Second Quarter 2024: Back to the Future

By: Eric Schopf

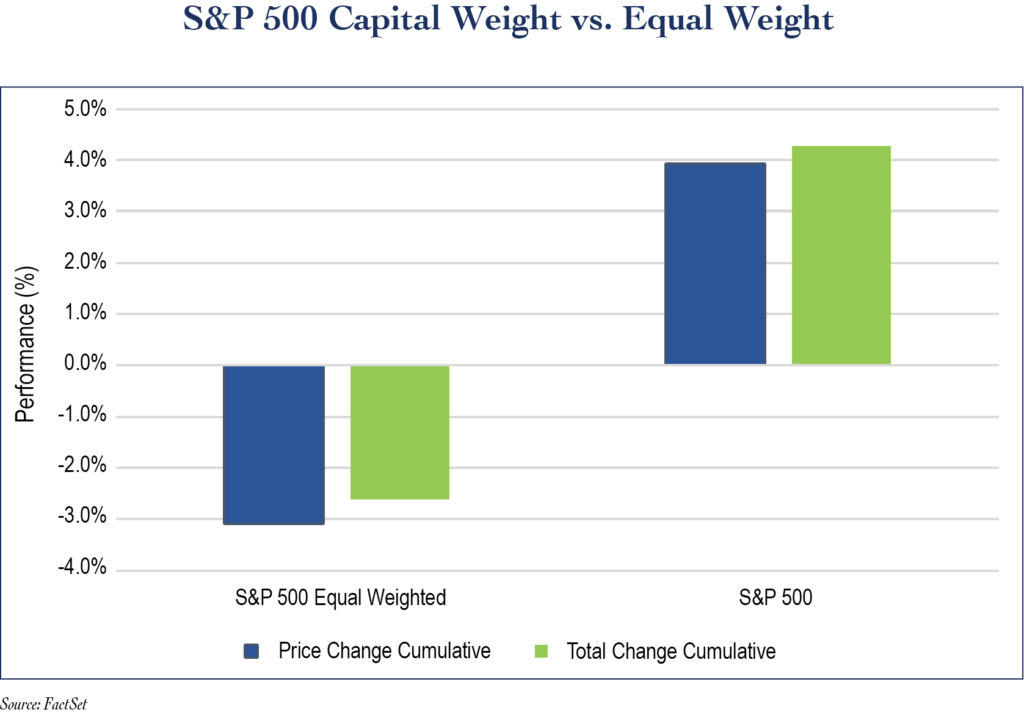

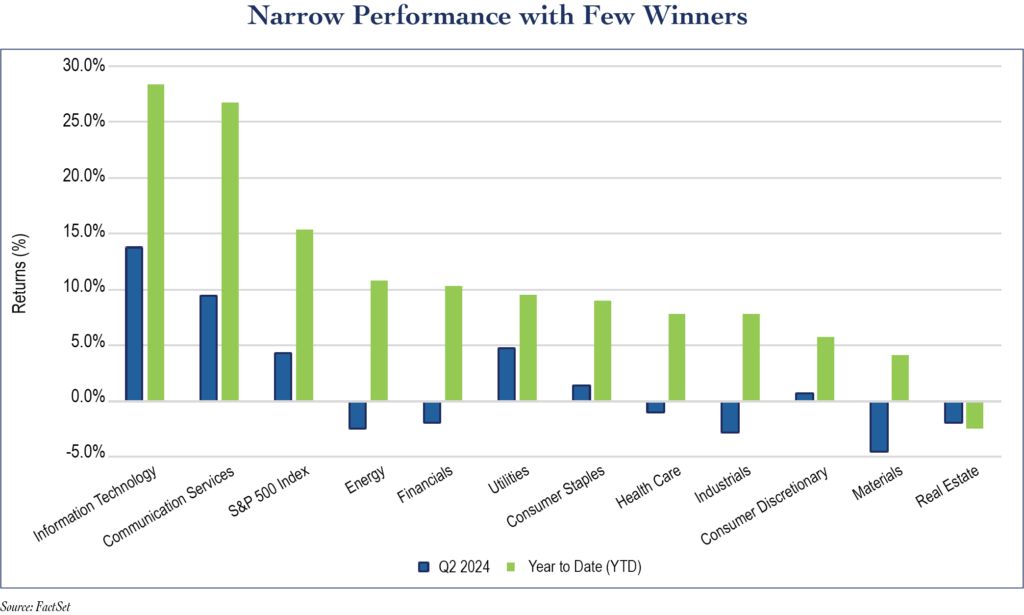

The second quarter of 2024 extended the bull market run. The Standard & Poor’s 500 delivered a total return of 4.28%. For the year, the index is up 15.4%, and it is up 55% following the 21% bear market decline experienced in the first nine months of 2022. Unlike the widespread price appreciation in the first quarter, the second quarter was a repeat of calendar year 2023 with a very small select group of stocks, most tied to the Artificial Intelligence boom, driving most of the performance. Only three of the eleven index sectors outperformed the broad index during the quarter. Utility stocks finally joined the party when investors realized that all the AI computing power will take a lot of energy. Year-to-date, only two sectors have outperformed. As was the case in 2023, diversification has not been rewarded, and the equally weighted S&P 500 declined by 2.6% in the quarter. Artificial Intelligence stocks have sucked all the oxygen out of the market.

Bond market volatility continued during the quarter with the 10-year United States Treasury Note moving from 4.20% to 4.44%. A brief spike in late April took the yield to 4.7%, and the interest rate gyrations reflect uncertainty. At the beginning of the year, the consensus opinion on interest rates cuts was “not if but when.” By the end of April, the market was asking “not when but if.”

Bond market volatility continued during the quarter with the 10-year United States Treasury Note moving from 4.20% to 4.44%. A brief spike in late April took the yield to 4.7%, and the interest rate gyrations reflect uncertainty. At the beginning of the year, the consensus opinion on interest rates cuts was “not if but when.” By the end of April, the market was asking “not when but if.”

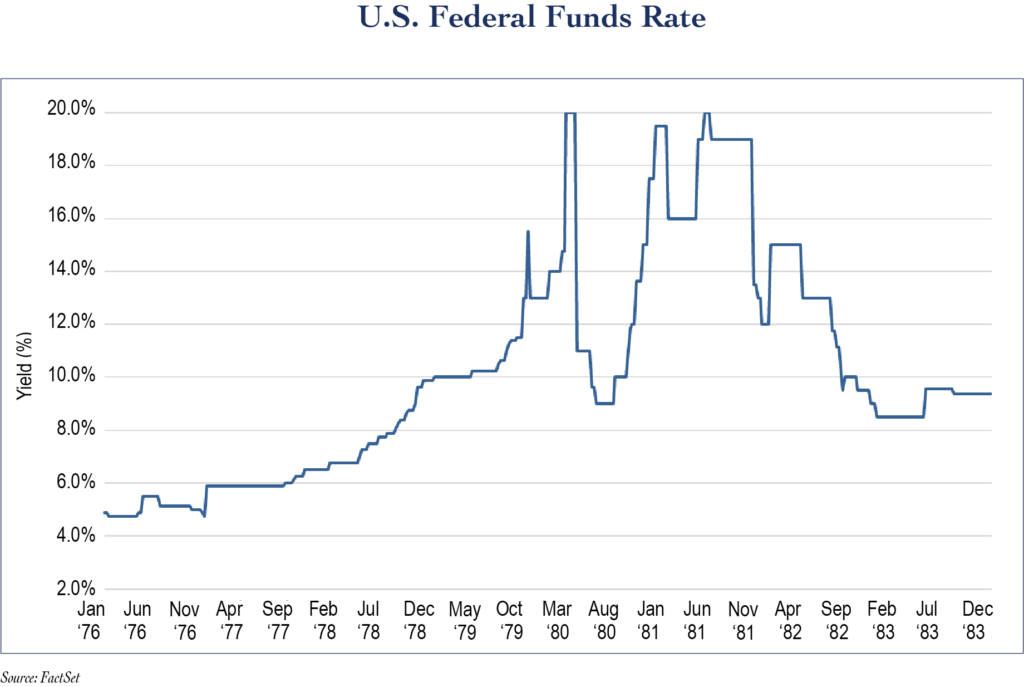

The Federal Reserve has remained resolute in its battle against inflation. The federal funds rate, which is the interest rate that banks charge each other to lend or borrow excess cash overnight, has been pegged by the Fed at 5.5% for the past year. The rate is a primary tool in achieving monetary policy. Higher rates make capital more expensive and act to slow the economy, but signs of success are becoming more apparent. Initial claims as well as continuing claims for unemployment continue to trend higher. The unemployment rate has reached 4.1%. Although the headline rate is still very low by historical standards, it is up sharply from the trough level of 3.5% reached in the first quarter of 2023. The Personal Consumption Expenditures Price Index, a broad measure of inflation at the consumer level, dropped to a 2.57% year-over-year gain in March. The rate is down significantly from the 6.81% peak recorded during the second quarter of 2022. We have reached an important inflection point, and the Fed will need to act because the federal funds rate is far too high given the level of inflation. Maintaining rates at current levels threatens to tip the economy into recession. In the early 1980s, the Fed, led by Chairman Paul Volker, ended tight monetary conditions too soon in an effort to help the economy escape a nasty recession that lasted five months. The result was a resurgence of inflation that required a second round of interest rate hikes. The second recession was worse than the first and lasted fifteen months. Despite risks to the economy, the Fed is in no mood to repeat the mistakes of the past.

Handicapping future fiscal policy became a lot tougher following the presidential debate. President Biden’s performance raised concerns about his health and his ability to serve. While Biden subsequently dropped out of the race, the Democratic nominee is now uncertain, but Vice President Kamala Harris appears to be at the top of the list as a replacement. A slew of state governors has also been mentioned as possible candidates. These include Gavin Newsom, Gretchen Whitmer, Josh Shapiro and J.B. Pritzker. Each has served as governor for five years except for Shapiro, who has only been in office for eighteen months. While their political agendas are not clear, the Democrats remain resolute in their plan to replace Donald Trump.

The Republican side of the aisle became more settled with the Supreme Court’s ruling that Donald Trump has immunity from prosecution for some official acts involving his alleged efforts to reverse the 2020 election result. The ruling means that the Republican nominee will not face trial in the federal case before November’s election and helps clear the deck for his presidential run. Although the candidate is now known, the platform is not. Competing agendas have emerged from factions within the party, and just how far to the right the party shifts has yet to be determined.

Regardless of where the Republicans land, platform differences between the party front-runners are stark. Spending priorities, taxation, regulation, trade and foreign relations are all priority issues with economic consequences that impact inflation, employment and ultimately interest rates and the value of the U.S. dollar. Regardless of who wins in November, the burden of a bloated federal debt may put a lid on political ambitions.

From an investment perspective, we are facing slower economic growth. Gross domestic product grew just 1.4% in the second quarter, a meaningful drop from 3.4% in the first quarter. Corporate revenue growth is decelerating, and profit margins are shrinking. The inflation bubble has been deflated, but the damage has been done and companies are having a difficult time passing on higher costs to consumers. As a result, dividend growth has cooled. Although the operating environment has become more challenging, the stock market is at record levels, primarily due to the hot industry sectors noted earlier.

I never cease to be amazed at the changes that occur in just three months when I write the review for the quarterly Viewpoint. Regardless of the uncertainty, we remain focused on the long term while heeding the mile markers along the way. We continue our search for value, and we manage your portfolio with an eye towards maximum return with minimum risk.