How The New Tax Code Affects Your Portfolio

by Ted Hart

The new tax plan promises to cut taxes for corporations. The companies in which we invest our clients’ funds have various options for the new-found savings.

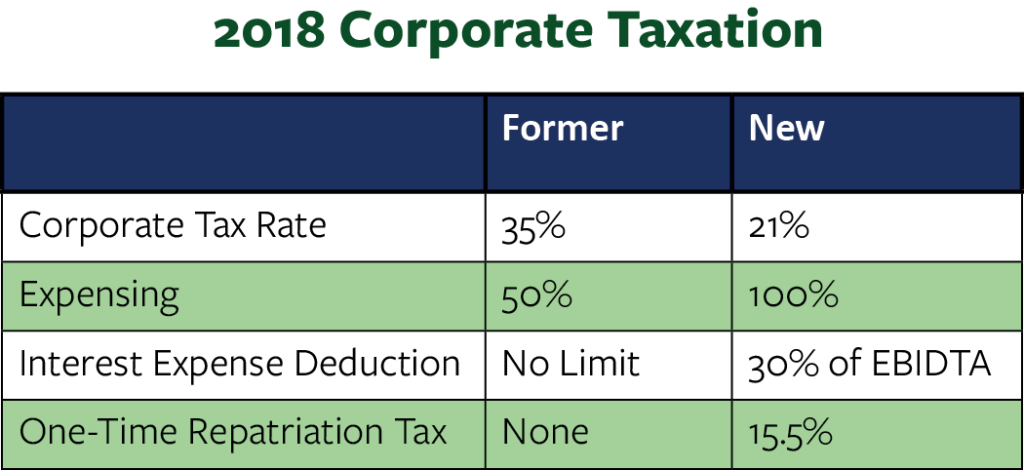

As stated in the preceding article, the corporate tax rate will be revised from 35% to 21% this year. On a global basis, the tax reduction takes the United States from the highest in the industrialized world to the middle of the pack – quite competitive for businesses in the world’s largest economy. One of the largest benefits that has flown under the radar is the provision that allows businesses to deduct the cost of their equipment immediately. Previously, these companies were required to deduct the cost over a period of several years.

Despite the tax break, not all businesses will find the new plan beneficial. Companies will no longer be able to fully deduct their interest expenses on their debt. Instead, companies can deduct up to 30% of their EBITDA (Earnings Before Interest, Taxes, Depreciation and Amortization) through 2021. Thereafter, companies will be able to deduct up to 30% of their EBIT (Earnings Before Interest and Taxes). This will ultimately hurt companies that carry a lot of debt and that have low profitability. Fortunately, a large majority of companies in our portfolios are highly profitable and have affordable amounts of debt.

What will the big multinational companies and other large U.S. businesses do with their tax savings? The answers have varied. AT&T has stated that it will increase its capital investments in the United States by $1 billion over the course of the next year. Additionally, it will provide a bonus of $1,000 to approximately 200,000 people. Boeing, the largest manufacturer of airplanes, says that it will make an additional $300 million in investments, with the idea of allocating one third of the investment to facility improvement, one third to employee training, and one third to corporate giving. In the banking sector, Wells Fargo and Fifth Third Bancorp both stated that their companies would increase their minimum wage to $15 per hour. Fifth Third also said they would reward some 3,000 employees with a $1,000 bonus.

In addition to capital investments and bonuses, many companies plan on additional share buybacks and dividend increases, which should drive investor returns higher. However, the lack of management voices claiming more capital investment implies that their production capacity is not that restrained. Furthermore, the prevalence of bonuses versus wage increases is also somewhat concerning. The lack of wage increases implies that the tax bill may not remain in effect if the Democrats gain control of the House and Senate in the 2018 Midterm Elections or if the Democrats win the White House in 2020. (Although the former is highly unlikely.) Overall, the tax overhaul should be positive for companies in our portfolios.