Steeling Ourselves for the Next Downturn

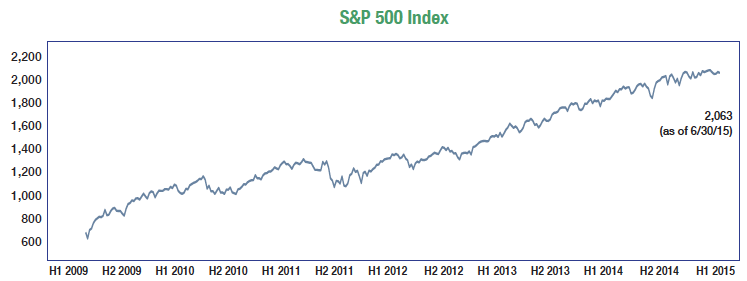

Many investors are riding high and feeling great as we continue to see gains in one of the longest bull markets since the 1940s.

Many investors are riding high and feeling great as we continue to see gains in one of the longest bull markets since the 1940s.

As we know, the bull market will only last so long: sooner or later, we are going to see a correction. We are monitoring the market’s higher valuation very closely. No one knows when it will come or how large the dip will be, but we do know it is coming. What’s important is staying strong in your investment strategy and fighting the urge to sell.

Retail investors (those who trade their portfolios non-professionally) have performance that significantly lags the market overall. This dynamic occurs because they tend to act on emotion, selling at the bottom and missing the large early gains of a recovery. There is a common example often given of the costs of missing the “best days in the market” that shows this point, but we find it misleading—missing the worst days is just as good as missing the best days is bad! So instead, we focus on the fact that if you act on emotion, you tend to sell near bottoms. We’re not missing “the best days,” we’re standing on the sidelines for the best months: the recovery itself.

We encourage our clients and friends to remember that we look to the long-term and that downturns are not only “ok,” they are expected, and are a reminder that our understanding of the markets is sound. We look for areas of the market that have good long-term growth. Short-term, temporary problems are at worst inconsequential, and may present a buying opportunity.

It’s easy to say these things when the market is chugging along. But we also remember the panic just seven years ago, when it seemed the world was ending. Even then, we knew of those who called their advisor or portfolio manager in March 2009 and told them to sell it all. That was the absolute bottom, and the S&P 500 has more than tripled since that month (see chart)! So, when the downturn comes, just remember: we’ve been here before, we’ll be here again, and we have a plan.