Active vs. Passive Strategies: What is Best for Your Portfolio?

By Chad Meyer, CFA

It’s an ongoing debate. Should investors use active or passive strategies in their portfolios? Proponents of active management argue that experienced money managers can outperform their benchmarks over market cycles while simultaneously positioning portfolios to avoid investments thought to have poor risk/return characteristics. Advocates of passive management, on the other hand, often point to greater tax efficiency and lower costs. Let’s explain how both of these two strategies work.

The difference between an actively managed fund and a passively managed fund is exactly what the name suggests. The managers of active funds make decisions that require attention and planning to yield solid investment results. The active fund’s portfolio is closely monitored and regularly adjusted to align with the manager’s optimal configuration. Generally speaking, the goal of the active manager is to “beat the market”, or outperform certain standard benchmarks. Conversely, a passive fund owns all of the stocks in a given market index, in the same proportions that they are held in that index. For example, an S&P 500 Index Fund will contain the same 500 stocks and weightings found in that index – no thought goes into which securities are selected (our bias towards active management may be emerging). These investments are then left to grow on “autopilot” without any regular or significant changes. For example, a computer knows that Apple (APPL) makes up approximately 3% of the total value of the S&P 500 index, and your portfolio would mirror that. Therefore, if you have $10,000 invested, you have $300 invested in AAPL.

Over our quarter-century history, Tufton Capital Management has followed a disciplined investment process where we focus on taking advantage of investors’ emotions and identify mispriced securities. As long-term value investors, we are happy to move against the herd and purchase securities when the market has given up on them, and later sell them when sentiment has improved. While indexing may be an appropriate, low-cost option for retail investors, we believe a portfolio constructed entirely of these products is suboptimal for investors with sizable assets. Quite simply, these passive products in and of themselves are not tailored to meet a client’s specific financial objectives or risk parameters.

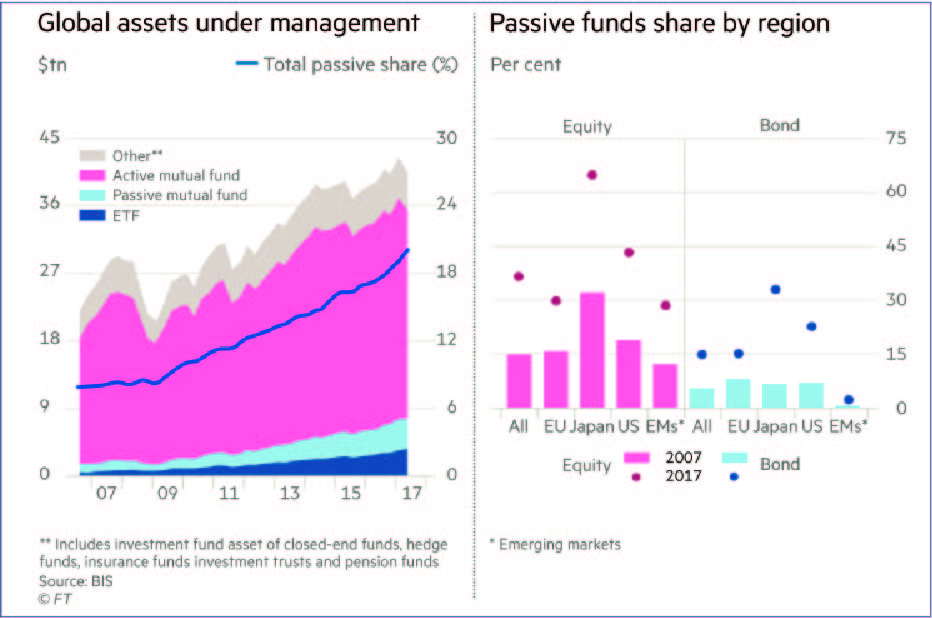

Why have investors (and financial advisors) moved towards passive indexing? First off, indexing is easy. You can purchase a few products and get a broadly diversified portfolio. Secondly, you don’t need to spend a lot of time or have expertise researching or monitoring the funds, as compared to the fundamental research we perform on our individual securities. Finally, most index funds and ETFs have lower management fees when compared to their actively managed counterparts. It’s no secret that only one out of five actively managed mutual funds typically beats its respective benchmark in a given year. Considering the poor performance and high fees of active funds, the move towards indexing can be a logical one for small investors, in spite of its drawbacks.

A fundamental flaw with passive indexing is that the funds often buy high and sell low to mirror the performance of a specific index. For example, when a company has done well and is added to an index, typically its business has been thriving, which would likely have already propelled shares higher. On the flip side, when a company’s business has underperformed and it is removed from an index, an index fund is forced to sell and their investors have no opportunity to profit once a company’s prospects start to improve. Furthermore, because indexes like the S&P 500 are market capitalization weighted, as the price of a stock increases, the stock receives a greater weighting in the index. This conflicts with what we focus on as value investors, which is buying securities as they fall in price.

Another issue with index investing comes when indexes and ETFs are forced to trade securities only after an index’s plan to add a new stock is announced to the market. Traders can “front-run” these additions and buy shares beforehand, since they know the index funds will be buying the shares when the company is officially added to the index. An example of this occurred in recent years when it was announced that American Airlines (AA) would be joining the S&P 500. Following this announcement, the stock rose 11% before it was even added to the index. Index funds were thus forced to buy the stock at a higher price. Similar to the way high-frequency traders are able game the market, this is an example of smart money taking advantage of an index fund. Over time these events may erode the returns of investing in these low-cost products.

An index fund may feel great during a bull market, but in a market downturn, index investors may be left exposed from a risk perspective. This is because an index fund may have larger positions in companies with high valuations and smaller positions in lowly valued companies. Thus, even though index investors are able to manage risk relative to their benchmark, they may struggle managing risk on an absolute basis. Without taking undue risk, our goal is to provide our clients a higher return than the S&P 500 on their equities over a full market cycle. Hence, we will stick to our guns and continue seeking to buy a dollar’s worth of assets for fifty cents.