Why Business Owner Should Hire a Fiduciary to Advise Their 401K Plans

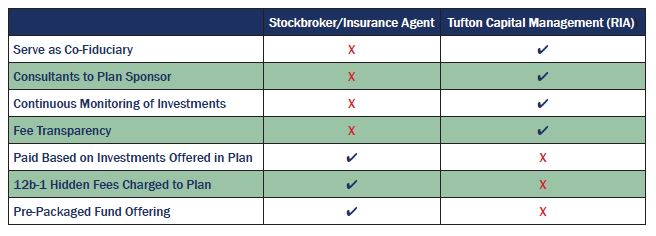

A 401k plan for a company’s employees should be a rewarding benefit to the business owners as well as to the participants. Many owners, or plan sponsors, continue to hire outside advisors who are not fiduciaries to oversee their plans. By hiring non-fiduciaries, such as investment brokers or insurance agents, fiduciary duties are not being upheld.

The 401k plan was originally established to offer long-term investment growth benefitted by tax-free compounding. This benefit can be largely offset by excessive fees, which are very harmful to compounded results. Because brokers and agents are incentivized by commissions, they might be tempted to add a mediocre fund with a hefty referral fee instead of a superior fund with no fee to your lineup. With new ERISA 408(b)(2) regulations, 401k service providers are required to disclose their entire fee structures. With these positive changes, employees will be better informed about the fees they’re paying, so plan sponsors should be prepared for more scrutiny.

A Registered Investment Advisor (RIA) has a fiduciary duty that sets it apart from stockbrokers and other salespeople. RIAs such as Tufton Capital Management will share in the fiduciary obligation to plan participants and ensure that the plan abides by ERISA and Department of Labor regulations.

Regarding your plan’s fund line-up, our fund selection process allows us to monitor the entire fund universe to select the best funds available. It’s just as important to have the right selection of fund types as it is to ensure those individual funds are the best in their class. We ensure that participants have a sufficient (but not overwhelming) number of choices to meet and reward requirements. Once the funds are chosen for a plan, we monitor the funds and make changes as necessary. Selecting and monitoring funds is an ongoing process that requires discipline.

One of the most important functions of a plan sponsor is to make sure that participants have the resources necessary to make informed investment decisions. We, at Tufton, will also educate your plan’s participants on the principles, risks and rewards of investing for their retirements. We will also provide in-person guidance for selecting appropriate asset allocations based on your employees’ risk tolerances.