The Third Quarter of 2020: Clawing Back

By Eric Schopf

The stock market continued marching higher in the third quarter. The Standard and Poor’s 500 provided a total return of 8.9% and finished the quarter with a year-to-date return of 5.6%. The strong returns came despite a mild correction that set the market back 7% in the first three weeks of September. Prior to the September correction, the S&P 500 was at an all-time high. Interest rates held steady with the 10-year U.S. Treasury bond closing at 0.68%, little changed from 0.65% at the end of June. The stock market stands in sharp contrast to an economy that is slowly healing from what we hope is a once in a lifetime pandemic. The “V” shaped recovery in the stock market has been compared to a “K” shaped economic recovery. Companies and individuals doing well continue their upward trajectory while those most negatively impacted by the virus fall further behind. Although the stock market has reached record highs, averages continue to be driven by large growth companies. Broader market strength will be a positive sign that the economy is normalizing.

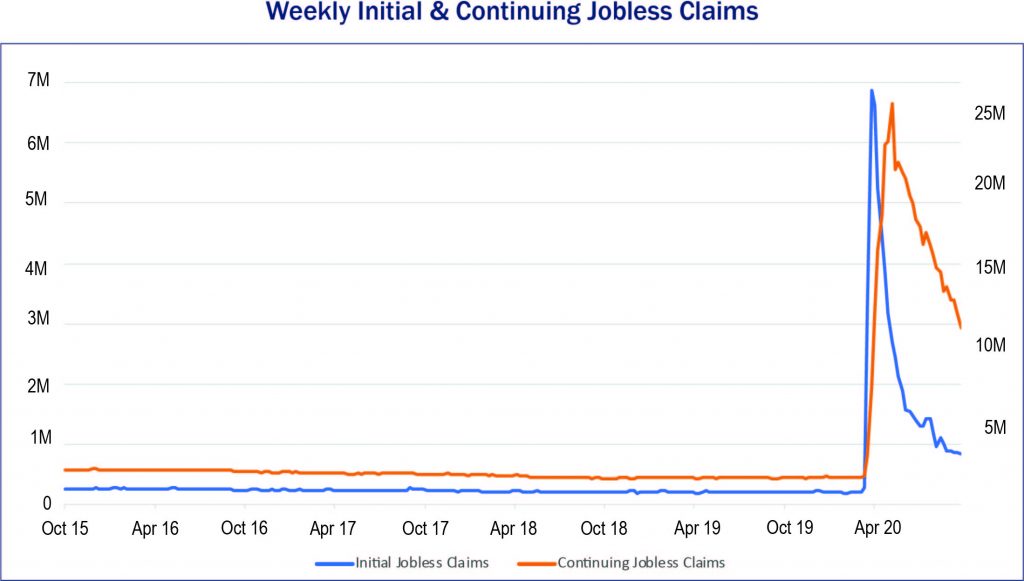

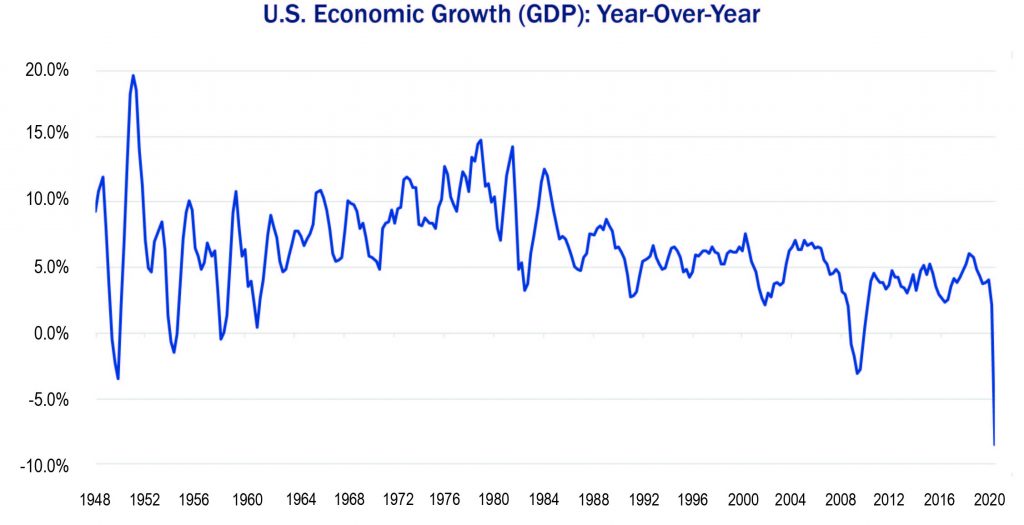

Economic indicators reveal improvement following the historic disruption in the first and second quarters. Manufacturing and service industries, as measured by the Institute for Supply Management, are growing again. Retail sales have returned to trend while home sales, housing starts and building permits have all recovered nicely. Most importantly, payrolls have expanded while claims for unemployment trend lower. Although these are all signs of an upswing, we still have a long way to go to return to pre-pandemic levels. It is estimated that between 22 and 25 million workers were let go in March and April. The number of individuals filing continuing claims for unemployment was nearly 11 million at quarter-end.

The dichotomy between the stock market and employment can be explained by the extraordinary levels of stimulus channeled through fiscal and monetary policy. Unemployment benefits, administered by states, were supplemented by an enhanced federal benefit of $300 per week. For many individuals, these combined benefits were greater than their previous income levels. Low interest rates, courtesy of the Federal Reserve’s asset purchase program, have been a catalyst for housing activity. Low interest rates also serve to push equity prices higher. Rates are used as a discounting mechanism to place a present value on future earnings, and low rates increase the value of future earnings, leading to higher stock prices.

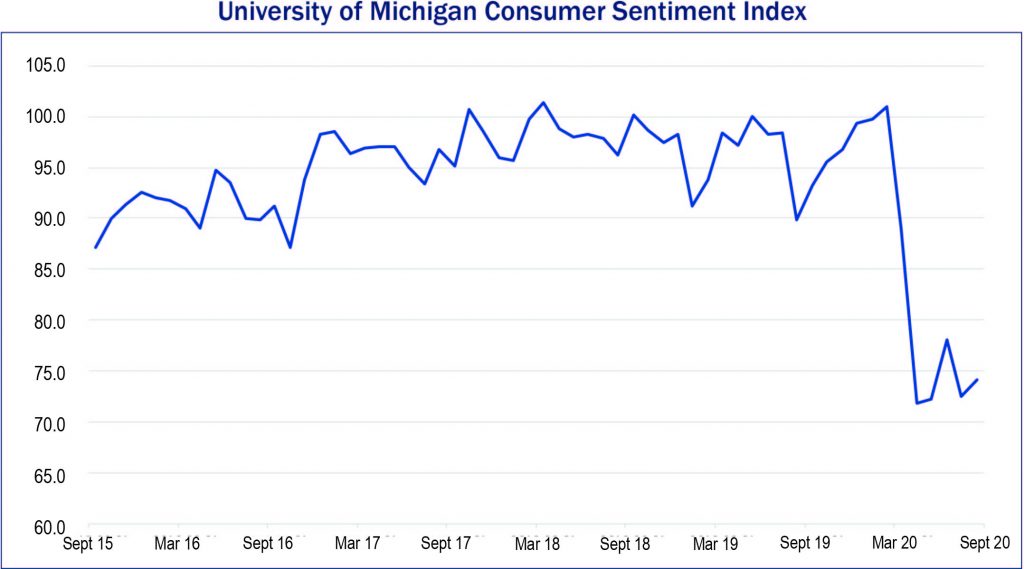

The strong stock market also stands in contrast to consumer confidence. Although there has been an improvement in confidence as measured by the Survey of Consumers by the University of Michigan, we are still well below levels attained in 2015 through 2019. The lower confidence is reflected in current savings rates. Savings rates spiked to 32% in April but have trended down to the current level of 14%. Savings rates were closer to 7% in 2019. Elevated savings reflect a cautious consumer who is uncertain of the future.

The future, however, does hold room for improvement. Further reductions in unemployment and loosening of the purse strings will benefit the economy. We are also faced with uncertainty and change. The greatest potential change may occur at 1600 Pennsylvania Avenue since polling estimates are pointing to a Biden victory. Control over the Senate is too close to call. President Trump, if reelected, could be expected to maintain his agenda of the last four years. His reductions in various regulations and tax reform are the two areas that may have impacted investors the most. Democratic nominee Biden has outlined an agenda of greater government spending and higher taxes. A Biden presidency would also bring potential changes to immigration and trade policies. Consensus is building on Wall Street for a Biden victory and a short-term economic boost delivered by increased spending. The longer-term impact of larger deficits and the need to issue additional debt have become a footnote in the discussion. Change, for better or worse, will impact our investment decisions, so we are monitoring the situation closely.

The transition away from government support as people return to work is important, although it has lost some significance as we approach the election. The 11 million still unemployed will require further assistance. The political parties are at odds over the size and provisions that would be included in an aid package, and negotiations have been fruitless. Regardless of November’s outcome, additional fiscal stimulus will most likely be implemented within the next three months.

We are closely watching the withdrawal of loan forbearance by financial institutions over the coming months. The deferral in collecting mortgage and credit card payments will soon come to an end. The impact on foreclosures, real estate values and the health of the financial industry hangs in the balance.

Covid-19 will also influence the near future as much as any other factor. We have seen firsthand the devastating impact of broad closures to prevent the virus’ spread. A second wave would be a major setback. A vaccine seems the only way to gain control. However, according to medical experts, development, manufacturing and distribution of an effective vaccine will take at least nine more months, so we are left vulnerable.

The one constant throughout the pandemic has been the Federal Reserve. This unelected group, the names of whom are unknown to most, has provided an abundance of monetary accommodation. Low interest rates, asset purchases and numerous credit facilities have delivered the liquidity necessary to keep the economic engine lubricated even as the motor was essentially shut off. The Fed has had our backs and has pledged their continued support. They have adopted a policy that will keep interest rates unchanged until inflation reaches and is sustained above their 2% target. The shift in policy is quite radical. In the past, the Fed always tried to shoot ahead of its target. Adjustments were made in anticipation of economic forecasts. They are now poised to accept wider tolerances and to exercise greater patience. The Fed’s patience will be tested, as we may potentially see exceptionally strong growth in the short term once the virus is under control and all of the stimulus money starts to circulate.

Uncertainty and change have been the order of the day in 2020. However, fewer than six months after the outbreak of the pandemic, and following a 34% decline in the stock market, equities have not only regained all of their losses but have reached record levels. The volatility serves as a valuable reminder to maintain your investment plan and to focus on long-term goals.