Company Spotlight: The Break-Up of DowDupont

By Rick Rubin, CFA

Eleuthère Irénée du Pont de Nemours (E. I. du Pont) was a chemist born in Paris in 1771. From a young age, du Pont was interested in explosives. In 1802, he founded DuPont de Nemours (legacy DuPont) in Wilmington, Delaware to manufacture high quality gunpowder. The company expanded rapidly and became a key specialty chemicals producer. Their research efforts led to the development of nylon, Lycra/spandex, Tyvek and Kevlar. In 2015, DuPont completed the spin-off of its Performance Chemicals division as a public company named Chemours. Chemours assumed certain liabilities from DuPont including litigation related to the Teflon product.

Dow Chemical (legacy Dow) was founded in 1897 by Herbert H. Dow. Dow was established as a bleach plant to utilize waste products from bromine extraction by Midland Chemical, a supplement company also founded by Herbert Dow. The company also began extracting other chemicals such as chloride, magnesium and calcium from Michigan’s brine deposits. Dow grew in part through acquisitions to become the second largest chemical company in the world with a focus on commodity chemicals.

In 2015, Dow merged with DuPont in an all-stock deal to form DowDupont (DWDP). Dow and DuPont sought to combine and enhance the overlapping segments of their companies to improve their scale and competitive position. Additionally, the merger plan contemplated subsequently dividing into three independent publicly traded companies – new Dow (DOW), new DuPont (DD) and Corteva (CTVA). Dow specialized in materials science, DuPont focused on specialty products, and Corteva concentrated on agriculture businesses formed from Dow and Dupont’s agricultural assets.

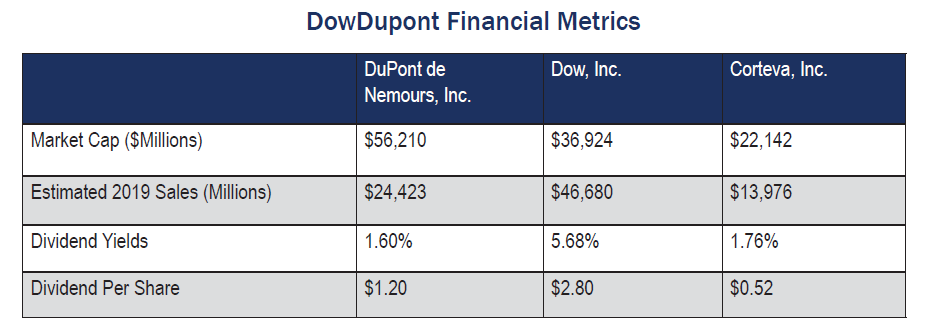

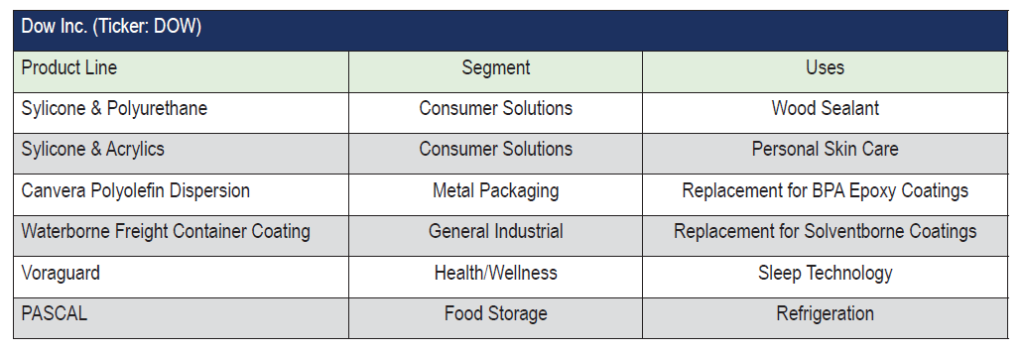

DowDupont completed the spinoff of Dow on April 1, 2019, which is now led by CEO James Fitterling. Dow is organized into three business segments: Performance Materials & Coatings (29% of EBITDA), Industrial Intermediates & Infrastructure (35%) and Packaging & Specialty Plastics (65%). We believe Dow’s spinoff will unlock significant synergies and value creation. We expect Dow to accelerate earnings growth using several levers, including consolidation, cross-selling and cost management. Stickier pricing in its differentiated products has upside surprise potential, and low valuation presents an attractive buying opportunity.

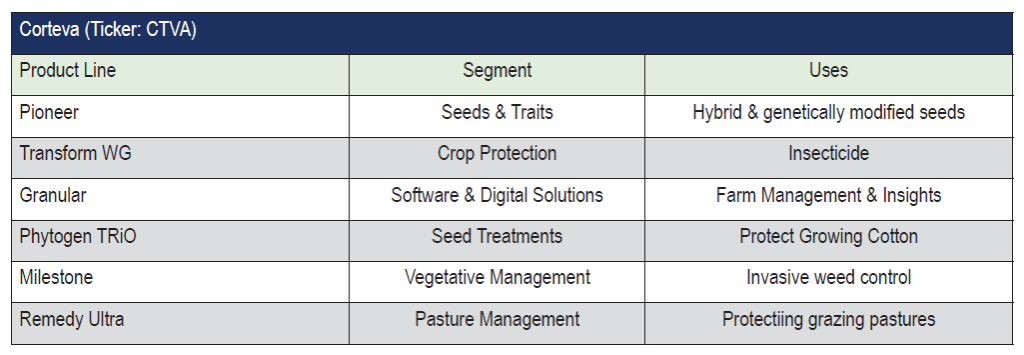

On June 1, 2019, DowDupont completed the spinoff of Corteva, a pure play agriculture business specializing in crop protection chemicals and seeds. Corteva is the combined business of Dow AgroSciences, DuPont Pioneer and DuPont Crop Protection (CP). Dow contributed 80% of the Crop Protection assets, including the company’s herbicide and insecticide portfolio. DuPont contributed 70% of the seed assets for Corteva. We see potential longer-term upside from a deep pipeline of new products. However, inclement weather has caused massive planting delays in U.S. agriculture, and this could result in weak near-term financial results.

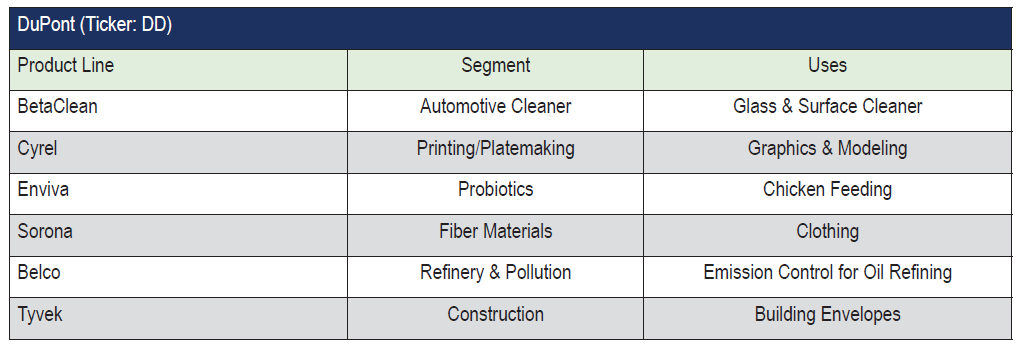

With the spinoff of Corteva, DowDupont changed its name to DuPont effective on June 1, 2019. The new DuPont consists primarily of the legacy pre-merger DuPont assets, which have been bolstered by high quality businesses from Dow Chemical. Agriculture and pure commodity assets have been eliminated. The company now operates through four primary reporting segments: Electronics and Imaging, Nutrition and Biosciences, Transportation and Advanced Polymers and Safety and Construction. We believe the new DuPont represents the best of legacy DowDupont assets. Executive Chairman Ed Breen’s plan is to earmark $2 billion in revenue generating assets for sale. Other plans include new cost savings, a rebound in cyclically depressed automotive and electronics markets, and accretive investments. We, at Tufton, feel that the new DuPont is well positioned for growth potential.