Company Update: Eli Lilly & Company (Ticker: LLY)

By: Eric Schopf

Eli Lilly and Company (Ticker: LLY) discovers, develops and markets human pharmaceuticals worldwide. The company was founded in 1876 and went public in 1923. LLY is headquartered in Indianapolis, Indiana and has a rich history of developing many important drugs. In the 1920s, they were the first company to mass-produce insulin, and in the 1940s they were the first company to mass-produce penicillin. In the 1980s they introduced Prozac for mental health conditions.

Today, their diverse therapeutic product portfolio addresses diabetes, immunology, neurosciences, oncology and weight loss. Their key products include Mounjaro, Trulicity and Jardiance for diabetes, Verenzio for breast cancer and Taltz for plaque psoriasis, psoriatic arthritis and other autoimmune disorders. The real growth driver, however, is Zepbound, a drug for the treatment of obesity. The active ingredient for the weight-loss drug is tirzepatide, the same ingredient found in Mounjaro. Mounjaro is a Food and Drug Administration-approved injectable drug that helps adults with type 2 diabetes control their glucose levels. During the trials, LLY observed that obese diabetes patients lost a considerable amount of weight during their treatments. After further studies, the same drug has been rebranded as Zepbound and has been approved by the Food and Drug Administration for the treatment of obesity.

Zepbound is a glucagon-like peptide 1 (GLP1) receptor agonist. GLP-1 drugs slow the movement of food from the stomach into the small intestine which makes a person feel full longer. People eat less while taking the medication and lose a considerable amount of weight. In a 72-week study of adults without diabetes, average body weight loss was between 15% and 21% of body weight, depending on the starting weight and dosage level.

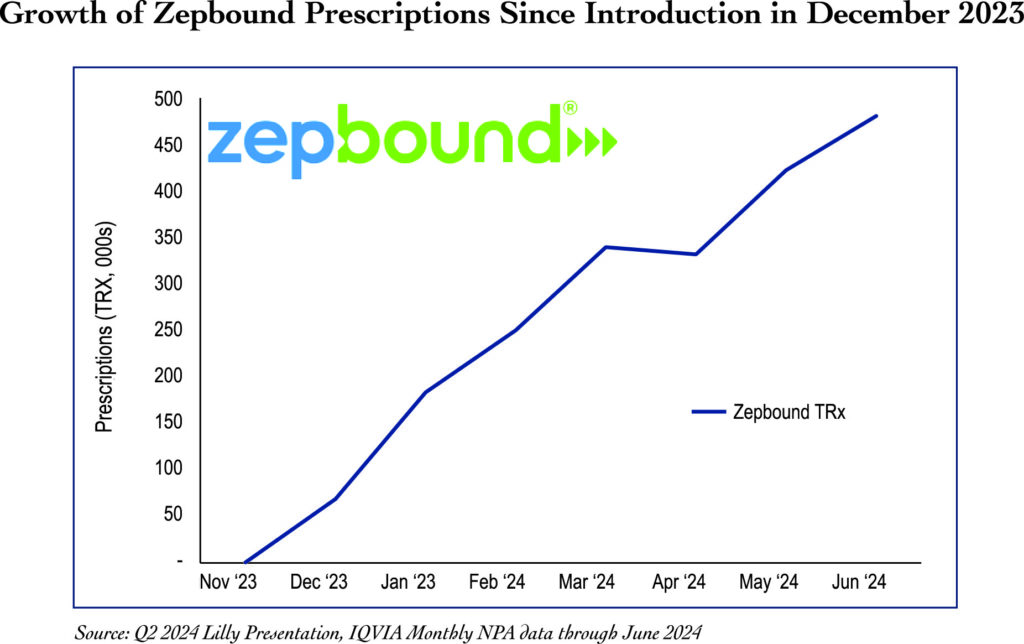

Zepbound, which has only been available since December 2023, has shown tremendous growth. Revenue for Q2 2024 was $1.2 billion, and forecasts for the GLP-1 weight-loss market range as high as $150 billion by 2035. The only other GLP-1 drug on the market today used for weight loss is Wegovy, which is manufactured by Novo Nordisk. The primary difference between Zepbound and Wegovy is that Zepbound is a GIP receptor and GLP-1 receptor agonist, whereas Wegovy is only a GLP-1 receptor agonist. Zepbound activates receptors (signaling proteins) in the brain that natural GIP and GLP-1 turn on. These signals make people feel less hungry, causing them to eat less and ultimately lose weight. Zepbound has been shown to provide superior results due to this dual action of the drug.

Research has shown that GLP-1 drugs may also be beneficial in treating cardiovascular disease, obstructive sleep apnea, fatty liver disease and certain cancers. LLY has a first-mover advantage and has committed considerable research and development efforts to expand the label. They have also spent billions of dollars to expand their manufacturing capability to ensure a steady supply to meet growing demand.

Eli Lilly faces several hurdles in gaining wide GLP-1 acceptance. The price of the drug is prohibitively high at about $1,060 for a one-month supply. Due to this high cost, most insurance policies do not cover the drug for obesity. Furthermore, side effects including nausea, diarrhea, vomiting, indigestion, heartburn and hair loss often result in patients discontinuing treatment.

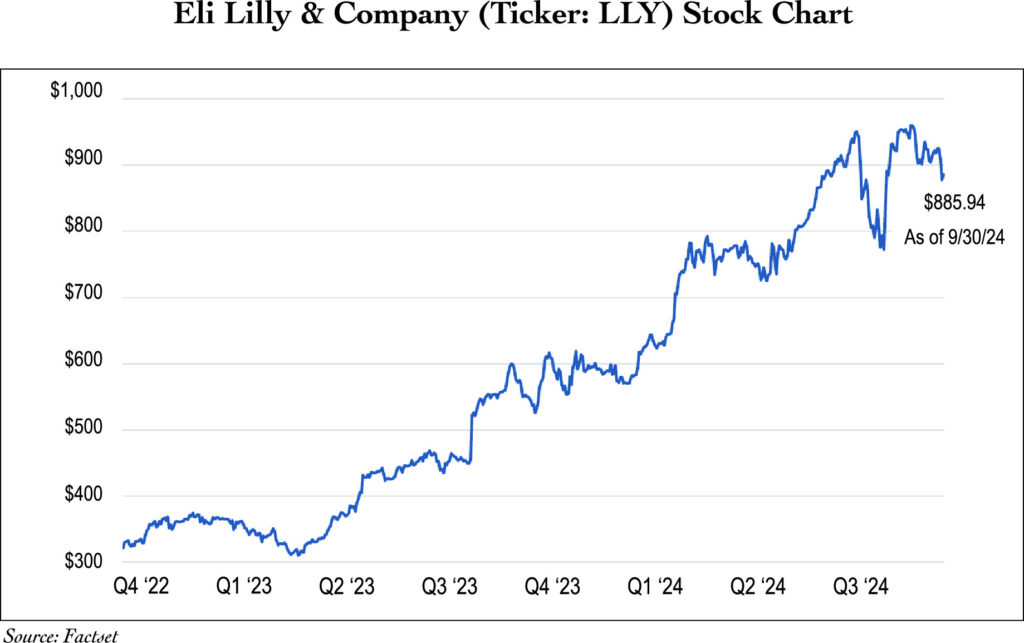

Looking at the stock price, LLY’s price-to-earnings (P/E) ratio is much higher than that of the overall market as well as of other health care stocks. This can certainly cause heartburn among investors. The price is high and so are expectations for growth. The stock trades at 58 times expected 2024 earnings, and the dividend yield is only 0.60%. Failure to meet expectations leaves the stock vulnerable to sharp corrections. We acknowledge the risk and classify the stock as a “special situation”. We have limited initial position sizes in our clients’ portfolios.