What’s On Our Minds:

It’s being called the “Invisible IPO Market”. This year’s first quarter Initial Public Offering (or IPO) market was the slowest of any quarter since the financial crisis of 2009. Nervousness about the financial markets and the related volatility, combined with continued uncertainty in the energy industry, was the main reason for this slowdown in capital raising. Eight deals, raising just $700 million, were launched in this year’s first quarter, compared with 34 IPOs, raising $38 billion, in last year’s same period. All eight IPOs this year were by early-stage healthcare (namely biotech) companies, led by substantial buying of company shares by existing shareholders.

The pipeline of companies looking to raise capital is strong, but most companies looking to raise initial public capital are awaiting better (i.e. less volatile) market conditions. Companies such as Univision, Albertsons, Elevate Credit and Neiman Marcus have planned their IPOs and may perhaps launch them later this year. There are over 120 companies that have already filed an S-1, the initial registration form required by the Securities and Exchange Commission for a future IPO.

Market-watchers look to the level of IPO activity as a barometer of the market’s health: a super-active IPO market often means the market is getting “too hot.” But as we can see in our inflation, interest, and employment numbers, that doesn’t appear to be the case at this time. In the past, a large swing downward in IPO activity has accompanied a major economic slowdown (see chart, below). It is possible that IPOs will rebound or at least slowly recover from this point, but caution is warranted. In finance, we say that at the top of the market, the fool says “this time is different.” At the same time, we have to recognize that the IPO slowdown came at the same time as a market correction- maybe this time was just less bad.

Last Week’s Highlights:

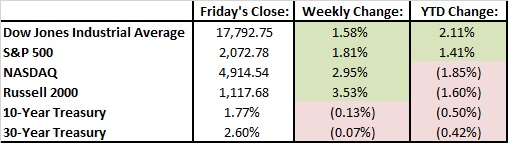

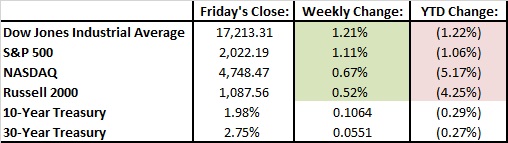

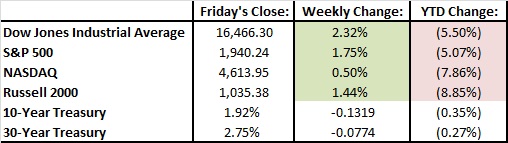

Strength continued in the equity markets, as stocks posted solid gains to close out the year’s first quarter. The Dow Jones (DJIA) rose 1.6% for the week, while the S&P 500 increased 37 points, or 1.8%. Bond prices were higher last week, pushing the U.S. 10-Year Treasury bond yield down slightly to 1.77%.

Comments by Federal Reserve Chair Janet Yellen on Tuesday helped the markets, as she indicated that the Fed should proceed cautiously with respect to future hikes in interest rates. Many investors welcomed these dovish comments, feeling that we may be in a “Goldilocks” economy: one that is not “too hot” and needing a cool-down in the form of a rate raise, but also not “too cold,” or growing too slowly.

March Madness lived up to its name, as the S&P rose 6.6% last month and approached new market highs. Stocks ended the first quarter slightly higher, following a very volatile period of double-digit losses followed by double digit gains.

Looking Ahead:

First quarter “earnings season,” when public companies report their financial results for the first three months of the year, takes off in a few weeks. As only a few companies will release their financial reports this week, investors’ focus will remain on any macroeconomic developments. Specifically, what is the Federal Reserve thinking, and how long can it continue saying the “right things” to help the stock market’s continued move up?

Minutes from the March meeting of the Federal Open Market Committee meeting will be released on Wednesday and closely examined by investors. Additionally, factory and durable goods orders, to be released Monday, will help determine if U.S. manufacturing growth, which has picked up, is sustainable.

What’s On Our Minds:

We try not to get political on this blog. But something that perhaps all of us can agree on: politicians don’t understand economics. Or at least, they say a lot of misleading things about the economy. One example in the headlines is trade protectionism: the “protect our jobs” argument. Here’s a non-partisan fact: those manufacturing jobs aren’t coming back. How can we say that? Because we can bring (and have brought) manufacturers back to the U.S., but we have become so good at automation that we don’t bring the factory workers’ jobs back with them. It’s not China taking those jobs. It’s our own technology.

What we should produce is based on our comparative advantage, as we economists call it. We have a comparative advantage in things like technology and services. The concept behind comparative advantage is simply that if each country specializes in what they are especially good at, every country is better off. This is true even if one country is better at everything. That far superior country (ours, of course) should specialize in what they’re good at making, since they can produce larger amounts of valuable stuff and trade for the rest.

But that arrangement creates problems for politicians who have voters to answer to. We might be able to import a million HDTVs a year from, say, Mexico and save ourselves $50 on each one- our consumers gain $50 million. But that comes at the expense of a factory that employs 50 people at $50,000 a year each, or $2.5 million per year. The net gains are a whopping $47.5 million a year- but the 50 factory workers who just lost their jobs are going to make a much bigger fuss to their congressman than the people who might not be able to buy a cheap TV.

We are not taking a political stance, but only hope that with a greater understanding of these concepts we might be able to better prepare for the future.

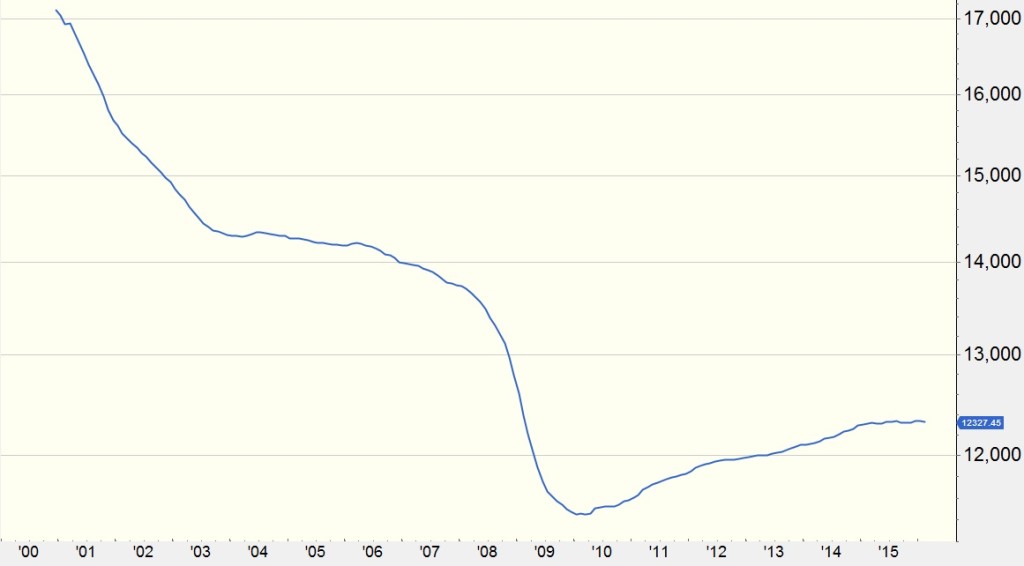

U.S. Manufacturing Jobs (thousands), as reported by ADP

Last Week’s Highlights:

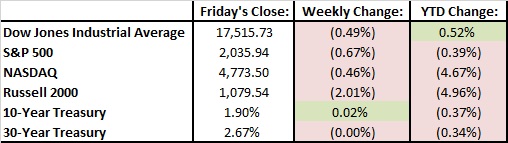

The S&P 500 and the Dow Jones fell about half a percent last week. Overall, we are still about flat for the year. The US economy continues to show signs of improvement. Oil is finally pulling back some after surging about 50% over the last few weeks (trough to peak).

Looking Ahead:

The first of April will be an important day for USA economics- we’ll see both manufacturing PMI numbers and the March jobs report. Until then, things are quiet as we await earnings season being kicked off on April 11 by Alcoa.

What’s On Our Minds:

Last week, the 50% plunge in the stock price of Canadian drug maker Valeant displayed the importance of diversification in an investor’s portfolio. In the past two years, Valeant was considered a hedge fund darling due to its unconventional business model that has produced significant growth in earnings and cash flow. Instead of spending money on research and development to develop new drugs, Valeant has acquired smaller pharmaceutical companies with mature specialty drugs. Following the closing of the acquisition, Valeant would restructure the former company’s costs and assets, raise their drug prices and by being based in Canada, utilize a lower corporate tax rate. Many investors fell in love with this business model and held positions in Valeant that amounted to over 15% of their total portfolio.

For some time, these investors looked like geniuses as the stock climbed from $50 in 2012 to $263 in July of last year. Then, in the Fall of 2015, accusations arose regarding the company inflating sales and price gouging – the stock tumbled. Next came legal investigations from customers and the regulators – the stock tumbled more. Last week, the company provided weak guidance and stated that they lacked cash to make further acquisitions, planned on spending more on compliance and reporting, and that first quarter earnings would be cut in half. As a result, the company’s stock lost $12 billion dollars – or 50% – in value.

One of the largest holders in Valeant is activist investor Bill Ackman, who runs hedge fund Pershing Square Capital Management. Prior to the company’s decline, Valeant was the largest of the fund’s nine holdings. According to the Financial Times, Ackman has now lost more than half of his client’s money since the stock peaked last July.

It pays to be diversified.

Valeant Pharmaceuticals (VRX)

Last Week’s Highlights:

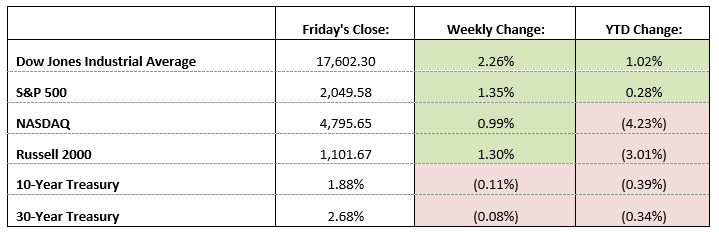

The S&P 500 rose 1.35% and the Dow Jones rose 2.26% on the week. The Federal Reserve held their March Federal Open Market Committee (FOMC) meeting and left interest rates unchanged and implied two possible rate-hikes during 2016. The markets cheered the lower-for-longer near zero interest rate policies. Increases in oil and other commodity prices also improved market sentiment.

Looking Ahead:

The week is somewhat light on economic data. The condition of US oil and gas companies will be in focus at the annual Howard Weil Energy Conference in New Orleans. On Thursday, investors will get a gauge of the industrial sector when the Flash Manufacturing PMI for March is released at 9:45 AM. Any reading above 50 implies that there was growth in the period – Wall Street is estimating a reading 50.3. The markets will be closed on Friday in observance of Good Friday as traders prepare for Easter.

Remember – don’t put all your eggs in one basket.

What’s On Our Minds:

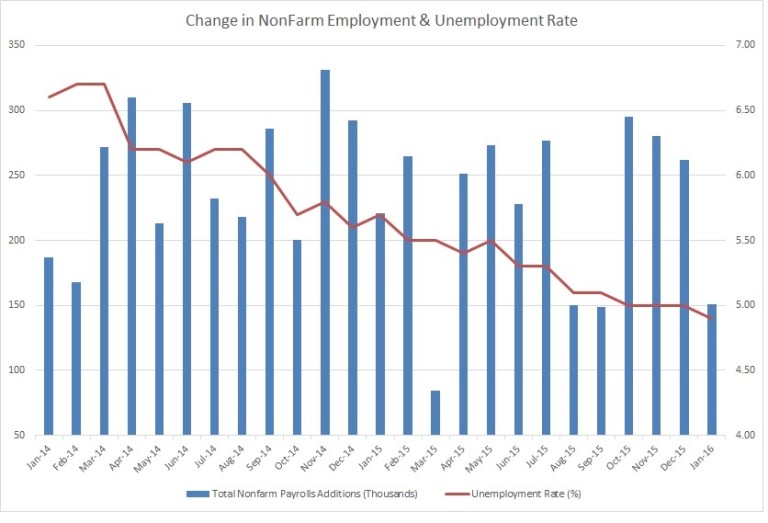

Our Investment Committee has been especially focused on recent employee figures and what they “really” mean. One of our crack analysts (who also writes for the Weekly View) prepared the below chart for the committee. It shows the timeline of a very familiar data point (in blue): Initial Claims. This figure is the number of people filing for unemployment benefits for the first time, and is widely considered to be an important leading (forward-looking) indicator of the stock market. The initial claims number shows that the number of people filing for first-time benefits is as low as it was in the late 90s.

The conclusion is not, however, “Sell everything.” We can see that between about 2005 and 2008, we were also at levels suggesting full employment. We certainly would not have wanted to be out of the market for that entire three year period

Last Week’s Highlights:

The S&P 500 was up 1.2% on better economic data and a rally in oil prices. The market has bounced off of February lows and is now down 1.2% Year to Date.

Last week we marked the seven year anniversary of the current bull market. Although it feels like investors have been beaten up over the past nine months, the bull market that began on March 6, 2009 continues: we have not seen a drop of more than 20% in the market in over seven years. We have seen two 10% corrections since last summer, but the market recovered on both occasions and the volatility presented tremendous buying opportunities. The average bull market since World War II has lasted 56 months and posted a 144% gain. In comparison, the current 84 month bull has posted a 193% gain in the S&P 500. Clearly, this bull has come a long way!

Looking Ahead:

After unexpectedly resorting to negative interest rate policy in January, the Bank of Japan will announce its updated interest rate policy on Tuesday. So far, the bank’s radical move has failed to assuage the country’s deflation and stagnation woes.

At home, investors will be watching the Federal Reserve this week as they hold their two-day policy meeting on Tuesday and Wednesday. We expect the Fed to keep another interest rate increase on hold this time around, but Janet Yellen could give an indication of future moves during her press conference on Tuesday at 2:30 PM.

On Tuesday we will get one step closer to electing our new president as Florida, Illinois, Missouri, North Carolina, and Ohio voters head to the polls in their respective primary elections.

What’s On Our Minds:

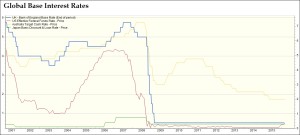

As talk about negative interest rates in Europe and Asia increases in the financial news, we’ve received more and more client inquiries asking what this means for global markets and their portfolios. After all, the financial system is built around positive interest rates, and the current overseas rate structure seems to be “upside down.” We spend a lot of time thinking about, discussing and structuring portfolios around various interest rate scenarios, whether they be positive or negative. We’ll first explain how and why rates can go negative, and then discuss the chances of negative rates entering our domestic financial system.

A negative interest rate policy means that a central bank will charge commercial banks negative interest: instead of receiving money on deposits, depositors must pay to keep their money with the bank. Central banks, specifically several in Europe and Asia, have introduced such a policy to stimulate their weak economies and increase inflation levels, which have been well below comfortable levels. By introducing negative interest rates, it is hoped that commercial banks will lend more money at very low interest rates. Doing so should entice bank customers to borrow more, spend more, and save less, thus boosting economic activity. As importantly, negative interest rates often drive down the value of a country’s currency, making its exports more affordable and competitive with overseas trade partners (which also helps economic growth). Banks must be careful, though, to avoid the specter of deflation.

While negative rates in the US are always a possibility, we think that such a scenario is highly unlikely, as the domestic economy would have to get much worse before the Fed would contemplate such a move. We are not forecasting such weakness or a related recession in the near term and therefore do not foresee negative rates in the US during this economic cycle. Moreover, introducing such a strategy would be an extreme move in the history of our country’s monetary policy. Such a move would likely have broad political implications, possibly provoking Congress to limit the powers of our country’s central bank.

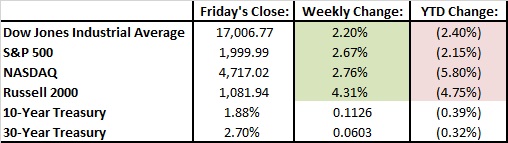

Last Week’s Highlights:

Strength continued in the equity markets, as stocks posted solid gains for the third week in a row. The Dow rose 2.2% for the week, the S&P 500 was up 2.7%, and the Nasdaq increased 2.8%. Many investors are becoming more confident in the US economy’s growth (slow growth though it is), and talk of a recession in the near term is less alarming.

Friday’s jobs report came in well above expectations, with the US economy adding 242,000 jobs in February (above economists’ 195,000 estimate). The unemployment rate remained 4.9% (as expected by the Street), and wages declined 0.1% for the month.

Looking Ahead:

Front and center for investors this week will be Thursday’s meeting of the European Central Bank (ECB), which is expected to push a key interest rate even further into negative territory. Doing so would boost its current stimulus program in order to help economic growth in the Eurozone. More volatility is expected with this week’s meeting, especially if the ECB provides less stimulus than investors are anticipating. Please read our thoughts on the negative interest environment and its impact on global markets (in the above “What’s On Our Minds” section).

There is little US economic data to be released this week, so all eyes will be on Europe.

What’s On Our Minds:

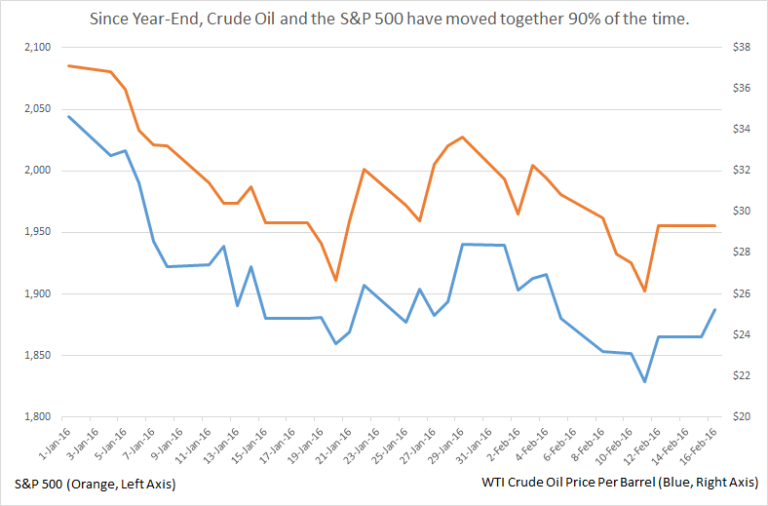

In the last two and a half weeks, the S&P 500 is up nearly 8%. This weekend, we were asked, “Does this mean that the market will go down again before it goes up more?” Our response was, “Yes, either that, or it will go up more before it goes down again.” The upward movement doesn’t seem to be because of any fundamental shift. Rather, what is improving is sentiment, the” wild card” of the market. The market recovered from its despondency that was building as a result of China worries, oil prices (fears of $20 crude), credit weakness, and more. Then, we got better US data, a rally in crude, waning China concerns, and the Fed came out against negative interest rates.

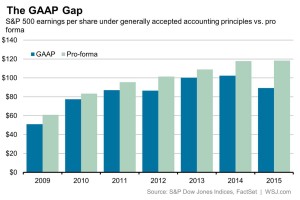

We are a bit worried, though, about pro forma (adjusted) earnings that have been reported over the last year vs. GAAP earnings (those adhering to strict accounting rules). While there can be good reason to present adjusted earnings that do not “reflect the realities of the business as a going concern,” a market-wide trend in the ballooning of these adjusted earnings is a bad sign. Adjusted numbers show that earnings grew just 0.4% last year, a very poor showing as it is. But the more-stringent GAAP numbers show a 12.7% earnings per share decrease, a number more reminiscent of 2008. Could stocks be more expensive than market participants believe them to be?

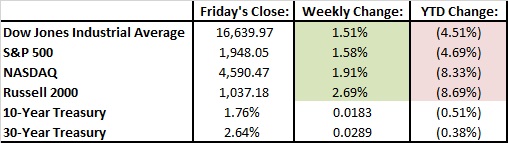

Last Week’s Highlights:

Last week was another relief, as stocks rose farther out of their earlier depths. While not as stellar as the previous week, it was still very rosy, with the Dow up 1.5%, the S&P 500 up 1.6% and the Nasdaq up 1.9%.

Looking Ahead:

Economic numbers come out this week- that is, real fundamentals. We will see the manufacturing price index PMI on Tuesday, auto sales also on Tuesday, and February US jobs on Friday. Something we will certainly be watching are the results of Super Tuesday’s primary races. We can’t make any hard calls at this point but the leaders in both parties are looking more and more inevitable…

The Baltimore Business Journal featured Tufton, and explained our vision of rebranding the company for a new era. Click here to read the article.

The Baltimore Sun featured Tufton, and briefly explaining our vision for the rebrand. Click here to read the article.

Effective February 23, Hardesty will being operating as Tufton Capital Management, LLC

Hunt Valley-based Hardesty Capital Management has rebranded and officially changed their company name to Tufton Capital Management effective immediately. The independently owned investment advisory firm is one of the largest in the region with nearly $1 billion dollars in assets for individual clients and institutions.

The firm previously known as Hardesty was founded in Baltimore, Maryland in 1995 by Jim Hardesty and Randy McMenamin. The namesake of the company, Jim Hardesty, retired from the firm in April of 2015 and passed away the following month. In explaining the name change, Chad Meyer, President of the firm remarked “The Hardesty name will always connote trust, financial acumen and a deep devotion to our clients. We feel strongly, however, that the contributions of all of our employees, and not just those of our co-founder, be reflected in our corporate name. While Jim Hardesty’s legacy and invaluable contribution to our organization will live on, we believe that a new name will best represent our entire firm as we move forward.”

The Tufton Capital Management name was selected after a thorough evaluative review and was ultimately voted on unanimously by the entire firm. The offices of Tufton Capital, a 13 person firm, overlook the beautiful Tufton Valley of northern Baltimore County. The company will celebrate their 21st anniversary this year.

Tufton Capital Management is an independently owned wealth management and investment advisory firm located in Hunt Valley, Maryland with nearly $1 billion in assets for individual clients and institutions. The 13-person firm, founded in 1995, provides a value-oriented investment approach to high net worth individuals, families and institutions.

For more information, please contact Dana Metzger Cohen or Karen Evander at Clapp Communications at 410-561-8886 or dana@clappcommunications.com or evander@clappcommunications.com.

What’s On Our Minds:

Recently, equity markets have been volatile and wild intra-day price swings have many investors on the edge of their seats. In times like these, it’s more important than ever to stick to your guns and focus on your long term portfolio. In this sort of environment, we are reminded of Ben Graham’s “Mr. Market” whose view on an individual company’s share price changes from wildly optimistic one day, to overly pessimistic the next. According to Graham, the only way to beat Mr. Market was to perform fundamental analysis on a company to determine it’s fair market value and trade shares with Mr. Market accordingly. This oversimplified version of investing rings true today.

Last Week’s Highlights:

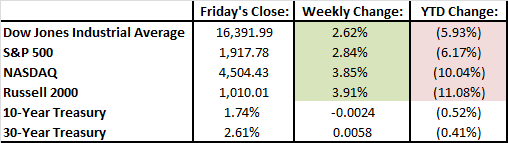

Last week was a breath of fresh air for investors as stocks rose out of correction territory. We saw the best week of the year with the Dow up 2.6%, the S&P 500 up 2.8% and the Nasdaq up 3.9%. Crude oil prices rallied last week on news that Saudi Arabia and Russia would agree to freeze production levels as long as other countries agree to participate. The Federal Reserve said that they would not change their economic outlook for the year but would keep a close eye on the global economy and developments in both the energy and stock markets.

Looking Ahead:

We will be monitoring economic and company data this week as we reach the end of 4th quarter earnings season. On Tuesday, January Existing Home Sales will be reported and J.M. Smuckers, Home Depot, and Macy’s will report earnings. On Wednesday we will see results from Target, HP, and Lowe’s followed by Campbell’s Soup, Best Buy and Kraft Heinz on Thursday. Finally, on Friday, J.C. Penney and EOG Resources will report their 4th quarter results and we will get a look at January’s consumption and personal income levels.

What’s On Our Minds:

Early Tuesday morning, it was announced that four oil producers (importantly Saudi Arabia and Russia) will “freeze” oil production levels. Though this may seem as a sign of higher oil prices, production levels for both the world’s largest producers were at an all-time high in January. However, a compromise among these producers appears to be an apparent sign of financial stress in these commodity dependent economies. If the price of oil does not stabilize or move higher, additional deals could be on the table. Furthermore, the markets have been consistently focused the price of oil as investors have increasingly been quick to sell their stock positions when the oil price declines.

Last Week’s Highlights:

Stocks rallied on Friday before the long-weekend as West Texas Intermediate crude oil had the largest daily gain since February of 2009. Nevertheless, markets were still down for the week without a clear catalyst for a global selloff. Investors cited a multitude of reasons for the market turmoil. The list included, but was not limited to Federal Reserve Chairman Janet Yellen’s observation that she was not in a hurry to raise interest rates, investors taking money out of China due to an economic slowdown, fear of slowing growth in United States, and additional in declines the price of oil. As a result of Chairman Yellan’s view for lower for longer interest rates, the financial stocks were the worst performers declining 2.4% on the week.

Looking Ahead:

This week, investors’ eyes will be on data for January housing starts and building permits on Wednesday morning. Housing starts have recently been hurt by harsh winter weather around the country. Following housing data, investors will get a gauge of the industrial sector with the release of Industrial Production. Output has been in decline since the beginning of the fall in the price of oil in mid-2014. And lastly, it will be hard to forget about South Carolina Republican Primary this weekend. This Primary is historically known for dirty politics – get your popcorn ready.

What’s On Our Minds:

Just as the Broncos and Panthers went into Super Bowl 50 with a game plan, investors are re-positioning themselves for what many expect to be a year of decelerated growth. Thus far in 2016, it appears investors are going on the defensive as consumer staples, telecom, and utility stocks have held up during sell offs. Meanwhile, financial, healthcare, consumer discretionary, and technology stocks (which largely led the market in 2015) have sold off in face of a slowdown in the global economy. Although nobody welcomes an economic slowdown, as a value-focused firm, we are reassured that our inherently defensive investment approach prepares our clients’ portfolios for this type of environment.

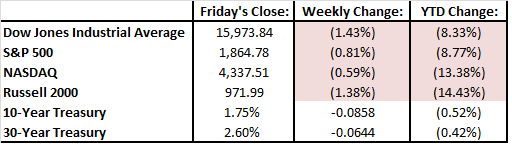

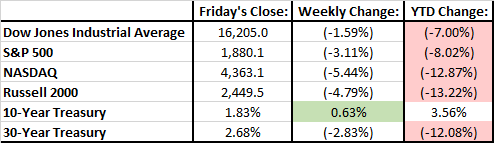

Last Week’s Highlights:

The volatility continued, with Friday capping off yet another turbulent week. Investors focused on oil, the US economy, and weakness in various industries’ corporate earnings, and there was not much good news to be delivered. The Dow Jones fell 1.6% on the week, and the S&P 500 dropped even more, closing down 3.1%. Technology shares were especially pressured, as earnings from companies such as LinkedIn (LNKD) and Tableau Software (DATA) disappointed shareholders. The tech-heavy NASDAQ finished last week down 5.4%.

Friday’s jobs report came in below expectations, with the US economy adding 151,000 jobs in January (below economists’ 190,000 estimate). While the figure was slightly disappointing, other employment data was more promising: the unemployment rate dipped to 4.9% (from 5%) and average hourly earnings increased 0.5% in January.

Looking Ahead:

While earnings season is nearing its end, we’ll see 65 more reports this week from S&P 500 companies, including Coca-Cola (KO), Disney (DIS), Time Warner (TWX) and Cisco (CSCO). Of the 315 S&P companies that have reported so far, 77% have beaten earnings estimates, while only 46% have beaten revenue expectations. For the quarter, earnings have declined by 6% and sales by 5%.

The economic calendar remains relatively light this week, although reports on retail sales, import and export prices, and consumer sentiment will be released on Friday. Comments from Fed Chair Janet Yellen will be closely monitored this week, as she’s scheduled to deliver her semi-annual testimony to Congress on Wednesday and Thursday.

What’s On Our Minds

Everyone has been talking about oil, so let’s revisit the energy markets this week. Oil is solidly above $30 a barrel- which sounds great until you remember that even sub-$50 was unthinkable not long ago. Talks and rumors abound suggesting that major oil-producing countries, if they perhaps aren’t about to enter a “grand bargain,” will at least move to stop the free fall. Additionally, some major US shale companies announced capital expenditure reductions, meaning 2016 supply should come down.

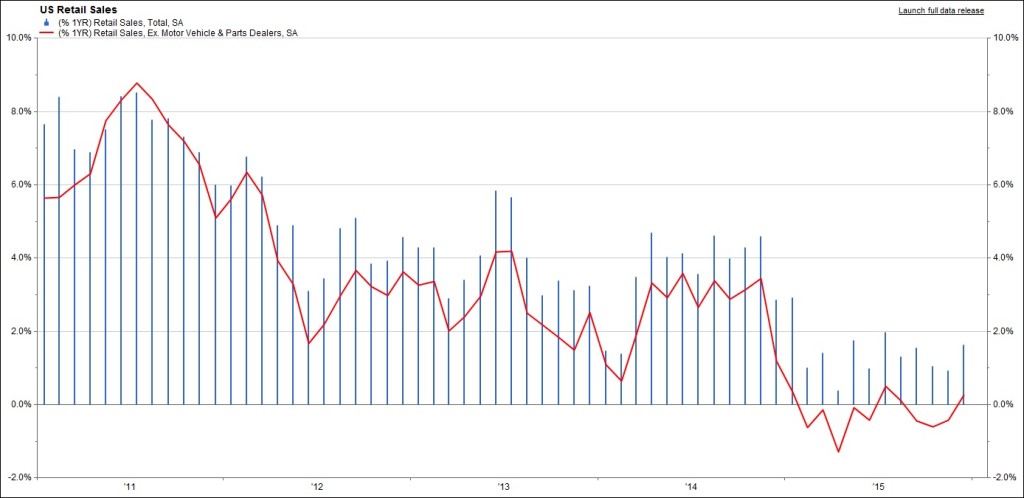

Also, what happened to the “oil dividend”? Prevailing theory is that a reduction in oil prices is like a check made out to the American consumer. Consumer demand hasn’t been awful (see chart), but it hasn’t been great, either. It seems Americans are saving their gas station discounts.

Last Week’s Highlights

Last week’s numbers were saved by a big rally Friday that turned what would’ve been a down week into a gain of 1.8%. This is the second week of gains in a row, easing some concerns, but we must not (and we certainly don’t around here) forget that we are still down 5% for the year.

Looking Ahead

On Monday morning, the Institute of Supply Management (ISM) released their manufacturing PMI for the US, coming in at 48.2 vs 48.0 last month. Any reading under 50 indicates contraction. The Purchasing Manager’s Index indicates that manufacturers are still feeling the effects of global issues here in the US. We try not to get political here, but we will all certainly be closely watching the Iowa caucus and a new president’s potential effects on the US’ business environment.

As we look back at last year’s financial market results, it appears at first blush that we had a very quiet, uneventful twelve months in the investment world. The Dow Jones Industrial Average (DJIA) increased a mere 0.2% (including dividends), while the S&P 500 eked out a 1.4% total return. But like the proverbial duck, calm on the surface but paddling like crazy underneath, there were indeed extensive market-driving global events throughout 2015 and the volatility that ensued.

Last year’s activity began with quantitative easing (QE) from the European Central Bank, followed by a spike in bond yields. As the year continued, we experienced the Greek drama, a stronger U.S. Dollar, a continued slide in commodity (namely oil) prices, and ongoing concerns over growth in China and other emerging markets. The terrible events in Paris in November and the increased threats of global terrorism continued to dominate headlines. And let’s not forget the Fed! After months of “will they or won’t they”, Federal Reserve Chair Janet Yellen and her Committee presented us in December with the first shortterm interest rate increase in almost ten years.

What do these events mean for investors as we look into the future? The volatility we are experiencing serves as a reminder: markets “climb a wall of worry” in the long term. That is, while things can and do get very choppy, investors need to hold on and stick to their long-term goals. Part of our job at Hardesty Capital Management is to guide our clients through these turbulent times, helping them to focus and not react emotionally. Back to the proverbial duck, our role is to analyze and manage the “craziness” that exists beneath the surface. Our goal is that this allows our clients to live calmer lives and focus on other, more important things.

We begin this quarter’s Hardesty Horizons with our firm’s outlook for the economy and financial markets beginning on Page 2. As you’ll read in our investment analyses throughout Hardesty Horizons, we continue to be cautious but still positive on the equity market and are forecasting a low single-digit percentage gain for stocks this year. While we anticipate a slightly positive year for equities, we foresee another year of significant volatility in getting there.

Also included in this Horizons issue is a timely discussion starting on Page 4 of the benefits of value investing over the long term. The investment professionals at Hardesty Capital Management have long subscribed to the value philosophy, seeking to purchase a dollar’s worth of assets for fifty cents. We continue to be confident that value investing will outperform growth investing over a full market cycle.

This quarter’s Hardesty Horizons analyzes one of our favorite stock ideas for the New Year: Qualcomm (QCOM). While QCOM’s business of making semiconductors might not be overly exciting to some, the company’s prospects and stock’s valuation excite us! Finally, our article on Pages 7-8 discusses the complications of transferring wealth to the next generation and how to avoid possible pitfalls.

As we enter our third decade in business, we’re as optimistic and excited as ever about the outlook for our clients and our firm. We wish all of you a very Happy New Year, and thank you again for your continued support!

A surge in the stock market over the closing two weeks of the year allowed the S&P 500 to post a positive total return of 1.4% for 2015. This meager return is more than welcome given the market’s mid-summer swoon of 10% and an increase in volatility prior to the Federal Reserve’s decision to increase short-term interest rates in December.

Although we flip the calendar to a new year, many of the headwinds buffeting the stock market persist. The U.S. Dollar remains strong, in part because Europe, China and Japan are stimulating their economies while the Fed is taking steps to limit future inflation. In turn, the strong Dollar has a pronounced negative impact on reported revenue and earnings by those U.S. companies with extensive international exposure. Further, the highly valued Dollar keeps a lid on energy and other commodity prices. Lower energy prices will reduce output in America, leading to slower economic growth in the short term. The impact of a strong Dollar and weak overseas markets can be seen in returns from the different major stock market indexes. The industrial-rich Dow Jones Industrial Average has now underperformed the S&P 500 and the NASDAQ for the fourth consecutive year.

The economic windfall provided to consumers from lower energy prices has not fully percolated through the economy. Instead, savings rates have increased. Expectations were for savings at the pump to be spent in other areas. Higher savings rates may portend a lack of confidence in our economy – a troubling development. Similarly, the popularity of Donald Trump may be a reflection of a loss in confidence and the dissatisfaction with the status quo.

Federal Reserve actions will also continue to impact the markets. We continue to believe the Fed will move slowly and deliberately. William McChesney Martin, Jr., the Chairman of the Federal Reserve from 1951 to 1970, once said that the Fed’s job is to take the punch bowl away just as the party gets going. From the depths of the recession in 2009 through the first half of 2015, average annual real gross domestic product growth in the U.S. has been just over 2%. This doesn’t exactly constitute a party. Although the first few rate hikes may remove a few hors d’oeuvres, the punch is still flowing.

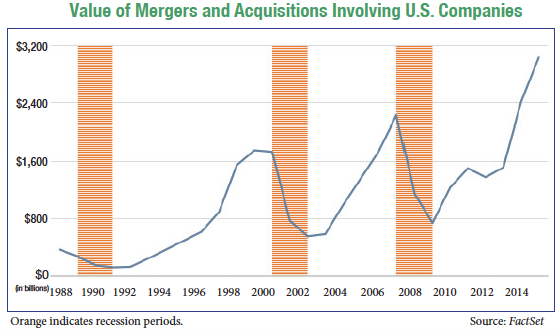

A few additional areas of concern have emerged during the course of the year. The value of merger and acquisition activity involving U.S. companies has reached $3 trillion. Prior peaks of $2.25 trillion in 2007 and $1.75 trillion in 1999 preceded recessions. The lack of organic growth has companies turning to M&A to provide the growth that investors expect.

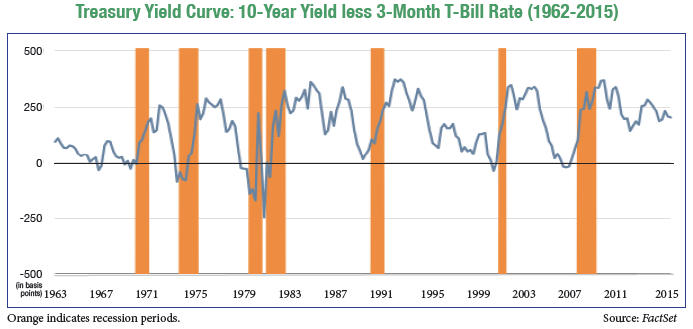

The compression of interest spreads in U.S. Treasury yields has also entered our radar screen. The Fed’s decision to begin raising short-term rates has had little impact on the 10-year Treasury. While the Fed has great sway over short-term rates, longer-term rates are controlled by the market and expectations for growth. A critical level for the spread is at the point of inversion, which occurs when the short-term rate actually exceeds the longerterm rate. The scenario is a good indication of a looming recession. We are not close to inversion yet, but the spread contraction is something we monitor very closely.

The upcoming presidential election will certainly begin to shape the investment landscape. It is difficult to handicap the race, especially for the Republican Party. However, with the left and the right pulling further apart, gridlock may be the end result. In any case, we continue to monitor the candidates and their platforms to determine the impact on your portfolios.

Not to be completely overshadowed, the economy continues to expand and the employment ranks grow. A late-year budget deal included increased government spending without raising taxes, which should boost our GDP by as much as 0.5% next year. Equity valuations are not cheap, but at the same time they are not excessively high. We anticipate below-average equity returns for 2016 with the S&P 500 delivering a total return of around 3%. We remain cautious but opportunistic in our equity investments.

The bond market has also experienced gyrations this year. Most of the action has been in the high-yield area. Many energy companies, having incurred high amounts of debt to build infrastructure to capture abundant deposits, have fallen on hard times as both oil and natural gas prices have collapsed. Bond prices have fallen and liquidity is now a concern. Investors who entered the space in a hunt for yield may precipitate further weakness as they head for the exit. Our investment-grade strategy has held up well. We own bonds for their stability and steady income. Equities are the asset class for risk-taking.

Given our outlook for modest interest rate increases, our primary concern is credit risk, not interest rate risk. Credit risk reflects the issuer’s ability to make interest and principal payments. Interest rate risk reflects price changes due to movements in interest rates. As interest rates move higher, the price of a bond with a fixed rate of return will move lower. Although interest rates are still at very low levels, we have started to extend maturities as rates have crept higher from the depths reached in 2012.

Each new year presents uncertainty and unique challenges, and 2016 will be no different. We appreciate your support and confidence as we work hard to add prosperity to your New Year.