The Third Quarter of 2021: In Like a Lion, Out Like a Lamb

By Eric Schopf

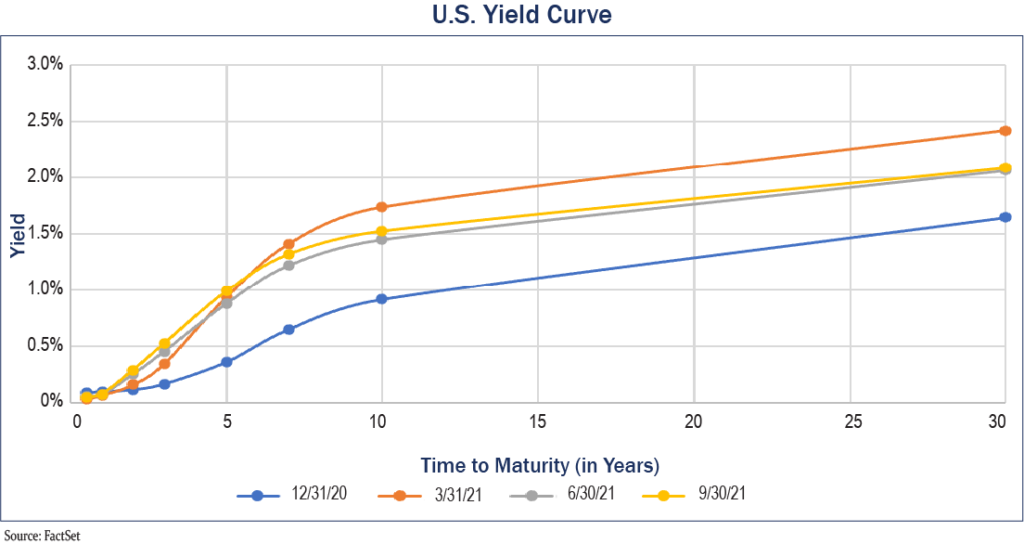

The Standard & Poor’s 500 carried strong momentum from the first half of the year into the third quarter. After setting fifteen new closing highs during the first quarter and nineteen during the second, twenty new all-time highs were recorded in the third quarter. A pullback of over 5% during the final weeks of September, however, all but erased these gains. For the quarter, the S&P 500 registered a total return of just 0.58%, but this year-to-date total return is still an impressive 15.92%. Interest rates moved higher during the quarter, with yields on the ten-year United States Treasury bond rising from 1.45% to 1.53%.

We welcome this rise in interest rates. Higher rates reflect a strong economy and a Federal Reserve intent on normalizing policy following a period of extraordinary intervention. Although higher rates are beneficial for prospective fixed income investments, they are corrosive to existing holdings. Interest rates and fixed income securities’ prices move inversely. As rates move up, bond prices fall. We have addressed the prevailing risk by keeping the maturity patterns of the fixed income portions of our portfolios short. Put another way, we do not want to lock the current low interest rates in by making long-term investments.

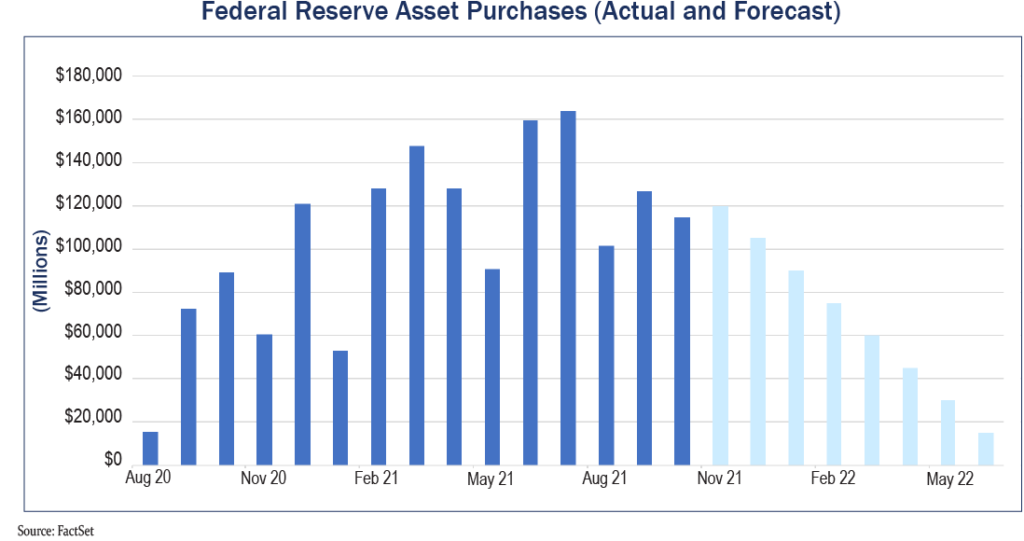

The September fade can be linked to the shifting winds on numerous fronts. The biggest shift came from the Federal Reserve. The Fed has clearly signaled that they will begin to taper their asset purchases, most likely beginning in November. Their current monthly purchases of $120 billion will be reduced by $15 billion each month until no new additional purchases will be made in July 2022. They will continue to reinvest the maturities of existing assets, but they are giving no indication of when the reinvestment period will end. The Fed has amassed $8.5 trillion in assets, so they will be a very active market participant. Equally important, they have been deliberate and transparent in their communications to help prevent market shocks.

The asset purchases have kept interest rates low. Although there will be additional purchases until the tapering ends, less demand for U.S. Treasury securities and mortgage-backed bonds on the margin will result in higher interest rates, a key support for stock and bond prices. Beyond open market operations to purchase securities, the Fed has remained silent on the timing of actually raising short-term rates.

A byproduct of the massive monetary stimulus has been a rise in inflation. This is most evident in asset prices, primarily with real estate and financial assets such as stocks and bonds. The Fed will need to walk a tightrope in deflating the economy at a pace that does not result in recession. Inflationary pressures have been exacerbated by the imbalance between the supply and demand for many goods. Footage of the port backups in Los Angeles and Long Beach, California has become a staple on the nightly news. Shortages and pricing pressures will continue until supply chains are restored. Covid-19 related issues have made the job of balancing full employment and stable prices as difficult as ever. The Fed’s response has been to err on the side of caution, and we expect this stance to remain unchanged.

A great deal of the supply and demand imbalance can be traced to the Covid Delta variant. This is clear in the United States where labor force participation is still below pre-pandemic levels, and the lack of workers has constrained output. However, demand has remained strong due to abundant levels of fiscal and monetary stimulus. Covid repercussions are felt throughout the world so there is not a short-term fix. Resolution will come with time – time for more people to get vaccinated, time for the variant to run its course and time for people to reenter the work force following the expiration of enhanced unemployment benefits.

China Evergrande Group, China’s largest property developer, has also raised concerns. The over-leveraged company has missed numerous interest payments and appears to be on the verge of collapse. Furthermore, the Chinese central government does not appear to be willing to support the company as they work to wean developers from the leverage business models and reduce risks within the financial system. Real estate and construction industries represent nearly 30% of China’s economy. A broad slowdown in development would not only impact the local economy but also companies around the world that provide goods and services for the industry.

The political wrangling in Washington has created an additional layer of uncertainty. Democrats are pushing $3.5 trillion in social investments through budget reconciliation. At the same time, a $1 trillion bipartisan infrastructure bill is waiting in the wings. This is occurring when the federal debt ceiling is about to be breached and needs to be raised. The political parties and their subgroups are linking the three issues in various ways with no clear winner emerging. Disparate agendas and an apparent shortage of compromise have resulted in a political standstill. This infighting has produced a precipitous drop in consumer confidence. These significant and far-reaching programs touch everything from education to health care to climate change. The size and scope of the final legislation will have a significant impact on future government spending and taxation.

Shifting winds also emerged from the south. The winds were named Ida, and she packed a mighty punch. Storm damage estimates are now approaching $95 billion, making it one of the costliest Atlantic hurricanes ever. The storm’s economic impact was just one more obstacle during the quarter.

Despite these headwinds, there is still room for optimism. The inventories depleted from supply and demand imbalances will be restored, and replenishing inventories will boost future economic growth. Increased output will require additional hiring, and the elimination of enhanced federal unemployment benefits should unleash a pool of workers to fill the job openings.

Another cause for optimism is strong corporate profit growth. Although gross domestic product is still slightly below pre-pandemic levels, corporate profits are at record levels. Earnings per share of the Standard and Poor’s 500 constituents reached record levels during the quarter. The most fundamental aspects of stock prices are the underlying earnings of its companies, and rising earnings support higher stock prices.

In September, the United States Fish and Wildlife Commission declared the ivory-billed woodpecker and twenty-two more birds, fish, and other species extinct. Absent from the list was the bear market. Equity valuations remain stretched, and interest rates continue on their upward trajectory. Except for the brief but sharp correction at the outset of Covid, the stock market has been strong since the financial crisis. From its low on March 9th in 2009 to the most recent all-time high, the S&P 500 has increased by 764%. The average annualized growth rate during this period was 18.8%, and the rates of return have been well above longer term averages. We remain focused on the economy and financial markets as we balance the risks with potential rewards.