Winners in a Self-Quarantined World

By Barbara Rishel

“May you live in interesting times” is an English expression often mistakenly associated with the Chinese philosopher Confucius that seems truly appropriate in today’s world. We are all overwhelmed by the deluge of negative news headlines about the impacts of the COVID-19 pandemic and the changes to our daily routines and lifestyles. We wonder if these changes are just temporary adjustments, or will they become a permanent and integral part of our lives? What are the impacts on the financial markets, and specifically, on our portfolios?

There are several key trends that many of us are relying on to manage through the current, “stay-at-home” or self-quarantine mandate, some of which are familiar and others quite new. Many of Tufton’s favorite companies are beneficiaries of these trends.

Telecommuting

Telecommuting is probably the trend that has the most wide-ranging implications for several industries:

Oil Industry: Less driving means less wear and tear on our vehicles, reduced need and lower price for gasoline. This is a positive for consumers because of fewer car repairs and cheaper gas.

Food Industry: More meals at home is positive for grocery stores, take-out restaurants and people who like to cook. The winners are companies such as Target, Amazon and home meal delivery companies (Blue Apron). Snack food companies such as Mondelez and PepsiCo are also BIG winners.

Telecommunications and Technology Industries: People spending more time at the computer is great news for wireless and wireline carriers (Verizon and AT&T), equipment producers, PC producers, bandwidth companies (Corning), tower companies (Crown Castle) and cloud companies (Microsoft). Verizon estimates that phone calls have increased to over 800 million calls daily, which is TWICE the volume of calls on Mother’s Day – usually the biggest call volume day of the year. Again, winners are wireless and wireline companies (Verizon, AT&T, Apple and Qualcomm).

Teleconferencing: This is a trend that is not new but is becoming increasingly important to employers in business, education and healthcare, with many of the nation’s schools and universities moving to more online classes. This is a big boon for companies that provide these services (Microsoft Skype, Zoom Video, Google Meets and Apple).

Social Distancing

Social distancing is a new trend, hopefully temporary, that has definitely changed how we interact with the people in our lives. This trend affects grocery shopping, routine visits to the doctor, sporting events and other social gatherings.

Consumer Staple Industry: Since we are limiting our time in public places, companies that sell essentials such as toilet tissue (!!), toothpaste and sanitizing products are big winners (Proctor & Gamble and Colgate-Palmolive). Companies making surgical masks and surgical gloves (Johnson & Johnson, Kimberly Clark and 3M) are ramping up production of these much-needed supplies.

Retail Industry: No shopping at the mall! This is a positive for retail companies with a strong online or curbside presence (Amazon, T.J. Maxx, Target and VF Corporation). Companies that provide “essential needs” such as groceries and pharmacy services (Target, Walmart and Amazon) are also benefitting from customers ordering more online.

Entertainment Industry: Bars, restaurants and theatres are closed now, and at home entertainment is soaring. The winners are AT&T, Time Warner, Disney, Netflix, Alphabet (Google), social media companies and video gaming companies (Microsoft and Apple).

Transportation Industry: All those packages must be delivered to homes, and many are time sensitive, such as fresh fruits and vegetables. Winners are United Parcel Service and FedEx.

Healthcare Industry: Telemedicine is emerging as a new trend. Doctors are being encouraged to provide virtual/remote clinical services to people with routine medical needs. Companies that offer teleconferencing services (Zoom) enable face to face meetings. Teledoc provides a platform for people to get healthcare from a variety of medical professionals, including mental health providers and specialists. In addition, many healthcare companies are joining forces with other industries to provide more tests (Abbott Labs) and clinical research/vaccine trials (AbbVie).

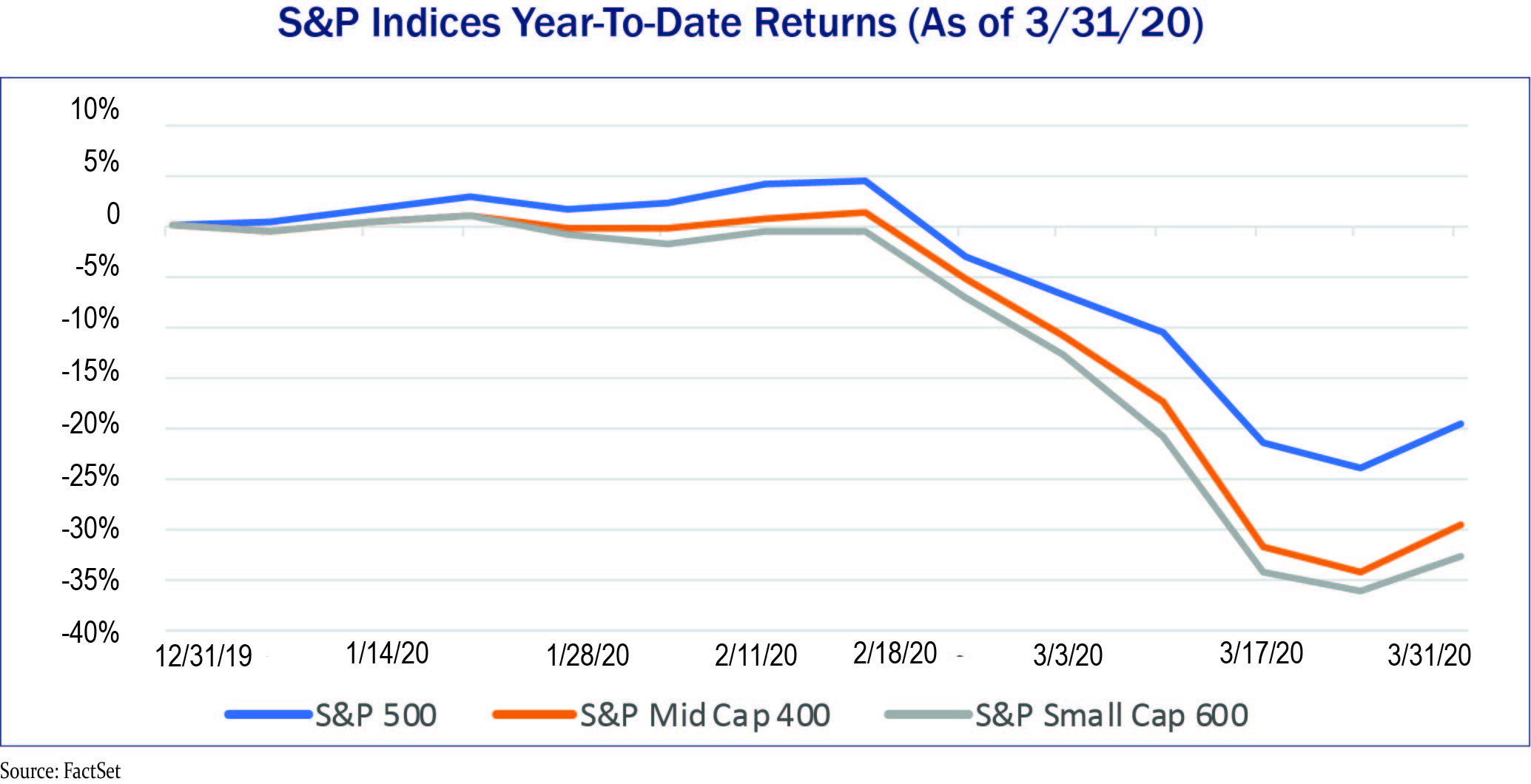

These are just a few samples of the current trends and companies that we feel may benefit from the myriad changes brought on by the pandemic. As you can see in the chart below, the stock prices of larger companies (S&P 500) continue to outperform those of mid- and small-cap ones, especially during these turbulent times. Our firm’s equity investments have and will continue to be primarily in these large-cap companies, as we find their strong balance sheets, dominant market positions and strong free cash flow generation help them outperform throughout the economic and market cycles. We are always on the lookout for appropriate investment opportunities for your portfolios. All of us at Tufton Capital Management sincerely hope you and your loved ones stay safe and healthy during these challenging times.