Q4 2023: Great Expectations

By: Eric Schopf

The fourth quarter provided excellent returns for the equity and credit markets. Standard and Poor’s 500 stock index gained 11.7% in the quarter and closed the year with a total return of 26.3%. The yield on the 10-year United States Treasury note fell from 4.57% at the beginning of the quarter to 3.88%. The drop in yields proved to be a strong catalyst for the surging stock market.

The quarter was a welcome relief for a market that had been dominated by a small group of stocks. The anointed Magnificent Seven: Apple, Amazon, Meta (Facebook), Alphabet (Google), Microsoft, Tesla and Nvidia, accounted for about 60% of the market’s total annual return, with individual returns ranging from 49% for Apple to 239% for Nvidia. The S&P 500’s return for the year, excluding the Magnificent Seven, would have been a more modest 7.6%. The explanation for the dominance is found in the calculation of the S&P 500 returns. The index is capitalization-weighted, which accounts for the lofty returns. A company’s weighting in the Index is calculated by multiplying the shares outstanding by the stock price, and these seven stocks represent 28% of the Index. The past year was far more lackluster for the remaining 72%. Had each index member been equally-weighted, index returns for the year would have been 13.9%. The equal-weighted index was in fact down 3.95% through October 27. Weakness was broad based with eight of the eleven market sectors underperforming. It was the late quarter surge of 18.6% in the equal-weighted index that made all the difference and provided relief.

Broad market weakness was accompanied by higher interest rates. The 10-year United States Treasury peaked at 4.99% on October 19, nearly to the day that the equal-weighted S&P 500 Index reached its low point. The 10-year Treasury was little changed for the year, rising from 3.81% to 3.88%. However, the intra-quarter move from 4.99% to 3.88% was high octane for the equity markets.

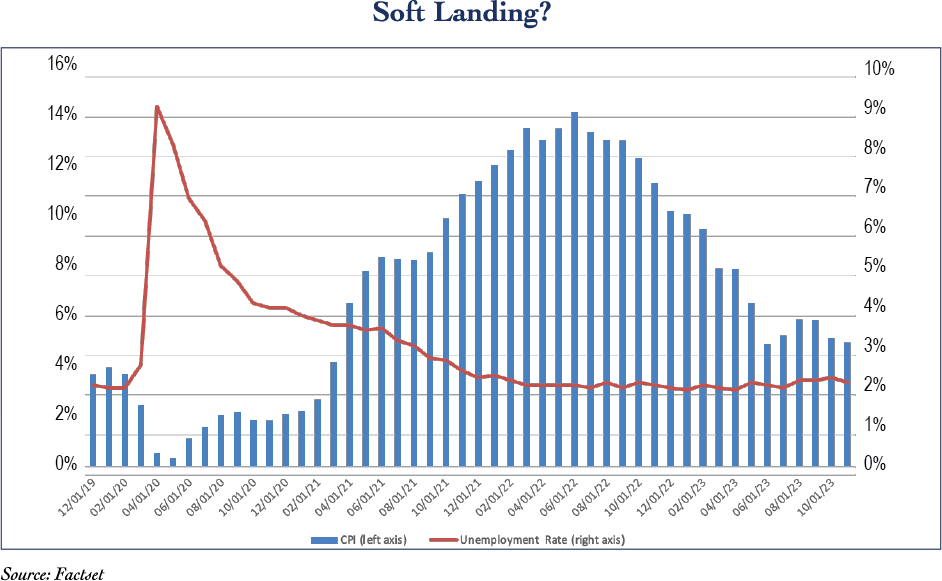

Signs of receding inflationary pressure were behind the big tumble in interest rates. The Consumer Price Index (CPI) and the Personal Consumption Expenditure Index (PCE) are approaching levels consistent with the Federal Reserve’s inflation target of 2%. CPI started the year at a 6.35% pace, and the read for November was 3.12%. The PCE showed similar progress, falling from 5.4% in January to 2.64% in November. Employment growth is slowing as is wage growth, but not at an alarming rate. The unemployment rate closed the year at 3.7%. Strong retail sales reflect a strong consumer, and economic growth continues to chug along.

The moderation of inflation was not lost on the Fed. In December, the Federal Open Market Committee, a 12-member group comprised of seven members of the Board of Governors of the Federal Reserve System along with the president of the New York Federal Reserve Bank and four of the other eleven Reserve Bank presidents, released their dot plot report signaling their future interest rate expectations. The median expectation for 2024 was 4.625%, 0.5% below the number communicated in September. Based on the current fed funds rate of 5.5%, the Fed is now projecting three quarter-point interest rate cuts in 2024. The same December dot plot report indicates four additional interest rate cuts in 2025 and three more in 2026. The shift in policy was due to the moderating inflation and not the economic weakness.

The Fed’s pivot was not lost on the market. Although the timing of interest rate cuts was not part of the Fed’s press release, the market quickly shifted their expectations. Futures contracts, which are legal agreements used to make bets on future moves in security prices, indicate that market expectations are for six interest rate cuts in 2024. The market will see the Fed’s three and raise it by three! The stock market responded to the lower rate scenario with surging prices lifting all boats in the last forty-five days of the year. Expectations are very high for the Fed to deliver.

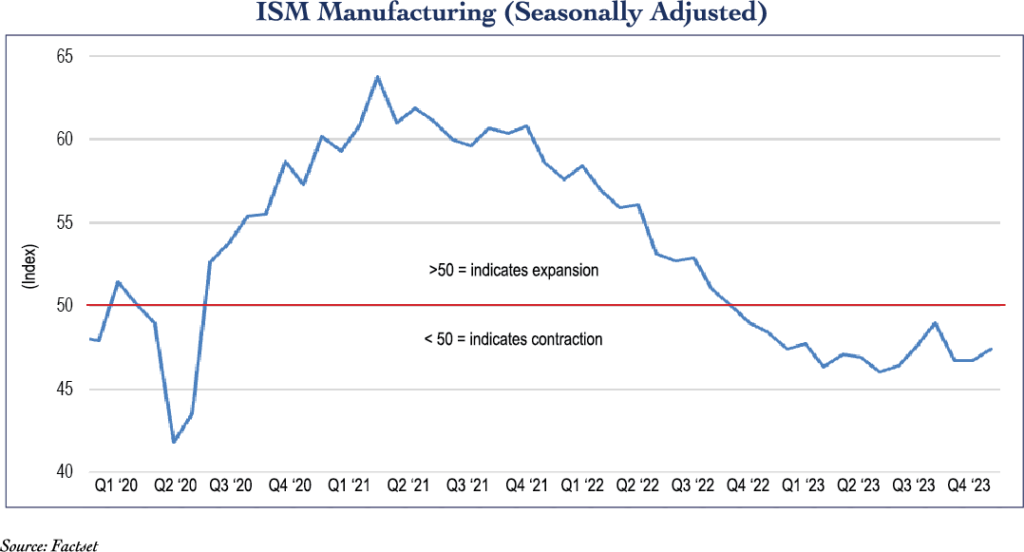

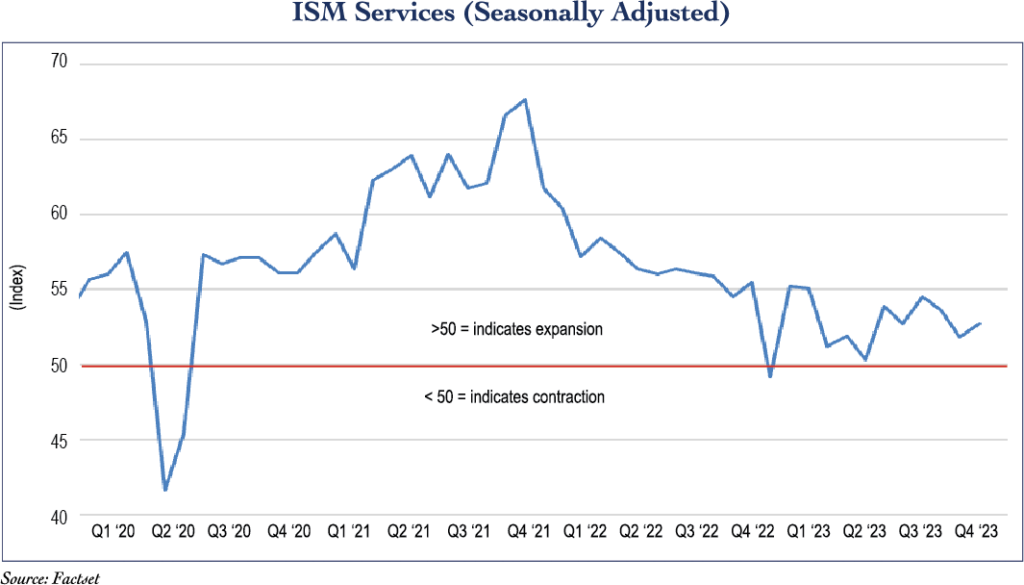

The strong returns in 2023 were a response to an overly pessimistic market. The much-anticipated recession never materialized. But as we move into the new year, we are confronted by many risks—some old and some new. The nearby charts reflect the two broad sectors of our economy: manufacturing and services. The charts are based on diffusion indexes, with readings above 50 indicating expansion and readings below 50 indicating contraction. The manufacturing sector has been in a funk since October 2022. The service sector has remained strong, with a few bumps along the Covid path. The easing of interest rates and lower cost of capital should allow manufacturing to regain some strength.

The greatest risk may have been caused by the market’s reaction to the shift in Fed policy. Appreciation in both stocks and bonds was built on a foundation of lower future interest rates—rates much lower than those signaled by the Fed. Should the timing or magnitude of rate changes differ materially from expectations, financial assets could suffer. Geopolitical risks escalated with the Hamas attack on Israel in October. In addition to the human toll exacted by war, this dynamic region has a tangible impact on commerce as demonstrated by shipping restrictions through the Red Sea, and the potential for regional escalation is a concern. The Russia/Ukraine War continues to drag on as the human and financial costs continue to grow. Although the risk of regional escalation is lower than that of the Middle East, the potential impact on commerce is still material. Russia is the third-largest producer of worldwide oil, accounting for over 12% of global oil production. The relationship between the United States and China continues to deteriorate, and tariffs, product restrictions and general mistrust reflect the frayed relationship.

The World Economic Forum, an international not-for-profit foundation formed to shape global, regional and industry agendas, released their survey data seeking to determine the five risks most likely to present a material global crisis in 2024. The question was posed to 1,490 leaders from around the world. Coming in at number one, reflecting a 66% response rate, was extreme weather. Number two, cited by 53% of the participants, was artificial intelligence (AI) misinformation/disinformation, providing cold comfort with our presidential election just eleven months away. The number three threat with a 46% response rate was societal/political polarization, while the cost-of-living crisis was not far behind at 42%. Year-over-year inflation peaked at 9% in June 2022, and although the final push to 2% may be a struggle, the Fed has made meaningful progress. Conviction in reaching the 2% inflation target and taking the necessary steps to get over the hump may determine the difference between a soft economic landing and recession.

We at Tufton remain committed to investing in companies with good value and strong fundamentals. We realize that short-term volatility can be uncomfortable, but we are typically rewarded for the risk over the long term. Through diversification and asset allocation, we ensure that your portfolio reflects your risk tolerance and investment time horizon.