Last Week’s Highlights:

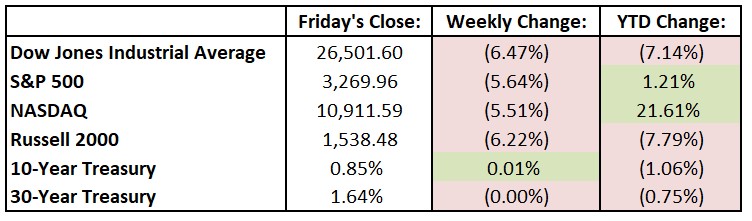

Wall Street closed out a tough week, as fear returned to the markets, fed by rising Covid-19 cases, no relief bill and the upcoming election. Third quarter earnings season continued with mixed results. On the economic front, gross domestic product (GDP) rose 7.4% in the third quarter. While this is a strong number, the result followed a 9% plunge in GDP in the previous quarter. For the week, the Dow Jones Industrial Average (DJIA) lost 1,844 points, or 6.5%, to 26,502, while the S&P 500 fell 5.6% to 327. The tech-heavy NASDAQ tanked 5.5%, closing at 10,012. Merger mania continued with numerous acquisitions and mergers announced. Chip maker Advanced Micro Devices (AMD) agreed to pay $35 billion in stock for Xilinx (XLNX). In a second chip deal, Marvell Technology Group (MRVL) announced that it would pay $10 billion for Inphi (IPHI). LVMH Moet Hennessy Louis Vuitton and Tiffany (TIF) neared an agreement on a price reduction for their contentious $16.6 deal.

Looking Ahead:

Third-quarter earnings season continues with a number of S&P 500 components releasing results this week, including Clorox (CLX), Ingersoll-Rand (IR), Mondelez International (MDLZ) and SBA Communications (SBAC) on Monday. The Institute for Supply Management announces its Manufacturing Purchasing Managers’ Index for October – consensus estimates call for a 56 reading, just above September’s print. Eaton (ETN), Emerson Electric (EMR) and McKesson (MCK) report financial results on Tuesday. Americans head to the voting booths on Election Day – the latest polls lean towards a Biden presidency, a Democratic House of Representatives and a close-call for control of the Senate. Wednesday brings earnings reports from MetLife (MET), Qualcomm (QCOM), Expedia Group (EXPE) and Public Storage (PSA). ADP releases its National Employment Report for October – economists forecast an increase of 875,000 in private-sector employment, up from September’s 749,000 increase. Thursday is the busiest day of the week for earnings reports, including results from Alibaba Group Holding (BABA), Cardinal Health (CAH), Uber Technologies (UBER), Zoetis (ZTS), and many more. The Federal Open Market Committee (FOMC) announces its monetary-policy decision – the central bank is expected to keep the federal-funds rate near zero until at least 2023 to boost the economy. American International Group (AIG), CVS Health (CVS) and Marriott International (MAR) release financials on Friday.

All of us at Tufton Capital wish you a safe and healthy week.

Last Week’s Highlights:

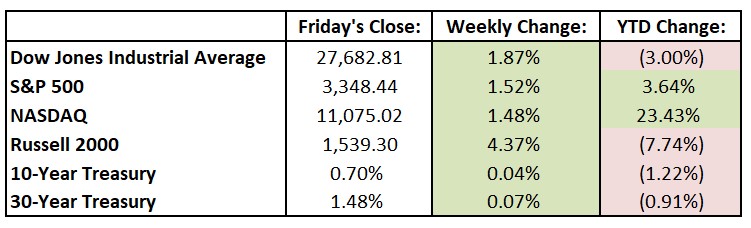

Wall Street brushed off the uncertainties around the economic recovery and finished the week higher on optimism that Congress will reach a deal on the next coronavirus-relief bill. Continued merger activity drove stocks higher much of the week before finishing lower on Friday in the wake of the president’s positive Covid-19 test. On the economic front, the U.S. economy added 661,000 jobs in September (about 200,000 short of projections), marking a slowdown in the pace of job gains. The unemployment rate, however, came in better than expected at 7.9% last month, down from 8.4%. For the week, the Dow Jones Industrial Average (DJIA) rose 509 points, or 1.9%, to 27,683, while the S&P 500 gained 1.5% to 3348, ending four-week losing streaks. The NASDAQ advanced 1.5%, closing at 11,075.

Looking Ahead:

Cisco Systems (CSCO) and Nvidia (NVDA) report quarterly earnings results on Monday. The Institute for Supply Management releases its Services Purchasing Managers’ Index for September – economists forecast a 56.1 reading, slightly below the August print. Levi Strauss (LEVI) and Paychex, Inc. (PAYX) release financials on Tuesday, and the Census Bureau announces the trade deficit for August – expectations are for a $66.6 billion trade deficit, in-line with the July data. Federal Reserve Chairman Jerome Powell gives the keynote address at the 62nd annual National Association for Business Economics meeting, which will be held virtually. Wednesday brings earnings reports from Lamb Weston Holdings (LW), and Costco Wholesale (COST) reports September sales data. The Federal Open Market Committee releases minutes from its monetary policy meeting in mid-September. Analog Devices (ADI) and Maxim Integrated Products (MXIM) hold shareholder meetings Thursday to seek approval for their proposed merger, first announced in July. The Department of Labor releases initial jobless claims for the week ending October 3rd – weekly jobless claims averaged 867,250 in September, the lowest level since February. Duke Energy (DUK) hosts a virtual ESG Investor Day on Friday.

All of us at Tufton Capital wish you a safe and healthy week.

Last Week’s Highlights:

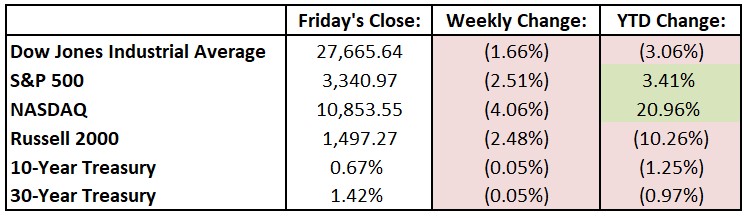

Wall Street closed out its worst week since June with another volatile trading day on Friday, as big technology stocks continued to weaken after their huge gains in recent months. Shares of Apple (AAPL), Facebook (FB), Microsoft (MSFT) and Alphabet (GOOG) fell 4% or more last week, weighing on the broader market. The swings in tech stocks have been especially alarming because of their outsize influence on the stock market’s gains this year. The market’s climb over the summer was largely fueled by a handful of tech companies that are expected to benefit from the stay-at-home economy created by the coronavirus pandemic. For the week, the Dow Jones declined 468 points, or 1.7%, to 27,666, while the S&P 500 fell 2.5% to 3341. The NASDAQ lost 4.1%, closing at 10,854. Oil prices fell to their lowest level since June.

Looking Ahead:

Most S&P 500 components are done with their Q2 earnings releases, so the week ahead will be especially focused on economic data rather than company-specific results. Lennar (LEN) reports quarterly earnings results on Monday, and Pfizer (PFE) hosts a two-day virtual investor day to discuss its pipeline of drugs. Adobe (ADBE) and FedEx (FDX) release financials on Tuesday. The Bureau of Labor Statistics (BLS) reports export and import prices for August – economists forecast a 0.4% month-over-month rise in export prices, compared with a 0.8% gain in July. On Wednesday, The Federal Open Market Committee (FOMC) announces its monetary-policy decision – the Committee is expected to stand pat with interest rates near zero. Thursday brings the Department of Labor’s report of initial jobless claims for the week ending on September 12th – weekly jobless claims remain elevated historically but have fallen from an average of 1.5 million in June to 992,250 in August. The University of Michigan releases its Consumer Sentiment Index for September on Friday – expectations call for a 75.5 reading, slightly ahead of August’s 74.1 print.

All of us at Tufton Capital wish you a safe and healthy week.

Last Week’s Highlights:

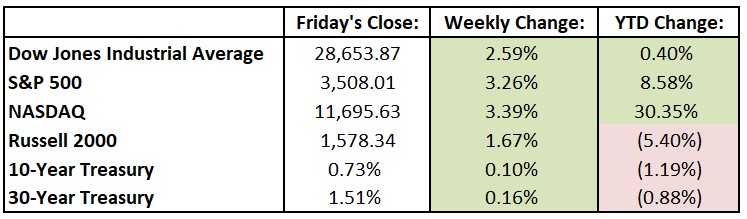

U.S. equity markets finished higher last week and are on track for the best August performance since 1984. The Dow Jones Industrial Average (DJIA) announced a shake-up to its components, swapping out Exxon Mobil (XOM), Raytheon Technologies (RTX) and Pfizer (PFE) for Salesforce.com (CRM), Amgen (AMGN) and Honeywell (HON). This comes after Apple’s (AAPL) 4-for-1 stock split, which reduces the index’s exposure to information technology. Federal Reserve Chairman Jerome Powell led off a virtual economic summit in Jackson Hole and presented a change in the Fed’s policy on inflation, a move that could possibly lead to an extended period of low interest rates. For the week, the Dow Jones rallied 723.54 points, or 2.6%, to 28,653.87, while the S&P 500 rose 3.3% to 3508.01. The NASDAQ gained 3.4%, closing at 11,695.63. The S&P is up nearly 52% since the bear market bottom on March 23rd and has risen over 8% for the year.

Looking Ahead:

Zoom Video Communications (ZM) reports quarterly results on Monday – the company has been a beneficiary of the work-at-home movement, and continued solid results are expected by Street analysts. H&R Block (HRB) announces financial results on Tuesday. The Census Bureau releases construction spending data for July – expectations are for a 1% monthly gain in construction spending, to a seasonally adjusted annual rate of $1.36 trillion. Wednesday brings earnings releases from Five Below (FIVE) and Brown-Forman (BF). ADP announces its National Employment Report for August – total non-farm private sector employment is expected to rise by 1.1 million after adding 167,000 jobs in July. Broadcom (AVGO), Campbell Soup (CPB) and DocuSign (DOCU) announce financial results on Thursday. The Institute for Supply Management reports its Services Purchasing Managers’ Index for August – economists call for a 57.8 reading, in-line with the previous two months’ data. The Bureau of Labor Statistics (BLS) releases the jobs report for August on Friday – estimates call for the economy to add 1.5 million nonfarm jobs, following a 1.76 million rise in July.

All of us at Tufton Capital wish you a safe and healthy week.

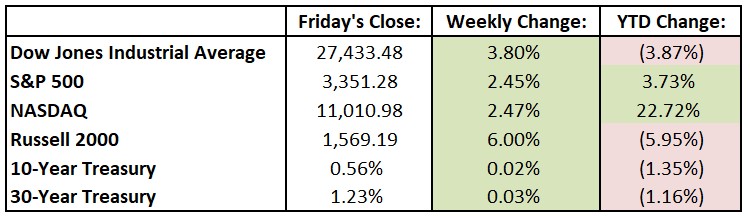

Last Week’s Highlights:

U.S. equities were higher last week across various indexes, as stocks were helped by encouraging employment numbers. Nonfarm payroll employment climbed by a stronger-than-expected 1.8 million in July. That was lower, however, than the 4.8 million and 2.7 million totals for June and May, respectively. Earning season continued with 82% of S&P components exceeding analyst forecasts so far this quarter, well above the 71% average during the past four quarters. Corporate America has held up better than many expectations according to these relatively upbeat results. For the week, the Dow Jones Industrial Average (DJIA) rallied 1,005.16 points, or 3.8%, to 27,433.48, while the S&P 500 rose 2.5% to 3351.28. The NASDAQ gained 2.5%, closing at 11,010.

Looking Ahead:

Second-quarter earnings season continues as a number of S&P 500 components release results this week beginning with Duke Energy (DUK), Marriott International (MAR) and Simon Property Group (SPG) on Monday. The Bureau of Labor Statistics (BLS) reports its Job Openings and Labor Turnover Survey for June – economists call for 5.1 million job openings on the last business day of June, down from 5.4 million in May. Sysco (SYY) announces financial results on Tuesday. The BLS releases the producer price index (PPI) for July, which is expected to rise 0.2% month over month after falling 0.2% in June. Wednesday brings earnings releases from Cisco Systems (CSCO) and Lyft (LYFT). The BLS releases the consumer price (CPI) data for July – consensus estimates call for a 0.7% rise from last year’s number. Applied Materials (AMAT), Baidu (BIDU) and Brookfield Asset Management (BAM) report financials on Thursday. On Friday, the Census Bureau announces retail sales data for July – economists forecast a 2% monthly rise in retail sales.

All of us at Tufton Capital wish you a safe and healthy week.

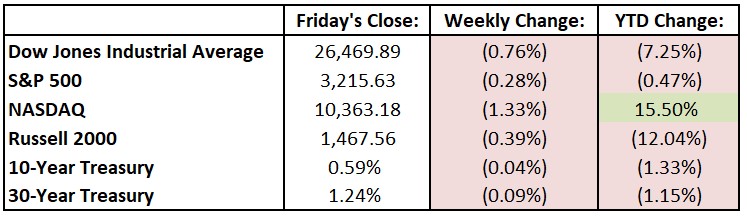

Last Week’s Highlights:

U.S. equities declined modestly last week, while long-term bond yields approached record lows. The S&P 500 turned positive for 2020 briefly before pulling back on escalating concerns over U.S/Chinese trade tensions. Initial jobless claims increased last week (to 1.4 million) for the first time since March, raising worries that the economic recovery may be starting to stall. For the week, the Dow Jones Industrial Average (DJIA) slipped 202.06 points, or 0.8%, to 26,469.89, while the S&P 500 declined 0.3% to 3215.63. The NASDAQ fell 1.3%, closing at 10,363.18.

Looking Ahead:

We’re in the thick of second-quarter earnings season, as many S&P 500 components release results this week beginning with F5 Networks (FFIV), Hasbro (HAS) and SAP (SAP) on Monday. The Census Bureau reports the Durable Goods number for June – expectations call for a 5.5% rise in new orders for durable manufactured goods, to $205 billion, after a 15.7% jump in May. Tuesday is packed with earnings as we’ll see financial results from 3M (MMM), Advanced Micro Devices (AMD), Altria Group (MO), Mondelez International (MDLZ), Raytheon Technologies (RTX) and others. The Conference Board releases its Consumer Confidence Index for June – economists look for a 95.5 reading, slightly below May’s 98.1 print. Wednesday brings earnings from Boeing (BA), Crown Castle International (CCI), General Electric (GE), Qualcomm (QCOM), among others. Alphabet (GOOG), Amazon.com (AMZN), Apple (AAPL), Ford Motor (F) and Procter & Gamble (PG) are among many companies releasing second-quarter financial results on Thursday. The Bureau of Economic Analysis reports gross domestic product (GDP) for the second quarter – consensus estimates call for a decline of 34% after a 5% decline in the first quarter. The business week ends with earnings reports from AbbVie (ABBV), Caterpillar (CAT), Chevron (CVX) and Exxon Mobil (XOM) on Friday. The Institute for Supply Management reports its Chicago Purchasing Manager Index for July – economists look for a 42 reading, above June’s 36.6 print but still below the expansionary level of 50, which the index hasn’t surpassed since last summer.

All of us at Tufton Capital wish you a safe and healthy week.

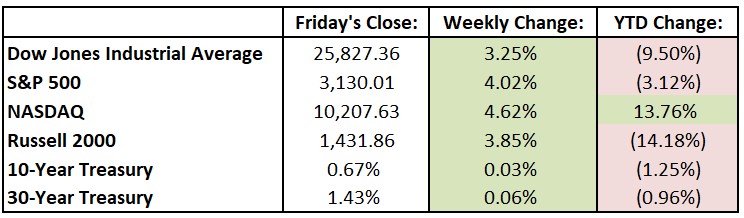

Last Week’s Highlights:

U.S. equities finished higher, capping the shortened July 4th holiday week. The second quarter came to a close on Tuesday with stocks all-but reversing the pandemic-related weakness experienced earlier in the year. The Dow Jones Industrial Average (DJIA) had its best quarter on record since 1987, closing up 17.8% in Q2. For the week, the DJIA rallied 811.81 points to 25,827.36, while the S&P 500 rose 4.0% to 3130.01. The tech-heavy NASDAQ increased 4.6%, closing at 10,207.63, an all-time high.

Looking Ahead:

The Institute for Supply Management releases its Non-Manufacturing Purchasing Managers’ Index for June on Monday – economists forecast a 54.5 reading, a return above the expansionary level of 50 after two months below it. Levi Strauss (LEVI) and Paychex (PAYX) report quarterly results on Tuesday. The Bureau of Labor Statistics announces its Job Openings and Labor Turnover Survey for May – estimates call for 4.9 million job openings on the last business day of May, down from five million in April. Wednesday brings earnings results from Bed Bath & Beyond (BBBY) and MSC Industrial Direct (MSM). Costco Wholesale (COST) releases sales results for June. The Federal Reserve reports consumer credit data for May – forecasters expect outstanding consumer credit to decline for a third month in a row. Walgreens Boots Alliance (WBA) reports fiscal third-quarter results on Thursday. On Friday, the Bureau of Labor Statistics releases its producer price index (PPI) for June – estimates call for a 0.4% monthly gain, which would match May’s increase.

All of us at Tufton Capital wish you a safe and healthy week.

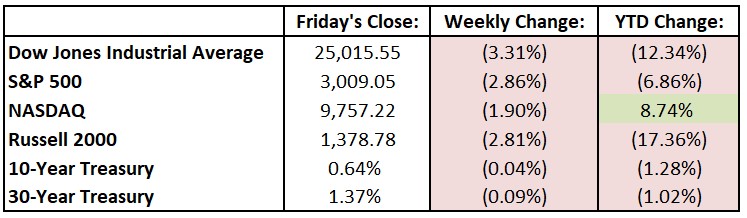

Last Week’s Highlights:

U.S. equities started the week on a positive note, as business re-openings continued throughout the country and solid economic news helped boost investors’ moods. The rally was short-lived, however, as rising COVID-19 case numbers were reported across the Sunbelt. Bank stocks were hit late in the week after an unfavorable result in the Federal Reserve’s latest stress test. An advertiser boycott at Facebook (FB) dragged down the market and especially hurt large technology stocks. For the week, the Dow Jones Industrial Average (DJIA) fell 855.91 points to 25,015.55, while the S&P 500 dropped 2.9% to 3009.05. The tech-heavy NASDAQ declined 1.9%, closing at 9757.22.

Looking Ahead:

Micron Technology (MU) releases fiscal third-quarter numbers on Monday. The National Association of Realtors reports its Pending Home Sales Index for May – economists forecast a sharp rebound of 25%, to an 89 reading. Conagra Brands (CAG) and FedEx (FDX) announce their financial results on Tuesday. The Conference Board releases its Consumer Confidence Index for June – expectations call for a 90 level, up from 86.6 in May. Wednesday brings earnings reports from General Mills (GIS) and Constellation Brands (STZ). The Federal Open Market Committee reports the minutes of its June monetary-policy meeting. ADP releases its National Employment Report from June – economists expect a gain of 2.9 million private-sector jobs, a large improvement over May’s 2.8 million drop. On Thursday, the Department of Labor reports on initial jobless claims for the week ended on June 27th – jobless claims have fallen for 12 consecutive weeks since peaking at 6.9 million in late March. U.S. equity and fixed-income markets are closed Friday in observance of Independence Day.

All of us at Tufton Capital wish you a safe and healthy week.

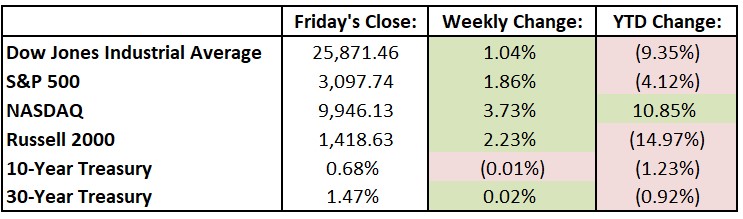

Last Week’s Highlights:

U.S. equities rallied early in the week after the Federal Reserve said it would expand its bond buying program. Strong retail sales numbers and news of a promising steroid for severely ill COVID-19 patients also helped boost stocks. The market wavered later in the week on renewed virus fears. On Friday, Apple (AAPL) announced that it was closing stores in four states that were experiencing an increase in coronavirus cases. Concerns that other companies could follow suit sent the major exchanges falling to end the week. Last week, the Dow Jones Industrial Average (DJIA) rose 265.92 points to 25,871.46, while the S&P 500 advanced 1.9% to 3097.92. The tech-heavy NASDAQ gained 3.7%, closing at 9946.12.

Looking Ahead:

Bristol-Myers Squibb (BMY) hosts a virtual investor meeting on Monday – the company’s management team will discuss drugs in the pipeline, with a focus on its immune-oncology portfolio. The National Association of Realtors reports existing-home sales for May – consensus estimates call for a seasonally adjusted annual rate of 4.2 million homes sold, down from 4.3 million in April. On Tuesday, Kansas City Southern (KSU) webcasts an investor meeting. IHS Markit announces its Manufacturing Purchasing Managers’ Index and Services PMI for June – expectations call for a 44 reading for both indexes. The Federal Housing Finance Agency releases its U.S. House Price Index for April on Wednesday – prices rose 5.7% year-over-year in the first quarter. Thursday brings earnings reports from spice maker McCormick (MKC) as well as Accenture (ACN) and Nike (NKE). The Census Bureau announces the durable goods report for May – new orders for manufactured durable goods are expected to rise by 9.8%, to $186 billion. On Friday, the Bureau of Economic Analysis reports personal income and spending for May – expectations call for a 6% decline in income, after an unexpected 10.5% jump in April.

All of us at Tufton Capital wish you a safe and healthy week.

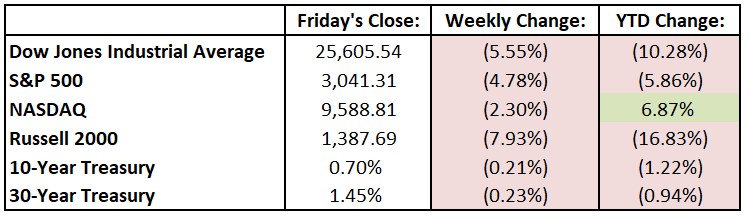

Last Week’s Highlights:

U.S. equities posted their worst weekly decline since March as fears of a second wave of infections and doubts about a speedy economic recovery dampened investor sentiment. The Federal Reserve indicated that interest rates are likely to remain near zero until 2022 and issued a cautious outlook for the economy. For the week, the Dow Jones Industrial Average (DJIA) fell 1505.44 points to 25,605.54, while the S&P 500 dropped 4.8% to 3041.31. The tech-heavy NASDAQ declined 2.3%, closing at 9588.81.

Looking Ahead:

The Federal Reserve Bank of New York releases its Empire State Manufacturing Survey for June on Monday – economists forecast a -27.5 reading, an improvement from May’s -48.5 print. Groupon (GRPN), Oracle (ORCL) and H&R Block (HRB) report quarterly earnings on Tuesday. Federal Reserve Chairman Jerome Powell is scheduled to testify before Congressional hearings on the central bank’s semiannual monetary policy report. The Census Bureau releases new residential construction data for May on Wednesday – economists forecast housing starts at a seasonally adjusted annual rate of 1.12 million. Thursday brings financial results from Kroger (KR) and At Home Group (HOME). The Department of Labor reports seasonally adjusted initial jobless claims for the week ending June 13th – weekly claims have been falling from their unprecedented high levels earlier this year. Lyft (LYFT), Slack Technologies (WORK) and Deutsche Telekom (DTEGY) are among the companies holding virtual shareholder annual meetings on Friday. CarMax (KMX) and Jabil (JBL) host quarterly earnings conference calls.

All of us at Tufton Capital wish you a safe and healthy week.

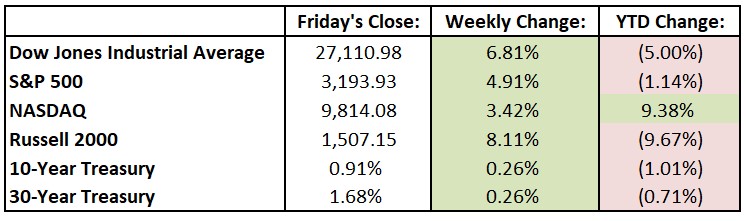

Last Week’s Highlights:

U.S. equities soared higher Friday after the May employment report showed that the country added 2.5 jobs last month, well above economists’ estimates for a loss of 8 million. The Dow Jones Industrial Average (DJIA) jumped over 800 points, or 3.2%, extending its gain for the week to 6.8% and marking the best week for the Dow in over two months. Investors continue to be encouraged by signs of states and businesses around the country reopening, helping stocks rebound from their March lows. For the week, the Dow rose 1727.87 points to 27,110.98, while the S&P 500 rallied 4.9% to 3193.93. The tech-heavy NASDAQ advanced 3.4%, closing at 9814.08. Since its bottom on March 23rd, the S&P has shot up almost 40% – the highest return over such a short period since 1933. Year-to-date, the S&P is down less than 3%, including dividends.

Looking Ahead:

Coupa Software (COUP) and Casey’s General Stores (CASY) report earnings on Monday. Look for financial results from Brown-Forman (BF), Chewy (CHWY) and HD Supply Holdings (HDS) on Tuesday. Nvidia (NVDA), Omnicom Group (OMC) and TJX Cos. (TJX) hold their annual shareholder meetings. The Bureau of Labor Statistics (BLS) releases its Job Openings and Labor Turnover Survey for April – economists forecast 5.9 million job openings on the last business day of April, down from 6.2 million in March. American Airlines (AAL), Caterpillar (CAT) and Target (TGT) hold shareholder meetings on Wednesday. The Federal Open Market Committee announces its monetary policy decision – the FOMC is sure to face questions about possible negative interest rates in the U.S. Adobe (ADBE) and Lululemon Athletica (LULU) release financials on Thursday. The BLS reports the producer price index (PPI) for May – consensus estimates call for a 0.1% uptick in the PPI, while the core PPI is expected to gain 0.2%. PVH (PVH) and Centene (CNC) hold investor calls on Friday to discuss earnings. The University of Michigan releases its Consumer Sentiment Index for June – economists forecast a 72.3 reading, about even with the previous two months’ data, and well below the recent peak of 101 reached in February (which occurred shortly before the COCID-19 outbreak).

All of us at Tufton Capital wish you a safe and healthy week.

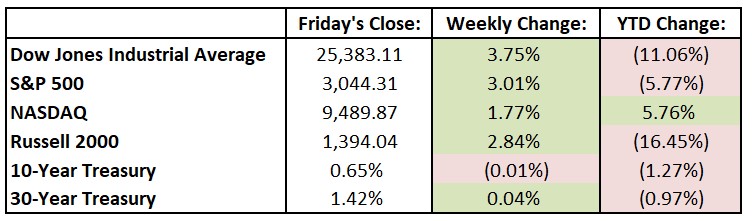

Last Week’s Highlights:

U.S. equities notched a second consecutive week of strong gains, as the S&P 500 recorded its best two-month performance in over ten years. Investors continue to be encouraged recently by signs of states and businesses around the country reopening, helping stocks rebound from their March lows. For the week, the Dow Jones Industrial Average (DJIA) rose 917.95 points, or 3.8%, to 25,383.11, while the S&P rallied 3.0% to 3044.31. The tech-heavy NASDAQ advanced 1.8%, closing at 9489.87. For the month of May, the S&P and DJIA both climbed by over 4%, building on April’s robust rally when the indexes posted their best monthly percentage gains since 1987. A market rotation has occurred in recent days, as market leadership has shifted from the tech giants (including Microsoft (MSFT), Amazon.com (AMZN) and Facebook (FB)) to industries that should benefit as the economy continues to rebound. These industries and their companies, led by the financials and the energy sector, have outperformed recently as this rotation continues.

Looking Ahead:

Monday is June 1st (rabbit! rabbit!). The Institute for Supply Management releases its Manufacturing Purchasing Managers’ Index for May – economists forecast a rebound to a 43 reading from April’s 41.5 print. Tuesday brings earnings results from Dick’s Sporting Goods (DKS) and Zoom Video Communications (ZM). Campbell Soup (CPB) announces financials on Wednesday. Alphabet (GOOG), Biogen (BIIB), Comcast (CMCSA) and Walmart (WMT) hold their annual shareholder meetings. ADP releases its National Employment Report for May – private-sector employment is expected to decrease by 9.5 million after 20.2 million jobs were lost in April. Broadcom.com (AVGO), Gap (GPS) and Slack Technologies (WORK) hold conference calls on Thursday to discuss quarterly results. The Department of Labor announces initial jobless claims for the week ending May 30th – weekly claims continue to fall from their unprecedented levels. On Friday, the Bureau of Labor Statistics releases the jobs report for May – estimates call for a seven-million drop in nonfarm payrolls after April’s record 20.5 million decline. The unemployment rate is expected to rise to 19% from April’s 14.7%.

All of us at Tufton Capital wish you a safe and healthy week.

Last Week’s Highlights:

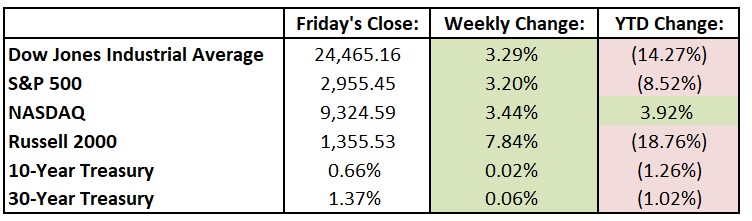

Equities started the week with a bang (the Dow surged over 900 points Monday) after Moderna (MRNA) reported a promising Phase 1 trial on its Covid-19 vaccine and Jerome Powell said the Federal Reserve still had tools available to fight the economic crisis. Stocks gave back some of these gains later in the week as more skepticism on the vaccine emerged and tensions with China rose. Equity markets had a very solid week with the Dow Jones Industrial Average (DJIA) rising 779.74 points, or 3.3%, to 24,465.16. The S&P 500 rallied 3.2% to 2955.45, and the NASDAQ advanced 3.4%, closing at 9324.59.

Looking Ahead:

U.S. equity and bond markets are closed on Monday in observance of Memorial Day. AutoZone (AZO), Bank of Nova Scotia (BNS) and Keysight Technologies (KEYS) report earnings results on Tuesday. The Conference Board releases its Consumer Confidence Index for May – the consensus estimate calls for a 87.3 reading, about even with April’s 86.9 print. Wednesday is busy with earnings as investors will focus of financial results from HP, Inc. (HPQ), Royal Bank of Canada (RY), Amerco (UHAL) and Bank of Montreal (BMO). Amazon.com (AMZN), Chevron (CVX), Exxon Mobil (XOM) and Facebook (FB) hold their annual shareholder meetings. Dell Technologies (DELL), Ulta Beauty (ULTA) and Costco Wholesale (COST) release financial results on Thursday. The Census Bureau announces April’s durable-goods report – economists look for a 15% drop in new orders for manufactured durable goods, to $173 billion – similar to March’s 15.3% decline. On Friday, the Institute for Supply Management releases its Chicago Purchasing Managers’ Index for May – a 40 reading is expected, up from April’s 35.4 print.

Happy Memorial Day! All of us at Tufton Capital wish you a safe and healthy week.

Last Week’s Highlights:

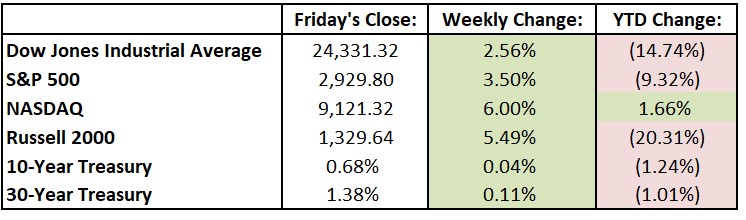

Equities posted a strong week as signs or reopening around the world and rising oil prices added to investors’ enthusiasm. The tech-heavy NASDAQ actually edged into the black for 2020 and is up 1.7% for the year. The stock market is indeed forward-looking, as the economic environment continues to be dire – unemployment hit 14.7% in April as 20.5 million jobs were lost. For the week, the Dow Jones Industrial Average (DJIA) rose 607.63 points, or 2.6%, to 24,331.32, while the S&P 500 rallied 3.5% to 2929.80. The NASDAQ soared 6%, closing at 9121.32. The S&P has now recouped about half of its losses from the record high earlier in the year on hopes that economic activity may be bottoming as restrictions ease and economies reopen. Last week, the price of oil recorded its first back-to-back weekly gain since February – oil companies appeared to be cutting production faster than expected and signs of increased demand emerged.

Looking Ahead:

Earning season is winding down, with financial reports coming from Cardinal Health (CAH), Under Armour (UA) and Marriott International (MAR) on Monday. Duke Energy (DUK), Honda Motor (HMC) and Toyota Motor (TM) release earnings results on Tuesday. The Bureau of Labor Statistics (BLS) announces the consumer price index (CPI) for April – economists call for a 0.4% year-over-year uptick, after a 1.5% gain in March. Wednesday brings earnings from Cisco Systems (CSCO) and Sony (SNE). The BLS releases the producer price index (PPI) for April – expectations are for a year-over-year fall of 0.2%, while the core PPI is seen gaining 0.8%. Applied Materials (AMAT) and Brookfield Asset Management (BAM) announce financial results on Thursday. The business week ends with earnings reports from JD.com (JD) and VF Corp. (VFC) on Friday. The Census Bureau releases retail sales data for April – forecasts call for sales to plummet by 10.6%, surpassing March’s 8.4% monthly decline as the steepest on record.

All of us at Tufton Capital wish you a safe and healthy week!

Last Week’s Highlights:

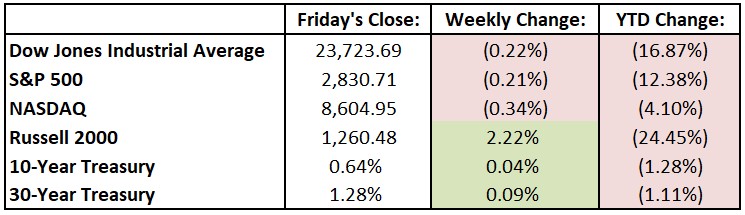

Equities started the week on a positive note, with the S&P 500 rising 3.6% during the first three days, only to fall 3.7% on Thursday and Friday. Even though stocks finished mixed last week, April was the best month since 1987 for the market (up 12.9%!). A slowdown in new coronavirus cases and synchronized initiatives globally have improved trader sentiment from the March 23rd stock market bottom. Earnings season continued with Apple (AAPL) and Amazon.com (AMZN), among many others, reporting financials. Dire economic data, while expected, dampened investors’ moods, as 3.8 million more jobless claims were reported, and March consumer spending fell 7.5%. For the week, the Dow Jones Industrial Average (DJIA) dropped 51.58 points, or 0.2%, to 23,723.69, while the S&P 500 was down 0.2% to 2830.71. The tech-heavy NASDAQ declined 0.3%, closing at 8604.95. Only the small-cap Russell 2000 was able to finish the week higher, up 2.2% to 1260.48.

Looking Ahead:

We’re in the thick of first-quarter earnings season – 150 S&P 500 components release results this week, including big names in media and food. The week begins with financial results from Mosaic (MOS), Tyson Foods (TSN) and Sempra Energy (SRE). On Tuesday, Walt Disney (DIS), DuPont (DD) and Martin Marietta Materials (MLM) report Q1 numbers. American Express (AXP) and General Electric (GE) hold their annual shareholder meetings. Look for earnings results from Ameriprise Financial (AMP), General Motors (GM) and Zoetis (ZTS) on Wednesday. On Thursday, the Department of Labor releases initial jobless claims for the week ending on May 2nd. In the past six weeks, more than 30 million Americans have filed for unemployment benefits, roughly 18% of the workforce. Bristol-Myers Squibb (BMY), Viacom CBS (VIAC) and Raytheon Technologies (RTX) announce earnings. Friday brings financials from Noble Energy (NBL) and Carrier Global (CARR). The Bureau of Labor Statistics releases the jobs report for April – economists call for a decline of 21 million nonfarm payrolls, after a loss of 701,000 in March. The unemployment rate is expected to rise significantly from 4.4% to over 16%.

All of us at Tufton Capital wish you a safe and healthy week!