% last week because second quarter profit and revenue missed.

Markets were closed on Monday for President’s Day.

This week, investors’ attention will be focused on economic data reports and minutes from the latest Federal Open Market Committee meeting.

Earnings reports from retailers will also be on tap this week. Wal-Mart, Home Depot, and Macy’s release earnings on Tuesday and Nordstrom reports on Thursday.

On Saturday, Warren Buffet will release his annual letter to Berkshire Hathaway shareholders.

What’s On Our Minds:

At Tufton, we are value investors. We seek to purchase securities trading at significant discounts to our internal assessment of their values. Our value philosophy is based on the principles of Benjamin Graham.

If anyone could be considered the father of modern stock analysis, it would be Ben Graham. During the ‘30s, ‘40s and ‘50s, Graham pioneered the ideas of “value investing” and taught the next generation of investors to see the difference between stock evaluation and market speculation.

Graham is possibly the most academic-minded investor of all time. He not only took a purely mathematical approach to investing but also used his knowledge to improve his principals and formulas to educate future investors. The heart of Graham’s strategy was value. He did not purchase shares assuming a company would have success with a new product or venture. Instead, he found companies that already had solid book values but were selling for below their logical price. He spurned the idea of buying trendy or on-the-rise stocks and believed most investors were just speculators.

Graham’s principles would have no credibility if they had not proved so effective. His concept of a close analysis of a company’s books proved to be extremely useful in an age when few others were doing the same. On one occasion, Graham’s analysis found that the Northern Pipeline Company was trading for $65 a share when it had bond assets worth $95 a share. He purchased a large number of shares and convinced the company to sell the assets, resulting in a $70 dividend. Graham walked away with a huge profit, simply because he was willing to look at the fundamentals of a company.

Graham’s lessons are still a foundational part of modern investing, but his teaching career is possibly best known for the students it produced. Warren Buffett, Walter Schloss and David Dodd are among the most famous students Graham taught at Columbia. Their successes have inspired a new generation of investors and have created a continual public interest in Graham’s theories.

These days, the epitome of Graham’s teachings lives on in his two popular books Security Analysis (1932) and The Intelligent Investor (1949), both of which are still in print to this day.

Last Week’s Highlights:

Major market indexes were up about 1% last week. The Dow Jones and the S&P 500 closed at a record high on Friday. The market rallied toward the end of the week after President Trump said he would announce his “phenomenal” tax plan in coming weeks. His plan is expected to include a massive cut in corporate tax rates. Based on last week’s move, it’s clear that investors are optimistic that a reformed tax code will benefit U.S. companies.

On the economic front, the cost of imported goods increased by 0.4% last month, mostly because of rising oil prices.

Despite a court’s decision last week that upheld Obama’s fiduciary rule, the Trump administration is working on a proposal to delay the April 10th implementation. A Texas court upheld the rule and rejected a lawsuit filed by business groups that challenged the new regulation. The court ruling could make it tough for Trump to make substantive changes to the new rule in the future.

Federal Reserve Chair Janet Yellen is giving her semiannual testimony on the economy and monetary policy before a Senate committee on Tuesday. Most are expecting her to stick to the message of three interest rate hikes this year.

Earnings season continues this week. Teva Paramedicals reports earnings on Monday. On Tuesday, Noble Energy, Vornado Realty Trust, and Discovery Communications post their results. Wednesday we will hear from Pepsico. On Thursday, we get results from Avon Products and TripAdvisor. We will finish the week on Friday with reports from Campbell Soup and V.F. Corp.

What’s On Our Minds:

What’s on our minds is the same thing that’s been on everyone’s minds lately: the Trump Presidency. We are going to take off our political hats for a moment and put on the economist’s cap. What effects will the Trump White House have on the economy?

(image source: k schirmann getty images/cnn money & Gwen Sung getty image/cnn money)

The Good

There are promises for many kinds of stimulus that would help the economy grow. A “Highway Bill” or other fiscal stimulus would work differently than monetary stimulus by actually spending real dollars and putting people to work, rather than adjusting federal interest rates, etc., to influence how financial institutions borrow and lend money.

However, the difficulties that the Republican Congress has had in repealing Obamacare something that was supposed to be priority #1, may forebode a long road to serious fiscal action.

Likewise, sensible tax code reform and reduction in financial and other regulation could boost business, but getting there may be more difficult than some had imagined.

The Bad

The “Trump Effect,” whereby a presidential tweet can make or break a company, a treaty, or a trade deal, seems to have had some destabilizing effect. It would be best if the president could tone down the speed and content of his tweets.

Tariffs, too, while good for headlines, are almost universally scorned by economists. They result in a net loss for a country in financial terms. While American businesses may gain on an individual level, American consumers pay the price.

Finally, the tax code overhaul could have “debt spiral” consequences if it is overzealously applied. The results of tax reform are often complicated, and it may be unwise to push a large reform through quickly.

The Uncertain

In geopolitics there is a huge question mark. What will the country’s relationship be with Russia? Are Trump and Putin secret friend, secret enemies, or neither? Will we let Russia’s influence continue to grow in the former USSR and China to become a major world power? Or are we going to reassert ourselves as the global leader both in finance and the military?

In healthcare, Obamacare seems to be on the way out. What will replace it? Trump has said we are going to “take care of everyone,” but what does that mean? Importantly, insurance companies might be in the crosshairs, no matter which way this goes.

And what about that wall? Limiting immigration is certainly bad for the economy as a whole. Will we decide that the security gains are real and worth that sacrifice? What would the effect be on our major trading partners?

Tufton is watching all of these topics carefully. Our long term views on the stock market did not (and likely will not) change, but we continue to be vigilant in guiding our clients’ investments around any stumbling blocks.

Last Week’s Highlights:

Equity indexes finished the week close to where they began. Markets sold off early in the week but rallied by almost 1% on Friday after a strong jobs report and news that President Trump signed an executive order aimed at rolling back financial regulations. The market rally was led by Financial stocks.

The US Federal Reserve left interest rates unchanged at its first meeting of 2017. The fed’s Open Market Committee noted improved consumer and consumer confidence. Currently, market participants are expecting two, twenty-five basis point increases on interest rates this year.

So far this earnings season, 65% of S&P 500 companies beat mean earnings per share estimates and 52% have turned in better than expected sales figures.

4th quarter earnings season continues this week with 84 of the S&P 500’s companies are scheduled to report earnings. Sysco reports on Monday. General Motors and BP report on Tuesday. Exelon and Allergan report on Wednesday. Thursday we will hear from Twitter and Coca-Cola and on Friday we will hear from EMC.

Lately, it appears investors are taking their cues from President Trump as everyone is focused on what his policies mean for the economy and individual companies. We expect that to continue this week.

What’s On Our Minds:

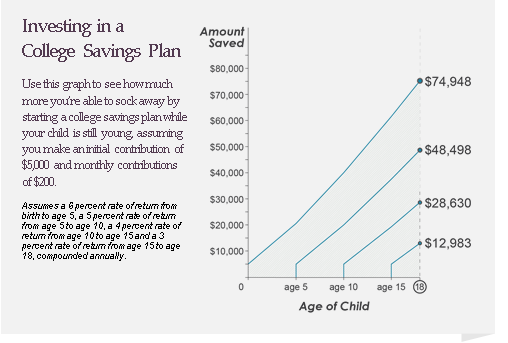

As education costs continue to rise year after year, the expenses have become an even larger component of a family budget. According to CollegeBoard.org, four years at a private nonprofit college, including tuition, fees, and room and board costs roughly $175,000 and a public four-year in state college, while less expensive, costs close to $80,000. One of the best options for families is to save for future education costs by opening 529 plans for their children.

Anyone can open a 529 plan and may list anybody of their choice as the plan’s beneficiary. Also, the plan’s owner can change the beneficiary at any time. For Maryland residents, contributions to the account are tax deductible against your state income tax.

While the state income tax deduction is a good benefit, the real power behind a 529 comes from the tax-deferred growth and tax-free withdraws the the plan allows. Distributions from the account are tax free so long as the funds go towards education expenses such as tuition, room and board, fees, books, or the purchase of necessary computer technology. With a long term investment horizon these accounts can grow into considerable assets. There will be added peace of mind knowing you don’t have to dip into your own personal savings to pay for college and your child or grandchild won’t be burdened by student loans when they graduate.

Tax issues around 529 plans get a bit complicated in that they count as a present interest taxable gift to the beneficiary of the account. Because contributions technically qualify as gifts, limit your contributions to $14,000 per person to avoid paying federal gift taxes. When saving for education costs it’s important to remember, the earlier the better!

Last Week’s Highlights:

Last Wednesday, for the first time in history, the Dow Jones Industrial broke through 20,000. The new high water mark was celebrated on Wall Street. The S&P 500 and the Nasdaq also closed at record highs on Wednesday. In general, investor sentiment was up last week and it seemed that many were optimistic that Trump’s economic policies will initiate a growth period. Since the election, the S&P 500 has risen 7.2%.

Some merger news broke last week. Verizon is considering a merger with Charter Communications and Johnson & Johnson agreed to purchase the biotech firm, Artelion.

In economic news, it was reported that fourth quarter U.S. GDP increased by 1.9%.

Looking Ahead:

The Trump Rally has stumbled a bit going into this week after the President issued an executive order last Friday barring immigrants from seven Muslim-majority countries from entering the US. The Dow opened below 20,000 on Monday morning.

Earnings season continues this week with Apple, Exxon, and UPS reporting on Tuesday. On Wednesday, the FOMC releases a policy statement on interest rates. Investors are not expecting the Fed to increase rates. On Thursday, Donald Trump is planning on announcing his Supreme Court nominee and International Paper and Merck release their quarterly results. On Friday, we close out the week with Hershey reporting earnings.

What’s On Our Minds:

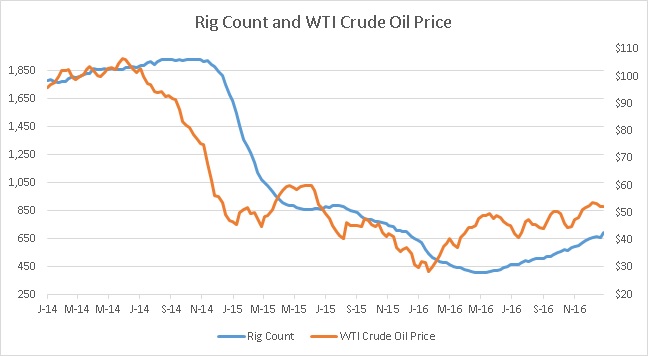

Acquisitions in the oil patch are finally back in style. Over the past few weeks, several multi-billion dollar acquisitions have occurred, particularly in the Permian Basin of West Texas. The Permian Basin has been established as the most prolific shale patch in the United States, possibly the world. Given this status, it should be to no one’s surprise that last week, energy bellwether ExxonMobil announced a $6.6 billion acquisition of Permian assets, their largest deal since the acquisition of XTO Energy in 2010. The company will net approximately 250,000 acres, paying roughly $27,000 per acre. On other metrics, Exxon paid $35,000 for each flowing barrel of oil per day – both attractive valuation multiples compared to other transactions in the oil patch.

In another transaction, Noble Energy agreed to purchase Clayton Williams Energy, another Permian based company, for $3.2 billion. The announced price values the assets at approximately $32,000 per acre, slightly higher than Exxon’s purchase price. It’s hard to believe that five years ago, the average price per acre in the same area was just roughly $4,500 when oil was trading in the range of $80 and $120 per barrel. This goes to show the profitability and efficiency of drilling in the shale patches.

All of these transactions come at an interesting time – most analysts expected distressed companies to sell themselves or their assets around the time oil bottomed at $26 per barrel nearly a year ago and the rig count bottomed last May. However, due to the efficiency of shale production (and cheap credit), the drillers prevailed. With interest rates on the rise and the price of oil somewhat range bound, time will tell which companies continue to survive.

Last Week’s Highlights:

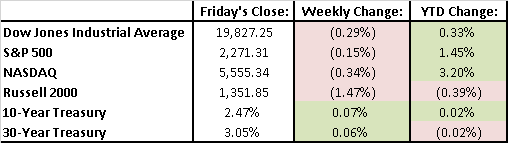

Last week, the Dow Jones Industrial Average fell 0.29%, the S&P 500 fell 0.15% while the Nasdaq slipped 0.34%. After beating the S&P 500 in 2016, the Dow is now barely positive on the year (up 0.33%), the S&P 500 is up 1.45% and the Nasdaq is leading the three major indexes, up 3.2%. Investors were focused on President Trump’s inauguration speech as well as rhetoric surrounding his changes to public policy.

Earnings season continued with most companies in the Financial sector reporting fourth quarter results. So far, 13% of S&P 500 companies have reported and 65% have had positive surprises relative to their earnings estimates.

This week, investors will continue to focus on President Trump and his policy initiatives. Earnings from several Dow Jones components will be released on Tuesday. Dupont, 3M, Johnson & Johnson, Travelers, and Verizon will all report before the opening bell. On Wednesday, AT&T and United Technologies will provide investors with their fourth quarter results. Thursday will give investors further insight into the oil patch as Helmerich & Payne and Baker Hughes both report. On Friday, the markets will be focused on the first read of fourth quarter GDP growth.

What’s On Our Minds:

The investment professionals at Tufton Capital believe that a long-term, buy and hold investment strategy is the to safest, and smartest, way to build wealth in the stock market. Quite simply, it’s been proven time and time again to return exponential gains on invested capital.

Cultivating Your Portfolio

The term “buy and hold” doesn’t mean investing and forgetting about your portfolio for the next 20 years. There are ways to cultivate and prune your portfolio while still maintaining a long-haul investing strategy. For instance, if a company you invest in changes fundamentally, you may not want to continue owning that security. If the overall market changes dramatically, as it has in the past, you may actually benefit from selling an investment or group of investments. Finally, changing goals as you get closer to retirement may warrant a more conservative portfolio.

Bad Markets

The typical investor is tempted to get out of a bad market by selling when prices are low, which is a poor strategy. The economy fluctuates between good and bad all the time, and those who constantly buy and sell will be hit the hardest in a bad economy. By holding on to your investments, you’ll be better able to ride out a down market, especially if your portfolio is diversified.

Taxes and Fees

Frequent trading results in higher fees, so long haul-investors pay less while fees eat up much of a day trader’s profits. Additionally, short-term gains are taxed at a higher rate than long-term gains. Even if you have the fortune of timing the market successfully, your profits will be diminished by taxes and fees.

Investing for the long-haul is the best investing strategy for the majority of investors because it not only ensures modest gains but is also less likely to yield major losses. A long-haul investment strategy is based on informed, careful decision making and patience.

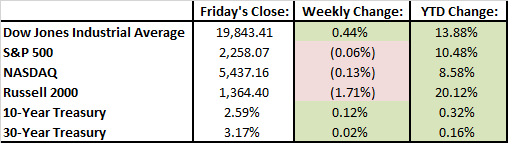

Last Week’s Highlights:

Investors were focused on the beginning of fourth quarter earnings season and political headlines last week. Stocks were slightly lower. After getting close earlier this month, the Dow Jones just can’t seem to crack the 20,000 point threshold.

President-elect Donald Trump held his first press conference in more than five months on Wednesday. Investors were looking for him to cover taxes, fiscal policy, or infrastructure spending but he didn’t elaborate on those topics.

Looking Ahead:

The market was closed on Monday for Martin Luther King Day.

Some important earnings announcements will be coming out this week including CSX on Tuesday, Netflix on Wednesday, and General Electric on Friday.

On Friday, Donald Trump will be sworn in as President. Investors are expecting a shift towards pro-growth policies that should result in better economic and earnings growth. Trump’s economic plans are broad and he hasn’t gone into specifics but he will likely focus on corporate tax cuts, repatriation of foreign cash, a fiscal push towards infrastructure spending, and perhaps some protectionist tariffs. We will have to wait and see if Washington can keep the bull market going in 2017.

What’s On Our Minds:

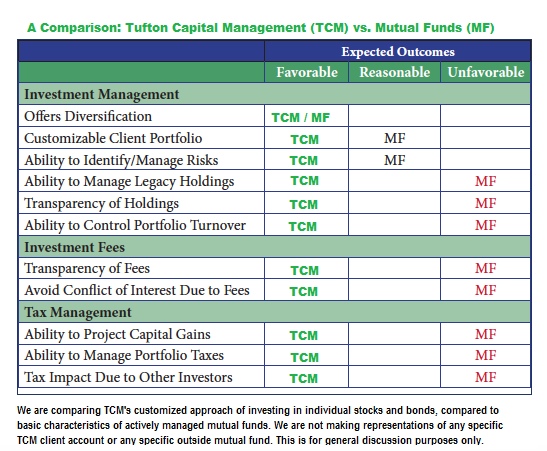

Often, members of Tufton’s Investment Committee are asked why our firm doesn’t use mutual funds in our clients’ accounts. While mutual funds may offer the benefit of diversification to small investors, our team doesn’t believe they are the best answer for clients with sizable assets. Sure, we could easily free up some time by directing assets to outside managers but we believe that mutual funds have a few key drawbacks.

First, they limit an advisor’s ability to customize a portfolio and manage risk effectively. Second, they add an additional layer of fees, which reduces an investor’s returns. Third, they are inefficient for investors who want to manage their tax bills.

We also believe the limited transparency of mutual funds is problematic. Most investors don’t know what stocks they are holding in the fund, and some funds disclose their holdings only semi-annually. An investor may have 50 stocks or more in a single fund. Imagine tracking your portfolio if you own five or ten stock funds – that can add up to 500 or more stocks in your portfolio. Why not just buy an index fund for a fraction of the price? Diversification is a good thing, but not so for over-diversification.

Fortunately, our clients enjoy a customized approach to managing their money. We invest in a diversified portfolio of individual stocks and bonds to meet your goals.

If you would like to hear more about our investment philosophy, please feel free to give one our portfolio managers a call.

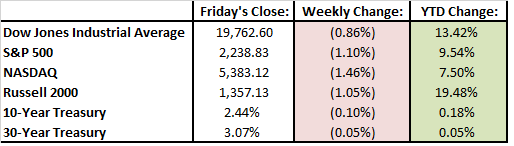

Last Week’s Highlights:

Stocks increased last week. The S&P 500 was up 1.7% and closed at an all time high on Friday. The Dow Jones also had a good week and came very close to hitting 20,000 for the first time in history. The December jobs report was solid. It showed the economy added 156,000 jobs and that hourly earnings rose by 2.9% through 2016. These results are in line with the Federal Reserve’s plan to increase rates two or three times in 2017.

The department store sector took it on the chin last week after Kohl’s and Macy’s reported downbeat holiday sales reports. With the advent of online shopping, brick and mortar stores are struggling.

Looking Ahead:

Analysts are gearing up for 4th quarter earnings season with Alcoa reporting after the closing bell on Monday. Delta Airlines reports its results on Thursday before the bell and Friday we will get results from Bank of America, Wells Fargo, and JPMorgan.

As of Monday morning, some merger news has come to light. Japanese drug maker Takeda Pharmaceiticals announced it is purchasing cancer treatment company Ariad for $5.2 billion. Ariad’s shares were up 75% on the news. M&M candy maker, Mars announced it is acquiring veterinary supply company VCA (WOOF) for $7.7 billion. Mars already has a large pet food business and VCA should help the business with future growth. On Monday, WOOF was up 27% in pre-market trading.

What’s On Our Minds:

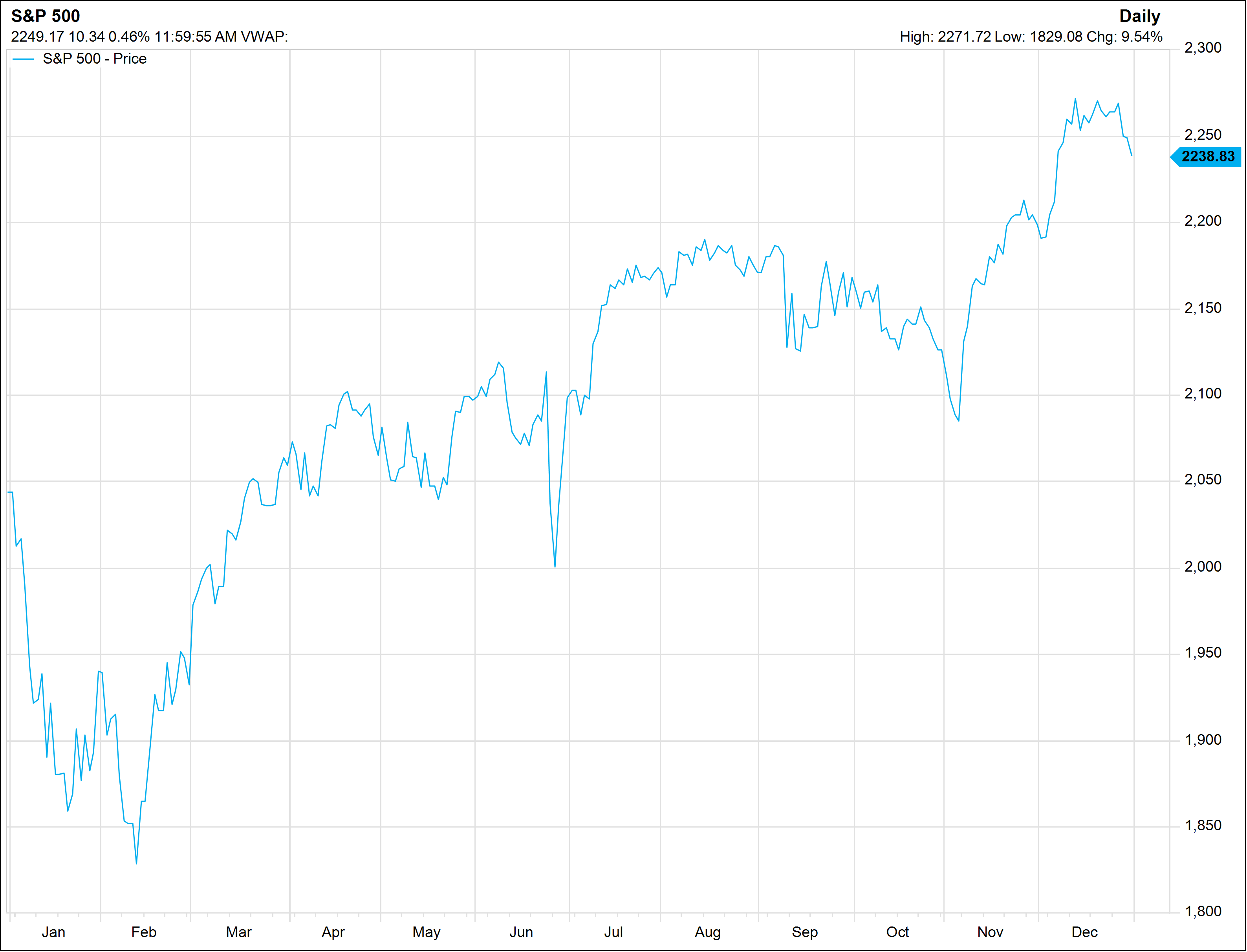

It’s official: the bull market continued in 2016! While investing with a “rear-view mirror” mindset is rarely a lucrative strategy, with the benefit of hindsight, a quick look back at 2016 helps set the stage for the year ahead.

A main take away from 2016 is that sticking to a disciplined investment process was extremely important. With a bull market that may have felt a bit long in the tooth, it was crucial to remain invested. Markets had a horrendous start to the year; stocks fell by 11% between Jan. 1 and Feb. 10th. At the time, many thought the U.S. economy may have been headed for a recession. With all the pessimism, it may have felt like a good time to take money off the table. However, this was a great time to get out your shopping list; stocks were on sale!

In June, the market sold off by 6% when panic was induced following Britain’s Brexit referendum. Yet again, gloom had taken over on Wall Street. The market didn’t stay down for long though. Stocks recovered the 6% over the next two weeks. In the rear-view mirror, the Brexit episode was yet another great buying opportunity. Over the summer, things calmed down as investors waited to see how the election would pan out.

Not many were expecting the Trump win in November, and stock market futures were down big overnight on news that he was going to win. Clearly, the market had priced in a Clinton win. To the surprise of many, by the time the opening bell rang the next morning, markets actually opened in the green. It is likely that most investors will remember this surprise election result as the highlight of the year as it showed how uncertainty can effect investor sentiment. The market continued its “Trump Rally” through the end of the year with hopes that Donald Trump will cut taxes, decrease regulations, and pass some sort of infrastructure spending program.

By the end of the year, the S&P 500 was up 9.54% and the Dow Jones was up 13.42%. Looking back, it wasn’t a bad year.

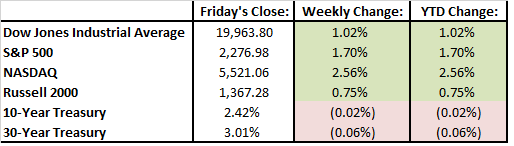

Last Week’s Highlights:

It was a quiet week on Wall Street last week as the Trump Rally lost a bit of its steam during the abbreviated week of trading. The S&P 500 lost just over 1% on light volume. We hope all of our clients and friends had a wonderful holiday season!

Looking Ahead:

Markets were closed on Monday for the New Year’s holiday. On Tuesday, Congress heads back to work and the ISM manufacturing index for December will be reported. On Wednesday, Ford Motors reports its sales from December and the Fed will release minutes from its December meeting. Thursday, we will see earnings results from Walgreens and Monsanto. On Friday, November’s import/export numbers will be released by the Commerce Department.

What’s On Our Minds:

With the end of the year quickly approaching, most folks are enjoying the holidays but some might be a bit worried about their tax situation for 2016.

Taxes are an inevitable part of investing. The tax code complicates investment planning, and the impact of taxes has been steadily increasing as investment planning becomes more individualized. With careful planning, you can minimize the effect that taxes have on your investments. Your focus should be on the return generated at the end of your investing time horizon—after tax and transaction returns—making taxes an important concern for all investors.

Types of Taxes

A seemingly endless list of potential taxes could affect your investments, portfolio and net worth. Some of the more critical ones are as follows:

- Interest: Interest you earn on investments (typically from bonds and large cash holdings) is subject to tax rates that are the same as your ordinary income tax rate.

- Dividends: You’ll have to pay taxes on dividends that come from stock you own, but dividends are taxed with preferential treatment in comparison to ordinary income and interest income. To receive this treatment, the dividend must meet several requirements to be considered a qualified dividend.

- Capital Gains: When the value of your investments in stocks, bonds and other assets increases from the purchase price and you sell it for a profit, you’ll trigger a capital gains tax. Similar to dividends, long-term capital gains are taxed at lower rates than ordinary income.

- Estate Tax: For investors with significant holdings, estate taxes can have a substantial effect on the total value they can pass on to heirs or charity. Planning for estate taxes is especially important, and there are many strategies to maximize the value of portfolio holdings.

Tax-advantaged Accounts

- Retirement Accounts: One of the most prominent ways to take advantage of tax-friendly regulations is to create retirement accounts. These accounts include 401(k)s or 403(b)s (depending on type of employer), Individual Retirement Accounts (IRAs) and Keogh plans. All of these accounts qualify for preferential tax treatment and therefore are often referred to as qualified accounts. The benefits of deferring taxes can dramatically compound over time. For example, $1,000 invested in an IRA at a tax-deferred rate of 8 percent grows to $10,063 over 30 years. In a taxable account (assuming 28 percent tax rate), the funds would grow to only $5,366. Roth and traditional IRAs are both effective ways to save for retirement. With a Roth IRA, you contribute money that has already been taxed in exchange for the ability to make tax-free withdrawals upon retirement. In a traditional IRA, your contributions are pre-tax, but you pay taxes on distributions later on. But how do you choose between the two? Your choice depends on how you think your future tax rate compares to your current tax rate. If you assume your individual tax rate is not going to change between now and retirement, then the net result will be the same regardless of which type of IRA you choose. When looking at changing tax rates, it is most important to focus on both the changing landscape of tax rates as a whole, as well as how changes in your income will affect which tax bracket you fall under. Generally, as people age they earn more money and enter higher tax brackets. In this case, and assuming no change in the overall level of taxes, it would be more beneficial to pay the taxes now, at a lower rate. However, if you believe that your tax rate will decrease, then traditional IRAs will be more beneficial.

Tax-advantaged Investments

- Municipal Bonds: In addition to tax-advantaged accounts, you can also choose tax friendly investments. For instance, municipal bonds are an ideal way to invest in fixed income while limiting the effect of taxes. Municipal bonds are any bonds issued by a U.S. city or other local government. The interest received by bondholders is generally exempt from the federal income tax and from income tax in the state in which they are issued. On the other hand, municipal bonds are usually priced higher to account for these tax effects. However, the tax exemption on interest income will be more beneficial for individuals with significant income. Therefore, investing in municipal bonds may minimize the tax effect on investments for individuals in higher tax brackets.

In addition to taxes, you should also be aware of the effects of transaction costs and fees on your investments’ growth. Tax-advantaged accounts help to alleviate these costs as well, making them practical for investors who want to save for retirement or education expenses. The uncertain outlook for taxes as they relate to investment planning makes it critical to stay up to date with new developments, and discuss strategies to minimize your tax burden with your financial and tax advisor.

Last Week’s Highlights:

The Federal Reserve increased interest rates last week by 25 basis points, to between 0.5% and 0.75%. Fed Chair Janet Yellen stated, “considerable progress the economy has made” when explaining the rationale behind the decision. For the most part, investors had expected this decision.

Oil prices increased last week as OPEC members, including Russia, agreed to cut output by 558,000 barrels a day. Oil prices increased to 51.90 dollars per barrel which is the highest it has traded in the last 17 months.

Donald Trump announced some important appointments last week. He tapped Exxon CEO, Rex Tillerson to be Secretary of State Rick Perry as energy secretary, and Goldman Sachs’ Gary Cohn as chief economic adviser.

Looking Ahead:

There are a few important economic reports in the coming this weeks. The Purchasing Managers’ Index (PMI), which is an indicator of the economic health of the manufacturing sector, will be released on Monday. Also on Monday, Janet Yellen will deliver a speech on the state of the job market and the electoral college will officially cast their votes for president. Existing home sales will be released on Wednesday, durable goods and personal income and spending on Thursday. On Friday, consumer sentiment and new homes sales numbers will be released.