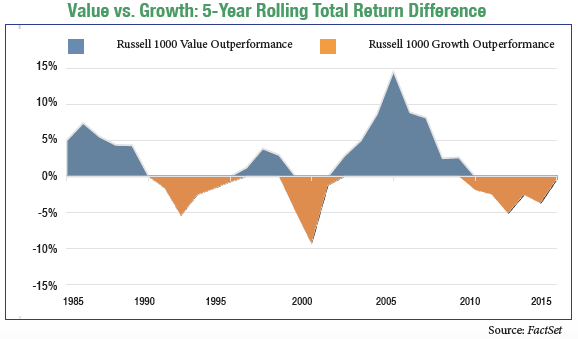

Generally speaking, there are two schools of investing: growth and value. Growth investors look to invest in companies that are normally growing their sales, earnings, and perhaps customers at a rate well above the typical company. A successful growth company firing on all cylinders and achieving the above factors often leads to the company’s stock outperforming the broader market. However, when the markets start to decline and overall growth is anticipated to slow, growth stocks frequently decline more than the market. On the other side of the spectrum lies value investing. Often, value investors are more risk-averse and first look for the downside scenario that might face a company. With the downside determined, value investors attempt to buy the company’s stock at a discount to the estimated intrinsic value. While the company’s earnings may not grow at a rate faster than or even matching the broader market, the expected downside in the company’s stock price is limited during periods of stock market volatility. As a result, value investing has proven to outperform growth investing over the long term.

The investing styles move in and out of favor depending on what investments are perceived to deliver the best returns. Since the beginning of this bull market in 2009, growth investing has been en vogue as investors have sought companies that are actually growing in a no-to-slow-growth economic environment. 2015 was no exception as Facebook, Amazon.com, Netflix, and Google were among the S&P 500’s best performers. Often known by the acronym FANG, these four companies held up the S&P 500 from further declines during the year, while the average stock in the index was down 18% from its 52-week high.

A handful of stocks leading the market is nothing new to Wall Street. In the late 1960s and early 1970s, investors were enamored with “the Nifty Fifty” which included companies such as IBM, Walt Disney, Coca-Cola & McDonalds. All came crashing down when the bear market arrived in 1974. A similar craze occurred in the late 1990s and early 2000s with several technology stocks, such as Microsoft and Intel, leading the market. Once the “tech bubble” burst, some overvalued technology stocks lost more than 80% of their value. A share purchased in Microsoft or Intel early in the 2000s would, even today, not have made an investor a single dollar.

At Tufton Capital, we practice the value investing philosophy, looking to outperform in bear markets while performing adequately in bull markets. There is no telling when the next bear market will arrive, but one thing is definite – we are currently in the second longest bull market of all time. Our style will come back into favor. Until then, we will maintain our discipline, be patient, and continue to focus on finding a dollar’s worth of assets trading for fifty cents.

We recently welcomed LaShawn Jenkins back to the Hardesty Capital team as an Account Administrator.

We recently welcomed LaShawn Jenkins back to the Hardesty Capital team as an Account Administrator.

LaShawn has over 20 years of experience working as an administrative and customer service professional. She began her career as a receptionist at Prudential Securities, followed by positions at A.G. Edwards & Sons and M&T Bank. LaShawn worked at Hardesty Capital Management from 1996 through 2001 and returned to the firm in 2015. Just prior to rejoining Hardesty, she worked as a Gift Entry Coordinator at Kennedy Krieger Institute.

LaShawn is involved in fundraising and raising awareness for the Cystic Fibrosis Foundation. She is also actively involved in fundraising efforts for the Kennedy Krieger Institute. LaShawn lives in Parkville with her daughter, Amaya.

Help your descendants help themselves by learning about these common wealth transfer problems.

Money can make even the closest family relationships turn ugly. Anticipating the emotional issues attached to wealth transfer can help you avoid them altogether or deal with them more efficiently if they do arise.

Sudden wealth syndrome

Coming into a large amount of money unexpectedly seems great from an outside perspective. However, if an heir receives this money without being adequately prepared for the responsibilities that come with it, he or she can experience something similar to what lottery winners often feel. This instant gratification is often called “sudden wealth syndrome.” Because the heir did not have to work to gain the money and/or may not have talked with his or her predecessor about the work that went into earning the money, it may result in a lack of motivation. The person may find it hard to develop skills like delayed gratification and thrift. Therefore, an heir is more likely to spend the windfall and blow through most of the inheritance. Heirs in this situation often experience frustration, feelings of failure or a false sense of entitlement. They may avoid accountability or withdraw from others, sometimes even developing serious social disorders.

How to fix it

The most important thing to remember to avoid giving your children sudden wealth syndrome is to take the time to communicate to your family the values that allowed you to accumulate your wealth. Children who understand and empathize with the struggle that their parents may have gone through to attain their wealth will feel more of an emotional attachment to this money and will be less likely to spend it all at once. If you feel that your children are not emotionally ready to handle this wealth, consider setting up trusts or placing an age restriction on when your future heirs can inherit their money. This sets up a longer time line and gives the next generation time to mature.

Leadership voids

A leadership void can occur when a family business owner dies suddenly before training the next generation. If it’s not clear who should step up to take responsibility of the business, power struggles can occur among the remaining heirs. Even if financial wealth or the entire business isn’t lost, the vision for the business often is.

How to fix it

If a business is among your assets, one of the first things your wealth transfer plan should establish is how that business will function after you are gone. Will your family continue to run the business, or will it pass through sale to a third party? If you choose to keep it within the family, you will want to set specific role designations for your future heirs. It’s important to remember that “fair” is not always “equal.” For example, if you have two children, one who has worked alongside you in the business for years and understands your business plan and ethics, and one who has shown no interest in the business and knows little about your business practices, you may not want to split the business equally between these children. When making these choices, it’s important to discuss your rationale with your family ahead of time so that your future heirs understand why they are placed in their roles and what is expected of them in those roles.

Trustee-beneficiary relationships

Difficult trustee-beneficiary relationships can occur when families adhere to the “nothing revealed until death” principle of estate planning. If trustees and beneficiaries are not kept in the loop during the planning process, the beneficiaries suddenly find themselves inheriting an unexpected amount of wealth at an already emotional time in their lives. If they haven’t talked to the grantor about the idea of a trust before the grantor’s death, they can feel as though the trustee is standing between them and what they are “rightfully entitled” to.

How to fix it

It’s important to consider who you name as trustee and why. For example, it can be common practice to name a child as a trustee. However, what if you die before your spouse and your spouse then has to ask your son or daughter for principal distributions from a trust? This can create an uncomfortable family situation. It’s important to consider the possible ramifications of who you name as trustee and whether or not they will be able to handle the difficult decisions left to them. Depending on your family situation, it may be best to name a trustee who is impartial to family dynamics.

Property squabbles

Depending on how specific you are in your wealth transfer, there may be certain items that are “up for grabs” in your estate. These items may have emotional value to one of your descendants, or may be culturally significant, such as prominent works of art. This can lead to arguments among family members over who gets to keep what, especially amongst siblings or descendants who may already be prone to fighting.

How to fix it

Depending on the personalities within your family, it might be wise to avoid leaving property division decisions to your descendants. You have the option to try to be as specific as possible in your estate planning documents, or you can name an impartial executor to divvy up your property. If you do choose to leave property division to yourself, make sure you are open and honest with your future heirs about how and why you chose to leave certain things to certain people. Also, you should avoid promising the same piece to more than one person—a tactic that some people use to try to avoid conflict in the moment. Unfortunately, this usually leads to enlarged conflict later on.

Communication is key

Even if you set up a beautifully planned wealth transfer with a variety of financial strategies and your financial planner executes it perfectly , it still has the potential to fail if you don’t have your future heirs on board. Beyond preserving your wealth, communicating money values and generational wealth transfer plans in the most open way possible can also help your children to become more knowledgeable and responsible with their finances.

This article was written by Advicent Solutions, an entity unrelated to HardestyCapital Management. The information contained in this article is not intended to be tax, investment, or legal advice, and it may not be relied on for the purpose of avoiding any tax penalties. Hardesty Capital Management does not provide tax or legal advice. You are encouraged by your tax advisor or attorney regarding specific tax issues. Copyright 2013 Advicent Solutions. All rights reserved.

What’s On Our Minds

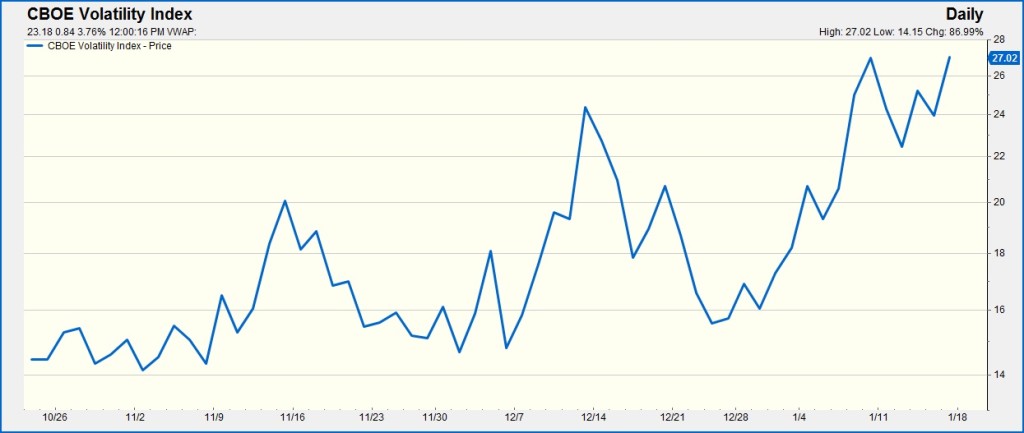

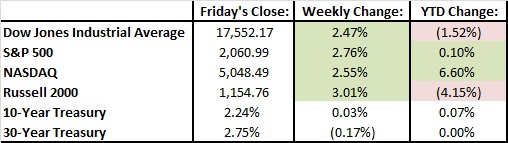

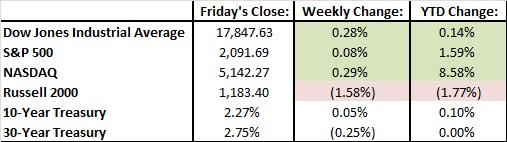

Last week, our Weekly View urged readers to “hold tight” and based on last week’s volatility, it looks like we got it right. Media pundits had many panicking last week as we saw a major sell off mid-week only to finish the week in positive territory. Yes, volatility can be very stressful for investors, but in situations like last week, we continue to stress the importance of keeping a long term view on your investment portfolio.

Last Week’s Highlights

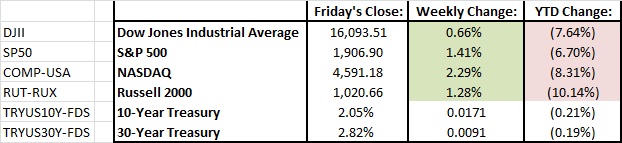

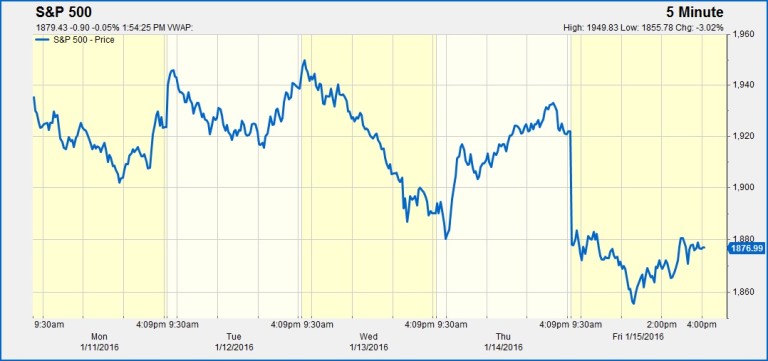

The S&P 500 closed out the week up 1.4%. The market kicked its 2016 weekly losing streak and finished in the green, but it wasn’t easy. Concerns over global economic growth continued and depressed oil prices worried investors. It was a wild week. On Wednesday, the Dow sank 1.6% on a day when oil hit $26.55 per barrel at one point, the lowest “black gold” has traded since May of 2003. By the end of trading Friday, oil rallied back to $32.16 per barrel, which helped the markets recover. As of the close Friday, the S&P 500 was still down 6.70% year to date.

Looking Ahead

The Federal Reserve will release its Federal Open Market Committee Statement on Wednesday afternoon and Fourth Quarter GDP numbers on Friday morning. This week we will also be watching fourth quarter earnings releases from notable companies such as Apple, Johnson & Johnson, Proctor & Gamble, and Microsoft.

What’s On Our Minds

Investors last week had concerns over corporate earnings and guidance as well as the further depreciation of the Chinese Yuan (implying slower economic growth from Chinese regulators). The decline in crude oil did not seem to help as WTI, the US Benchmark, fell to approximately 10.5%. Despite anxieties over global growth, there are several companies that have been beaten up year to date that will be able to grow their sales and earnings this year. Taking advantage of these opportunities, rather than locking in losses, is often the more prudent action.

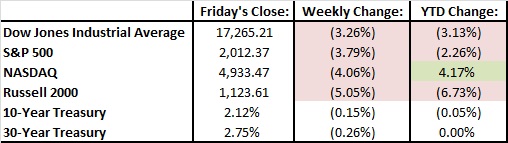

Last Week’s Highlights

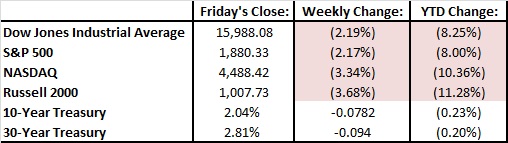

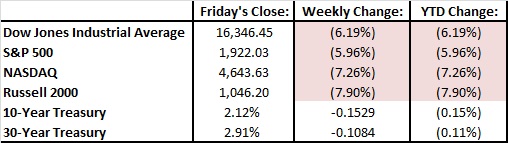

The markets had a rough second week with the Dow Jones and the S&P 500 falling 2.2%. The Dow Jones is now down 8.25% for the year and 10.7% off its all-time high while the S&P 500 is down 8% for year and off 11.8% from its all-time high. Year to date, the defensive Utility and Telecom sectors have shown to be the best performers while Materials has been hurt by concerns over global growth and lower interest rates continue to weigh on Financials.

Looking Ahead

Looking to the week ahead, the market will mostly be focusing on corporate earnings. On Tuesday, investors will get a gauge of the banking and financial sectors with earnings releases from Bank of America and Morgan Stanley. Results from the long-time technology blue chip IBM and new technology high-flier Netflix will also report after the closing bell. On Thursday, the railroads will report earnings – in addition to energy companies, this group has also suffered from the decline in crude oil as the transportation of the commodity has declined. Finally, the oldest Dow Jones component, General Electric, will give investors a view into the power, aerospace, energy, and health care sectors.

Hold on tight.

What’s On Our Minds

Last week, good news was hard to come by in the investment section of any paper and investors took it on the chin. It’s not easy seeing your holdings come down in value when the market experiences a pullback. Value investors seek opportunity in these situations, and while many investors rushed for the exits last week, our firm’s shopping list grew and we carefully continue to look to put cash positions to work for our clients. In times like these we remember Warren Buffet’s quote: “Be fearful when others are greedy and greedy when others are fearful.”

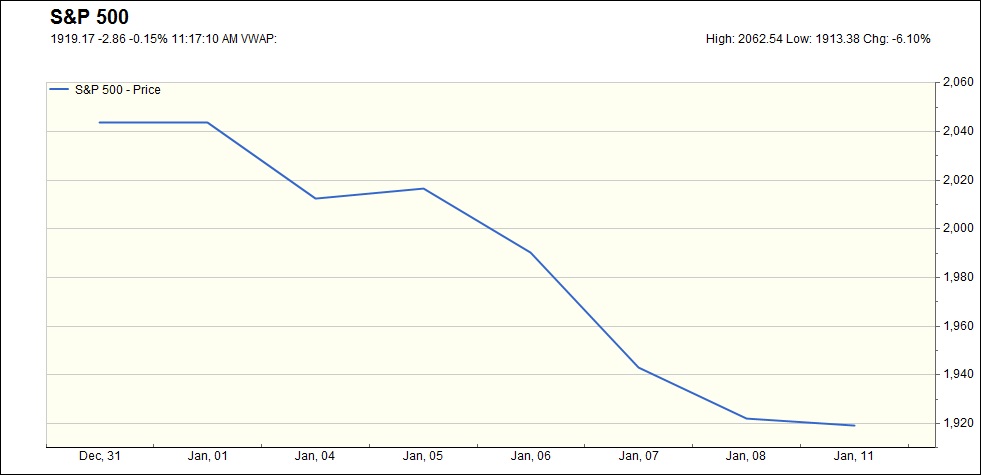

Last Week’s Highlights

On the back of plunging stock prices in China, last week was nothing short of ugly on Wall Street as we experienced the worst opening week in history. On top of China’s woes, an alleged North Korean nuclear test, lower oil prices, and tensions in the Middle East added to bearish sentiments last week. With all this negativity on the Street, the S&P finished the week down 6%. On the bright side, Friday’s U.S. jobs report numbers were higher than expected and the automotive industry closed out 2015 with record domestic sales.

Looking Ahead

China’s markets continued their slide downward Monday in the face of a slowing Chinese economy and continued currency troubles. In domestic markets, Alcoa kicks off earnings season on Monday when the company reports 4th quarter earnings following the closing bell. This week, retail sales and consumer sentiment numbers are reported which, based on last Friday’s positive job numbers, could very well confirm that the US consumer is doing well.

What’s On Our Minds

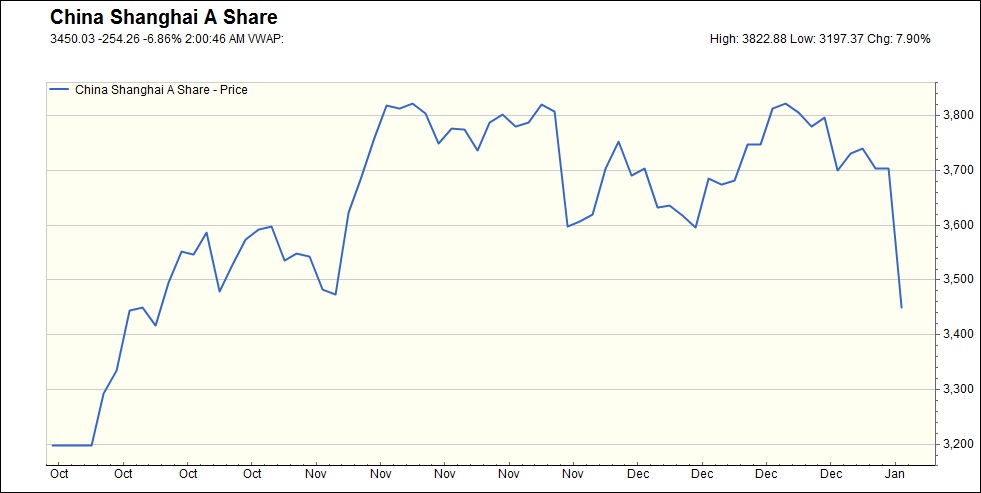

The new year started with a perhaps not-so-shocking 7% drop in the Chinese equity market. Once again, the drop in the East doesn’t seem to have to do with fundamentals so much as expectations about how the People’s Bank of China (PBOC) will juggle interest rates, foreign exchange rates, and policy. We fielded questions in the past about why the firm didn’t invest more in China and other foreign markets during their booms. This is why: countries developing their physical markets means still-developing financial markets, too.

Last Week’s Highlights

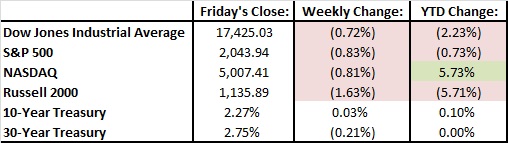

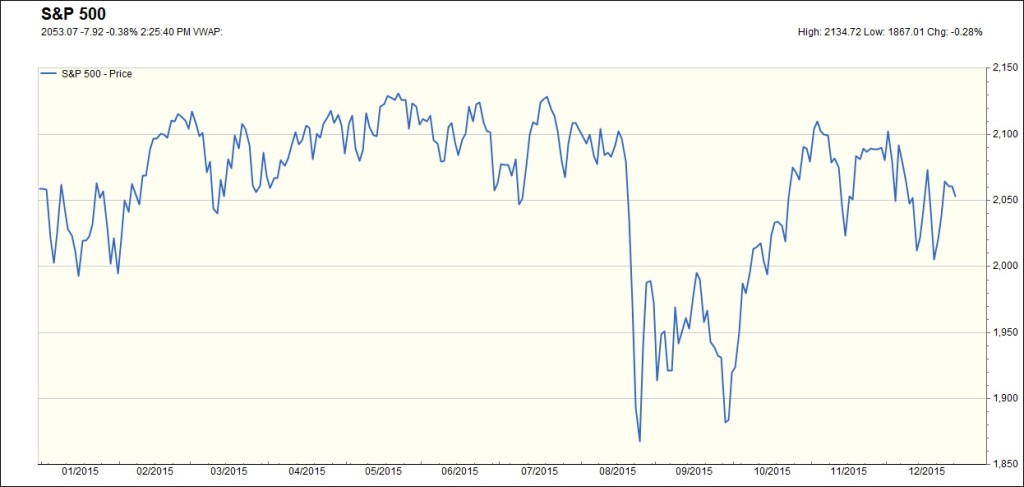

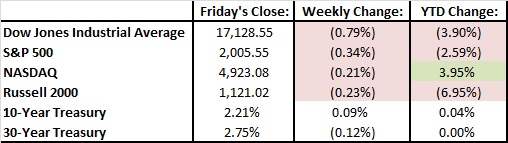

Last week was another holiday-abbreviated one that featured little in the way of news, economic or otherwise. We did get our year-end numbers (below), capping off a disappointing but not disastrous year.

Looking Ahead

On Friday, we will get the December jobs report and see how the US labor is holding up this winter. We’ll also see how the Fed thought about last month’s interest rate increase with the release of the FOMC’s minutes. However, there are likely no surprises in those minutes. Markets are still slow-moving after the holidays.

What’s On Our Minds

While investors have had a tough time in this year’s choppy (and ultimately flat) market, our firm has seen a major benefit from our bias toward owning dividend-paying stocks. We continue to focus on the long term. There are major forces acting in the markets right now that will have major effects in the new year. Some look positive, and some are not as rosy. We know that whatever plays out, our disciplined strategy will build wealth over time.

Last Week’s Highlights

Last week, stocks rose 3%. It was a quiet week of trading as markets closed for the week on Christmas Eve (Thursday) at 1 PM. Energy stocks lead the market, but still remain beaten up for the year. Many market participants hoped for more of a rally in the U.S. stock market to wrap up the year, but a combination of the strong dollar, shrinking corporate profits, slow economic growth, and depressed commodity prices continue to be a drag. Heading into last week of 2015, the S&P is up 0.1% and the Dow Jones is down 1.5%.

Looking Ahead

After a long weekend, many investors continue to look for a year-end rally but with markets trading sideways this year, a Santa Claus rally may be too little, too late. It will likely be a quiet week for US investors as there is very little economic news coming across the wire.

What’s On Our Minds

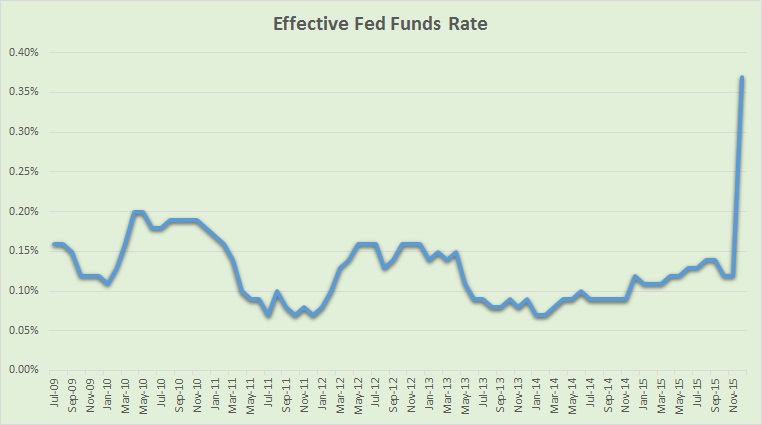

The markets had a choppy week, with the S&P 500 finishing down 0.34%. Investors kept a close eye on the Federal Reserve interest rate decision last Wednesday as well as the price of oil which continued to decline to one of the lowest levels since 2009. The Federal Reserve raised their target interest rate to 0.5%, which represented their first increase in nearly a decade. Now, creditworthy banks that are lending money that is maintained at the Federal Reserve will be charged an annual rate of 0.5% for each overnight stay as opposed the 0.07% to 0.20% range that was charged over the last six and a half years. As a result, banks will begin raising interest rates on their future and some current customers and we have already seen this occur at many financial institutions – Bank of America and Wells Fargo both raised their prime lending rate to 3.50% from 3.25%.

Looking Ahead

Looking to the week ahead, the Bureau of Economic Analysis will release their final calculation of 3rd quarter of Gross Domestic Product. The previous reading released in November estimated that the US economy grew 2% year over year. Analysts believe the economy was actually stronger than 2.0% in the 3rd quarter as tomorrow’s estimate is for growth of 2.2%.

On Wednesday, investors will be gain further insight on the American consumer with the release of data on personal income and spending for November. Growth in the month is estimated to be 0.3%, which was the same rate as last November. Though growth in economy is stronger this year, Black Friday sales were not as strong as anticipated. Black Friday sales have displayed that online spending has continued to grow as percentage of the total weekend sales with “Cyber Monday” becoming increasingly popular.

The stock market will close at 1 PM on Thursday as investors prepare for Santa. All are hoping Old Saint Nick will bring us a nice year-end market rally as we close out 2015.

Have a Happy Holiday!

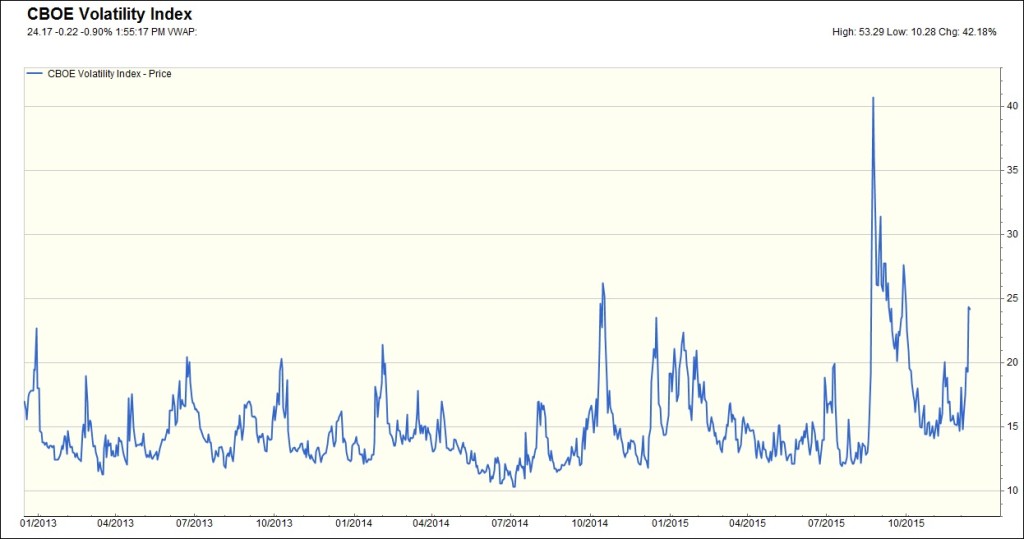

What’s On Our Minds

Understanding the stock market’s unpredictable tendencies is a challenge during the best of times. But what happens when price swings grow abnormally large? It is the stock market’s nature to be volatile over the short term. Staying informed, understanding risk tolerance, and sticking to long-term goals and planning is in our clients’ (and everyone’s, we believe) best interest.

Last Week’s Highlights:

The financial markets faced a rough week last week as participants prepare for the Federal Reserve to raise interest rates this Wednesday (12/16). The Dow finished the week down 3.3% and the S&P 500 closed out the week down 3.8%, which puts the index in the red for the year. In company news, Dupont (DD) announced it would merge with Dow Chemical (DOW). After the merger, the new company plans on splitting itself into three publicly traded companies.

The pain in the oil markets continues to play out as prices dropped significantly, with crude futures falling $4.35, or 10.9%, for the week. We also saw a major selloff in Junk bonds last week. Fears in the junk bond market were exacerbated when the Third Avenue Credit fund, which owns distressed bonds and private equity holdings, closed its doors on Wednesday.

Looking Ahead:

The long awaited Federal Reserve meeting takes place this Tuesday and Wednesday, when the Fed is widely expected to raise short term interest rates by 25 basis points. Despite recent volatility, it is unlikely that the Fed will pass up a gradual increase in rates. Janet Yellen will likely emphasize the Fed’s intent to gradually raise rates going forward.

What’s On Our Minds

Oil continues its downward slide, and is now at levels not seen since ’09. A lot of people wonder what that means at the pump: how low could gas prices get? We’ve seen a few stations with sub-$2 gas recently, but gasoline can’t get too cheap- they still have to pay to refine it and ship it to the station. Even if the cost of a barrel of West Texas Crude were $0, it would still cost almost a dollar to get it to us.

Last Week’s Highlights

Are we done talking about the Fed yet? Well, the board itself is: Fed members are about to enter their quiet period ahead of next week’s meeting. Given Chair Janet Yellen’s comments, the market has baked in a hike at this point. The stellar jobs report on Friday was the final nail in the coffin. Yellen had earlier commented that it would take a new-jobs number of around 100,000 or less to change the Fed’s views, and the report came in with a higher than expected 211,000. Add to that the fact that unemployment remained unchanged at 5%, and we are ready for liftoff.

Looking Ahead

Looking ahead, there isn’t much going on this week. There will be some Chinese economic data being released throughout the week, but none of it should be too earth-shattering.

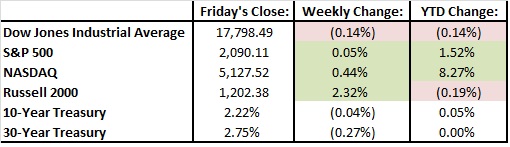

A combination of strong economic data and concerns over tensions in the Middle East left us with a flat week in the markets last week. In the short week of trading due to the Thanksgiving holiday, the S&P 500 closed on Friday at 2090.11, gaining 0.05% for the week. Stocks slid on Tuesday morning when news broke that Turkey had shot down a Russian fighter jet after it violated its airspace, but markets rebounded to finish the day as strong numbers were reported for durable goods orders and home price data. An upward revision of third quarter GDP growth also provided support to the market last week. These positive numbers helped the market to rebound towards the end of the week and demonstrate that the economy could very well be ready for a minor increase in interest rates next month. An increase in rates would be the first rise in the Fed’s official short-term rate since 2006. We saw a change in consumer habits over the Thanksgiving/Black Friday weekend. According to the National Retail Federation, more people took to their computers and smart phones than actual stores for their annual Holiday shopping sprees.

This week, Fed Chair Janet Yellen is in the spotlight. She is speaking twice this week ahead of the December Fed meeting on the 16th. While market participants will look at her comments for confirmation or denial for a rate hike, the rate liftoff seems to be all but foregone. The only thing that may derail the Fed is a truly dismal jobs report this Friday.

Abroad, OPEC has a policy meeting, at which Saudi Arabia will likely be under pressure from other members to lower output in the face of low oil prices. It’s unlikely that the Saudis will bend, however.

MARKETS IGNORE PARIS ATTACKS. POST BEST WEEK OF THE YEAR.

Believe it or not, the S&P 500 quietly posted the best week of 2015 as the index jumped 3.3%. The Dow Jones Industrial Average posted stronger results with a 3.4% gain led by better than anticipated earnings from Nike. Nevertheless, Dow Jones returns are flat for the year while S&P 500 has returned 1.5%. After shrugging off the horrifying terrorist attacks in Paris, investors seem to finally be embracing a potential interest rate hike from the Federal Reserve in December as it appears the growth of US economy could be getting stronger. Previously, any signs of ending the zero-interest rate “party” was taken as bad news as there was nervousness that higher interest rates could derail the slow economic recovery.

Looking to the week ahead, the markets will be focusing on several economic reports that will provide a further reading on the US economy as Thanksgiving approaches. Like the rest of us, Wall Street traders will be enjoying their turkeys on Thursday with the markets closed for the holiday. They will also reap the benefits of an early weekend with a shorter trading day on Friday (US markets will have the normal 9:30 AM open, but will close at 1:00 PM on 11/27).

Monday morning will provide insight into the housing market as Existing Home Sales results are released for the month of October. Wall Street estimates a seasonally adjusted rate of 5.4 million existing homes were sold last month, up 3.8% from 5.2 million in October of last year.

Eyes will also be on the Purchasing Managers’ Index (PMI) that will give a gauge of economic conditions in the private company sector. The survey follows product output, new orders, and prices for the construction, service, and retail industries. A reading of over 50 implies that there was growth in the previous month. Estimates are for a reading of 54.5.

All reports will influence the Federal Reserve’s decision on interest rates at their December 16th meeting. Until then, Have a Happy Thanksgiving!

U.S. Stocks snapped a six-week winning streak, with the S&P 500 declining 3.6% and the Dow falling 3.7% during the week. Stocks appear to be digesting the reality of a near-term interest rate increase (December 16th Fed meeting), which would be the first hike since 2006. While this move would reflect a stronger economy, it means the days of easy money won’t last forever.

Consumer discretionary stocks, specifically the retailers, had a difficult week following earnings reports from companies such as Macy’s, Nordstrom and J.C. Penney. While the warm weather has been an excuse for many department store operators, there’s no doubt that online retailers continue to take share from the bricks and mortar retailers.

Commodity prices also had a tough week, with oil falling 8% to $40.74 per barrel, contributing to a 6% slide in the overall energy sector.

Here is a look at last week’s numbers:

| Friday’s Close: | Weekly Change: | YTD Change: | |

| Dow Jones Industrial Average | 17,245.24 | (3.71%) | (3.24%) |

| S&P 500 | 2,023.04 | (3.63%) | (1.74%) |

| NASDAQ | 4,927.88 | (4.26%) | 4.05% |

| Russell 2000 | 1,146.55 | (4.43%) | (4.83%) |

| 10-Year Treasury | 2.27% | (0.06%) | 0.10% |

| 30-Year Treasury | 2.75% | (0.34%) | 0.00% |

Looking Ahead – A preview of the week of November 16, 2015:

This week will be filled with more earnings reports, largely from retailers such as Wal-Mart, Target, Home Depot and Best Buy. The coming days will also be busy with more “Fed speak”, with minutes from the October 27-28 meeting being released on Wednesday. Wall Street is now expecting the first rate hike since 2006. Fed funds futures, used by investors to place bets on central-bank policy, have risen to reflect a 70% likelihood of a rate hike in December. Wall Street is beginning to look past December and focus on rate hike #2 and its timing. The pace of tightening is beginning to become more important than the date Fed liftoff.

Commodity prices, oil in particular, will continue to be on the minds of investors this week. Energy stocks have been hit hard over the past 20 months, falling by a third since oil prices began to plunge in mid-2014.

Major earnings this week include:

Monday (11/16): Tyson Foods (TSN), Agilent Technologies (A), Urban Outfitters (URBN), JD.com (JD)

Tuesday (11/17): Dick’s Sporting Goods (DKS), Home Depot (HD), TJX (TJX), Wal-Mart (WMT)

Wednesday (11/18): Lowes (LOW), Staples (SPLS), Target (TGT), salesforce.com (CRM), NetApp (NTAP), Semtech (SMTC)

Thursday (11/19): Best Buy (BBY), J.M. Smucker (SJM), Autodesk (ADSK), The Gap (GPS), Intuit (INTU), Splunk (SPLK), Fresh Market (TFM), Workday (WDAY)

Friday (11/20): Abercrombie & Fitch (ANF), Foot Locker (FL), Hibbett Sports (HIBB)

Economic / macro reports this week include:

Monday (11/16): G20 Leaders Summit (11/15 and 11/16)

Tuesday (11/17): October CPI (consensus +0.2%) and IP #s

Wednesday (11/18): Fed minutes from 10/27-28 meeting

Thursday (11/19): ECB meeting minutes

This past Friday, all eyes and ears were turned to the Fed. That morning, the Labor Department reported 271,000 new jobs, a number much higher than expected. Of course this is great news for the markets and our economy in general. More hiring means that managers are expecting business to pick up, orders to increase, and for the health of our nation’s commerce to generally improve. We take this as a sign that business profits will improve. All good things for the market.

But what about the Fed? This much stronger than expected number is widely expected to be the signal the Fed takes to mean the economy is ready for an increase in interest rates. It almost certainly won’t be much: 0.25% or 0.5%. But what it will do is end eight years of the zero interest rate policy (ZIRP) that has defined our, and indeed the world’s, economy. It will mean recognition by the Fed that we are moving into a new economic time. It could also means a short-term dip in the market, but we are not concerned with such temporary movements.

Our nervousness about the market is assuaged by the jobs number. We continue to be positive for the long term.

Looking ahead, this week we will see how the nation’s retail sales are holding up. Last month, we saw month-over-month growth of just 0.1%, lower even than the consensus of 0.2%. A beat in this metric would underscore the need for action on interest rates.