What’s On Our Minds:

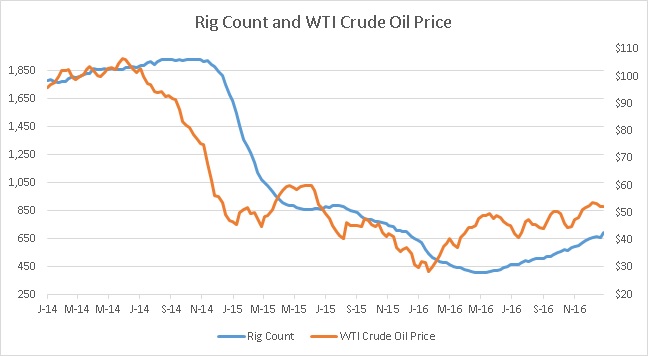

Acquisitions in the oil patch are finally back in style. Over the past few weeks, several multi-billion dollar acquisitions have occurred, particularly in the Permian Basin of West Texas. The Permian Basin has been established as the most prolific shale patch in the United States, possibly the world. Given this status, it should be to no one’s surprise that last week, energy bellwether ExxonMobil announced a $6.6 billion acquisition of Permian assets, their largest deal since the acquisition of XTO Energy in 2010. The company will net approximately 250,000 acres, paying roughly $27,000 per acre. On other metrics, Exxon paid $35,000 for each flowing barrel of oil per day – both attractive valuation multiples compared to other transactions in the oil patch.

In another transaction, Noble Energy agreed to purchase Clayton Williams Energy, another Permian based company, for $3.2 billion. The announced price values the assets at approximately $32,000 per acre, slightly higher than Exxon’s purchase price. It’s hard to believe that five years ago, the average price per acre in the same area was just roughly $4,500 when oil was trading in the range of $80 and $120 per barrel. This goes to show the profitability and efficiency of drilling in the shale patches.

All of these transactions come at an interesting time – most analysts expected distressed companies to sell themselves or their assets around the time oil bottomed at $26 per barrel nearly a year ago and the rig count bottomed last May. However, due to the efficiency of shale production (and cheap credit), the drillers prevailed. With interest rates on the rise and the price of oil somewhat range bound, time will tell which companies continue to survive.

Last Week’s Highlights:

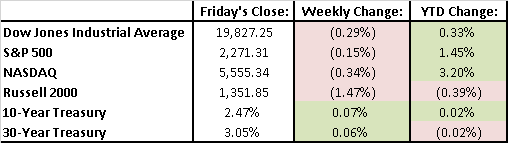

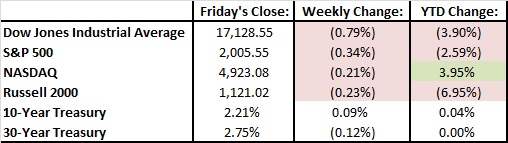

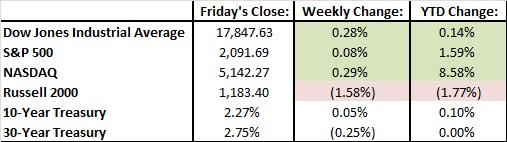

Last week, the Dow Jones Industrial Average fell 0.29%, the S&P 500 fell 0.15% while the Nasdaq slipped 0.34%. After beating the S&P 500 in 2016, the Dow is now barely positive on the year (up 0.33%), the S&P 500 is up 1.45% and the Nasdaq is leading the three major indexes, up 3.2%. Investors were focused on President Trump’s inauguration speech as well as rhetoric surrounding his changes to public policy.

Earnings season continued with most companies in the Financial sector reporting fourth quarter results. So far, 13% of S&P 500 companies have reported and 65% have had positive surprises relative to their earnings estimates.

This week, investors will continue to focus on President Trump and his policy initiatives. Earnings from several Dow Jones components will be released on Tuesday. Dupont, 3M, Johnson & Johnson, Travelers, and Verizon will all report before the opening bell. On Wednesday, AT&T and United Technologies will provide investors with their fourth quarter results. Thursday will give investors further insight into the oil patch as Helmerich & Payne and Baker Hughes both report. On Friday, the markets will be focused on the first read of fourth quarter GDP growth.

What’s On Our Minds:

Over the weekend, some of the world’s largest oil producers met at the center of the Middle East in Doha, Qatar to discuss a potential production “freeze” from each participant. Going into the weekend, signs of the freeze deal collapsing began as the oil representative from Iran decided not to attend. Late Sunday afternoon, it was announced that the freeze deal had in fact collapsed as the Saudi Arabian oil ministers got up from the table apparently stating that they would not freeze unless their political rival Iran agreed to take the same actions.

The oil price crash began in mid-2014 when Saudi Arabia refused to cut production as oil prices declined. This coincided with US Shale Oil production rising to a record 9.6 million barrels of production per day. Many speculated that the oil kingdom’s refusal to cut was to regain market share and put the growing US shale companies out of business. Others speculated that the Saudis took action to prevent rival Iran from funding their own operations and nuclear ambitions. Like Saudi Arabia, much of Iran’s income is derived from oil sales.

Now, the ladder theory appears to be evident. Since the lifting of federal and international sanctions last year, Iran has ramped oil production by 600,000 barrels per day and continues to develop for further production. A future production freeze or even cut among large producers is still not entirely out of the question. However, without Iran’s cooperation, expect the soap opera to continue…

Last Week’s Highlights:

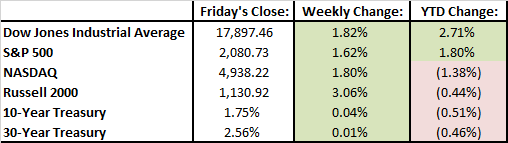

Last week, the S&P 500 rose 1.62% while the Dow rose 1.82%. Financial stocks helped drive the major averages higher as the big banks reported better than expected earnings. JPMorgan Chase, the largest US Bank in terms of assets, has stated that even if the Federal Reserve does not increase interest rate, they can still expect to grow their net interest income by $2 billion – an impressive feat for any financial institution in a low interest rate environment.

Investors also received some good news out of China. The world’s second largest economy reportedly grew 6.7% in the first quarter. This was slightly down from the 6.8% increase in the fourth quarter, but still a welcoming relief to investors as growth in China has recently been a concern.

Looking Ahead:

Looking forward to this week, more first quarter earnings reports will be on the docket. After the bell on Monday, technology companies Netflix and IBM will report. Subsequently to being a “high flyer” in 2015, Netflix is down 4.3% this year – under performing the market by 6.5%. On Tuesday morning, investors will hear about earnings and future plans from internet company Yahoo!. The company is shopping it’s core search business to potential bidders as a breakup of the company appears to be imminent. The week will finish off with results from industrial bellwethers Caterpillar and General Electric. As Jim Hardesty would say, “Pushing dirt is good business.” Let’s hope we hear the same from Caterpillar.

What’s On Our Minds:

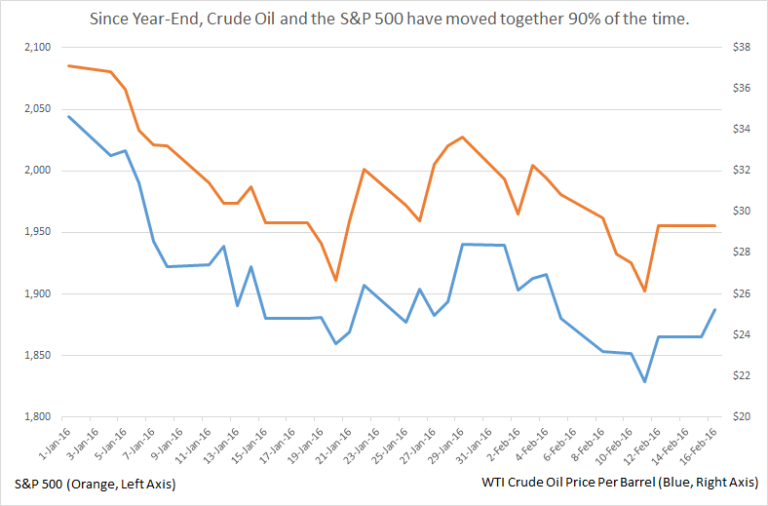

Early Tuesday morning, it was announced that four oil producers (importantly Saudi Arabia and Russia) will “freeze” oil production levels. Though this may seem as a sign of higher oil prices, production levels for both the world’s largest producers were at an all-time high in January. However, a compromise among these producers appears to be an apparent sign of financial stress in these commodity dependent economies. If the price of oil does not stabilize or move higher, additional deals could be on the table. Furthermore, the markets have been consistently focused the price of oil as investors have increasingly been quick to sell their stock positions when the oil price declines.

Last Week’s Highlights:

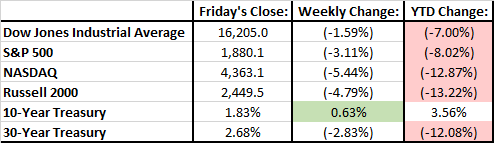

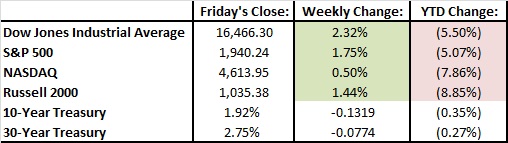

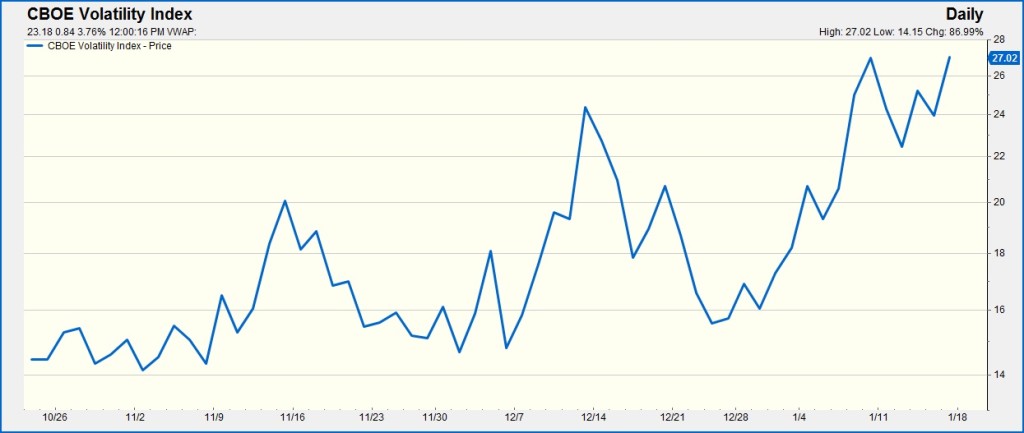

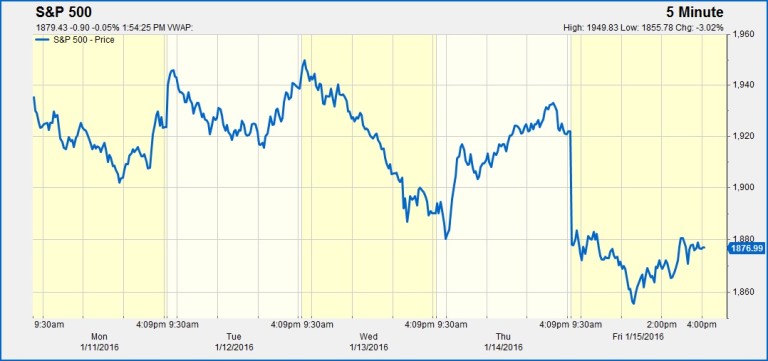

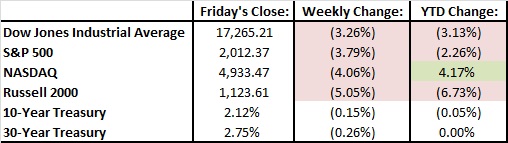

Stocks rallied on Friday before the long-weekend as West Texas Intermediate crude oil had the largest daily gain since February of 2009. Nevertheless, markets were still down for the week without a clear catalyst for a global selloff. Investors cited a multitude of reasons for the market turmoil. The list included, but was not limited to Federal Reserve Chairman Janet Yellen’s observation that she was not in a hurry to raise interest rates, investors taking money out of China due to an economic slowdown, fear of slowing growth in United States, and additional in declines the price of oil. As a result of Chairman Yellan’s view for lower for longer interest rates, the financial stocks were the worst performers declining 2.4% on the week.

Looking Ahead:

This week, investors’ eyes will be on data for January housing starts and building permits on Wednesday morning. Housing starts have recently been hurt by harsh winter weather around the country. Following housing data, investors will get a gauge of the industrial sector with the release of Industrial Production. Output has been in decline since the beginning of the fall in the price of oil in mid-2014. And lastly, it will be hard to forget about South Carolina Republican Primary this weekend. This Primary is historically known for dirty politics – get your popcorn ready.

What’s On Our Minds:

Just as the Broncos and Panthers went into Super Bowl 50 with a game plan, investors are re-positioning themselves for what many expect to be a year of decelerated growth. Thus far in 2016, it appears investors are going on the defensive as consumer staples, telecom, and utility stocks have held up during sell offs. Meanwhile, financial, healthcare, consumer discretionary, and technology stocks (which largely led the market in 2015) have sold off in face of a slowdown in the global economy. Although nobody welcomes an economic slowdown, as a value-focused firm, we are reassured that our inherently defensive investment approach prepares our clients’ portfolios for this type of environment.

Last Week’s Highlights:

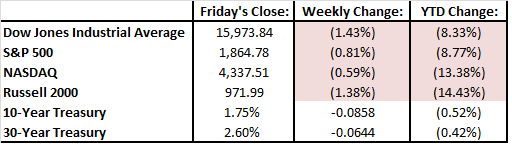

The volatility continued, with Friday capping off yet another turbulent week. Investors focused on oil, the US economy, and weakness in various industries’ corporate earnings, and there was not much good news to be delivered. The Dow Jones fell 1.6% on the week, and the S&P 500 dropped even more, closing down 3.1%. Technology shares were especially pressured, as earnings from companies such as LinkedIn (LNKD) and Tableau Software (DATA) disappointed shareholders. The tech-heavy NASDAQ finished last week down 5.4%.

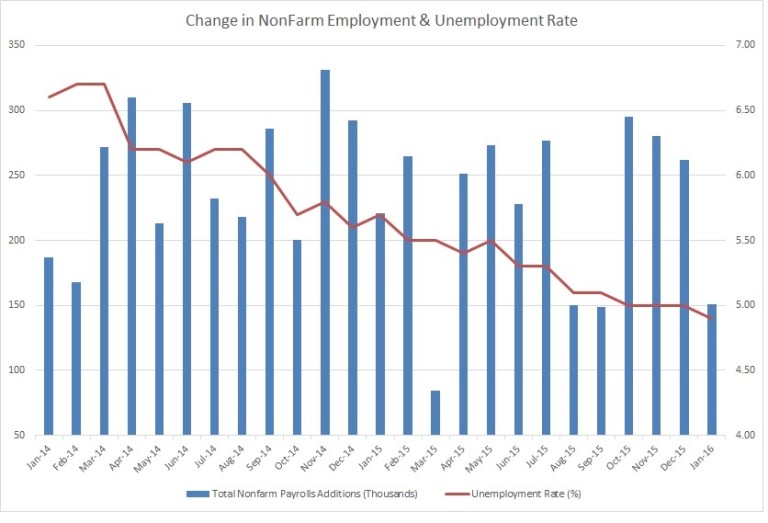

Friday’s jobs report came in below expectations, with the US economy adding 151,000 jobs in January (below economists’ 190,000 estimate). While the figure was slightly disappointing, other employment data was more promising: the unemployment rate dipped to 4.9% (from 5%) and average hourly earnings increased 0.5% in January.

Looking Ahead:

While earnings season is nearing its end, we’ll see 65 more reports this week from S&P 500 companies, including Coca-Cola (KO), Disney (DIS), Time Warner (TWX) and Cisco (CSCO). Of the 315 S&P companies that have reported so far, 77% have beaten earnings estimates, while only 46% have beaten revenue expectations. For the quarter, earnings have declined by 6% and sales by 5%.

The economic calendar remains relatively light this week, although reports on retail sales, import and export prices, and consumer sentiment will be released on Friday. Comments from Fed Chair Janet Yellen will be closely monitored this week, as she’s scheduled to deliver her semi-annual testimony to Congress on Wednesday and Thursday.

What’s On Our Minds

Everyone has been talking about oil, so let’s revisit the energy markets this week. Oil is solidly above $30 a barrel- which sounds great until you remember that even sub-$50 was unthinkable not long ago. Talks and rumors abound suggesting that major oil-producing countries, if they perhaps aren’t about to enter a “grand bargain,” will at least move to stop the free fall. Additionally, some major US shale companies announced capital expenditure reductions, meaning 2016 supply should come down.

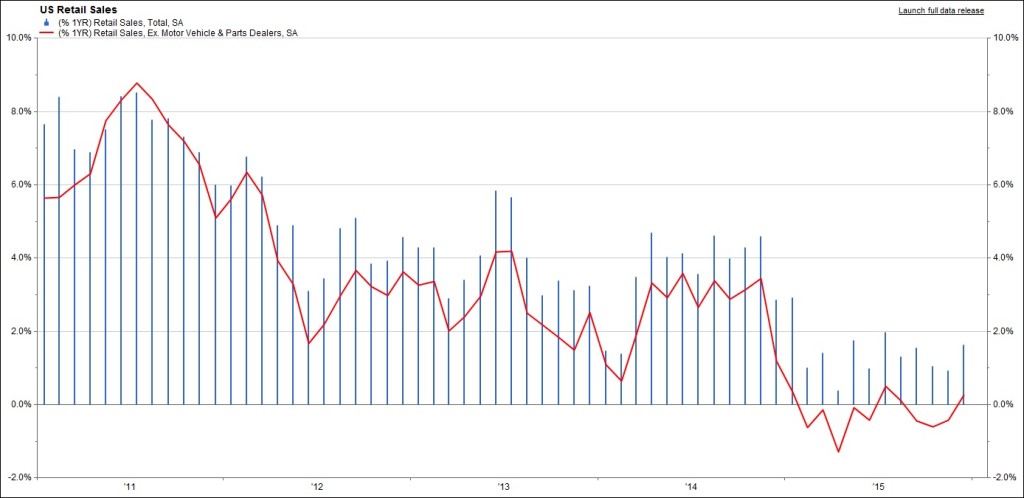

Also, what happened to the “oil dividend”? Prevailing theory is that a reduction in oil prices is like a check made out to the American consumer. Consumer demand hasn’t been awful (see chart), but it hasn’t been great, either. It seems Americans are saving their gas station discounts.

Last Week’s Highlights

Last week’s numbers were saved by a big rally Friday that turned what would’ve been a down week into a gain of 1.8%. This is the second week of gains in a row, easing some concerns, but we must not (and we certainly don’t around here) forget that we are still down 5% for the year.

Looking Ahead

On Monday morning, the Institute of Supply Management (ISM) released their manufacturing PMI for the US, coming in at 48.2 vs 48.0 last month. Any reading under 50 indicates contraction. The Purchasing Manager’s Index indicates that manufacturers are still feeling the effects of global issues here in the US. We try not to get political here, but we will all certainly be closely watching the Iowa caucus and a new president’s potential effects on the US’ business environment.

What’s On Our Minds

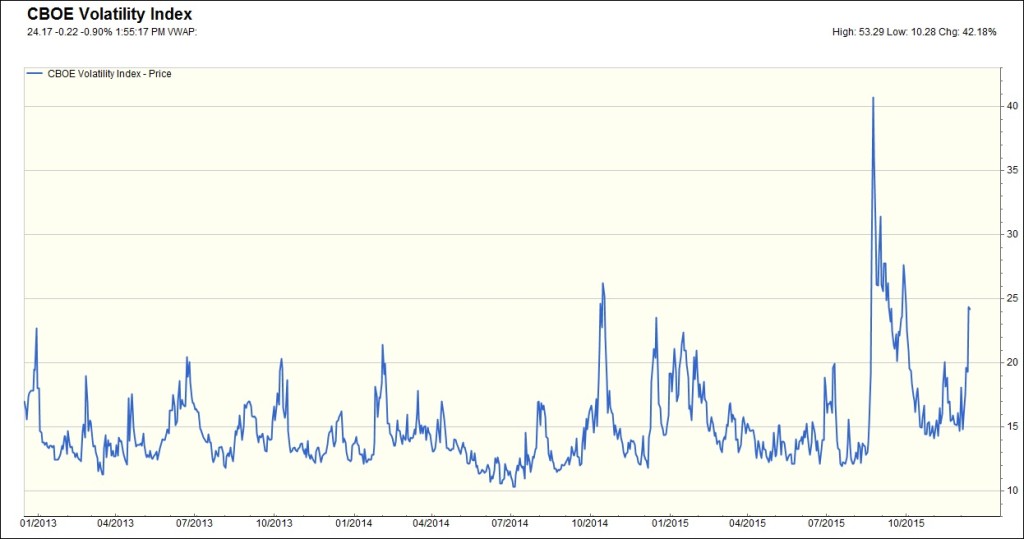

Last week, our Weekly View urged readers to “hold tight” and based on last week’s volatility, it looks like we got it right. Media pundits had many panicking last week as we saw a major sell off mid-week only to finish the week in positive territory. Yes, volatility can be very stressful for investors, but in situations like last week, we continue to stress the importance of keeping a long term view on your investment portfolio.

Last Week’s Highlights

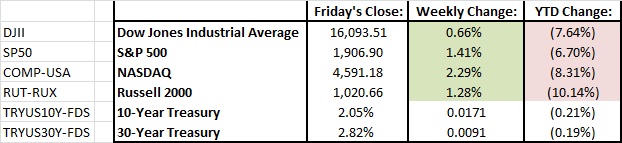

The S&P 500 closed out the week up 1.4%. The market kicked its 2016 weekly losing streak and finished in the green, but it wasn’t easy. Concerns over global economic growth continued and depressed oil prices worried investors. It was a wild week. On Wednesday, the Dow sank 1.6% on a day when oil hit $26.55 per barrel at one point, the lowest “black gold” has traded since May of 2003. By the end of trading Friday, oil rallied back to $32.16 per barrel, which helped the markets recover. As of the close Friday, the S&P 500 was still down 6.70% year to date.

Looking Ahead

The Federal Reserve will release its Federal Open Market Committee Statement on Wednesday afternoon and Fourth Quarter GDP numbers on Friday morning. This week we will also be watching fourth quarter earnings releases from notable companies such as Apple, Johnson & Johnson, Proctor & Gamble, and Microsoft.

What’s On Our Minds

Investors last week had concerns over corporate earnings and guidance as well as the further depreciation of the Chinese Yuan (implying slower economic growth from Chinese regulators). The decline in crude oil did not seem to help as WTI, the US Benchmark, fell to approximately 10.5%. Despite anxieties over global growth, there are several companies that have been beaten up year to date that will be able to grow their sales and earnings this year. Taking advantage of these opportunities, rather than locking in losses, is often the more prudent action.

Last Week’s Highlights

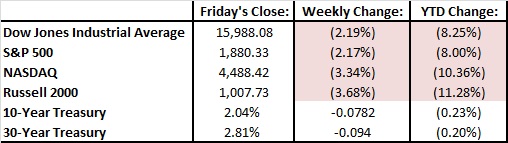

The markets had a rough second week with the Dow Jones and the S&P 500 falling 2.2%. The Dow Jones is now down 8.25% for the year and 10.7% off its all-time high while the S&P 500 is down 8% for year and off 11.8% from its all-time high. Year to date, the defensive Utility and Telecom sectors have shown to be the best performers while Materials has been hurt by concerns over global growth and lower interest rates continue to weigh on Financials.

Looking Ahead

Looking to the week ahead, the market will mostly be focusing on corporate earnings. On Tuesday, investors will get a gauge of the banking and financial sectors with earnings releases from Bank of America and Morgan Stanley. Results from the long-time technology blue chip IBM and new technology high-flier Netflix will also report after the closing bell. On Thursday, the railroads will report earnings – in addition to energy companies, this group has also suffered from the decline in crude oil as the transportation of the commodity has declined. Finally, the oldest Dow Jones component, General Electric, will give investors a view into the power, aerospace, energy, and health care sectors.

Hold on tight.

What’s On Our Minds

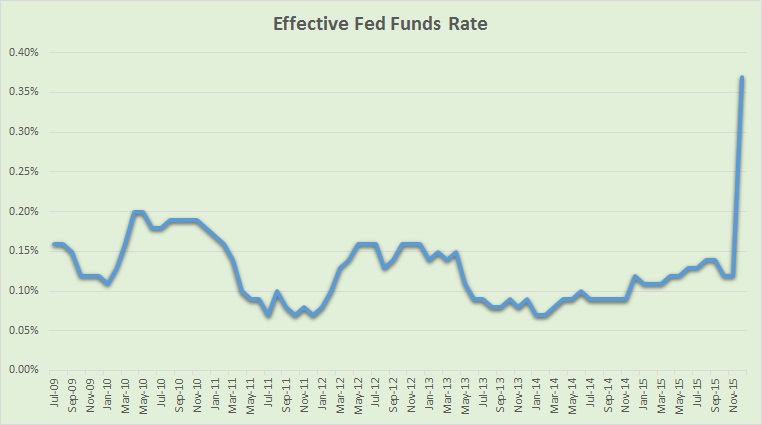

The markets had a choppy week, with the S&P 500 finishing down 0.34%. Investors kept a close eye on the Federal Reserve interest rate decision last Wednesday as well as the price of oil which continued to decline to one of the lowest levels since 2009. The Federal Reserve raised their target interest rate to 0.5%, which represented their first increase in nearly a decade. Now, creditworthy banks that are lending money that is maintained at the Federal Reserve will be charged an annual rate of 0.5% for each overnight stay as opposed the 0.07% to 0.20% range that was charged over the last six and a half years. As a result, banks will begin raising interest rates on their future and some current customers and we have already seen this occur at many financial institutions – Bank of America and Wells Fargo both raised their prime lending rate to 3.50% from 3.25%.

Looking Ahead

Looking to the week ahead, the Bureau of Economic Analysis will release their final calculation of 3rd quarter of Gross Domestic Product. The previous reading released in November estimated that the US economy grew 2% year over year. Analysts believe the economy was actually stronger than 2.0% in the 3rd quarter as tomorrow’s estimate is for growth of 2.2%.

On Wednesday, investors will be gain further insight on the American consumer with the release of data on personal income and spending for November. Growth in the month is estimated to be 0.3%, which was the same rate as last November. Though growth in economy is stronger this year, Black Friday sales were not as strong as anticipated. Black Friday sales have displayed that online spending has continued to grow as percentage of the total weekend sales with “Cyber Monday” becoming increasingly popular.

The stock market will close at 1 PM on Thursday as investors prepare for Santa. All are hoping Old Saint Nick will bring us a nice year-end market rally as we close out 2015.

Have a Happy Holiday!

What’s On Our Minds

Understanding the stock market’s unpredictable tendencies is a challenge during the best of times. But what happens when price swings grow abnormally large? It is the stock market’s nature to be volatile over the short term. Staying informed, understanding risk tolerance, and sticking to long-term goals and planning is in our clients’ (and everyone’s, we believe) best interest.

Last Week’s Highlights:

The financial markets faced a rough week last week as participants prepare for the Federal Reserve to raise interest rates this Wednesday (12/16). The Dow finished the week down 3.3% and the S&P 500 closed out the week down 3.8%, which puts the index in the red for the year. In company news, Dupont (DD) announced it would merge with Dow Chemical (DOW). After the merger, the new company plans on splitting itself into three publicly traded companies.

The pain in the oil markets continues to play out as prices dropped significantly, with crude futures falling $4.35, or 10.9%, for the week. We also saw a major selloff in Junk bonds last week. Fears in the junk bond market were exacerbated when the Third Avenue Credit fund, which owns distressed bonds and private equity holdings, closed its doors on Wednesday.

Looking Ahead:

The long awaited Federal Reserve meeting takes place this Tuesday and Wednesday, when the Fed is widely expected to raise short term interest rates by 25 basis points. Despite recent volatility, it is unlikely that the Fed will pass up a gradual increase in rates. Janet Yellen will likely emphasize the Fed’s intent to gradually raise rates going forward.

What’s On Our Minds

Oil continues its downward slide, and is now at levels not seen since ’09. A lot of people wonder what that means at the pump: how low could gas prices get? We’ve seen a few stations with sub-$2 gas recently, but gasoline can’t get too cheap- they still have to pay to refine it and ship it to the station. Even if the cost of a barrel of West Texas Crude were $0, it would still cost almost a dollar to get it to us.

Last Week’s Highlights

Are we done talking about the Fed yet? Well, the board itself is: Fed members are about to enter their quiet period ahead of next week’s meeting. Given Chair Janet Yellen’s comments, the market has baked in a hike at this point. The stellar jobs report on Friday was the final nail in the coffin. Yellen had earlier commented that it would take a new-jobs number of around 100,000 or less to change the Fed’s views, and the report came in with a higher than expected 211,000. Add to that the fact that unemployment remained unchanged at 5%, and we are ready for liftoff.

Looking Ahead

Looking ahead, there isn’t much going on this week. There will be some Chinese economic data being released throughout the week, but none of it should be too earth-shattering.

U.S. Stocks snapped a six-week winning streak, with the S&P 500 declining 3.6% and the Dow falling 3.7% during the week. Stocks appear to be digesting the reality of a near-term interest rate increase (December 16th Fed meeting), which would be the first hike since 2006. While this move would reflect a stronger economy, it means the days of easy money won’t last forever.

Consumer discretionary stocks, specifically the retailers, had a difficult week following earnings reports from companies such as Macy’s, Nordstrom and J.C. Penney. While the warm weather has been an excuse for many department store operators, there’s no doubt that online retailers continue to take share from the bricks and mortar retailers.

Commodity prices also had a tough week, with oil falling 8% to $40.74 per barrel, contributing to a 6% slide in the overall energy sector.

Here is a look at last week’s numbers:

| Friday’s Close: | Weekly Change: | YTD Change: | |

| Dow Jones Industrial Average | 17,245.24 | (3.71%) | (3.24%) |

| S&P 500 | 2,023.04 | (3.63%) | (1.74%) |

| NASDAQ | 4,927.88 | (4.26%) | 4.05% |

| Russell 2000 | 1,146.55 | (4.43%) | (4.83%) |

| 10-Year Treasury | 2.27% | (0.06%) | 0.10% |

| 30-Year Treasury | 2.75% | (0.34%) | 0.00% |

Looking Ahead – A preview of the week of November 16, 2015:

This week will be filled with more earnings reports, largely from retailers such as Wal-Mart, Target, Home Depot and Best Buy. The coming days will also be busy with more “Fed speak”, with minutes from the October 27-28 meeting being released on Wednesday. Wall Street is now expecting the first rate hike since 2006. Fed funds futures, used by investors to place bets on central-bank policy, have risen to reflect a 70% likelihood of a rate hike in December. Wall Street is beginning to look past December and focus on rate hike #2 and its timing. The pace of tightening is beginning to become more important than the date Fed liftoff.

Commodity prices, oil in particular, will continue to be on the minds of investors this week. Energy stocks have been hit hard over the past 20 months, falling by a third since oil prices began to plunge in mid-2014.

Major earnings this week include:

Monday (11/16): Tyson Foods (TSN), Agilent Technologies (A), Urban Outfitters (URBN), JD.com (JD)

Tuesday (11/17): Dick’s Sporting Goods (DKS), Home Depot (HD), TJX (TJX), Wal-Mart (WMT)

Wednesday (11/18): Lowes (LOW), Staples (SPLS), Target (TGT), salesforce.com (CRM), NetApp (NTAP), Semtech (SMTC)

Thursday (11/19): Best Buy (BBY), J.M. Smucker (SJM), Autodesk (ADSK), The Gap (GPS), Intuit (INTU), Splunk (SPLK), Fresh Market (TFM), Workday (WDAY)

Friday (11/20): Abercrombie & Fitch (ANF), Foot Locker (FL), Hibbett Sports (HIBB)

Economic / macro reports this week include:

Monday (11/16): G20 Leaders Summit (11/15 and 11/16)

Tuesday (11/17): October CPI (consensus +0.2%) and IP #s

Wednesday (11/18): Fed minutes from 10/27-28 meeting

Thursday (11/19): ECB meeting minutes

The economic recovery that began in Q1 2009 slowed unexpectedly in the first half of 2011. Reported growth of the GDP in Q1 2011 was only at an annualized rate of 1.9%, and a similar modest increase is anticipated for the second quarter. At the beginning of the year, a Bloomberg survey had consensus number for the quarter at 2.5%.

The economic recovery that began in Q1 2009 slowed unexpectedly in the first half of 2011. Reported growth of the GDP in Q1 2011 was only at an annualized rate of 1.9%, and a similar modest increase is anticipated for the second quarter. At the beginning of the year, a Bloomberg survey had consensus number for the quarter at 2.5%.

The shortfall caught the stock markets by surprise, and after reaching a high of 12,810 on April 29, the Dow Jones Industrial Index fell 3.1% to 12,414 to end the quarter. For the quarter, the Dow was up 1.4%, and up 8.6% for the first half. The S&P 500 was also up a hair, 0.22% for the quarter. Although there was a lot of volatility this quarter, stocks ended up where they started.

On the other hand, interest rates, sensing an economic slowdown, fell to new lows for this cycle. The 10 year U.S. Treasury note closed at a low of 2.86% on June 24th. Returns of short term Treasury notes (U.S. government securities with maturities less than a year) were even more startling. (more…)

There was another pullback this week (the fourth consecutive), after a relatively steady, significant increase from the March 10th lows. The Dow was down 1.6%, the S&P 500 1.9%, and the NASDAQ 2.3%. Year-to-date, the Dow and S&P are still negative, down 7.2% and 2.7%, respectively, and the NASDAQ remains positive with an 11.4% year-to-date gain.

In commodities, the price of gold has decreased, down to a little over $900 per ounce. Oil prices have also decreased to $60, back down to where they should be — between $45-65 a barrel. The federal funds rate has also dropped to 0.16%, down more than 10 basis points from just two weeks ago. The market is no longer pricing in a rate increase.

At the close of Monday, June 22nd, the S&P 500 was down 1.1% year-to-date while the Dow Jones Industrial Average was down 5% year-to-date. So far this quarter, however, both reported positive increases: the S&P was up 11.9% and the DJIA 9.6%. The NASDAQ year-to-date showed an increase of 12%, down from last week’s 17.5%. After a very aggressive upward move off of the March 9th lows, the markets appear to be taking a breather. World-wide economic growth and recovery are currently being questioned.

While foreign markets are doing well, the current yield of 10-year Treasury bonds is 3.69, down significantly from the 3.98 we saw earlier this month. The prices of gold and oil are down as well, with oil dropping from the low 70s to the high 60s. But with the number of new home starts up and the number of weekly unemployment claims stabilizing, the economy seems to be showing signs of life.

At this point, we really need the government spending programs to actually kick in. Though the money has been appropriated, very little has been spent; for economic growth to really begin, this money needs to work its way into the economy. Until then, we should be in a trading range for stocks.

It was another disappointing quarter for the financial markets as investors remained cautious in the face of high energy prices and continued weakness in the housing market. Uncertainty regarding the Federal Reserve’s course of action in dealing with the economic weakness and credit market issues has also constrained investors. For the quarter, the Dow Jones Industrial Average was off 6.9% following a decline of 6.8% in the first quarter, bringing the year-to-date decline to 13.3%. The month of June was the worst June since 1930, as the Dow was off 10.0%. The S&P 500 was down 11.9% in the first-half. Other indices reported similar first-half results, with the NASDAQ down 13.5% and the Russell 2000, an index of small capitalization companies, off 10.0%. Stock prices tumbled in the quarter due to an especially poor performance by the financial sector. Although J.P. Morgan Chase successfully completed its merger with the failing Bear Stearns, continued problems remain in the sector. The rescue of Bear Stearns was necessary because its business model was not adequately diversified, as it was dependent primarily on sub-prime mortgages and newer “experimental” derivative products, such as credit default instruments.

It was another disappointing quarter for the financial markets as investors remained cautious in the face of high energy prices and continued weakness in the housing market. Uncertainty regarding the Federal Reserve’s course of action in dealing with the economic weakness and credit market issues has also constrained investors. For the quarter, the Dow Jones Industrial Average was off 6.9% following a decline of 6.8% in the first quarter, bringing the year-to-date decline to 13.3%. The month of June was the worst June since 1930, as the Dow was off 10.0%. The S&P 500 was down 11.9% in the first-half. Other indices reported similar first-half results, with the NASDAQ down 13.5% and the Russell 2000, an index of small capitalization companies, off 10.0%. Stock prices tumbled in the quarter due to an especially poor performance by the financial sector. Although J.P. Morgan Chase successfully completed its merger with the failing Bear Stearns, continued problems remain in the sector. The rescue of Bear Stearns was necessary because its business model was not adequately diversified, as it was dependent primarily on sub-prime mortgages and newer “experimental” derivative products, such as credit default instruments.

It was not much better in the bond market as yields across the U.S. Treasury curve moved higher by about a half percent, driving bond prices down during the quarter. For the year, though, yields are essentially unchanged. The yield on the 10-year Treasury, for example, was 3.94% at the end of the period versus 4.15 % on December 31st. (more…)