What’s On Our Minds:

With the end of the year quickly approaching, it’s time to look back at what’s happened and how it will affect your financial future. Go through these important items so that you can go into the new year with financial peace of mind.

INVESTMENTS

- Consider tax-loss harvesting to lower taxes on capital gains.

By selling positions that are down this year, you can use the losses to reduce up to $3,000 of taxable income. If your total losses surpass $3,000, you can roll over excess losses to offset gains in another year. If you have losses from a previous year, calculate how they affect your gains or losses from this year.

- Check your performance.

Are your investments on track to meet your goals? If your portfolio is lagging behind the appropriate benchmarks, it may be time to reconsider your investments.

INCOME TAX

- Review your tax withholdings.

Have you had a major life change (employment change, marriage/divorce, a new child) that affects your income tax? Check to make sure your tax withholdings have been properly adjusted. Having low withholdings can lead to tax penalties, while having too high of withholdings prevents you from accessing your money until your tax return is filed.

- Estimate your AGI.

Determine your adjusted gross income (AGI) with the help of your tax advisor. Your AGI will help determine your tax bracket, which you’ll need for investment and retirement planning.

- Estimate your AMT.

Determine whether you will be subject to the Alternative Minimum Tax (AMT) and if there are ways to mitigate your AMT liability.

GIVING

- Reduce your estate through gifts.

You are permitted to give up to $14,000 ($28,000 for married couples) a year per recipient as an untaxed gift. Gifts above this value will consume part of your lifetime/estate tax exemption amount, $5.45 million in 2016.

- Donate to charity as a way to reduce taxes.

You can lower taxable income by 50 or 30 percent with a gift to a public charity or by 30 or 20 percent with a gift to a private foundation. If your gifts exceeds these limits, you can roll over the excess deduction for up to 5 years.

RETIREMENT ACCOUNTS

- If you are retired, make sure you’ve taken all necessary required minimum distributions (RMDs).

RMDs may be one of the most important items to review when going over your finances at the end of the year. Standard IRAs require these distributions be taken annually after the year you turn 70 ½; standard 401(k)s require them annually after you retire or turn 70 ½ (whichever is earlier). Failure to take an RMD will trigger a 50 percent excise tax on the value of the RMD.

- Max out contributions to an IRA and employer retirement plan for the year.

Both IRAs and 401(k)s have annual contribution limits. If you find you have excess savings and have not reached your annual limit, it may be a good idea to make additional contributions. Similarly, you may also consider making greater monthly contributions to your accounts next year, spreading out the cost of contribution. The deadline for IRA contributions is usually April 15 of the following year; 401(k) deadlines may be restricted to the calendar year, depending on your employer. If your children or grandchildren make less than $132,000 per year, consider gifting them $5,500 so they can make a Roth IRA contribution.

- Consider converting a traditional IRA to a Roth IRA.

Did you have a good tax year? It may be an opportune time to convert a portion (or all) of your traditional IRA to a Roth IRA and pay your taxes at a lower rate. It is important to understand, however, that Roth accounts have contribution limits placed on them, so keeping a traditional IRA might be beneficial. Before making any changes, consider seeking the help of a professional accountant who can help you with the conversion and calculate your new tax liability.

Last Week’s Highlights:

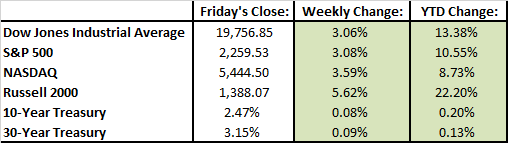

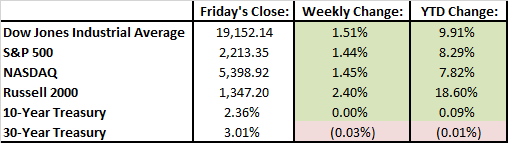

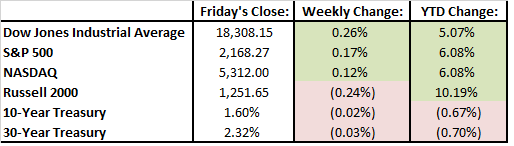

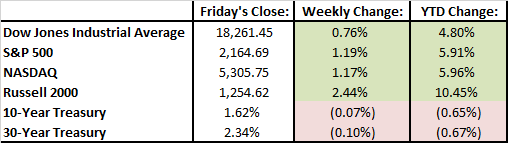

Markets continued their rally last week as indices continued to break records. The rally was broad; no sectors booked a loss last week. Among industries, chipmakers and banks had a particularly strong week as they outperformed the market. Since the election, investors have been favoring financial companies on the assumption that Trump’s administration will work to create a much more lenient regulatory environment. In general, a brighter economic outlook is favoring stocks.

The selloff in the bond market continued last week which is translating into higher rates and lower prices across the board.

Looking Ahead:

All eyes will be on the Federal Reserve this week as investors are expecting them to raise short-term interest rates on Wednesday. Janet Yellen will also talk about the Fed’s plans for 2017 during her press conference. Also on Wednesday, November retail sales and industrial production figures will be released. On Thursday, we will also get weekly jobless claim number.

Companies are releasing earning this week as well. On Wednesday, Pier 1 Imports releases their results and on Thursday Oracle released their numbers.

What’s On Our Minds:

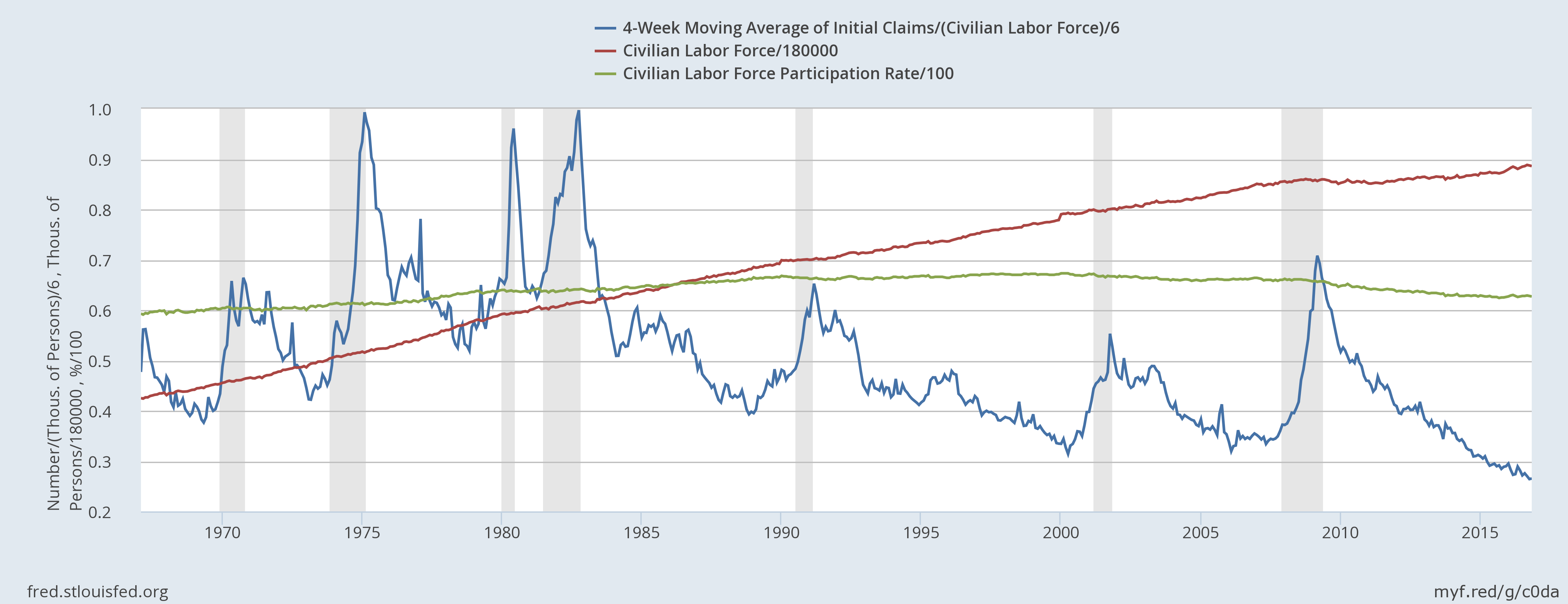

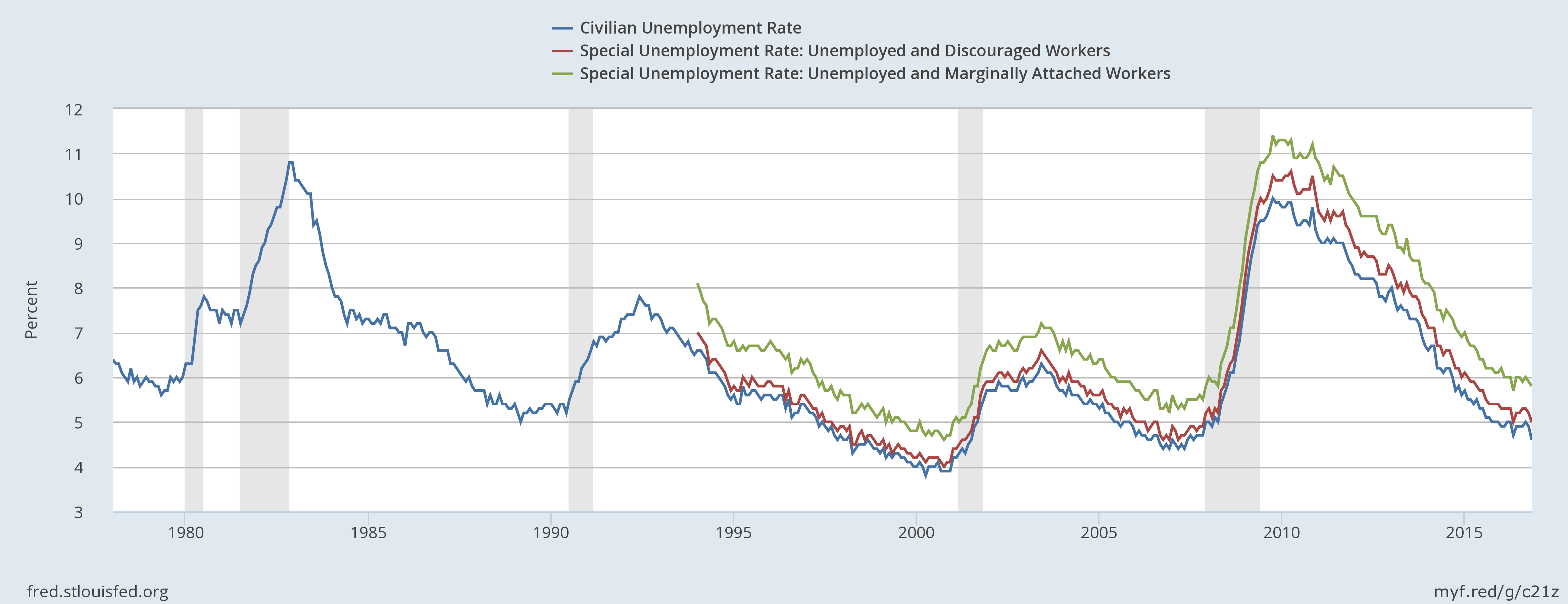

Last week, we saw some good employment numbers as the Bureau of Labor Statistics (BLS) reported 178,000 new jobs in November and a jobless rate that ticked down to 4.6%. This has been the longest continuous streak of job growth on record. The economy has added almost 16 million jobs since 2010. All good news, right?

Hopefully, yes. But a tiny detail from the White House’s statement reminds us that all good things do come to an end. In the statement, the White House boasts that this is the lowest unemployment since August 2007, but we remember that was two months before the S&P 500 reached its peak before the financial crisis. Now, of course, we can’t point to one metric and forecast a recession, but we returned to one of our favorite charts that we put together using the St. Louis Fed’s excellent online tool.

We plotted three data series. Each series we scaled down to be represented on the same axis:

- Initial claims for jobless benefits as a percentage of the civilian labor force (blue). Taking this commonly viewed number as a percentage of the labor force adjusts for the fact that we have seen an increase in the US population over time.

- The civilian labor force (red),which includes all employable persons, not just those employed, which has steadily risen over time, albeit more slowly in recent years.

- The Labor Force Participation Rate, or the percentage of employable people who either have work or are seeking work.

The level of initial claims is at the lowest it’s been since records are available. We also see that the labor force participation rate, green, has been declining in recent years. The factors causing this are likely varied, and a combination of automation and workforce changes which lead to discouraged workers, or those who have removed themselves from the workforce. This is a sort of “shadow unemployment,” meaning that these people might want more work, but have given up their search. There are also those who would like full-time positions but who have only been able to find part-time work. To account for these underemployed people, the BLS provides several employment measures that add back discouraged and otherwise marginally attached workers:

This graph looks significantly different from the previous graph, in that the current employment situation does not appear from these data to be as overheated.

We continue to monitor both of these graphs. We also keep in mind that the character of the American workplace has changed dramatically, where the Internet has enabled companies to produce much more output with drastically fewer employees. It is possible that there is a new, higher equilibrium unemployment rate, or a “natural rate of unemployment”. Determining that exact (and unobservable) number will prove to be difficult even for the crack economic team at Tufton Capital.

Last Week’s Highlights:

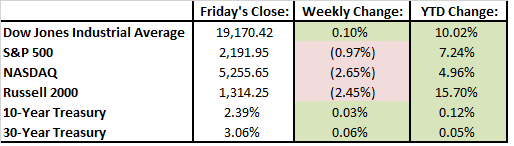

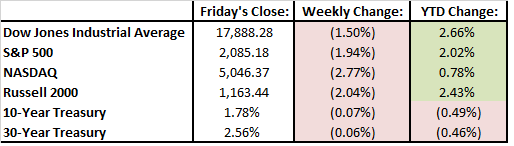

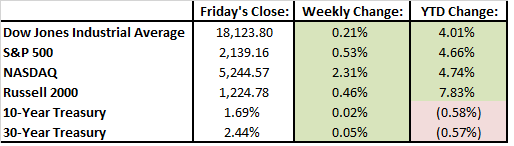

Stocks were mixed last week as investors sold technology stocks, bought financial services stocks, and the energy sector rallied on news that OPEC agreed to cut production levels. Overall, the Dow Jones was flat, the S&P 500 fell a bit, and the NASDAQ was down over 2.5%.

We had a strong jobs report last week and we are nearing full employment levels. The jobless rate fell to 4.6%, leading many to believe that the fed will raise interest rates later this month.

In politics, President-elect Donald Trump made a few important appointments last week. He chose former Goldman Sachs banker Steven Mnuchin as Treasury Secretary and billionaire Wilbur Ross as Commerce secretary. These appointments had financial stocks on the move higher as many believe these two will decrease regulations on the industry. Over the weekend, Trump tweeted warnings to companies planning on outsourcing business abroad saying they should be prepared to face “retribution”. On the other side of aisle, house Democrats re-elected Nancy Pelosi as their leader.

Looking Ahead:

News out of Italy could have international investors on high alert this week. Early on Monday, Prime Minister Matteo Renzi said that he would resign following defeat in a referendum on constitutional reform. That being said, polls had predicted a “no” on the referendum so the fallout should be muted.

On Monday, the ISM nonmanufacturing index for November is reported. On Tuesday, Bob Evans, Michaels and Toll Brother report their quarterly results. On Wednesday, H&R Block, lululemon, and Vera Bradley report their earnings. On Thursday, Broadcom, Liberty Tax, and Ceina report earnings and Baker Hugh should discus merger plans with GE’s energy division during their investor meeting.

What’s On Our Minds:

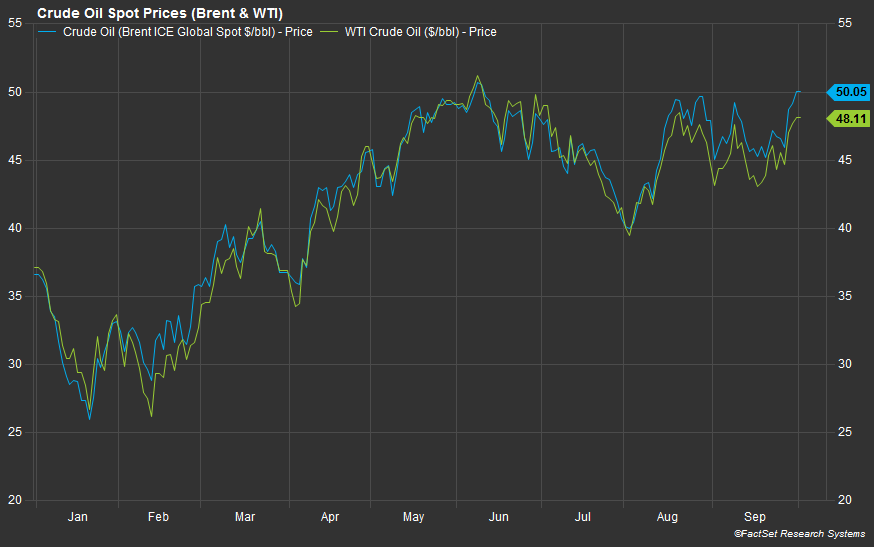

This week, investors’ eyes will be on OPEC and their meeting in Vienna, Austria. The members of the Organization of Petroleum Exporting Countries (OPEC) will come together on Wednesday to decide on whether or not to cut oil production in their respected countries. Saudi Arabia, the world’s largest oil producer with production of approximately 10.5 million barrels per day, has allegedly proposed that they will cut 4.5% of their production if Iran freezes their own production at roughly 3.8 million barrels per day. In addition, the Saudis also desire additional outside countries, such as Russia, to agree to freeze as well. Production levels would be verified by a third party to avoid any kind of cheating.

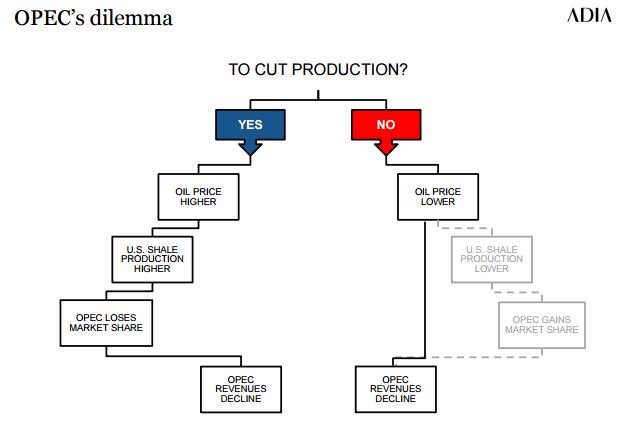

OPEC is in quite a situation as Saudi Arabia is no longer the world’s swing producer. US shale producers can react to increases in the price of oil in a matter of days to weeks. Christof Ruhl, Head of Global Research at the Abu Dhabi Investment Authority, presented the chart diagram below nearly two years ago before the November OPEC meeting and the argument still holds true today. In the current situation, with lower oil prices, OPEC countries obviously have lower oil sales than they did when oil was at $100 per barrel. If they cut production, propping up the price of oil, US shale producers will ramp up production and take market share from OPEC. As OPEC loses market share, sales will again be lower.

Could this be the end of the traditional OPEC as we know it? Only time will tell.

Source: Christof Ruhl – Abu Dhabi Investment Authority

Last Week’s Highlights:

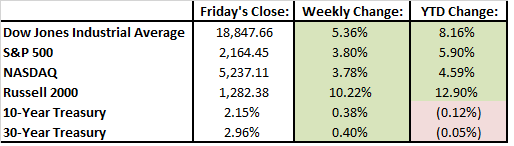

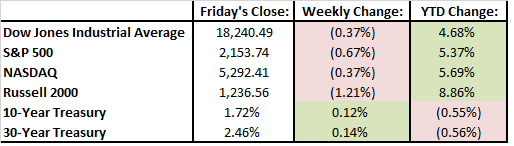

For the third week in a row, stocks were up on continued reflationary hopes following the US presidential election. On Tuesday, for the first time since 1999, the Dow Jones, the S&P 500, the Nasdaq, and the Russell 2000 all set record highs. Domestic small-caps had a particularly good week as investors believe these companies will benefit from accelerated growth and tax reform.

Existing home sales were reported at 5.6 million. Durable goods sales were up 4.8% month over month. Jobless claims were reported and are down to 251,000.

American shoppers unofficially kicked off holiday shopping season on Friday. As has been the trend in recent years, brick and mortar store sales are shrinking and online sales are growing. On Thursday and Friday, online sales surpassed $5 billion with more than $1.2 billion coming from mobile devices.

Looking Ahead:

Thanksgiving is now behind us and Americans are back to work after a holiday packed full of turkey and rivalry football games. Online holiday sales will continue on “Cyber Monday”. On Tuesday, Third Quarter US GDP will be released and Chicago O’Hare airport workers are set to go on strike. OPEC is having a meeting on Wednesday where they will try to agree on a production cut. On Thursday, we will get automotive sales figures from November. Friday is a big day as November’s jobs report will be released.

What’s On Our Minds:

Our focus in recent weeks has been on the election and while we like to keep our topics fresh from week to week, it would be remiss for us to ignore the effect that the election’s results are having on financial markets.

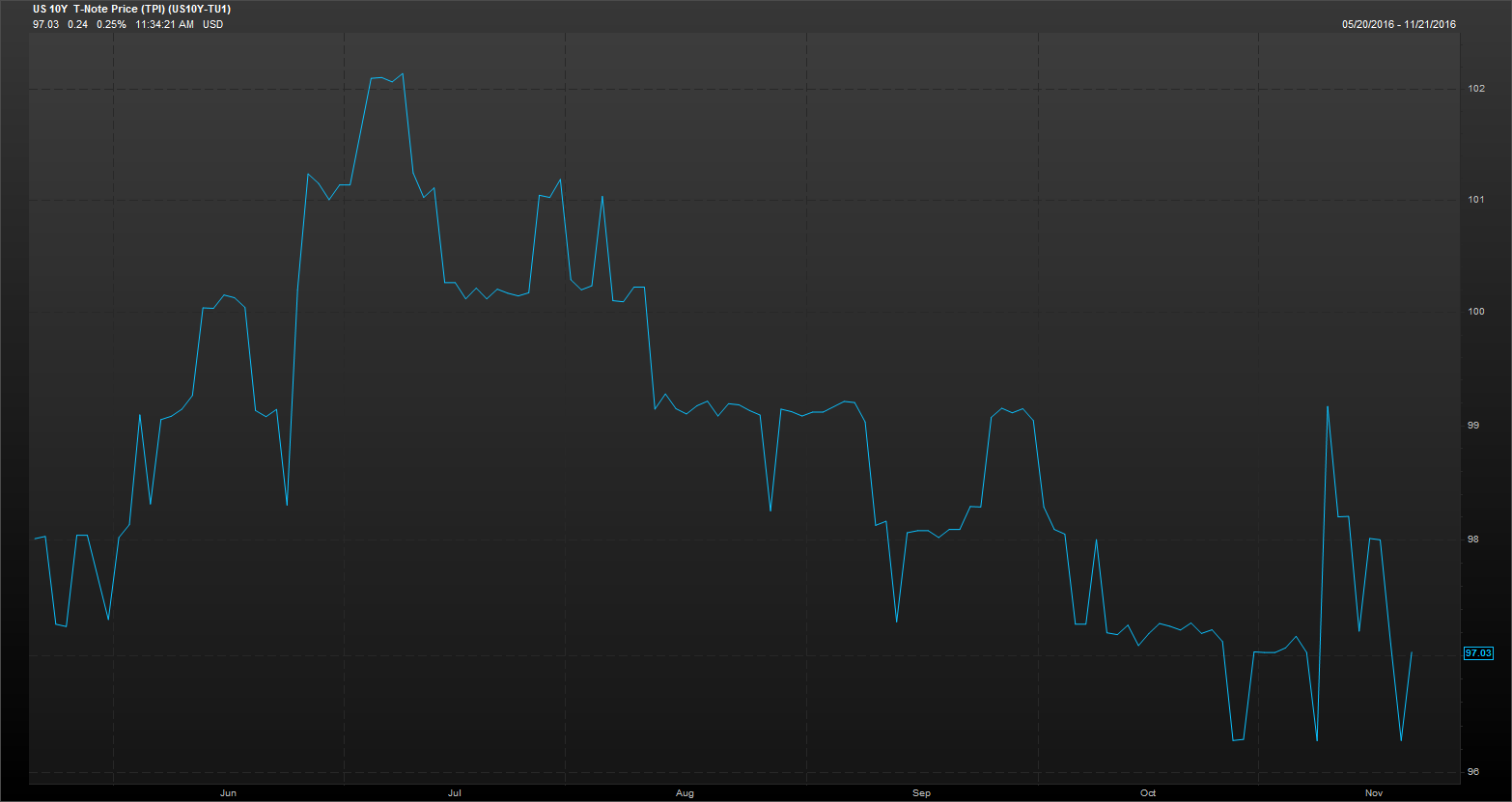

While campaign promises don’t always come to complete fruition, based on recent market movements, it’s clear that investors are expecting a lot out of Trump. Specifically, his plans to rebuild the country’s infrastructure through a stimulus package, cut taxes on corporations and individuals, and increase trade barriers are being seen has major policies that could improve our domestic economy and thus, move the market. While these plans have been good news for equity markets, it has triggered a selloff in the fixed income market.

Global bond yields, which rise as bond prices fall, have been falling since the Brexit in June, but the selloff has accelerated since Trump’s upset victory. The rationale behind the continued sell off is that Trump’s policies will provide a boost to inflation, which is the enemy of long-term bonds, because it erodes the value of interest payments. Furthermore, bonds just seem less attractive compared to stocks when hopes of economic growth is on the horizon.

All of this action in the market is exciting, but we continue to remind our clients and friends of the importance of sticking to a long term investment plan. Instead of speculating how new policies may affect the investment landscape, we believe it is best to focus on underlying fundamentals and make investments accordingly. With the benefit of hindsight, recent market moves can be viewed as an example of how tough it is to predict short-term market moves. Media pundits had many convinced that a Trump victory would be calamitous for the markets, but we’ve seen numerous record highs since his election. As is usually the case, we believe that calm heads prevail over the long-term.

10 Year Treasury Since 6/1/2016

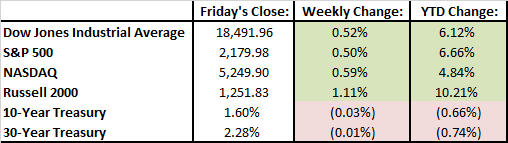

Last Week’s Highlights:

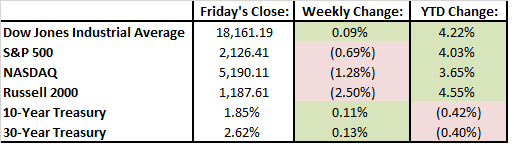

It was another busy week on Wall Street. The Dow Jones finished the week marginally higher last week after reaching numerous record highs. The S&P 500 had a better week and was up 80 basis points due to its lower exposure to industrial and financial services sectors. With only a few weeks left in the year, both indexes are up by more than 6% year to date.

Janet Yellen delivered remarks to the Joint Economic Committee of the US Congress on Thursday. She stated that the economy is making good headway and that a hike in interest rates could be coming “relatively soon”. Markets are currently pricing in a 25 basis point hike for the next FOMC meeting in December.

Retail sales numbers came in strong last week. Merchants in the U.S. reported increased retail sales in October by 0.8%. These numbers should bolster the Fed’s pending decision to increase rates next month.

Looking Ahead:

Higher yields and a strong dollar should continue to dominate financial headlines this week.

On Tuesday, Barnes & Noble, Campbell Soups, Chico’s FAS, GameStop, Dollar Tree, and Hewlett Packard Enterprises report their quarterly results.

Some important economic data comes across the wire this week. U.S. existing home sales are released on Tuesday and Global Flash Purchasing Managers’ indices will be released on Wednesday.

It will be a short week for investors as domestic markets will be closed on Thursday for Thanksgiving and the stock market closes at 1 PM on Friday.

What’s On Our Minds:

Many would agree that we were put through the ringer with divisive campaign rhetoric this year. Well, it’s finally come to an end and the uncertainty is behind us. Folks on both sides of the aisle were surprised by last week’s election results but many would probably agree that it’s nice to have the contentious campaign season in the rear view mirror.

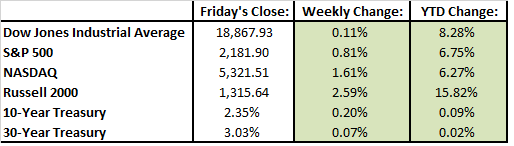

After a majority of market pundits had predicted that a Donald Trump victory would send equity markets crashing, the markets have been on a tear since he delivered his quelled down acceptance speech on Wednesday morning. Perhaps this is a sign of a new Donald Trump? The pollsters may have expected a Clinton landslide and market pundits predicted a doom and gloom if Trump won, but markets posted one of their strongest weeks in history. Rather than panic selling, investors repositioned themselves for how the election results will effect public companies, financial markets and the economy.

While Trump had some grandiose ideas and lofty rhetoric on the campaign trail, it will be interesting to see how his policies play out now that he’s actually headed to Washington. Like any campaign, it’s likely that a good deal of Trump’s campaign rhetoric won’t actually be implemented in legislation. For instance, he has said that his wall is now probably going to just be a fence. On a corporate level, Trump’s campaign promises to slash the 35% corporate tax rate for some of the largest U.S. companies to 15% is being seen as a rallying point for investors. On the national level though, a trade war with China probably won’t make investors and US consumers very happy. Whatever happens, we’ll have to wait and see how Trump handles the transition from twitter ranting Donald to Mr. President in White House.

While the president may be a significant figure in influencing the financial markets, it’s important to remember that stock and bond prices are closely tied to fundamentals that don’t just change on the flip of a dime. With that in mind, instead of trying to speculate, the Tufton investment team remains focused on investing in high quality yet undervalued companies that may be temporarily out of favor in the financial markets.

The S&P 500 Index Last Week

Last Week’s Highlights:

Stocks rose last week as investors weighed what a Trump Presidency means for the markets and the economy. Initially, futures crashed on Tuesday night with news that Trump was going to win but then, to many peoples’ surprise, domestic markets rebounded sharply on Wednesday morning. The rally in blue chip stocks continued through Friday. Trump’s promises of decreased regulation and increased infrastructure spending had investors repositioning themselves into shares of industrial companies and banks. Biotech and pharma stocks had also had a big week after investors previously priced expected a Hilary Clinton victory. Many of these stocks had been beaten up after Secretary Clinton had promised increased government regulation over these industries during her campaign. Companies benefitting from the Affordable Care Act had a tough week as many believe Trump will repeal and replace it.

The biggest reaction to the election occurred in the bond market. US Treasurys have sold off because many believe that Trump’s economic policies will lead to higher inflation. Bond yields, which move inversely to bond prices, rose to the highest level of the year last week.

By the close on Friday, the Dow Jones Industrial average was up 5.4%, closing at a record high. This was the index’s strongest week in 5 years. The S&P 500 also had a strong week, up 3.8%.

Looking Ahead:

Domestic equity markets will begin the week trading at all-time highs. 31 S&P 500 companies will be releasing earnings this week. Home Depot, Target, Cisco, and Wall-Mart are included in the bunch. We will also get some economic reports this week. Retail sales will be reported on Tuesday, industrial production will be reported on Wednesday, and inflation data will be reported on Thursday. Members of the Federal Reserve are also speaking this week. With big moves currently occurring in the bond markets and an interest rate bump expected next month, their comments will be followed closely.

What’s On Our Minds:

Can’t we just get this election over with already? Unfortunately not, but we are almost there. While technically not an event from last week, we would be remiss in not pointing out the big market move this morning after Hillary Clinton was cleared by the FBI regarding the newly-discovered emails. It has become fairly evident that the markets are hoping for a Democratic victory.

The division in American politics is real and often frightening. The FBI’s involvement in politics has many people even more concerned about the direction of our political system and the way we conduct elections. However, we hope and believe that calm heads can prevail. Further, we know that whatever the outcome of the election, there will be plenty of work to do in evaluating the economic effects of the new president-elect’s plans. If your favored candidate doesn’t win, it might seem like the end of the world, but financial markets will keep on trading, and investing wisely will still be important to secure your future.

Last Week’s Highlights:

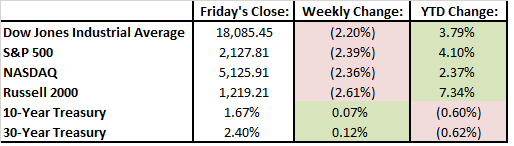

The markets took it on the chin last week. By Friday, markets had declined for 9 straight days, the longest losing streak since 1980. Trump’s momentum and a general feeling of uncertainty surrounding the election weighed on global markets with the S&P 500 giving up nearly 2%.

It wasn’t all bad though. The U.S. jobs report was good on Friday and third quarter GDP grew more than expected. The country saw strong wage growth in October with the Fed reporting that non farm payrolls increased by 161,000. The unemployment rate is now down to 4.9%. The Fed didn’t raise interest rates going into the election but gave some hints that they will likely increase rates soon. Investors are expecting a bump in rates in December.

It was a crazy week in the energy business with crude oil prices ticking down 9.5% to $44.07 on news that crude stock piles grew much more than expected. Ironically, gasoline prices rose 15% because a pipeline in Alabama ruptured.

In company news, GE struck a deal to combine its oil and gas business with Baker Hughes. Generic drug manufacturers are being investigated by the federal government for alleged price collusion. These companies include Teva, Mylan and Endo.

Looking Ahead:

With all the election hype it’s easy to forget that we are still in the thick of third quarter earnings season. Chemours and Sysco report earnings on Monday. CVS, Johnson Controls, and News Corp report their results on Tuesday. Mylan and Wendy’s will share their quarterly results on Wednesday. Thursday we will get reports from Disney, Kohl’s and Macy’s. Finally, on Friday, Armstrong Flooring and J.C. Penney post their third quarter numbers.

On Tuesday Americans head to the polls. Markets will probably experience some short term volatility around the election as investors figure out who will be leading our country for the next four years. Election jitters will be in full force.

The bond market will be closed on Friday for Veteran’s Day. Tufton would like to thank all Veterans for their service to our great country.

What’s On Our Minds:

Over the past few weeks, the news headlines have been filled with many merger and acquisition deals and this morning continued the trend as the oil and gas service company Baker Hughes agreed to combine with General Electric’s oil and gas business. In terms of market value of the deals, October represented the second largest month ever for US listed companies. Other deals included communication company CenturyLink’s acquisition of Level3 Communications for $34 billion, AT&T’s acquisition of Time Warner for $108 billion, chipmaker Qualcomm’s acquisition of European based NXP Semiconductors for $47 billion, and British American Tobacco’s agreed buyout of the rest its stake in cigarette maker Reynolds America for $58 billion.

This past quarter represents the sixth straight quarter of earnings declines for S&P 500 companies. Facing diminishing earnings, corporate executives are looking for new ways to grow their businesses (and bonuses). Many executive bonuses are partly dependent on year over year growth in their company’s earnings per share (EPS). When growth declines or disappears, executives look to other sources of generating revenue, such as acquiring other companies.

Seeing that the M&A business has heated up this year, we would be willing to bet that a good bit of investment bankers will be very happy with their year-end bonus checks in December!

Last Week’s Highlights:

Stock market indexes were mixed last week. The Dow increased just a bit, and the S&P 500 lost some value. For the most part, third quarter earnings announcements drove results last week.

It was announced that U.S. GDP increased at an annual rate of 2.9% in the third quarter. This was up from just 1.4% in the second quarter. The accelerated GDP number reflects an upturn in private inventory investment, increased exports, less decreases in local government spending, and an upturn in federal government spending.

Twitter’s stock has been beaten up this year, and the company announced it is planning on laying off 9% of their employees to focus on profits. Meanwhile, Snap (the parent company of social app Snapchat) is planning on raising up to $4 billion in an IPO deal. Based on these metrics, Snapchat is being valued anywhere between $25 and $40 billion. Clearly, Twitter has lost some of its birdsong while Snapchat is snapping along nicely.

Finally, on Friday afternoon the presidential race heated back up when the FBI announced it would re-open investigations into Hilary Clinton’s emails after discovering related emails on Anthony Weiner’s laptop during an unrelated investigation. Markets decreased on the news, which shows investors were probably expecting (and perhaps even hoping for) a Clinton victory next week. What we know for sure is that any bit of uncertainty introduces pessimism to the markets.

Looking Ahead:

The presidential election is just over a week away, which should dominate headlines this week, but we are still in the thick of third quarter earnings season. Home improvement giant Lowes reports earnings on Monday. Occidental Petroleum reports on Tuesday. On Wednesday, we will get results from Qualcomm. The Fed will announce its interest rate policy moving forward on Wednesday but it’s unlikely that they will raise rates right before the election. They should give some signals as to whether they will raise rates in December. CBS and Starbucks report earnings on Thursday. On Friday, the October jobs report is released.

What’s On Our Minds:

In just two weeks, Americans will head to the polls to determine our next president. A lot of folks seem a bit nervous regarding their investment portfolios heading into this year’s election. Anxiety ahead of any presidential election is hardly unusual as elections bring change into the picture and for investors. Furthermore, this year’s election has brought a sense of dread into the 24-hour news cycle which doesn’t help investor angst. While campaign related news can quickly move the stock market one way or the other, it’s important to remember that these types of events rarely have a long-term impact on the markets.

Sometimes it’s hard to keep emotions out of financial decision making. More often than not, your investment portfolio’s highs, lows, twists, turns and plummets are actually courtesy of your own psychology. Emotions substantially affect rational thinking; when you let certain emotions fuel your investment decisions, your portfolio could be in trouble. So over the short term, it’s important to try to keep your emotions in check and divorce politics from your investment portfolio.

While the past doesn’t predict the future, one could note that the S&P 500 has been positive in 76% of presidential election years. Even though historical figures might not reflect what will happen the rest of this year, we suggest that investors stick to their long term plan rather than let their emotions surrounding the election drive their investment decisions. For folks looking to make trades around what they think we happen in the coming election, we would remind you that trying to time the market almost never works out over the long run.

Last Week’s Highlights:

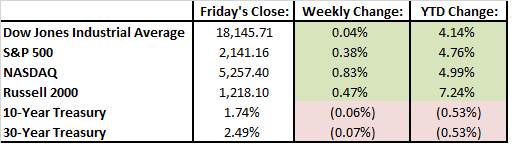

Markets were up modestly last week but it was a bit of a bumpy ride getting there. The S&P 500 and Nasdaq rose by 0.38% and 0.83% respectively. The Dow finished the week almost exactly where it started.

U.S. crude oil prices hit a 15 month high of $51.60 a barrel, after data showed stockpiles had fallen. Saudi Arabia also said that many OPEC members are planning on participating in a production cut. Doubts persist over the production cut deal between OPEC nations though.

On Saturday night, the largest take over deal of the year was announced. AT&T has agreed to buy Time Warner for about $107.50 a share in cash and stock. Both presidential candidates have scrutinized the deal and competitor Walt Disney Co. stated, “a transaction of this magnitude obviously warrants very close regulatory scrutiny.”

Looking Ahead:

Third quarter profit reports are coming through day by day, and the presidential election is right around the corner. We will be in the thick of 3rd quarter earnings season again this week. Visa will kick off the week, releasing earnings on Monday. Tuesday, we will hear from Apple, Fiat Chrysler, and Chipotle. Wednesday, we will get numbers from Southwest Airlines, Boeing, and Coca-Cola. On Thursday, Apple is revealing its new Mac computer and Google, Samsung, and ConocoPhillips will release their earnings. On Friday, we will finish the week with earnings reports from Legg Mason, MasterCard, Anheuser-Busch, and U.S. GDP figures for the 3rd quarter will be released.

What’s On Our Minds:

Corporate earnings season kicked off last week with aluminum producer Alcoa reporting after the bell last Tuesday. The “Big Banks” followed to finish out the week. Each of them – JP Morgan, Citigroup, Bank of America, and Wells Fargo – reported earnings that beat Wall Street’s expectations. However, all of them, with the exception of Bank of America, experienced earnings declines compared to the same quarter last year. Results continue to be weighed down by lower interest rates.

Though at large the “Big Banks” generally are perceived as almost identical, each of them have established a different reputation since the Financial Crisis.

JP Morgan has been associated with being extremely conscious of cost, while investing in mobile platforms, internet banking and cyber security. CEO Jamie Dimon continues to boast about the bank’s strong capital position with their “fortress balance sheet.” The bank also has strong investment banking and asset management divisions, which helped beat earnings this past quarter.

Citigroup has earned lower returns than peers as the have continued to dispose of some of their legacy assets that no longer fit management’s business strategy. The bank continues to own one of the largest banks in Mexico, which many Wall Street analysts believe they should sell.

Bank of America has been known to move slightly slower than their competitors when it comes to integrating Merrill Lynch and cleaning up expenses. Thus, this has weighed on their returns to shareholders over the years. Although, the bank is considered to be the biggest beneficiary of rising interest rates, if they are to ever increase.

Finally, Wells Fargo has made been in the headlines almost on a daily basis due to their falsifying accounts scandal. The company was traditionally known to earn the most on their loans to customers when compared to peers. Their cross-selling strategies helped the bank produce some of the best returns of any bank since the Financial Crisis. Now, the former CEO has retired and the new CEO, Tim Sloan, is determined to repair the company’s reputation.

In all, higher rates would appear to help increase earnings for all of the “Big Banks.” However, they can only improve on what they can control – the rest is up to Chair Yellen.

KBW Nasdaq Bank Index (Year-to-date)

Last Week’s Highlights:

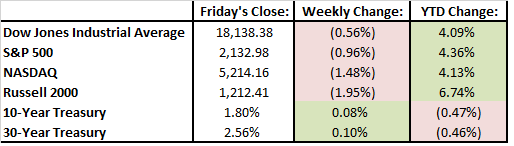

For the week of October 10th, the broader market indices were slightly down as the Dow Jones fell 0.56%, the S&P 500 fell 0.96% and the Nasdaq fell 1.48%. Corporate earnings report from Alcoa, which lowered their guidance, weighed on the market earlier in the week. Weak exports numbers out of China were also a concern on minds of investors. The Federal Reserve obviously continues to be a focus of the markets. Investors were listening closely to Chair Yellen’s speech last Friday for hints of an interest rate hike that may come before the end of the year.

Looking Ahead:

The week ahead will be filled with additional corporate earnings reports. Netflix will report after the closing bell on Monday. Wall Street is expecting sales growth of nearly 30% year over year for the streaming media company. On Tuesday, many of the blue chip stocks of the Dow Jones will report their results with Goldman Sachs, Johnson & Johnson, and United Health Group all releasing earnings before the opening bell. Intel will provide their quarterly earnings update after the market closes. Wednesday will give investors a look into the conditions of the housing market as housing starts for September are released. In addition, Morgan Stanley, American Express and Halliburton are all report earnings. Halliburton will be one of the first energy companies to give investors an idea of conditions in the oil patch. Finally, on Thursday and Friday, tech giant Microsoft and industrial conglomerate General Electric will provide details about their third quarter.

What’s On Our Minds:

The low-price nature of ETFs is again grabbing headlines, as BlackRock lowered the fees of many of their most popular funds even further. The move has drawn comparisons to Walmart: no frills, bare bones, low to no service, and commensurately low prices.

By and large, the move is generally seen as good for retail investors. Indexing provides a way for those with little capital and knowledge to start investing. At the same time, ETFs provide a good option for 401(k) plans whose participants are concerned with fees’ impact on performance.

What’s not to like, then? Issues arise when the investor is in a position when things like diversification, asset classes, and long-term planning start to matter.

A long-term plan for someone who wishes to retire comfortably is no simple matter. Simply investing one’s nest egg in the S&P 500 is appropriate for almost no retiree. Instead, decisions have to be made about not only the allocation between stocks and bonds, but also between small-/mid-/large-cap stocks, international investments, etc.

It is also important to get input on non-liquid holdings and how it affects your overall portfolio. For example, a financial adviser might tell a client who owns his or her $1 million home outright that more risk is appropriate in his or her portfolio than the client who just took out a mortgage on that same house.

The bottom line is that there is a place for Walmart investing, just as there are times when we all might stop by Walmart. However, for a custom fit, excellent service, and the perfect style, the discerning investor might prefer a Saks Fifth Avenue approach.

Last Week’s Highlights:

As investors were waiting for third quarter earnings season to kick off, most were focused on economic data last week. Even though September vehicle sales and manufacturing data was better than expected, an unfortunate jobs report caused stocks to fall modestly last week. The jobs report was not horrible. It showed that the US economy added 156,000 jobs in September which was a slightly shy of expectations. Job growth has been decent over the last 12 months and the US has added 2.4 million jobs. Job growth is slowing down a bit as we have averaged 169,000 over the past 6 months but 238,000 job per month in the preceding 6-month period. Even though the job number missed expectations by a bit, it was not big enough of a miss to derail any of the Fed’s plans to potentially raise rates one more time this year.

Hurricane Matthew battered coastal areas in the south east through the weekend. Market wise, there’s been increases in roof supply companies’ stocks and volatility in some insurance companies’ stocks. Hopefully folks in the affected areas are able to clean up quickly and get back to everyday life soon.

Looking Ahead:

Over the past few weeks, it has seemed like investors have been fixated on economic data, the presidential election, and controversies at Wells Fargo and EpiPen maker Mylan. Now, earnings reports will reenter the fray on Tuesday when aluminum manufacturer Alocoa releases its third quarter report at the closing bell. Also on the earnings calendar this week, CSX will report on Wednesday, Progressive on Thursday, and some of the big banks, JPMorgan and Wells Fargo on Friday.

Fed-speak will continue to be a factor this week with speeches from Chicago Fed President Charles Evans on Monday morning, New York Fed President William Dudley and Kansas City President Esther George on Wednesday, and Philadelphia President Patrick Harper delivering a Q&A on Thursday. Also, Janet Yellen will address Both Fed’s 60th Economic Conference on Friday. With uncertainly around interest rate policy moving forward, investors will be picking apart these speeches for any hints on future moves.

What’s On Our Minds:

Since our firm was founded in 1995, there has always been a saying floated around the Tufton offices that, “crude is king”. Even with vast changes in the oil business over the last couple of years, oil arguably remains the world’s most important commodity and companies involved in the business play a major role in our clients’ portfolios.

Since oil prices collapsed two years ago thanks to the rise of U.S. shale producers, OPEC has struggled to keep prices inflated and has not made a deal to cut production since 2008. Rather, since the oil collapse, Saudi Arabia has been pumping oil nonstop in attempt to put smaller producers out of business. At home, smaller producers aren’t making the money they were two years ago as the Saudis have attempted to pump them out of business. That all changed last week. A deal was made to bolster oil prices.

Last week OPEC met in north Africa’s Algiers, and after 2 years of arguing, the cartel agreed that they needed to collectively make a cut to their crude output. In reality, the deal is being made between Saudi Arabia and Iran who are OPEC’s most powerful members. According to Iran’s oil minister, Bijan Zanganeh, “OPEC made an exceptional decision”. They didn’t actually cut production yet though but decided to create a committee that will determine how much each country would have to cut. So, OPEC hasn’t succeeded yet.

All that came of the meeting in Algiers is that OPEC agreed to make an agreement and there are still questions as to whether or not the agreement goes through. No actual cut is going to be made until their next meeting in November where they plan on finalizing the agreement. So, oil prices are tracking higher, but we are going to have to wait and see OPEC’s next move.

Many analysts are citing OPEC has found itself stuck with a huge dilemma where they will lose revenue no matter what they do. On one hand, if they cut production and oil prices move higher, U.S. competitors will bring wells back online at prices where they are profitable and OPEC will lose market share. On the other, if they don’t cut production, oil prices will move back lower and they will continue hemorrhaging revenue on their oil sales.

Last Week’s Highlights:

With the 3rd quarter wrapping up last week, we can take a look at market performance. Even though volatility picked up towards the end of the quarter, we saw strong returns of 3.5% in the S&P 500. This run marks the 4th consecutive quarter of gains.

Volatility was the theme of last week and investors seemed to be on an emotional roller coaster as the Dow moved by triple digit figures each day. Worries included a potential rate hike that didn’t go through, a heated presidential debate, and concerns over global economic health. A rally in oil prices brought some optimism to the market which helped it remain in the green for the week.

In company news, the U.S. Department of Justice announced that Germany’s Deutsche Bank was being fined $14 billion for its involvement in sales of mortgage backed securities that factored into causing the financial crisis. The company’s stock hit a record low point as investors were worried it would need to seek additional capital (a bailout of sorts). Then on Friday, the stock rallied 14% when news broke that the fine may actually be settled for just $5.4 billion.

Looking Ahead:

News broke Monday morning that outdoor superstore Cabela’s (CAB) had been bought by privately owned rival Bass Pro Shops for $5.5 billion. The stock opened up on Monday 19% above its closing price on Friday.

Investors will be focusing on numerous data points being released later this week. Economic indicators being released include ISM, automotive sales for September, ISM non manufacturing, weekly jobless claims and non farm payrolls. On Tuesday night, Vice Presidential candidates will square off in their debate. Furthermore, all eyes will be on Deutsche Bank’s situation as they try to make an official settlement with the U.S. justice department. As we stand now, most investors seem to be agreeing that weak corporate profits and election uncertainty are keeping markets from breaking out higher.

What’s On Our Minds:

Colleges and Universities typically rely on their endowment funds to cover about 10% of their operating budgets. Thus, in order to maintain quality of life on campuses, folks running endowments need to come up with decent long term returns. Though many people do not think of schools as investing powerhouses, a few university endowments have an enviable legacy of successful investing. Some endowment managers have been so influential that Wall Street investors have attempted to copy them and strategies have emerged such as “the Yale Model” and “the Harvard Approach”.

When you consider that over the past 10 years, the S&P 500 has returned 7.42% annually and the average college endowment has returned 5.1% annually, not all endowment managers are hot shot investors. One of the most noteworthy endowment manager is David Swensen at Yale. In New Haven, his strategy has been to play “quarter back” where he allocates funds to various outside money managers that he believes can outperform. During his tenure, he has increased allocations towards hedge fund and private equity strategies. He manages $25.4 billion for the Bulldogs and has been able to achieve returns of 8.1% annually over the past ten years. When you consider the size of Yale’s endowment, 68 basis points of outperformance is pretty good and surely has made a difference for the University. Last week, Yale reported that its endowment earned 3.4% for the fiscal year ending June 30th. While he didn’t beat the S&P 500’s 3.99% over the same time frame, he did beat arch rival Harvard’s 2% loss. According to Cambridge Associates, a firm that manages about $9 billion in foundation and endowment assets, the average endowment returns, over the same times frame, was a loss of 2.7%.

It may seem tempting to try and mimic David Swensen’s strategy at Yale, but it’s important to remember that he has a few distinct advantages over wealthy individuals and families that makes his returns virtually impossible to copy. First, Universities have a boundless time horizon, which means they can take much riskier investments than what would be prudent for an individual. Another consideration is that due to the size of endowments that utilize numerous complex strategies, they enjoy lower fees than even the wealthiest private investors. Lastly, Universities don’t have to worry about Uncle Sam. Tax free exemption is by far the biggest advantage that endowments have over everyday investors. With long term capital gains taxed at 15-20%, a school’s tax free status makes a huge difference in returns each year.

While some investors may find success focusing on complex strategies, and other are better off using more simple approaches, we believe that being smart about your personalized strategy is the key for each investor.

Last Week’s Highlights:

The Fed didn’t raise rates last week and is most likely holding off until December. Stocks rallied on the announcement but then pulled back some of their gains on Friday. We saw a lot of price movement in oil towards the end of the week. Oil prices surged on Friday on speculation that Saudi Arabia was going to agree to trim production and Iran was going to agree to cap its output, but prices came back down when a Saudi official said nobody should expect a deal coming out of next week’s meeting.

Looking Ahead:

Headlines this week will likely revolve around the presidential debate scheduled for Monday night, OPEC’s meeting in Algiers through the middle of the week, and the releases of consumer and manufacturing data that could show us whether or not the economy is struggling. The market hasn’t reacted to the pending election very much this year but Monday night’s debate could shake things up a bit. Another political worry is that congress won’t be able to reach a budget deal by Sept. 30th. If they don’t, congress could “shut down” the federal government.

What’s On Our Minds:

Tune your TV to CNBC on any given day and more and more attention is given to activist investors and the companies they target. As activists, investors look to maximize shareholder value by often taking large enough positions to influence management decisions- they are looking to shake things up at the company. Activists may decide to move in on a company if they believe management has stumbled, it would be better off as a private company, it has excessive costs, or if the activist think they have a better capital allocation strategy, such as buying back stock or raising the dividend

Often activists are targeted by the media and politicians for being “hit and run” investors, but activists will argue that they are genuinely concerned about companies and the U.S. economy. The issues surrounding activism are not clear cut; some activist may just be greedy, while others actually want to maximize shareholder value over the long term. Earlier this year, billionaire investors decided to take on these attacks from Washington by launching their own lobbying group to fight these attacks, The Council for Investor Rights and Corporate Accountability (CIRCA). Bill Ackman, Paul Singer, Carl Icahn, Daniel Loeb, and Barry Rosenstein are the group’s largest backers. Together, they manage over $90 billion and believe that lousy corporate performance is a drag on the US economy.

Activists take positions in all different types of companies, across many different industries and of various market caps, but more often than not, activist target companies that have been beaten up and are considered value stocks. At Tufton Capital, we are not activist investors but we do look for undervalued stocks so it’s not uncommon for companies in our equity portfolio to have activist involvement. Thus, we do have to pay attention to the hype created by these market players.

While activist investors grab plenty of headlines, it’s tough to determine the actual impact activism is having on the overall market. According to a study conducted by the Wall Street Journal last year, of the largest 71 activist campaigns between 2009 and 2014, only about 50% of targeted companies outperformed their peers.

Last Week’s Highlights:

Global stock markets were mixed last week and Investors continue to fixate on central bank policy. Apple released the iphone 7 last week and shares jumped 11.4%. Because Apple is such a large company, the move accounted for a good part of broader stock market gains through the course of the week. Up until Friday September 9th, equity markets had not seen a 1% move for 59 days. This stretch of low volatility was actually pretty remarkable considering that, on average, since 1928, markets make a 1% move about once in every 4 days. So, after a pleasant summer of low volatility, 1% moves are back with speculation that the Federal Reserve will or will not increase interest rates this year. Lower August retail sales and lower industrial production numbers were released last week and are being viewed as factors that will keep the Fed from moving rates higher this week.

Looking Ahead:

All eyes will be on the Federal Reserve this week as they hold their 2 day September meeting. Janet Yellen will make an official announcement on interest rate policy on Wednesday. Right now, the market is not expecting a rate increase and is only pricing in a 12% chance of a rate hike. The sea-saw of arguments continue surrounding Fed policy. If the Fed increases rates too early, there’s a risk that the US economy won’t be able to sustain higher borrowing costs when banks abroad are easing rates. On the other hand, keeping rates low this month may push the Fed into a corner in December where they will be forced to raise rates or scrap their long term policy which was to make two increases this year.

What’s On Our Minds:

This weekend, we got some questions about investing in real estate vs. investing in the stock market. Clearly, investing in a home can be a great decision. But we maintain that for excess capital, the stock market is the right choice for almost everyone. Here’s some point to consider when making the decision.

First, if you don’t plan on moving in the next couple of years, owning the home in which you live is usually the right decision. Rent isn’t exactly “throwing money away” like some people have said, because home ownership brings with it taxes, maintenance, and very importantly, transaction costs. But, over many years, there is great value in owning a home as a major asset.

Second, the expected return on a piece of property, on average about 3%/year, is much lower than that of the market, at about 8% a year. People who invest in property often do so because they believe they’ve found a special deal or have some special knowledge about the development of the area. That may be true- but you have to be really sure, because the direction of a development plan or even an entire city can change overnight.

When investing in property, the real advantage comes from the leverage you get from your mortgage. If you put down $40,000 on a $200,000 home, your equity after closing costs on day 1 might be $15,000. If your equity in the first year rises to $22,500 (both repayment and appreciation) that is a 50% return on equity. In the last year, though, when your equity rises from $192,500 to $200,000, that is just a 4% return. Leverage seems like magic, but one must remember- leverage also works on the downside.

Also, when it comes to investment, buying a single property carries with it a lot of risks that one doesn’t get in the stock market. A single house can get flooded, or a school district can go downhill, or myriad other problems. With a diversified stock portfolio, the only comparable risk is that the entire U.S. economy collapses, and we return to a barter system before your retirement, in which case that property investment probably wouldn’t work out either.

One final thing we stress: there has never been a period of twenty years in the market in which a diversified investor would have not gained money. Over even the worst-timed thirty year period, there is no such investment that would not have appreciated greatly. The same cannot be said for property.

Of course, this very brief overview of the ins and outs of the decision to invest in property only begins to scratch the surface. There is much more to consider. But hopefully this post can give you a broad starting point to think about where to invest your money.

Below, as an example, we see the Case-Shiller home price index (red) vs. the S&P 500’s total return (blue). While the housing bubble seemed like the best investment around in the early 2000s, we all know how that turned out. Since then, the stock market has rebounded very nicely. A $100,000 investment 15 years ago in housing would be worth $157,760 now. The same investment in the market would be worth $276,160 now.

Last Week’s Highlights:

In a short week of trading due to the Labor Day Holiday on Monday, the market was rather flat until Friday when indexes took a big turn south. By the close on Friday, the Dow Jones had sold off 2.2% to finish its worse week since January. Investors were surprised by news that the European Central Bank decided against increasing its stimulus plans. Furthering selling pressure, Boston Fed President Eric Resengren, said that persistently low interest rates have “created excesses in the financial system”. This idea that the stock market is “addicted” to low rates is nothing new but his comments had the bears out in full force on Friday.

Looking Ahead:

While market moving news was hard to come by in August, volatility has returned to equity markets with uncertainty surrounding this month’s fed interest rates decision and the upcoming Presidential election. While awaiting 3rd quarter earnings season to begin in October, investors will continue to focus on fundamental economic indicators and monetary policy at home and abroad. Fed officials are not allowed to make public statements after Monday so investors will be listening intently to their last comments before their official decision is released at their Sept. 20-21st meeting. Some more important data comes across the wire this week that will factor into the Fed’s September rate decision. Retail sales numbers will be released on Thursday and producer price index numbers will be released on Friday. Currently, fed funds futures indicate there is a 27% likelihood of a September rate hike and a 46% chance of a December hike.

What’s On Our Minds:

Last week, all eyes were on Friday’s Jobs Report released by the U.S. Bureau of Labor Statistics. Wall Street was estimating growth of 180,000 jobs in August, however, the report showed the economy added 151,000 jobs last month. As a result, investors speculated that the Federal Reserve could delay an interest rate hike when they meet in two weeks – September 20th and 21st.

Historically, the initial read on August job growth appears to be “noisy.” In this economic cycle, with an exception of last year, every August employment report has been revised higher – sometimes by more than 100,000 jobs. Growth in wages also appears to be in an upward trend as Average Hourly Earnings grew roughly 2.4% year over year, now comfortably above the average growth rate of 2.1% for the past five years. On the downside, people employed part-time for economic reasons (those looking for full-time employment but unable to find it) was essentially unchanged. Thus, the U-6 unemployment rate barely budged to 9.7% of the workforce. Included in this rate are the total unemployed, all workers marginally attached to the labor force, and those that part-time for economic reasons. In past economic cycles, this rate has trended as low as 7% to 8%, suggesting the current labor force still has room for improvement.

Consequently, the Fed faces a tough decision yet again as job and economic growth just cannot seem to switch into a higher gear. Fed Chair Yellen’s time at the September meetings could end much like Bill Murray’s character in Groundhog Day – “reliving the same day over and over.”

Last Week’s Highlights:

Last week, the main market averages rose about 0.5% on the back of the Jobs Report. The Dow Jones Industrial Average is now up 6.1% year-to-date, while the S&P 500 and Nasdaq Composite are up 6.7% and 4.8% respectively. The tech-heavy Nasdaq continues to be weighed down by Apple, which has return 2.4% this year. Apple currently represents approximately 10.6% of the Nasdaq Composite Index. The main market averages all sit just below their all-time high.

Looking Ahead:

Looking to the week ahead, the calendar is somewhat light on economic data and earnings announcement. On Wednesday, Apple is expected to present the iPhone 7 and the upgrade of the Apple Watch at an event in San Francisco. Also on Wednesday, computer manufacturer Dell and storage provider EMC are expected complete the largest technology merger to date. The markets will also gain further insight on the economy from the Federal Reserve when the Fed’s Beige Book is released. On Thursday, the European Central Bank releases their monetary policy decisions and US Consumer Credit information is reported for the month of July. On Thursday, the NFL season kicks off with a rematch of the Super Bowl as the Carolina Panthers travel west to take on the defending Super Bowl champion Denver Broncos.