The American Jobs Plan: A Detailed View of the $2.7 Trillion Proposal

By Barbara Rishel

On March 31, 2021, President Biden released details for a proposed American Jobs Plan – a $2.7 trillion package aimed at addressing a range of issues, including transportation and other infrastructure, climate change, caregiving and housing. If approved by the Congress, the plan would represent one of the largest investments in the nation’s infrastructure in history, although the scope of the proposal goes beyond what is traditionally thought of as “infrastructure”. As a means of fully offsetting the cost of the package, the Administration has proposed increasing the corporate tax rate from 21% to 28%.

In addition to spending on transportation infra-structure such as roads and bridges, the package plans to address issues such as clean drinking water, electric grid improvements, high-speed internet, racial and economic inequality, affordable housing, job training and expanded access to home and community care for the elderly and individuals with disabilities. Auto manufacturers, semiconductor makers and fiber-optic companies would be affected by the plan, as would renewable-energy producers, pharmaceutical developers, home builders and construction firms. President Biden’s infrastructure plan touches a wide array of American businesses and industries.

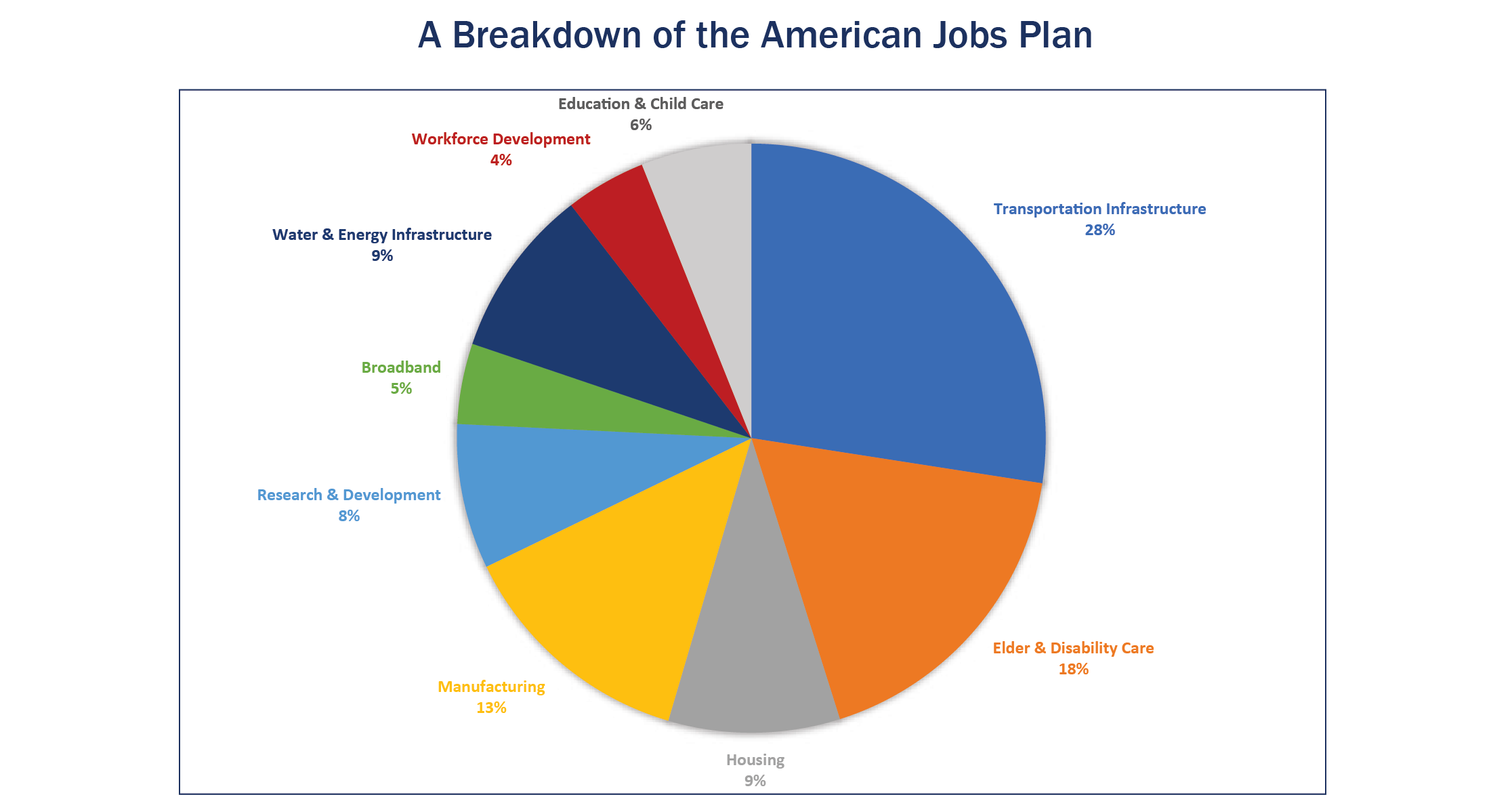

The proposed spending in the American Jobs Plan covers an eight-year window and breaks down in the following ways:

Transportation Infrastructure includes $115 billion to modernize the U.S. bridges, highways and roads, and $80 billion to invest in passenger and freight rail services. In addition, $85 billion is earmarked for modernizing public transit systems. However, it also includes $174 billion to boost companies making electric vehicles, with direct subsidies to manufacturers with tax credits and other incentives for consumers.

President Biden also plans to use the power of federal procurement to order agencies such as the U.S. Postal Service to “Buy American” and use these funds for electric vehicles including school bus conversions.

Construction companies and their suppliers would see a huge boost from the package, which plans to modernize 20,000 miles of roads and repair 10,000 bridges. Both the steel and aluminum industries issued statements endorsing the plan.

Approximately $50 billion is earmarked for a Disaster Relief Fund. The Cares Act would receive $30 billion for funding over four years focused on reducing the risk of future pandemics through measures such as replenishing the national stockpile of vaccines and therapeutics, accelerating the timeline for drug development and boosting domestic production of pharmaceutical ingredients that are currently made largely overseas.

Manufacturing, Jobs and R&D includes $310 billion for domestic manufacturing. Semiconductor manufacturers would receive $50 billion to subsidize domestic research and manufacturing. This proposal would emphasize a bipartisan initiative that Congress pushed into a defense bill late last year called the CHIPS Act. This action authorizes research and subsidies to increase domestic manufacturing of semiconductors, and lessens dependence on China for the computer chips that are so essential to a wide array of products. The plan would inject $100 billion into workforce development and job retraining programs and $180 billion into incentives to increase research and development efforts. The U.S. is still the world leader in R&D spending, but China has been closing the gap.

Caretaking Investment should improve the country’s “care infrastructure”, providing $400 billion in funding for long term care for the elderly and people with disabilities. The plan would allow families to use Medicaid to cover these services. It also attempts to restructure the caregiving labor market by seeking a way to allow workers to join labor unions and create well-paying caregiver jobs. The plan also includes a down payment on the President’s pledge to expand child care, with $25 billion to upgrade existing child-care facilities, and expanded tax credits for employers to build their own facilities.

Housing and Buildings includes $328 billion for upgraded and energy-efficient housing, schools, child-care facilities and federal buildings.

Broadband, Power and Clean Water includes $100 billion to expand access to high-speed broadband internet. The Administration is trying to avoid the appearance of providing aid to private internet giants, stating in the plan that it gives priority to support networks tied to local governments, nonprofits and cooperatives, favoring those “with less pressure to turn profits”. A $100 billion is slated to be invested in the nation’s power structure to ensure clean drinking water. Over half of the money would be used to upgrade the drinking water supply, and the rest would be used to replace lead pipes and service lines.

Clean Energy plans for an additional $400 billion in estimated clean energy tax breaks. President Biden wants to create a new “clean electricity standard” that would force utilities to wean themselves entirely from carbon-emitting sources by 2035.

Key provisions in the Made in America Tax Plan include eliminating tax preferences for fossil fuels, ensuring that polluting industries pay for environmental cleanup and investing in the Internal Revenue Service to make sure it has the resources it needs to enforce the new corporate tax policies.

How will $2.7 trillion be funded?

The Administration has proposed fully offsetting the spending in the American Jobs Plan through a range of corporate tax increases and policy changes. Such proposals in the Made in America Tax Plan could generate enough new revenue to fully pay for the President’s infrastructure package in fifteen years and reduce deficits in subsequent years.

According to estimates from the Biden Administration, the policies outlined in the Made in America Tax Plan could raise nearly $2.8 trillion over fifteen years, which would be enough to offset the $2.7 trillion in spending over eight years from the American Jobs Plan. Central components of the Administration’s proposed tax policy changes are projected to have the following revenue effects over this period:

- Increasing the statutory income tax rate to 28%, a 7 percentage point increase from its current level of 21%, should generate $1.3 trillion. (The current level was lowered from 35% as part of the 2017 Tax Cuts and Jobs Act).

- Imposing a 21% global minimum tax for U.S. multinational corporations should produce $750 billion. It would be calculated on a country-by-country basis to discourage offshoring.

- Eliminating the deduction for Foreign Derived Tangible Income, which is income generated through the sale of goods and services overseas that are attributable to U.S. patents, trademarks and copyrights should add an additional $400 billion.

- Enacting a 15% minimum tax on corporate “book income”, or the amount of income that corporations publicly report to shareholders, should accrue $200 billion.

Many of the companies in the Tufton portfolio are poised to benefit from these initiatives. These include Caterpillar, Emerson Electric, United Parcel Service, Norfolk Southern, Qualcomm, NXP, Corning, Verizon and AT&T. Your team at Tufton will continue to monitor attractive investments for your portfolio as these potential opportunities arise.