What’s On Our Minds:

What’s on our minds this week is the same thing that’s on everyone’s minds this week. And on their screens every day. And their phones. And, maybe, in their data, rummaging around: Facebook. “Lax Data Policies Haunt Facebook.” “Data Blowback Pummels Facebook.” As of this writing, Facebook (FB) is down a hefty 22.1% from its February 1st high.

The trouble last week initially centered on the issue of how Cambridge Analytica used millions of users’ information that it collected over the years. It tied in with the Trump campaign, Russia, and raised hackles in Congress, where lawmakers called for CEO Mark Zuckerberg to explain himself. The ire spread across the pond, where British MPs similarly demanded an explanation. Each day, Facebook dropped precipitously.

At Tufton, we are watching carefully. Not because we own Facebook in spades- FB is a ticker that rarely passes over a value investor’s desk. But rather, we watch because the calls for regulation and oversight of how data is used will affect not just Facebook, but other big-tech names. Notably, Google. We expect that we’ll see if GOOGL’s “Don’t Be Evil” motto did, in fact, prevent data from being used improperly.

No company wants to see an article about itself that includes the phrase “The Federal Trade Commission is investigating…” If the FTC finds Facebook violated terms of a 2011 settlement, it will face large fines, to be sure, but it will also call into question its business model generally. Further, it will raise questions over the business practices of Silicon Valley generally.

The Technology team at Tufton continues to believe that the United States’ strength in the world is in its superior brainpower and knowledge in tech (the Technology team, who is writing this piece, also recognizes it may be biased). As the world moves away from manufacturing and toward automation and services as the highest value-add, superior technology will be integral throughout all of business. However, as with any major change, we do not expect there to be a smooth ride to get there.

Last Week’s Highlights:

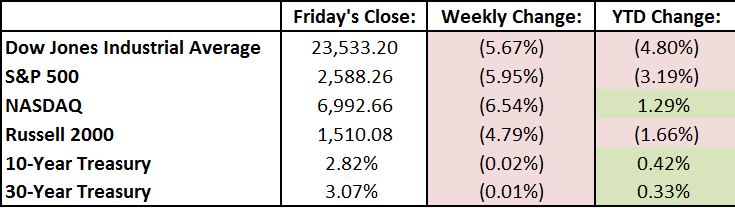

Stocks were lower last week on sharpening fears of a trade war with China. And of course, as we detailed above, high-flier Facebook was pummeled.

Looking Ahead:

Tufton’s economic team will be interested in the GDP numbers released Wednesday. Otherwise, it will be a short and largely uneventful week with Good Friday leading into the holiday weekend.

What’s On Our Minds:

What is an activist investor? Well, sometimes companies just need a little push.

As activists, investors look to maximize their own returns by taking large enough positions in the company’s stock that they can influence management decisions. Often, they are looking to shake things up at the company. Activists may decide to move in on a company if they believe management has stumbled, it would be better off as a private company, it has excessive costs, or if the activist thinks they have a better capital allocation strategy, such as buying back stock or raising the dividend. Activist investing continues to gain supporters (and investment capital), according to Hedge Fund Research, activist funds’ assets under management increased by four times over the past 9 years, from a level of $32 billion to $176 billion.

Recently, activists have achieved increased success and gained credibility as the size of their targets have grown. Last year, Nelson Pletz was successful in his fight for a seat on the board of directors at Proctor and Gamble, a mega-cap blue chip company.

Often, activists are targeted by the media and politicians for being “hit and run” investors, but activists will argue that they are genuinely concerned about companies and the U.S. economy. The issues surrounding activism are not clear cut: some activist may just be greedy, while others want to maximize shareholder value over the long term. In 2016, billionaire investors decided to take on these attacks from Washington by launching their own lobbying group to fight these attacks, The Council for Investor Rights and Corporate Accountability (CIRCA). Bill Ackman, Paul Singer, Carl Icahn, Daniel Loeb, and Barry Rosenstein are the group’s largest backers. Together, they manage over $90 billion and believe that lousy corporate performance is a drag on the US economy.

Activists take positions in different types of companies across many different industries and of various market caps. Often, though, activists target companies that have been under pressure and are considered value stocks. At Tufton Capital, we are not activist investors, but we do look for undervalued stocks. Therefore it’s not uncommon for companies in our equity portfolio to have activist involvement. As a result of this overlap, we do have to pay attention to the hype created by these market players.

While activist investors grab plenty of headlines, it’s tough to determine the actual impact activism is having on the overall market. According to a study conducted by the Wall Street Journal last year, of the largest 71 activist campaigns between 2009 and 2014, only 50% of targeted companies outperformed their peers- that is, the same as chance.

Last Week’s Highlights:

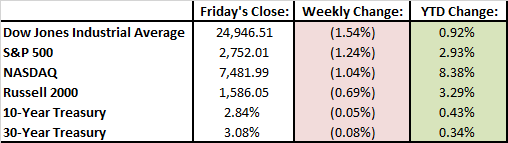

Stocks were lower last week and we continued to see elevated volatility. Partisan reaction to President Trump’s proposed steel and aluminum tariffs grabbed headlines. In a partisan flip flop, Congressional Republicans discussed limiting Presidential power on tariffs, while Democratic Senator Elizabeth Warren supported them. Technology stocks, which have been the best-performing sector so far in 2018, experienced a pullback last week as President Trump also proposed tariffs on Chinese imports.

Looking Ahead:

While tariff fears and political headlines influenced the market last week, investors will likely refocus on the Federal Reserve this week. The Fed will hold its two-day policy meeting on Tuesday and Wednesday where it is expected that Jerome Powell will increase interest rates for the first time in 2018. Investors will be listening to his comments Wednesday to hear how they might deviate from his predecessor, Janet Yellen. The federal funds futures market expects three rate increases by the end of the year, with a more than 30% chance of four.

What’s On Our Minds:

Tune your TV to CNBC on any given day and more and more attention is given to activist investors and the companies they target. As activists, investors look to maximize shareholder value by often taking large enough positions to influence management decisions- they are looking to shake things up at the company. Activists may decide to move in on a company if they believe management has stumbled, it would be better off as a private company, it has excessive costs, or if the activist think they have a better capital allocation strategy, such as buying back stock or raising the dividend.

Often activists are targeted by the media and politicians for being “hit and run” investors, but activists will argue that they are genuinely concerned about companies and the U.S. economy. The issues surrounding activism are not clear cut; some activist may just be greedy, while others actually want to maximize shareholder value over the long-term.

Over the summer, Nelson Peltz’s $12.7 billion hedge fund, Trian Partners, took aim at household product conglomerate Proctor and Gamble. His fund currently owns $3.3 billion worth of P&G shares. Peltz thinks P&G is not structured properly and believes that the company in resistant to change. He is currently in a proxy fight for a seat on the company’s board. The company says they have been actively working with Trian but is against adding him to the board. In dollar terms, P&G is the largest company to ever face a proxy fight of this nature.

Activists take positions in all different types of companies, across many different industries and of various market caps, but more often than not, activist target companies that have been beaten up and are considered value stocks. At Tufton Capital, we are not activist investors but we do look for undervalued stocks so it’s not uncommon for companies in our equity portfolio to have activist involvement. Thus, we do have to pay attention to the hype created by these market players.

While activist investors grab plenty of headlines, it’s tough to determine the actual impact activism is having on the overall market. According to a study conducted by the Wall Street Journal last year, of the largest 71 activist campaigns between 2009 and 2014, only about 50% of targeted companies outperformed their peers.

Last Week’s Highlights:

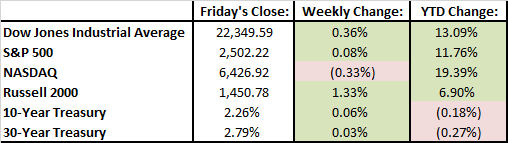

Stocks were marginally higher last week and hit record highs. The highlight of the week was the Federal Reserve’s announcement that it would begin normalizing its balance sheet in October. The Fed also stated that it would keep its federal funds rate between 1 and 1.25 percent. The announcement caused 2 and 10 year Treasury yields to increase along with the the value of the dollar.

Looking Ahead:

Investors will see how the housing market is doing this week when the Case-Shiller Index of home prices and new home sales figures are released on Tuesday. We will also get a report on consumer confidence on Tuesday and Janet Yellen is scheduled to deliver a speech. Investors are expecting her elaborate on the Fed’s plans to unwind the huge balance sheet it has amassed since the financial crisis.