Dividends Make a Difference

By Randy McMenamin

Receiving dividend payments from your equity holdings every quarter is similar to collecting interest on money in a savings account. It’s very nice but it’s not exciting. Buying a stock and betting its share price will increase is much more exhilarating. There are, however, several advantages of owning dividend-paying stocks.

- Dividends provide passive income, which investors can either spend or reinvest. Dividend-paying stocks are particularly attractive to retirees and others looking to benefit from supplemental income.

- Companies that pay a dividend tend to be mature, stable and often raise their dividends.

- Dividends can be viewed as a hedge against inflation. Many blue-chip companies have a dividend yield higher than the rate of inflation and higher than the rate in a savings account.

Investors who opt to re-invest their dividends, rather than spend them, have a far better rate of return thanks to compounding interest. With compounding, the original investment grows exponentially with the repeated reinvestment of the dividends. Imagine a snowball rolling downhill, growing bigger in size as it picks up more snow along the way.

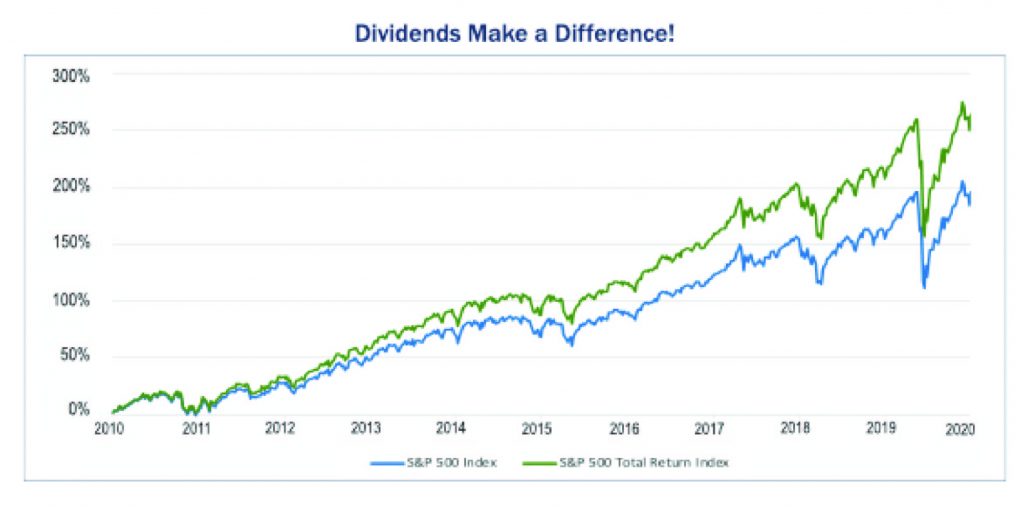

Dividends are central to long-term returns, and studies have shown that a portfolio without dividend paying stocks will underperform the market over the long term. The credit rating agency Standard & Poor’s recently conducted a study showing that over the past eighty years, dividends were responsible for 44% of the S&P 500’s total return.

The chart below shows the S&P 500 Index’s return (without dividends) vs. the S&P 500’s total return (including dividends). Dividends do make a difference!