by Chad Meyer

As the temperature finally drops, the landscape subtly shifts, and children everywhere resignedly dig out their real shoes and dust off their school uniforms, it’s difficult not to take pleasure in the perennial change that autumn brings. As anyone who has watched more seasons pass than they care to admit knows, this brand of change—the predictable kind—doesn’t really count as change at all. Instead, it represents a keeping of plans, and all the comforts that come with knowing the world is still spinning right on schedule.

Of course, in an autumn like this one, even the most optimistic among us could be forgiven for suspecting that there may be a different sort of change afoot—and that whatever “schedule” once reigned is now subject to revision with a few hours’ notice. As a glance at the evening news suggests, our country is plainly on the brink of a dramatic and unpredictable change on multiple fronts. From the hurricanes rocking our nation’s shores, to the political debates rocking our national dialogue, to the looming prospect of war with North Korea, stability appears to be a commodity that grows scarcer in America by the day.

Nor, it would seem, is the the financial sector bucking the trend. As hordes of market commentators (and, perhaps, your local cabbie) will eagerly attest, Bitcoin, Ethereum, and various other “crypto-currencies” may well be on the verge of sending dollar bills the way of the dodo bird. But even as the market’s enthusiasm for digital currency renders it the hottest asset class of the year, all the fervor has some experts crying foul. Bitcoin “is a fraud,” declared JPMorgan Chase CEO Jamie Dimon at a recent investor conference. “It’s just not a real thing.”

Finally, and perhaps most perplexingly, there’s the stock market itself, humming along nicely as the world around it rattles and shakes. In the third quarter of 2017, the Dow Jones, S&P500, and NASDAQ all rose by roughly 4% or more, with the latter index posting gains of nearly 6%. That level of performance and the low volatility that attended to it have, in some circles, given rise to the anxiety that the market is “ignoring” broader macroeconomic trends. Doesn’t the market see (so this brand of hand-wringing goes) all the change that’s lurking about?

Put simply, it does, but it also recalls that it has seen all this before. For the last two hundred years, while America has faced conflicts and crises of every ilk, at home and abroad, the U.S. stock market has quietly chugged along as one of the most reliable wealth creation vehicles in the history of mankind. And at the risk of seeming old-fashioned, we here at Tufton Capital tend to believe it’s going to keep chugging, no matter how the wind howls outside our door.

In a world that changes by the minute, we thank you for the opportunity to protect and grow your capital, and we remain honored by the trust you’ve placed in us.

by Eric Schopf

The third quarter gave us yet another solid advance in the stock market. The Standard & Poor’s 500 delivered a total return of 4.5%, and for the year in full, the broad-market benchmark has delivered 14.3%. Also keeping in line with the first half, the S&P saw little volatility in the quarter. Wanting to give us at least a little excitement, the bond market gyrated throughout the past three months. However, by September 29, intermediate- and long-term interest rates closed essentially unchanged from June 30. Short-term interest rates continued to move higher in reaction to Federal Reserve policy. And so, we march steadily upward.

The stock market’s lack of volatility is truly remarkable given the wide range of social, geopolitical, and meteorological events that punctuated the quarter. The largest setbacks in the markets occurred in mid-August, when tensions with North Korea rose. Reports from the self-isolated nation revealed that it was examining an operational plan to strike areas around the United States’ territory of Guam with medium-to-long range strategic ballistic missiles, enough to rattle any market participant. Then, a week later, it was rumored that Gary Kohn, the Director of the National Economic Council and a chief economic advisor to President Trump, was considering resignation after the President failed to blame neo-Nazis for the Charlottesville, VA violence. The resultant selloff was short-lived, though, and the stock market was within a few points of its all-time high by the end of the month. The Category 5 forces of Harvey, Irma, Jose, and Maria only fueled the market’s advance. Investors looked past the short-term effects and saw that building reconstruction and automobile replacement will more than offset the temporary slowdown in economic activity.

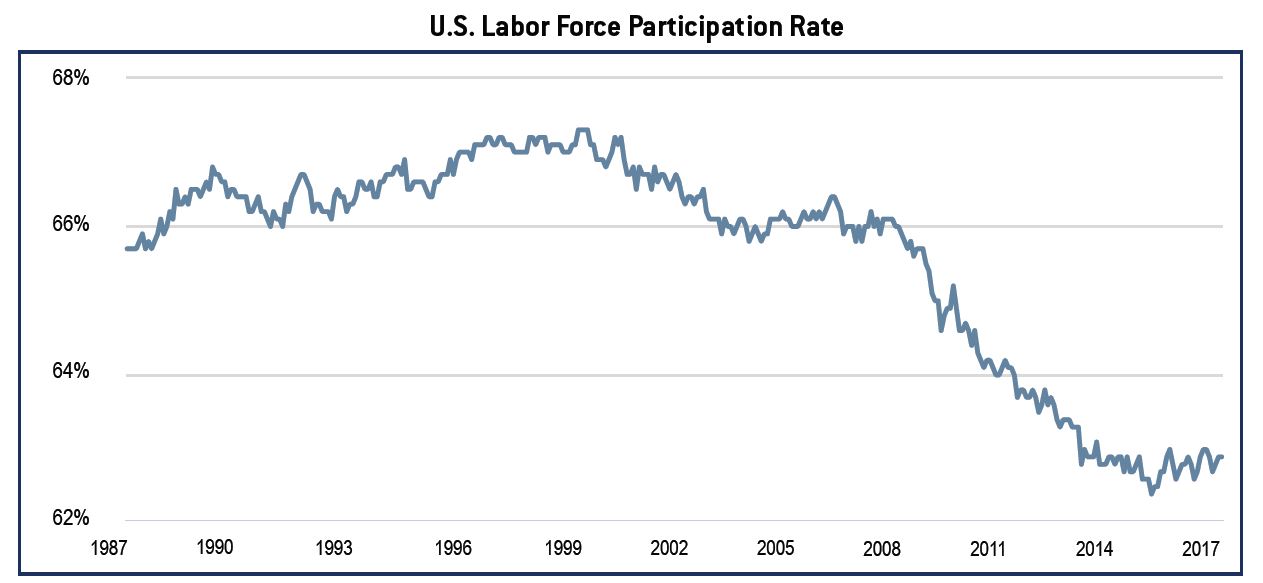

Falling in line with the squadron of ho-hum, the interest rate backdrop changed little during the quarter. Rates remain at historically low levels. The Federal Reserve did announce plans to begin winding down their $4.3 trillion bond portfolio by letting bonds mature without reinvestment. This development didn’t raise rates, though, as the pace of contraction will initially be so slow as to be almost undetectable. Inflation is also keeping rates down below the Fed’s 2% target, despite a low unemployment rate of 4.3%. Low unemployment rates belie the true state of the labor market, which is likely looser than we’d prefer, given the labor force participation rate.

Labor force participation, the ratio of payrolls to the working age population, is a clear indication that there is still slack in the work force (see chart). The broader deflationary themes of an aging population (and thus, work force), globalization, and technological innovation continue to play a significant role in the disinflationary environment. Low inflation undermines the Fed’s case for interest rate hikes. Low interest rates in turn support higher stock valuations. Thus, we seem to be stuck with low inflation, low interest rates, and a richly-valued market.

Source: FactSet

Source: FactSet

We turn now from the “boring” market to the piece of modern America that seems more turbulent than it has ever been – politics. Washington’s focus has now shifted from the Affordable Care Act to tax reform. Potential changes in the tax code have replaced the Fed as the primary influence on interest rates for the balance of the year. If these reforms were both successfully passed and meaningful, they would be a major catalyst for the equity and credit markets. The ultimate scope of reform will depend on Congress’ ability to compromise on change, something that has been rare of late to say the least. The very idea of implementing a complex reform versus a simple tax cut gives some uncertainty to any such proposal. The more variables that are added to any plan, the less certain economic growth becomes. A tax reform cannot avoid adding many unknowns.

The current tax thinking goes like this. Seeking to reshape both tax structure and the U.S.’ prosperity, the heart of reform lies in reducing corporate tax rates. Our statutory rate of 35% puts America at a competitive disadvantage with nearly all global peers. So, the plan is to reduce corporate rates to a level that makes it economically feasible to keep jobs at home. These additional jobs would lead to a greater collection of personal income taxes. If the Administration’s math is to be believed, the larger take on personal income taxes will largely offset the loss of corporate taxes. Thus, a balance is achieved, and everyone is happy.

However, there is also discussion of lowering taxes on individuals. Lowering personal taxes strains the Administration’s math, which to begin with is somewhat tenuous. Many experts do not think that the taxes from the higher spending that are supposed to come on the back of greater growth will compensate for the proposed cuts in tax rates. To help bring taxation and spending more into line, the elimination or reduction of tax deductions will be required. This is the part that requires compromise and is so difficult, since no taxpayers want to give up their deductions. Furthermore, reductions in Federal spending have been absent from the conversation.

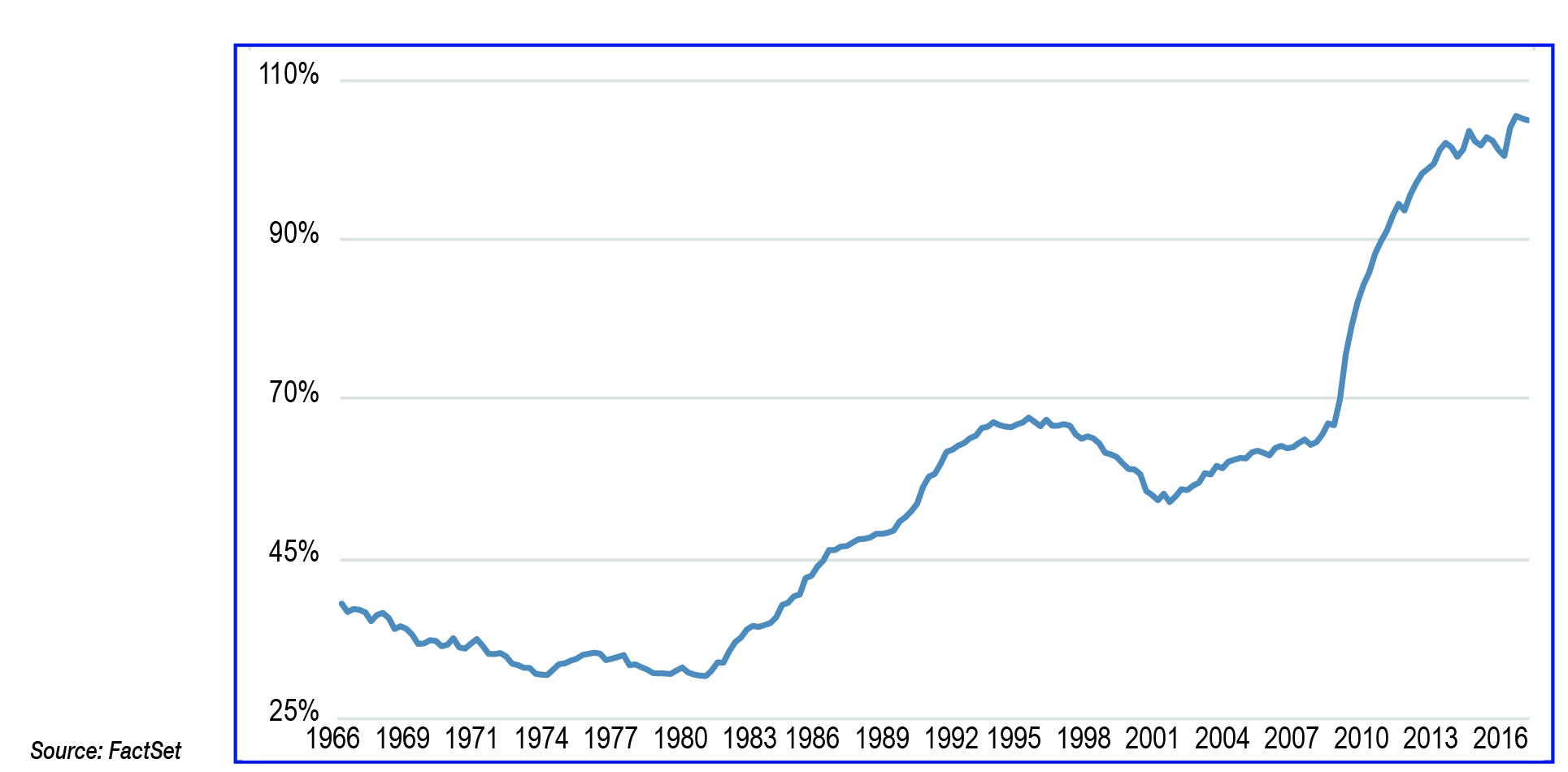

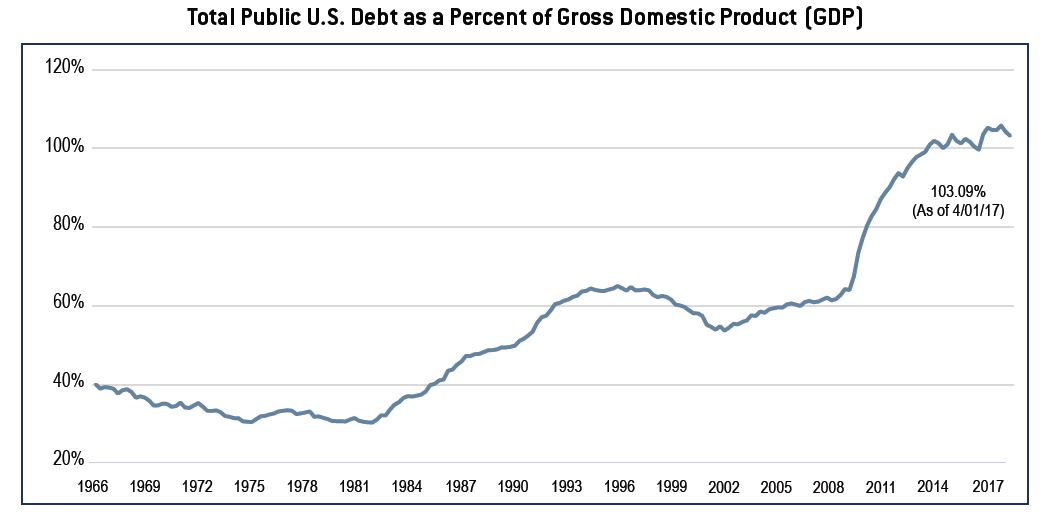

We have no doubt that the economy could benefit, at least in some small measure, from changes in the tax code or a tax cut. There is little room for error though. Should tax reform not generate the desired growth, the national debt will balloon (see chart). A greater national debt at a time when the Federal Reserve is reducing their net holdings of Treasury securities will most likely push interest rates higher. The Fed could always modify their strategy and slow the pace of balance sheet reduction. Low rates have been the catalyst for the stock market for a long time. The question is whether the economy and the stock market can support higher rates.

While Washington squabbles, the economy continues to churn upward in unimpressive but steady fashion. Annual gross domestic product growth in the range of 1.5% – 3%, par for the course since the end of the Great Recession, appears to be the new normal. However, accommodative monetary policy, gridlock in Washington, falling unemployment, and this slow but steady economic growth have provided a powerful foundation for stocks and bonds. The trends are still in place but the sands are beginning to shift.

We are at an inflection point with Fed policy. If the Fed raises interest rates, they would eventually become an economic headwind. But higher rates could also impact corporate profits in the near term, because higher rates would likely mean a stronger U.S. dollar. A stronger dollar makes corporations’ exports more expensive to foreign buyers, and thus less competitive.

Corporate profits have been aided by a dollar weakened by the Fed’s pivot to a slower monetary policy pace in 2017. Also menacing are the classic late-cycle signs throughout the markets. Stock valuations are elevated, the yield curve has flattened, and balance sheets are more levered. We remain cautiously optimistic but mindful of the environment as we work hard to grow and preserve your capital.

Source: FactSet

by Neill Peck

You may have heard this old Wall Street maxim that warns against greed and impatience, but have you followed it? Without a doubt, the stock market can be an exciting place, and it’s easy to get roped into the allure of finding the next home run or timing a trade just right. For instance, a friend at a cocktail party may tell you about the killing he made off that ABC trade, and you may think, heck, why can’t I do that? Then there’s your inner trader who may get the best of you and get you thinking that you too can perfectly time your entry and exit points. If you have ever found yourself directing trades based on your emotions or you have attempted to time the market, are you really investing for the long haul? Or are you looking to make a quick buck? At Tufton, we may even suggest that you are gambling (not investing) with your retirement savings.

Research has shown that investors are significantly better off by following the approach of “time in the market” rather than timing the market. From 1998 until 2012, CXO Advisory Group ran a study to attempt to see if 28 self-described market timers could successfully time the market. The overall results were not good. They found that market experts accurately predicted the direction of the market only 48% of the time. Only 10 of the 28 experts could accurately forecast equity returns more than 50% of the time, and not even one could outperform the S&P 500. The evidence was so conclusive that CXO decided to stop tracking the statistics entirely! Unfortunately, sales skills triumph over investment skills on Wall Street from time to time, and often the loudest pundits get most of the attention. If an investment strategy sounds too good to be true, it is.

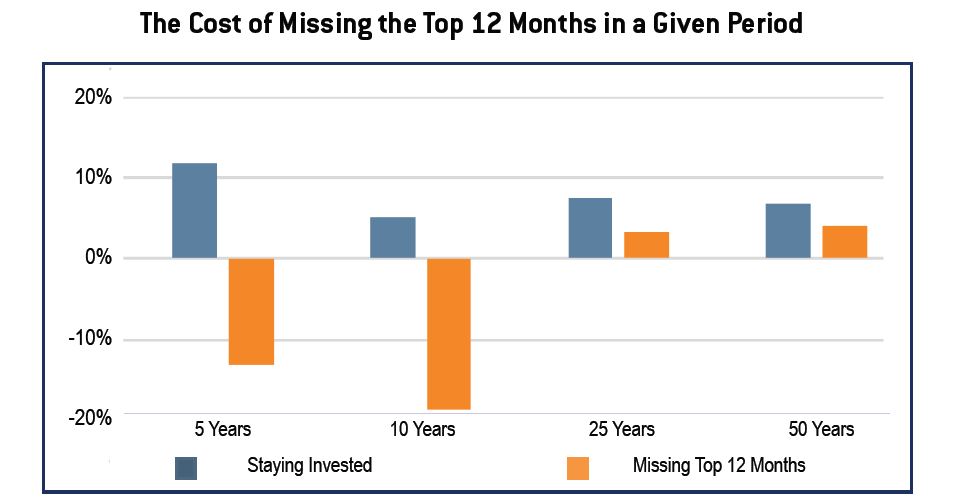

Another caveat to deter you from timing the market is that, over time, it’s possible to underperform significantly by sitting on the sidelines. Yes, it can be very costly to sit in cash. For instance, if you examine the chart below, you see that if you missed the top 12 months in the past 5, 10, 25, and 50 years, you would have underperformed the S&P 500 significantly in each scenario.

Even though a disciplined investment approach may sound like it’s old advice straight from your grandfather’s roll top desk, it’s an idea that has stood the test of time. By staying the course and grinding it out over a long period, investors avoid the worst of which can happen and will happen over the years. A disciplined approach to portfolio management keeps average investors from overreacting and hurting their long term positive return that we all need to retire well. It’s almost impossible to avoid the allure of “knocking it out of the park” with your investments. Just remember, as history has shown us, if you’re not careful, you may end up “getting slaughtered.”

by Scott Murphy

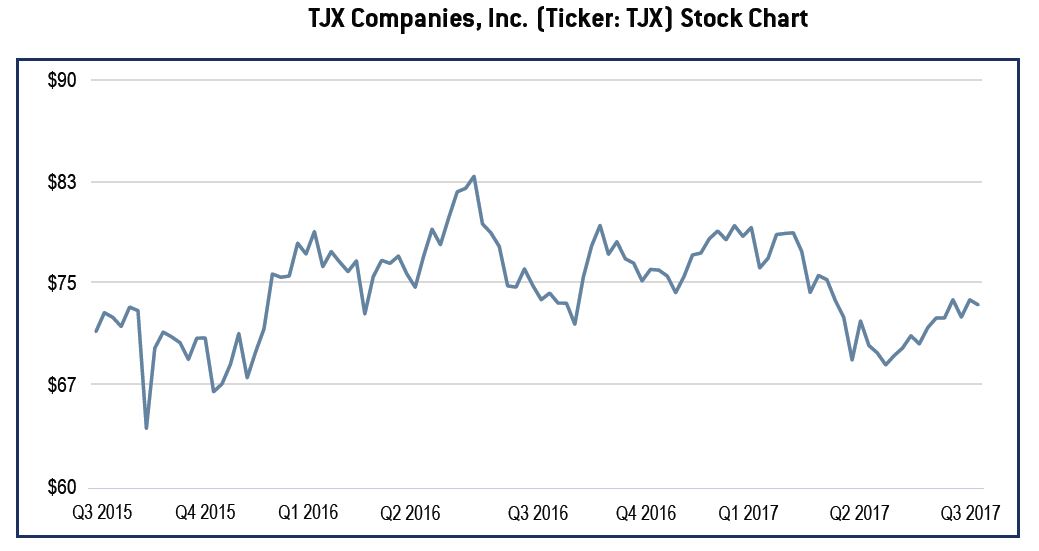

While the overall stock market has been rewarding for most investors in 2017, the same cannot be said for the retail sector. Amazon has become a “legendary and mythical beast” of sorts and has become the biggest competitive threat for every retailer, placing the stocks of traditional brick-and-mortar retailers on the sale rack. As value investors, we readily acknowledge the magnitude of change in retail but still believe there is a place in our portfolios for a traditional retailer like TJX Companies, Inc. (TJX).

TJX has a leading market position in the off-price retail market. They control 45% of the discount retail market and operate 3,800 stores under the brands TJ Maxx, Marshalls, HomeGoods, and HomeSense. In a tough and changing retail environment, TJX has been able to grow its same store sales for twenty one consecutive years. Simply put, they have proven they can grow sales and earnings through good and bad economic times. Many attribute this resilience to their customers’ “treasure hunting” experience. At TJ Maxx, customers can arrive at the store not knowing exactly what they are looking for, and end up finding something they like at an irresistible price – a “treasure.” This customer experience and incredibly low prices have largely allowed TJX to defend itself from the industry disruption caused by Amazon.

Therefore, we have begun to initiate positions in this well managed, industry leading discount retailer that has underperformed the market for two straight years. Our expectation is the market will realize they have misjudged the power of this off-price traditional retailer and will become buyers again, boosting the stock price in the process.

Source: FactSet

Source: FactSet

by Ted Hart

As mentioned in our lead article, the S&P 500 is up 14.3% this year through the third quarter. With that gain, the market has witnessed the second-longest period without a 3% pullback since 1928. If this streak continues through October, the S&P 500 will set the record for longest such period. On top of that, the average range between daily highs and lows on the index is also hitting historical bottoms. Investors are attributing this low volatility to a number of factors, some of which include passive and quantitative investing strategies. In fact, many of these approaches might be providing investors competitive returns. However, all of them ignore company fundamentals and can often push stocks higher without any regard for how a company or an industry is performing. Money has poured into these strategies in the past few years. As volatility inevitably rises, these trades should begin to unwind.

Passive investing is the most basic form of this investment trend and simply involves investing money in a stock market index, such as the S&P 500. This strategy has rewarded investors over the course of the bull market, but despite having low fees, it still has a few flaws. To maintain the proportional stock weightings of a given index, the fund or ETF provider must buy shares in stocks that have increased, and sell shares in stocks that have decreased. This can lead to overvaluation of the companies that are consistently bought (think Netflix). In addition, because of the flows to passive investment vehicles, Goldman Sachs estimates that the average stock in the S&P 500 trades on fundamental news only 77% of the time, down from 95% ten years ago. When the markets eventually turn south and investors pull their money from these indexed products, the forced selling will likely create a cascade effect as index fund suppliers are forced to sell securities to meet investor redemptions.

Risk parity is another investment strategy that often ignores company fundamentals and feeds off low volatility. Risk parity investors make investments in a company, index, or asset class based on volatility. The strategy targets a specific volatility measure and will typically be buying securities as the volatility is declining and selling securities when volatility rises above the target. Recently, risk parity strategies have pointed to holding more stocks than bonds as the volatility of stocks has significantly declined. As volatility increases, the recent trends should flip as risk parity strategies begin selling stocks and proceed to buy bonds to “pare the risk.” Many investors believe that because risk parity strategies have grown, the forced selling could create a sharp selloff in stocks – possibly creating an opportunity for the patient investor.

While these strategies continue to push stocks higher and investors likely buy every dip in the market, market liquidity is also plentiful. As a result, buyers of stocks and ETFs are not having difficulty finding sellers and vice versa – sellers of stocks and ETFs are easily finding buyers. In fact, since the Federal Reserve started tracking the data, the M2 money supply (which includes checking accounts and mutual funds) as a percentage of nominal GDP has never been higher. The elevated levels of liquidity in the markets can be the result of many factors, including the Federal Reserve’s Quantitative Easing policy and low interest rates. QE, as it is known, took the Fed’s balance sheet from just under $1 trillion in 2009 to over $4 trillion today. Also adding to liquidity are additional flows into ETFs, particularly from the retail investor.

No matter what the cause of low volatility and rising markets, we at Tufton continue to search for new investment ideas and monitor our buy prices. As one investor said, “Investments are the only business where when things go on sale, everyone runs out of the store.” Whenever that happens, we will be right at the front door.

With the fireworks long faded, and the bunting stowed away, the high holiday of summer has come and gone. But if the party is over, a question now looms large. Who’s going to tell that to the American stock market?

For all the talk of stormy seas that preceded it, the story of 2017 has turned out to be one of decidedly smooth sailing. In the first six months of the year, both the Dow Jones Industrial Average and the S&P 500 rose by 9%, more than doubling their gains over the same period last year. Over on the NASDAQ, where high-technology (and high-publicity) business models reign supreme, the good fortune rolled in even faster. Up 15% since the year began, the index is on track to turn in its best year in nearly a decade. A few weeks back, while all three indices breached or skirted all-time highs, the VIX—which measures fear in the market—approached a 20- year low. Just like those 4th of July fireworks, the year has certainly begun with a “bang.”

In a market that can be difficult to anticipate, there’s a simple pleasure to seeing spring arrive right on time. And if the April showers outside our office are any indication, it would seem that May is planning to make a colorful entrance, indeed.

Of course, encouraging though the view outside our windows may be, rest assured that your team of investment professionals remains focused on an entirely different landscape. In the first three months of 2017, as the Fed raised rates and forecasters fretted over policy, the S&P 500 rose by roughly 6%, while the Dow Jones Industrial Average rose by nearly 5%. Together, these indices contributed to the best quarter for American equities in over a year, and the best quarter for global equities in over three years.

To some, these gains signal clear skies—and good times—ahead. In a recent poll survey of C-suite sentiment, JP Morgan Chase found that over three quarters of executives expect the new administration to be a boon for business. On Wall Street, where marquee brands like Canada Goose and Snapchat are stepping out confidently into the public markets, the feeling appears to be mutual. As Goldman Sachs chief Lloyd Blankfein pithily put it in a February presentation to clients, “It feels like…it’s going to get growthier.”

Greetings from Tufton Capital, where the tinsel has been packed away, the winter weather has formally arrived, and your team of investment professionals has been busy closing the books on yet another banner year.

Of course, for many investors, “banner” may not be the first word that comes to mind at the mention of 2016. Faced with one of the most turbulent years in recent memory, an unfortunate number of market participants spent the last twelve months swinging from one bout of paralysis to the next. After all, in between British referendums, American elections, and all the other stories that kept us on our toes, how could one have possibly anticipated what tomorrow had in store?

Put simply, one could not. And regardless of what the market’s soothsayers would have you believe, that will remain the case in 2017. Perhaps, as some news outlets are quick to suggest, the broader economy will thrive under the coming administration, buoyed by the message that America is now “open for business.” Or perhaps, as other outlets have asserted—with equal volume and vigor—our new president will prove uniquely problematic, unduly influencing the market one late-night “tweet” at a time.

Short of procuring a crystal ball (which I imagine was on many a wish list this holiday season), your team here at Tufton Capital has no way of knowing which of these scenarios is more likely to unfold. But here’s what we do know: in a year marked by extraordinary surprises, this firm’s diligent, value-based investment approach comfortably outperformed both our benchmarks and the market at large. At the risk of seeming boastful, that’s no surprise to us.

Since our founding in 1995, it has been our firm’s guiding belief that a good business, bought at a fair price, is among the most powerful wealth-creation vehicles in the world. Reflecting back on 2016, I’m pleased to report that this belief continues to keep you, our valued client, in good stead. As we enter into our second year under the Tufton Capital name, we look forward to providing you with the level of service, insight, and performance you’ve come to expect—no matter what comes around the bend. From all of us at Tufton Capital, here’s to a Happy New Year for you and yours, and to our achievement of even greater success, together, in the year ahead.

Chad Meyer, CFA

President

by Eric Schopf

The stock market continued to march higher in the second quarter. A solid 4% total return in the second quarter of the year brings performance for the first half of 2017 to around 9%. On June 19, the Standard & Poor’s 500 reached an all-time high of 2,453. The Dow Jones Industrial Average and the NASDAQ markets also hit record highs during the quarter. This strong performance has been accompanied by very low volatility. For example, the stock market fell for three consecutive days just twice during the quarter. Another positive mark was that the largest one-day drop in the S&P 500 during the quarter was 1.82% on May 17, which more than recovered in the five trading days that followed. The lack of volatility in the stock market reflects the placid, stable U.S. economy. This year will mark the eighth consecutive year of economic growth falling in a tight range of 1.5% – 2.5%.

On the other side of the fence, the bond market marched to the beat of a different drum during the quarter. Short-term interest rates moved higher in reaction to Federal Reserve policy, but intermediate- and long-term rates moved significantly lower. The yield on 10-year U.S. Treasuries touched 2.14%, approaching levels that prevailed in December 2015, prior to the start of the Fed’s tightening cycle. Lower long-term rates cast doubt over anticipated future economic growth and the inflationary pressures that typically accompany such growth.

by Eric Schopf

The stock market built on year-end momentum and racked up impressive gains in the first quarter. The Standard and Poor’s 500 provided a total return of 6.07%. Optimism ran high for President Trump’s aggressive fiscal policy. Consumer confidence reached levels not experienced since 2000. The mantra of lower taxes, reduced regulation, and increased infrastructure spending was the sweetener for a powerful sugar buzz. The market’s rapid ascension was dubbed the “Trump Bump.”

The sugar high began to wear off as plans to repeal and replace the Affordable Care Act floundered. Even with control of the House and Senate, Republicans could not find common ground. Revised healthcare legislation didn’t even make it to the Floor for a vote. With that failure, suddenly the remaining tenets of the President’s platform appeared vulnerable. The Trump Bump became the Trump Slump as the stock market delivered negative returns in March.

by Eric Schopf

Donald Trump’s victory and his subsequent tweets announcing fiscal policy initiatives dominated the fourth quarter. The Standard and Poor’s 500 had posted modest gains for the year heading into the election. However, from November 8th through the close of the year, the market tacked on over 5%, bringing the year’s total return to 12%. Not bad reflecting back to mid-February when the market was down over 10%.

President Trump’s platform of fiscal stimulus has resonated with equity investors. More spending, lower tax rates, and fewer regulations are a stark contrast to the restrictive policies in place since the financial crisis. With a Republican-controlled Congress, many of the financial goals should be attainable. Early Cabinet appointees, which have included many experts from the corporate world, are proof that Mr. Trump is quite serious about achieving his goals.

The Federal Reserve has stated on many occasions that monetary policy alone wasn’t enough to revive the economy. The Fed encouraged greater fiscal action by lawmakers. Mr. Trump has delivered. The Fed’s response to more robust economic growth could be the difference between success and failure. Although the Fed did increase the Federal Funds rate by 0.25% in December, the rate hike is just the second in the past eight years. Interest rates remain low, reflecting anemic economic growth and inflation levels running consistently below the 2% target. Letting inflation run hot for a period may allow the economy to build momentum to withstand higher interest rates.

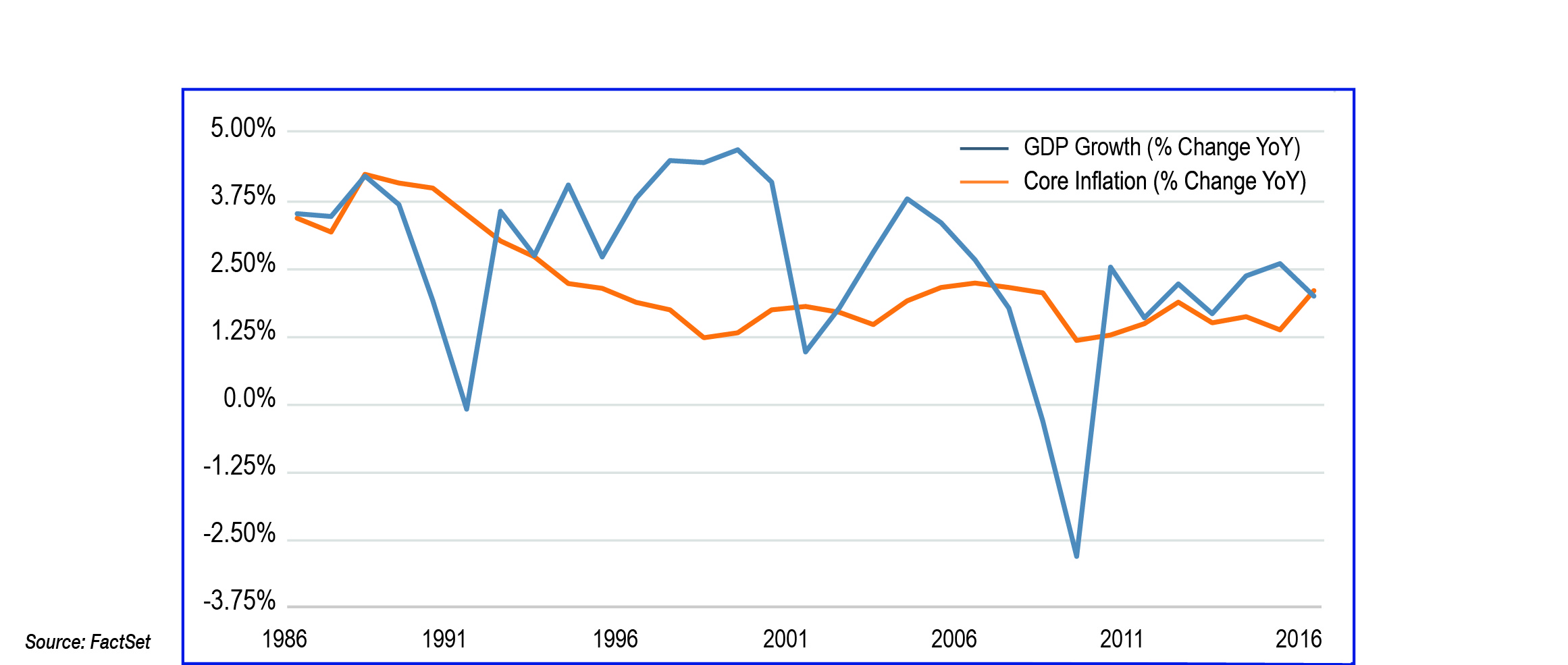

U.S. Core Inflation vs. Real GDP Growth

Future market returns will depend on two key variables. First, what incremental growth will be provided by the new policies? Second, how and when will the Federal Reserve respond to stronger growth and higher inflation? Before answering these important questions, we must first understand the limitations of lower tax revenue and greater spending. The U.S. national debt now stands at roughly $20 trillion, or 106% of gross national product. The debt/GDP ratio is at record levels (discounting periods of war). Entitlement programs, Medicare/Medicaid and Social Security, combined with defense spending, account for approximately 78% of total spending, leaving little room for financial maneuvering.

Various sources have estimated that the fiscal policy could add anywhere between 0.25% and 1.8% to economic growth. While the improvement would be welcomed, the estimates fall short of the 4% economic growth trumpeted by Mr. Trump. The U.S. has not posted a 4% annual GDP growth since 1999. However, just reaching 3% growth could provide the perfect blend of growth. This rate would likely not ignite inflation and would thus avoid the commensurate response of higher interest rates.

Interest rates have also had a dramatic move since the election. The rate on the 10-year U.S. Treasury moved from 1.78% prior to the election to 2.48% by year-end. Higher rates reflect expectations for better economic growth and the need for the Treasury to issue more debt to finance anticipated spending. Interest rates on one-month to five-year Treasury issues are at multi-year highs in anticipation of further Fed tightening. Municipal bonds did not fare well in the quarter as the prospect for lower individual tax rates reduces the appeal of tax-exempt income. Higher interest rates will come as a relief to investors who have watched yields continuously fall from the peak reached in 1981.

An improving economy coupled with an accommodative Fed can provide a powerful environment for the equity markets. Soaring consumer confidence adds a strong third rail. However, there are two potential hurdles in this rosy scenario. The first is the uncertainty surrounding U.S. trade policy. Mr. Trump has talked tough on trade, continuing his campaign theme of staunching the exodus of U.S. jobs. Intervention in current trade pacts, regardless of whether they are free or fair, may lead to retaliatory actions. Trade restrictions or other protectionist measures would have a profound impact on the economy and the fortunes of many multi-national companies. Second, the continuing strength of the U.S. Dollar presents challenges to corporate profits. Revenue and profit generated overseas is translated from foreign currency to U.S. Dollars for financial statements. Weak foreign currencies lead to fewer U.S. Dollars being reported and a possible reduction in earnings. The Mexican Peso, Canadian Dollar, Chinese Yuan, Japanese Yen, British Pound, and the Euro are all trading at multi-year lows versus the U.S. Dollar.

As we begin the New Year, we are confronted with risk and uncertainty. The strong post-election response of the stock and bond markets has quickly discounted the potential positive results of policies that aren’t even in place. However, risk and uncertainty present opportunity. We will continue to maintain our value discipline in identifying high quality investments that, in our opinion, are trading at temporarily depressed levels. We appreciate your support and confidence as we remain focused and dedicated to achieving favorable results, regardless of the market environment.

U.S. Debt as a Percentage of U.S. GDP

by Neill Peck

In 2016, the Department of Labor finalized its rule expanding its definition of “investment advice fiduciary.” The new rule, which is applicable as of April 10th, is meant to force financial advisors and brokers to give advice that is in clients’ best interests – not their own.

Believe it or not, until now, anyone giving advice (like stockbrokers or insurance salespeople) only had to meet a “suitability standard.” This low bar meant that whatever option the advisor recommended only had to be a “reasonable” option for the client. In practice, this meant that the advisor could recommend a high-fee fund (with a nice kickback to the advisor, of course) instead of a low-fee fund. The scale of the problem is significant: The White House Council of Economic Advisors estimates that these conflicts of interest lead to $17 billion in lost retirement savings every year.

The new rule greatly expands the circumstances that call for an advisor to meet a fiduciary standard. The concept of “fiduciary” has a specific legal definition that a given advisor can’t get around, and it is the highest standard of care. There is extensive case history in which courts have imposed separately-defined duties of Care, Loyalty, Good Faith, Confidentiality, Prudence, and Disclosure upon fiduciaries1. A client whose advisor meets a fiduciary standard knows that they are in good hands. The new rule can’t eliminate all bad investment advice, of course. Advisors can be careful, loyal, and honest and still be wrong. And there are still some small holes by which bad advice can be disseminated. But overall, this is definitely a step in the right direction for the industry.

The new rule might seem like a no-brainer, but it has been met with criticism from some parts of the financial industry. Predictably, the critics of the rule are those who benefit financially from the ability to receive kickbacks from 12b-1 and other fees from fund management companies. Also, there are many in the insurance business who push expensive annuity products that pay high commissions but aren’t necessarily in their clients’ best interests. To be frank, a good number of people saving for retirement have been paying too much for bad advice.

On the other side of this rule are Registered Investment Advisors (RIAs), who have always acted as legal fiduciaries. Tufton Capital falls into this category. As an RIA, our firm is not affected by the rule change. Our structure by its very nature puts our clients’ interests ahead of our own. Unlike the salesmen in our business who parade as “financial advisors,” our firm has no motive to recommend one investment product over another – other than its suitability for the client. Nor do we gain any benefit from extra or excessive trading in our clients’ accounts. Here at Tufton, our primary focus and only incentive is to grow our clients’ assets by following our investment process.

Some expect that Donald Trump will undo the new D.O.L. rule. For our firm, though, it won’t matter: we always have and always will put the client first.

1 www.law.cornell.edu/wex/fiduciary_duty

by Barbara Rishel

Bristol-Myers Squibb (Ticker: BMY) is a leading biopharmaceutical company that discovers, develops, manufactures, and distributes products worldwide. Squibb was founded in 1858 and Bristol-Myers Corporation was founded in 1887, and the two came together a hundred years later in 1989 to form BMY. Today, the company generates annual revenues of $20 billion.

BMY’s product line serves several important therapeutic areas, but most important to Bristol is its oncology business. Within oncology, investors’ hopes focus on Bristol’s drug Nivolumab, marketed as Opdivo. Opdivo works as a checkpoint inhibitor, using the patient’s own immune system to combat cancer. Immune checkpoint science has been progressing in the fight against cancer for almost twenty years, but Opdivo only received FDA approval for the treatment of melanoma in 2014, making it a cutting-edge treatment. The drug is undergoing further testing in combination with other drugs to improve outcomes and expand the addressable market.

by Ted Hart

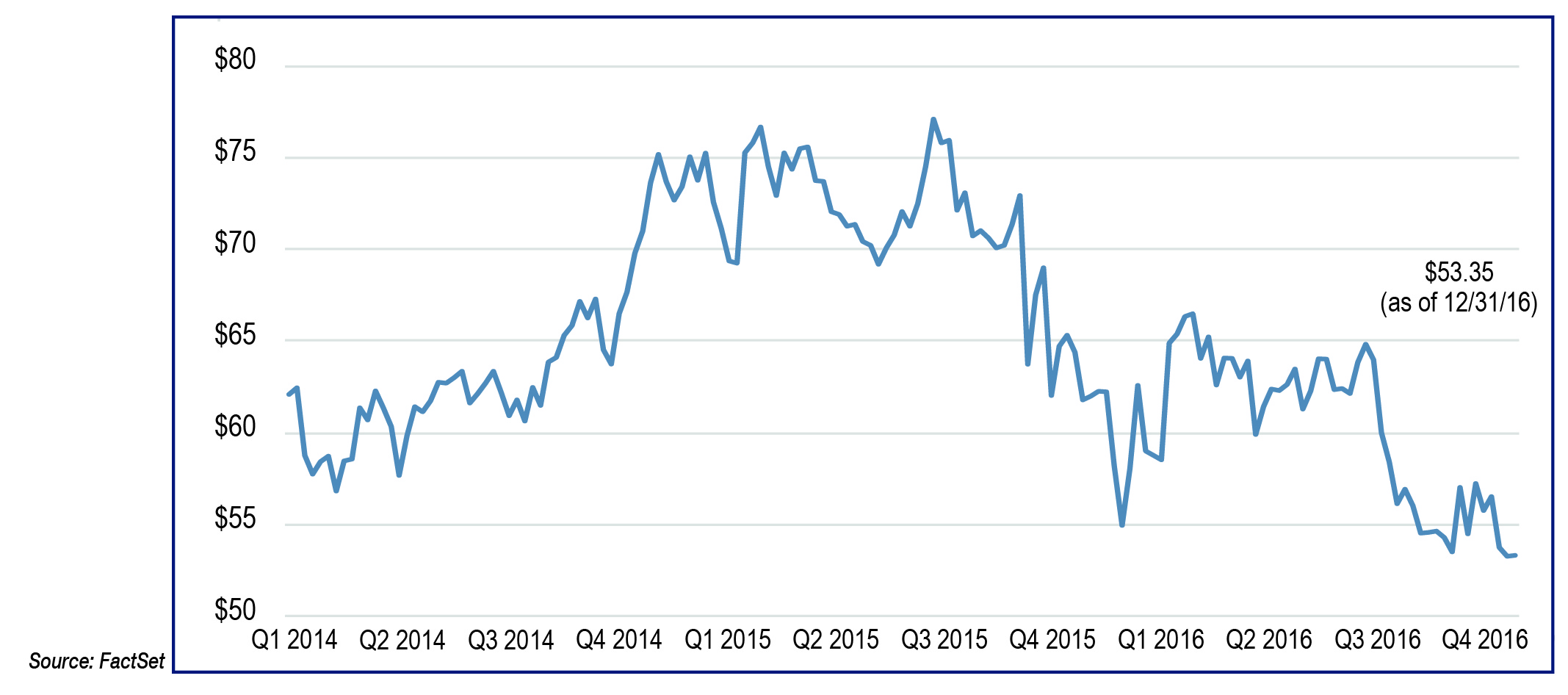

Started by John D. Rockefeller as Standard Oil in 1870, ExxonMobil (Ticker: XOM) is the world’s largest diversified petrochemical company with a market capitalization of $343 billion. The company is split into three businesses: Upstream, Downstream, and Chemical. The Upstream segment engages in the exploration and production of crude oil and natural gas. Downstream refines the oil into liquids such as gasoline and markets the finished product at your nearby gas station. Finally, the Chemical business manufactures chemicals like ethylene, which is a basic petrochemical product that is the building block for many everyday products including packaging materials, storage containers, bottles, and toys.

by Scott Murphy

VF Corp. (Ticker: VFC) is one of the largest apparel and footwear companies in the world. VF has a diverse portfolio of brands, including five with revenue exceeding $1 billion: The North Face, Vans, Timberland, Wrangler, and Lee.

The stock has underperformed the market by (16%) in 2015 and (24%) in 2016. This 40% relative underperformance to the S&P 500 should prove to be a nice entry point. It seems Wall Street is questioning VFC’s ability to maintain its prior growth. Other issues potentially causing a drag on the stock include a strong dollar, which has impacted earnings growth over the past few years, and some downgrades by Wall Street analysts.

VF Corp is a pioneer in inventory management, enabling them to partner with their customers (retail stores) to effectively and efficiently get the right assortment of products that matches consumer demand in a real-time environment. Retailers value this “just in time” inventory replenishment system since it allows them to minimize inventory costs. Internally, VF is organized into four segments: Outdoor and Action Sports, Jeanswear, Imagewear, and Sportswear/Contemporary Brands. VF derives approximately 70% of revenues from the Americas, 20% from Europe and 10% from its Asia Pacific business.

Steven Rendle will become the new CEO in the first quarter of 2017. He is currently the President of VF and his tenure with the company began when VF purchased The North Face in 2000. This was a planned transition and he is succeeding current CEO, Eric Wiseman, who will continue as the Chairman of the Board. With an improvement in earnings slated for next year due to better internal performance coupled with a reinvigorated consumer, the stock is ripe for a recovery in 2017.

VF Corp. (Ticker: VFC)