Company Spotlight: VF Corporation (VFC)

By Scott Murphy

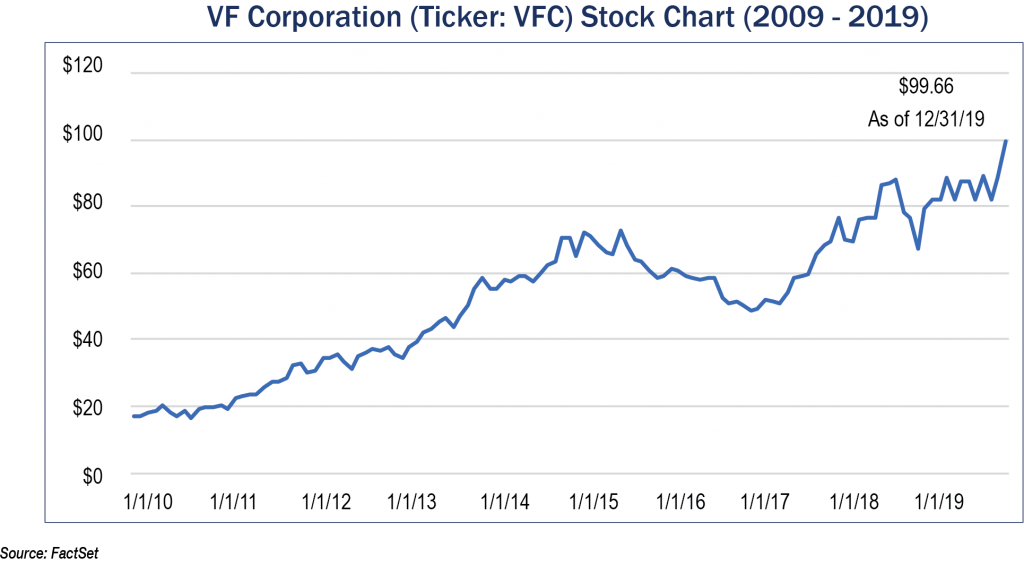

Tufton Capital has been shareholders of VF Corporation (Ticker: VFC) for years, and we last featured the company and its stock in our Winter of 2016 quarterly newsletter. Since Tufton started investing in VFC in 2016, the stock has been a great performer because company management has been able to successfully address many of the “temporary” issues the company faced at the time. Good companies (and their stock prices) are always susceptible to short-term pullbacks when the news flow turns negative or when a short-term operational issue affects the revenue and earnings picture. In the summer of 2019, an inverting yield curve, fear of a weakening consumer and the prospects of a recession were enough to push shares of VFC down approximately 15%. This instance of negative market news afforded us the opportunity to add to our existing positions and establish holdings in newer accounts. With the benefit of hindsight, our timing was good, and the stock has reversed its decline and currently trades near all-time highs as we move into 2020.

VF Corporation is one of the largest clothing and footwear companies in the world. Expected revenues in 2020 will exceed $11.8 billion. VFC has a diverse portfolio of brands, including two with revenue exceeding $2.0 billion each (The North Face and Timberland) and one exceeding $3.2 billion (Vans). In June of 2019, VF Corporation spun off its jeanswear business, which was mostly comprised of Lee and Wrangler, into a brand new company called Kontoor Brands (ticker: KTB). As VFC shareholders, Tufton clients received shares of this spin-off, and our research department worked hard to understand this newly formed company. While we are familiar with the jeans business, our goal has been to best understand the market, its supply and demand dynamics and the potential upside of this new holding. While we have maintained the bulk of this Kontoor holding for a number of reasons, we have not added to the position due to our feeling of a lack of perceived growth potential.

While the strengths of VF Corporation are many, two qualities especially stand out. First, VFC is a pioneer in inventory management, enabling the company to partner with its customers (retail stores) to effectively and efficiently get the right assortment of products that match consumer demand in a real time environment. Retailers value this “just in time” inventory replenishment system, since it allows them to minimize inventory costs. Second, VF Corporation is known for astute management of its company brands, and their corporate leadership has demonstrated an expertise with both exiting underperforming businesses as well as purchasing companies with brands that complement the existing portfolio. Economies of scale and the synergies between their portfolio of branded clothing and footwear are competitive advantages. The VFC team does everything within its power to maintain and grow its stable of brands. In summary, we expect VF Corporation to continue executing, and we feel comfortable maintaining our existing positions in this highly regarded and industry leading brand.