The U.S. Approach to the Worsening Trade Deficit

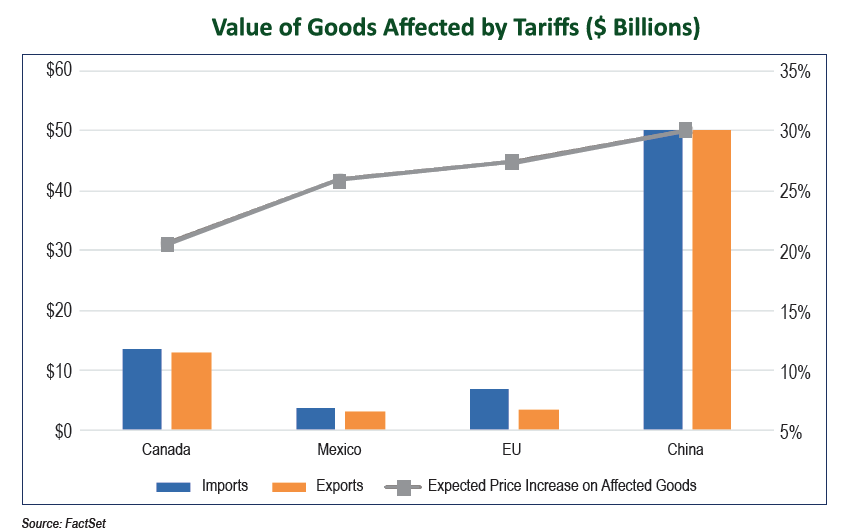

After campaigning during the 2016 presidential election on the promise that he would renegotiate unfair trade deals for the United States, President Donald Trump has begun to attack the country’s trade deficits in the form of international tariffs being placed on imports. Trump has pledged to level the playing field, citing many “unfair” taxes foreign countries have long placed on U.S. exports. The president has also pointed to national security as a reason for the tariffs, directly claiming the need for a strong steel industry to supply our military with tanks and fighter jets. Indirectly, through Commerce Secretary Wilbur Ross, the administration stated definitively, “Economic security is national security.” On this issue, Trump may have an unlikely yet familiar ally in decrying our nation’s balance of trade. In 2003, Warren Buffett wrote in an article entitled “America’s Growing Trade Deficit Is Selling The Nation Out From Under Us” that, “our trade deficit has greatly worsened, to the point that our country’s ‘net worth,’ so to speak, is now being transferred abroad at an alarming rate.” Our nation’s leader and the head of Berkshire Hathaway may propose different practical solutions to the problem, but at the very least they agree that a trade deficit is not good for America. As a result, the ultimate question is: how would a potential tit-for-tat trade war affect businesses and consumers here at home?

On June 25, in response to the European Union’s retaliatory tariffs, Harley Davidson (HOG) announced plans to shift some production overseas. The tariffs placed a 31% tax on motorcycle imports, which Harley projected would add $2,200 to the cost of each bike. The company sold nearly 40,000 bikes in Europe last year, which represented 16.38% of total sales (the highest since 2011), and ridership growth internationally for the first quarter of 2018 totaled 12%, compared to a decline of 0.2% in the U.S. Harley simply could not afford to lose a significant and growing international market. As a result, the company announced that it would not raise prices and alienate riders, but instead eat the expense of the tariffs itself and shift production overseas. Harley expects to take a $35 million-$45 million hit for the rest of their 2018 fiscal year, and up to $100 million annually as a result of this move. However, the company sees this move as the “only sustainable option” to ensure that its motorcycles will continue to sell internationally. While the full scope of this decision has yet to be determined, it could take between nine and eighteen months for the company to shift targeted production overseas, resulting in significant layoffs at U.S. based plants.

Like Harley Davidson, domestic companies that are reliant on goods and raw materials affected by the tariffs will have to make a tough decision. Do they pass the cost increase along to the consumer, or eat the additional expense and allow it to cut into their bottom-line? For some companies, this choice is easier than others. For expensive “big-ticket” consumer items like cars, washing machines, and ride-on lawnmowers, the price increase is less noticeable. For a $33,000 vehicle, additional cost estimates as a result of the tariffs range from $150 to $300. As these purchases are non-recurring, consumers are less likely to notice a less-than-1% increase. Additionally, because manufacturers of these steel and aluminum intensive products purchase their metals in advance, their actual costs will not increase until months after the tariffs have gone into effect. Continuing with the automobile example, dealers in the U.S. have many flexible financing options to lessen the shock of a higher sticker price.

With everyday purchases such as canned food and beverages, companies have less flexibility on pricing. Companies like Campbell’s and MillerCoors which rely on steel and aluminum, respectively, for packaging face mounting pressure from retailers to offer the lowest possible prices. Their margins are already thin, so in order to cut costs they anticipate having to lay off thousands of workers to make up the difference. According to the Beer Institute, a trade group representing producers of alcoholic drinks, the aluminum tariff is equivalent to a $347 million tax on the industry, and will likely result in over 20,000 lost jobs. On the canned goods side, the Can Manufacturers Institute estimates that a tariff on the raw material would cause multi-billion-dollar additional costs, giving companies no choice but to lay off thousands of workers.

That being said, the tariffs will not greatly affect the U.S. consumer right away. Moody’s Analytics predicts the import duties already in place should cost the average family only an extra $80 this year. That number rises to $210 when accounting for additional threatened tariffs that have yet to be imposed. However, the ripple effects on the rest of the economy have the potential to be much more impactful than a few hundred dollars. The Chamber of Commerce estimates that each individual tariff could costs hundreds of thousands of jobs throughout the country, totaling over 750,000 jobs lost between Chinese goods, steel, aluminum, and automobiles. While the metal tariffs are designed to boost American producers, the number of jobs dependent on using steel in production of other goods (6.5 million) far outnumber steelmakers (140,000). This means that the cost of raw materials rising due to the tariffs, there is more potential for net job losses than net gains. These projections align with what we saw happen with the Bush administration’s tariffs in 2002, which saw the loss of over 200,000 jobs by the end of that year.

Is it all worth it? The facts of the matter are that the United States currently has a trade deficit of over $500 billion and has not run a surplus since 1975. While the importance of such statistics can be debated, most economists would agree that a surplus is more preferable than a deficit. The rest of the world has created barriers for U.S. companies to operate within their borders, but they do not face such barriers when they operate within the United States itself. Thus, the president has ultimately decided that these days are over. The result could end up becoming a war of attrition, with negative impacts being felt on all fronts before cooler heads prevail and come to the negotiating table. Based on the relative strength of the U.S. economy, now could be as good a time as any for the country to weather some short-term pain if it means more beneficial trade deals are on the horizon. Conversely, the uncertainty surrounding the threat of a trade war could be enough to plunge the world into a global recession. Only time will tell if these recent developments will result in improvement of the lives of average Americans, but we are keeping a keen eye on political discourse and the market movements they may cause.