The First Quarter of 2021: A Glimpse of Things to Come

By Eric Schopf

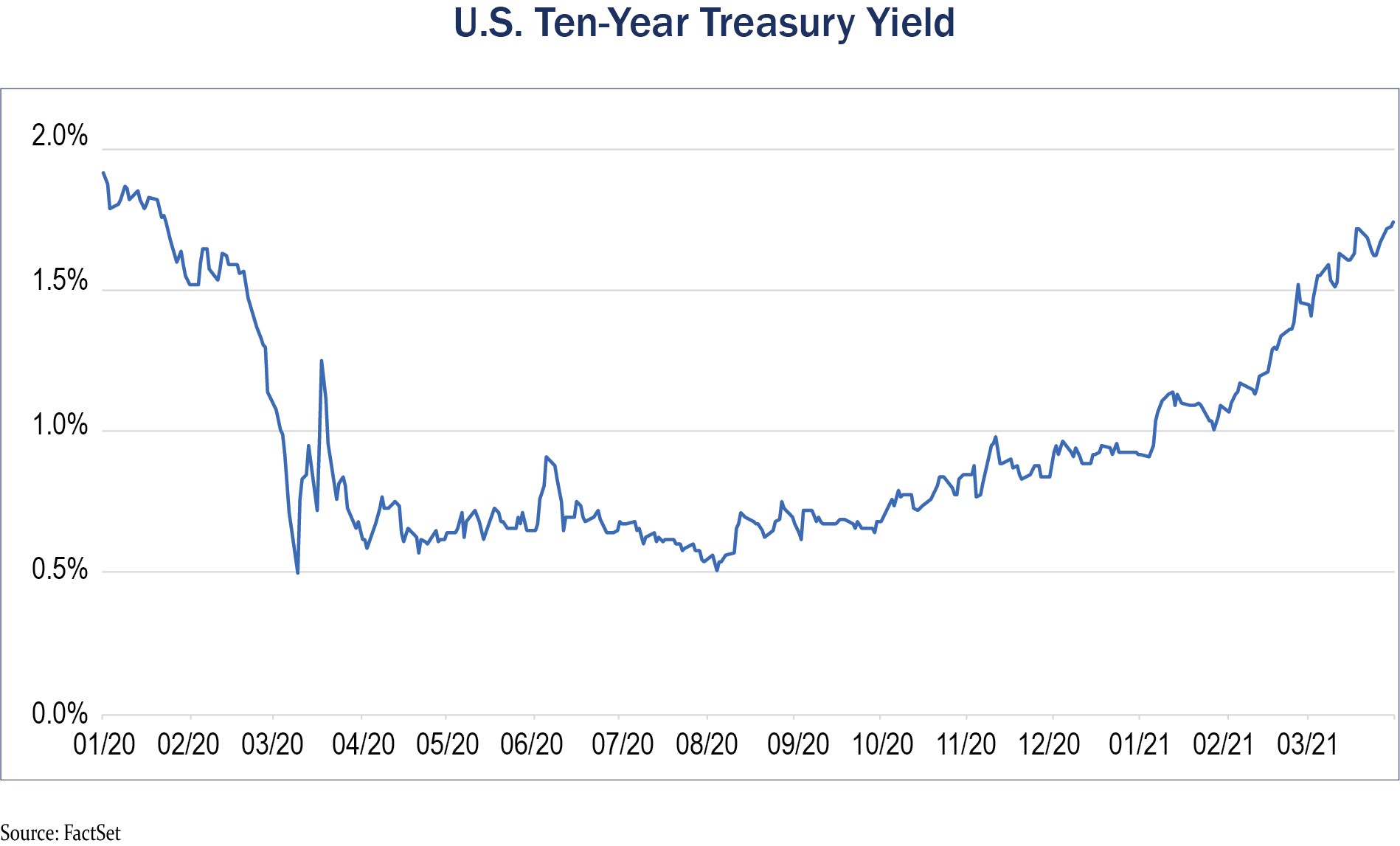

The first quarter of 2021 gave investors a little bit of everything. We saw a second impeachment of Donald Trump, the inauguration of Joe Biden, two more shots of fiscal stimulus, multiple Covid-19 vaccines, the rise of retail investors and meme stocks, unseasonable weather patterns and the collapse of a hedge fund masquerading as a family investment office. Through it all, the stock market maintained a bullish stance with the Standard & Poor’s 500 delivering a total return of 6.2%. The improving outlook for the economy was confirmed by the bond market as interest rates rose sharply. The yield on the 10-Year U.S. Treasury note spiked to 1.74% from 0.92% at year end.

If the first quarter of 2020 was a bridge to somewhere, the first quarter of 2021 was an extension and buttressing of the superstructure. The engineering work was provided by two rounds of stimulus. The $900 billion first package was distributed through direct cash payments and an enhanced Paycheck Protection Program. Although the Covid-19 relief package was passed by Congress in December, it was not implemented until January. That was followed in March by the $1.9 trillion American Rescue Plan. Among other things, the ARP includes additional direct cash payments, extended unemployment benefits and funding for state and local governments. The original framework was sourced from the $2.2 trillion Coronavirus Aid, Relief and Economic Security Act of 2020. Without the additional monetary support, our economy would likely have experienced a double-dip recession. Even more spending is on the way as President Biden calls on his political experience to pass an infrastructure bill, The American Jobs Plan, that could be worth as much as $2.7 trillion. This ambitious plan covers everything from roads to schools to broadband connectivity.

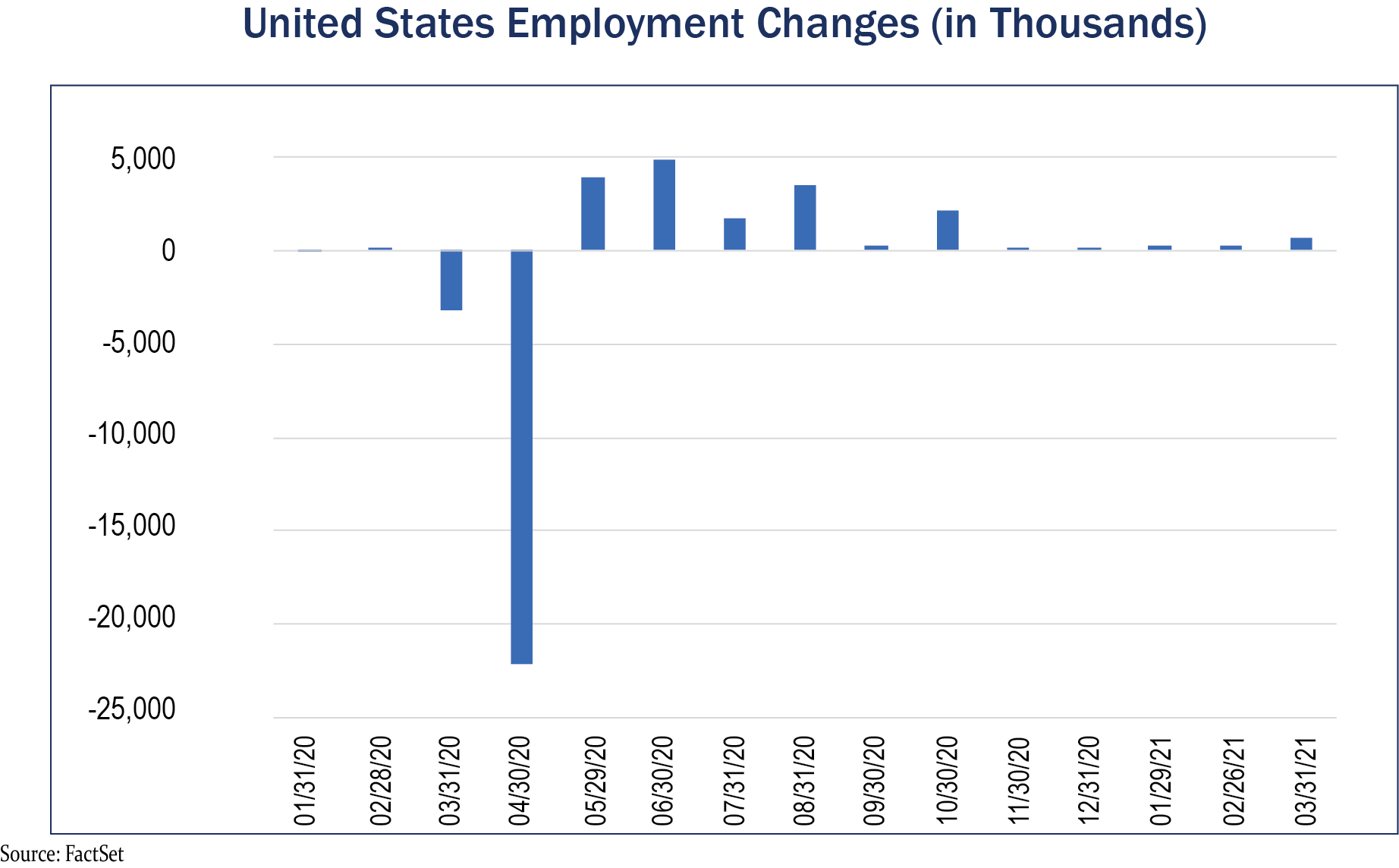

Clearly the most important development during the quarter was the introduction and acceptance of numerous Covid-19 vaccines. Millions of people are getting inoculated daily, and travel restrictions are gradually being lifted. Herd immunity is projected by June or July. Rising consumer confidence, combined with overflowing savings accounts, have put Americans in a position to spend. As spending patterns shift from goods to services, more people will return to work and the unemployment rate will continue to fall. This will be a welcome development since we still have more than eight million unemployed people as a result of the pandemic. Fiscal and monetary stimulus combined with strong employment growth are powerful catalysts for the stock market.

With the economy heating up and economic growth accelerating at the fastest quarterly pace in nearly forty years, we should turn our attention to the other side of the bridge. If we wait until we get to the bridge to cross it, it will be too late. To be sure, we do not exactly know what the other side will look like because it is unclear whether changes made during the pandemic will prove durable. For example, according to the Bureau of Labor Statistics, less than 10% of the workforce worked consistently from home prior to the pandemic. That figure rose to over 30% during the depths of the lockdown. Working from home has wide ramifications ranging from the cost of gasoline to the prevailing rents in business districts. Although leisure travel is expected to rebound, the future of business travel is also in question. Further challenges will come as the economy weans itself off of fiscal support. Deficit-funded pandemic support will reach nearly $5 trillion, which is over 25% of the nation’s pre-pandemic gross domestic product. The large accumulated federal debt with its higher interest expenses may stymie future growth. Many corporations are facing the same situation. Trade and immigration policies, restrictive under Trump, will most likely change under the Biden Administration. We are, however, gaining some clarity on tolls for our bridge. Higher taxes on corporations and on those couples earning more than $400,000 per year appear set to absorb the tab.

The Federal Reserve’s response to robust economic growth and inflationary pressure will put their resolve to the test. The Fed’s role in averting a financial crisis cannot be overstated. Interest rates were cut to zero, quantitative easing was ramped up to provide liquidity and clear the Treasury market, and credit facilities were established to provide support for businesses. They have pledged to remain accommodative and show no interest in beginning to disassemble our bridge. Investors are focused on just one thing. When does easing end and tightening begin? Although inflationary pressure will temporarily exceed the Fed’s 2% target, unemployment is still too high to warrant action in the near term. Furthermore, despite the record levels of fiscal stimulus, inflation will not become a systemic issue due to our aging population, productivity improvements and global competition. This was evident prior to the pandemic and will become obvious once again. What we do expect is a tapering of current monetary policies executed through quantitative easing. Monthly purchase of U.S. Treasury and mortgage securities will slowly be reduced from their current monthly purchase levels of $80 billion and $40 billion, respectively.

The impact of interest rates cannot be overstated. Stimulus combined with low rates have sent stock valuations soaring. Prices relative to earnings are high. Total stock market values as a percentage of gross domestic product are at record levels. These are ratios supported by low interest rates, and if they remain low, we should not have any issues. How long will rates remain low? We should focus on employment trends and the ranks of the unemployed for guidance. At our current rate of monthly employment growth, we should return to full employment in 2023. Until then, we would expect the current accommodative backdrop to remain in place.

There is still progress to be made with Covid immunizations. Herd immunity is expected by summer in the United States. However, we are not okay until everyone is okay, and global herd immunity is not expected for many years, if at all. We turn to investment objectives and asset allocation guidelines to balance the risks with rewards. Investors who have stayed the course have been rewarded. We will be rewarded again when we get back to giving hugs and handshakes.